Exclusive Interview with Raymond Qu, Co-Founder of PolyFlow: Building PayFi Infrastructure

TechFlow Selected TechFlow Selected

Exclusive Interview with Raymond Qu, Co-Founder of PolyFlow: Building PayFi Infrastructure

PolyFlow is the infrastructure layer of a blockchain network, designed to integrate traditional payments, Web3 payments, and decentralized finance (DeFi).

In 2008, the Bitcoin whitepaper painted a vision of a peer-to-peer electronic cash payment network that operates without trusted third parties. Payments were one of the earliest promises made by cryptocurrency and blockchain technology, and also Satoshi Nakamoto’s blockchain solution to the failing financial system at the time.

Although the industry has invested billions of dollars over the past decade into developing underlying blockchain infrastructure, and we now see high-performance blockchains like Solana and the explosive rise of stablecoins, most current market infrastructure still revolves around trading rather than truly supporting the real-time capabilities and scalability required for payments—hindering the mass adoption of Web3 payments.

So what kind of infrastructure do we need to support real-world payment scenarios? And what is the value and significance of PayFi?

In this article, we had the privilege of conducting an in-depth conversation with Raymond Qu, co-founder of PayFi infrastructure—PolyFlow. More than just an interview, it was an opportunity to understand and learn from a seasoned expert with over two decades of international financial consulting and management experience, exploring his comprehensive thinking and practical insights on digital finance from a global perspective, as well as his profound understanding of cryptocurrency and blockchain technology.

Raymond possesses a unique insight into innovative financial services in international markets. Under his leadership, Geoswift became a comprehensive global financial services company covering international payments, cross-border remittances, foreign exchange, and prepaid card businesses. He is also a well-known investor in the global digital finance space, with investments spanning leading companies in fintech, digital banking, blockchain, Web3, and artificial intelligence. Raymond serves as a senior advisor to the Business Development Bank of Canada and is a member of the expert panel at the Financial Research Institute of China’s State Council Development Research Center.

1. The Vision Behind PolyFlow

PolyFlow is an infrastructure layer for blockchain networks, aiming to integrate traditional payments, Web3 payments, and decentralized finance (DeFi). It processes real-world payment scenarios in a decentralized manner and will serve as the foundational infrastructure for PayFi, driving the creation of a new financial paradigm and industry standards.

Before diving into PolyFlow specifically, Raymond first explained the essence of financial transactions to help us better grasp its true value.

1.1 The Core of Financial Transactions

In traditional financial markets, every financial transaction and value transfer relies on two inseparable components: information flow and fund flow, which together form the foundation of financial transactions.

-

Information Flow refers to the data involved in a transaction process, including transaction initiation, payment instructions, and settlement orders. It ensures accuracy and timeliness, focusing on the transmission of transaction instructions and data.

-

Fund Flow refers to the entire process of actual capital movement among parties during a transaction, emphasizing the physical transfer of funds.

Information flow and fund flow are deeply intertwined in financial transactions. Their effective integration ensures that financial transactions can be completed securely and efficiently.

1.2 Information and Fund Flows in Cross-Border Contexts

Due to differences in language, currency, and regulation, the implementation paths of information and fund flows diverge significantly in cross-border transactions.

A well-known example is SWIFT, which focuses solely on transmitting information flow and does not involve fund flow. SWIFT uses standardized message formats to build a highly automated global financial messaging network, enabling banks worldwide to exchange transaction information quickly and accurately.

While information flow can be fully transmitted via SWIFT, fund flow remains constrained by foreign exchange controls, regulatory compliance, anti-money laundering (AML) requirements, and other jurisdiction-specific factors, making real-time synchronization between information and fund flows impossible. Fund flow still depends on intermediaries such as domestic banks and financial institutions, involving complex domestic clearing systems, cross-border settlement mechanisms, and international payment infrastructures.

Even more obstructive to global value movement is the fact that possessing a SWIFT code does not automatically grant eligibility to participate in the network when it comes to processing fund flows.

1.3 Enabling Value Circulation Through PolyFlow

This leads directly to the founding mission of PolyFlow: to build a decentralized infrastructure that enables broader participation in the global payment network, reduces regulatory compliance burdens, eliminates custodial risks, and minimizes reliance on third parties.

The core idea of PolyFlow is to use modular design to decouple the previously centralized control of information and fund flows. By decentralizing these processes, PolyFlow ensures better compliance, eliminates custody risk, and leverages blockchain's properties to connect with the DeFi ecosystem—accelerating large-scale PayFi adoption.

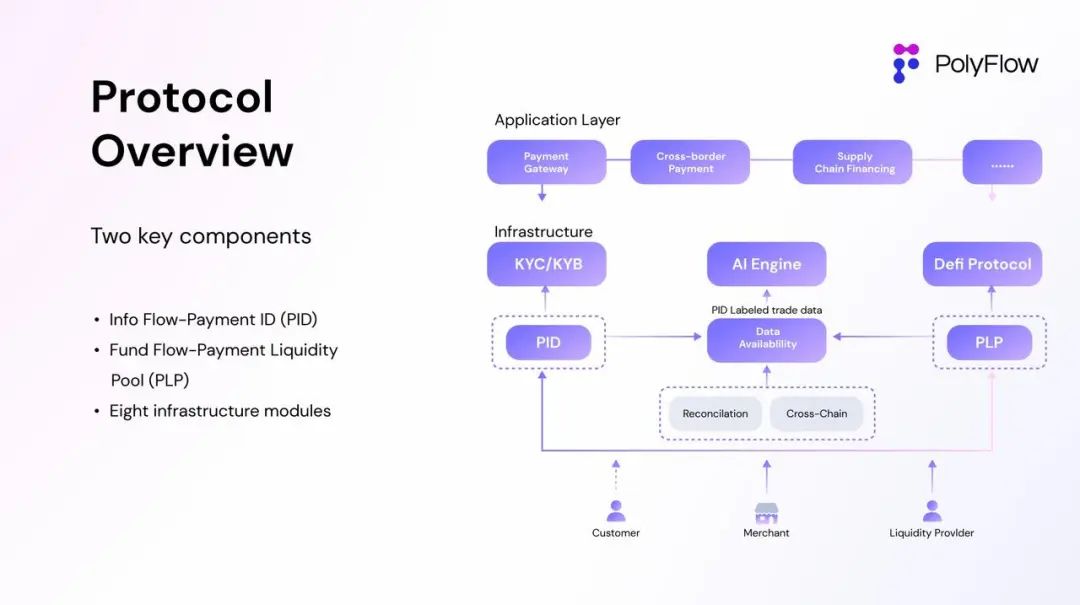

PolyFlow introduces two key components: Payment ID (PID) and Payment Liquidity Pool (PLP):

-

PID is linked to information flow and serves as a powerful tool enabling user identity verification, compliance onboarding, privacy protection, data sovereignty, AI-driven data processing, and X-to-earn functionalities;

-

PLP is tied to fund flow and consists of smart contract-managed pools for payment transactions. It provides a secure and compliant framework for digital asset circulation, custody, and issuance, while introducing composability and scalability from the DeFi ecosystem.

Together, PolyFlow establishes a lightweight-compliance, non-custodial, DeFi-compatible architecture for PayFi applications, along with a secure and compliant framework for digital asset circulation, custody, and issuance.

It's important to recognize that Bitcoin and its blockchain network, created by Satoshi Nakamoto, represent a new digital-era solution to long-standing financial problems—not only addressing how value moves across time and space but also eliminating reliance on third-party trust in transactions. These are exactly the goals PolyFlow aims to achieve.

2. PID – Bridging the Physical World and Digital Wallets

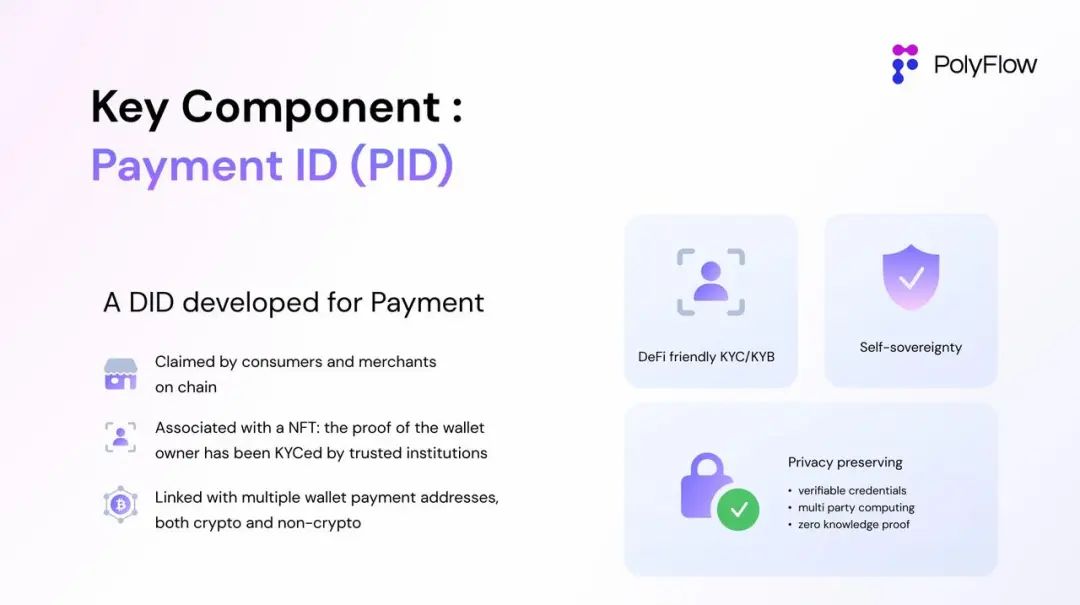

PolyFlow’s Payment ID (PID) is a decentralized identifier derived from the separation of information flow. It binds encrypted KYC/KYB proof data while connecting verifiable credentials across multiple platforms, enabling:

-

Compliant Onboarding: PID can aggregate verified information from multiple platforms, simplifying validation processes for partners.

-

Privacy Protection: Using zero-knowledge proofs and other technologies, PID allows AML/CTF obligations to be fulfilled without exposing user privacy—an essential prerequisite for participating in both traditional finance and DeFi ecosystems.

-

Data Sovereignty: PID enables transaction data to be shared with regulators to meet compliance needs, while returning behavioral data ownership back to users.

-

AI-Driven Insights: Beyond KYC/KYB data, PID can link off-chain uploaded or on-chain collected transaction data. AI analyzes this rich dataset to extract additional value for PID owners—playing a crucial role in building on-chain credit systems.

The innovative introduction of PID gives PolyFlow, as PayFi infrastructure, transformative advantages—bridging traditional finance and DeFi, offering users flexible and reliable ways to manage digital identities, engage in cross-platform transactions, and build on-chain credit.

How should we understand the goal of PID being to link the physical world with cryptocurrency wallets?

Raymond explains: “A PID isn’t necessarily just a payment ID—it should be more like a physical wallet.”

Think about what’s inside your physical wallet besides cash: family photos (NFTs), bank cards, driver’s license, and ID documents (extractable via ZK proofs, protected for data privacy).

From this perspective, a Wallet shouldn’t equal just a Money Wallet—the potential of PID goes far beyond. Current projects like Scan-to-Earn built around PID are just the beginning.

3. PLP – Achieving Consensus on Fund Flow

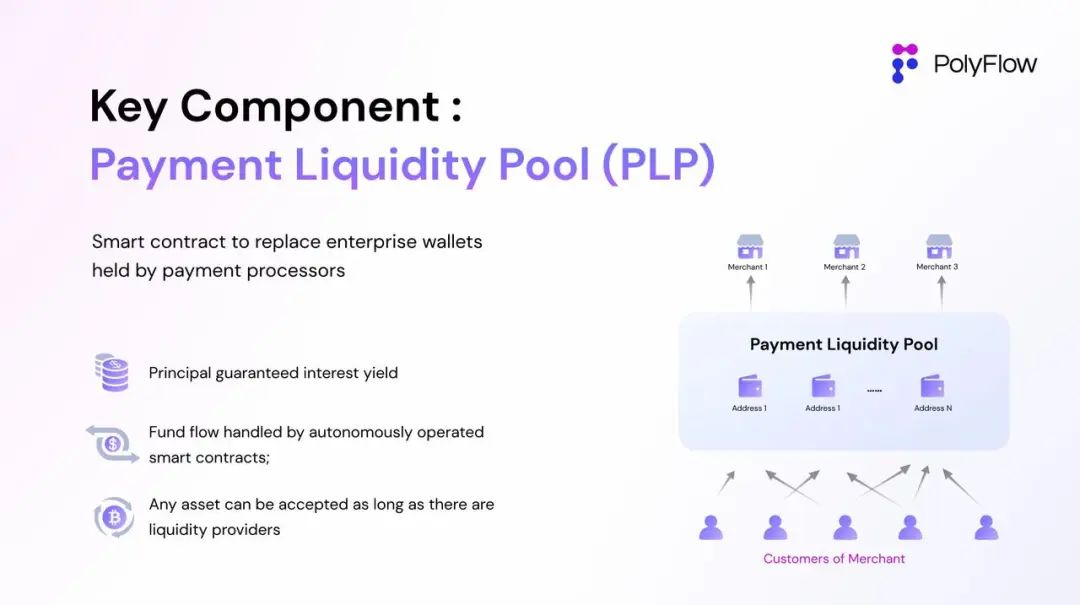

PolyFlow’s Payment Liquidity Pool (PLP) emerges from the separation of fund flow. It uses smart contract addresses to receive transaction funds and enable on-chain custody, replacing the costly, centralized enterprise wallet model.

This more decentralized approach enables:

-

Decentralized Fund Custody: Offers PayFi applications a convenient, secure, and compliant custody method, minimizing dependence on intermediaries while ensuring fund safety.

-

Liquidity Pools: Aggregates transaction funds via smart contracts, providing liquidity to meet financing needs within payment transactions.

-

DeFi Compatibility: Centralized architectures cannot interoperate with decentralized DeFi ecosystems. Being built on blockchain, PLP seamlessly integrates with DeFi and brings DeFi logic to PayFi applications.

-

Risk-Free RWA Yield Category: Protocol-generated yields are directly reflected in PLP, offering DeFi a stable, low-risk income source rooted in real-world payment scenarios.

This PLP architecture flexibly integrates with the DeFi ecosystem, ensuring PayFi applications can adapt to the evolving digital asset landscape.

How then do we understand PLP’s goal of achieving consensus on fund flow?

To explain this, Raymond walks us through three settlement models of Web3 payments:

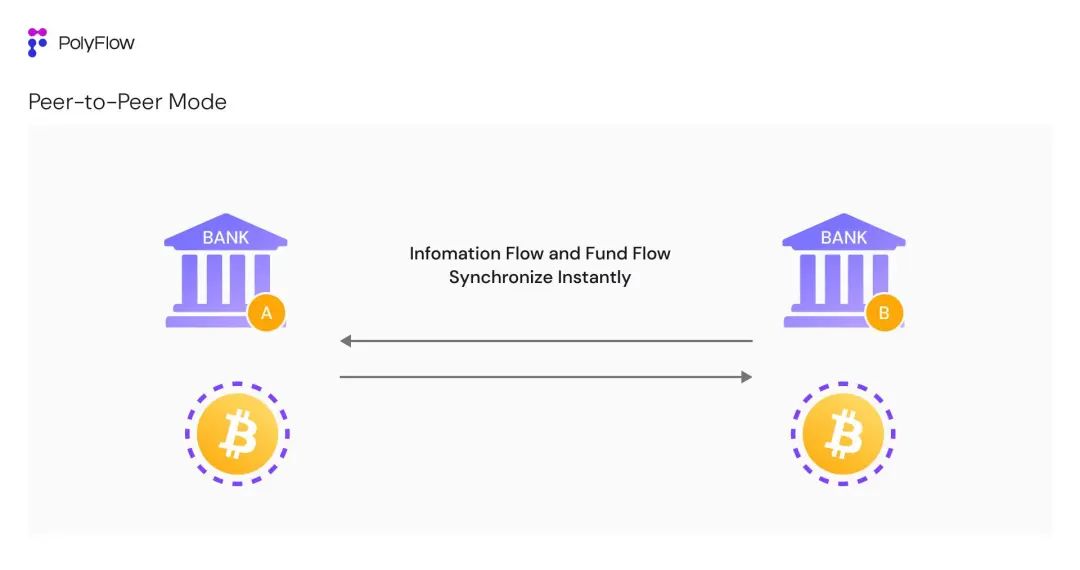

3.1 Peer-to-Peer Model

Imagine a cross-border remittance scenario—sending funds from Address A to Address B. Web3 payments leveraging blockchain characteristics can synchronize information and fund flows. Transaction details are recorded on a transparent, public blockchain ledger where all participants jointly verify and confirm records, making them tamper-proof.

In relatively low-frequency scenarios, the synchronization of information and fund flows fully demonstrates Web3 payment advantages: near-instant settlement, low transaction costs, transparent ledgers, and global reach.

However, this current on-chain, point-to-point synchronization model cannot meet the high-frequency demands of traditional financial systems—processing thousands of transactions per second/hour/day—which easily causes blockchain network congestion.

In 2023, Visa processed approximately 720 million transactions daily, averaging around 8,300 transactions per second (TPS)—eight times higher than Solana, currently the highest-performing blockchain. Thus, Web3 payments appear inefficient compared to traditional systems under such conditions.

"Current blockchain and distributed ledger technologies cannot support recording every single transaction. In traditional finance, only counterparties need to reconcile their books. But today’s peer-to-peer model requires the entire network to jointly record each transaction—a nearly unimaginable burden of tens of thousands of transactions per second," Raymond explains. "Consider that the current $2 trillion crypto market has already caused repeated network congestion. Integrating the $400–600 trillion traditional financial market would be even less feasible."

So how can we build a suitable payment settlement model for Web3?

Raymond says: "Our initial answer used to be: trust in technological progress—eventually, computing power will solve efficiency issues. But we can’t use future technology to solve today’s problems. We must return to the essence of blockchain—building consensus on fund flow."

3.2 Hedging Model

In traditional finance, although information and fund flows eventually align, they are not synchronized. Information flow data can be exchanged instantly over digital networks, while actual funds remain held in fixed accounts and settled independently according to predefined cycles—meaning interaction requirements for fund flow are actually quite low.

Raymond illustrates this with a cross-border settlement example.

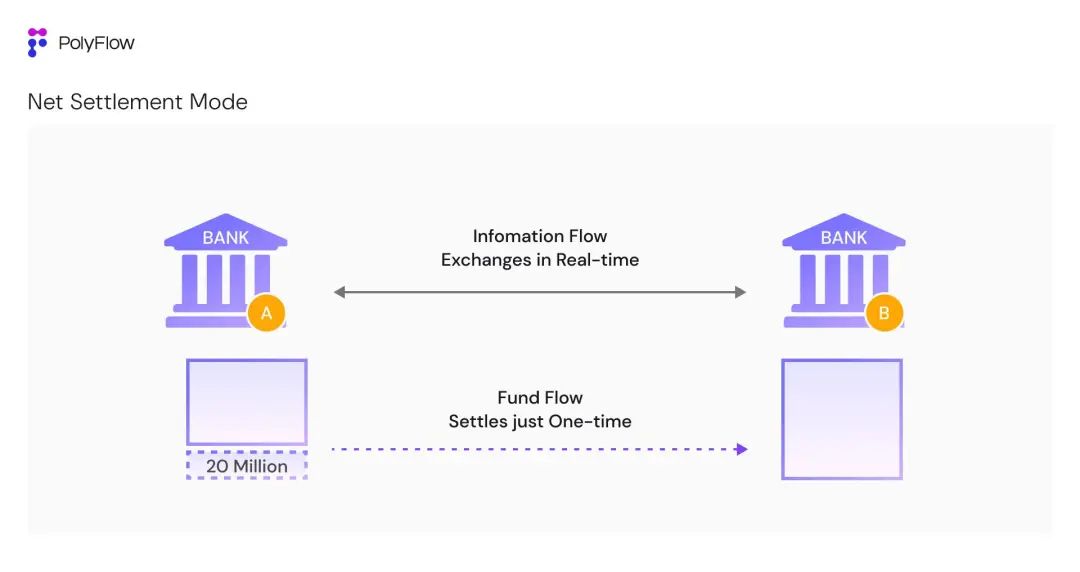

In the traditional world, Bank A in China and Bank B in the U.S. conduct daily fund settlements involving tens of thousands of transactions. As mentioned earlier, synchronizing information and fund flows for each individual transaction would overwhelm any existing financial infrastructure—and is unnecessary.

Hence, net settlement (or multilateral netting) is used to settle multiple transactions between counterparties. Here, information flows are exchanged in real time, allowing both banks to offset entries in their respective ledgers. At the end of the day (assuming daily settlement), after reconciling all transaction data, only the net amount is settled through fund flow.

For instance, if the net position shows Bank A owes Bank B $20 million, Bank A simply makes one transfer to settle all daily transactions. Or if the net is zero, no fund movement occurs.

Raymond explains: "In this case, the actual movement of underlying funds is minimal—most activity involves exchanging information. This is why, despite massive asset volumes in traditional finance, the system’s requirement for processing underlying assets, infrastructure capacity, and settlement efficiency remains manageable."

Net settlement greatly reduces transaction costs, improves settlement efficiency, lowers counterparty credit risk, and enhances capital utilization.

Yet, this traditional model inherently relies on a centralized trust system—a strong trust relationship established through historical reputation, strict audits, regulatory compliance, collateral backing, and contractual guarantees—all of which carry custodial risks and lack transparency.

To achieve this more efficient hedging-style settlement on blockchain while eliminating centralized third-party risks, PolyFlow introduced PLP to pool funds on a shared blockchain ledger.

The purpose is clear: enable cooperation among untrusted parties without relying on third-party endorsements, avoid uncertainties in fund custody, and allow verification of every transaction’s authenticity without mutual trust.

Only through full verifiability can reliance on trust be completely eliminated. Don’t trust, verify.

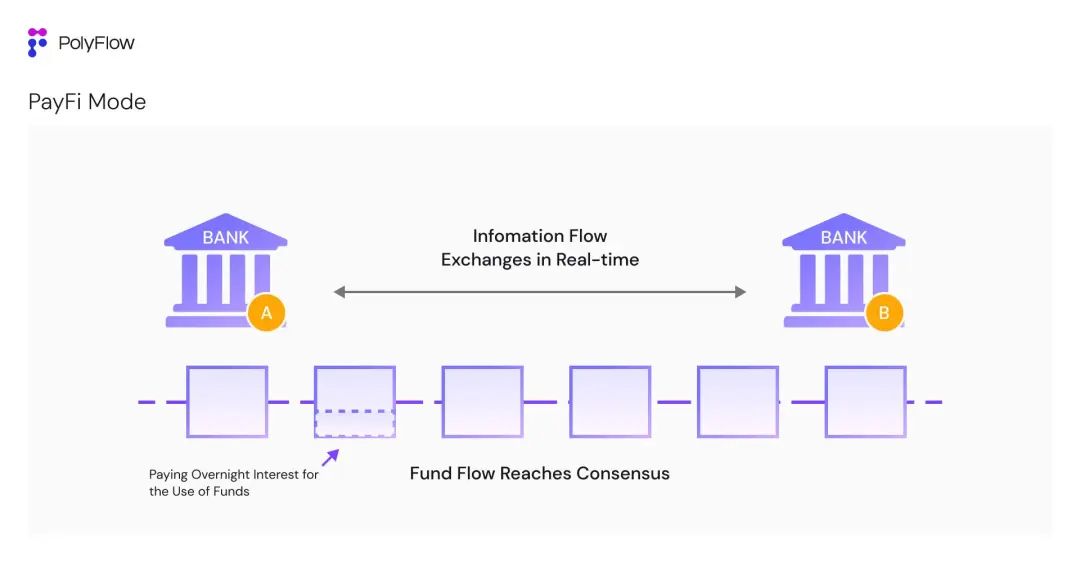

This is consensus on fund flow within a unified blockchain ledger.

Transactions recorded by institutions like banks are essentially bookkeeping entries on the blockchain ledger. Just as in the example above, once both Bank A and Bank B maintain their books on the same blockchain ledger, consensus on fund flows between them is achieved—eliminating the need for costly, time-consuming trust-building mechanisms and creating a truly trustless network.

3.3 PayFi Model

Only after achieving consensus on fund flow within a unified blockchain ledger can we truly enter the so-called PayFi era.

Returning to the bank example: once Bank A and Bank B both record transactions on the same blockchain ledger, foundational trust is established, and consensus on fund flow is reached. Based on this, instead of settling via daily netting, they could transition to directly paying overnight interest on utilized funds—further unlocking liquidity.

This resembles a mortgage loan: a bank releases funds based on the mortgaged property, yet the underlying capital remains untouched—you only pay interest because all fund flows are accounted for on the bank’s ledger.

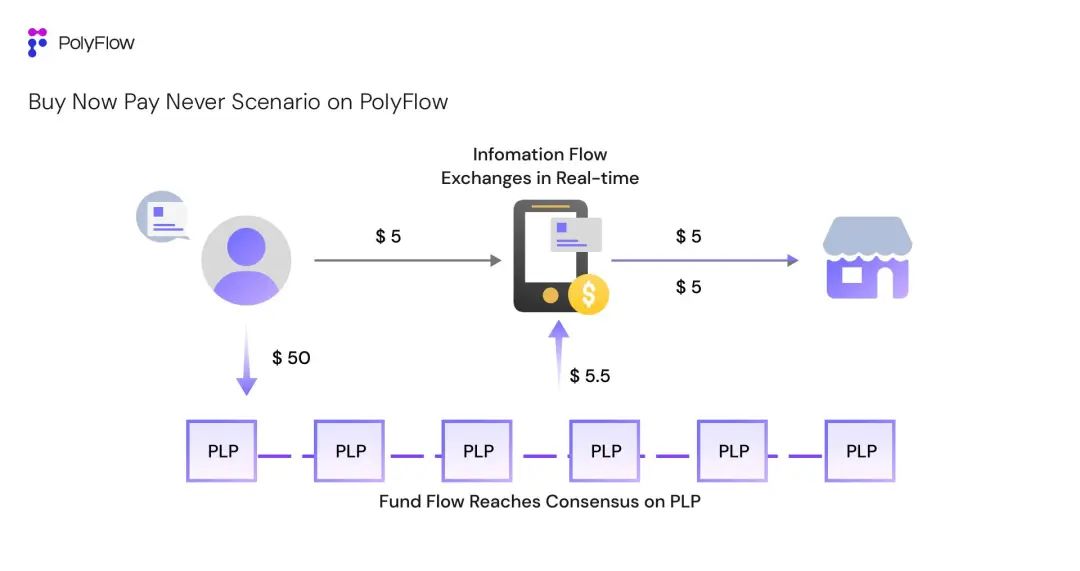

Let’s construct a Buy Now Pay Never scenario using PolyFlow:

User Kevin purchases a $5 coffee via a decentralized payment gateway built on PolyFlow, where both the gateway and merchant hold funds in PLP. Suppose Kevin is also a liquidity provider to the same PLP, contributing $50 (generating $5.5 daily yield). Thanks to consensus on PLP’s fund flow ledger, Kevin can buy the coffee today (without immediate payment) and use tomorrow’s PLP yield to cover the $5 cost—with the extra $0.5 serving as overnight interest for borrowing against future yield.

This scenario highlights PayFi’s value:

1) Cost Reduction & Efficiency: Full information exchange occurs, but fund flow remains static—fully pooled on the PLP ledger.

2) Improved Capital Efficiency: Keeping funds stationary maximizes the utility of Kevin’s $50 liquidity provision.

3) Innovative Financial Paradigm: Scenarios like Buy Now Pay Never enable novel financial products and experiences impossible in traditional finance, accelerating PayFi mass adoption.

Under this PayFi model, asset utilization becomes extremely efficient. With all parties sharing a single blockchain ledger, full trust is enabled—allowing instant verification of bilateral data and confirmation of funding gaps.

Raymond has been researching blockchain since 2011: "Terms like unified ledger, immutability, and transparency have become clichés—everyone talks about them, but few understand their real-world implications.

The true meaning of blockchain lies in achieving consensus on fund flow within a unified ledger. This will elevate the efficiency of the entire crypto and Web3 industry."

This is precisely the foundational principle upon which PolyFlow builds its decentralized PayFi infrastructure.

4. The Value and Significance of PayFi

The convergence of Web3 payments and DeFi has given rise to PayFi, which demands a new financial infrastructure to support its deployment and resolve complex compliance challenges. Since Lily Liu, President of the Solana Foundation, introduced the concept at Hong Kong Web3 Festival, PolyFlow has been recognized as one of the first protocols aiming to build PayFi infrastructure.

On the surface, PayFi may seem no different from GameFi or SocialFi. But its deeper significance lies in promoting real-world applications of cryptocurrency in everyday life.

From a forward-looking view, PayFi allows Web2 players—such as traditional payment firms—to leverage blockchain technology to capture greater market share and avoid missing the next technological wave.

Conversely, Web3 communities can use payments as a vehicle to address pain points in traditional finance, creating new financial paradigms and user experiences previously impossible.

Raymond offers a deeper perspective on PayFi: "PayFi doesn’t primarily solve visible Web3 payment issues like cross-border transfer challenges or limited financial inclusion. Instead, it tackles the fundamental problem: effectively separating information and fund flows and establishing consensus on fund flow within a unified blockchain ledger. Only then can we improve overall Web3 efficiency and drive true mass adoption."

Today, Web3 payments remain in early-stage, primitive forms—mostly using cryptocurrencies as payment media for peer-to-peer settlement (e.g., OTC, crypto payment cards) or facilitating cross-border convenience via hedging models, but still limited in scope.

With the launch of PolyFlow, not only can more PayFi participants easily join the blockchain network and realize real-life PayFi scenarios like Buy Now Pay Never, but more importantly, it fosters consensus on fund flow—boosting efficiency across the entire Web3 ecosystem.

5. Beyond Payment

The concept of blockchain as a distributed ledger may not sound revolutionary or exciting—much like double-entry bookkeeping or joint-stock companies once did. Yet, like those groundbreaking innovations, this seemingly mundane technological advancement holds the potential to transform how human society operates.

Blockchain’s inherent strength lies in financial infrastructure. PolyFlow is harnessing the transformative power of cryptocurrency and blockchain technology to build a new decentralized PayFi payment network—one that drives a shift toward innovative financial paradigms and unlocks the true value of Web3.

In doing so, it brings the grand vision of the Bitcoin whitepaper to life.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News