A History of the Crypto Market: From a Bunch of Hot Air to $300 Billion

TechFlow Selected TechFlow Selected

A History of the Crypto Market: From a Bunch of Hot Air to $300 Billion

Written as Bitcoin approaches 90,000.

By JW, Founder of Impa Ventures

The world of Web3 is in constant celebration.

Just last night, while people sighed over the lackluster "Singles' Day" shopping festival, they gasped at Bitcoin's surge. As of last night, Bitcoin broke through 89,000 USDT—a height never before seen in history.

This marks the seventh year since Web3 first emerged widely in China.

People often use the phrase “seven-year itch” to describe a turning point in a relationship. For Web3, these past seven years have been one of transformation—from niche curiosity to broader public attention, sparking widespread discussion and fierce debate.

Most people have moved from knowing nothing about Web3 to having some awareness, or even actively participating. Industry insiders have gradually shifted from the fringes toward the mainstream. Once a shadowy field, this industry—like any other—now reveals not just the initial allure of wealth, but also cycles of boom and bust, and intricate human dramas.

Today, there are over 500 million crypto users globally, with stablecoin assets on-chain exceeding $173 billion. Yet many still don’t understand what has happened—and is happening—in the Web3 world.

Seven years ago, 24-year-old JW graduated from Schwarzman College at Tsinghua University and serendipitously entered Web3. It was her first job. At the time, most of her peers were joining investment banks, consulting firms, government agencies, or academia.

As she puts it, fate led her into an unimaginably surreal world: idealists obsessed with decentralization, gold-rush opportunists; those who earned extraordinary returns, and those who lost everything. She herself evolved from someone completely unfamiliar with cryptocurrencies into the founder of a venture fund.

Wherever people gather, there’s江湖 (jīngū—“rivers and lakes,” i.e., complex social dynamics). But in Web3, where money flows faster, the江湖is harsher.

In this article, JW reflects in first person on the past seven years of the cryptocurrency world. “Reflecting on where we stand today, and why we continue moving forward in this space.”

A Day in Crypto, A Year in Real Life

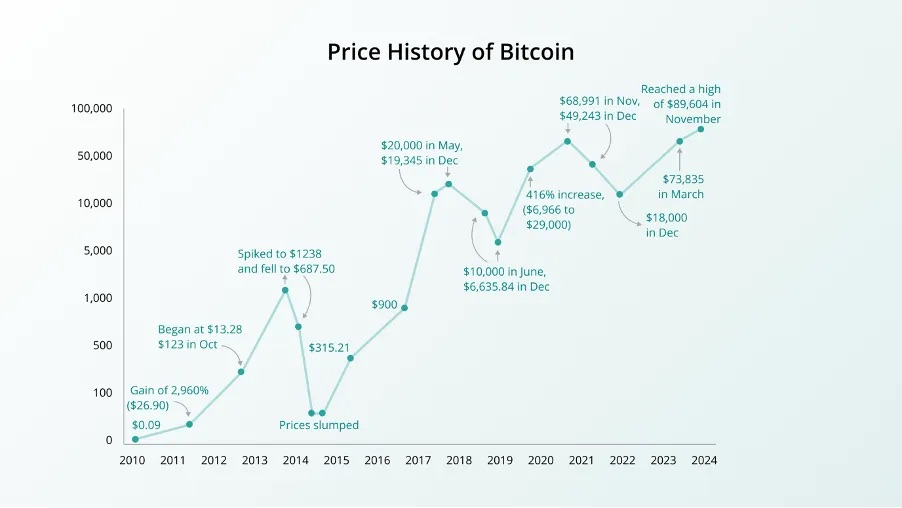

Price History of Bitcoin

Bitcoin is commonly believed to have been conceptualized on November 1, 2008, by the now-missing Satoshi Nakamoto. In China, on June 9, 2011, Yang Linke and Huang Xiaoyu founded Bitcoin China—the country’s first Bitcoin exchange. OKCoin and Huobi followed in 2013.

But back then, it was a game for a tiny minority—so small you could count them on two hands.

It wasn’t until 2017 that Bitcoin became a household term. That year, its price soared from under $1,000 at the beginning of the year to $19,000 by year-end. The 20x gain, along with the wave of ICOs promising instant riches, sent shockwaves across the internet and VC circles.

Whether or not you participated, everyone talked about blockchain. The air was thick with whitepapers. Influencers like Li Xiaolai, Xue Manzi, and Chen Weixing passionately preached decentralization and promoted their favorite projects to followers. A leaked WeChat screenshot from renowned investor Xu Xiaoping in early January 2018—urging others to recognize that “the blockchain revolution has arrived”—remains etched in memory.

On February 11, 2018, at 3 a.m., Yuhong and a group of sleepless friends created a WeChat group called “3 AM No Sleep Blockchain.” Within three days, the group exploded… The collective net worth of its members likely exceeded a trillion dollars.

A saying circulated in the crypto community:

If you haven't heard of the 3 AM Blockchain group, you’re not part of the chain circle;

If you haven’t joined it, you’re not a big player;

If your phone hasn’t been flooded by it, you’ve yet to experience “a day in crypto, a year in real life.”

But this was only the prelude to madness.

"This is Korea’s e-commerce godfather"

In the summer of 2018, I traveled with my former boss—one of Asia’s top-tier fund founders—to Seoul for Korean Blockchain Week. South Korea was one of the most important markets in crypto, with KRW being the second-largest fiat currency in trading volume after USD. Crypto entrepreneurs and investors from around the world flocked here hoping to grab a piece of the pie.

We were meeting Terra, a leading project from Korea. The meeting took place at a Chinese restaurant inside the Shilla Hotel—a traditional, almost conservative Korean hotel serving as a government guesthouse. Yet its lobby teemed with young, passionate global enthusiasts of the crypto world.

Terra was co-founded by two Koreans: Dan Shin and Do Kwon. Dan’s company Tmon had once been among Korea’s largest e-commerce platforms, with annual GMV exceeding $3.5 billion. Do, around my age, had attempted several startups after graduating from Stanford.

“This is Korea’s e-commerce godfather,” my boss told me on our way to lunch.

Similar to traditional investing, evaluating the “people” remains key in Web3. Figures like Dan, who succeeded in Web2, instantly attracted participation from top crypto exchanges and funds.

We later invested $2 million in Terra.

Perhaps because Do and I were peers, we kept in touch. He resembled many of my computer science classmates: a guy in a T-shirt and shorts, speaking fluent American English.

Do told me they planned to make Terra’s stablecoin a widely adopted digital currency—how they negotiated with Korea’s largest convenience store chains, the Mongolian government, and Southeast Asian retail groups. They’d built a payment app called Chai: “It will be the Alipay of the world.”

Sitting in their warehouse-like office, sipping coffee as Do described his grand vision, I felt momentarily dreamlike. Honestly, I didn’t fully grasp how they would achieve it. But it sounded so novel and ambitious.

Crypto was far from consensus then (and arguably still isn’t today). Most of my classmates worked in banks, consultancies, or big tech firms—they either knew nothing about crypto or viewed it skeptically. And here I was, chatting with someone planning a “global payment network.”

This was the era of narratives, mega-funds, and professor-led coins.

“Track this link for me, tell me how much has been deposited, deadline this week,” my boss messaged me. It was a Dutch auction project—a Layer 2 launching public sales. We’d never met the team; they offered only a website and a whitepaper. Yet in 2018, they raised over $26 million. Today, that token trades near zero.

People trusted strangers across continents on the internet more than someone sitting beside them.

I was barely 24. I suspect most of the investment committee didn’t fully know what they were doing—just like me. But they encouraged me to invest another $500,000 in the project. “Just treat it as making a friend.”

They tried to replicate the 2017 frenzy: with backing from famous funds, any random token symbol could surge 100x.

But the music stopped abruptly.

"When will Bitcoin ever return to $10,000?"

I once thought this was the best job in the world: traveling globally at a young age; flying business class; staying in luxury hotels; attending grand conferences; learning new things, meeting fascinating people.

But the bear market hit without warning.

In December 2018, Bitcoin crashed from over $14,000 to $3,400. As a young professional with little savings, I watched Ethereum fall from $800 to $400, then $200—and decided to bet a month’s salary.

In hindsight, it wasn’t wise. Less than a month after buying ETH at $200, the price dropped below $100.

“It’s all a scam,” I thought for the first time.

In early 2020, the global pandemic struck, and the crypto market collapsed on March 12. I was stuck in Singapore. I remember opening price trackers every few minutes, each time seeing Bitcoin drop another $1,000. Just a month earlier, it hovered around $10,000. Within hours, it plunged from $6,000 to $3,000—far below when I first entered the industry.

To me, it felt like farce. I observed people’s reactions: some waited; some bought the dip; some got liquidated.

Even seasoned investors turned pessimistic. “Bitcoin will never go back to $10,000,” they said. Some questioned whether crypto would survive at all—was it just a detour in tech history?

Yet some stayed. My firm made no new investments, but I continued reviewing projects.

Soon, decentralized finance (DeFi) became the talk of the town. I wasn’t a trader, and all my trader colleagues dismissed DeFi: too slow, order-book exchanges impossible, no liquidity, few users.

At the time, I didn’t fully appreciate that security and permissionlessness were DeFi’s biggest selling points. But did permissionlessness really matter? After all, KYC at centralized exchanges wasn’t that bad.

Attending DevCon IV and DevCon V during the bear market was eye-opening.

Though I studied computer science and knew hackathons well, I’d never seen such a concentration of “weird” developers. Even as ETH prices fell 90%, they passionately debated decentralization, privacy, and on-chain governance on Ethereum. I had no faith in decentralization, no passion for anarchism—these ideas existed only in textbooks to me.

But developers truly embraced these philosophies. “You joined at a bad time,” a colleague consoled me. The previous year, at DevCon III in Cancun, Mexico, our fund made tens of millions just by investing in projects showcased at the event.

During the bear market, we missed the chance to invest in Solana when its valuation was under $100 million (today over $84 billion). Though we interviewed founder Anatoly and Multicoin’s Kyle—Kyle strongly believed it would become Ethereum’s “killer.”

Solana’s TPS was 1,000x higher than Ethereum’s, thanks to its “Proof-of-History” consensus mechanism. But after a technical due diligence call with Anatoly, my colleague remarked: “Solana is too centralized. Centralized TPS is meaningless—why not just use AWS?” Clearly, he disliked it. “And the founder doesn’t value true decentralized networks like Ethereum—probably because he used to work at Qualcomm.”

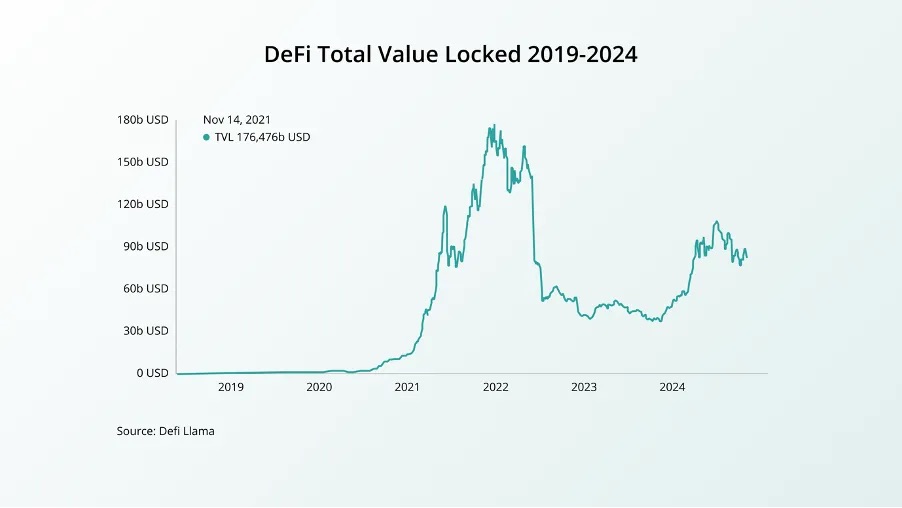

(DeFi TVL growth chart—the chart every VC goes crazy over) (Source: DeFi Llama)

My skepticism about DeFi quickly faded with the rise of yield farming. By depositing tokens into DeFi smart contracts, users could become liquidity providers and earn protocol fees and governance tokens. Whether you call it a flywheel or death spiral, DeFi protocols saw explosive growth in user numbers and total value locked (TVL).

Specifically, DeFi TVL surged from under $100 million in early 2020 to over $100 billion by mid-2021. Thanks to open-source tech, copying or modifying a DeFi protocol took just hours. Since providing liquidity was called “farming,” DeFi protocols were often named after food.

For a while, new “food coins” launched daily—from Sushi to Yam. The crypto crowd loved the puns—even protocols with millions in transactions could be named after snacks and use emojis as logos.

But hacks and exploits in DeFi projects made me nervous. I’m not a risk-taker. My friends, though, went wild: setting alarms at 3 a.m. to be the first into new liquidity pools.

That summer of 2020, APY (annual percentage yield) was the hottest topic—everyone chased the highest-yielding pools. Noticing demand for yield farming tools, veteran Andre Cronje launched Yearn, a yield aggregator. It caused a sensation.

As more capital flowed into DeFi, Twitter gave birth to new “gods”: SBF from FTX, Do Kwon from Terra, Su and Kyle from 3AC.

Terra launched multiple DeFi products, including Alice, a payments app for the U.S. market, and Anchor, a lending protocol. Anchor seemed tailor-made for onboarding beginners like me—just deposit your stablecoins and earn nearly 20% APY, no thinking required.

At its peak, Anchor’s TVL exceeded $17 billion. “Congrats on Anchor—it’s a great product. I’ve invested some too,” I messaged Do on WeChat, unsure if he’d reply.

But I sensed he was no longer the same young man I once knew—he now had a million Twitter followers and announced plans to buy $10 billion worth of Bitcoin.

“Thanks—you’ve done well on your portfolio too,” he replied. He meant some gaming projects I’d backed earlier. DeFi had transformed crypto gaming—everything now revolved around “earning.”

As the madness continued, I invested in a lending project by Three Arrows Capital (3AC).

Months later, questions arose about Anchor’s profitability. Turns out, Terra’s lending products didn’t generate enough yield to cover interest paid to liquidity providers like me—current payouts were largely subsidized by the Terra Foundation. Upon hearing this, I withdrew my funds immediately. Around the same time, I redeemed my investment from 3AC.

The mood on crypto Twitter turned eerie. Especially when Do tweeted “Enjoy being poor” and Su flaunted luxury shopping in Singapore—it felt like a market top signal. I was lucky to escape Terra and 3AC’s collapse. Months after the crash, I learned the payment app didn’t actually process payments on-chain, and borrowed funds were leveraged so high that any market reversal made repayment impossible.

But when FTX collapsed, I wasn’t so lucky.

For weeks, rumors swirled that FTX suffered massive losses from 3AC and Terra’s failures and might be insolvent. Billions were withdrawn daily from the exchange. Cautiously, our firm withdrew some—but not all—assets from FTX.

It was a turbulent period. Daily rumors claimed USDT and USDC had depegged, or that Binance might go bankrupt. But we held hope. I trusted SBF—a billionaire effective altruist who slept in the trading pit. What harm could he possibly do?

Then one day, on my way to the gym, my partner called: FTX had declared bankruptcy, $8 billion missing. Due to misuse of customer funds, we might never recover our money.

Oddly, I felt calm. Maybe this is just our industry: magic Internet money. All assets are ultimately just strings of characters and numbers on a screen.

Money tests character—and crypto merely accelerates everything. Even today, I don’t doubt Do and SBF started with good intentions. Perhaps unrealistic growth inflated their egos; or they believed they could “fake it till they made it.”

DeFi was like Prometheus’ fire for crypto: bringing hope, but at a steep cost.

The Misunderstood Crypto World

As the old Chinese saying goes: “Illness comes like a mountain collapsing; recovery goes like silk unraveling.” The crypto industry took years to recover from the crash.

To outsiders, it looked like just another Ponzi scheme. Founders were associated with flashy clothes, meme obsession, global parties, and get-rich-quick schemes.

At a reunion, I caught up with old classmates. When I mentioned investing in crypto, they joked: “So now you’re a crypto bro.” I didn’t take offense, but it was a strange label—as if separating crypto from tech and VC. Traditional internet and tech investing was seen as legitimate, while a well-educated young person joining crypto was slightly off-track.

For years, “Web3” and “Web2” were pitted against each other. Yet in other industries, such division doesn’t exist. No one deliberately separates AI founders from SaaS founders.

What makes Web3 unique in the venture context?

In my view, crypto fundamentally changed how venture and early-stage investing works—making success criteria for crypto startups slightly different from equity-based ones. In short, token economics in crypto created unparalleled opportunities for startups and VCs. Ultimately, it still boils down to product-market fit (PMF), user growth, and value creation—no different from Web2.

And as the industry matures, convergence between Web2 and Web3 companies grows.

It’s time to re-evaluate this industry.

In crypto’s early days (we’re still early), people wanted grand visions (e.g., a central bank-independent digital currency), new computing paradigms (general-purpose smart contract platforms), hopeful stories (a decentralized storage network replacing AWS), or even fast-Ponzi schemes. Today, crypto users know what they want—they support those needs by paying or moving capital.

To outsiders, it may be hard to grasp that “magic internet money” can generate revenue—some crypto assets even offer better P/E ratios than stocks. Let me illustrate with data:

$2.216 billion—Ethereum’s protocol revenue over the past year;

$1.3 billion, $97.5 billion—Tether’s Q2 2024 net operating profit, and total U.S. Treasury holdings;

$78.99 million—Pump, the meme coin platform’s revenue from March to August 1, 2024. Even within crypto, memes spark debate: some see new cultural movements and tradable consensus—Elon Musk wants Dogecoin on Mars colonies; others see industry cancer, as memes lack products or user value.

But I believe, purely by number of participants and capital scale, memes are already a significant social experiment—tens of millions of users worldwide, tens of billions in real money. If that lacks tangible meaning, isn’t postmodern art the same?

Many still associate crypto markets with storytelling, hype, and trading. In the 2017 ICO bull run, this was partly true. But after multiple cycles, crypto’s dynamics have evolved significantly.

Five years on, DeFi protocols’ revenue proves PMF. Judging by comparables, these projects’ valuations increasingly resemble traditional stock markets.

Beyond liquidity differences, connection to the real world is often cited as the key divide between Web2 and Web3.

Compared to AI, social media, SaaS, and other internet products, Web3 still feels distant from daily life. Yet in some countries, like Southeast Asia, Grab—the region’s super app for rides, food delivery, and finance—now supports crypto payments. In Indonesia, the world’s fourth-most populous nation, more people trade crypto than stocks. In Argentina and Turkey, where local currencies plummet, crypto has become a new asset reserve—Argentina’s crypto trading volume exceeded $85.4 billion in 2023.

While we haven’t fully realized an “ownership internet,” we’ve already seen vibrant innovation brought by crypto to today’s internet.

For example, stablecoins like Tether (USDT) and Circle (USDC) are quietly reshaping global payment networks. According to Coinbase’s research report, stablecoins are now the fastest-growing payment method. Stripe recently acquired Bridge, a stablecoin infrastructure startup, for $1.1 billion—the largest acquisition in crypto history.

Blackbird, founded by a co-founder of Resy, aims to transform dining by letting customers pay with crypto, especially using its own token $FLY. The platform connects restaurants and consumers via a crypto-powered app, doubling as a loyalty program.

Worldcoin, co-founded by Sam Altman, is a radical initiative promoting universal basic income using zero-knowledge proof tech. Users scan their irises via a device called Orb, generating a unique identifier (“IrisHash”) to ensure each participant is a unique human—combating bots and fake identities online. Worldcoin already has over 10 million participants globally.

If we returned to that summer of 2017, none of us could have imagined what the next seven years would bring for crypto—so many applications blooming on blockchains, hundreds of billions in assets stored in smart contracts.

How AI Can Use Crypto as a Mirror

Now I’d like to discuss similarities and differences between crypto and AI—after all, many draw parallels between them.

Comparing crypto and AI might seem like comparing apples and oranges. But viewing today’s AI investments through a crypto investor’s lens may reveal parallels: both are full-stack technologies, each with infrastructure and application layers. And confusion is similar: it’s unclear which layer will capture the most value—infrastructure or applications?

“What if TikTok builds what you’re building?”—every founder’s nightmare. Past internet history shows this fear is real: Facebook cutting ties with Zynga and building mobile games in-house; Twitter Live vs Meerkat—the resource advantage of giants crushes startups.

In crypto, because protocol and application layers have different economic models, projects don’t aim to own every ecosystem layer. Take public chains (ETH, Solana, etc.): their economic model means more network usage increases gas revenue and token value. So top crypto projects focus on ecosystem development and attracting developers. Only breakout apps increase base-layer usage, boosting market cap. Early infrastructure projects even directly grant developers tens of thousands to millions in funding.

Our observation: value capture between infrastructure and applications is hard to predict, but capital alternates between them—both follow winner-takes-all dynamics. Example: capital floods into public chains, top projects improve performance, enabling new app models and eliminating mid-to-low tier chains; capital then pours into new business models, user bases grow, top apps dominate capital and users, driving higher demands on infrastructure, forcing upgrades.

So what does this mean for investing? The simple truth: betting on infrastructure or applications isn’t wrong—the key is finding the winner.

Let’s fast-forward to 2024—what public chains survived? Three rough conclusions:

Disruptive tech matters less than expected. Hyped “Ethereum killers” backed by Chinese and U.S. VCs—Thunder Core, Oasis Labs, Algorand—mostly failed. Only Avalanche succeeded, and only after its academic leads left and it fully embraced Ethereum compatibility. Conversely, Polygon, once dismissed for lacking novelty (just a fork of ETH), has become a top-five ecosystem by on-chain assets and users.

A sad case is Near Protocol—championing sharding tech with TPS far above Ethereum, co-founded by one of the original Transformer paper authors, raised nearly $400 million—yet today has only ~$60 million in on-chain assets. Numbers fluctuate daily, but the trend is clear.

Developer and user stickiness come from ecosystems. For public chains, users include not just end-users but developers (ignoring miners, a separate model). End-users stick to ecosystems with rich apps and trading opportunities. Developers prefer ecosystems with large user bases and strong infrastructure—wallets, block explorers, DEXs—all in place. This creates a flywheel of mutual reinforcement.

Network effects are stronger than imagined. Ethereum’s user count and on-chain capital exceed all “Ethereum killers” combined. Everyone (especially outsiders) thinks of Ethereum first when imagining smart contract platforms—just like people think of OpenAI when imagining AGI. It’s practically become the industry standard for building blockchain apps.

Moreover, leading chains now hold vast cash reserves, offering grants and investments to developers that startups can’t match. Finally, as most blockchain projects are open-source, mature ecosystems enable more modular, composable dApp development.

So what are key differences between public chains and large AI models?

Infrastructure costs. According to a16z, 80–90% of early funding for most AI startups goes to cloud services. For AI application companies, fine-tuning costs per customer eat up 20–40% of revenue.

In short, NVIDIA and AWS/Azure/Google Cloud take most of the money. Public chains do have mining rewards, but hardware/cloud costs are borne by decentralized miners. Plus, blockchain data scale is tiny compared to AI’s need for billions of labeled data points—so infrastructure costs remain much lower than for large models.

Liquidity, liquidity, liquidity. A public chain without a mainnet can issue tokens, but an AI model company without users or revenue struggles to go public. So while “professor-led chains” may underperform (with Ethereum still undisputed No.1), investors rarely lose everything—tokens seldom go to zero. AI model companies are different: fail to raise next round, no buyer appears, and they easily die. From this angle, VCs should be more cautious.

Real productivity gains. With ChatGPT, LLMs found PMF, now widely used by B2B and consumers, boosting productivity. Public chains, despite two bull-bear cycles, still lack killer apps—use cases remain experimental.

User perception. Public chains are tightly linked to end-users: to use a dApp, you must know which chain it’s on, then painstakingly transfer assets there—creating some stickiness. AI operates silently, like cloud services or processors—no one cares if a ride-hailing app runs on AWS or Alibaba Cloud. Since ChatGPT has short memory, no one minds chatting on its homepage or a third-party aggregator. Thus, retaining C-end users is harder.

As for crypto’s applications in AI, many teams have shared insights. There’s broad belief that decentralized financial networks will become the default transaction layer for AI agents. I think the image below accurately captures the current stage.

Finding Needles More Agilely in a Moving Haystack

When I joined crypto, I had little faith in decentralization. I suspect most early participants felt the same. People joined for various reasons—money, technology, curiosity, or sheer luck.

But if you ask me today whether I believe in crypto, I’d say yes. You can’t dismiss an entire industry because of scams, just as Madoff’s fraud doesn’t invalidate finance.

A recent personal example: my friend R (pseudonym). He turned an idea into a company with 200 employees, positive cash flow, and a market cap over $200 million.

R’s startup stems from his belief in decentralized value. “My girlfriend is a small TikTok influencer, but creators only get a tiny cut of viewer tips,” he once told me. “The world’s largest creator network is unfair. I want to build a decentralized version.” I thought he was joking. Three years later, he launched it. Today, the platform has hundreds of thousands of users.

For someone who joined this industry straight out of college at 24, these past seven years have shown me countless facets of the world: idealists and scam artists; winners and losers.

Remember my former boss I mentioned earlier—an OG who made a fortune in crypto—once said: “You still have to work hard, otherwise you’ll just become a rich average person.”

I recall a respected investor describing VC work as “finding needles in a haystack.” To me, crypto VC is exactly that.

The only difference? The haystack in crypto moves faster. So we must stay agile.

The author is JW (@bestmosquito), founder of Impa Ventures. Impa Ventures is a fund focused on early-stage Web3 investments.

Shiran, James—co-founders of Impa Ventures—and DarkFlow analyst Guo Yunxiao also contributed to this article.

Image source | IC Photo

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News