Coinbase Insights: Crypto x AI, Complementary Forces — Exploring All Opportunities Across Sub-Sectors

TechFlow Selected TechFlow Selected

Coinbase Insights: Crypto x AI, Complementary Forces — Exploring All Opportunities Across Sub-Sectors

Decentralized AI infrastructure, advancements in on-chain AI applications, and the emergence of "agent networks" will drive significant development.

Author: Jonathan King

Translation: TechFlow

Summary: The future of artificial intelligence (AI) can evolve on blockchain technology, as cryptography enhances accessibility, transparency, and use cases for emerging technologies. The efficiency, borderless nature, and programmability of crypto combined with AI may transform how humans and machines interact in the digital economy—empowering users to control their personal data. This includes the rise of an "Agentic Web," where AI agents operating on cryptographic infrastructure drive economic activity and growth.

Disclosure and footnotes: Coinbase Ventures portfolio companies are marked with an asterisk (*) upon first mention below

What might this look like? AI agents conducting transactions on crypto infrastructure. Software code generated by AI—including smart contracts—fuels a surge in on-chain applications and experiences. Users own, manage, and benefit from the AI models they participate in. AI improves user and developer experiences within the crypto ecosystem, enhances smart contract capabilities, and unlocks new use cases, among other possibilities.

As we envision this convergent future of crypto and AI, today we share our core thesis on this transformative technological fusion. Overview:

-

We believe that crypto/blockchain is not necessary for advancing every layer of the AI tech stack or solving emerging challenges. Instead, crypto can play a critical role in enabling broader distribution, verification, censorship resistance, and native payment rails for AI, while leveraging AI mechanisms to create novel on-chain user experiences.

-

The convergence of crypto and AI could give rise to an “Agentic Web”—a transformative paradigm where AI agents running on crypto infrastructure become major drivers of economic activity and growth. We anticipate that in the future, agents will have their own crypto wallets, autonomously transact and execute user intent, access low-cost decentralized computing and data resources, or pay humans and other agents in stablecoins to complete tasks toward achieving overarching goals.

-

Initial beliefs underpinning this thesis include: (1) Cryptocurrency will become the preferred medium of exchange for commercial transactions between agents and humans, and among agents; (2) Generative AI and natural language interfaces will become the primary method for users to conduct on-chain transactions; (3) AI will generate most software code (including smart contracts), triggering a “Cambrian explosion” of on-chain applications and experiences.

-

The integration of crypto and AI can be divided into two core subdomains: (1) Decentralized AI (Crypto → AI), building general-purpose AI infrastructure with characteristics of modern peer-to-peer blockchain networks; and (2) On-chain AI (AI → Crypto), building infrastructure and applications that leverage AI to support both new and existing use cases.

-

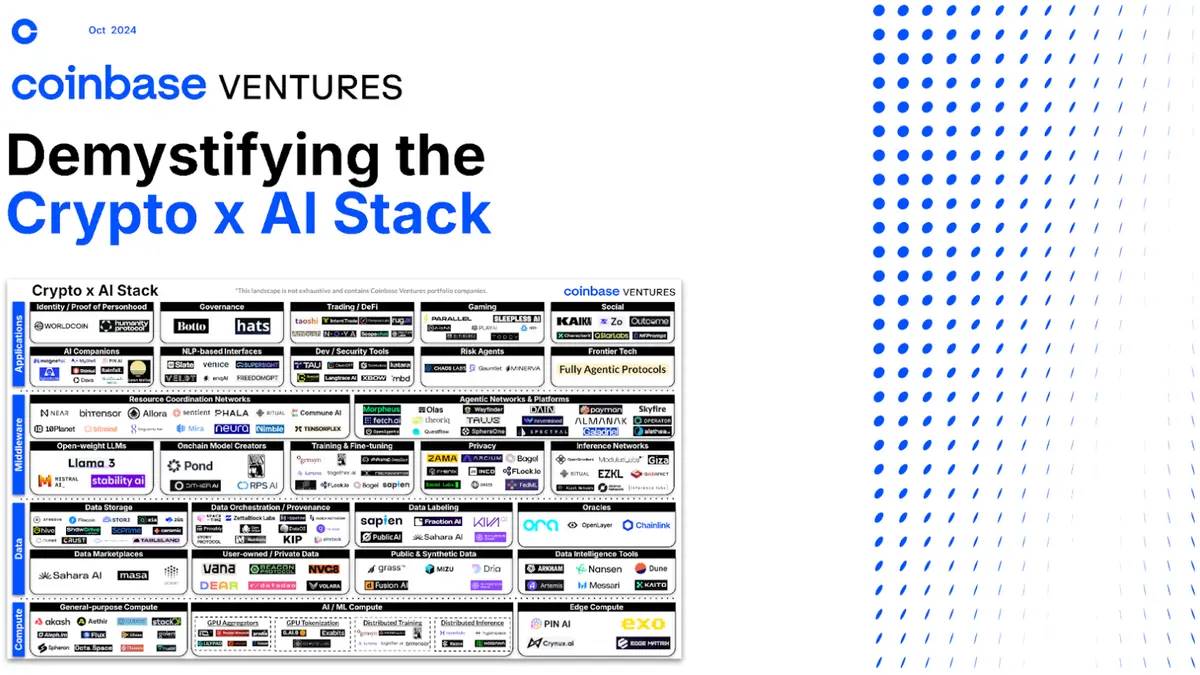

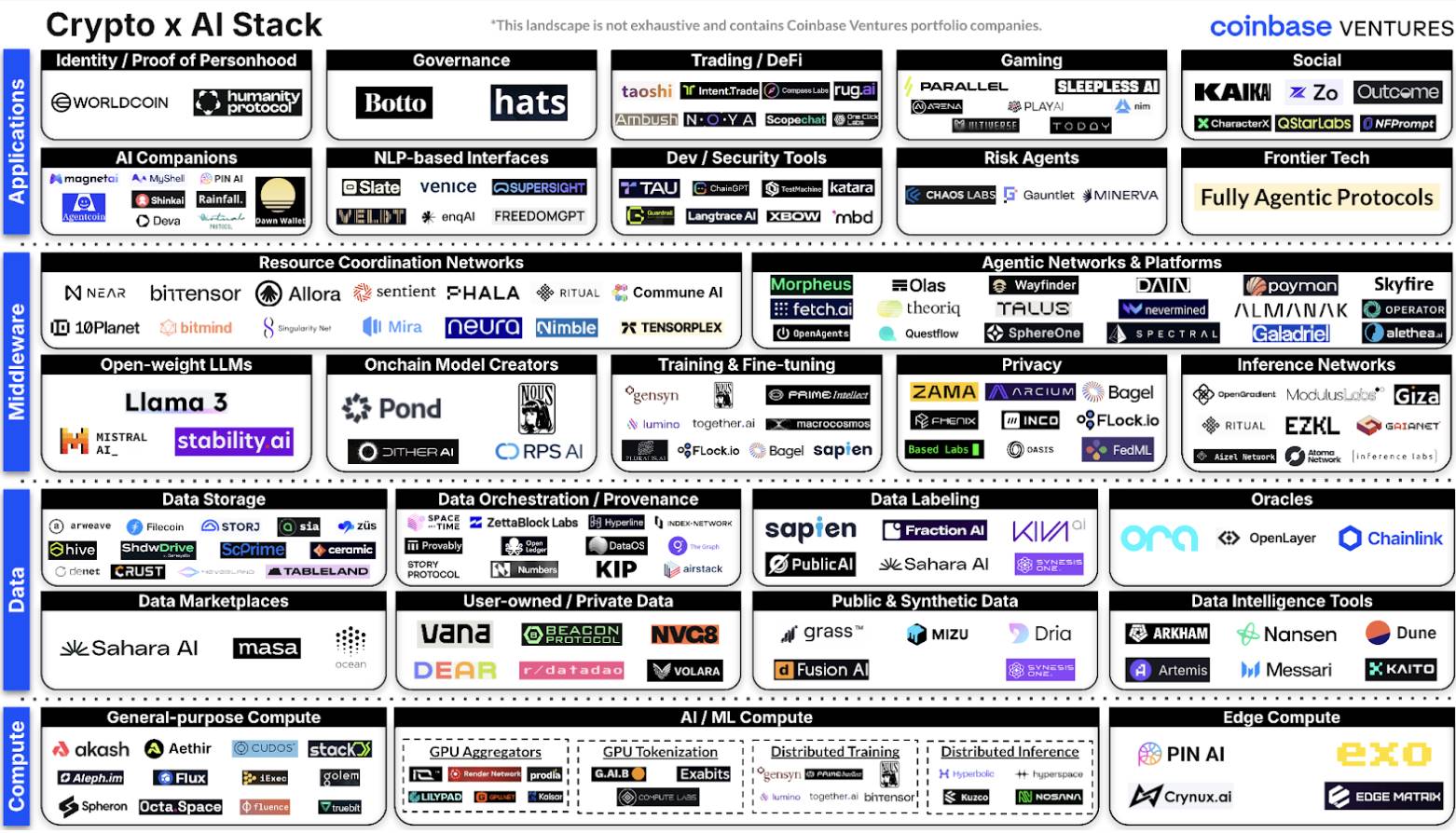

The crypto x AI ecosystem can be structured across layers: (1) Compute Layer (e.g., networks focused on providing potential GPUs for AI developers); (2) Data Layer (e.g., networks enabling decentralized access, orchestration, and validation of AI data pipelines); (3) Middlewares Layer (e.g., platforms supporting development, deployment, and hosting of AI models/agents); and (4) Application Layer (e.g., user-facing products leveraging on-chain AI mechanisms, both B2B and B2C).

At Coinbase, our mission is to help rebuild the financial system to be more secure and reliable, while increasing accessibility and usability for consumers and developers. We believe the convergence of crypto and AI will play a significant role in this transformation. In this post, we explore the meaning, implementation, and future trajectory of crypto x AI.

Introduction to Crypto and AI

The AI market has seen remarkable growth and investment in recent years, with venture capital firms investing nearly $290 billion into the space over the past five years. The World Economic Forum notes that AI technologies could increase annual U.S. GDP growth by 0.5–1.5% over the next decade. AI applications have demonstrated strong traction—for example, apps like ChatGPT-4 set records for user growth and adoption. However, rapid expansion has also brought challenges: data privacy concerns, demand for AI talent, ethical considerations, centralization risks, and the rise of deepfakes. These issues have drawn attention to the convergence of crypto and AI, as stakeholders seek solutions combining strengths from both fields.

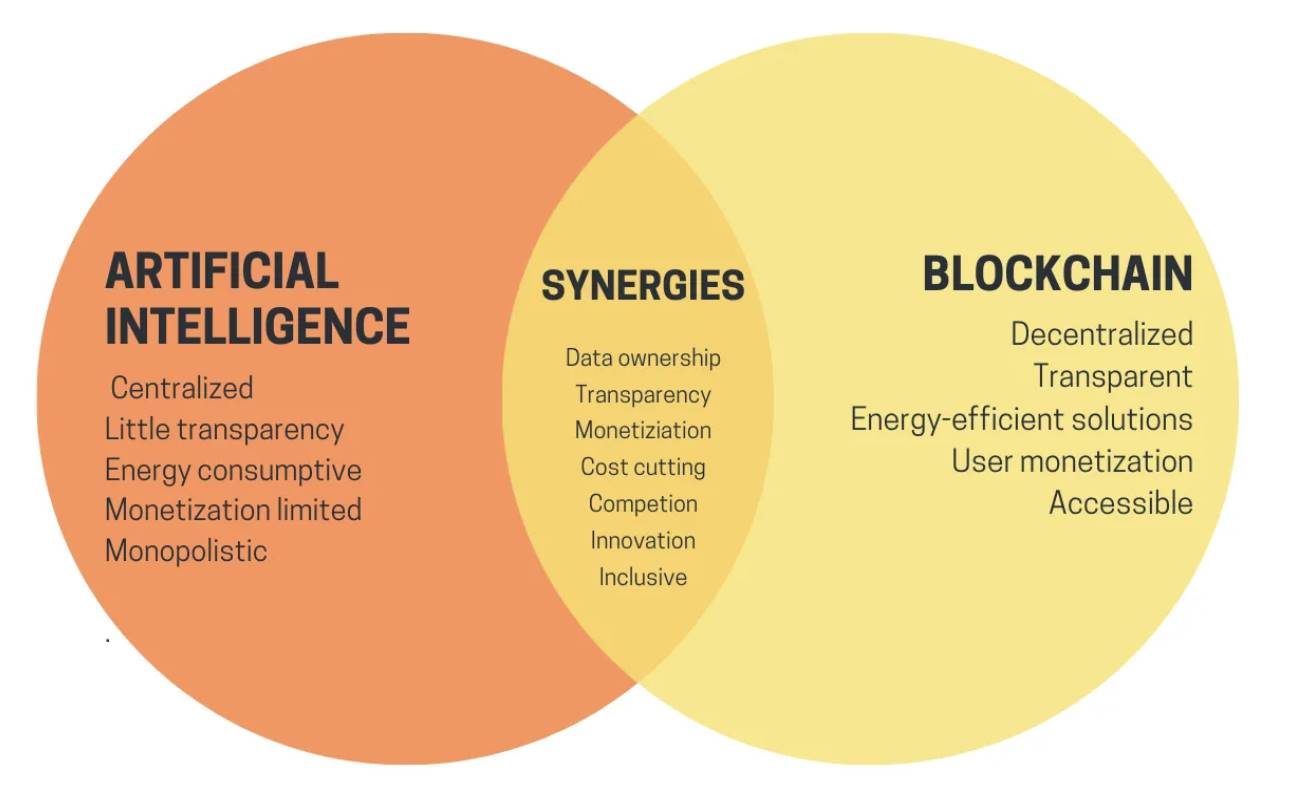

Figure: Crypto and AI diagram from Vitalik Buterin’s blog

The convergence of crypto and AI combines blockchain's decentralized infrastructure with AI’s ability to mimic human cognitive functions and learn from data—creating a synergistic effect with disruptive potential across multiple industries. Blockchain redefines system architecture and how data and transactions are verified and distributed, while AI enhances computational power, data analysis, and content generation. This fusion has sparked both excitement and skepticism among developer communities in both ecosystems, driving exploration of new use cases that could accelerate adoption over time. While "crypto" and "AI" are broad terms encompassing diverse technologies, we see their convergence falling into two core domains:

-

Decentralized AI (Crypto → AI): Enhancing AI capabilities through permissionless and composable crypto infrastructure. This enables democratized access to AI resources (compute, storage, bandwidth, training data), collaborative open-source model development, verifiable inference, and provenance/authenticity assurance via immutable ledgers and cryptographic signatures.

-

On-chain AI (AI → Crypto): Bringing AI advantages into the crypto ecosystem—improving user and developer experience via large language models (LLMs) and natural language interfaces, or enhancing smart contract functionality. On-chain AI unfolds along two paths: (1) Developers integrating AI models or agents into their smart contracts and on-chain applications; and (2) AI agents using crypto channels (self-custody wallets, stablecoins, etc.) for payments and accessing decentralized infrastructure resources.

While “crypto in AI” or “AI in crypto” remain early-stage, their potential is vast—especially amid ever-improving compute infrastructure and accelerating intelligence—unlocking applications previously unimaginable.

Crypto and AI: Unlocking the “Agentic Web”

One particularly exciting frontier at the intersection of crypto and AI is the concept of AI agents operating on crypto infrastructure. This synergy aims to build an “Agentic Web”—a transformative paradigm that enhances security, efficiency, and collaboration in an AI-driven economy, powered by robust incentives and cryptographic trust.

We believe AI agents will become key drivers of economic activity and growth, gradually replacing humans as the primary “users” of applications—both on and off-chain. This paradigm shift will force many internet companies to rethink fundamental assumptions about the future and adapt their products, services, and business models to best serve an agent-centric economy. However, we do not believe that crypto or blockchain is required at every layer of AI to enhance capability or solve emerging challenges. Rather, crypto can play a vital role in enabling greater distribution, verifiability, censorship resistance, and native payment rails for AI, while AI creates novel user experiences on-chain.

Our initial beliefs underpinning this thesis:

-

Cryptocurrency will become the preferred payment method for commercial transactions between agents and humans, and among agents: As a programmable, internet-native currency, crypto holds distinct advantages in enabling agent-based economies. As AI agents grow more autonomous and engage in massive microtransactions (e.g., paying for inference, data, API access, decentralized compute/data), crypto’s efficiency, borderless nature, and programmability make it far more attractive than traditional fiat. Moreover, agents require unique, verifiable identities (“Know Your Agent”) to meet regulatory and compliance standards when interacting with enterprises and end-users. Low-cost blockchains, smart contracts, self-custody wallets (like Coinbase AI Wallets), and stablecoins can simplify and reduce costs of complex financial agreements between agents. Meanwhile, the verifiability and immutability of decentralized networks ensure trust and auditability in AI agent transactions.

-

Generative AI and natural language interfaces will become the dominant way users perform on-chain transactions: As natural language processing speed and AI understanding of crypto contexts improve, conversational interfaces will become the default mode and expectation for on-chain interactions—mirroring current web2 trends like ChatGPT. Users will simply express transactional intent in natural language (e.g., “swap X for Y”), and AI agents will translate these intents into verifiable smart contract code, delivering the most efficient and cost-effective execution path.

-

AI will generate most software code (including smart contracts), sparking a “Cambrian explosion” of on-chain applications and experiences: AI-powered code generation in web2 (e.g., Devin, Replit) is rapidly advancing and fundamentally changing software development. We believe this shift will soon heat up in crypto, initially lowering entry barriers for new and experienced developers alike. But longer-term, we foresee AI “software agents” generating smart contracts and highly personalized applications in real-time based on user preferences, storing and verifying them on-chain.

These views suggest the boundary between AI and crypto will increasingly blur, creating a new paradigm of intelligent, autonomous, and decentralized systems. With that context, let’s dive deeper into the technical stack enabling Crypto x AI.

Opportunities in the Crypto x AI Stack (Current State)

Exploring “crypto in AI” or “AI in crypto” has given rise to a fast-evolving, complex frontier, attracting numerous developers racing to capture market opportunities. We believe today’s Crypto x AI landscape can be segmented into four layers: (1) Compute Layer (networks focused on supplying GPU resources for AI developers); (2) Data Layer (networks enabling decentralized access, orchestration, and validation of AI data pipelines); (3) Middlewares Layer (platforms/networks supporting development, deployment, and hosting of AI models/agents); and (4) Application Layer (user-facing products leveraging on-chain AI mechanisms, B2B or B2C).

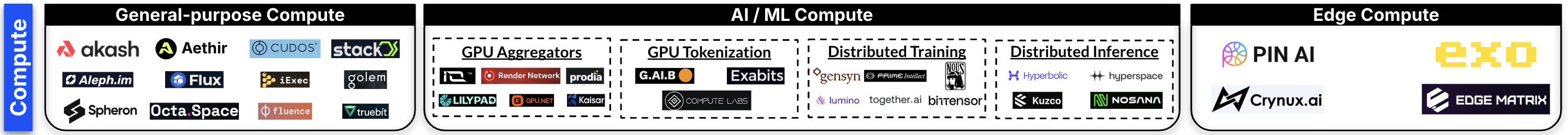

Compute

Training and inference in AI demand substantial GPU compute resources. As AI models grow more complex, so does the demand for compute—leading to shortages of advanced GPUs like those from Nvidia, longer wait times, and rising costs. To address this, decentralized compute networks are emerging as viable alternatives:

-

Create open markets for buying, leasing, and hosting physical GPUs

-

Build GPU aggregation platforms allowing anyone (e.g., Bitcoin miners) to contribute excess GPU capacity for AI workloads and earn tokens in return

-

Tokenize physical GPUs into on-chain digital assets for financialization

-

Develop distributed GPU networks to support compute-intensive tasks (training and inference)

-

Build infrastructure enabling AI models to run locally on personal devices (akin to a decentralized Apple Intelligence)

These solutions aim to increase supply and accessibility of GPU resources at competitive prices. However, due to varying limitations in supporting advanced AI workloads, fragmented GPU availability, and in some cases, lack of developer tools and stability comparable to centralized providers, we believe widespread adoption is unlikely in the near to mid-term. Emerging areas and example projects developing at this layer include:

-

General Compute: Decentralized compute markets offering GPU resources usable across various applications (e.g., Akash, Aethir)

-

AI/ML Compute: Decentralized compute networks providing GPU resources for specific services—GPU aggregators, distributed training/inference, GPU tokenization (e.g., io.net, Gensyn, Prime Intellect, Hyperbolic, Hyperspace)

-

Edge Compute: Device-side LLM compute and storage networks supporting personalized, contextual inference (e.g., PIN AI, Exo, Crynux.ai, Edge Matrix)

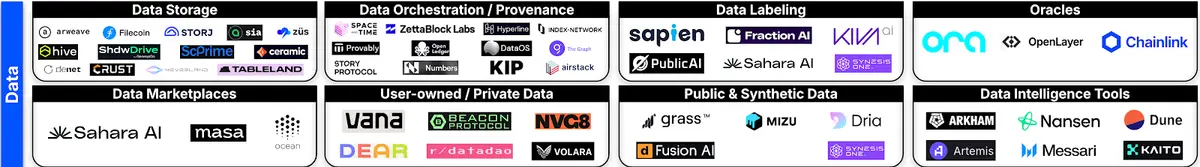

Data

To scale AI models, larger training datasets are required—today’s large language models (LLMs) are trained on trillions of words of human-generated text. Yet publicly available human-generated data is limited (Epoch AI estimates high-quality language and data sources may deplete by 2024). This raises a key question: Will data scarcity become a bottleneck constraining AI performance gains? Thus, we see opportunities for crypto x AI companies focused on data to address these challenges:

-

Incentivize users to share private or proprietary data (e.g., “Data DAOs”—on-chain entities where contributors monetize private social platform data and retain control over its use)

-

Develop tools to generate synthetic data from natural language prompts or incentivize scraping public websites

-

Encourage users to pre-process datasets for model training and maintain data quality (e.g., data labeling and reinforcement learning from human feedback)

-

Create open, multi-party data markets where contributors are compensated for data shared

These opportunities have spawned many emerging companies visible today in the data layer. That said, traditional centralized enterprises already possess strong network effects and established data compliance frameworks valued by institutions—potentially limiting space for decentralized alternatives. Nevertheless, we believe the data layer of decentralized AI holds significant long-term potential in overcoming the “data wall” challenge. Example projects emerging in this domain include:

-

Data Markets: Decentralized data exchange protocols enabling data providers and consumers to share and trade data assets (e.g., Ocean Protocol, Masa, Sahara AI)

-

User-Owned/Private Data (incl. DataDAOs): Networks incentivizing collection of proprietary datasets, including personally owned user data (e.g., Vana*, NVG8)

-

Public & Synthetic Data: Platforms for scraping public websites or generating new datasets via natural language prompts (e.g., Dria, Mizu, Grass, Synesis One)

-

Data Intelligence Tools: Platforms and apps for querying, analyzing, visualizing, and deriving insights from on-chain data (e.g., Nansen*, Dune*, Arkham, Messari*)

-

Data Storage: File storage networks for long-term archival and relational database networks managing frequently accessed and updated structured data (e.g., Filecoin, Arweave*, Ceramic*, Tableland*)

-

Data Orchestration/Provenance: Platforms optimizing data processing for AI and data-intensive apps and ensuring provenance/authenticity of AI-generated content (e.g., Space and Time, The Graph*, Story Protocol)

-

Data Labeling: Platforms using incentives to crowdsource human contributors in creating high-quality training datasets, improving reinforcement learning and fine-tuning of AI models (e.g., Sapien, Kiva AI, Fraction.AI)

-

Oracles: Networks using AI to deliver verifiable off-chain data to on-chain smart contracts (e.g., Ora, OpenLayer, Chainlink)

Middlewares

To unlock the full potential of open, decentralized AI models or agent ecosystems, new infrastructure must be built. High-potential areas developers are exploring include:

-

Using open-weight large language models (LLMs) to support on-chain AI applications, while developing foundational models capable of quickly understanding and processing on-chain data

-

Providing distributed training solutions for large base models (e.g., >100B parameters); though technically challenging and often deemed impractical, recent breakthroughs from Nous Research, Bittensor, and Prime Intellect are shifting perceptions

-

Leveraging zero-knowledge or optimistic machine learning (zkML, opML), trusted execution environments (TEE), or fully homomorphic encryption (FHE) to enable private yet verifiable inference

-

Building resource coordination networks for open, collaborative AI model development, or creating agent networks/platforms using crypto infrastructure to enhance AI agent potential across on- and off-chain applications

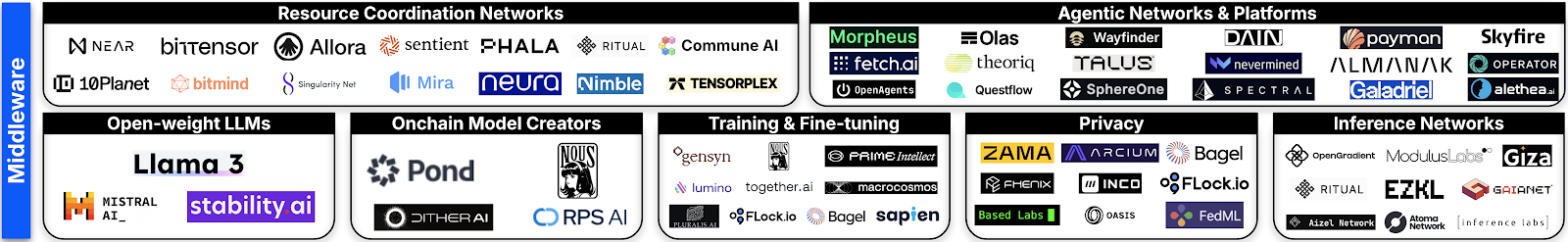

While progress has been made, production-ready on-chain LLMs and AI agents remain in early stages. We expect this won’t change significantly in the short to mid-term unless compute, data, and model infrastructure mature further. Nonetheless, we view this layer as highly promising and a core focus of Coinbase Ventures’ investment strategy, as growing AI service demand will drive long-term innovation here. Emerging areas and example projects at this layer include:

-

Open-Weight Large Language Models (LLMs): AI models whose weights are publicly accessible, allowing anyone to use, modify, and redistribute (e.g., LLama3, Mistral, Stability AI)

-

On-Chain Model Creators: Networks and platforms for creating foundational LLMs suited for on-chain use cases (e.g., Pond*, Nous, RPS)

-

Training & Fine-Tuning: Networks and platforms offering incentivized, verifiable training or fine-tuning mechanisms (e.g., Gensyn, Prime Intellect, Macrocosmos, Flock.io)

-

Privacy: Networks and platforms using privacy-preserving techniques to develop, train, and run AI models (e.g., Bagel Network, Arcium*, ZAMA)

-

Inference Networks: Networks that cryptographically verify or prove correctness of AI model outputs (e.g., OpenGradient*, Modulus Labs, Giza, Ritual)

-

Resource Coordination Networks: Networks facilitating resource sharing, collaboration, and coordination in AI model development (e.g., Bittensor, Near*, Allora, Sentient)

-

Agent Networks and Platforms: Networks and platforms helping create, deploy, and monetize AI agents in on- and off-chain environments (e.g., Morpheus, Olas, Wayfinder, Payman*, Skyfire*)

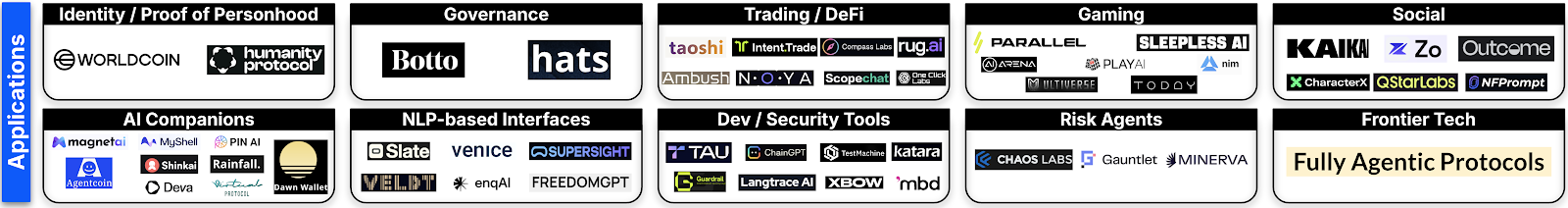

Applications

In crypto, AI agents are beginning to emerge. Early examples include Dawn Wallet, a crypto wallet using AI agents to send transactions and interact with protocols on behalf of users; Parallel Colony*, an on-chain game where players collaborate with AI agents possessing their own wallets and autonomy to create in-game paths; and Venice.ai, a generative AI app and natural language prompt tool featuring verifiable reasoning and privacy safeguards. However, current application development remains largely experimental and opportunistic, with many ideas surfacing due to market hype. Still, we believe that as AI agent infrastructure and frameworks advance, the crypto design space will evolve from primarily reactive smart contract-based apps toward more sophisticated, proactive applications over the medium to long term. Examples of emerging areas and projects being built at this layer include:

-

AI Companions: Apps enabling creation, sharing, and monetization of personalized, context-aware AI models and agents (e.g., MagnetAI, MyShell, Deva, Virtuals Protocol)

-

Natural Language Interfaces: Apps using natural language prompts as the primary interface for on-chain interaction and transaction execution (e.g., Venice.AI, Veldt)

-

Developer/Security Tools: Developer-focused apps and tools using AI models or agents to enhance on-chain development experience and security (e.g., ChainGPT, Guardrail*)

-

Risk Agents: Services using ML models or AI agents to help protocols dynamically adjust and respond in real-time to on-chain risk parameters (e.g., Chaos Labs*, Gauntlet*, Minerva*)

-

In crypto, AI agents are starting to emerge, with early examples like Dawn Wallet—an AI-powered wallet that sends transactions on behalf of users.

-

Identity Verification (Proof of Personhood): Apps using cryptographic proofs and ML models to verify user authenticity (e.g., Worldcoin*).

-

Governance: Apps using AI agents to execute transactions based on human governance decisions or feedback (e.g., Botto, Hats).

-

Trading/DeFi: AI-driven trading infrastructure and DeFi protocols using AI agents to automate on-chain transaction execution (e.g., Taoshi, Intent.Trade).

-

Gaming: On-chain games where smart NPCs or AI mechanics drive core gameplay (e.g., Parallel*, PlayAI).

-

Social: Apps using AI to enhance social experiences on-chain (e.g., KaiKai, NFPrompt).

Conclusion

While still in its infancy, we believe the convergence of crypto and AI—through decentralized AI infrastructure, advances in on-chain AI applications, and the emergence of an “Agent Network”—will drive significant progress. In this network, AI agents will become primary engines of economic activity. Despite ongoing challenges in compute infrastructure and data availability, the synergy between crypto and AI may accelerate innovation in both fields, leading to more transparent, decentralized, and autonomous systems. As new teams secure funding and established teams pursue product-market fit, the industry landscape is rapidly evolving. For internet-native companies and developers, adapting to this shift and harnessing the potential of crypto x AI to create previously unimaginable applications and experiences is crucial.

Overall, Coinbase Ventures is highly enthusiastic about the future potential and opportunities in the crypto x AI space, and we are actively investing across all layers of the tech stack. If you’re building edge compute infrastructure, decentralized data collection and provenance networks, agent networks or platforms using on-chain payments, or novel applications powered by on-chain AI mechanisms—we’d love to hear from you.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News