Small Capital Trading Advancement Guide: Choose Niche Markets and Try Intraday Trading

TechFlow Selected TechFlow Selected

Small Capital Trading Advancement Guide: Choose Niche Markets and Try Intraday Trading

If you engage in day trading and execute a small number of trades during each trading session, theoretically, your account balance will grow faster.

Author: adam

Translation: TechFlow

Before diving in, remember this: trading is a complex and high-risk activity.

There is no method that allows you to rapidly grow your account without experiencing any losses.

In fact, those who achieve rapid growth often do so by taking enormous risks—sometimes bordering on all-or-nothing bets.

This article isn't about patiently waiting for ideal market conditions or conducting deep market analysis.

Instead, I’ll share strategies to help you accelerate account growth while maintaining reasonable risk control.

If you're unfamiliar with foundational concepts like “risk management,” I strongly recommend reading this article on risk management first.

If you find this content helpful, consider exploring other posts on the blog, or join the TradingRiot Bootcamp for full video courses, access to a private Discord group, and regularly updated trading strategies.

Why Trade Niche Markets?

If you primarily trade large markets such as BTC, ES (S&P 500 futures), major forex pairs, or gold,

you’re competing not only against retail traders like yourself but also institutional players and quantitative firms.

This is mainly because these markets have extremely high liquidity, allowing big players to enter and exit easily.

While trading these markets isn’t impossible, if you don’t have substantial capital, you may actually have more advantages in lower-liquidity markets.

For example, many altcoin derivatives, NFTs, or on-chain tokens are less appealing to large players due to insufficient liquidity to accommodate their position sizes.

When I began studying altcoin markets more deeply, I frequently found the clearest trading signals in less liquid markets.

Initially, I was confident in these seemingly accessible markets—until I attempted to execute larger positions and realized my orders stood out prominently in the order book, exposing the downside of poor liquidity.

However, small-account traders needn’t worry much about this issue, as liquidity constraints typically only become problematic when your order size reaches five or six figures.

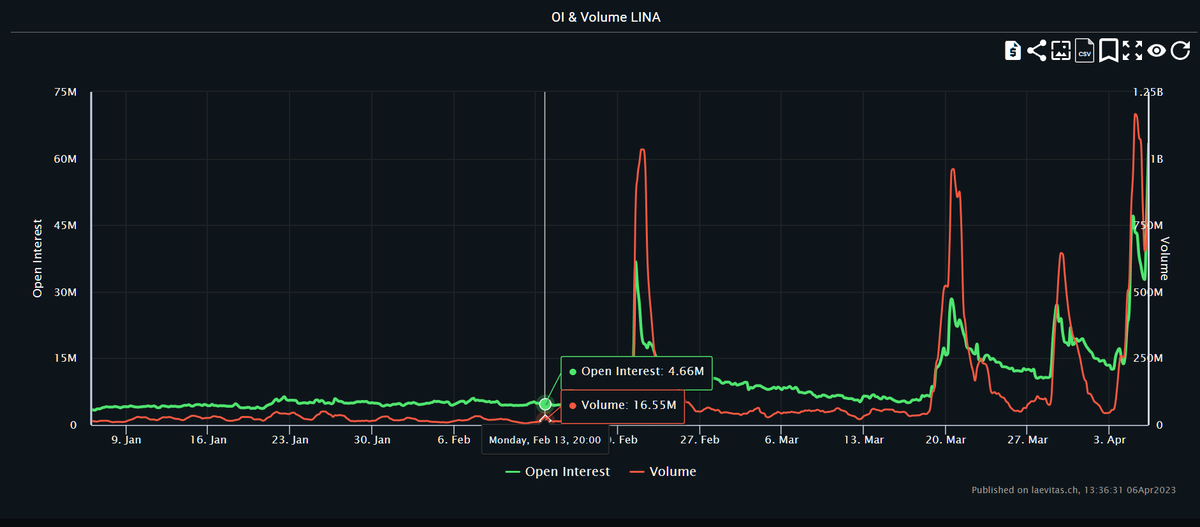

Take Lina on Velo, for instance. The chart shows potential breakout signals visible several days before the actual breakout occurred.

Such opportunities can yield significant returns, but we must also assess the associated risks.

Using the Laevitas platform to check Lina’s volume and open interest data, we see daily volume at $16 million and open interest at $4.5 million prior to the breakout.

If the trade fails and you hold a large position, slippage on your stop-loss could result in losses far exceeding expectations. However, smaller accounts face minimal impact since their stop-losses are typically executed close to intended levels.

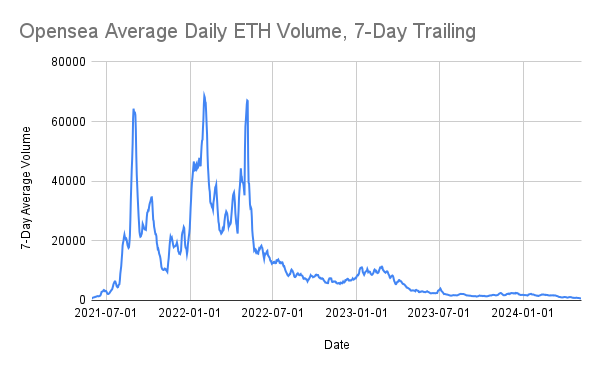

Low-market-cap derivative products aren’t the only niche you can explore—on-chain tokens and NFTs fall into this category too.

When trading, it's crucial to understand where the current "meta" lies.

For example, NFTs were highly popular a few years ago but have since declined.

You need to grasp how quickly information spreads in these spaces to avoid unnecessary risks and prevent exiting too early before major moves.

On-chain trading is particularly challenging. Despite seeing many success stories on X, the likelihood of turning “1 SOL” into “1000” is extremely low.

Unique strategies exist in on-chain trading—such as tracking different wallets, analyzing holdings distribution, or simply using common sense to avoid tokens heavily promoted by KOLs.

Beyond that, basic tools like support/resistance levels or technical indicators are often sufficient, especially for larger-cap tokens with lower rug-pull risks.

Intraday Trading

Price exhibits fractal characteristics. This means if I showed you a price chart, you might struggle to determine whether it’s a daily, monthly, or 5-minute chart.

Additionally, for highly liquid markets, unless you're familiar with them, it can be hard to identify which specific market you're looking at.

For instance, the chart above shows the 5-minute timeframe of XRP.

If you engage in swing trading, your trading frequency will naturally be lower. Even when profitable, most of your time involves patiently waiting for setups—which usually occur just once or twice per week per market.

I'll discuss swing trading shortly, but intraday trading differs significantly—it provides immediate feedback and offers numerous small moves each day to capitalize on.

Therefore, if you conduct intraday trading and execute multiple small trades per session, theoretically, your account can grow faster.

However, intraday trading is one of the most challenging disciplines. A momentary lapse in focus or a minor mistake can erase all gains within minutes—just as quickly as they were made.

I recommend every new trader try intraday trading, as it delivers fast market feedback and accelerates the learning curve.

A key advantage of intraday trading is the ability to focus on highly liquid markets, enabling scalability. By concentrating on BTC, ETH, ES, NQ, gold, or major forex pairs, you won’t encounter position size limitations.

That said, intraday trading is extremely difficult and not suitable for everyone. It demands intense focus, quick decision-making, and strict discipline in cutting losses.

Thus, having a detailed trading plan and defined strategy for every step is critical. Once in a trade, emotions can cloud judgment—this is where pre-defined plans prove invaluable.

There are various approaches to intraday trading—price action, order flow, news, or technical indicators. Each has its context; none are universally superior.

If you're interested in my methods for intraday and swing trading, check out the TradingRiot Bootcamp, a comprehensive training program designed specifically for traders.

Trade With Other People’s Money

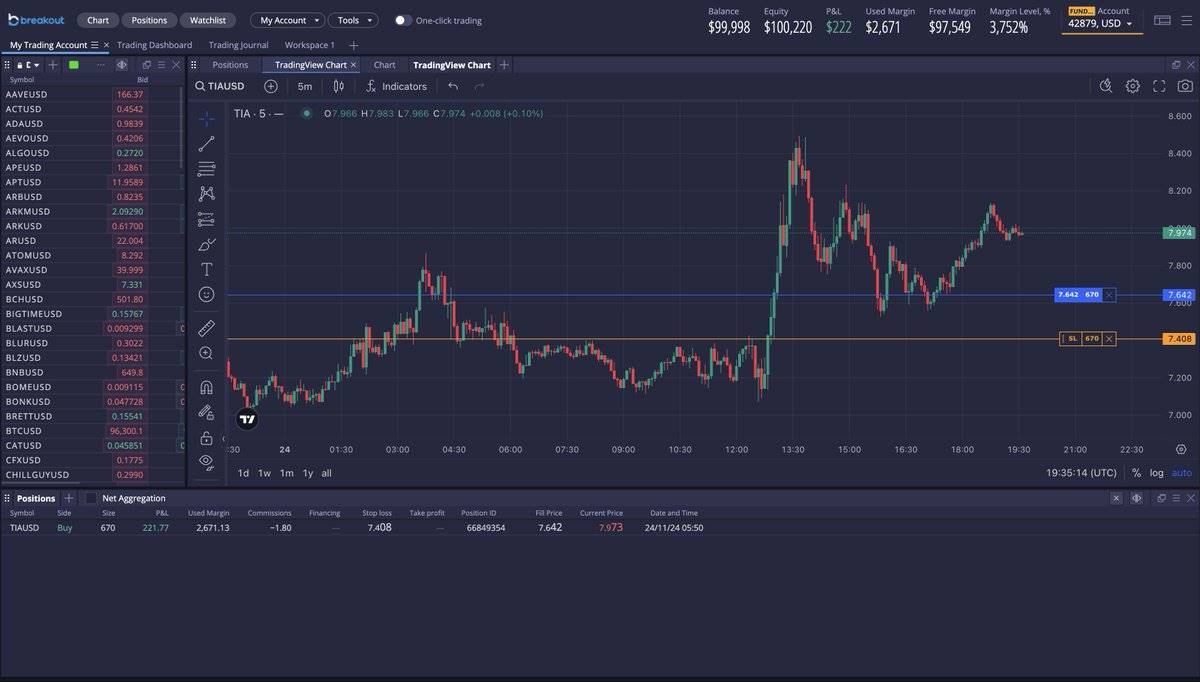

In recent years, proprietary trading firms ("prop firms") have experienced explosive growth online.

If you're new to this model, you typically pay an evaluation fee and must pass certain rules in a simulated account to qualify for a funded account.

This setup allows you to trade with significantly larger capital—the only cost being the evaluation fee.

However, if you lack trading proficiency, you may repeatedly fail evaluations, wasting money without ever securing a funded account.

Although prop firms are controversial, I believe they offer excellent opportunities for skilled traders lacking capital.

With rapid expansion in this space, selecting a reputable and reliable firm is crucial. In recent years, we’ve seen companies refuse payouts, impose nearly impossible rules, or shut down entirely.

I may sound biased here, as I’m directly involved with Breakout Prop Firm. But if you focus on crypto trading, Breakout is an excellent choice. They offer daily payouts, have never refused a withdrawal, and maintain fair evaluation criteria.

High-Timeframe Analysis With Low-Timeframe Execution

If intraday trading doesn’t suit you, don’t lose hope. This alternative method can also accelerate account growth—and requires less screen time.

In fact, this approach isn’t limited to small accounts. Personally, I’ve fully transitioned to this style because I no longer want to spend hours staring at charts.

That said, I still value the years I spent doing intraday trading, studying various futures markets, and understanding market microstructure. I’m grateful for that experience.

While price is fractal in nature, key levels on higher timeframes—like daily, weekly, or monthly charts—often trigger stronger market reactions than those on 1-minute charts. More traders and algorithms watch and react to these higher-timeframe levels.

For example, at the end of February 2023, Solana rose to a daily resistance level, reversed, and fell to the next daily support. Entering a short position at daily close with a stop based on 1-day ATR would have yielded a 2.5R return over 18 days.

Of course, achieving 2.5R in 18 days is solid performance. But if your account is small—say risking $100 per trade—making $250 may not feel exciting. Contrast that with risking $10,000 to make $25,000, which feels much more rewarding.

To accelerate account growth, switch to lower timeframes while following high-timeframe (HTF) analysis. Your target remains the same, but executing on lower timeframes (LTF) allows tighter stops, enabling larger position sizing.

You don’t need to drop to 1-minute or 5-minute charts—H1 or H4 timeframes are sufficient. Over-focusing on very low timeframes may improve risk-reward ratios but greatly increases the chance of being shaken out before the move begins.

Even on H1/H4, you might miss optimal entries or get stopped out prematurely. But based on my experience, giving a HTF idea 1–3 attempts via LTF execution usually produces better results than relying solely on daily chart entries.

Conclusion

Trading isn’t easy—it takes time and patience. But with proper risk management, even small accounts can grow into substantial ones.

In trading, always strive to think outside the box, maintain disciplined execution, and develop a robust trading plan.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News