Stablecoin Sector Insights: How Did a Multi-Trillion-Dollar Market Emerge?

TechFlow Selected TechFlow Selected

Stablecoin Sector Insights: How Did a Multi-Trillion-Dollar Market Emerge?

The younger generation are digital natives, and stablecoins are their natural currency.

Author: Rui Shang, SevenX Ventures

Translation: Mensh, ChainCatcher

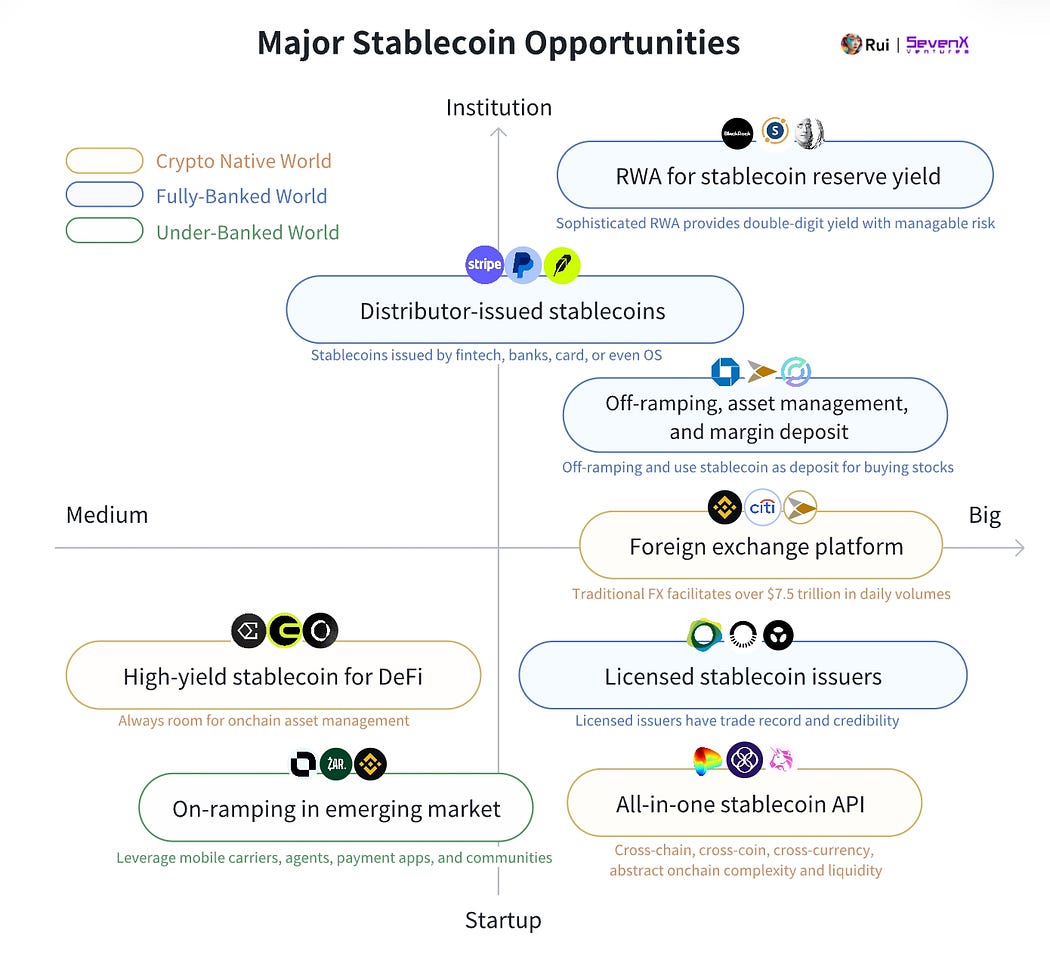

Overview: 8 Major Opportunities in Stablecoins —

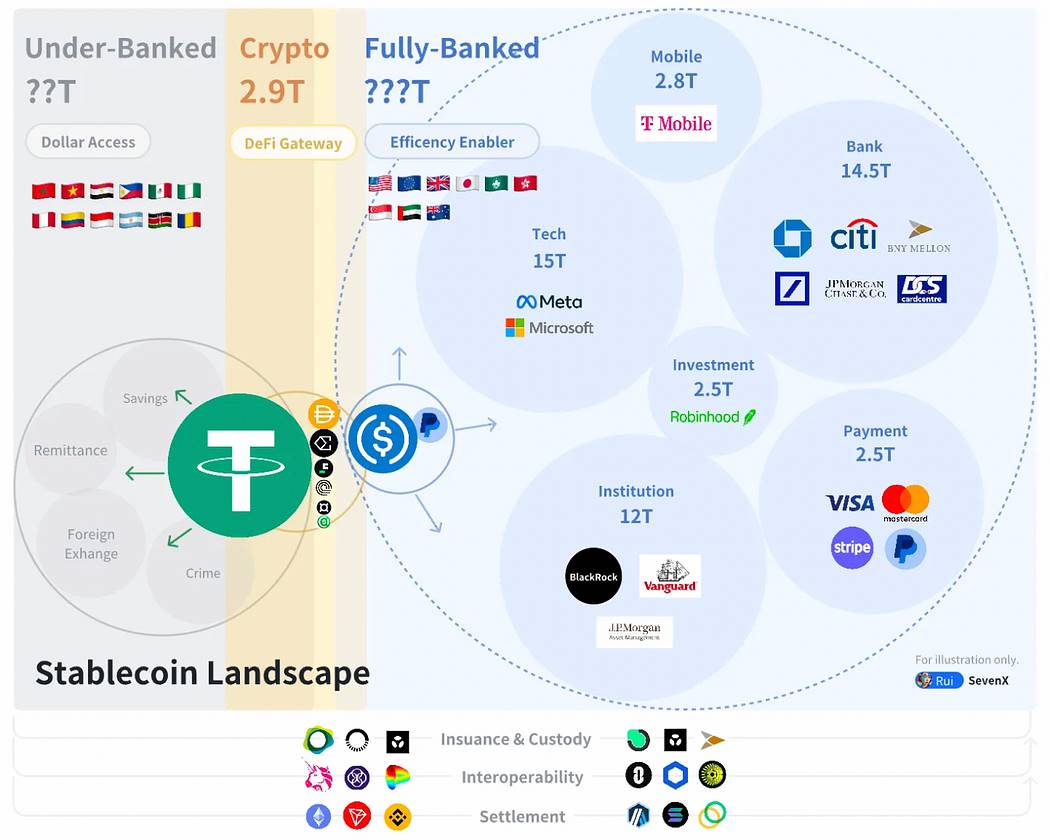

The younger generation are digital natives, and stablecoins are their natural currency. As AI and IoT drive billions of automated microtransactions, global finance needs flexible monetary solutions. Stablecoins act as "money APIs," transferring seamlessly like internet data, reaching $4.5 trillion in transaction volume in 2024—a number expected to grow as more institutions recognize stablecoins as an unparalleled business model—Tether earned $5.2 billion in profit during the first half of 2024 by investing its dollar reserves.

In the battle for stablecoin dominance, complex cryptographic mechanisms are not key—distribution and real adoption matter most. Adoption manifests across three critical domains: crypto-native, fully banked, and unbanked worlds.

In the $29 trillion crypto-native world, stablecoins serve as gateways to DeFi, essential for trading, lending, derivatives, liquidity farming, and RWA. Crypto-native stablecoins compete through liquidity incentives and DeFi integration.

In the fully banked world exceeding $400 trillion, stablecoins enhance financial efficiency, primarily used for B2B, P2P, and B2C payments. These stablecoins focus on regulation, licensing, and distribution via banks, card networks, payment processors, and merchants.

In the unbanked world, stablecoins provide access to the U.S. dollar, promoting financial inclusion. They are used for savings, payments, foreign exchange, and yield generation. Grassroots market outreach is crucial.

Natives of the Crypto World

In Q2 2024, stablecoins accounted for 8.2% of total crypto market capitalization. Maintaining exchange rate stability remains challenging, and unique incentives are key to expanding on-chain distribution—the core issue being limited utility in on-chain applications.

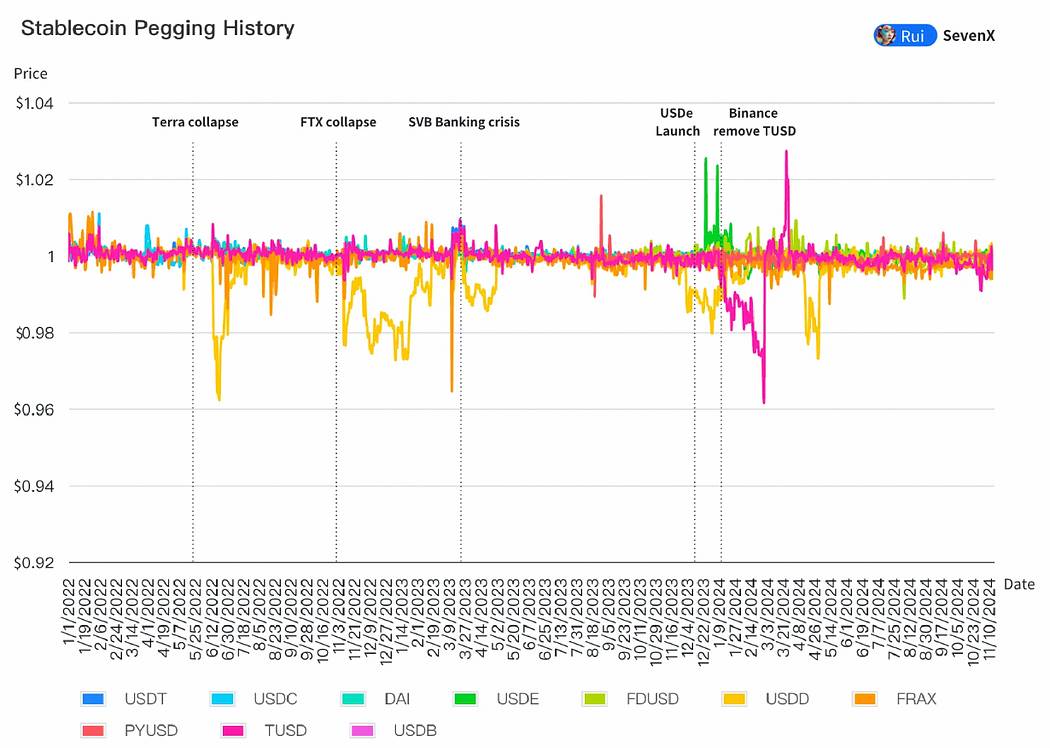

The Battle for Dollar Pegging

- Fiat-backed stablecoins rely on banking relationships:

93.33% of stablecoins are fiat-backed. They offer greater stability and capital efficiency, with banks holding final authority over redemptions. Regulated issuers like Paxos have gained trust by successfully redeeming billions in BUSD and now serve as PayPal’s USD issuer. - CDP stablecoins improve collateral and liquidation to enhance peg stability:

3.89% are Collateralized Debt Position (CDP) stablecoins. They use cryptocurrencies as collateral but face scalability and volatility challenges. By 2024, CDPs have improved resilience by accepting broader liquid and stable collateral—Aave’s GHO accepts any asset within Aave v3, while Curve’s crvUSD recently added USDM (real-world assets). Partial liquidations are improving, especially crvUSD’s soft liquidation, which uses a custom AMM to buffer further bad debt. However, the ve-token incentive model faces issues—as CRV valuation drops after large-scale liquidations, so does the market cap of crvUSD. - Synthetic dollars use hedging to maintain stability:

Ethena’s USDe alone captured 1.67% of the stablecoin market share within a year, reaching a $3 billion market cap. It is a delta-neutral synthetic dollar that opens short positions in derivatives to counter volatility. It is expected to perform well in funding rates during upcoming bull markets, even after seasonal fluctuations. However, its long-term viability heavily depends on centralized exchanges (CEX), raising concerns. As similar products emerge, smaller funds’ impact on Ethereum may diminish. These synthetic dollars may be vulnerable to black swan events and can only sustain low funding rates during bear markets. - Algorithmic stablecoins have declined to 0.56%.

Liquidity Bootstrapping Challenges

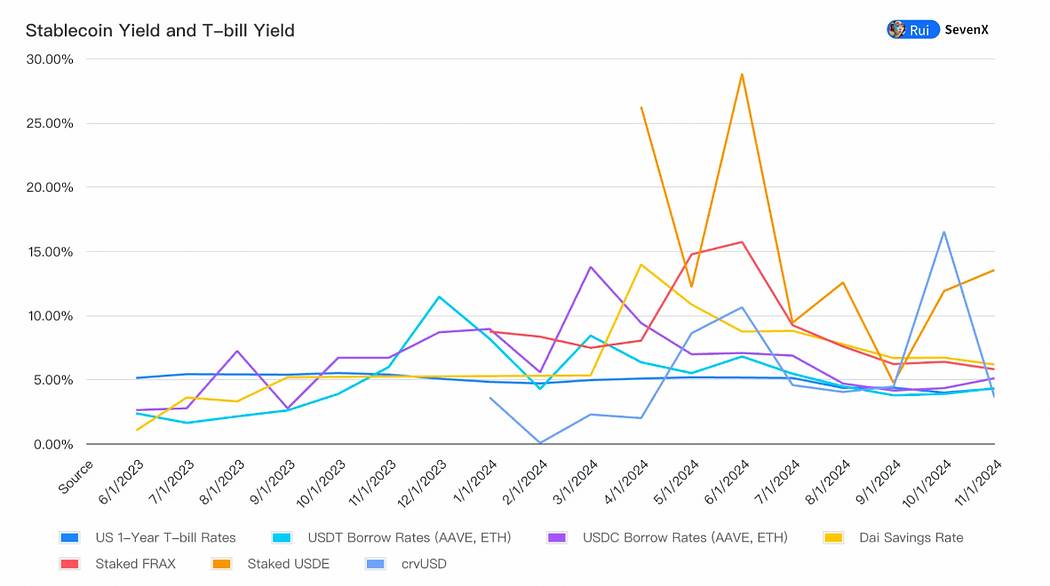

Crypto-native stablecoins use yield to attract liquidity. Fundamentally, their liquidity cost consists of the risk-free rate plus a risk premium. To remain competitive, stablecoin yields must at least match T-bill rates—we’ve already seen borrowing costs decline as T-bill yields reached 5.5%. sFrax and DAI lead in T-bill exposure. By 2024, multiple RWA projects enhanced on-chain T-bill composability: crvUSD includes Mountain’s USDM as collateral, while Ondo’s USDY and Ethena’s USDtb are backed by BlackRock’s BUIDL fund.

Based on T-bill yields, stablecoins adopt various strategies to increase risk premiums, including fixed-budget incentives (such as token emissions from decentralized exchanges, which may lead to constraints or death spirals); user fees (tied to lending and perpetual contract volumes); volatility arbitrage (declines when volatility weakens); and reserve utilization such as staking or restaking (currently underwhelming).

In 2024, innovative liquidity strategies are emerging:

- Maximizing in-block rewards:

While many current yields stem from self-consuming DeFi inflation as incentives, more innovative approaches are emerging. Projects like CAP aim to function as banks, directing MEV and arbitrage profits directly to stablecoin holders, offering sustainable and potentially higher returns. - Compounding T-bill yields:

Leveraging new composability from RWA projects, initiatives like Usual Money (USD0) offer “theoretically” infinite yields via governance tokens, benchmarked against T-bill returns—attracting $350 million in liquidity and entering Binance Launchpool. Agora (AUSD) is another offshore stablecoin offering T-bill yields. - Balancing high yield against volatility:

Newer stablecoins adopt diversified basket approaches, avoiding single-source yield and volatility risks, delivering balanced high returns. For example, Fortunafi’s Reservoir allocates across T-bills, Hilbert, Morpho, PSM, dynamically adjusting allocations and incorporating other high-yield assets as needed. - Is Total Value Locked (TVL) fleeting?

Stablecoin yields often face scalability challenges. While fixed-budget incentives can drive initial growth, yields dilute as TVL increases, weakening effectiveness over time. Without sustainable yield sources or genuine utility in trading pairs and derivatives post-incentives, TVL is unlikely to remain stable.

DeFi Gateway Dilemma

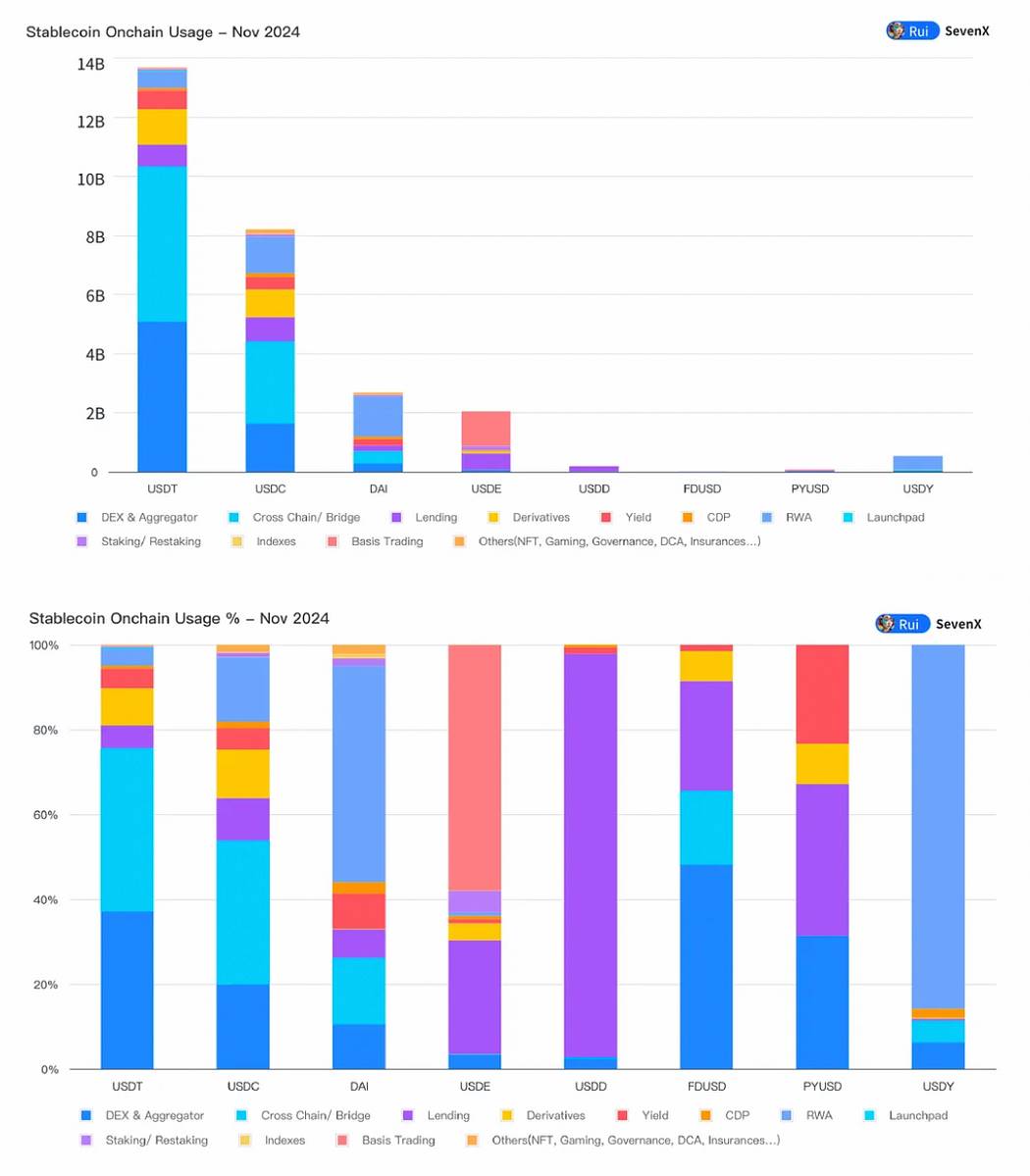

On-chain visibility allows us to examine the true nature of stablecoins: Are they functioning as genuine mediums of exchange, or merely as yield-generating financial instruments?

- Only top-yielding stablecoins become CEX trading pairs:

Nearly 80% of trading still occurs on centralized exchanges, where leading CEXs support their “preferred” stablecoins (e.g., Binance’s FDUSD, Coinbase’s USDC). Others rely on spillover liquidity from USDT and USDC. Additionally, stablecoins struggle to become margin deposits on CEXs. - Few stablecoins are used as DEX trading pairs:

Currently, only USDT, USDC, and a small amount of DAI serve as trading pairs. Other stablecoins, like Ethena, see 57% of USDe staked within their own protocol—held purely as financial instruments to earn yield, far from being mediums of exchange. - MakerDAO + Curve + Morpho + Pendle combo allocations:

Markets like Jupiter, GMX, and DYDX prefer USDC for deposits due to skepticism around USDT’s mint-redeem process. Lending platforms like Morpho and Aave favor USDC due to its superior liquidity on Ethereum. PYUSD is mainly used for borrowing on Solana’s Kamino, especially when incentivized by the Solana Foundation. Ethena’s USDe is primarily used on Pendle for yield activities. - RWA is underestimated:

Most RWA platforms, such as BlackRock, use USDC for minting due to compliance reasons—and BlackRock is also a shareholder of Circle. DAI has achieved success in its RWA offerings. - Expand existing markets or explore new frontiers:

Although stablecoins can attract major liquidity providers through incentives, they face bottlenecks—DeFi usage is declining. Stablecoins now face a dilemma: they must either wait for expansion in crypto-native activity or seek new utility beyond this domain.

Outliers in the Fully Banked World

Key Players Are Moving

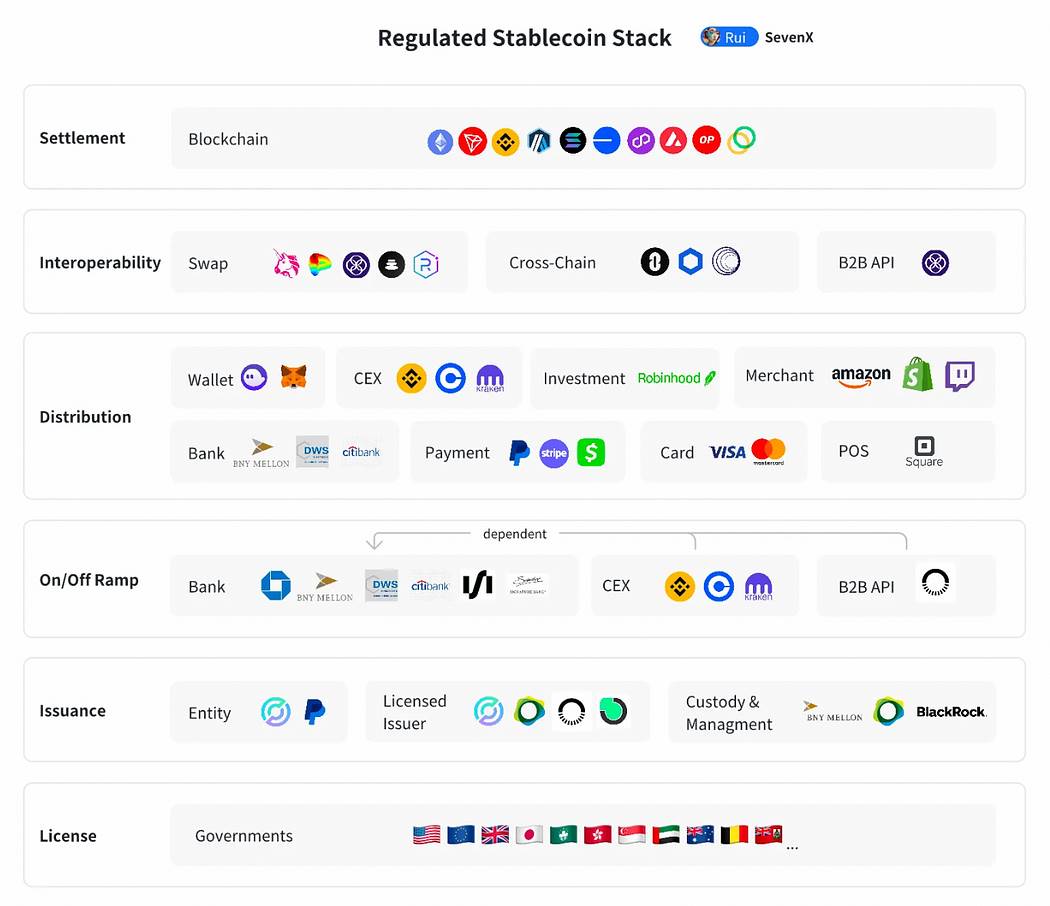

- Global regulation is becoming clearer:

99% of stablecoins are USD-backed, giving the U.S. federal government ultimate influence. Following an anticipated crypto-friendly Trump administration that promises lower interest rates and bans on CBDCs, U.S. regulatory clarity may benefit stablecoins. A U.S. Treasury report highlights stablecoins’ impact on demand for short-term Treasuries—Tether holds $90 billion in U.S. debt. Preventing crypto-related crime and preserving dollar dominance are additional motivations. By 2024, multiple countries established regulatory frameworks under common principles, including approval requirements for stablecoin issuance, reserve liquidity and stability mandates, restrictions on foreign-currency stablecoins, and typically prohibitions on interest-bearing stablecoins. Key examples include MiCA (EU), PTSR (UAE), sandbox regimes (Hong Kong), MAS (Singapore), and PSA (Japan). Notably, Bermuda became the first jurisdiction to accept tax payments in stablecoins and license interest-bearing stablecoin issuers. - Licensed issuers gain trust:

Stablecoin issuance requires technical capability, cross-jurisdictional compliance, and strong governance. Key players include Paxos (PYUSD, BUSD), Brale (USC), and Bridge (B2B API). Reserve management is handled by trusted institutions like BNY Mellon, which securely generates yield via investments in BlackRock-managed funds. BUIDL now enables broader on-chain projects to earn yield. - Banks are gatekeepers for cash-out:

While cash-in (fiat to stablecoin) is becoming easier, cash-out (stablecoin to fiat) remains challenging due to difficulties verifying fund origins. Banks prefer licensed exchanges like Coinbase and Kraken, which conduct KYC/KYB and operate under similar anti-money laundering frameworks. Although high-credibility banks like Standard Chartered are beginning to accept cash-outs, mid-sized banks such as DBS in Singapore are moving faster. B2B services like Bridge aggregate cash-out channels and manage billions in transaction volume for premium clients including SpaceX and the U.S. government. - Issuers hold final say:

Circle, the compliance leader among stablecoin issuers, relies on Coinbase and is pursuing global licenses and partnerships. However, this strategy may be disrupted as institutions launch their own stablecoins—an unparalleled business model exemplified by Tether, which generated $5.2 billion in profit from reserve investments in H1 2024 with just 100 employees. Banks like JPMorgan have already launched JPM Coin for institutional transactions. Payment app Stripe acquired Bridge, signaling interest in owning the full stablecoin stack rather than simply integrating USDC. PayPal issued PYUSD to capture reserve yield. Card networks like Visa and Mastercard are tentatively embracing stablecoins.

Stablecoins Enhance Efficiency in the Banked World

Backed by trusted issuers, healthy banking relationships, and robust distributors, stablecoins can significantly improve efficiency in large-scale financial systems, particularly in payments.

Traditional systems face efficiency and cost limitations. In-app or intra-bank transfers offer instant settlement but are confined within ecosystems. Interbank payments incur ~2.6% fees (70% to issuing bank, 20% to receiving bank, 10% to card network) with settlement taking over a day. Cross-border transactions are even costlier (~6.25%) and can take up to five days.

Stablecoin payments eliminate intermediaries, enabling peer-to-peer instant settlement. This accelerates capital velocity, reduces capital costs, and offers programmable features like conditional automatic payments.

- B2B ($120–150 trillion annually):

Banks are best positioned to drive stablecoin adoption. JPMorgan developed JPM Coin on its Quorum chain, processing approximately $1 billion in transactions daily as of October 2023. - P2P ($1.8–2 trillion annually):

Digital wallets and mobile payment apps are ideally placed. PayPal launched PYUSD, now with a $604 million market cap on Ethereum and Solana. PayPal allows end users to register and send PYUSD for free. - B2C commerce ($5.5–6 trillion annually):

Stablecoins need to integrate with POS systems, bank APIs, and card networks. Visa became the first payment network to settle transactions using USDC in 2021.

Innovators in the Underbanked World

Shadow Dollar Economy

Due to severe currency depreciation and economic instability, emerging markets urgently need stablecoins. In Turkey, stablecoin purchases account for 3.7% of GDP. Individuals and businesses willingly pay a premium above fiat USD for stablecoins—Argentina sees a 30.5% premium, Nigeria 22.1%. Stablecoins provide dollar access and promote financial inclusion.

Tether dominates this space with a reliable 10-year track record. Even amid complex banking ties and past redemption crises—Tether admitted in April 2019 that USDT was only 70% backed by reserves—its peg remained stable. This is because Tether built a robust shadow dollar economy: in emerging markets, people rarely redeem USDT for fiat—they treat it as USD. This phenomenon is evident in Africa and Latin America, where USDT is used for payroll, invoicing, and daily transactions. Tether achieved this without incentives, relying solely on longevity and consistent utility, enhancing credibility and adoption. This should be every stablecoin’s ultimate goal.

Access to Dollars

-

Remittances:

Remittance inequality hampers economic growth. In Sub-Saharan Africa, individuals sending money to lower-middle-income and high-income countries pay an average of 8.5% of the remittance value. For businesses, the situation is worse—high fees, long processing times, bureaucracy, and exchange rate risks directly affect regional firms’ growth and competitiveness. - Dollar Access:

From 1992 to 2022, currency volatility cost 17 emerging market economies $1.2 trillion in GDP—equivalent to a staggering 9.4% of their combined GDP. Access to dollars is vital for local financial development. Many crypto projects focus on on-ramps, with ZAR emphasizing grassroots “DePIN” methods. These leverage local agents to facilitate cash-to-stablecoin transactions across Africa, Latin America, and Pakistan. - Foreign Exchange:

Today, the forex market exceeds $7.5 trillion in daily volume. Across the Global South, individuals often rely on black markets to convert local fiat into USD, primarily because black-market rates are more favorable than official ones. Binance P2P is gaining traction but lacks flexibility due to its order-book model. Many projects like ViFi are building on-chain AMM-based FX solutions. - Humanitarian Aid Distribution:

Ukrainian war refugees received humanitarian aid in USDC, which they could store in digital wallets or cash out locally. In Venezuela, frontline healthcare workers used USDC to pay for medical supplies during the deepening political and economic crisis amid the pandemic.

Conclusion: Interwoven

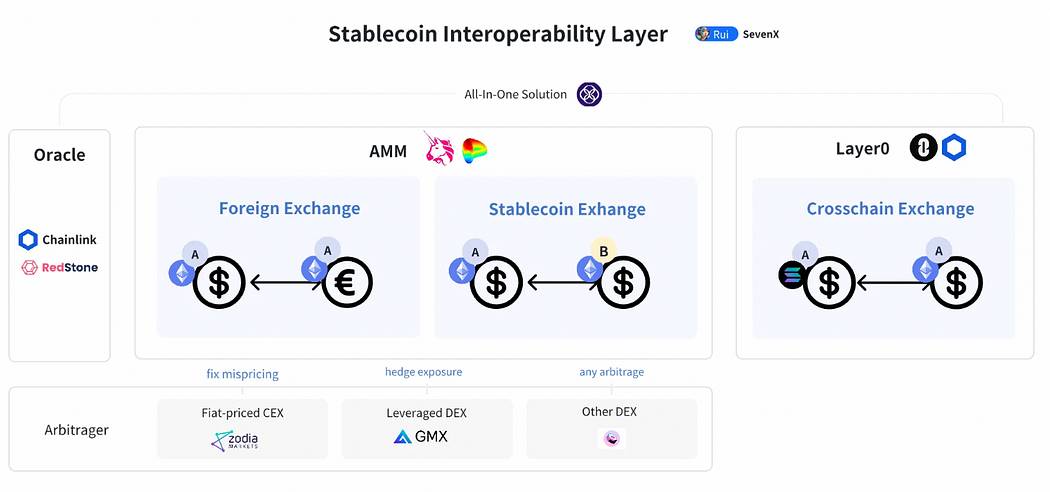

Interoperability

- Cross-currency swaps:

Traditional forex systems are highly inefficient, facing multiple challenges: counterparty settlement risk (CLS improves but remains cumbersome), multi-bank system costs (buying yen from an Australian bank to a London dollar office involves six banks), limited global settlement window overlaps (CAD and JPY banking systems overlap less than 5 hours daily), and restricted FX market access (retail users pay up to 100x the fees of large institutions). On-chain FX offers significant advantages:

– Cost, efficiency, and transparency: Oracles like Redstone and Chainlink provide real-time pricing. DEXs offer cost efficiency and transparency—Uniswap CLMM reduces trading fees to 0.15–0.25%, roughly 90% lower than traditional FX. Moving from T+2 bank settlements to instant settlement allows arbitrageurs to deploy multiple strategies to correct mispricing.

– Flexibility and accessibility: On-chain FX enables corporate treasurers and asset managers to access diverse products without maintaining multiple currency-specific bank accounts. Retail users can obtain optimal FX rates via crypto wallets embedded with DEX APIs.

– Separation of currency from jurisdiction: Transactions no longer require domestic banks, decoupling from underlying jurisdictions. This leverages digital efficiency while preserving monetary sovereignty, though drawbacks remain.

Challenges persist, including scarcity of non-USD denominated digital assets, oracle security, support for long-tail currencies, regulation, and unified on/off-ramp interfaces. Despite these, on-chain FX presents compelling opportunities. For instance, Citigroup is developing a blockchain-based FX solution under the guidance of the Monetary Authority of Singapore. - Cross-stablecoin swaps:

Imagine a world where most companies issue their own stablecoins. Stablecoin interoperability poses a challenge: paying a JPMorgan merchant using PayPal’s PYUSD. While on/off-ramp solutions can bridge this gap, they forfeit the efficiency promised by crypto. On-chain AMMs offer optimal real-time, low-cost stablecoin-to-stablecoin trading. For example, Uniswap hosts multiple such pools with fees as low as 0.01%. However, once billions flow on-chain, smart contract security must be trusted, and sufficient liquidity depth and instant performance are required to support real-world activity. - Cross-chain swaps:

Major blockchains have varied strengths and weaknesses, leading stablecoins to deploy across multiple chains. This multi-chain approach introduces cross-chain challenges, with bridges posing significant security risks. In my view, stablecoins launching their own Layer 0 is the optimal solution—examples include USDC’s CCTP, PYUSD’s Layer 0 integration, and signs that USDT may recall bridged tokens and launch a similar Layer 0 solution.

Unanswered Questions

Meanwhile, several questions remain unresolved:

- Will compliant stablecoins undermine “open finance,” given their potential ability to monitor, freeze, and extract funds?

- Will compliant stablecoins avoid offering yield that could be classified as securities, thereby preventing DeFi from benefiting from large-scale adoption?

- Given Ethereum’s slowness and L2 reliance on single sequencers, Solana’s imperfect uptime, and other popular chains lacking long-term performance records, can any open blockchain truly handle massive capital flows?

- Will separating currency from jurisdiction introduce more chaos or opportunity?

The stablecoin-led financial revolution before us is both exciting and unpredictable—a new chapter where freedom and regulation dance in delicate balance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News