The $15 Billion Overt Play: Where Will MicroStrategy Take Bitcoin?

TechFlow Selected TechFlow Selected

The $15 Billion Overt Play: Where Will MicroStrategy Take Bitcoin?

MicroStrategy's only soft threat is the Bitcoin whale.

Author: 0xTodd

First, let's celebrate our beloved Bitcoin reaching $98,000!

There's no doubt that ETFs were the driving force behind Bitcoin’s rise from $40K to $70K, while MicroStrategy (MicroStrategy) deserves full credit for pushing it from $70K to $100K.

Nowadays, many people compare MicroStrategy to Luna of the BTC world, which makes me slightly uncomfortable—because Bitcoin is my favorite cryptocurrency, whereas Luna happens to be my least favorite.

I hope this post helps everyone better understand the relationship between MicroStrategy and Bitcoin.

Here are a few key takeaways upfront:

-

MicroStrategy is not Luna—it has a much thicker safety margin.

-

MicroStrategy acquires Bitcoin through bond issuance and stock sales.

-

MicroStrategy’s next debt maturity isn’t until 2027—over two years away.

-

The only soft threat to MicroStrategy comes from major Bitcoin whales.

MicroStrategy Is Not Luna—It Has Far Greater Safety Margins

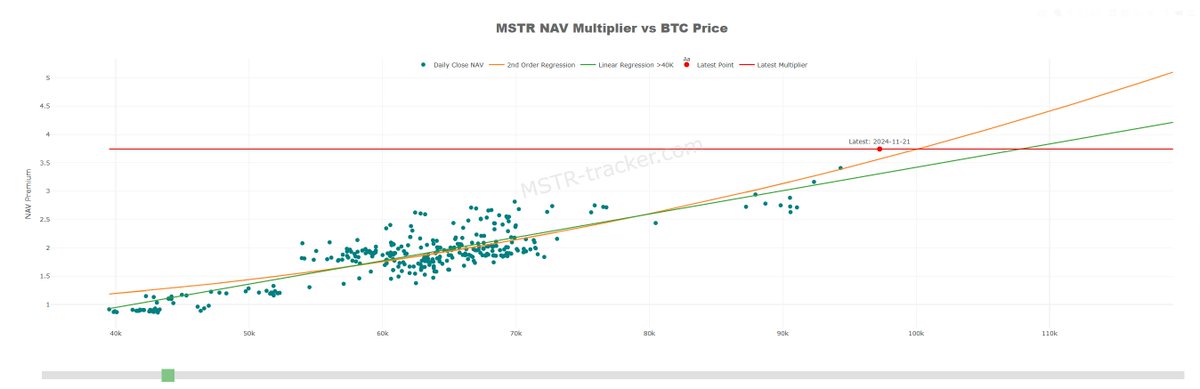

MSTR Net Asset Value vs Bitcoin Price

MicroStrategy was originally a software company with substantial unrealized gains on its balance sheet. Having decided against further investment in core operations, it began going all-in on Bitcoin starting in 2020, using its own capital.

Once it exhausted its cash reserves, MicroStrategy started leveraging—specifically off-exchange leverage—by issuing corporate bonds to borrow money for buying more Bitcoin.

The fundamental difference between MicroStrategy and Luna lies here: Luna and UST engaged in circular minting, where UST was essentially unbacked fiat creation sustained only by an artificial 20% yield—a classic Ponzi scheme.

In contrast, MicroStrategy is akin to dollar-cost averaging at the bottom with leverage—standard bullish leverage betting, and they bet correctly.

Bitcoin’s adoption vastly exceeds that of UST, and MicroStrategy’s influence over Bitcoin is far smaller than Luna’s control over UST. As the saying goes: daily 2% returns spell Ponzi; annual 2% returns spell banking. Quantity changes lead to qualitative shifts. MicroStrategy isn't the sole determinant of Bitcoin’s price—therefore, it's absolutely not Luna.

MicroStrategy Acquires Bitcoin Through Bonds and Stock Sales

To raise funds quickly, MicroStrategy has issued multiple debt instruments totaling $5.7 billion (for perspective, that’s about 1/15th of Microsoft’s total debt).

Almost all of this money has been used to continuously accumulate Bitcoin.

Most are familiar with on-exchange leverage—where you deposit Bitcoin as collateral so exchanges (and other users) can lend you funds. Off-exchange leverage, however, works differently.

All creditors care about one thing: repayment risk. Without physical collateral, why would anyone lend to MicroStrategy off-exchange?

The answer lies in how uniquely MicroStrategy structures its debt. Over recent years, it has primarily issued convertible bonds.

These convertibles work like this:

Bondholders have the right to convert their bonds into MSTR shares, under two phases:

1. Initial Phase:

-

If the bond price drops >2%, bondholders can exercise conversion rights—converting bonds into MSTR shares and selling them to recoup principal;

-

If the bond price remains stable or rises, bondholders can simply sell the bonds on secondary markets to exit profitably.

2. Later Phase: As bonds approach maturity, the 2% rule no longer applies. Bondholders may either redeem in cash or directly convert bonds into MSTR equity.

From the creditor’s standpoint, this setup is nearly risk-free:

-

If Bitcoin falls but MSTR remains solvent, creditors get their cash back;

-

If Bitcoin falls and MSTR lacks liquidity, creditors still have a fallback—convert to stock and liquidate;

-

If Bitcoin rises, MSTR stock will likely appreciate even more, giving bondholders higher upside via equity conversion.

In short, this structure offers high floors and high ceilings—making fundraising relatively smooth for MicroStrategy.

Luckily—or rather, faithfully—MicroStrategy chose Bitcoin.

And Bitcoin hasn’t let it down.

MicroStrategy Stock Performance in 2024

As Bitcoin surged, the value of MicroStrategy’s early Bitcoin holdings rose dramatically. According to traditional and classic valuation principles, a company’s market cap should grow alongside its asset base.

Hence, MicroStrategy’s share price skyrocketed.

Today, MicroStrategy’s daily trading volume exceeds that of Nvidia—the undisputed blue-chip stock of 2024. This gives MicroStrategy even more options now.

Now, beyond issuing debt, MicroStrategy can also raise capital by directly issuing new shares.

Unlike meme coins or Bitcoin developers who lack minting privileges, traditional public companies can issue additional shares upon regulatory compliance.

Last week’s jump from just above $80K to today’s $98K wasn’t coincidental—it was fueled significantly by MicroStrategy. Yes, they conducted a secondary offering, raising $4.6 billion by selling newly issued shares.

PS: A company with greater liquidity than Nvidia naturally commands such capacity.

Sometimes, when you admire a company generating extraordinary profits, you must also respect its extraordinary boldness.

Unlike many crypto firms that dump and cash out selfishly, MicroStrategy continues operating at maximum conviction. They reinvested every dollar raised from share sales entirely back into Bitcoin—pushing Bitcoin toward $98K.

By now, you should see the magic trick clearly:

Buy Bitcoin → Stock price rises → Borrow more to buy Bitcoin → Bitcoin rises → Stock climbs further → Borrow again → Buy more Bitcoin → Stock keeps rising → Issue and sell new shares → Buy even more Bitcoin → Stock continues climbing…

A masterpiece performed by the great magician: MicroStrategy.

MicroStrategy’s Next Debt Maturity Isn’t Until 2027—We Have At Least Three Years

Every magician eventually faces exposure.

Many MSTR bears believe we're already in standard short territory, even suspecting a "Luna moment" has arrived.

But is that really true?

According to recent data, MicroStrategy’s average Bitcoin acquisition cost stands at $49,874—meaning they currently enjoy nearly 100% unrealized gains. That’s an extremely thick safety cushion.

Let’s assume the worst-case scenario: Bitcoin plunges 75% immediately (highly improbable), dropping to $25,000. So what?

MicroStrategy uses off-exchange leverage—there’s no margin call mechanism. Angry creditors can at most convert their bonds into MSTR shares at designated times and dump them onto the market.

Even if dumping drives MSTR stock to zero, there’s still no forced liquidation of Bitcoin holdings—because the earliest debt repayment date isn’t due until February 2027.

Look closely: not 2025, not 2026—but Tom’s 2027.

This means MicroStrategy wouldn’t need to sell any Bitcoin unless, in February 2027, Bitcoin crashes *and* no one wants MSTR shares anymore.

In other words, we’ve got over two years left to keep dancing.

This is the magic of off-exchange leverage.

You might ask: Could interest payments force MicroStrategy to sell Bitcoin?

The answer remains no.

Thanks to MicroStrategy’s convertible bond structure—where creditors are largely guaranteed profit—the interest rates are extremely low. For example, the bond maturing in February 2027 carries a 0% interest rate.

Creditors are purely chasing potential gains in MSTR equity.

Subsequent debt issues carry rates of 0.625%, 0.825%, and only one at 2.25%—all negligible. Interest burden is not a concern.

MicroStrategy's Key Bond Interest Rates, source: BitMEX

MicroStrategy’s Only Soft Threat: Bitcoin Whales

At this point, MicroStrategy and Bitcoin have become mutually reinforcing.

More companies are preparing to emulate David Saylor’s legendary playbook.

For instance, MARA, a publicly listed Bitcoin miner, recently issued a $1 billion convertible bond specifically earmarked for accumulating Bitcoin at low prices.

Therefore, shorts should proceed with caution. If more firms follow suit, Bitcoin’s momentum could become unstoppable—after all, there’s nothing but open sky ahead.

Hence, MicroStrategy’s biggest adversary now is only the ancient Bitcoin whales.

As many predicted earlier, retail investors have largely exited their Bitcoin positions—given countless distractions like the meme coin frenzy. I don’t believe anyone remained completely blind to these opportunities.

Thus, the battlefield now belongs solely to these whales. As long as they remain passive, this rally will be hard to stop. If fortune smiles further, subtle coordination between whales and MicroStrategy could propel Bitcoin into an even greater future.

This highlights a key difference between Bitcoin and Ethereum: Satoshi Nakamoto, theoretically holding close to 1 million early-mined Bitcoins, remains silent to this day; meanwhile, the Ethereum Foundation occasionally feels compelled to test liquidity by selling just 100 ETH.

As of today’s writing, MicroStrategy has accumulated $15 billion in unrealized gains—all thanks to loyalty and faith.

Because it’s profitable, it will keep doubling down. There’s no turning back—and more players will inevitably follow. Given current momentum, $170K appears to be Bitcoin’s mid-term target (not financial advice).

Of course, we’re used to seeing conspiracy theories unfold daily in the meme sphere. But once in a while, witnessing a genuine, top-tier grand strategy executed openly—truly deserves admiration.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News