9 Visual Charts to Understand the Real State of L2

TechFlow Selected TechFlow Selected

9 Visual Charts to Understand the Real State of L2

In short, ZK Rollup still has a long way to go before achieving mass adoption.

Author: Stacy Muur

Translation: TechFlow

Red markets serve as the ultimate test for protocols, revealing true user distribution.

This is my in-depth research on the state of Ethereum L2s, complete with rich visualizations and on-chain data analysis.

Since 2023, Ethereum L2s have rapidly risen. @l2beat currently tracks data for 74 L2s and 30 L3s.

However, only a few general-purpose rollups have gained widespread attention, attracting significant TVL and users. This study focuses on the nine largest rollups.

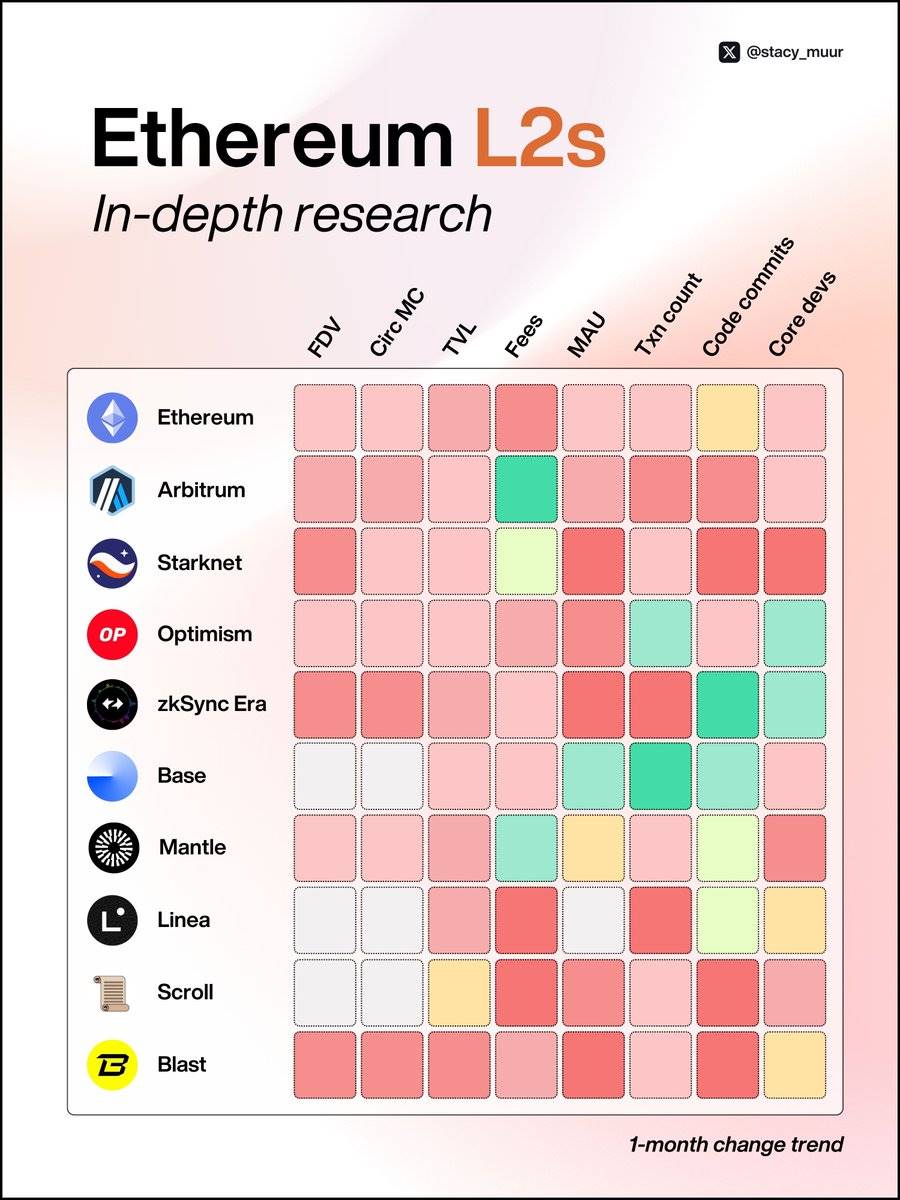

Market Capitalization: Circulating and Fully Diluted Valuation

Currently, most L2s have fully diluted valuations (FDV) reaching several billion dollars, yet their circulating market caps remain below $1 billion—indicating that the majority of tokens have not yet entered circulation.

The sole exception is @0xMantle, where 52% of the supply has already been unlocked, making it the only L2 with a circulating market cap exceeding $1 billion.

The gap between high FDV and low circulating supply is one of the main reasons many recent airdrops failed to meet user expectations.

Evaluating current valuations is challenging, and future downside risks remain uncertain.

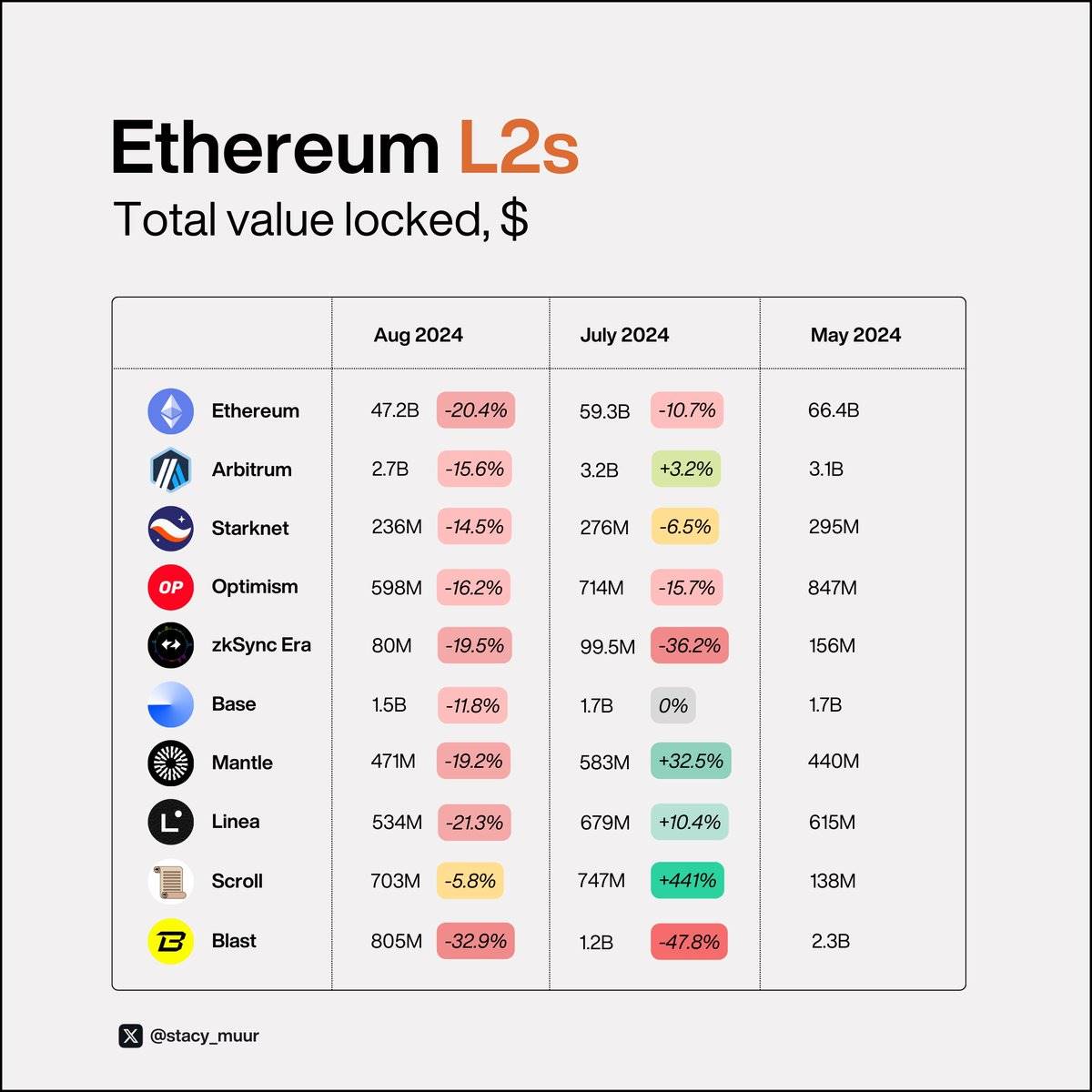

Total Value Locked (TVL)

In terms of TVL, all chains except those with sustained incentive programs—such as @Scroll_ZKP, @LineaBuild, and @0xMantle—experienced a difficult summer.

However, compared to Scroll’s newly launched program, Linea’s nearly year-long airdrop campaign has seen declining community interest.

Among underperforming chains, @zksync and @blast were hit hardest, as both launched their tokens this year, causing liquidity to shift toward more attractive destinations.

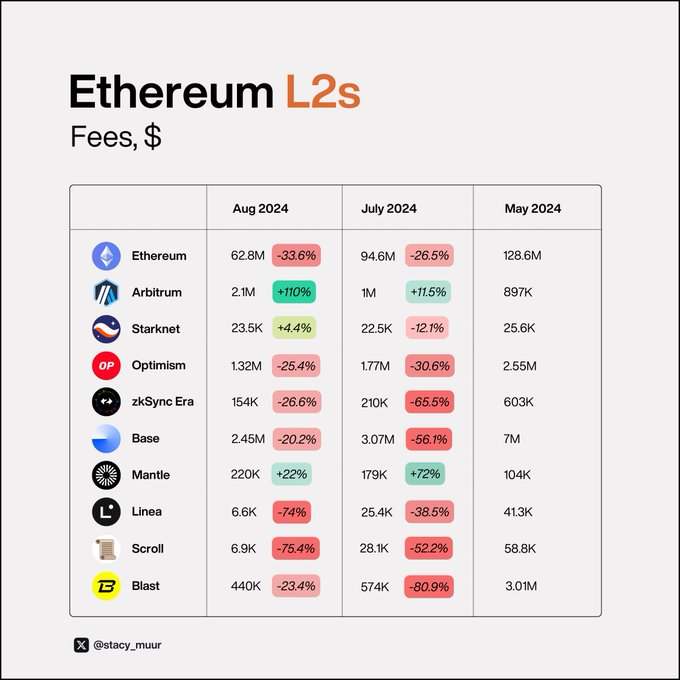

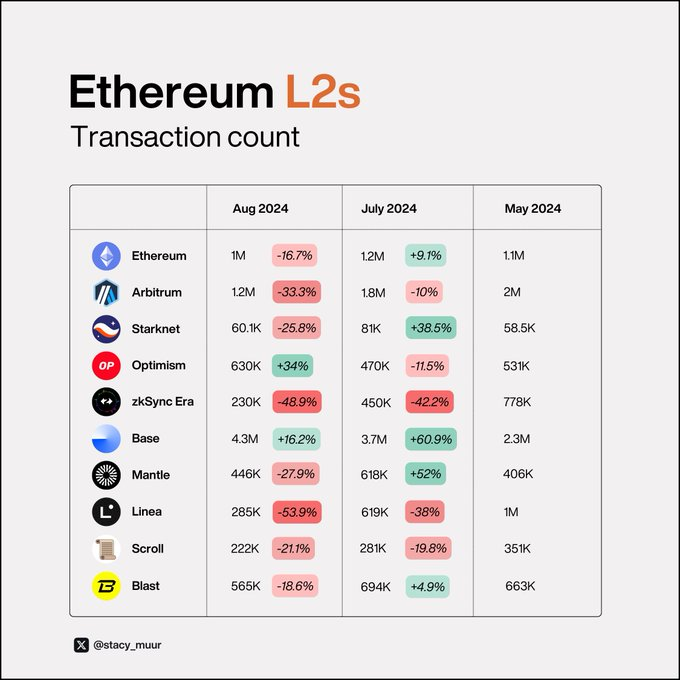

Fees and Transaction Activity

Since Dencun, data availability (DA) has no longer significantly driven Ethereum's economics, impacting fees on both Ethereum and L2s. Therefore, analyzing fee dynamics alongside transaction activity has become especially important.

In this regard, fueled by speculative activity, @base has emerged as the primary destination for launching new memecoins on Ethereum L2s, demonstrating strong appeal with consistently growing transaction volume.

In contrast, despite ongoing incentives, @zksync and @LineaBuild have underperformed.

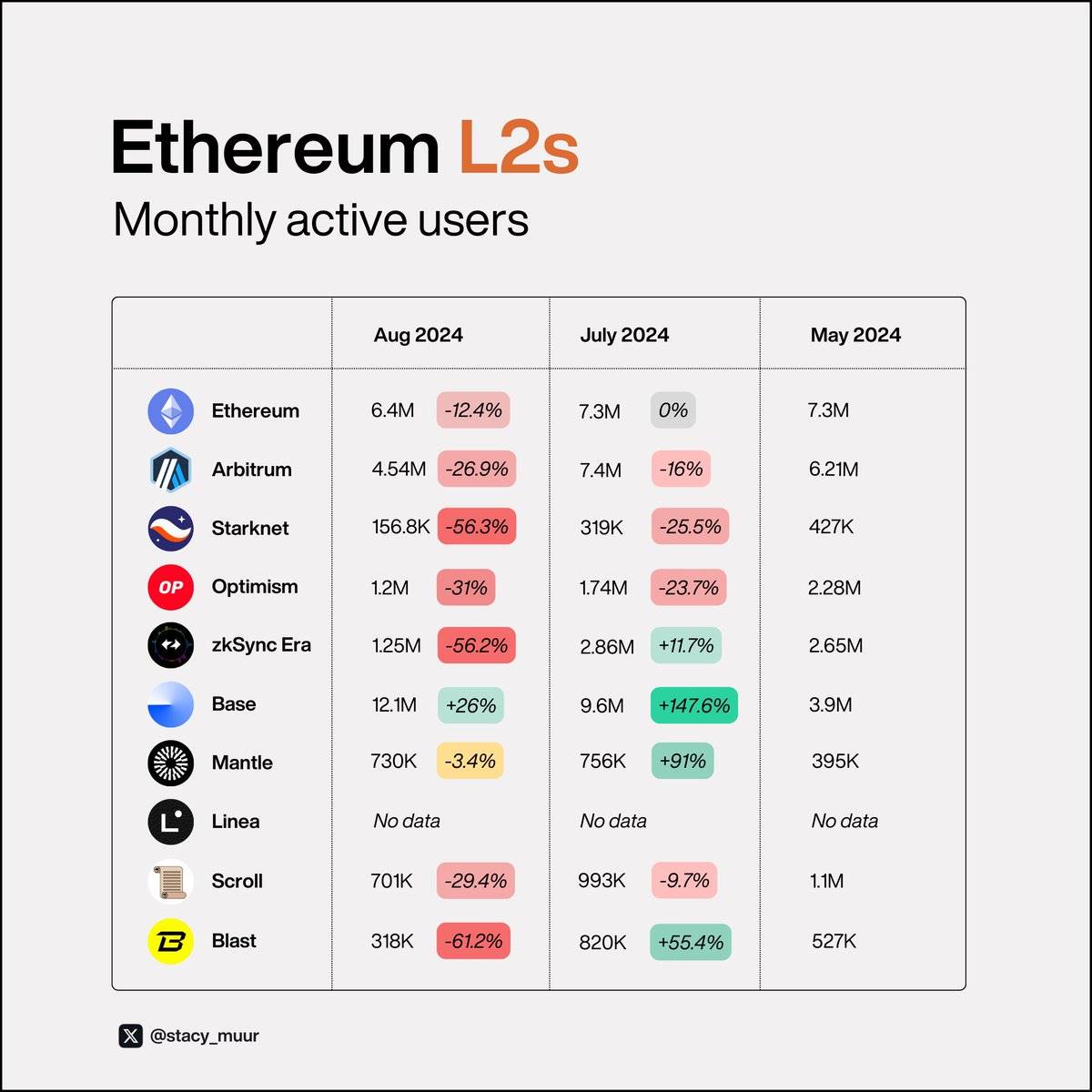

Monthly Active Users (MAU)

Changes in MAU are a key metric for assessing user retention across chains, showing a similar trend.

@0xMantle and @base stand out positively, while @StarknetFndn, @zksync, and @blast show weaker performance.

When comparing MAU figures against fully diluted valuation (FDV), it becomes evident that Starknet is significantly overvalued relative to Arbitrum, Optimism, and even ZKsync.

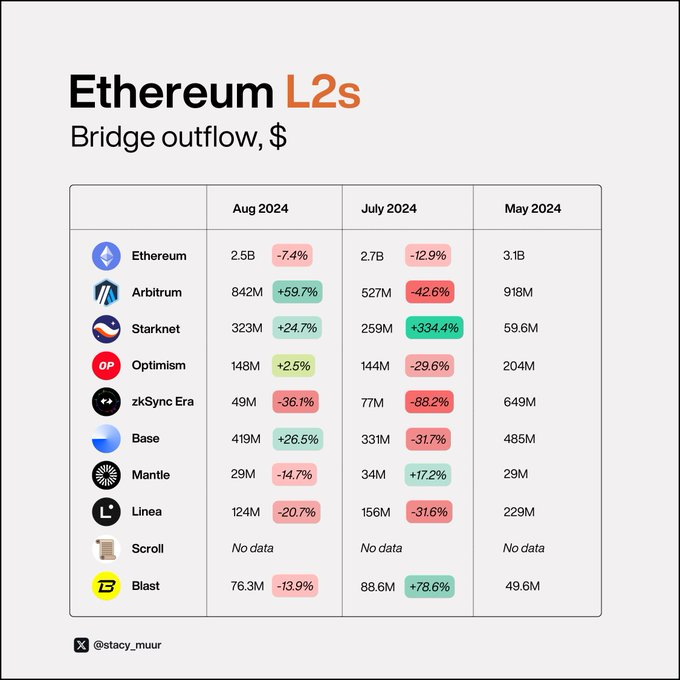

Bridge Inflows and Outflows

Net bridge flow is a crucial indicator of new user and capital inflows.

Among L2s, those with positive net flows include @Arbitrum, @StarknetFndn, @Optimism, @base, and @0xMantle, with @0xMantle showing the largest gap between inflows and outflows.

Conversely, @LineaBuild, @zksync, and @blast exhibit negative net flows.

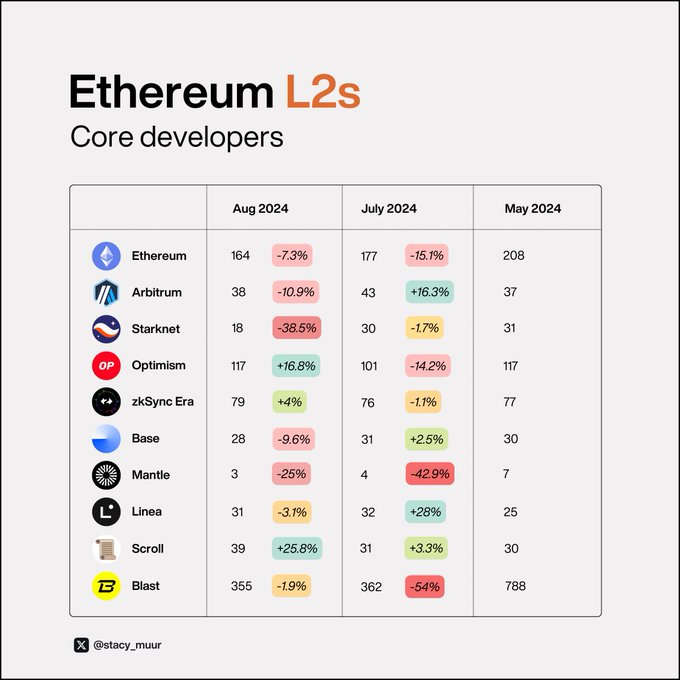

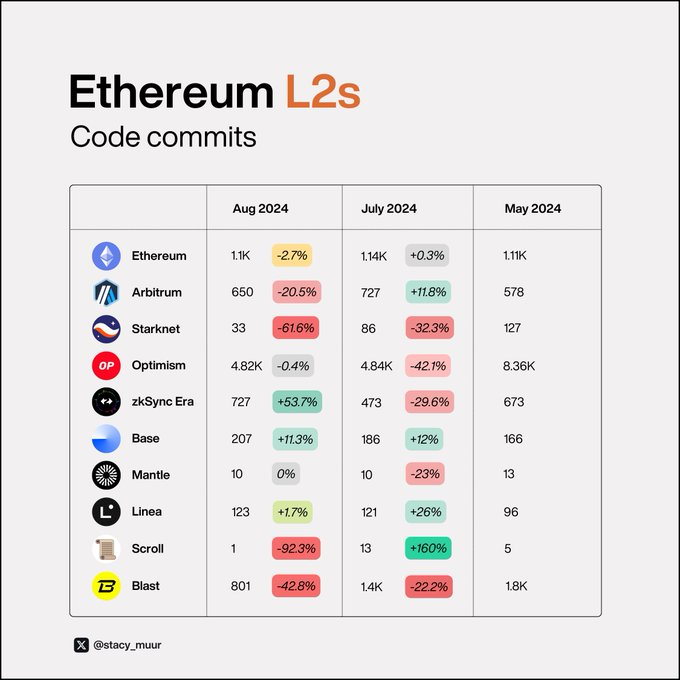

Developer Activity

Finally, developer activity is measured by the number of core development projects and code commits. These metrics help assess current team productivity and identify potential headcount reductions.

The most surprising case is @blast, which currently has over 300 core developers—compared to most L2s, which typically have only 30–50. This large team also contributes a substantial volume of code commits.

What exactly they're working on remains unclear.

If you'd like to dive deeper into how airdrop activities impact various metrics across Ethereum L2s, check out my Substack article "The State of Ethereum Rollups."

This piece summarizes my research findings and shares my personal perspective on the power distribution among Ethereum rollups.

In short: ZK rollups still have a long way to go before achieving mass adoption (which is unfortunate).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News