When Tariff Winds Pause, Where Will U.S. Mining Head?

TechFlow Selected TechFlow Selected

When Tariff Winds Pause, Where Will U.S. Mining Head?

For the development of Bitcoin itself, the decline in hash rate controlled by U.S. mining and the shift of the Bitcoin mining industry could be beneficial.

By: TechFlow

On April 2 at 4:00 PM Eastern Time, Trump signed an executive order implementing a comprehensive new reciprocal tariff policy, imposing a minimum 10% tariff on all goods imported into the U.S. starting April 5, and higher tariffs on about 60 trading partners—including the EU and China—starting April 9.

This move triggered global market turmoil. After negotiations with multiple countries, Trump announced on April 9 a 90-day suspension of these tariffs, but simultaneously raised tariffs on Chinese exports to a staggering 125%.

The erratic tariff policies have sent ripples through global stock markets, while the crypto market continues its downward spiral. Beyond financial markets, these tariffs also conceal a looming cost crisis for Bitcoin mining in the United States.

On April 13, the U.S. Customs and Border Protection (CBP) website released the latest "Guidelines for Reciprocal Tariff Exemptions on Specific Products," exempting 20 product codes from tariffs. However, the chip models required by mainstream mining rigs are currently not included in the designated CBP categories.

With tariff tensions temporarily paused, can the U.S. Bitcoin mining industry catch its breath—and where is it headed next?

"Tit-for-Tat" Tariffs Trap U.S. Miners

After China banned cryptocurrency mining in 2021, the U.S. emerged as one of the world’s largest crypto mining hubs, thanks to its relatively lenient regulatory environment, abundant energy resources, and advanced technological infrastructure.

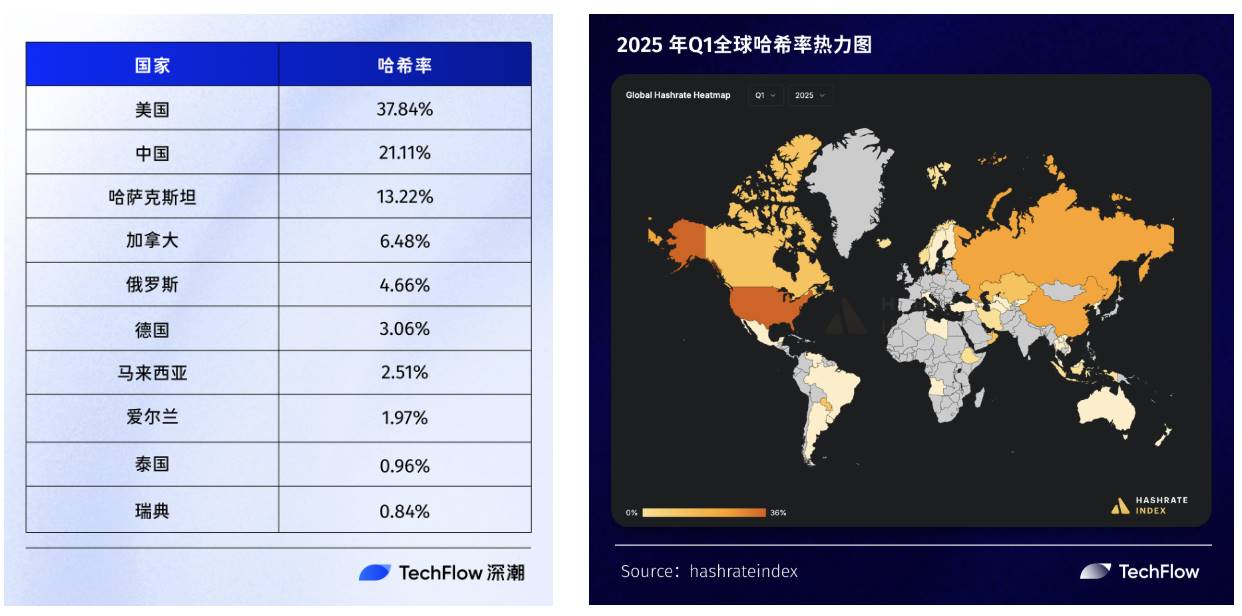

In the global Bitcoin mining landscape, the U.S. leads with a monthly hash rate share of 37.84%. Yet, following Trump’s announcement of new tariffs, the American Bitcoin mining sector may now be mired in the quagmire of a trade war.

For Bitcoin miners, hardware costs account for 30% to 40% of total expenditures. While the U.S. has become a major global mining center hosting many large-scale operators, the mining supply chain remains rooted in Asia.

Chinese companies control 70% to 80% of the global ASIC hardware market. Pat Zhang, Research Head at WOO X, noted that this means the high tariffs imposed by Trump on China will directly lead to significantly increased equipment costs for U.S. mining firms.

Mitchell Askew, Chief Analyst at Blockware Solutions, pointed out that tariffs could restrict offshore miner supply, intensifying demand among U.S. miners. Combined with rising Bitcoin prices, ASIC miners could surge 5 to 10 times in price—as they did in 2021.

Against this backdrop, shares of U.S.-listed mining companies dropped sharply. The Bitcoin Mining Stocks Index hit two troughs on April 4 and April 9. This index is a weighted composite of publicly traded stocks related to Bitcoin mining, including manufacturers, foundries, and miners.

Corroborating this trend, after the tariff policy took effect on April 9, share prices of U.S.-listed Bitcoin mining firms such as MARA Holdings and CleanSpark Inc. plunged nearly 10%.

Blockspace estimates that U.S. Bitcoin miners imported over $2.3 billion worth of ASIC miners last year, with more than $860 million imported in the first quarter alone—primarily manufactured in Malaysia, Thailand, and Indonesia.

In recent years, U.S.-listed mining firms have raised billions of dollars to build data centers in energy-rich regions like Texas. Their mining equipment largely comes from Beijing-based Bitmain Technologies—the world’s largest Bitcoin mining hardware manufacturer.

Bitmain operates factories in Indonesia, Malaysia, and Thailand. Prior to Trump’s announcement of a 90-day suspension of so-called “reciprocal tariffs” on most countries—leaving only a 10% “minimum baseline tariff”—these nations were subject to harsher levies. But it's not just Bitmain; Southeast Asia also hosts production facilities for other key players such as MicroBT and Canaan.

Hardware represents a significant portion of capital expenditure for crypto miners. Lin, Hardware Lead at Luxor Technology (a Bitcoin mining software and services company), said the tariffs mean “their return on investment will be severely impacted.” Additionally, the new tariffs will “inhibit sustained growth in the industry,” said Taras Kulyk, CEO of Synteq Digital.

On April 12, the U.S. CBP website published the "Guidelines for Reciprocal Tariff Exemptions on Specific Products," granting exemptions to 20 product codes.

Bitcoin mining machines are classified under HS code 8543 as electrical machinery and appliances having individual functions not specified or included elsewhere. Therefore, application-specific integrated circuit (ASIC) miners designed specifically for Bitcoin mining do not qualify under the exemption guidelines. Moreover, U.S. component rules are difficult to apply effectively to domestic crypto mining hardware manufacturers. The 90-day pause offers only temporary relief, and the threat of steep tariffs returning remains real. Thus, cost projections in this article still reference the original tax rates scheduled for implementation on April 9.

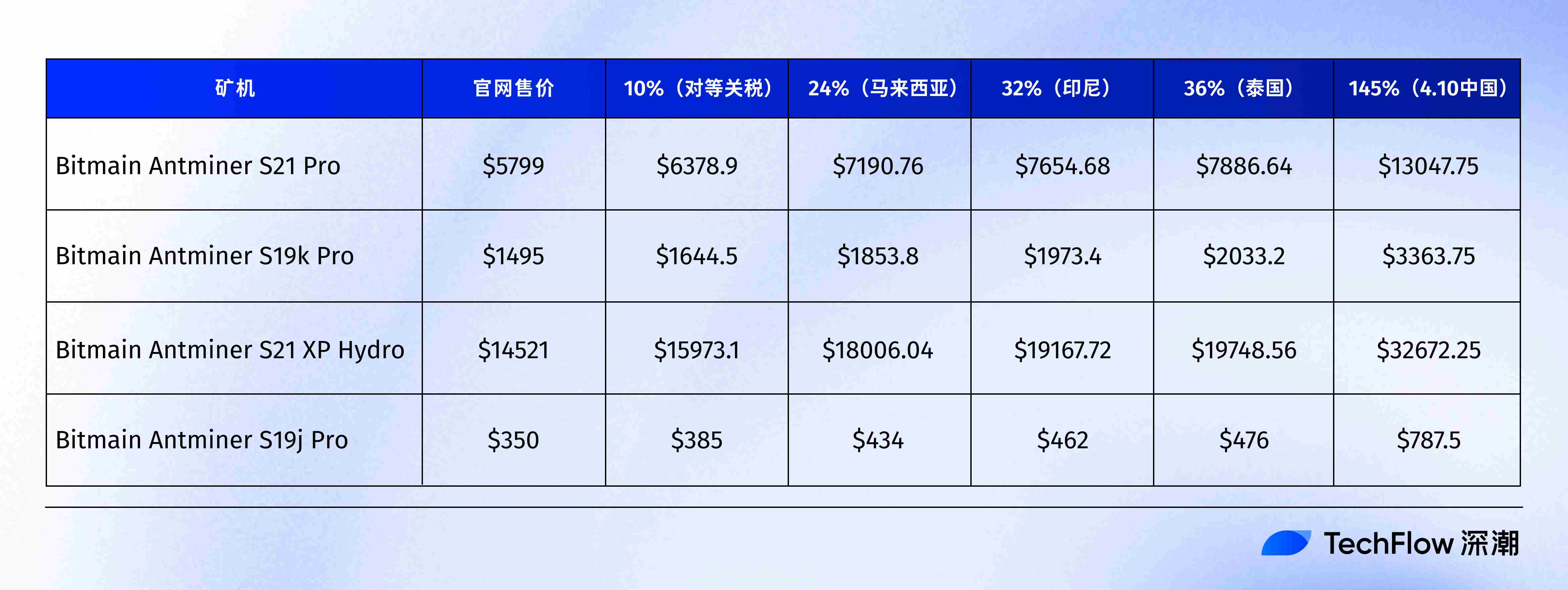

Below is a comparison of select Bitmain miner prices under the April 2 tariff list (updated for China), based on Top 10 Bitcoin Mining ASIC Machines for 2025:

The added tariffs dramatically increase miner costs. To avoid price hikes due to U.S. tariffs on mining equipment from China and Southeast Asian countries, Blockspace reported that large U.S. mining firms are paying 2 to 4 times the usual price to charter planes instead of using cheaper maritime shipping from China, Malaysia, and Thailand—spending $2 million to $3.5 million per shipment to bypass potential tariff-driven inflation.

This echoes the rush in May 2021 when Chinese miners began air-freighting mining rigs abroad after China signaled its crackdown on Bitcoin mining and trading.

Nick Hansen, CEO of Bitcoin mining firm Luxor, said in an interview: "Goodness, every day is chaos."

To beat the implementation of Trump’s tariff policy, both Kulyk and Lin said they were frantically accelerating the shipment of mining equipment produced overseas into the U.S.

“Ideally, we’d charter a plane to get the machines over—just get creative and get them shipped out,” said one executive. After Trump’s April 9 announcement of a 90-day reprieve, cost pressures on U.S. Bitcoin mining firms eased slightly, and their stock prices gradually rebounded.

The tariff hammer was raised high, scattering panic before seemingly being lowered gently. But has the storm truly passed—or is it merely gathering strength for another strike?

Panic and Relocation?

Amid the heavy cost blow inflicted by these tariff policies on U.S. mining firms, Bitcoin’s hash price—a key indicator of mining profitability—fell below $40/hour/PH on April 7, 2025, hitting its lowest level since September 2024. Although the market recovered somewhat after Trump’s 90-day suspension announcement on April 9, the Bitcoin hash price has hovered below $45/hour/PH, lingering around $44/hour/PH over the past four days—still near its 2025 lows.

Hansen said, “Most miners consider $40 to be their bear market floor.” He has spoken with numerous mining companies, all expressing uncertainty about what to do next.

According to TheMinerMag, the $40 figure means many miners are operating at or below break-even levels.

Rising triple-digit total tariff costs on new machines imported from China are painful for U.S. miners. But beyond tariffs, Bitcoin price volatility, declining block rewards, and ever-increasing network difficulty are all contributing to “declining profitability, slowed growth among mining firms, and potentially leading to consolidation, shutdowns, or even relocation of hash rate out of the U.S.,” Eli Nagar, CEO of Braiins, said in an interview.

Hash cost measures the raw electricity cost (in USD) required for each TH/s or PH/s of computing power to generate corresponding revenue within 24 hours. The formula is: Daily Hash Cost ($/PH/s) = Power Efficiency (J/TH) × Electricity Cost ($/kWh) × 24 (hours). Thus, under current policy, mining costs are influenced by two factors: the energy efficiency of the ASIC miner used and the local electricity rate paid by the operator.

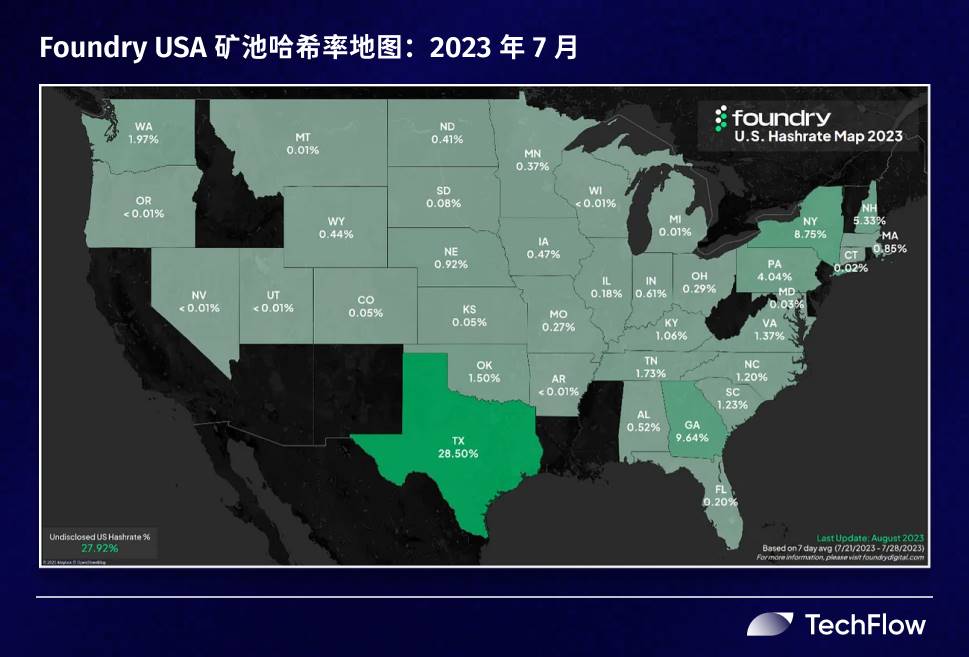

Since mining requires massive amounts of power to run and cool computers, energy costs remain central to mining profits. Affected by energy prices, U.S. mining farms are primarily located in Texas, New York, Kentucky, and Georgia—with Texas standing out notably.

According to a July 18, 2024 report from the U.S. Energy Information Administration, Texas produces about one-quarter of the nation’s primary energy. In addition to vast reserves of crude oil, natural gas, and coal, Texas also boasts rich renewable resources, leading the U.S. in wind power generation. Compared to its 11.2% share in the national hash rate distribution in December 2021 (per Cambridge data), Texas accounted for nearly 30% of the U.S. hash rate in Foundry USA’s July 2023 update.

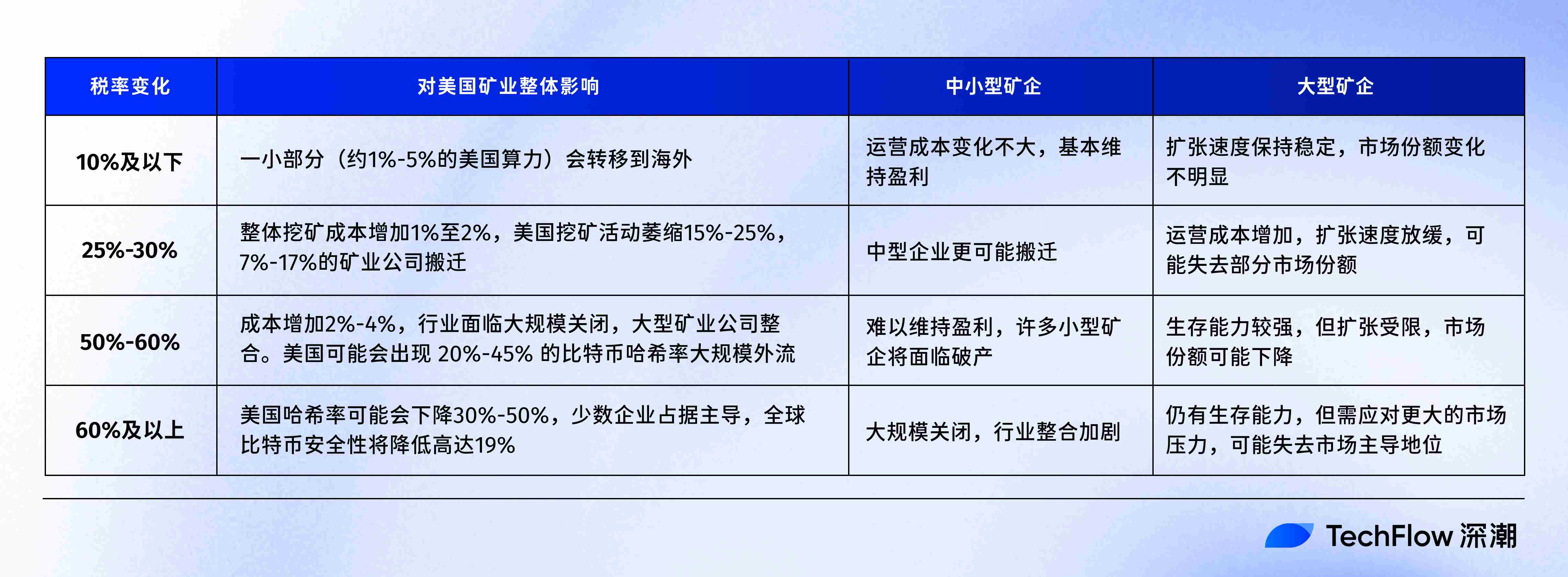

In the current climate of rising miner costs due to tariffs, small and medium-sized mining operations will face the harshest impact. A study by Investing shows that higher tariff rates could gradually reduce the U.S. share of global Bitcoin hash rate. Once tariffs exceed 25%, the U.S. share could fall below 30%. As rates rise further, smaller and mid-sized mining firms may struggle to survive, face profit collapse, or eventually exit the market—leading to greater concentration of hash rate among larger U.S. mining firms.

Source: Investing

Jaran Mellerud, CEO of Hashlabs Mining, believes that even if future Trump administration tariffs are reversed, confidence among U.S. crypto mining operators may not recover. "Even if these tariffs are lifted within months, the damage is done—the confidence needed for long-term planning has been shaken," Mellerud said. "When critical variables can change overnight, few will be willing to make major investments." This might further push domestic mining firms to relocate within the U.S.—to energy-rich states like Texas—or even abroad.

Additionally, because tariffs raise the cost of importing ASIC miners and other mining equipment, under equal conditions, existing U.S. facilities become more valuable. American miners seeking expansion may turn their attention toward acquisitions.

Kulyk expects that “suddenly, those miners with outdated equipment, previously seen as zombie companies, actually present attractive acquisition opportunities.”

In the long term, underlying forces of reconsolidation are stirring within the U.S. Bitcoin mining industry. A few large-scale companies may come to dominate the market. Globally, the international Bitcoin mining landscape may quietly shift.

A Blessing in Disguise?

For the U.S. mining industry alone, this storm brings not only hardship but also opportunity. Hansen sees a silver lining in the turmoil caused by Trump: “The resilience of already-deployed U.S. miners is strengthening.”

U.S. mining firms are responding by establishing domestic ASIC manufacturing to reduce exposure to future high tariffs—a step toward reducing reliance on Chinese hardware.

As for Bitcoin itself, a decline in U.S. dominance of hash rate and the redistribution of mining operations could ultimately prove beneficial.

Troy Cross, Professor of Philosophy and Humanities at Reed College, once stated that if any single country controls too much Bitcoin hash power, one of Bitcoin’s core value propositions—censorship resistance—is put at risk.

Cross argues that unlike other emerging technologies, Bitcoin does not benefit from any one country dominating most of the industry. For the health of the Bitcoin network, no country should ideally control more than 50% of the network. High concentration of hash rate in one nation or region increases the risk of government interference. The potential impact of high tariffs may prompt U.S. miners to cede part of the international market, reshaping the global mining landscape.

In a report dated April 8, Jaran Mellerud said, “Manufacturers’ excess inventory originally intended for the U.S. market will pile up, forcing them to lower prices to attract buyers from other regions.”

Ethan Vera, COO of Luxor, added, “If you’re paying more for a machine than your competitors in Canada or Russia, it becomes extremely difficult to compete internationally.”

“From an economic standpoint, Canada could actually become a more attractive place to do business. Corporate taxes are expected to decrease. Capital gains taxes will also go down. There’s strong promotion of Canadian economic growth, especially in the data center sector,” said Kulyk, who also believes Northern Europe could become a target for hash rate expansion. Some parts of South America and Africa may offer gigawatt-scale opportunities for miners, Vera said.

The 90-day pause is both a buffer and a countdown. As the hurricane passes, U.S. miners stand at a crossroads. How many will grit their teeth and hold their ground domestically—and how many are already plotting a global exodus?

The tariff specter has not vanished. It hangs over U.S. miners like a sword of Damocles. The countdown clock ticks during the exemption period. Order shifts silently, while the flood of computational power flows relentlessly forward.

References:

https://www.coindesk.com/tech/2025/04/10/how-bitcoin-miners-are-adjusting-to-trump-s-tariffs-blockspace

https://store.bitbo.io/blogs/mining/country

https://cn.cointelegraph.com/news/trumps-tariffs-lower-bitcoin-miner-price-outside-us

https://www.dlnews.com/articles/markets/trump-sons-launch-american-bitcoin-mining-with-hut-8/

https://www.newsbtc.com/news/bitcoin-mining-in-the-u-s-4-states-attract-the-most-miners/

https://www.theminermag.com/learn/2022-09-08/bitcoin-mining-wikipedia-glossary

https://www.bloomberg.com/news/articles/2025-04-03/tariffs-threaten-to-upend-bitcoin-mining-supply-chain-mara-riot

https://share.foresightnews.pro/article/detail/82090

https://www.editverse.com/zh-CN/%E6%AF%94%E7%89%B9%E5%B8%81%E5%93%88%E5%B8%8C%E7%8E%87/

https://news.marsbit.co/flash/20230928021623518179.html

https://cointelegraph.com/news/texas-home-nearly-30-percent-bitcoin-hash-rate-foundry

https://medium.com/foundry-digital/foundry-usa-pool-hashrate-by-state-f9dc92e7bc3b

https://hashrateindex.com/blog/top-10-bitcoin-mining-asic-machines-of-2025-2/

https://www.findhs.codes/hs-code-for-bitcoin-mining-machine?locale=zh_CN

https://content.govdelivery.com/bulletins/gd/USDHSCBP-3db9e55?wgt_ref=USDHSCBP_WIDGET_2

https://bitcoinmagazine.com/print/the-future-of-bitcoin-mining-is-distributed

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News