Interpretation of the SFC's Report on the Application of RegTech for Anti-Money Laundering and Counter-Terrorist Financing Compliance

TechFlow Selected TechFlow Selected

Interpretation of the SFC's Report on the Application of RegTech for Anti-Money Laundering and Counter-Terrorist Financing Compliance

On November 3, the Hong Kong Securities and Futures Commission (SFC) released a report titled "Report on the Application of Regtech for Anti-Money Laundering and Counter-Terrorist Financing Compliance," aiming to examine the use of regulatory technology ("Regtech") by Hong Kong financial institutions in AML/CFT compliance processes.

Author: Beosin

1. Report Background and Objectives

On November 3, the Hong Kong Securities and Futures Commission (SFC) released its "Report on the Adoption of Regtech for Anti-Money Laundering and Counter-Financing of Terrorism," aiming to explore how financial institutions in Hong Kong are applying regulatory technology ("Regtech") in AML/CFT compliance processes.

As financial crime methods continue to evolve, traditional manual monitoring approaches struggle to meet increasingly complex compliance demands. Regtech is emerging as a key tool for enhancing AML/CFT compliance effectiveness and efficiency. Through a survey of 50 licensed firms, the SFC analyzed the current application, benefits, and challenges of various Regtech solutions in AML/CFT.

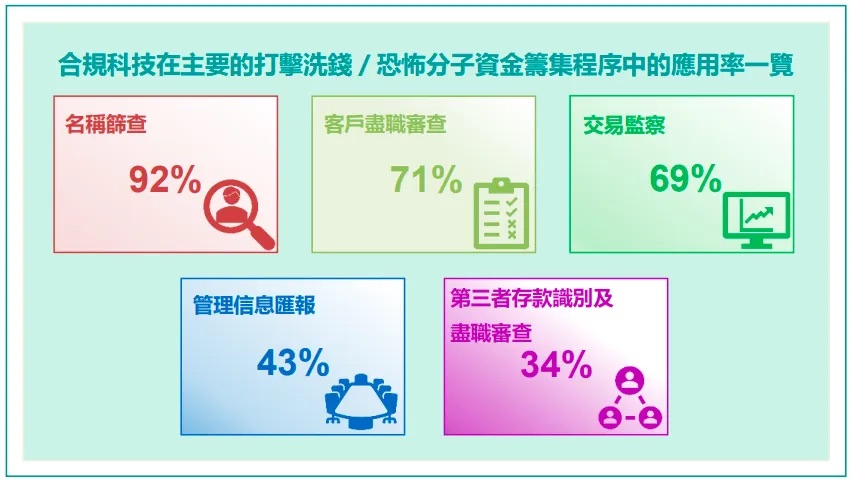

2. Key Application Areas and Current Status of Regtech

1. Name Screening (AML screening, 92%)

As the most widely adopted AML/CFT process, name screening has significantly reduced false positives and improved efficiency through automation. Regtech solutions commonly employ fuzzy logic and AI technologies to effectively identify potential risks even when names vary slightly in spelling or format. These tools enhance screening accuracy, making detection of high-risk clients or related parties more reliable.

2. Customer Due Diligence (CDD, 71%)

Regtech has optimized client onboarding and risk assessment workflows, particularly in identity verification, data collection, and risk rating. Automated customer risk scoring enables financial institutions to complete account reviews faster and more accurately, while dynamically updating client risk profiles to promptly detect potential AML/CFT risks.

3. Transaction Monitoring (KYT/TM, 69%)

Transaction monitoring is a critical component of AML/CFT, involving detection of large-value transactions or suspicious activities. Traditional rule-based monitoring often generates numerous false alerts, whereas Regtech solutions leverage AI and machine learning to dynamically analyze transaction behavior patterns and assign risk scores, significantly reducing false positives and prioritizing high-risk cases.

4. Management Information Reporting (Reporting, 43%)

In reporting and information management, Regtech provides senior management with comprehensive compliance overviews via data visualization and real-time monitoring tools, enabling decision-makers to quickly identify compliance risk areas and resource allocation needs based on dynamic data.

5. Third-Party Deposit Identification and Due Diligence (34%)

This process requires identifying third-party funding sources to prevent illicit funds from entering the system. Some firms use API integration to obtain real-time deposit data from banks and automated matching tools to rapidly verify fund origins, ensuring compliance.

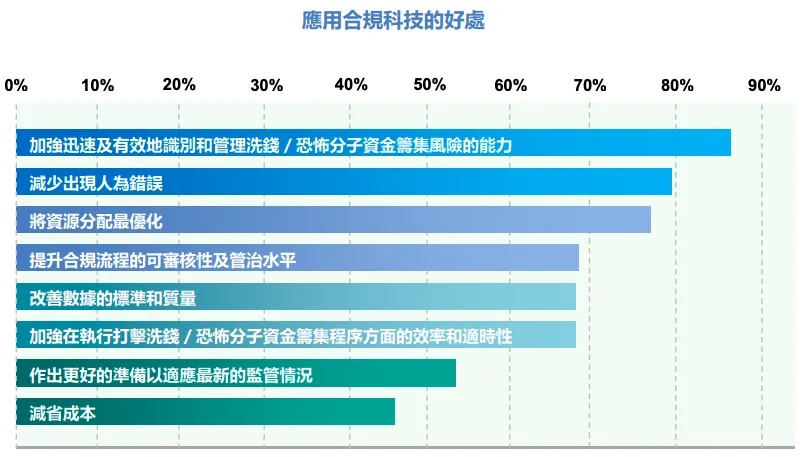

3. Key Advantages of Regtech Applications

Source: SFC: Report on the Adoption of Regtech for Anti-Money Laundering and Counter-Financing of Terrorism

The report indicates that over 85% of licensed firms believe Regtech has significantly enhanced the efficiency of AML/CFT risk identification and management. Key advantages include:

1. Improved Efficiency and Resource Optimization

Automated AML/CFT processes reduce time spent on manual reviews and operational errors, allowing human resources to focus more on high-risk clients and transactions, thereby optimizing resource allocation.

2. Enhanced Data Consistency and Quality

Data standardization and digitization improve data quality, increasing the reliability of review processes. With Regtech, financial institutions can establish more efficient data validation workflows to meet regulatory requirements.

3. Greater Adaptability and Update Capability

More than half of surveyed firms indicated that Regtech helped them quickly adapt to new regulatory changes. Some Regtech providers offer software updates aligned with policy adjustments, enabling firms to flexibly meet evolving compliance standards.

4. Improved Customer Experience

By streamlining client onboarding and ongoing monitoring, Regtech reduces unnecessary verification steps and enhances customer experience. For example, automated systems flag suspicious transactions with lower false positive rates, minimizing disruptions for legitimate customers.

Source: SFC: Report on the Adoption of Regtech for Anti-Money Laundering and Counter-Financing of Terrorism

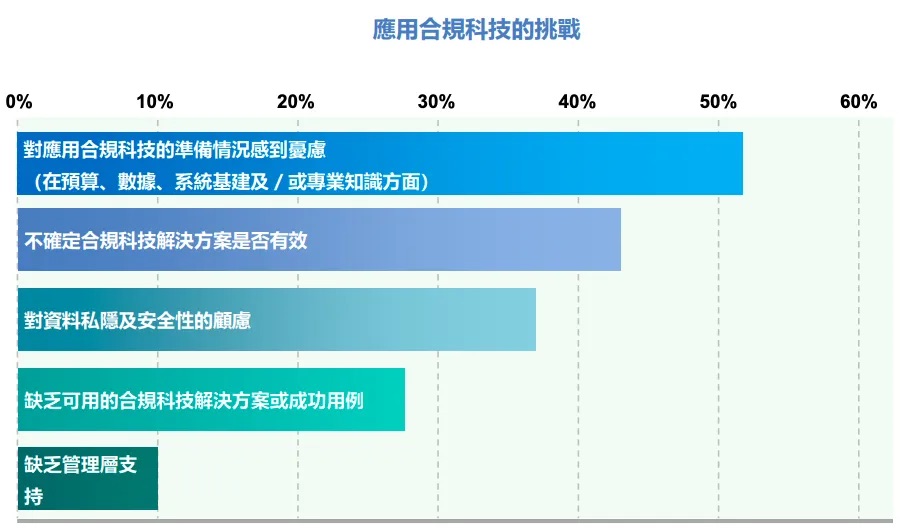

4. Main Challenges in Regtech Adoption

Despite its many benefits, the report also highlights several ongoing challenges:

1. High Implementation Costs and Stringent Infrastructure Requirements

Some financial institutions, especially small and medium-sized firms, face limitations in budget, data management, and IT infrastructure. Additionally, initial implementation costs are high, while long-term cost savings may only become apparent after the system stabilizes.

2. Concerns Over Data Privacy and Security

For cloud-based solutions, some institutions express concerns about data privacy and security, particularly regarding cross-border data transfers. The report recommends that firms rigorously assess vendors' security measures and ensure robust data protection protocols.

3. Need for Higher Technical and Operational Expertise

Firms must have sufficient technical support to manage and maintain Regtech systems. Some licensed firms reported difficulties adapting to new technologies and automated operations due to limited precedents and industry experience.

4. Need for Greater Executive Engagement and Support

While most firms received management backing, others lacked strong leadership commitment, resulting in slower implementation. The report emphasizes that top-down compliance culture is crucial for effective Regtech adoption.

Source: SFC: Report on the Adoption of Regtech for Anti-Money Laundering and Counter-Financing of Terrorism

5. Outlook and Recommendations

The report also outlines a phased roadmap for Regtech adoption. For financial institutions considering implementation, it recommends:

-

Adopt a phased approach: Regtech implementation should not be rushed; firms can begin with a specific process and gradually expand across broader AML/CFT functions to reduce upfront costs and gain operational experience.

-

Assign dedicated oversight personnel: Even with advanced technology, firms must ensure appropriate human supervision—especially when using AI models—to prevent false or missed alerts.

-

Select qualified service providers: When relying on external vendors, institutions should verify their compliance expertise and technical capabilities, and establish contingency plans for system outages or other disruptions.

Conclusion

For both the industry and regulators, recent discussions in Hong Kong around RWA and stablecoin regulation further underscore the importance of AML compliance.

The SFC continues to stay ahead of technological advancements by issuing this report, offering practical insights and guidance on Regtech applications in AML/CFT. As fintech evolves rapidly, Regtech will play an increasingly vital role in strengthening compliance capabilities and optimizing resource allocation for financial institutions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News