One Day 10x, Developers Earn $30K Daily: What Is EtherVista, the So-Called "New DEX Standard"?

TechFlow Selected TechFlow Selected

One Day 10x, Developers Earn $30K Daily: What Is EtherVista, the So-Called "New DEX Standard"?

Will EtherVista save Ethereum?

Author: Joyce

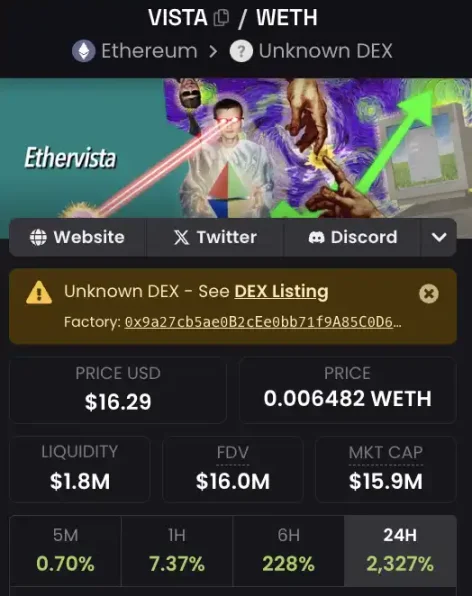

Today, a newly launched token named "VISTA" surged over 10x within a single afternoon just one day after its creation. On Dexscreener, VISTA’s details are still labeled as “Unknown DEX.” VISTA originates from EtherVista, a decentralized exchange (DEX) that has only been operational for one day and brands itself as a “DEX challenging Uniswap.” Some token holders have dubbed it the “Pump.fun of Ethereum,” with several tokens already deployed on EtherVista.

What is EtherVista?

EtherVista claims its core innovation lies in challenging Uniswap's AMM model.

According to EtherVista’s six-page whitepaper, the platform introduces a new mechanism where fees are paid exclusively in ETH and distributed among liquidity providers and token creators in every transaction via a novel reward distribution system—all while maintaining low gas costs. Unlike Uniswap, EtherVista’s key feature ensures that market makers and creators profit from trading volume rather than solely relying on token price appreciation. This incentivizes long-term engagement over short-term price speculation. Additionally, investors benefit from a delayed liquidity withdrawal mechanism designed to prevent rapid dumping and rug pulls.

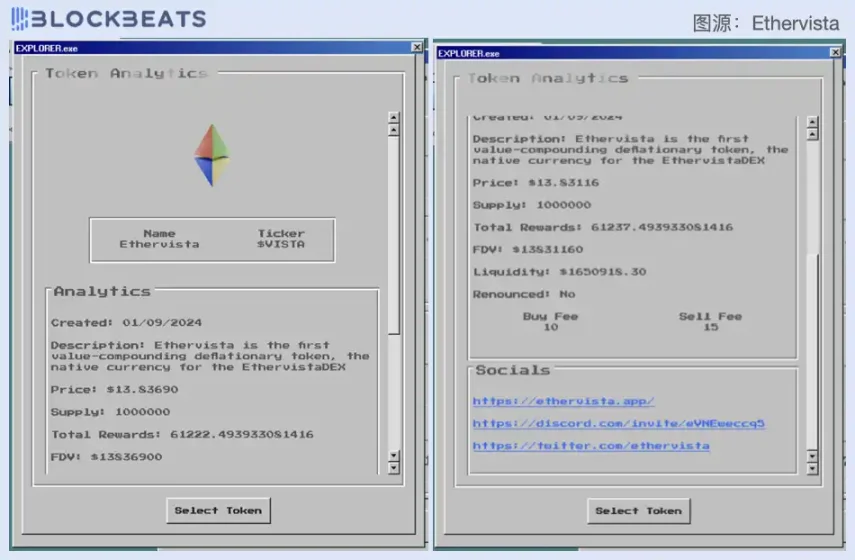

In simple terms, under traditional Uniswap-style AMMs, developers creating tokens can set buy/sell fees—such as 5% per trade—and profit directly when the token price rises, potentially leading them to cash out and abandon the project once profits are sufficient. In contrast, on EtherVista, developers can only earn transaction fees defined by smart contracts and settled in ETH. For example, if the contract sets a 10 USDC fee for buying VISTA and 15 USDC for selling, regardless of VISTA’s market price, developers earn based purely on transaction frequency, significantly reducing the incentive for “cash-and-rug” scenarios.

The EtherVista smart contract maintains a numerical sequence called the “Euler Sequence,” which updates each time ETH is transferred into the contract. Each Euler number is calculated by adding the previous value plus the ratio of transaction fees to total liquidity provider token supply. This ensures that every liquidity provider receives precisely their fair share of earnings per transaction.

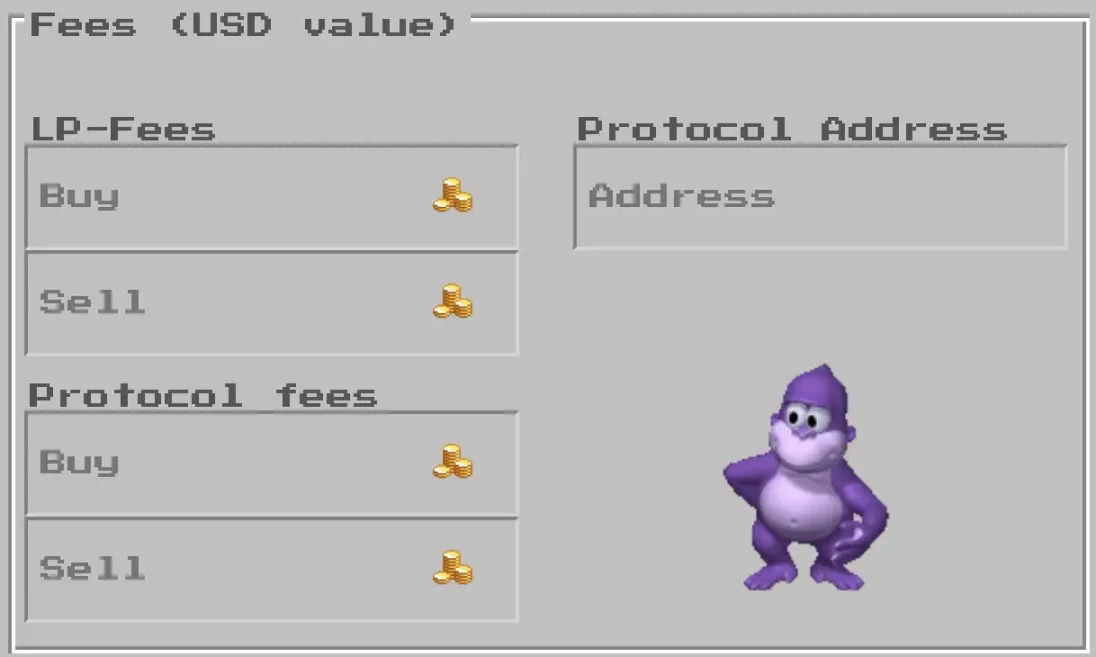

Each trade incurs an ETH fee collected by EtherVista, which is then split between liquidity providers and the protocol. Each pool contains four configurable fee variables dynamically adjusted based on on-chain trading activity. For instance, a pool may set a $10 buy fee and $15 sell fee. When users sell tokens, they pay 15 USD worth of ETH to liquidity providers and the protocol. The protocol uses these fees to establish a stable price floor and generate sustainable income for project creators. Liquidity providers can claim their accrued rewards at any time.

Users providing liquidity are referred to as “Creators,” who have permission to configure various pool parameters such as fees, protocol addresses, and metadata. This new model shifts focus from short-term gains and price volatility toward sustained activity and project utility. Creators can also define on-chain metadata for their tokens—including website links, project descriptions, and social media accounts—which are displayed on the EtherVista platform to ensure users access reliable information. The platform also integrates a global real-time chat function (SuperChat) to facilitate faster communication among users.

EtherVista further states in its whitepaper plans to expand into broader markets, aiming to create ETH-BTC-USDC liquidity pools and offer lending, futures, and zero-fee flash loans—ultimately positioning itself as a multifunctional, all-in-one decentralized application (DApp).

Protocol Mechanism

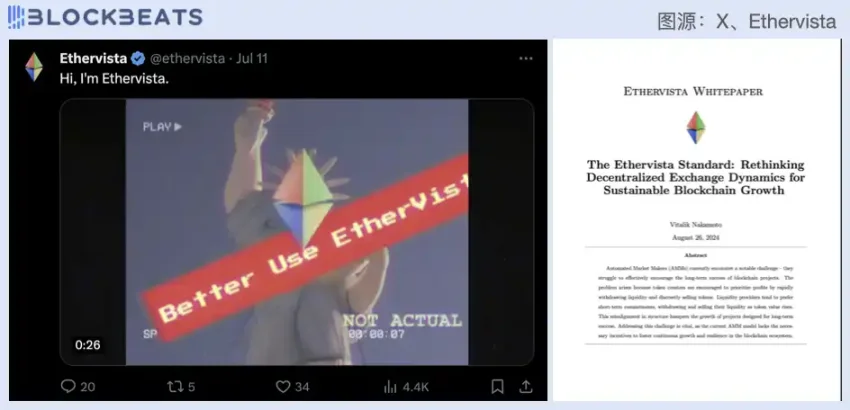

On July 11, EtherVista posted its first tweet. On August 19, it announced it was “airdropping the whitepaper”—users who retweeted would receive the project whitepaper via DM from the official account.

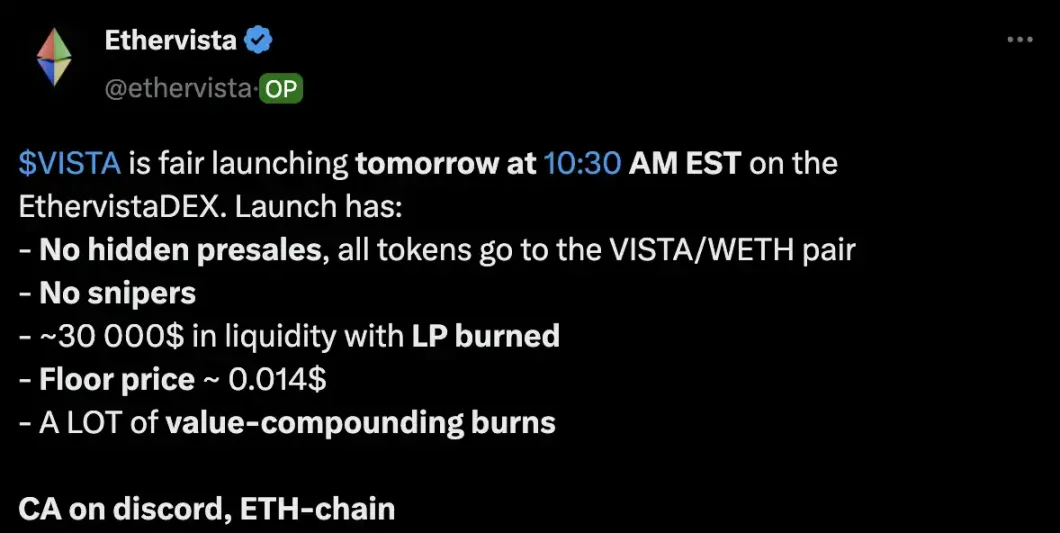

On August 31, EtherVista announced via Twitter that VISTA would launch fairly on September 1 at approximately 0.014 USD per token, with initial liquidity around $30,000 and LP tokens burned. With the current price reaching 18 USD, this represents a staggering increase of 12,857x. Prior to launch, the team emphasized there was no pre-sale or team allocation; instead, team members would use personal funds to purchase tokens simultaneously with other users during the public launch.

The platform token $VISTA has a fixed supply of 1 million tokens. It is described as a “value-compounding deflationary token,” meaning a portion of tokens is burned with every transaction. This design allows VISTA’s value to grow over time through trading activity, enabling it to resist inflation and drive continuous price appreciation.

EtherVista’s whitepaper proposes a novel DEX model aimed at solving existing issues through more equitable fee distribution and innovative tokenomics. Compared to traditional AMM models, EtherVista adopts an ETH-only fee structure and unique reward mechanisms like the Euler Sequence to encourage long-term participation over short-term speculation. The platform also offers distinctive features such as SuperChat and customizable token metadata display, striving to build a more transparent and information-rich DeFi ecosystem. Overall, EtherVista’s architecture supports the sustainable growth and stability of the blockchain ecosystem.

To ensure the long-term success of $VISTA and other projects on EtherVista, the platform enforces a 5-day lock-up period. This prevents creators and liquidity providers from withdrawing liquidity too early and abandoning projects. The 5-day countdown starts when the token creator first adds liquidity, ensuring that creators cannot withdraw before other liquidity providers.

Although liquidity cannot be withdrawn during the first five days, providers can claim their earned rewards at any time. According to EtherVista, LP rewards for $VISTA have already exceeded $25,000 in just five hours—all paid in ETH. Since these fees do not come from $VISTA or other platform tokens, they avoid introducing additional sell pressure, thereby reducing potential risks to the project.

How to Use EtherVista

Trading

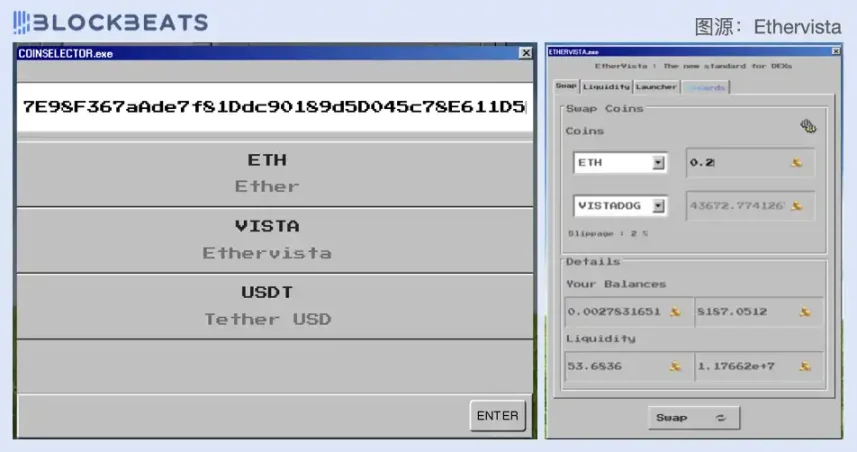

EtherVista directly displays only ETH, USDT, and VISTA on its interface. To buy other tokens, users must paste the token’s contract address into the input field and press ENTER. After entering the desired amount, the interface shows the tradable token quantity and current pool liquidity details.

Token Information & Chat

The EXPLORER tab allows users to view detailed information about tokens created on the platform—defined by the token creators themselves, including website links, project descriptions, and social media accounts. A distinguishing feature of EtherVista is that users can also see the rewards generated by a given token, which are distributed to LPs.

Additionally, EtherVista includes a built-in real-time chat feature. By entering the SuperChat window and setting a username, users can begin chatting directly within the interface. This functionality resembles Pump.fun’s comment section but is simpler and more rudimentary.

Popular Tokens & Holdings

VISTA

$VISTA, EtherVista’s platform token, launched at midnight on September 1. Today at noon, VISTA began a sharp rally, surging 10x within five hours with over $8.5 million in trading volume. Its current market cap stands at $13 million. EtherVista reports that VISTA has generated $67,334 in rewards for LPs. Data from GMGN shows that the top 70 buyers collectively hold 56% of the supply, currently representing 6.38% of total holdings.

VISTADOG

VISTADOG was created around 2 PM on September 2 and rose over 40x within four hours of launch, achieving $1.5 million in trading volume. At the time of writing, its market cap is $1.2 million. EtherVista indicates that VISTADOG has generated $2,431 in rewards for LPs. GMGN data reveals that the top 70 buyers acquired 36% of the supply, now holding 12% of total tokens.

Are Developers Earning $30,000 Daily?

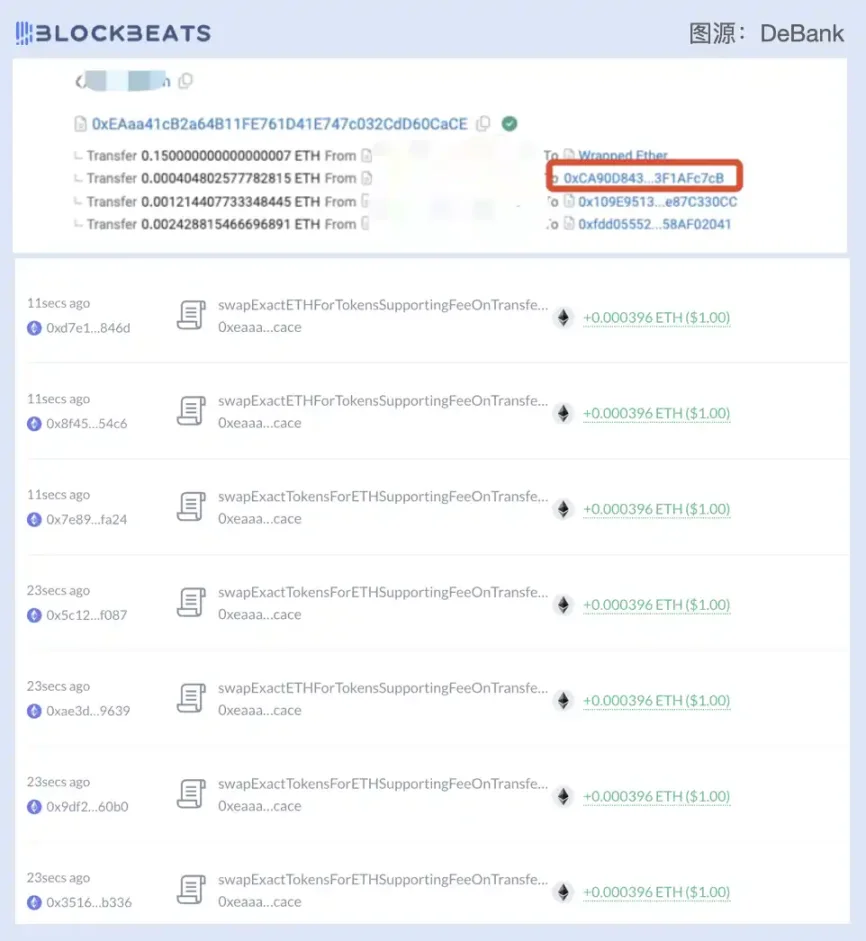

After conducting a trade on EtherVista, BlockBeats observed approximately $1 worth of ETH being sent to an address starting with 0xCA9. DeBank data shows that, at the time of writing, this address receives multiple ETH transactions valued at around $1 each second—strongly suggesting it belongs to VISTA’s developer(s).

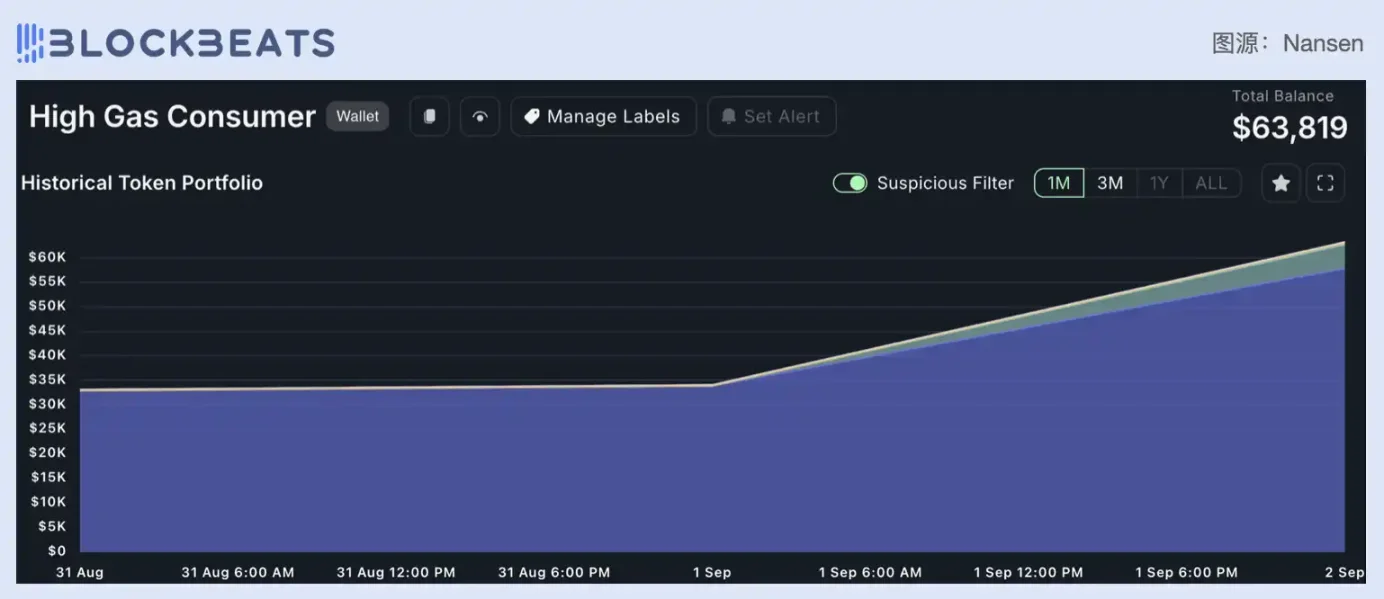

On Nansen, this wallet is labeled as a “High Gas Consumer.” It currently holds 63,819 USD, consisting of 57,856 USD in ETH, 4,875 USD in CLIPPY, and 281 USD in VISTA. Yesterday, it held 33,833 USD in ETH, indicating that the EtherVista developer earned approximately 24,023 USD in ETH within a single day from VISTA-related fees.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News