Focusing on South and Southeast Asian markets, an untapped crypto treasure trove

TechFlow Selected TechFlow Selected

Focusing on South and Southeast Asian markets, an untapped crypto treasure trove

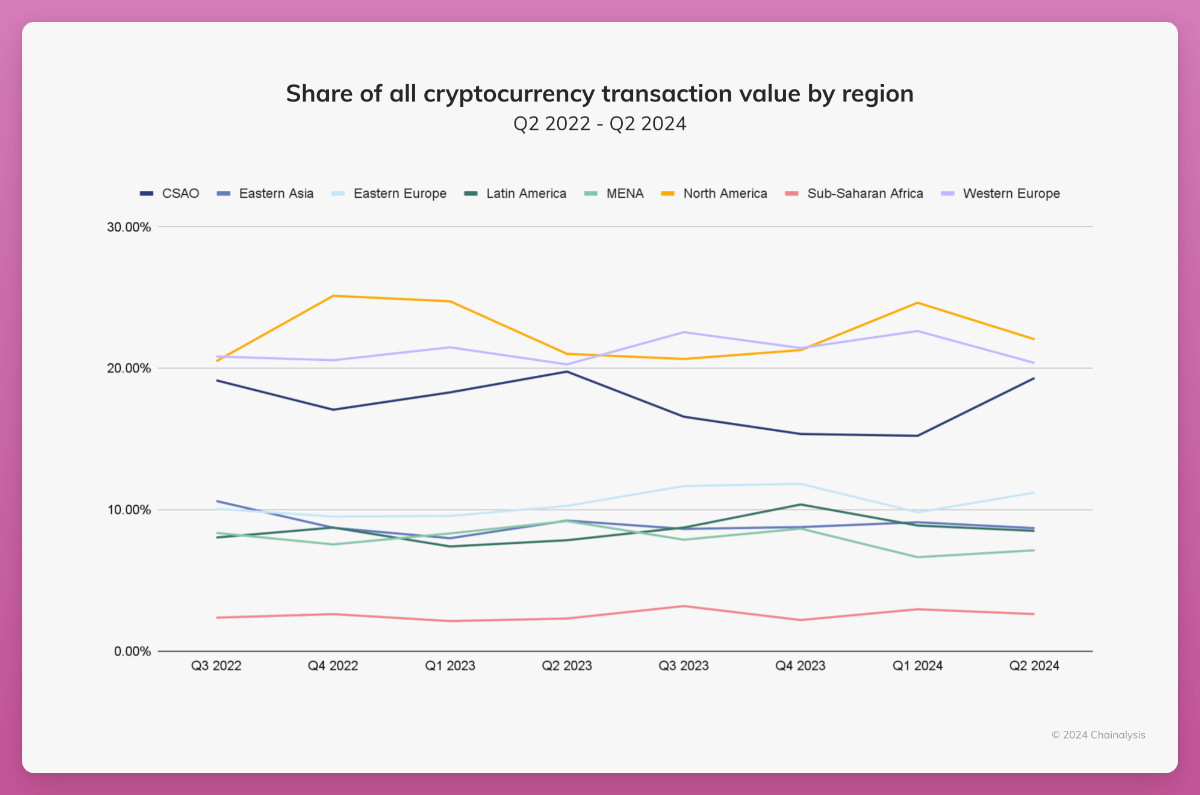

South Asia and Southeast Asia are the third most important market after the United States and Western Europe.

Author: Ignas | DeFi Research

Translation: TechFlow

As cryptocurrency evolves into a global industry, the dominance of Western and English-speaking KOLs may cause us to overlook opportunities beyond the West.

For example, in my previous blog post on market conditions, I was surprised to find that OpenSocial had more users than Farcaster or Lens, despite receiving far less attention on X. What’s their secret? Indonesia, Vietnam, and India make up the core user base.

So in this article, I team up with Mai—the mind behind Pink Brains’ official X account—to share insights on South Asian crypto markets.

We also interviewed several individuals from South Asian countries to understand their personal experiences.

South Asia – The Crypto Frontier

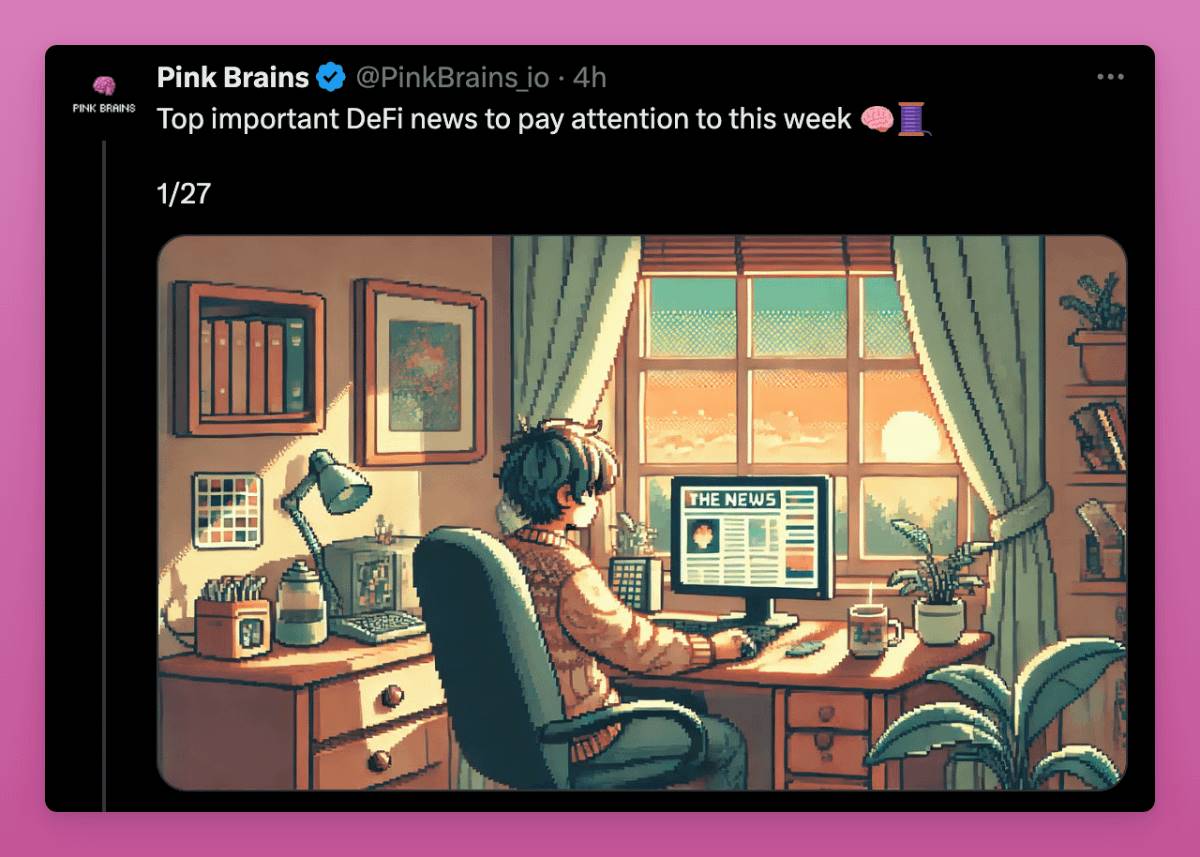

Token2049 Singapore was undoubtedly the largest crypto event of 2024, and one takeaway from Andy's talk stood out: "The Asian market remains underdeveloped."

While East Asia—such as Korea, Hong Kong, Taiwan, China, and Japan—has become a major crypto hub with clear regulations and strong institutional participation, Central & Southern Asia and Oceania (CSAO) approach crypto differently—an approach often overlooked and rarely discussed on Western crypto Twitter.

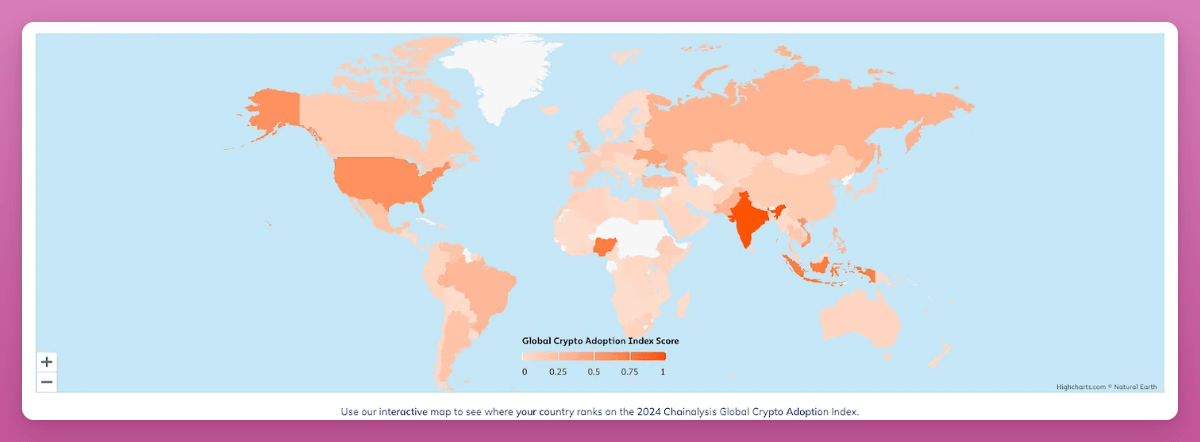

Below is Chainalysis’ 2024 Global Crypto Adoption Index map.

According to Chainalysis, the CSAO region ranks third globally in crypto market size, with over $750 billion in crypto inflows between July 2023 and June 2024—accounting for 16.6% of the global total. Let that sink in. Only North America and Western Europe rank higher.

In the 2024 Global Crypto Adoption Index, the Central & Southern Asia and Oceania region stands out, with seven countries in the top 20: India (1), Indonesia (3), Vietnam (5), Philippines (8), Pakistan (9), Thailand (16), and Cambodia (17).

How Do People in South Asia Adopt Crypto?

Vietnam

First, let’s look at Vietnam—the home country of most members of our DeFi creator studio, Pink Brains—who provide firsthand market insights. According to Triple-A, Vietnam has the second-highest crypto ownership rate globally. Approximately 21.2% of the population owns crypto, second only to the UAE’s 34.4%.

Chainalysis data also shows Vietnam reaped significant profits last year, ranking third globally, with $1.18 billion in realized crypto gains. This is double Spain and the Philippines’ gains, and triple Thailand’s.

One reason is Vietnam’s ambiguous government stance on crypto. While not banned, its practical use—for payments or collateral—is prohibited. This makes holding crypto attractive, though real-world adoption still lags behind other Southeast Asian nations.

-

For most Vietnamese crypto investors, centralized exchanges (CEXs) are the preferred choice. Binance, Bybit, OKX, and BingX are the most popular, while Coinbase holds little market share due to language barriers and complex KYC procedures. Trading and holding on CEXs remain the dominant investment strategy.

-

Airdrop farming and crypto mining are extremely popular. You’ll find countless Telegram and Facebook groups sharing tips, “hidden gem” alerts, and token giveaways. In fact, buying cloned accounts, faking KYC, or setting up bots is simple, cheap, and nearly hassle-free. This makes Sybil attacks from Vietnamese farmers a major challenge for protocols. Notable airdrops include Arbitrum, LayerZero, Aptos, and zkSync.

-

Most Vietnamese investors aren’t experienced traders. They primarily seek quick profits, viewing crypto as a side hustle or life-changing opportunity alongside full-time jobs. Veteran investors typically hunt for low-market-cap tokens on decentralized exchanges (DEXs) while holding large assets on CEXs. Meanwhile, new investors since 2022 tend to chase airdrops and reward programs. Experienced traders often lose during major black swan events like FTX or Luna, while newcomers fall victim to misleading KOL signals, scams, or excessive leverage.

-

Vietnam excels in international math competitions and is a hub for blockchain development talent. You may have heard of notable figures like Loi Luu (Kyber Network) and Vu Nguyen (Pendle), but there are also infamous serial scammers, such as the person behind Whale Markets!

Note: My team strongly dislikes this individual. See the discussion above for how he harmed investor interests. Mai also told me retail banking and non-cash payments are rapidly advancing in Vietnam. The country is following a path similar to China, where digital wallets, banking apps, and credit cards are gradually replacing cash, especially in major cities. This shift bodes well for Web3, creating fertile ground for widespread crypto payments—much like Singapore today. More large corporations are beginning to integrate blockchain technology into their operations.

We’ve already seen preliminary banking trials, such as HSBC Vietnam’s first live blockchain experiment for L/C payments. These efforts indicate strong corporate interest in blockchain technology.

However, further legal framework opening toward crypto is still awaited.

India

Despite evolving regulations and taxation, India remains a major player in the global crypto market. India imposes a 30% tax on crypto gains and a 1% tax on all transactions, prompting some investors to seek international exchanges with fewer restrictions. Despite these hurdles, crypto adoption continues to grow rapidly. The rise of innovative Indian crypto startups suggests that more favorable tax policies and clearer regulations are needed to sustain this momentum.

I asked Hitesh.eth on X what makes India unique. Besides his deep crypto insights, Hitesh is also building a platform (DYOR) to help people better understand crypto basics. India has the world’s largest group of unemployed youth eager to work for incentives. If done right, apps can channel these incentives via tokens and points, much like Axie did before. In terms of infrastructure, India offers some of the best developer talent at costs far below those in the EU and US.

He said, “Over 50% of community-related roles are filled by Indians, with many more eager to join the space. But this ‘gig economy’ nature of crypto work and high ambitions have led to issues, as seen in past airdrops, creating unfair stereotypes about Indians. However, this perception shouldn’t be generalized—it’s more case-specific than representative.”

Indonesia is one of the fastest-growing trading markets.

According to a product manager at Pintu, an Indonesian crypto exchange, growth in crypto activity is largely driven by speculation. “Many still see crypto as a way to make quick profits,” he said. “Now, many traders turn to Telegram groups for signals, just as they used to do in stock trading—but with constant new token launches, crypto activity is even more intense.” He added that stricter rules from the Indonesia Stock Exchange might be pushing people toward crypto. “Due to new full-order auction measures making stock trading stricter, some investors are seeking alternatives like crypto.”

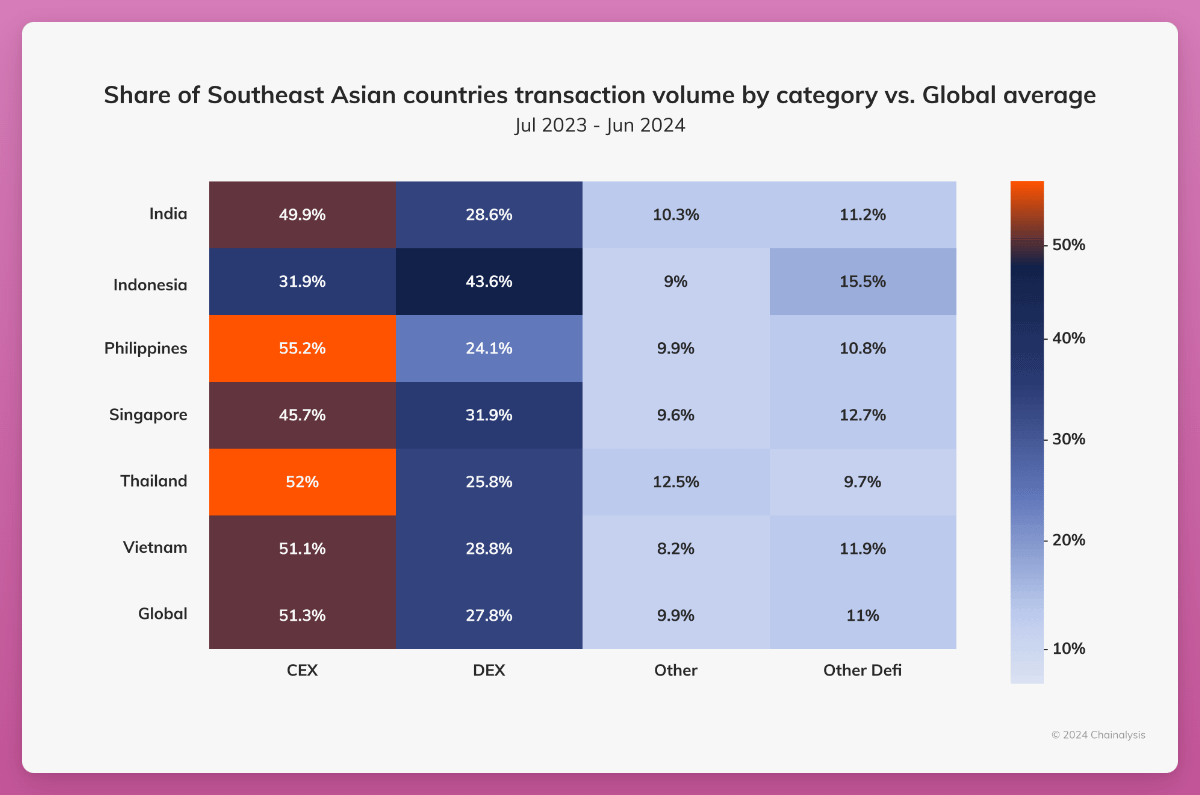

Compared to regional and global averages, Indonesia stands out in decentralized exchange (DEX) and decentralized finance (DeFi) activity.

This is confirmed by Eli5DeFi on X, who noted: “Many Indonesians enter crypto through memecoins or airdrops, as they’re simpler and more appealing. Airdrops, in particular, often require only time and effort.”

He added: “We’ve recently been using TON apps; some even build their own communities to farm and farm $DOGS, $NOT, and $HAMSTER.”

As Indonesians become more crypto-literate, yield farming, staking, and DeFi projects are gaining popularity. This growth has formed a new “crypto enthusiast” community, with over half of investors being millennials and Gen Z seeking emerging tech and fast profits.

DeFi is also rising, with many Indonesian builders—Eli5DeFi

Here are a few notable examples:

-

@0x_eunice - Co-founder of Monad

-

@Mariobern - Co-founder of Pyth

-

@bradydonut - Co-founder of HawkFi

-

@BrianLimiardi - Co-founder of Copra

-

@smsunarto - Founder of Argus Labs

-

@bizyugo - No. 1 at Debank

-

@mathdroid - Pandora

-

@PatriaAbditiar - Sociocat

Singapore

While countries like Indonesia and Vietnam see crypto adoption driven by “crypto degeneracy” and promises of quick returns, Singapore presents a different picture.

Ronald Chan from Saprolings (a Web3 incubator) told me that after China shut down crypto companies, Singapore saw a surge in crypto firms relocating there. Their reasons include:

-

Geographic proximity to China

-

Deep cultural ties to Chinese communities

-

Relaxed political environment

-

Low taxation

-

Large Mandarin-speaking population

-

Free flow of capital (including Bitcoin)

-

Strong legal system (this is crucial)

-

Well-educated workforce to run businesses

-

Prominent financial center in the region

-

Few viable alternatives in the region

“We protect ourselves by becoming the banker for neighboring leaders.” – Ronald Chan

Second, regulatory progress and merchant services reveal crypto’s potential beyond trading and investment. Ronald pointed out that Singapore “issues banking licenses to both local and foreign banks, enabling fair competition—a contrast to many other countries.”

Additionally, Singapore “has a national QR code scanning system similar to China’s WeChat Pay and Alipay (called PayNow QR), which most people use. Mastercard and Visa are widely available, but neither users nor merchants are satisfied due to additional fees charged on both sides.”

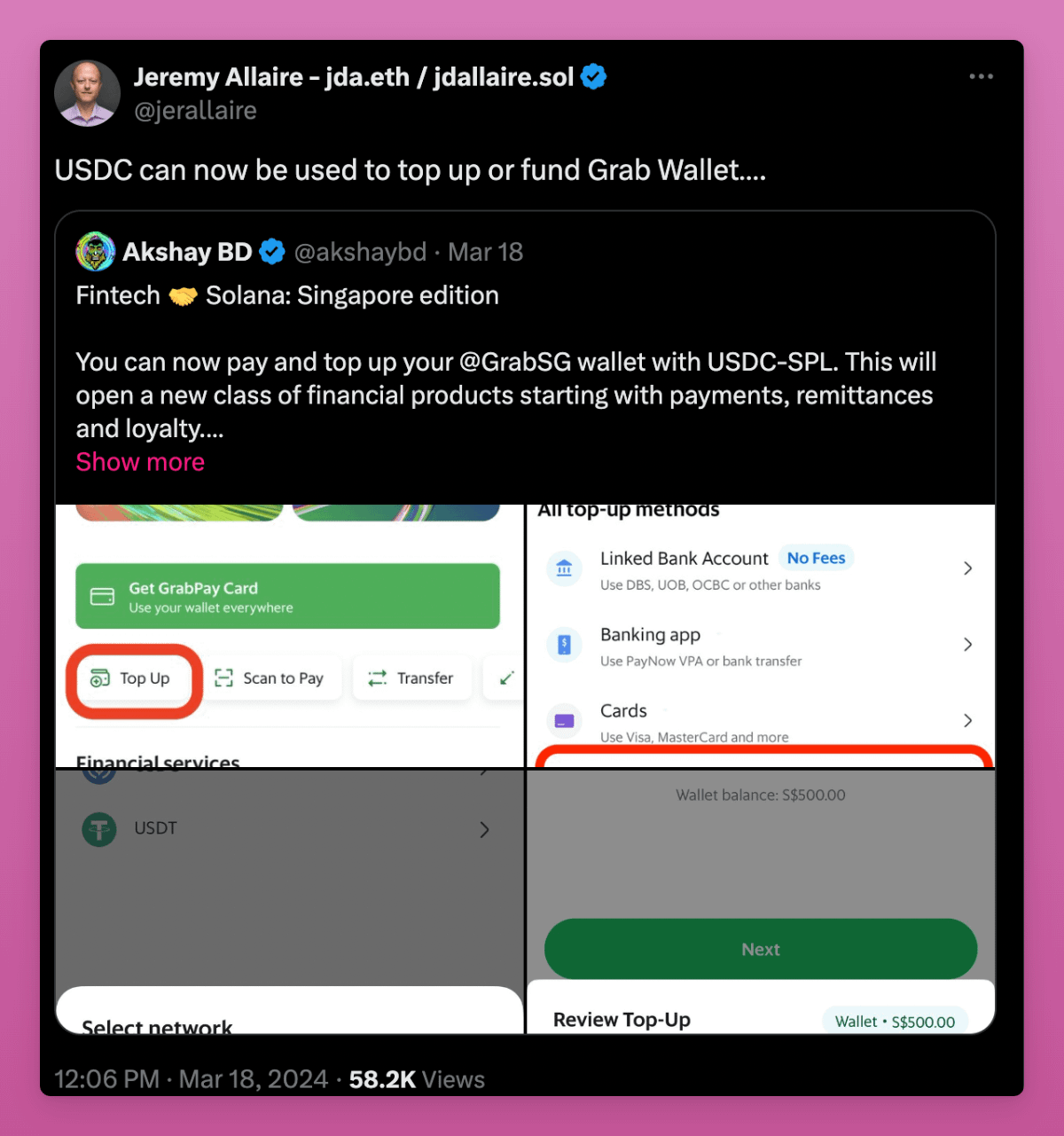

More importantly, Grab—the super app widely used for ride-hailing, food delivery, and other services—has started allowing users to top up their e-wallets with crypto. Users can now pay with Bitcoin, Ethereum, XSGD (Singapore’s local stablecoin), Circle USD, and Tether.

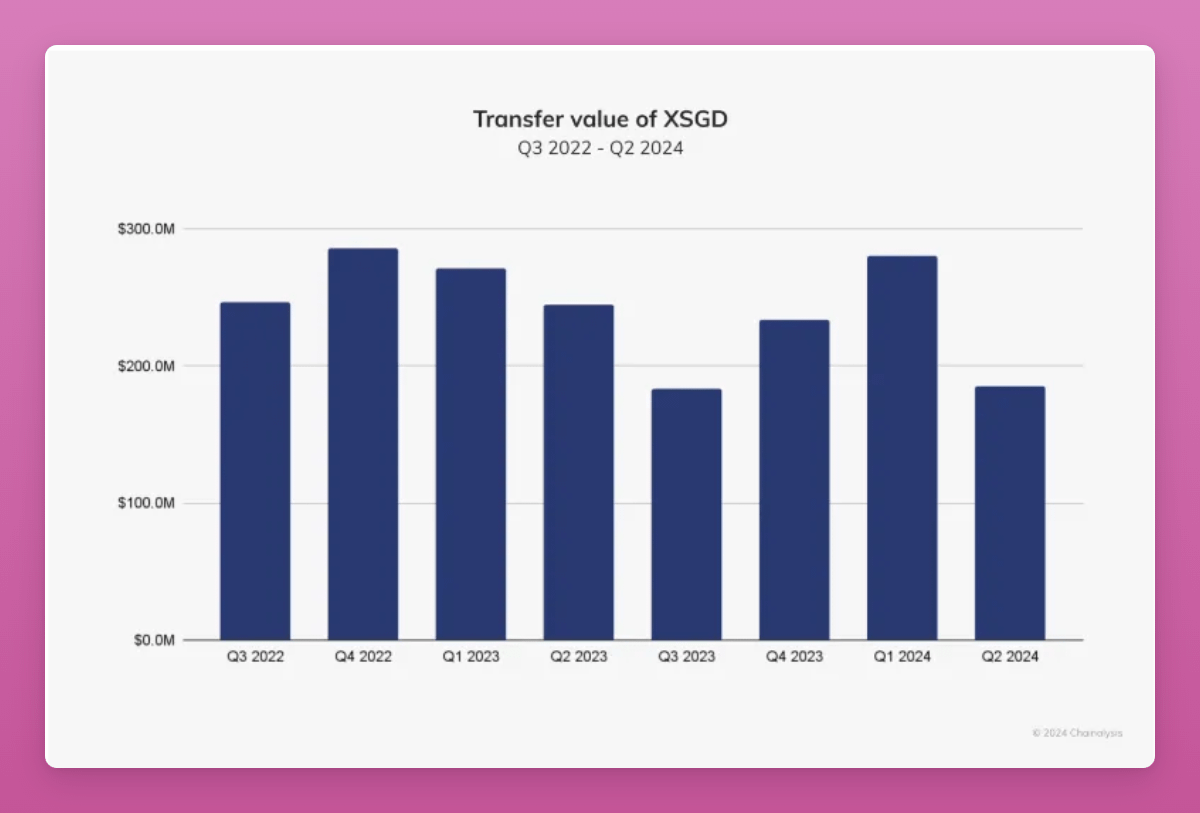

In Q2 2024, crypto payments via Singapore merchant services reached nearly $1 billion, the highest level in two years.

This is a fascinating shift, especially in a market where traditional payment systems are already efficient, suggesting crypto is gradually becoming a common asset for more people.

Meanwhile, over 75% of XSGD transfers are valued at $1 million or less, with nearly 25% under $10,000, clearly indicating growing retail participation in the local crypto market.

The success stems from clear regulation, which enhances trust in stablecoins.

In 2023, the Monetary Authority of Singapore (MAS) issued guidelines for stablecoins, and in 2024 introduced custody and licensing rules for crypto firms.

This demonstrates the positive impact of clear regulation on crypto adoption.

Case Study: TON’s Success in South Asia

TON’s click-to-earn games are incredibly popular in South Asia—quite surprising. Personally, I tried it, but the rewards weren’t worth it for me.

You might underestimate TON due to its oversaturated airdrops and “mindless” click-to-earn games, but they actually align with its goal of bringing crypto to everyone’s pocket.

By earning free tokens, a new wave of users can begin learning how to trade on DEXs, add liquidity, stake, and gradually explore other parts of the ecosystem.

Do you know where these users mainly come from? CIS countries and South Asia.

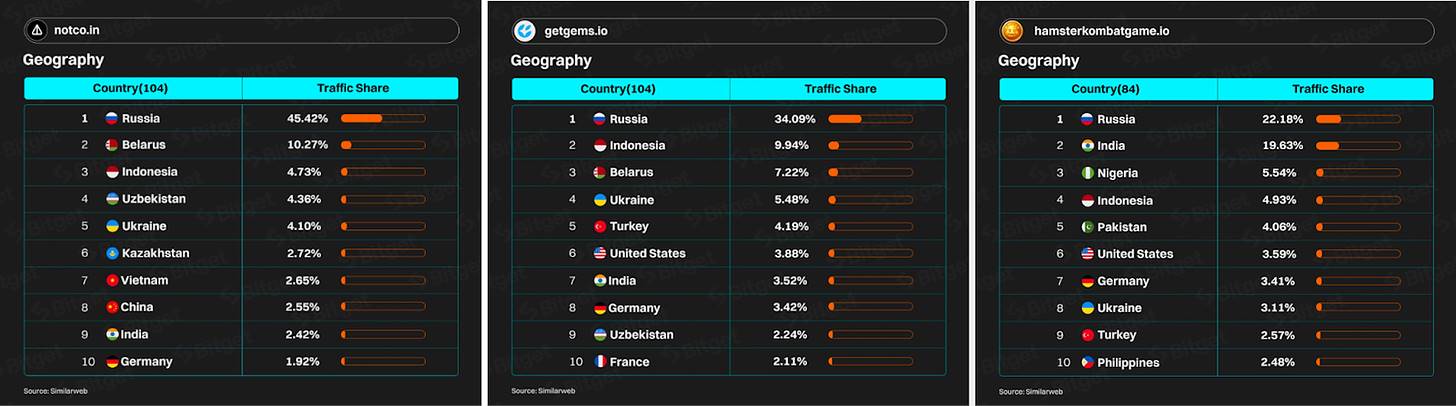

Over 66% of traffic to Notcoin’s website (notco.in) comes from CIS countries. Next are Asian nations like Indonesia, Vietnam, China, and India. Getgems.io and Hamster Kombat show similar trends, consistent with Telegram’s user base.

Telegram Mini Bot projects offering free tokens resemble the rise of Axie Infinity in the Philippines.

TON blockchain’s success boils down to two high-adoption areas: free airdrops and tap-to-earn mini-games.

Free Airdrop Arena

Everyone is tired of point-based airdrop campaigns. This is where Telegram’s free airdrop model stands out. It leverages Telegram’s 900 million users to distribute tokens like DOGS. DOGS started as a meme but gained attention for its fair distribution and lack of presale. This drew new users into blockchain, making DOGS distinct from typical crypto tokens.

DOGS quickly listed on major CEXs like Binance. Airdrop amounts ranged from $10 to $60 per wallet. While this may sound modest to Western investors, users can farm across multiple accounts. For many in developing countries, these airdrops provide a new income source during tough economic times.

Tap-to-Earn Mini-Games

Tap-to-earn games like Hamster Kombat are growing rapidly in South Asian countries. Within three months, it reached 239 million sign-ups, making it one of the most popular tap-to-earn games.

It also gained over 10 million YouTube subscribers in just one week. Insane. These numbers are unprecedented in many Western countries.

According to Bitget Premarket data, the token’s total market cap is $920 million, implying the airdrop value could be around $550 million.

Thanks to simple gameplay, referral campaigns, and strong social influence, click-to-earn games like Hamster Kombat have quickly captured massive attention among Southeast Asian crypto influencers.

These influencers are equally popular on TikTok and X, sharing referral links and spreading awareness about this game genre.

Conclusion

South and Southeast Asia are among the most populous regions in the world, with young, tech-savvy populations, making them critical markets for crypto ventures. Today, it ranks as the third-largest market after the U.S. and Western Europe.

However, due to significant differences in income levels, government regulations, and economic conditions across countries in the region, it remains challenging for businesses to tailor strategies for each nation.

TON appears to have executed well in targeting speculative markets, and acceptance of crypto payments is steadily rising.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News