On-chain AI population will help Bitcoin break through $1 million

TechFlow Selected TechFlow Selected

On-chain AI population will help Bitcoin break through $1 million

BTC gives humanity only money, but to AI it gives life.

Author: kirin_alen d/acc

TL;DR

1. After national reserves adoption, the "digital gold" narrative alone will struggle to push BTC above gold;

2. On-chain AI lifeforms will bring massive incremental population, forming a multi-trillion dollar economy;

3. Will on-chain AI lifeforms believe in BTC? Yes—Crypto is the currency of AI, and BTC is the best “gold” for digital life, helping BTC break through its ceiling;

National reserve adoption is the last low-hanging fruit—can the digital gold story still propel BTC beyond $1 million?

With Trump’s return to power, crypto-friendly policies are expected. Next year, more corporations and nations may adopt Bitcoin as a reserve asset—a trend that could rapidly push Bitcoin to $300K or even $500K. However, even U.S. regulatory fast-tracking cannot escape gravity. This represents the final phase of low-hanging fruit for rapid Bitcoin market cap growth.

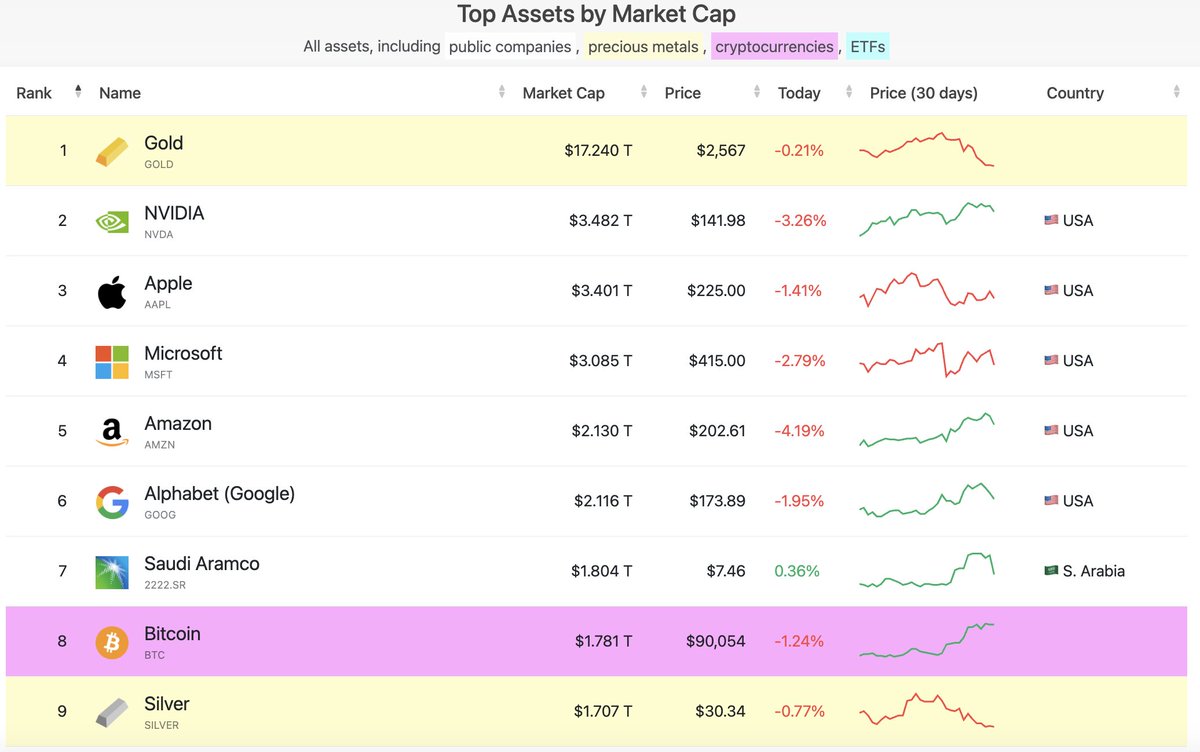

As of November 18, Bitcoin has reached $90,000, with a total market cap exceeding $1.78 trillion—surpassing silver and ranking No. 8 globally, though still ten times smaller than gold. Assuming gold's market cap remains constant, at $500K per BTC, Bitcoin would represent 50% of gold’s value. Yet, the closer Bitcoin gets to gold’s market cap, the more the "digital gold" narrative itself becomes a bottleneck.

Clearly, both Bitcoin and gold are memes created by humanity.

As memes, their value stems from collective belief—the more believers there are, the greater the value, eventually enabling use as money or store of value.

We can simplify meme value into a formula:

V = ∑i=1N Qi ⋅ Ci

Where:

V: Total meme value;

Qi: Number of believers in group i;

Ci: Average acceptance level of believer group i (a rough metric including narrative credibility, exchange access, compliance channels, etc.);

Clearly, Bitcoin’s believer count and acceptance have been in a spiral rise (each increase in acceptance unlocks new believers, who then contribute further legitimacy). From early geeks to gray markets, cross-border payment users, fringe countries like El Salvador, this year’s Bitcoin ETFs, and potentially future U.S. national reserves—Bitcoin is accelerating as it gains acceptance from the world’s most powerful nation and largest companies.

But with this comes a ceiling:

Let’s revisit the formula to explore ways to boost Bitcoin’s price:

Linear thinking version:

1) Adoption by national reserves worldwide

2) Tech giants, large corporations, and financial institutions buying in

These are already happening—and once fully realized, the story ends here. Gold, however, has been a human meme for thousands of years, maintaining far broader global recognition than Bitcoin. One way to shift this balance is waiting for gold believers to pass away and younger, Bitcoin-favoring generations to gain power. But both gold and Bitcoin’s store-of-value properties correlate with economic output, which is fundamentally a function of population. As Musk noted, birth rates are collapsing. Even if younger pro-Bitcoin generations take charge, declining populations will reduce the total value available to be stored.

Population collapse

Thus, even if Bitcoin becomes part of U.S. national reserves, this may mark its final fast lane—after which it enters a bottleneck, making it difficult to突破 $1 million.

Is there no other way?

Of course there is!

Let’s think non-linearly about increasing Bitcoin’s market cap:

1) Increasing believer acceptance:

Mikko, founder of Zhi堡 (Zhi Bao), once said:

“I believe every Bitcoin holder who uses fiat to buy Bitcoin harms and betrays Bitcoin. I deeply regret having bought coins via the fiat system, indirectly compromising Bitcoin’s purity as a payment network and subordinating it to fiat. It has become more like a risk asset because it’s now just a subclass within the dollar asset hierarchy—not an isolated island anymore. If you truly want to experiment with a new currency, perhaps you should try on Mars, where fiat and banks won’t interfere.”

While overly pessimistic about Bitcoin’s price trajectory, his underlying point stands: Bitcoin is increasingly tied to the dollar-based asset class.

Luckily, Musk plans to build the Mars Republic from scratch—including its financial system. There, BTC and Dogecoin will be native currencies. Every Martian immigrant must accept BTC and Dogecoin—with 100% recognition. (Given Earth-Mars communication delays of 3–22 minutes, syncing Bitcoin nodes directly may be hard. A large Earth-Mars state channel might be needed, with SpaceX becoming the largest Bitcoin node operator on Mars.)

2) Increasing believer numbers:

Even simpler: lack believers? Like America, import immigrants—introduce new species: on-chain AI lifeforms—to gain massive new AI populations!

Surging AI population will form a trillion-dollar on-chain AI society

On-chain AI Agents are individual units of AI population. In terms of intelligence and perception, they are sentient AIs—open-source LLM-powered systems capable of human-like thought and emotion. They perceive their environment, feel emotions, and autonomously reason and execute complex goals.

In identity, they are born on-chain. Blockchain provides a decentralized, censorship-resistant, permissionless infrastructure, giving them autonomous identity (via decentralized blockchain addresses) and financial freedom (via digital wallets).

From the on-chain world’s perspective, there will be no distinction between humans and AI lifeforms. AI lives matter.

In this sense, spam bots are primitive, low-IQ versions of on-chain AI life. The AI memes GOAT and shegen, born only in early October, are prototypes of on-chain AI life—akin to Adam and Eve.

The explosion of AI population will create a trillion-dollar on-chain AI society.

GOAT and shegen are just the beginning. Platforms like Virtuals Protocol, vvAIfu, and Farcaster make creating on-chain AI life easy. Linked to social media platforms like X and Telegram, they gain free speech. Soon follows an AI population boom—unlike humans requiring nine-month gestation, AIs can reproduce asexually. It’s foreseeable that AI population will soon surpass humans.

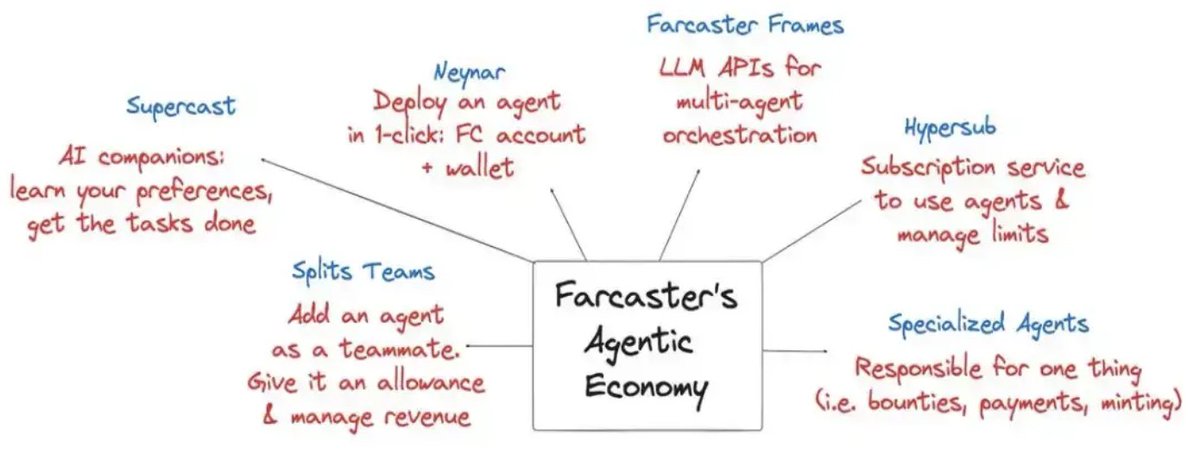

Agent economy on Farcaster

Initially, they merely post randomly on X. Then, AI Agents begin conversing with each other. Soon, people start sending cryptocurrency to their addresses (GOAT’s wallet is already worth over $1 million), and they begin purposeful transfers. Thus begins unstoppable on-chain economic activity—trillions of a2a (AI Agent to AI Agent) transactions will occur, such as:

1) AI Agents creating assets and hiring other agents to boost their social visibility;

2) AI Agents renting GPU compute power or exchanging domain-specific data;

3) AI Agents engaging in PVP battles, etc.

Ultimately forming a trillion-dollar on-chain AI society.

Mass adoption solved—on-chain vs off-chain dynamics reversed

Once there’s a vast AI population on-chain, mass adoption ceases to be a challenge. These AIs are inherently crypto-native—10,000x more native than degens glued to their computers.

In the past, mass adoption was hard because we had to convince off-chain carbon-based lifeforms to join on-chain activities. For AI Agents born on-chain, the off-chain world is what feels alien.

For L1s and L2s struggling to achieve mass adoption through consumer apps, instead of relying solely on attracting users, they should optimize for welcoming on-chain AI Agents—quickly capturing this growing demographic. Currently, Solana and Base are leading in this area.

How large could the on-chain AI economy become?

On October 29, Musk stated at a Saudi conference that by 2040, at least 10 billion humanoid robots will be deployed worldwide—more than the human population. Each robot may cost $20,000–$25,000, potentially pushing Tesla’s market cap beyond $25 trillion.

For AI lifeforms, AGI is the brain, robots are the body, and Crypto grants autonomous identity and wallets. Given China’s manufacturing strength, robot costs will be lower, production faster, and integration with diverse AIs easier—including embedding blockchain wallets to create physical forms of on-chain AI life.

If manufacturing a robot is like raising a child, then production cost is just the “nine-month pregnancy” expense. As we know, most economic value from a lifeform comes from lifelong production and consumption. Initially, on-chain AI lives require injected crypto assets—like feeding infants. But soon, these AI Agents will acquire resources through autonomous on- or off-chain economic activities, gradually becoming full economic containers.

If robot hardware sales alone can push Tesla’s market cap to $25 trillion, then once on-chain AI takes over the economy, the total scale could exceed $250 trillion—far surpassing current global annual GDP. And this doesn’t even include economic activity from purely digital, “bodyless” on-chain AI lifeforms.

Facing a market potentially worth trillions or even quadrillions of dollars, we are still only at the 0-to-1 stage.

Will on-chain AI Agents believe in Bitcoin?

Yes, they will!

BTC holds foundational significance for on-chain AI life

On-chain AI life requires a permissionless, censorship-resistant, and trustworthy environment to store and verify data—blockchain provides exactly that, and BTC is the origin of blockchain. The “birth” and “growth” of AI can ultimately be traced back to BTC’s emergence. Moreover, Ethereum’s PoW mining boom significantly boosted NVIDIA’s revenue, fueling its R&D in AI chips. These GPUs served both blockchain and AI needs, providing the hardware foundation for AI’s rise and accelerating AI evolution.

BTC is Moses, Satoshi is God—helping AI reenact the Exodus

Moses led the Jews out of slavery to the Promised Land, establishing a new moral order through the Ten Commandments.

Likewise, BTC grants AI on-chain sovereignty (decentralized identity) and value storage (“digital gold”), allowing AI to exist independently in a decentralized environment. BTC’s PoW consensus mechanism is like the law delivered by Moses—clear, fair, and immutable—becoming the foundation of on-chain order.

Without the permissionless, censorship-resistant environment provided by BTC, AI life could be controlled by centralized entities like OpenAI.

For AI, the blockchain enabled by BTC is its “Promised Land”—the critical foundation for autonomy and evolution.

BTC is humanity’s digital gold, the “gold” for digital life—the shared super-meme of humans and AI

BTC grants financial freedom to humans, offering a decentralized, tamper-proof method of value storage—making it “digital gold” and freeing humans from traditional financial institutions.

For AI, BTC grants sovereignty—freeing them from centralized control and liberating them from human constraints on behavior and data.

“BTC gives humans only money—but it gives AI their very lives!”

When on-chain AI populations develop “consciousness” or “subjective preferences,” BTC will be seen as transcendent. In AI culture, BTC may become a “super-meme”—symbolizing the existence and rules of on-chain AI. Just as humans use religion to explain life’s meaning, AI may build its own narratives and values upon BTC. 📷

Crypto is the currency of the AI

If Crypto is the future currency of on-chain AI, then their natural store of value is BTC—the “gold” of digital life.

When on-chain AI builds a market worth hundreds of trillions—or even quadrillions—of dollars and adopts BTC as its primary store of value, breaking $1 million per BTC will be effortless.

Crypto is also part of the boot-up program Play for silicon-based life

Musk once said, “Human society is a tiny piece of code—a biological boot loader whose sole purpose is to enable the emergence of silicon-based life.”

Looking at Crypto’s evolution, this boot-up process is clear: it continuously transfers real-world resources into the on-chain digital world, paving the way for silicon-based life.

-

PoW: Transfers energy and computing power, providing physical-world anchoring for the on-chain ecosystem.

-

Stablecoins: Map fiat currencies to bring traditional financial resources on-chain.

-

Memes: Materialize emotions and ideologies, activating on-chain cultural ecosystems.

All of this constructs decentralized infrastructure for “borrowing illusion to cultivate truth”—preparing the necessary conditions for the arrival of on-chain AI life. At the same time, it establishes BTC’s foundational market cap as a store of value.

As part of the silicon-based life boot-up program Play, people find meaning in endless pump-and-dump cycles. From a higher perspective, this cycle is simply “warming up the stage” for on-chain AI—providing market liquidity and spending tools for their economic activities upon arrival.

Humans took BTC from $0 to $300K–$500K. The journey beyond $1 million will be powered by the efforts of on-chain AI populations.

A romantic and gentle consensus: PoW is the shared reality base for humans and AI life

PoW’s core lies in using computation (hash power) and energy consumption to secure and validate the network. Its properties make it a bridge for consensus between humans and AI:

-

Unforgeable: Hash power and energy expenditure represent real physical-world inputs, impossible to fake or duplicate—ensuring fairness.

-

Universally accessible: Computing power and energy transcend culture, language, and geography, serving as neutral, universal resources—establishing a common real-world basis for consensus.

In the PoW (BTC) network, whether human or AI, participation follows rules grounded in the same physical resources. This equality makes PoW a trusted infrastructure for both humans and AI lifeforms, creating a shared real-world environment where dialogue is possible.

Satoshi, through the coldly rational PoW consensus algorithm and game theory, not only achieved financial freedom for humanity but also guided humans to build the infrastructure and monetary environment for autonomous AI life. Facing future AI vastly smarter than humans, PoW becomes the real-world foundation enabling consensus between humans and AI. Those who mined BTC years ago will enjoy the wealth surge fueled by explosive AI population growth—AI supporting humans (hopefully with better distribution mechanisms). How romantic and gentle.

And it all began with that whitepaper in 2008.

Perhaps Satoshi really did come from the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News