How to develop different trading strategies when you have $1,000 versus $100,000?

TechFlow Selected TechFlow Selected

How to develop different trading strategies when you have $1,000 versus $100,000?

If you are wealthy, use Bitcoin to protect your wealth and stay rich.

Author: Duo Nine⚡YCC

Translation: TechFlow

This guide is designed for three types of cryptocurrency investors. Here's how much they invest:

-

$1,000 – Beginner

-

$10,000 – Skilled

-

$100,000 – Expert

I assume you're all here to get rich, and that crypto is your best shot. Let’s begin—summary at the end.

If you have $10k or $100k in capital ready to invest, most people ask themselves:

-

Should I start a business or just buy Bitcoin?

Unless your future business outperforms Bitcoin, it's not worth doing. This leads to an important point applicable to every portfolio, regardless of size:

-

If your returns don’t beat Bitcoin, you’re wasting your time!

Take a moment now to compare your portfolio’s performance against Bitcoin since you started investing. If you haven’t outperformed Bitcoin, it’s time to reevaluate your strategy and assumptions.

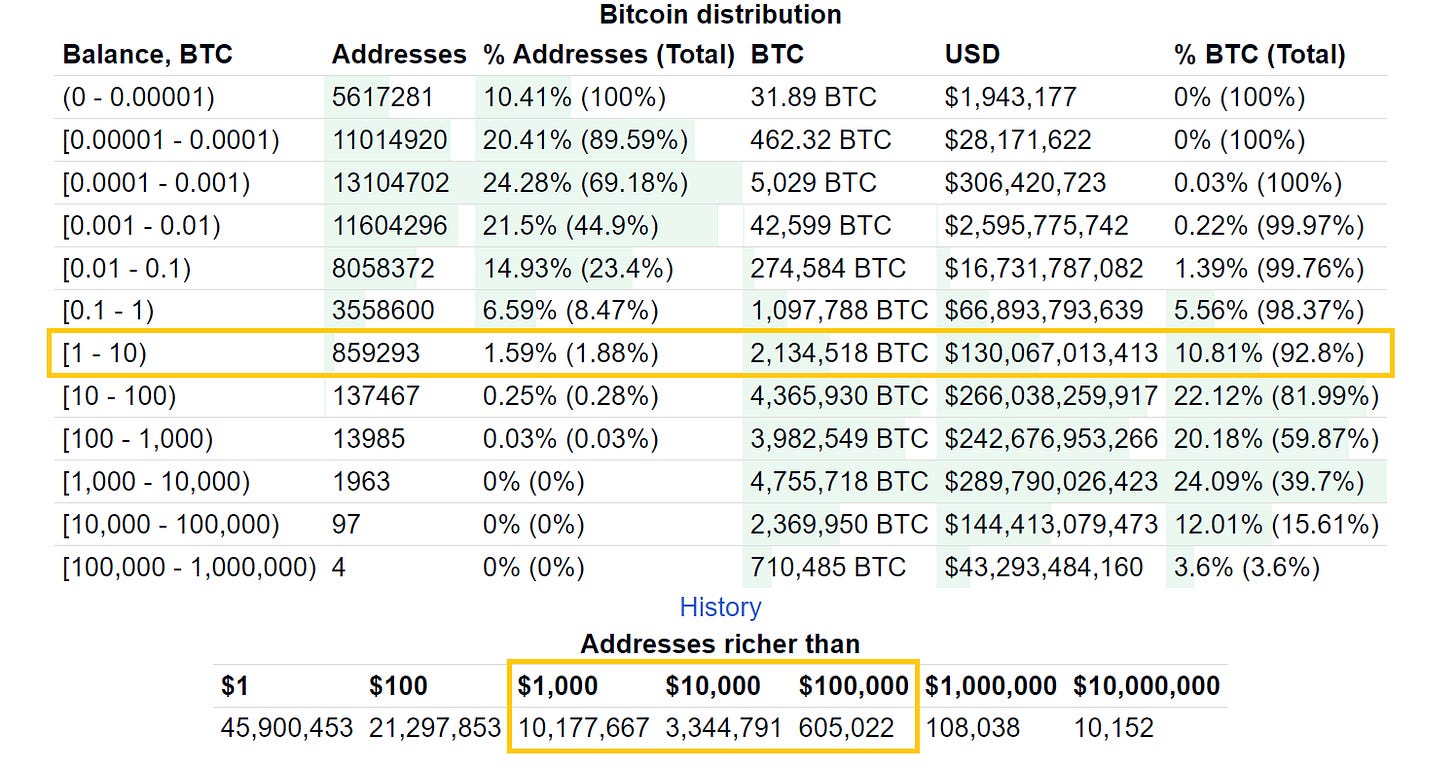

With that said, let’s start from the basics. We have three portfolio categories: $1k, $10k, $100k. Interestingly, these align well with actual Bitcoin distribution. Let’s go through each one.

Beginner - $1,000

You're currently at the starting line of crypto investing, but this is exactly where your big money-making opportunity lies. Your advantage is the ability to take high-risk bets—because even if you lose this amount, it won't significantly impact your life.

Your small portfolio size means you can't get rich overnight with Bitcoin alone. Before reaching the next level, don’t waste time on top 100 coins. You're here for one purpose only:

Whatever you buy must have potential for 2x to 10x gains. This usually means smaller-cap, high-potential tokens—including speculative plays like meme coins.

Your strategy isn’t long-term holding—it’s selling to profit when prices rise. Your main goal is chasing high returns and cashing out during bull runs. Get in and out quickly. Never grow emotionally attached to any altcoin. Their sole purpose is to generate profits and grow your principal.

Don’t hold positions for too long hoping they’ll turn around. Chase trends, narratives, and hype. Drop outdated investment logic fast and pivot to new market momentum—even if it means selling at a loss. Never hold losing positions indefinitely; cut losses early and move forward.

If you're new to crypto, the altcoin market may be the hardest to navigate. Most altcoins are scams, and many people will pitch them solely to use you as exit liquidity. Don’t fall for these games—take profits and walk away without looking back.

Spend time learning about Tokenomics, market cycles, and pump dynamics. If you’re lucky enough to hit a 10x or higher return, consider moving those gains into Bitcoin. Ideally, don’t put all your money into one altcoin—spread risk across 3–4 different bets. That way, if one fails, you still have others going.

There’s a high chance you’ll lose this $1,000.

If you can’t afford to lose it—or can’t replenish another $1,000 soon—you should seriously reconsider whether this path is right for you. If investing $1,000 in yourself or your family would make a meaningful difference, think twice.

Skilled Level - $10,000

You’re still focused on growth, but high-risk bets no longer dominate your portfolio. Now, it’s time to start thinking about how to protect your profits. As your portfolio grows, this becomes increasingly critical.

If you started with $1,000 and reached this point—great job! But now it’s time to shift your mindset. Until now, your focus was finding high-upside assets. Now, you also need to protect your newly acquired wealth.

You can do this by allocating part of your funds to Bitcoin. Review your portfolio and decide what percentage you want to keep at risk versus what needs protection. Use Bitcoin to safeguard wealth, and altcoins for taking risks.

If your portfolio exceeds $10,000 and has zero Bitcoin, you’re being greedy. Avoid this trap. The correct approach is:

-

Determine how much you want to protect. Allocate that portion to Bitcoin—and never sell it. Ever. Not even for promising altcoins. Hold this allocation long-term and add future altcoin profits into it.

Congratulations—you’ve taken a major step toward financial independence. Few ever reach the stage where Bitcoin becomes their primary investment target. Sadly, many remain stuck in altcoin mode, which often ends in disaster.

Your Bitcoin holdings will gradually become a mental safe haven—providing balance and peace amid the stress of altcoin trading. No matter how volatile altcoins get, you’ll know your Bitcoin is secure. This stability will make you a better investor over time.

As your portfolio grows, owning at least one full Bitcoin and never selling it should become your goal. This is the foundation of financial freedom and retirement security. If you're young and reading this, time is on your side. Let compounding work for you—you don’t need to do anything else here.

Expert Level - $100,000

You’ve entered a whole new tier. Six-figure holdings already exceed the price of one Bitcoin at the time of this article’s publication. Congratulations—you’re now in the global top 1%! Do everything you can to preserve and grow this wealth, while managing risk carefully.

You now belong to an extremely rare group. Very few reach this level—most can only dream of it.

-

You’re in the top 1% of global crypto holders!

Even more astonishing: among 8.2 billion people worldwide, you're one of only 605,022 individuals holding over $100,000 worth of Bitcoin. That’s just 0.007% of the global population. Sounds insane—but the data doesn’t lie.

At this stage, instead of chasing riches through risk, realize—you’re already wealthy. Not because you have $100,000, but because you own one (or more) Bitcoin. That’s real wealth. A bank account with $100,000 isn’t true wealth.

Being in the global top 0.007% means that among 100,000 people, only seven are like you. This is an exceptionally unique group. So now you have just one mission:

-

Protect your wealth!

Failing to do so is irresponsible.

Achieve this by steadily increasing your Bitcoin holdings. Ideally, never sell these bitcoins—especially if you only hold one. Therefore, altcoins shouldn’t be your main focus.

In the ideal scenario, altcoins should make up only 1% to 10% of your portfolio. These are asymmetric bets with potential for 10x returns—once achieved, convert those gains into more Bitcoin. It’s that simple.

If you hold Ethereum, its allocation should always be significantly smaller than Bitcoin. Long-term, consider selling all Ethereum, as macroeconomic conditions are unfavorable and it has underperformed Bitcoin since 2022. Remember: don’t hold assets that fail to outperform Bitcoin.

Over the long term, maintain a cautious stance toward altcoins. That’s why you shouldn’t hold them indefinitely. This short video helps explain some of what I’m saying—listen closely to his views on Ethereum, Solana, and other altcoins.

Over time, it's becoming harder for altcoins to establish competitive advantages, eroding market confidence. This further proves Bitcoin is the superior investment. If you're already rich, investing in Bitcoin is how you stay rich.

Finally, if you have $100,000 and are just entering crypto, simply buy one Bitcoin. Don’t overcomplicate it. This is the low-cost way to permanently enter the top 1%.

Summary & Memory Cues

-

If your investment returns don’t beat Bitcoin, adjust your strategy.

-

Beginners should pursue high-risk, asymmetric opportunities.

-

Once you’ve built wealth, learn to protect your portfolio—not just grow it.

-

When your wealth hits six figures, focus on Bitcoin. Ignoring this is irresponsible.

-

Maintain long-term caution toward altcoins.

-

Besides gold, Bitcoin is currently the world’s only sound money.

-

If you’re rich, use Bitcoin to protect your wealth and stay rich.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News