Arthur Hayes: Bull market delayed, Fed policy shift could trigger market changes in September

TechFlow Selected TechFlow Selected

Arthur Hayes: Bull market delayed, Fed policy shift could trigger market changes in September

Bitcoin is the most sensitive indicator of U.S. dollar liquidity conditions.

Author: Arthur Hayes

Translation: TechFlow

(The views expressed in this article are solely those of the author and should not be taken as investment advice or a basis for investment decisions.)

Like Pavlov’s dogs, we have all been conditioned to respond to rate cuts with “Buy The F***ing Dip” (BTFD). This behavioral reflex stems from memories of low inflation during the Pax Americana era. Whenever deflationary threats emerged—bad news for holders of financial assets (i.e., the wealthy)—the Federal Reserve would decisively fire up the printing press. As the issuer of the world’s reserve currency, the dollar created loose monetary conditions globally.

Fiscal policies deployed worldwide in response to the COVID pandemic (or what you may believe was a hoax) ended the deflationary era and ushered in an inflationary one. Central banks were slow to acknowledge the inflationary impact of COVID-19 and only later adjusted monetary and fiscal policies by raising interest rates. Global bond markets, particularly the U.S. market, believed in central banks’ resolve to control inflation and therefore did not push yields to extremely high levels. However, the assumption that central banks will continue satisfying bond market expectations through higher interest rates and reduced money supply is highly uncertain under current political conditions.

I focus on the U.S. Treasury market because the dollar’s status as global reserve currency makes it the most important debt market in the world. All debt instruments, regardless of issuing currency, are influenced by U.S. Treasury yields. Bond yields reflect market expectations for future economic growth and inflation. The ideal scenario is strong growth with low inflation; the worst is growth accompanied by high inflation.

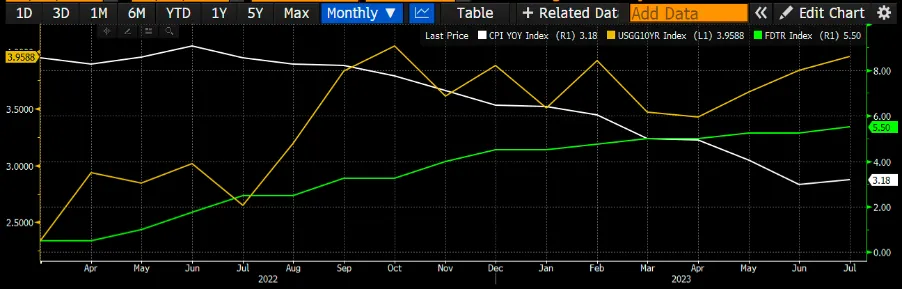

The Fed successfully convinced the Treasury market of its determination to fight inflation by raising policy rates at the fastest pace since the early 1980s. From March 2022 to July 2023, the Fed raised rates by at least 0.25% at every meeting. Even as government-reported inflation reached 40-year highs during this period, the 10-year Treasury yield never exceeded 4%. The market believed the Fed would keep hiking to suppress inflation, so long-term yields did not spike.

U.S. Consumer Price Index (white), 10-Year U.S. Treasury Yield (gold), and Upper Bound of Federal Funds Rate (green)

However, everything changed at the Jackson Hole symposium in August 2023. Powell signaled that the Fed might pause rate hikes at its September meeting. Yet, the shadow of inflation still looms over markets, primarily because increased government spending has become a key driver—and shows no sign of slowing.

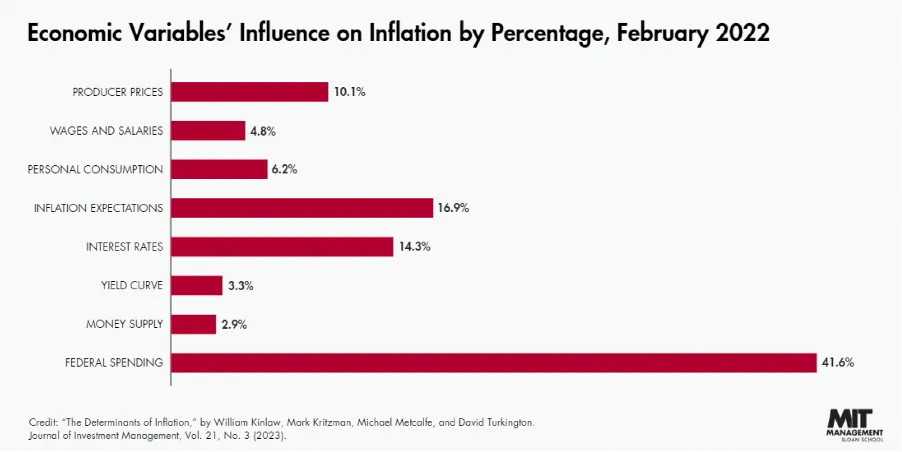

Economists from MIT have found that government spending is one of the main drivers pushing inflation higher.

On one hand, politicians know high inflation reduces their chances of re-election; but on the other, providing voter benefits through currency devaluation increases their odds. If they deliver benefits exclusively to their supporters while making opponents and savers pay via inflation, then politically, increasing government spending becomes advantageous. Thus, they are hard to vote out. This is precisely the strategy adopted by President Biden's administration.

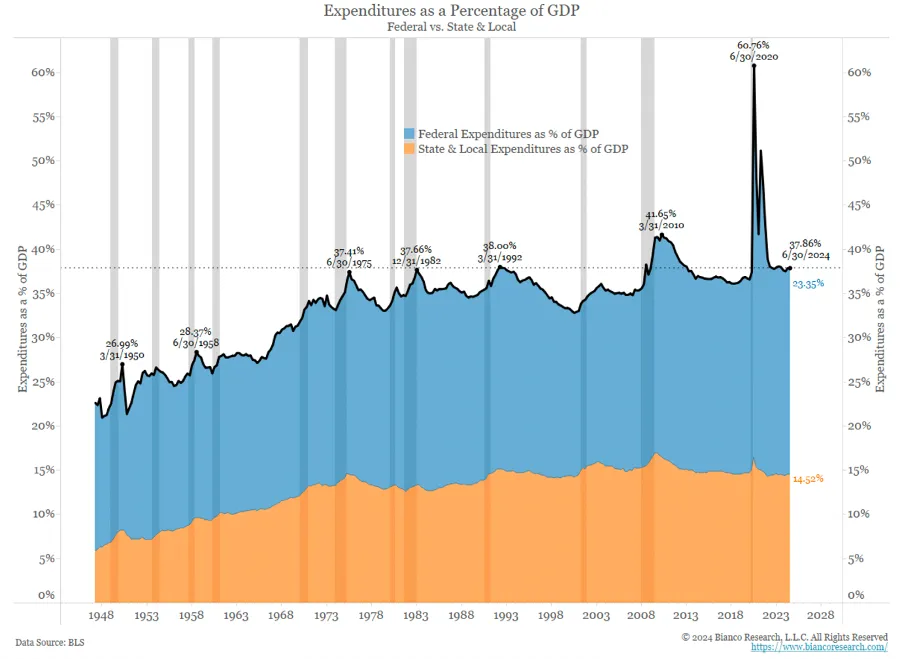

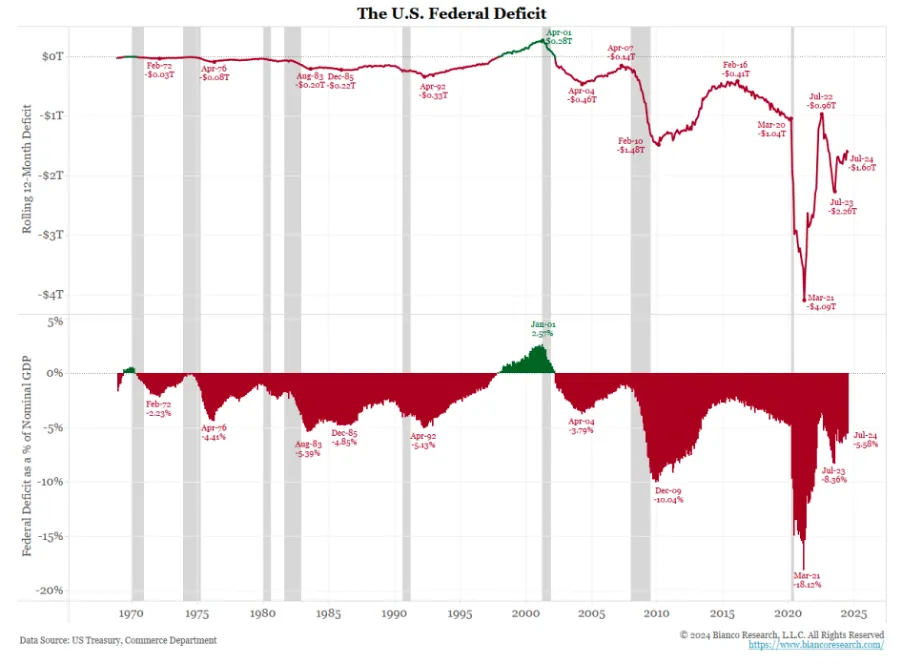

Overall government spending during peacetime has reached historical highs. Of course, “peace” here is relative—only from the perspective of imperial citizens; for those killed by American weapons, recent years have hardly been peaceful.

The problem wouldn’t be so severe if these expenditures were funded by tax increases. But raising taxes is deeply unpopular for incumbent politicians, so it hasn’t happened.

Against this fiscal backdrop, at the Jackson Hole symposium on August 23, 2023, Fed Chair Powell announced the Fed would likely pause rate hikes at its September meeting. The more the Fed raises rates, the higher the cost for the government to finance its deficits. By increasing deficit financing costs, the Fed could theoretically curb unchecked spending—since spending drives inflation. But ultimately, the Fed chose to pause, leaving the market to adjust itself.

After Powell’s speech, the 10-year Treasury yield quickly rose from around 4.4% to 5%. This was surprising because even when inflation hit 9% in 2022, the 10-year yield stayed near 2%; yet 18 months later, with inflation down to about 3%, yields approached 5%. Higher yields caused equities to drop 10%, and more importantly, sparked concerns about potential collapses of regional U.S. banks due to losses on their Treasury portfolios. Facing rising deficit financing costs, declining capital gains tax revenues from falling stock prices, and possible banking crises, "bad girl" Yellen stepped in, injecting dollar liquidity to stabilize the situation.

As I discussed in my article Bad Gurl, Yellen announced the U.S. Treasury would issue more Treasury bills (T-bills). This would shift funds from the Fed’s Reverse Repo Program (RRP) into T-bills and re-leverage the financial system. That statement, released on November 1, 2024, fueled a bull run across stocks, bonds, and cryptocurrencies.

From late August to late October 2023, Bitcoin prices fluctuated sideways. But once Yellen injected liquidity, Bitcoin began rising and hit a new all-time high in March this year.

Reverse Reflection

History doesn't repeat itself exactly, but it often rhymes. In my earlier article Sugar High, I failed to fully grasp this point when discussing the implications of Powell’s shift in wage policy. Like most people, I assumed upcoming rate cuts would positively impact risk markets—a view that now makes me uneasy. On my way to Seoul, I randomly checked my Bloomberg watchlist tracking daily RRP changes. I noticed the RRP had risen, which puzzled me because I expected it to keep falling due to net Treasury bill issuance by the U.S. Treasury. Digging deeper, I found this increase started on August 23—the very day of Powell’s policy pivot. I considered whether quarter-end window dressing could explain the surge. Financial institutions often park cash in RRP at quarter ends and withdraw it the following week. But Q3 didn’t end until September 30, so window dressing couldn’t account for this.

Then I wondered if money market funds (MMFs), seeing falling T-bill yields, sold bills and moved cash into RRP to capture higher short-term dollar returns. I plotted a chart showing yields for 1-month (white), 3-month (yellow), and 6-month (green) T-bills. Vertical lines mark key dates: red is when the Bank of Japan hiked rates, blue when it backtracked after poor market reaction, and purple marks the Jackson Hole speech.

Money market fund managers must decide how to maximize returns on new deposits and maturing bills. RRP pays 5.3%. If T-bill yields are slightly higher, money flows there. Starting mid-July, 3-month and 6-month bill yields fell below RRP yields. This was mainly due to carry-trade unwinding driven by expectations of yen strength and anticipated Fed easing. One-month bill yields remained marginally above RRP, which made sense since the Fed hadn’t clearly signaled a September cut. To test my hypothesis, I plotted RRP balance data.

Prior to Powell’s Jackson Hole speech on August 23, RRP balances were generally declining. During the speech, he signaled a September rate cut (marked by vertical white line). The Fed planned to lower the federal funds rate to at least 5.00%-5.25% at its September 18 meeting. This confirmed market expectations driving 3-month and 6-month bill trends, and 1-month bill yields began narrowing against RRP. RRP yield only drops the day after a rate cut. So between now and September 18, RRP offers the highest return among available instruments. As expected, immediately after Powell’s speech, RRP balances jumped as money market managers scrambled to maximize current and forward interest income.

Although Bitcoin briefly surged to $64,000 on the day of Powell’s policy shift, it has since dropped 10% over the past week. I believe Bitcoin is the most sensitive indicator of U.S. dollar liquidity conditions. When RRP balances rose toward $120 billion, Bitcoin prices declined. Increased RRP means money remains trapped on the Fed’s balance sheet, unable to be recycled into the global financial system.

Bitcoin is extremely volatile, so I admit I may be over-interpreting a one-week price move. But my explanation aligns so closely with actual observed price action that it’s hard to dismiss as mere randomness. Testing my theory is simple. If the Fed does not cut rates before its September meeting, I expect T-bill yields to remain below RRP. Consequently, RRP balances may continue rising, Bitcoin could trade sideways, or at worst slowly fall to $50,000. We’ll see. This shift in my market outlook has made me hesitant to hit the buy button. I haven’t sold crypto because my bearishness is short-term. As I’ll explain, my pessimism is temporary.

Runaway Fiscal Deficits

The Fed has taken no real action to control the primary driver of inflation: government spending. Only when deficit financing costs become prohibitively high might the government reduce spending or raise taxes. The Fed’s so-called “restrictive policy” is just talk, and its independence is merely a fairy tale told to gullible economics disciples.

If the Fed doesn’t tighten, the bond market will adjust on its own. Just as 10-year Treasury yields unexpectedly spiked after the Fed paused hikes in 2023, the Fed’s 2024 rate cuts could push yields toward the dangerous 5% level.

Why is a 5% 10-year Treasury yield so dangerous for the fragile financial façade of “Pax Americana”? Because that was exactly the threshold where Yellen felt compelled to intervene and inject liquidity last year. She knows better than I do how fragile the banking system becomes when bond yields spike; I can only guess at the severity based on her actions.

She has trained me like a dog to expect certain responses to specific stimuli. A 5% 10-year yield will stall the equity bull market. It will also revive concerns about balance sheet health at banks that aren’t “too big to fail.” Rising mortgage rates will hurt housing affordability—an election-cycle issue for American voters. All this could happen even before the Fed begins cutting. In such a scenario, given Yellen’s firm support for Democratic “puppet candidate” Kamala Harris, markets could face severe disruption.

Clearly, Yellen won’t stop until she has done everything possible to ensure Kamala Harris wins the U.S. presidency. First, she may start drawing down the Treasury General Account (TGA). She might even signal her intent to drain the TGA early, so markets react swiftly and enthusiastically—reviving activity! Next, she could instruct Powell to halt Quantitative Tightening (QT), or even restart Quantitative Easing (QE). All such monetary operations would be highly favorable for risk assets, especially Bitcoin. If the Fed proceeds with rate cuts, the amount of injected money must be large enough to offset rising RRP balances.

Yellen must act fast, or the situation could deteriorate into a full-blown crisis of voter confidence in the U.S. economy—bad news for Harris unless miraculously, a batch of mail-in ballots is discovered. As Stalin might have said, “It’s not who votes that matters, but who counts the votes.” Just kidding, don’t take that seriously.

If this unfolds, I expect market interventions to begin by late September. Until then, Bitcoin may continue to chop, while altcoins could fall further.

I previously stated publicly that the bull market would restart in September, but I’ve changed my view—though it hasn’t altered my investment strategy. I remain firmly holding, without leverage. I’ll only add positions in select quality altcoin projects whose prices are significantly discounted relative to their fair value. Once fiat liquidity is expected to increase, tokens of projects with users actually paying to use their products will surge.

To professional traders with monthly P&L targets or leveraged weekend investors: sorry, my short-term market predictions are no more reliable than a coin toss. I tend to believe those in control will ultimately solve everything by printing money. I write these pieces to provide context for current financial and political events and to test whether my long-term assumptions still hold—hoping that one day, my short-term forecasts will become more accurate.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News