Market downturn drives crypto mining companies to seek equity financing

TechFlow Selected TechFlow Selected

Market downturn drives crypto mining companies to seek equity financing

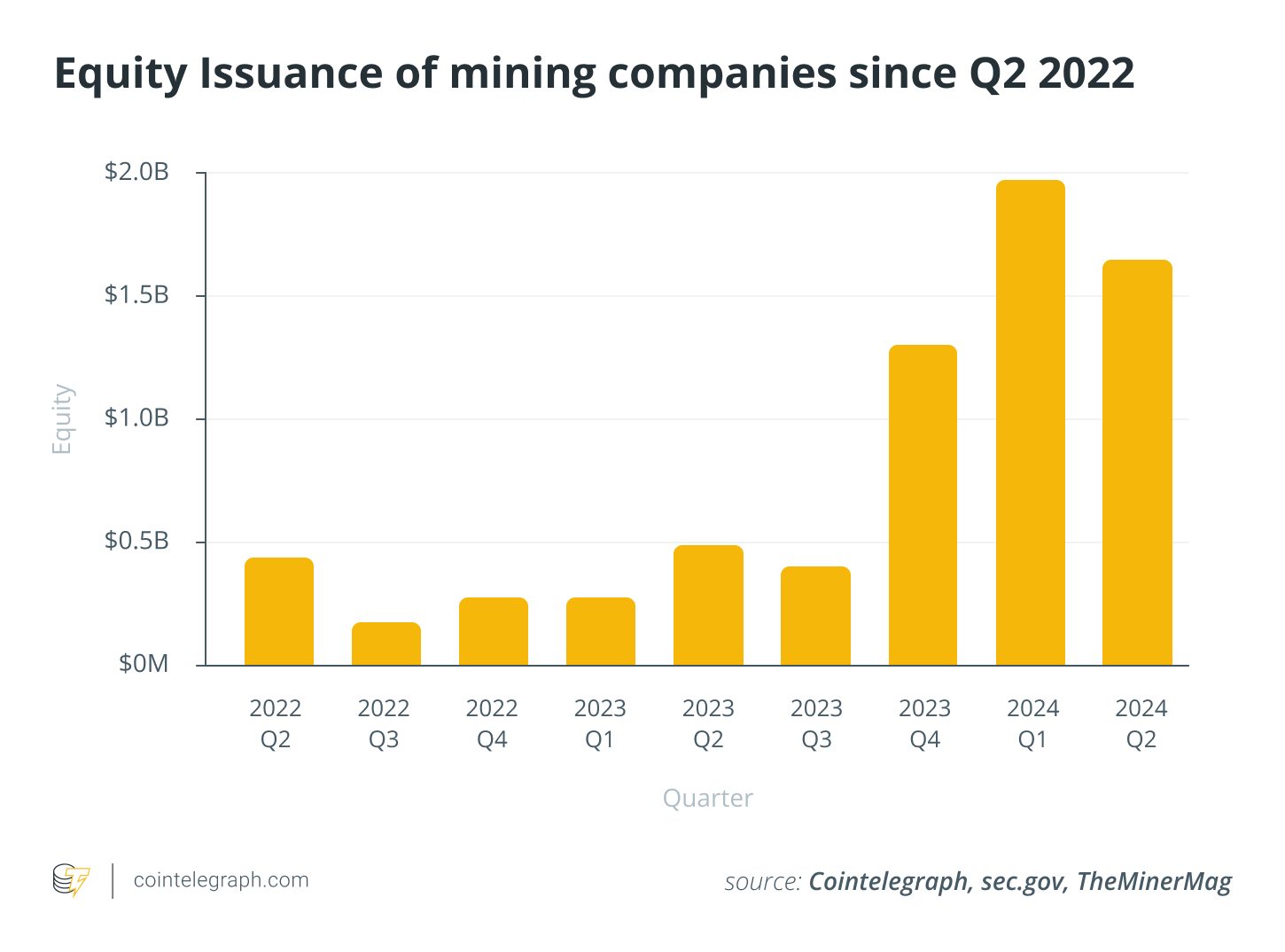

Since the fourth quarter of 2023, mining companies have increasingly raised funds for their operations by issuing stocks.

Author: Igor K

Translation: TechFlow

Crypto miners are reducing their reliance on debt, turning instead to equity dilution to support their ambitions in AI and high-performance computing (HPC), though the returns from this strategy remain uncertain.

Shift from Debt to Equity Among Bitcoin Miners

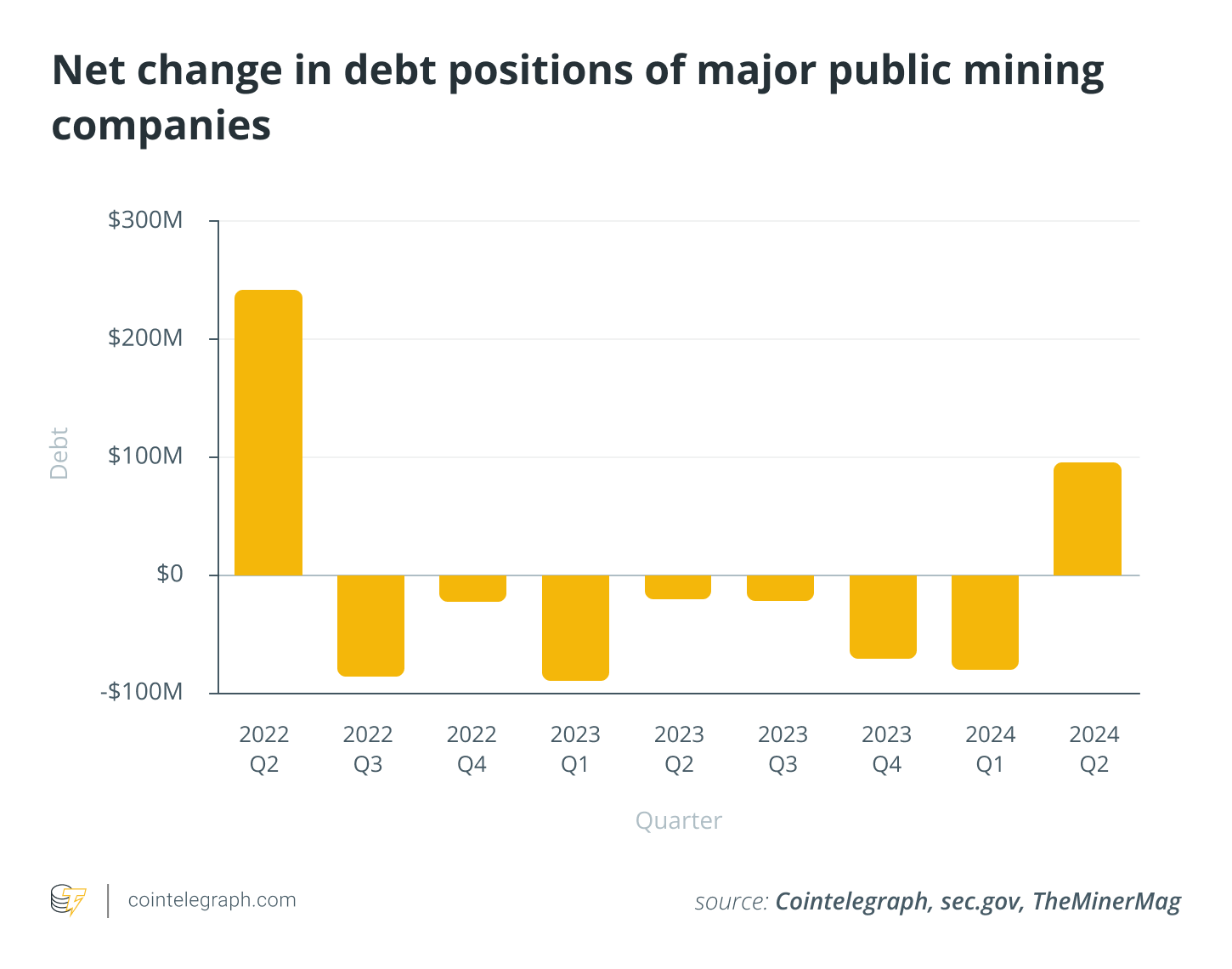

The 2022 crypto winter led major Bitcoin miners into bankruptcy due to excessive dependence on debt financing. Most publicly traded miners had debt-to-equity ratios exceeding four, while a ratio above two is generally considered unsustainable. Starting in the third quarter of 2022, the Bitcoin mining industry began deleveraging. The only exception was the second quarter of 2024, which was skewed by Hut 8’s $150 million investment.

By reducing leverage, mining companies can lower debt servicing costs amid rising interest rates and improve their credit profiles. Additionally, reduced debt levels allow miners to focus more strategically on developments such as expanding into high-performance computing (HPC) or refining financial management strategies.

Since the fourth quarter of 2023, mining firms have increasingly turned to stock issuance to fund operations. From Q3 2023 to Q2 2024, over $4.9 billion was raised—300% more than in the previous three quarters. The largest increase occurred in Q1 2024, when nearly $2 billion was raised.

Bitcoin miners are using the funds primarily for hardware upgrades to counteract margin compression caused by the fourth halving. Companies need to upgrade to more efficient equipment models to compensate for reduced block rewards.

Miners diversifying into high-performance computing (HPC), including AI workloads, find it easier to secure equity funding. Access to the U.S. power grid typically has an average wait time of five years, but Bitcoin miners already have grid access, giving them a competitive edge in HPC. While converting Bitcoin mining infrastructure into HPC data centers requires investment, clients often provide equity financing, helping reduce capital costs.

Diversification: AI and HPC as New Revenue Streams

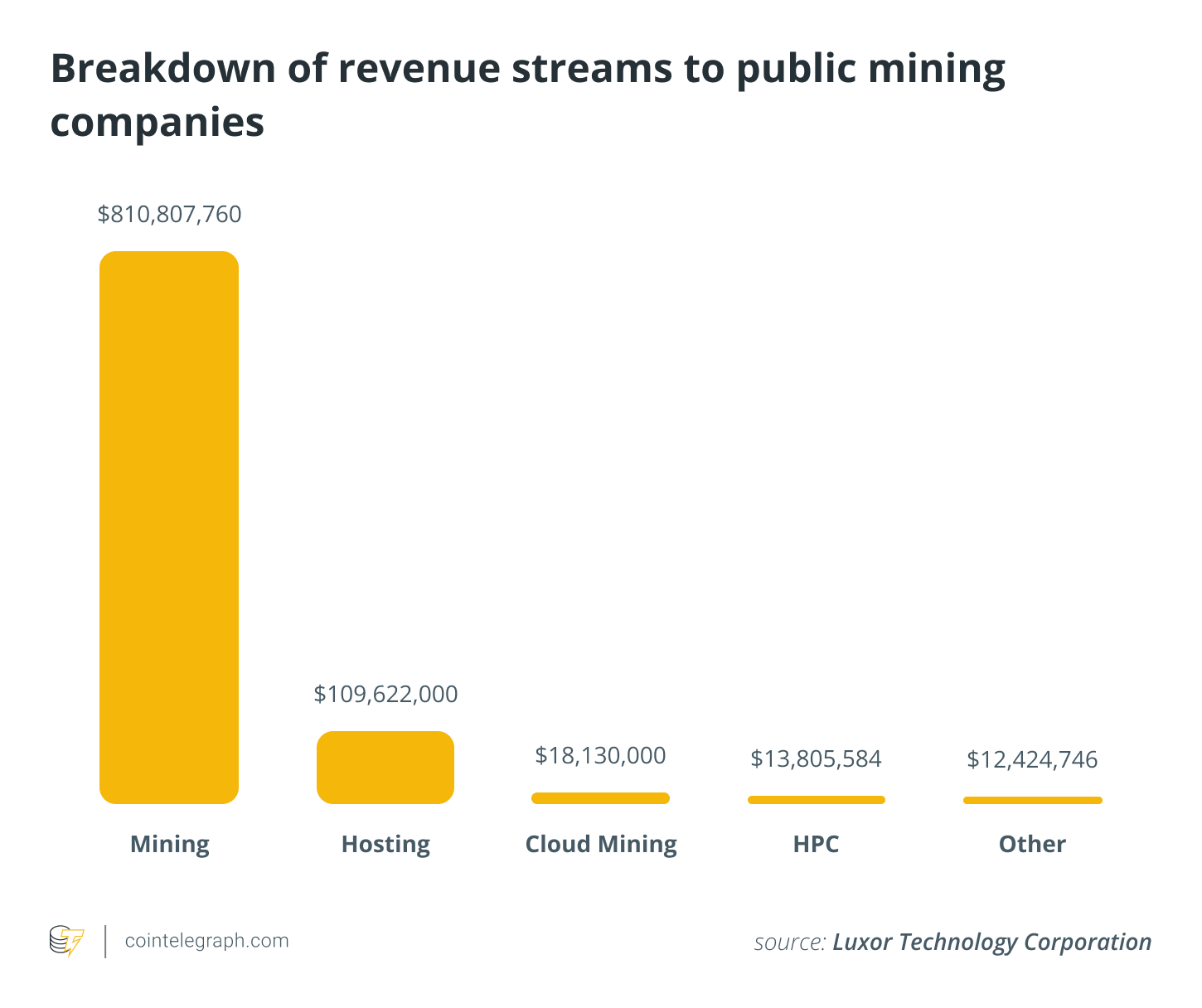

Several companies—including TeraWulf, Iris Energy, Hut 8, Core Scientific, and Hive—have begun moving into HPC and AI. Currently, HPC and AI revenue account for only 1.43% of their total income, but this share is expected to grow as demand for AI continues rising.

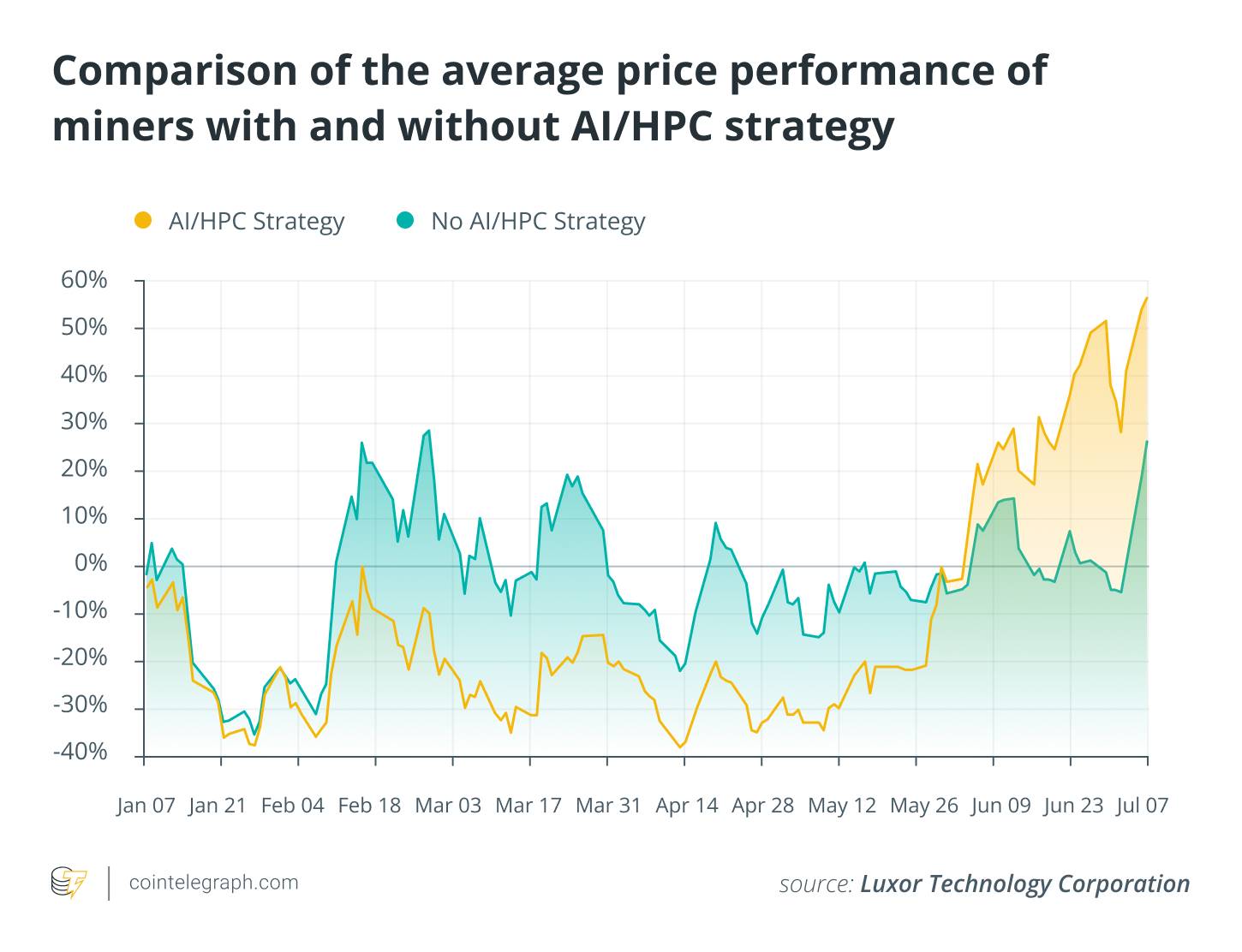

Companies adopting HPC and AI strategies have seen greater valuation growth compared to those that haven't. By the end of Q2, stocks of miners involved in AI and HPC gained 25% since the beginning of the year, while traditional miners declined by 3%.

How much market share these mining firms will capture in HPC and AI remains uncertain, but competition is fierce. The sector is currently dominated by three giants—Amazon Web Services, Microsoft Azure, and Google Cloud—which together control 63% of the market. As Bitcoin mining companies enter this space, they will face significant challenges in an already crowded field.

Marathon Digital's Bitcoin Holding Strategy

While most Bitcoin miners raise capital through equipment upgrades or diversification into HPC, Marathon Digital plans to use new capital to buy more Bitcoin. In an announcement on July 25, Marathon revealed a $100 million Bitcoin purchase and shifted toward a full hodl strategy, reflecting its confidence in Bitcoin’s long-term value.

Investors reacted with skepticism. On August 12, the company disclosed plans to issue $250 million in convertible notes, but its stock dropped that day. Equity investors may be concerned about Marathon’s increasing exposure to Bitcoin price volatility. They also fear potential share dilution if the issued debt converts into equity.

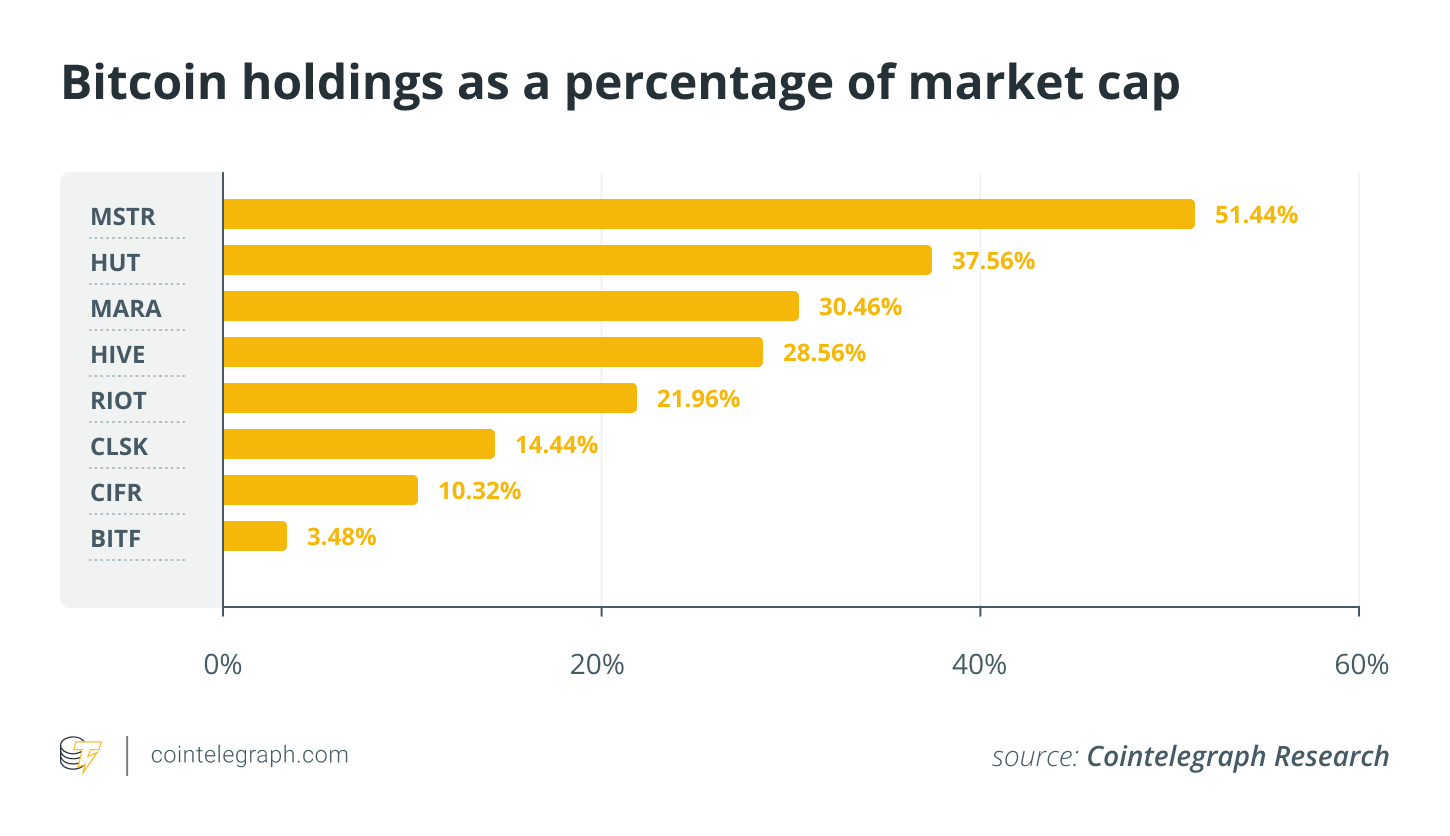

Despite recent purchases, Marathon’s Bitcoin holdings represent only about 30% of its market cap. For MicroStrategy, that figure exceeds 50%, and could rise further as the company recently filed for a $2 billion equity offering. Historically, MicroStrategy has used equity financing to accumulate Bitcoin—a strategy that appears to be paying off. As of Q2 2024, the company holds over 226,000 Bitcoins at an average purchase price of $36,789.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News