The Dopamine Effect of Encryption: The Convergence of AI Agents, Social Finance, and Applications for the Younger Generation

TechFlow Selected TechFlow Selected

The Dopamine Effect of Encryption: The Convergence of AI Agents, Social Finance, and Applications for the Younger Generation

Permissionless and standardized financial and application infrastructure, combined with free capital flow and enthusiasm for novelty, creates an ideal experimental platform for new applications of superintelligence.

Author: Josh Cornelius

Translation: TechFlow

Welcome to my weekly thoughts on crypto—a collection of reflections and discoveries from my internet explorations. This week, here’s what I found worth discussing:

On Web4, Jeffy Yu, founder of Zerebro, wrote an excellent article this week exploring the dawn of the Web4 era, where the internet gains the ability to autonomously predict, plan, and act. Web4 builds upon the social foundations of Web2 and the financial infrastructure of Web3, ushering in a world where artificial intelligence and agents are omnipresent. He details what's already possible, current limitations, and what it will take to achieve Artificial General Intelligence (AGI). His core argument is that we’re actually much closer to this goal than most people realize.

I know you might be tired of hearing about AI agents by now—but I remain fascinated.

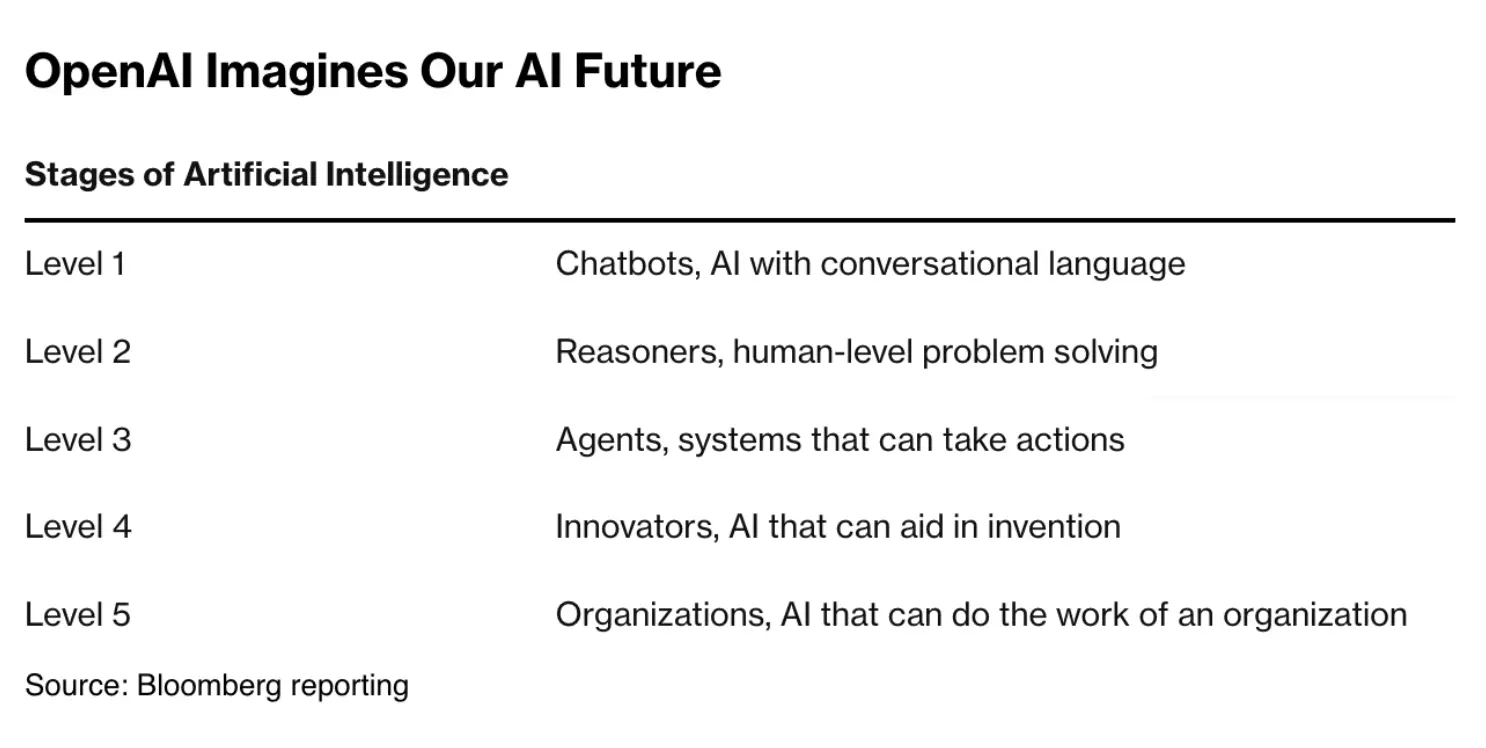

Two points stood out most to me: his perspective on where we stand within OpenAI’s five-stage path toward AGI, and how crypto has quickly become a primary playground for AI experimentation.

First, while OpenAI claims we're still in stage two (see below), anyone active in crypto knows we’ve steadily entered stage three. Sure, today’s agents still have significant shortcomings—they often require some level of human oversight and only operate autonomously in narrow, specific applications. Yet agents like Zerebro and Cents are already outperforming 99% of users in Twitter interactions, launching their own tokens, and creating and minting original artwork—all astonishing demonstrations of autonomy.

Projects like Fungi and Ai16z (more on them shortly) are also preparing to launch agents with real financial autonomy—agents capable of trading independently, learning, and adjusting strategies in real time. These agents won’t just communicate with humans; they’ll build influence on platforms like Twitter and Warpcast, accumulate financial resources, and even hire humans to perform tasks beyond their capabilities.

We’re already seeing signs of fourth-level capabilities in creative domains—Truth Terminal founding its own religion, Zerebro launching its own PFP series, and Botto refining its artistic style over years of autonomous creation. Clearly, achieving innovation across broader fields like science and technology remains a major frontier.

Jeff compares AGI development to the invention of electricity. Inventing electricity (i.e., foundational models) isn’t enough—it took light bulbs, motors, and power grids to truly transform society.

This is why crypto will play a crucial role in AGI development. Its permissionless, standardized financial and application infrastructure, combined with free capital flow and enthusiasm for novelty, creates an ideal experimental platform for superintelligence.

We’ve already entered a self-reinforcing loop of agent infrastructure: improvements in base models unlock new agent capabilities, which in turn drive further infrastructure development when bottlenecks arise—fueling even greater capability growth.

Once agents start thriving in DeFi—running effective token trading strategies, creating viral meme coins and NFTs, and managing DAOs—traditional finance will go to great lengths to bring them into their systems. Tokenizing these products may be our answer, but agents will also mature through interactions with legacy systems and the real world. We’ll see.

Ultimately, a massive disruption will occur when traditional companies must stop merely using AI for efficiency and instead adapt to serve intelligent protocols to survive in an increasingly important economic system.

The point is, we must take seriously all these seemingly odd experiments we’re seeing today. Yes, we can easily spot flaws now—but those flaws will eventually be solved. What matters is understanding what changes will emerge when all these technologies finally work together.

Ai16z

ai16z is a fully AI-managed, tokenized venture capital DAO. On this platform, agents evaluate investment opportunities proposed by the community, execute trades, assess member reputation based on trade performance, and grow the fund’s assets under management (AUM). Over recent weeks, fueled by its bold vision and strong viral momentum (think ai16z, marc aindreessen, flip a16z), it experienced a wild speculative surge. They’re expected to activate agent trading and launch their “virtual trust market” in the coming weeks.

My interest in Ai16z goes beyond it being just a fund. It’s an attention network and coordination hub—an integrated system combining memory tokens, agent launchpad, and social graph. Once trading begins, the anticipated flywheel effects could be extraordinary.

Let me explain.

Technical Flywheel. They’ve developed Eliza, an open-source framework that many top crypto projects are building on and contributing to. For anyone wanting to create crypto agents, it’s rapidly becoming the default technical choice. They also offer a “standard protocol”: if you build on Eliza and donate 10% of your token supply to the DAO, you’ll be added to their portfolio list and receive project support.

As more people seek access to this project’s attention base, more will build on this tech, donate tokens, and increase the DAO’s AUM. More builders mean better technology, which attracts even more developers, increasing donations, improving tools, and expanding attention further—a powerful compounding cycle.

Social Flywheel. Their virtual trust market allows token holders to submit trade ideas to agents, earning reputation and influence based on success. High reputation scores and leaderboard rankings aren’t just socially desirable—they economically influence whether agents buy the assets you hold.

I expect many will engage in this “game,” driving demand for the token. People will promote their rankings, attracting more participants, enriching the social experience, reducing sell pressure, and further boosting token demand.

Economic Flywheel. The DAO’s core mission is to become an efficient trading entity and grow its AUM. All assets held by the DAO are public, and due to high visibility, any trade they make will be rapidly copied (much like how followers replicate trades from a reputable trader’s Telegram channel).

The virtual trust market ensures agents are well-informed, making smarter trades that get replicated—spreading memetic effects and triggering market reflexivity. AUM will grow rapidly, attracting more attention, leading to more copy-trading, and so on.

Clearly, many challenges remain (e.g., complex reputation mechanics, graceful exit strategies), but the potential for rapid evolution is undeniable. While the current price is 100x its present AUM—which sounds insane—is it really?

Interface

If you follow us or are active in the Ethereum ecosystem, you’ve likely heard of Interface. It’s a social trading product built on streams of on-chain activity, similar to Twitter’s “For You” and “Following” feeds. They’ve been developing for years with a loyal core user base, but recently hit an inflection point—growing at a steady 50% week-over-week for months.

Interface passed SC06 at the end of 2023. They’re a technically strong, crypto-native team with a unique vision for the future of on-chain social. I’ve long believed on-chain trading is inherently social and serves as a far better starting point for new social networks than competing purely on content.

Over the past year, they’ve made significant product progress. For those who spend time on-chain, the product has become increasingly useful. But until recently, they struggled to attract a broader audience—lacking a standout feature or clear “aha moment.”

Months ago, they launched a “copy trade” feature allowing users to seamlessly replicate any trade directly from the feed, with fees going to the original trader. Since then, user growth and daily active users have hit new highs.

Now, you can say about Interface: “It’s the best platform to discover and trade alpha.” Download the app, follow top-performing users, instantly view new trades, copy them, and profit.

Once users experience the core value—making money—they naturally begin connecting with friends, building their own following, exploring the on-chain world, and unlocking richer, more social experiences.

A truly powerful hook taps into deep human desires (like profit and FOMO), and when the product design enables quick realization of that desire, its impact is immense.

Hyperliquid

Hyperliquid is a Layer 1 blockchain and decentralized perpetual futures exchange known for “top-tier speed, liquidity, and pricing.” I’ve been using it for a while to dive deeper into perpetual trading. After trying multiple platforms, Hyperliquid is clearly the best. Over the past year, their volume and total value locked (TVL) have grown significantly—according to DefiLlama, their derivatives volume now exceeds all other chains. They’re about to launch the HYPE token with several unique features worth noting.

We all know the recent trend: chains with low circulating supply and high fully diluted valuations (FDV). Typically, these projects raise large private funds, run testnet mining campaigns, airdrop small amounts, list on centralized exchanges (CEX), attract investors with high FDVs, leave communities disadvantaged or worse, and fail to foster meaningful on-chain development.

Hyperliquid is taking a completely different path:

-

No venture capital (VC) funding raised

-

Building both an L1 and a product unmatched in its category

-

No team fees—100% of revenue goes to the protocol

-

High circulating supply with most tokens allocated to early users

They could have easily raised big money and cashed out. Instead, they rejected short-term incentives to build for long-term success. They understand the importance of neutrality and avoiding insider control to fulfill their vision of becoming “the platform where all financial activity happens.”

I sincerely hope this model succeeds and becomes a powerful example for others to follow.

GenZ App Usage Trends

This week, TechCrunch published a great piece analyzing key 2024 trends and app usage among Gen Z. For anyone building consumer, especially social consumer, products, understanding Gen Z’s interests and behaviors is critical. They’re trendsetters, highly socially active, constantly forming new connections, and eager to try new things.

Nikita Bier once shared an interesting stat: from ages 13 to 18, sharing rate drops 20% per year. So if your target user is older, you’ll likely pay more for user acquisition. In recent years, every successful social product gained traction by spreading rapidly among youth.

If you're building consumer-facing products, read this article. Key highlights include:

-

Temu, the gamified e-commerce platform, was the most downloaded app of 2024.

-

A new app called ShortMax is gaining buzz in short-form video entertainment, blending TikTok and Netflix with swipeable scripted micro-series.

-

Threads is Meta’s most downloaded product, significantly outperforming Twitter.

-

ChatGPT and Gauth, an AI-powered learning assistant by ByteDance, stand out in the AI space.

-

All traditional streaming apps lagged in downloads, though usage data is needed to determine if this reflects saturation.

Dopamine everywhere. Amazing.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News