Aptos Phase 2 Airdrop Comprehensive Analysis: Ecosystem Expansion and Potential Opportunities

TechFlow Selected TechFlow Selected

Aptos Phase 2 Airdrop Comprehensive Analysis: Ecosystem Expansion and Potential Opportunities

This article will analyze the possibility, timing, and participation strategies for Aptos Phase 2 airdrop from multiple dimensions.

Author: Bingwa

It has been two years since Aptos' initial airdrop. Back then, simply minting an NFT on the testnet could net you over a thousand dollars in airdropped tokens. As the Aptos ecosystem continues to mature and activity intensifies, anticipation is building for a potential second airdrop. This article analyzes the likelihood, timing, and participation strategies for Aptos' potential second airdrop from multiple angles.

1. Overview of Aptos Airdrops

-

Aptos Phase 1 airdrop size: 23,454,750 APT (3% of total supply)

-

Community token pool: 510M APT (51% of total supply) Tokens used from community pool: ~130M APT Remaining available tokens: ~380M APT

-

Current token price: $9.6

-

Current market cap: $5 billion

-

The token distribution shows that the project places strong emphasis on the community, allocating as much as 51% to community incentives. The first airdrop was merely a 3% appetizer.

-

With a vast amount of tokens still reserved for future distribution, such a high allocation naturally raises expectations for a second round of airdrops.

2. Analysis of the Possibility of a Second Airdrop

Sufficient Token Reserves

The Aptos Foundation and Aptos Labs still hold approximately 380 million APT tokens yet to be released, unlocking linearly on a monthly basis. These ample reserves lay the foundation for a second airdrop. Notably, these tokens will unlock gradually over 10 years, indicating the team’s long-term planning for ecosystem development.

Ecosystem Development Needs

The Aptos ecosystem is currently in a critical expansion phase. Neil, Aptos’ strategy lead, previously stated on X (formerly Twitter):

“Aptos 2024 = Move + DeFi/RWA + AI,” signaling a strategic focus on these four areas. Once meaningful progress is achieved in these core sectors, the team may proceed with a second airdrop to further incentivize and stimulate ecosystem growth.

Move

Let's begin with Move—the foundational programming language and technological bedrock of Aptos. Building impressive applications on this foundation requires skilled developers, who are essentially the artisans crafting on the Aptos platform.

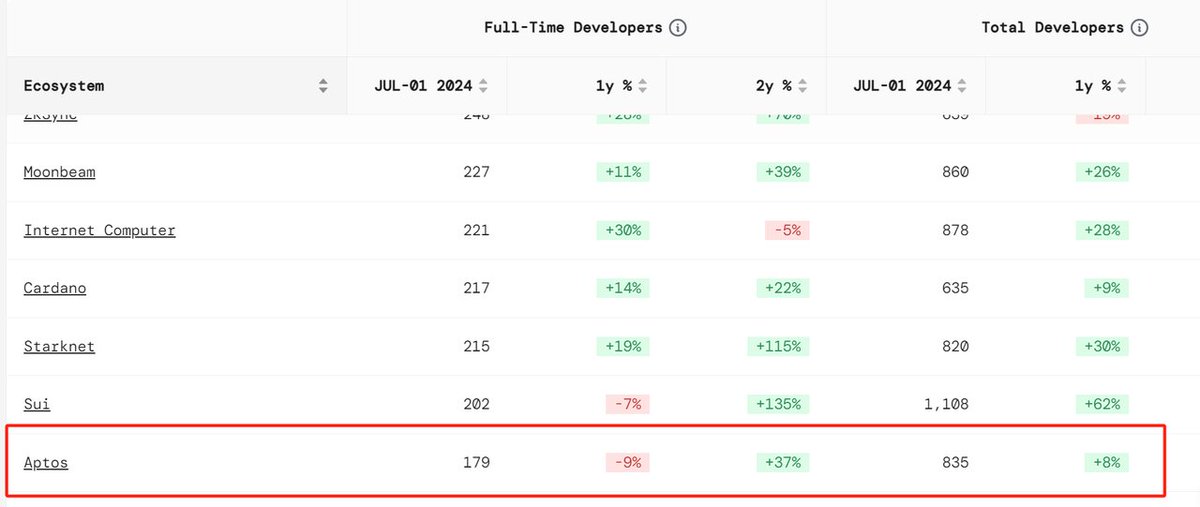

According to Electric Capital, at the beginning of this year, Aptos had around 500 monthly active developers and cumulative code commits exceeding 5 million, making it the largest Move developer community at the start of the year.

Although Sui surpassed Aptos in developer count due to explosive growth in meme and gaming projects, Aptos has maintained steady development. It currently hosts 835 active developers—a 37% increase over the past two years—showing consistent momentum despite facing strong competition.

DeFi

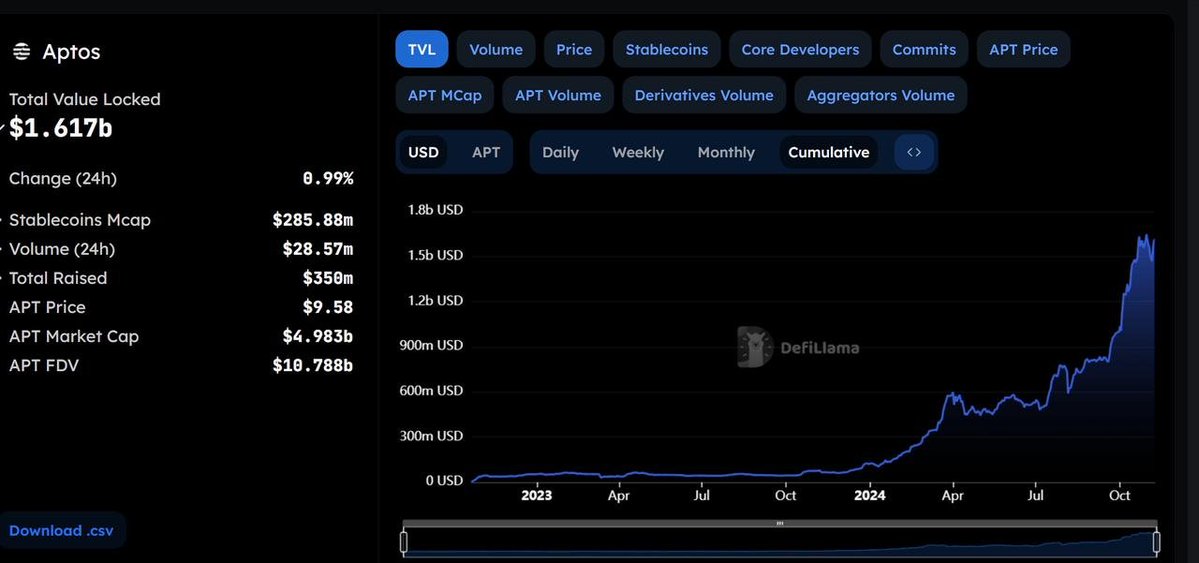

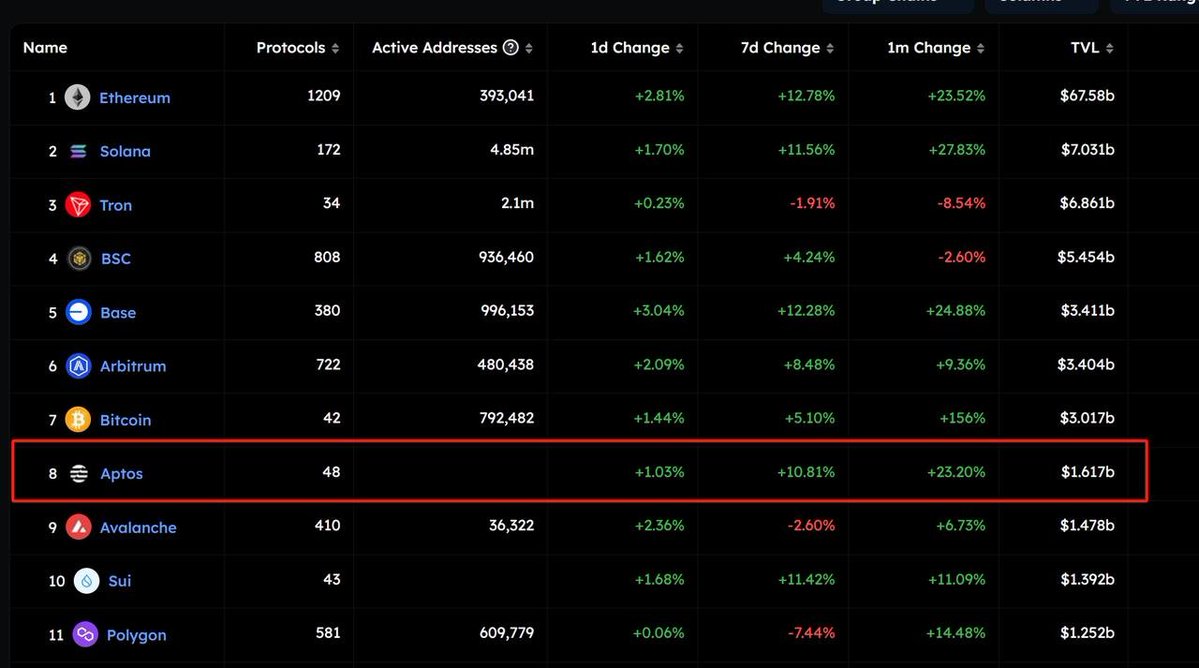

DeFi on Aptos is thriving. Its Total Value Locked (TVL) has quietly entered the top 10 among all public blockchains, currently ranking 8th—surpassing established Layer 1s like Polygon and Avalanche from the previous cycle, as well as rival chain Sui. TVL now stands at $1.617 billion, up from $55.23 million in 2023—an astonishing annual growth rate of 2,840%.

Since August of this year, daily active users have surged—from 630,000 to 6.73 million today—an astonishing tenfold increase within just three months.

Trends in on-chain transaction volume and active addresses are also rising, indicating growing project engagement, which serves as a positive signal for a potential airdrop. Additionally, user growth is a crucial metric. Continued increases in Aptos’ user base suggest growing appeal and may foreshadow an upcoming second airdrop.

RWA

RWA (Real World Assets) refers to bringing real-world assets—such as loans, funds, luxury goods, art, and real estate—onto the blockchain. This sector is widely recognized as one of the most promising narratives in crypto and is considered a key pathway to driving Web3 user adoption. Below is a summary of Aptos’ major achievements in the RWA space:

Funds:

Franklin Templeton—one of the world’s largest asset managers and issuer of the second-largest tokenized fund—is the only fund utilizing blockchain technology for transaction processing.

With $1.6 trillion in assets under management and 9,200 employees, Franklin Templeton holds a prominent position in global asset management.

They have partnered with the Aptos Foundation to launch FOBXX, an on-chain money market fund. FOBXX invests in low-risk U.S. government securities, including fixed, floating, and variable-rate instruments, as well as repurchase agreements fully collateralized by U.S. government securities or cash.

Real Estate:

Propbase is a real estate trading marketplace and the only real estate tokenization company operating in Southeast Asia. Propbase allows token holders to directly trade assets on its platform. Its end-to-end tokenization solution seamlessly integrates traditional real estate with blockchain technology.

This comprehensive approach demonstrates Aptos’ ability to transform traditionally illiquid assets into easily tradable digital tokens, potentially revolutionizing real estate investment and attracting significant capital inflows.

Treasury Bonds:

Ondo Finance, the first company to tokenize U.S. Treasury bonds, has made its collaboration with Aptos particularly groundbreaking.

Rooted in traditional finance and working closely with BlackRock, Ondo effectively meets institutional demand for RWA solutions. This partnership positions Aptos as a premier institutional-grade RWA platform.

Leveraging Ondo’s financial expertise, potential support from BlackRock, and Aptos’ superior technology, this alliance enables seamless integration between traditional finance and blockchain, opening new opportunities for bridging on-chain and off-chain assets.

The above highlights three representative RWA projects collaborating with Aptos. Integrations with Ondo Finance and Propbase showcase Aptos’ transformative potential in asset tokenization—from U.S. Treasuries to real estate. These partnerships not only validate Aptos’ capabilities but also pave the way for broader blockchain adoption in traditional finance, giving Aptos a significant edge in this domain.

AI

Aptos Labs is collaborating with tech giant Microsoft to develop AI applications. Microsoft brings formidable strength in artificial intelligence and cloud computing, while Aptos Labs offers unique advantages in blockchain scalability and performance—a true synergy of strengths.

Aptos can currently process up to 13,000 transactions per second with sub-second finality. This level of performance is crucial for AI applications requiring rapid data processing and validation.

The collaboration aims to reshape digital experiences, making Web3 more accessible and user-friendly while maintaining high security and performance standards. An AI chatbot has already been launched, opening exciting possibilities for deeper integration between AI and blockchain in the future.

In summary, each of the 2024 strategic pillars—Move, DeFi/RWA, and AI—has shown strong progress. Particularly in DeFi and RWA, where significant milestones have been reached, a second airdrop may soon follow to further accelerate ecosystem growth and push Aptos to new heights.

3. Market Signals

Several recent signals suggest a second airdrop may be imminent:

From the Project’s Perspective:

Bull market expectations: With Trump’s potential election win possibly triggering a bull market, conducting an airdrop during such favorable conditions offers numerous benefits. Elevated market sentiment and strong investor confidence reduce selling pressure on newly distributed tokens, allowing prices to remain stable or rise. This creates substantial value for community members while enhancing the project’s visibility—achieving a win-win scenario for both the ecosystem and the core team.

Timing and Ecosystem Maturity:

Last month, Aptos celebrated its second anniversary. OP, another project that conducted its first airdrop in 2022, launched its second airdrop just nine months later. From a timeline standpoint, Aptos has now reached a similar stage, meeting the temporal conditions for a follow-up distribution.

Infrastructure maturity: After two years of development, Aptos now ranks among the top 10 blockchains by TVL. Its DeFi sector continues to expand, and both core technology and ecosystem protocols have matured sufficiently to handle the influx of new users expected from an airdrop, ensuring system stability and efficiency.

Recent Project Activity:

The core team has recently increased engagement with ecosystem projects. Beyond promoting milestone achievements, they’ve actively supported meme coins and gaming initiatives—some of which may be internally incubated. Once these projects mature, it would be logical to reward early contributors via a structured airdrop mechanism.

Token Unlock Schedule:

We are currently in a window of relatively low token unlock pressure. Conducting an airdrop during this period avoids market imbalances caused by large-scale token releases, helping maintain price stability and enabling a smoother, more orderly distribution process without negatively impacting investors or the project due to excessive volatility.

4. Scale and Eligibility

Airdrop Size

Considering the scale of the first airdrop (23.45 million APT) and current market conditions, the second airdrop is expected to range between 15–20 million APT—worth approximately $130–180 million at current prices. However, as the number of active ecosystem users has grown significantly, individual allocations are likely to be smaller than those in the first round.

Eligibility Criteria

Based on Aptos’ strategic priorities, the following activities may qualify for inclusion in the airdrop:

- Participation in DeFi protocols (e.g., Thala, Amnis, Aries Markets) - NFT trading activity - Early contributions to ecosystem projects - Frequency and diversity of on-chain interactions

5. Conclusion

Based on existing data and observable trends, Aptos appears to have met many favorable conditions for launching a second airdrop:

-

Trump’s potential victory and the onset of a bull market have pushed market sentiment to a peak.

-

Significant progress across key strategic areas—Move, DeFi/RWA, and AI—has fulfilled the ecosystem readiness required for a second airdrop. Aptos is in a pivotal growth phase, and another airdrop could further catalyze ecosystem expansion.

-

Factors such as timing, infrastructure maturity, and the project team’s increased engagement all point toward an opportune moment for an airdrop, further suggesting its proximity.

In conclusion, the conditions for Aptos’ second airdrop are largely in place. It may arrive in the near future. While the exact timing and rules remain uncertain and require further observation, users are already forming their own participation strategies—on which we won’t elaborate here.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News