November Crypto Market Outlook: Elections, Bitcoin ETFs, and Emerging Sectors

TechFlow Selected TechFlow Selected

November Crypto Market Outlook: Elections, Bitcoin ETFs, and Emerging Sectors

In any case, post-election clarity tends to drive a Bitcoin rebound.

Author: arndxt

Translation: TechFlow

Some notable trending themes to watch include Memes, AI, BRC-20, and RWA.

In a bull market, my strategy is to double down on projects that have already proven successful and stay closely aligned with these trends.

Trends to watch in November.

Weekly Updates

Market Momentum from the Election

Bitcoin is nearing all-time highs, but market calm reflects anticipation. With the U.S. election approaching, significant market volatility may follow.

While Trump leads in Polymarket predictions, the outcome remains extremely close. Candidates can no longer ignore a $2 billion industry and millions of holders. A pro-crypto victory could be the catalyst for a market breakout.

Bitcoin Post-Election: Prepare for a Rebound

Trump’s stance is clear—he supports crypto leadership, Bitcoin reserves, and a new SEC head. Harris expresses support, but her position remains ambiguous. Regardless, post-election clarity typically drives Bitcoin rebounds. Some volatility is expected, but patience will likely be rewarded.

Why This Setup Matters

Despite being near all-time highs, retail capital has not flooded in yet.

Bitcoin supply on exchanges is rapidly declining.

Gold and the S&P 500 are reaching new highs.

Interest rate cuts may be on the horizon.

All conditions are aligning. Short-term volatility is possible, but the overall return outlook remains positive.

Hot Trends in 2024

What are the key trends? Memes, AI, BRC-20, and RWA.

Future strategy: Double down on winning projects. As the market cycle heats up, sticking with these trends provides a competitive edge.

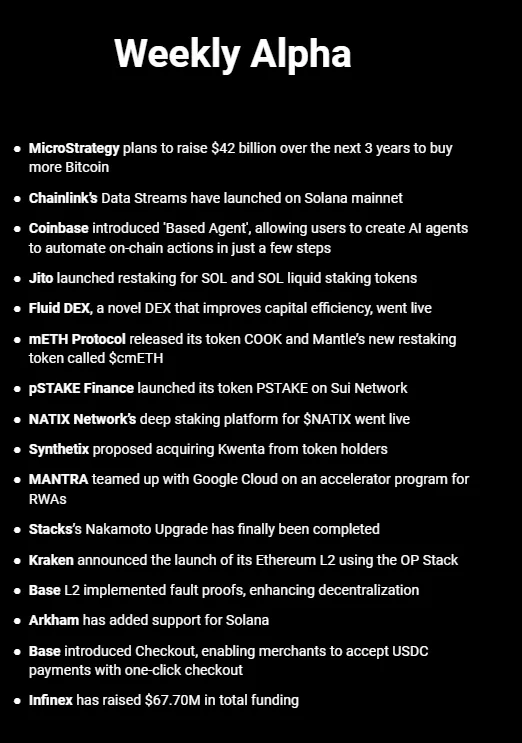

Weekly Alpha Source @TheDeFinvestor

Weekly Alpha

-

MicroStrategy plans to raise $42 billion over the next three years to buy more Bitcoin

-

Chainlink's data streaming feature has launched on the Solana mainnet

-

Coinbase launched "Based Agent," allowing users to create AI agents in just a few steps to automate on-chain operations

-

Jito has introduced restaking functionality for SOL and liquid staked SOL tokens

-

Fluid DEX, an innovative decentralized exchange designed for higher capital efficiency, is now live

-

mETH Protocol launched its token COOK and a new restaked token $cmETH on Mantle

-

pSTAKE Finance launched its token PSTAKE on the Sui network

-

NATIX Network’s deep-staking platform for $NATIX is now live

-

Synthetix proposed acquiring Kwenta from token holders

-

MANTRA partnered with Google Cloud to launch an accelerator program focused on RWA

-

Stacks’ Nakamoto upgrade has been successfully completed

-

Kraken announced the launch of an Ethereum L2 built on OP Stack

-

Base L2 implemented fault proofs, further enhancing decentralization

-

Arkham added support for Solana

-

Base launched a one-click checkout feature enabling merchants to accept USDC payments

-

Infinex has raised a total of $67.7 million to date

Narrative Overview

The real strategy is to avoid chasing the hype around newly launched meme coins.

The true investment opportunities lie in established meme coins that have weathered market turbulence.

Why Buying Newly Launched Coins Is a Trap for Most Traders

Murad recently spoke at Token2049, and his recommended $SPX surged shortly after. But the core of his thesis is about identifying survivors in the market.

In on-chain investing, maximizing expected value (EV) means focusing on "older" meme coins with historical volatility—especially those that have dropped at least 80% from their all-time highs. These are the real goldmines.

Let’s dive deeper into this goldmine strategy.

The Problem with Chasing New Coins

In reality, for every coin that goes up 50x or 100x, hundreds go to zero. Only the top-tier traders, equipped with advanced tools and relentless effort, can sustainably achieve positive EV in such environments.

A Better Strategy: Target Cryptos with Strong Growth Potential

Most newly launched coins vanish within hours or days. However, when a coin survives for months and endures major drawdowns without collapsing, it demonstrates resilience. These coins might not deliver 100x immediately, but this investment approach offers a clear advantage.

-

Launched several months ago

-

Down 80% or more from all-time highs

-

Chart shows stable or upward trend (higher lows)

-

Has an active and loyal community, not just bots or hype

-

Possesses a unique meme and “cult” potential

-

High awareness relative to market cap

-

Low market cap

Other Updates

Runes Explosion

Runes activity is growing rapidly—volume has tripled since August, and transaction count has surged fourfold. Bitcoin’s on-chain fees have also increased by 32% due to Runes, highlighting Bitcoin’s adaptability and resilience.

Magic Eden’s Role

Magic Eden dominates Runes trading, capturing 90% of user activity in the Bitcoin ecosystem. With Runes bringing true fungibility to Bitcoin, it's evolving beyond digital gold into a platform for memes and collectibles. High fees and slow speeds? These issues are fading thanks to innovations like Runes and OP_CAT, potentially triggering a “meme coin supercycle” on Bitcoin.

Key Drivers

$DOG currently leads, but emerging tokens like $PUPS, $GIZMO, and $BDC (especially with the upcoming OP_CAT) are shifting attention toward cat-themed tokens.

Growth Potential

BTC meme coins have a $2 billion market cap—just 0.11% of Bitcoin’s $1.9 trillion value. In contrast, ETH meme coins are worth $20 billion, and SOL meme coins $12 billion. BTC’s meme market has substantial room to grow, and early CEX listings could bring outsized returns for current investors.

Token Unlock Dynamics

This week saw significant movement in token unlocks:

-

$PORTAL: Classic crypto volatility, price swinging up to 10%

-

$TIA: Down 21% ahead of a major upcoming unlock

Focusing on $TIA

The upcoming unlock of 92.3 million TIA makes this one of the largest events of the year. Open interest is near all-time highs, and the market is reacting cautiously—this month’s strategy appears more deliberate compared to September’s wild 30% surge.

Despite recent price declines, early $TIA investors have still seen massive returns: seed investors up 526x, Series A investors 50x, and Series B investors 5x.

BlackRock’s Bitcoin ETF Is Setting Records

BlackRock’s Bitcoin ETF is making history, reaching $30 billion in assets under management in less than a year—the fastest-growing ETF ever. This isn’t a trickle of institutional interest; it’s a flood.

Bigger Picture

Capital inflows continue to rise, exceeding $1 billion daily in March alone. This intense demand signals we’re at the frontier of a new wave of institutional adoption. Watch daily inflows—they hint at an impending tidal wave of large-scale adoption.

BTC Price Action: Consolidation with a Bullish Bias

BTC is consolidating, but the long-term trend remains bullish. Currently trading above the 50-day MA, near prior all-time highs, and poised for a potential breakout.

The current setup could trigger the next major rally, or BTC might pull back slightly to allow for a fresh accumulation phase before rising again. A distributed breakdown would be concerning, but there are no signs of that yet.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News