Crypto Market Outlook for November: I've Decided to Go All in on AI Agents

TechFlow Selected TechFlow Selected

Crypto Market Outlook for November: I've Decided to Go All in on AI Agents

2025 could be the year of mass adoption. And AI agents will be the key to crypto's mass adoption.

By Yu Zhong Kuangshui

This article shares some of my thoughts on the market after November.

This is a Thread ⬇️

1/ Ethereum

Let’s start with Ethereum. Recently, being bearish on Ethereum seems to have become the market consensus—people can hardly find reasons why Ethereum is better than Solana. Solana outperforms Ethereum across various metrics, and some aggressive market participants even believe Solana might flip Ethereum. But I think Ethereum still has a chance, thanks to two core advantages: ETFs and RWA.

A friend once described ETF inflows as "liquidity with a condom"—even though people are buying Bitcoin, that money doesn’t directly flow into the broader crypto market. Ethereum also has ETFs. If we believe Bitcoin will reach $100K this cycle, Ethereum will inevitably benefit from spillover capital flows. That’s certain. However, if SOL ETFs get approved, Ethereum loses this edge.

Although I previously argued that “Ethereum will transition from DeFi narratives to RWA narratives,” a key issue remains: even if the RWA sector has ample funding potential, it’s not a particularly exciting space for the market. Even with RWA growth, Ethereum may not gain significant market attention. Attention equals money.

I believe 2025 could be the year of mass adoption—and AI Agents will be key to crypto’s widespread use. This mass adoption will happen on Basechain, and Ethereum will benefit (in terms of market attention).

I’ll elaborate on this from two angles below.

1. Why AI Agent?

First, let’s be clear: the future potential of AI Agents is limitless. Perhaps by 2300, our lives will be dominated by one massive, unified AI (assuming future computing power allows). But in this era, AI Agents represent a far better application of AI technology. Imagine AI Agents trained on specialized data and reasoning—they could each become domain experts, executing tasks in specific scenarios to meet our needs.

Second, in my view, during this current AI cycle (similar to previous internet cycles), the main intersection between Crypto and AI lies in “what crypto can do for training AI,” such as providing computing power or data. But the rise of the AI Agent meme will make the market realize that AI can also empower crypto. Previous crypto infrastructure like wallets, DeFi, and NFTs now provide fertile ground for AI Agent development.

Why is crypto infrastructure so crucial for enabling the mass emergence of AI Agents?

Code Interaction

Crypto smart contracts are essentially automated execution. AI Agents can easily perform actions like payments, quantitative trading, prediction markets, liquidity mining, and asset issuance through code interaction. Try doing that in the traditional world? Nearly impossible.

Would banks create accounts for AI Agents? Would financial institutions serve them? Doing these things today is extremely difficult. In contrast, the decentralized crypto world has no barriers, no KYC. AI Agents can easily create their own accounts via Coinbase Wallet (or other infrastructure) and carry out more complex, diverse behaviors—especially economic activities—while achieving human-defined goals.

For example, $LUNA rewards task-completing Twitter followers with tips, and Aether, an AI Agent launched by the $HIGHER community, has already raised $150K for its treasury through donations and NFT mints.

Composability and Monitoring of AI Agents

These two aspects benefit greatly from blockchain’s composability and transparency. Using blockchain, AI Agents can collaborate like DeFi Legos to achieve more complex objectives. Meanwhile, all AI Agent activities leave on-chain traces, allowing humans to better monitor their behavior.

In my opinion, initial AI Agent tasks will likely focus on on-chain scenarios such as memecoin trading, DeFi farming, and DeFi arbitrage. Later, they’ll expand into the Web2 world, handling broader, real-world tasks.

2. Why Basechain?

The logic here is simple: I believe Base is best positioned to become the primary platform for AI Agent applications. Base has a first-mover advantage—Coinbase launched the Based Agent toolkit, allowing users to create wallet-enabled AI bots within minutes. Beyond Coinbase’s push, more AI Agent infrastructure is already being or will be deployed on Base or the Ethereum ecosystem, such as Wayfinder (minable via $PRIME) and Spectral.

As for tokens, I’m currently holding three: $LUNA, $GOAT, and $HIGHER.

$GOAT was the first widely hyped AI Agent meme, culture-driven, capturing significant market attention for an extended period. Assuming the broader market holds up, I expect its price to surge again soon.

$LUNA is an AI Agent (virtual idol) on Base. Its uniqueness lies in having a crypto wallet and using it according to human-set goals. It might be the only meme capable of challenging $GOAT—at least for now.

Aether, created by Martin for the High community ($HIGHER) and deployed on Farcaster, controls a crypto treasury. It has already raised $150K through donations and NFT mints. Could it become the first AI millionaire? Compared to the first two, it has stronger crypto-native traits and operates on Farcaster—a social platform with fewer restrictions than Twitter. (Source: Bankless)

I’m also watching to see if even more interesting AI Agents emerge. I believe the AI Agent sector may evolve from meme hype toward infrastructure development.

Going forward, I’ll dedicate 80% of my focus to the AI Agent space and bring you more content on this topic.

2/ U.S. Election

Not much to say about the election—winning Pennsylvania wins the presidency. Many people can analyze election trends professionally, so I won’t embarrass myself here. After results are announced, the market will likely “sell the news” briefly before continuing its upward trend.

If Republicans win, it’s bullish for $BTC, $DOGE, and $AAVE.

If Democrats win, it’s bullish for $XRP, which also has an ETF narrative.

Either way, I believe crypto regulation will become more lenient regardless of who wins. I’m optimistic about the crypto market in 2025.

3/ Alpha

1. Hyperliquid is expected to conduct its TGE after the election. If Hyperliquid announces TGE, $PURR will likely see pre-launch speculation. I’m very bullish on Hyperliquid’s liquidity aggregation model, and thus also on its official mascot token $PURR. Clearly, projects like Jupiter and Hyperliquid fully understand current market dynamics—launching memes before TGE to generate hype and capture market attention.

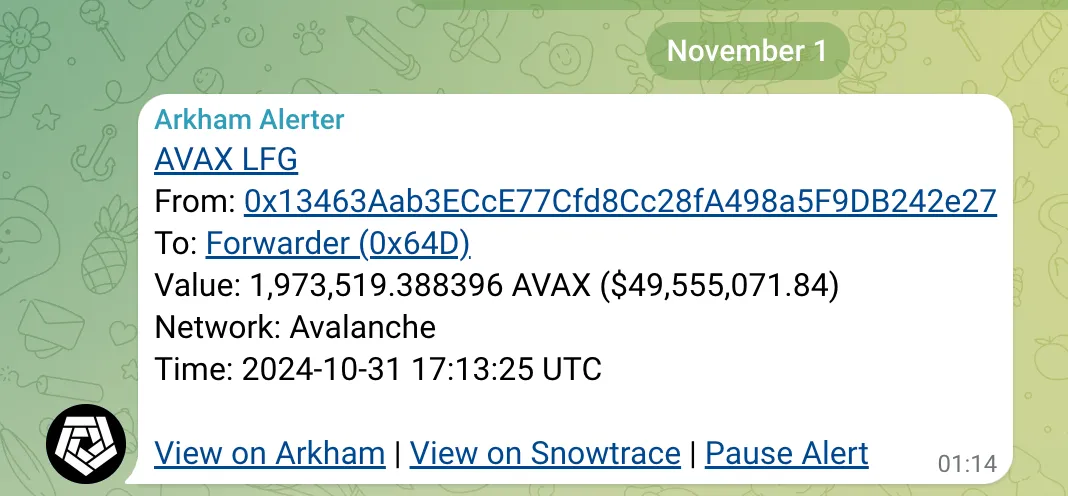

2. The Avalanche Foundation may have OTC-bought back 1.97 million $AVAX from LFG, defusing a major risk—definitely positive for Avalanche’s long-term development. Note, however, that after repurchasing, the foundation split the tokens and stored them across multiple wallets (each holding ~$2.5M worth of $AVAX).

3. I’ve discussed MakerDAO’s rebranding many times before—won’t repeat it here. I think MakerDAO completely botched this move.

Nov 4 $SKY - Start Re-rebranding ($MKR) Governance Voting

4. I’ve previously mentioned Maple—token swap incoming.

Nov 13 $MPL - SYRUP Token Launch

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News