Crypto Market Outlook for October: The Clash of Chain Abstraction, L1 Competition, and AI Narratives

TechFlow Selected TechFlow Selected

Crypto Market Outlook for October: The Clash of Chain Abstraction, L1 Competition, and AI Narratives

Mainstream memecoins could see a significant surge once liquidity returns, with at least two memecoins potentially reaching over $1 billion in market cap.

By: Rain Sleep

As mentioned earlier, this October outlook will be very concise—only covering 3–5 tokens I personally want to participate in. I hope you enjoy this format (previously it was too scattered and inefficient).

TLDR: $UNI $SOL Berachain $TAO $WELL $ENA

Market hype generally follows two patterns. The first is artificial narratives that push a flagship token into an independent rally, such as $SUI. The second is the incubation, emergence, and explosion of genuine innovation—this could be an entertaining Ponzi or a narrative that substantially meets market demand, like $AXS (this cycle’s Memecoins are a non-typical example).

Typically, the first type of narrative wave offers more opportunities for average investors. Major innovations often emerge under conditions of macro liquidity overflow—when capital seeks higher returns and improved capital efficiency, driving innovation forward.

A key issue this cycle is the absence of a strong narrative capable of guiding liquidity inflow and reallocation—similar to what we saw last cycle. Liquidity is crucial for asset pricing; without a narrative to direct it, speculative momentum struggles to build. Everyone is focused on Memes, and any small trigger quickly sparks new Meme activity. However, Meme narratives also fatigue investors fastest, ultimately leaving behind chaos.

So, does crypto still have opportunities?

I believe so—at least there are several core narratives currently evolving in parallel.

Intent Abstraction & Chain Abstraction

The ultimate goal of this narrative is enabling users and liquidity to enter and engage with crypto seamlessly and accessibly. The vision appears bright. But this isn’t a Ponzi—massive wealth creation across the board is unlikely.

Fundamentally, these speculations still rely on the belief within the crypto community that this narrative can bring in new buyers. Whether it truly brings substantial real users and sustained liquidity into crypto remains questionable.

The key catalyst here is the launch of $UNI v4.

Uniswap v4 acts as a catalyst drawing market attention toward this narrative. Going forward, front-end applications may become the most favored targets for speculation, followed by infrastructure-layer projects like Uniswap v4 and liquidity interaction layers. Initially, however, the biggest opportunity likely remains $UNI. Similarly themed tokens such as $COW and $1INCH should also see corresponding opportunities.

Layer1 Competition

In today's market, Layer1 competition is the dominant narrative—unquestionably.

This cycle’s primary speculative theme has been Solana, occasionally interrupted by another Layer1 attempting to challenge its position.

For instance, $AVAX rose through "Meme炒作" and high-profile PR announcements with top companies. $SUI operates similarly—potentially using OTC deals to get influential English CT figures to promote it (uncertain), creating a new narrative from scratch, promoting Memecoins (Sui already shows promising yield opportunities), and incentivizing liquidity with $SUI tokens (akin to Arbitrum) to attract attention and improve liquidity stickiness. Notably, DeFi yields on Sui remain attractive.

Many Layer1s now try leveraging Memecoins to capture market attention and liquidity, though results are generally poor (e.g., BSC).

Therefore, I view the rotating spotlight among Layer1s as likely short-term phenomena. Participating briefly when these chains make moves can certainly yield profits—your actions align with project incentives.

Another Layer1 strategy is Fantom’s rebranding—launching a higher-performance chain as a brand upgrade. If a blockchain starts with no users, use future airdrop expectations as incentive. This approach mirrors previous Layer2 strategies—lacking novelty but effective before airdrops.

My preferred Layer1 picks: Solana $SOL and Berachain.

The reason for favoring Solana is simple—just check which ecosystem hosts more large-cap Memecoins on Binance. Memecoins are a Layer1’s ace card.

Berachain’s Proof-of-Liquidity (PoL) represents the only major consensus innovation among Layer1s this cycle, introducing dynamic game theory between users, validators, and developers. They’re also actively supporting ecosystem projects transparently, decentrally, and fairly. I’m deeply involved in Berachain’s ecosystem, so consider this biased—do your own research (DYOR).

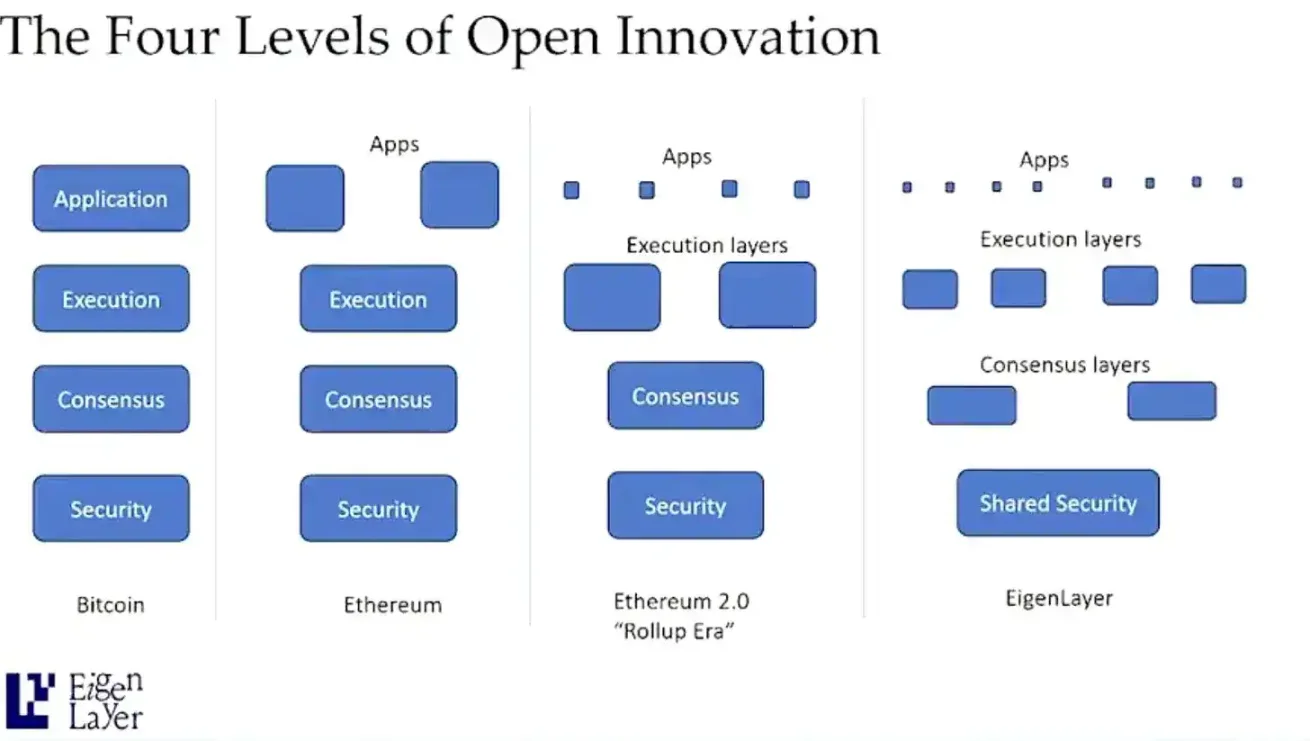

Beyond basic Layer1 competition, I’m also fond of modularization—a frequently discussed new narrative this cycle. Just refer to the image below.

That said, modularization assets are somewhat complicated. I originally intended to support $EIGEN, but then the hack incident triggered significant community backlash. Overall, I remain bullish on $EIGEN and believe it could absorb value from other modular projects, potentially seeing price strength at some point in Q4 (though widespread speculation might not occur until the next cycle).

AI

The AI narrative needs little explanation—just observe OpenAI’s recent moves. Previously, AI tokens moved in tandem with NVIDIA stock. Currently, the best-performing crypto AI token is $TAO—if you pick one, pick the strongest. AI token speculation is detached from fundamentals; our focus should remain on broader AI industry shifts. (China’s $NMT is worth watching too, though its momentum would follow $TAO.) Key factors: “price performance during market pullbacks” and “timing.”

This speculation will persist until the AI bubble bursts. Until then, all we can do is ride the wave.

Stablecoin Competition and DeFi

The stablecoin race is intensifying—PayPal’s entry, Binance shifting support to FDUSD, BlackRock actively expanding into stablecoins, Coinbase pushing USDC and Euro stablecoins on Base.

Under this fierce competition, the main tokens available for speculation are Sky (formerly MakerDAO), $LQTY, and $ENA.

Sky is the oldest decentralized stablecoin project. Recently, it’s transitioning its governance and native stablecoin model. Clearly, Sky aims to reduce sensitivity to interest rate cuts by shifting from “RWA yield-driven adoption” to “token-incentivized adoption.” It will later launch SubDAOs to open new growth vectors and maintain stablecoin adoption scale. Wealth opportunities will exist, but the community currently disapproves of Sky’s recent moves—I’ve seen notable negative feedback.

Additionally, as Shen Yu pointed out, rate cuts will inevitably boost DeFi competitiveness. DeFi sectors on both Ethereum and Solana stand to benefit. In short, the more active a Layer1 is—with higher TVL—the more favored its DeFi tokens become. Later, demand for high yields may spawn new opportunities. But that’s likely bull-market territory—we’ll cross that bridge when we come to it.

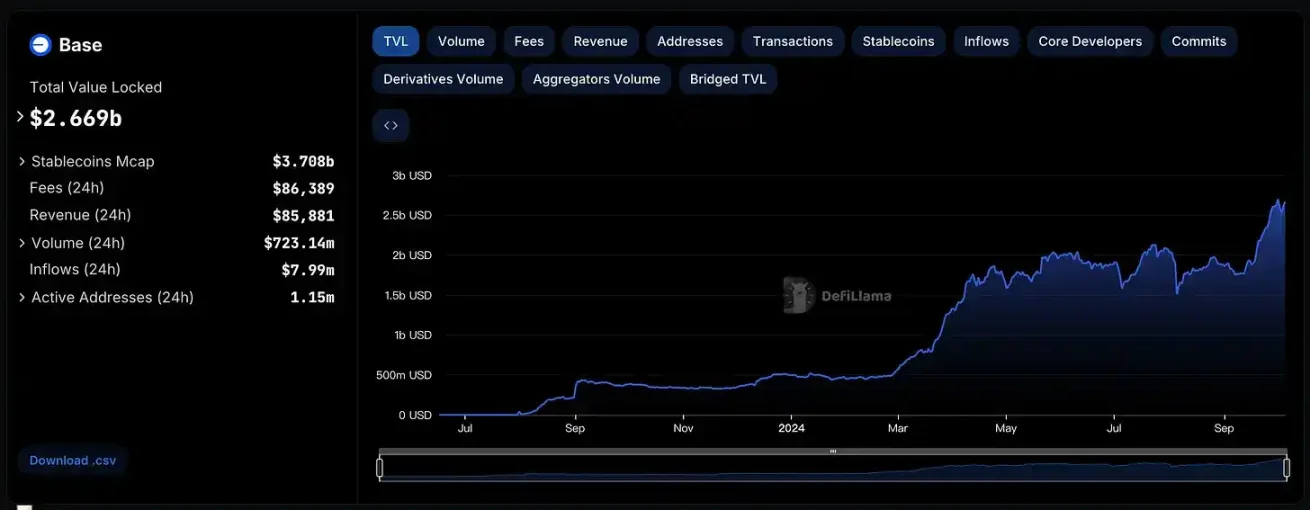

I’d like to highlight Ethereum L2 Basechain separately. Base has performed well recently, with TVL surging in September—fundamental growth brings new wealth potential. We must understand Coinbase’s motivation for building Base: expanding its influence in crypto and generating sequencer revenue. A successful Base benefits Coinbase directly, giving them strong incentive to drive continued ecosystem growth (same logic behind pumping $AERO earlier).

What is Coinbase pushing right now?

cbBTC.

Moonwell and Aerodrome will be central to cbBTC adoption growth. Currently, Moonwell has launched liquidity mining incentives for cbBTC. Pumping $WELL could accelerate broader cbBTC adoption (my personal view).

$LQTY has upcoming v2 expectations (November) and enjoys community trust as a decentralized stablecoin. Sky’s transition itself benefits $LQTY—one reason for its strong rally earlier (in my view). Industry dynamics and imminent realization of expectations may impact $LQTY’s future price.

$ENA’s strengths lie in being “a new-generation stablecoin launched this cycle” and “partnering with BlackRock to launch UStb.” This level of collaboration carries far greater impact than merely participating in BlackRock’s Buidl fund—deep partnership is the best catalyst. $ENA’s recent airdrop and token unlocks should provide entry opportunities.

Other tokens I like include $PENDLE and $BANANA. I've discussed $PENDLE multiple times—it's currently pushing BTCFi and has v3 anticipation. For $BANANA, refer to @BensonTWN’s excellent thread.

For gaming, I’m considering $PIXEL, $PRIME, and $PIRATE. I don’t think we should evaluate these solely as part of the gaming sector—each requires individual assessment based on specific catalysts.

Bitcoin ecosystem needs further observation (core demand persists—see my Metagame article). We're still in a phase where the market believes miners need on-chain activity to boost income. Hopefully, new opportunities will emerge in the BTC ecosystem. But transaction fee spikes are likely temporary—miners love it, but the market won't sustainably pay premiums.

Regarding Memecoin narrative, I believe mainstream Memecoins will surge significantly once liquidity returns—$WIF and $PEPE have the highest potential. Memecoins are unpredictable—you can only surf the wave. Overall, I remain bullish on the Memecoin space and expect at least two Memecoins to reach 10B+ market cap, just like $DOGE and $SHIB last cycle.

Finally, let’s review key October events:

-

$JEWEL Colosseum PvP on Metis: Unclear how these two projects will interact, but $METIS has been performing well;

-

$XRP ETF and SEC: Potential for a solid rebound;

-

$STX Nakamoto Upgrade: Positive for $STX, likely bringing good opportunities on Stacks;

-

$DUSK Mainnet Launch: Not a focus area for me currently;

-

$AVAX Summit (Oct 16–18); $WLD “New World” with Sam Altman: Related to AI;

-

$RENDER Migration Rewards End; $TIA Unlock of $1.05B; JPY Interest Rate Decision

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News