With institutional accumulation and strong ecosystem momentum, is the Bitcoin bull market set to continue?

TechFlow Selected TechFlow Selected

With institutional accumulation and strong ecosystem momentum, is the Bitcoin bull market set to continue?

But no matter how panicked the market sentiment becomes, the "Bitcoin ecosystem" remains the most talked-about.

Text: Joyce

After a fresh wave of market turbulence, as Bitcoin's price rebounds, panic across the entire market has eased significantly.

Amid repeated crashes in altcoins, skepticism over "whether an altcoin bull run still exists" and increasing voices of professional investors exiting the market have cast a shadow over the crypto space beyond Bitcoin during the past one to two months.

Yet regardless of how fearful market sentiment becomes, when asked which sector they're most bullish on next, "Bitcoin ecosystem" remains the top answer.

Recently, institutional players have taken large positions in Bitcoin, holdings in Bitcoin ETFs continue to rise, and projects like Stacks and Fractal Bitcoin are thriving—giving strong signs of driving the next market cycle.

Institutional Holdings and ETFs

As a major Wall Street holder of Bitcoin, MicroStrategy has been on another buying spree recently.

According to its latest SEC filing, MicroStrategy purchased 18,300 BTC over the past month and a half, investing approximately $1.11 billion at an average price of around $60,655. MicroStrategy now holds a total of 244,800 BTC—equivalent to 1% of Bitcoin’s total supply.

MicroStrategy's decision to spend another $1.1 billion on Bitcoin after three years delivers a powerful vote of confidence to the nascent recovery of the crypto market.

Despite the shaky appearance of the market over recent months and rising FUD about “the bull run being over,” the SEC’s Q2 2024 13F filings reveal that U.S. institutions continued accumulating Bitcoin ETFs even as Bitcoin prices fell:

According to Bitwise Chief Investment Officer Matt Huang, institutional holders of Bitcoin ETFs increased from 965 to 1,100 in Q2, with over 130 institutions making their first Bitcoin ETF purchases during the quarter. The share of total ETF holdings held by these institutions also rose from 18.74% to 21.15%.

Thus, despite high volatility and unclear trends, these institutions were not deterred but instead kept adding positions. One can only imagine how much greater institutional participation and purchase volumes would be if a full-fledged bull market were underway.

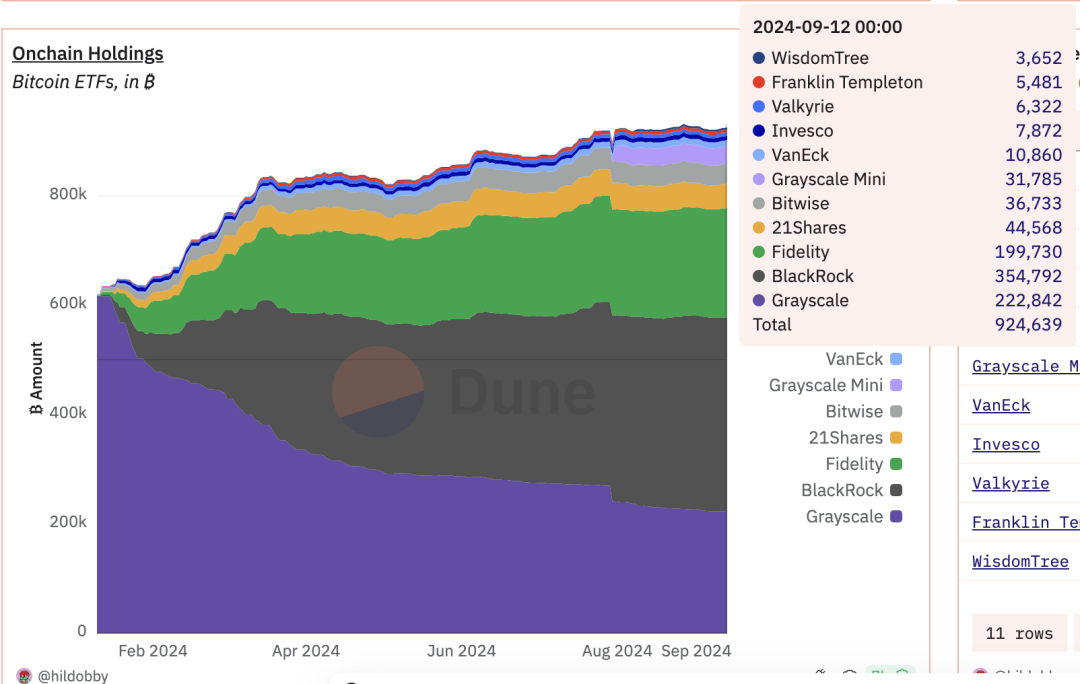

Looking at the trend of total Bitcoin held by Bitcoin ETFs since their launch, the figure has generally risen steadily over the past nine months. Even during periods of extreme market fluctuation, the total holdings of Bitcoin ETFs remained largely stable.

Hence, despite market swings and Bitcoin’s Fear & Greed Index plunging into the “extreme fear” zone, major U.S. institutional players continued testing the waters and buying.

Bitcoin holdings by ETFs, Source: Dune

Fractal Bitcoin

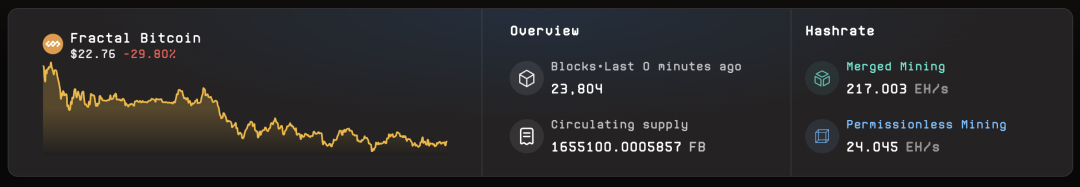

Fractal Bitcoin (FBTC) has emerged as one of the most eye-catching projects in the market lately. Beyond its generous airdrop attracting widespread attention, within just days of launch, Fractal Bitcoin’s total hash rate surpassed 241 EH, reaching 38.1% of Bitcoin’s total network hash rate—an impressive testament to its popularity.

Fractal Bitcoin price and hash rate overview, Source: UniSat Explorer, September 16, 2024

Launched by the Unisat team—a group deeply rooted in the Bitcoin ecosystem and backed by top-tier investors such as Binance Labs—the project’s level of traction was somewhat expected.

Fractal Bitcoin is also a Layer2 for Bitcoin, branded as the “only native Bitcoin scaling solution.” It emphasizes stronger compatibility with Bitcoin and shared security, improving transaction speed without altering Bitcoin’s base code. Transaction confirmation time is reduced to 30 seconds—compared to at least 10 minutes on Bitcoin’s mainnet—boosting TPS by over 20x.

To differentiate Fractal Bitcoin from other L2s and sidechains, its founder explains: “If other L2s and sidechains are like building a separate highway, Fractal is like building countless highways running parallel to the Bitcoin mainnet. Each of these roads can either extend the Bitcoin mainnet or branch off further.”

Certainly, many Bitcoin scaling solutions exist, and the ultimate goal is clear: maximize Bitcoin’s security while greatly enhancing TPS—exactly what Fractal Bitcoin aims to achieve. However, few such solutions have been truly implemented so far.

Since the explosion of activity in the Bitcoin ecosystem, the Layer2 space has become highly competitive. In addition to established players like Stacks and RSK, newcomers including RGB++, BEVM, Merlin, and others have entered the race—making it a bustling landscape indeed.

Yet, it remains to be seen which project will truly lead Bitcoin’s Layer2 evolution, bringing DeFi, GameFi, NFTs, and massive dormant Bitcoin holdings into the broader crypto liquidity pool. Further observation and validation are needed.

Stacks Nakamoto Upgrade

As the most well-known Layer2 in the Bitcoin ecosystem, Stacks completed its long-awaited Nakamoto upgrade on August 28.

The upgrade is highly significant for Stacks, bringing four key improvements:

1) STX Emission Halved: After the Nakamoto upgrade, STX rewards per Bitcoin block dropped from 1,000 to 500 STX, significantly reducing inflationary pressure.

2) Over 60x TPS Improvement: By decoupling Stacks’ block production from Bitcoin’s block timing through this hard fork, block confirmation time decreased from over 10 minutes to just 10 seconds, increasing TPS by more than 60 times.

3) Enhanced Security: The new consensus mechanism writes Stacks chain history data directly into Bitcoin blocks. This makes Stacks’ blockchain immutable unless Bitcoin’s own blocks are altered—greatly strengthening its security.

4) Decentralized Pegged Token sBTC Launch: Approximately one month after the upgrade, sBTC will go live. As the first fully decentralized pegged Bitcoin token, permissionless and open to all participants, it holds particular appeal for large Bitcoin holders.

With the completion of the Stacks Nakamoto upgrade, competition in Bitcoin’s Layer2 arena is set to intensify. After all, Stacks has long proven its mainchain security under market scrutiny. Now, with dramatically enhanced security and substantial TPS optimization post-upgrade, it stands out clearly.

Combined with strong recognition in Western markets and being the first token project compliant with SEC regulations, Stacks currently leads among Layer2 ecosystems in terms of development maturity. With notable first-mover advantages, it is undoubtedly a heavyweight contender in the battle for dominance in Bitcoin Layer2.

Summary

Beyond these developments, the Bitcoin ecosystem has seen numerous other recent activities. For example, Babylon launched its mainnet in late August, enabling staking. Within just three hours, it reached its cap of 1,000 BTC staked. Backed by a prestigious funding profile and strong airdrop expectations, it attracted considerable market attention. Additionally, recent launches of several OP_CAT protocols within the Bitcoin ecosystem have also sparked intense interest.

In any case, compared to the dullness or even stagnation seen in other ecosystems, the wealth-generation effect and vibrancy of the Bitcoin ecosystem are clearly visible. After inscriptions and runes cooled down, the ecosystem continues to innovate and attract significant capital and resources—truly something to look forward to.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News