Strategy Test 04 | OKX and AICoin Research Institute: Funding Rate Arbitrage Strategy

TechFlow Selected TechFlow Selected

Strategy Test 04 | OKX and AICoin Research Institute: Funding Rate Arbitrage Strategy

A simple way to help you understand classic strategies.

OKX, in collaboration with the premium data platform AICoin, has launched a series of classic strategy research initiatives aimed at helping users better understand and learn different trading strategies through empirical data analysis and core dimensions such as strategy characteristics—minimizing blind usage.

Funding rate arbitrage is a widely used arbitrage strategy in the cryptocurrency market, designed to profit from discrepancies in funding rates between perpetual contracts and spot markets. The core of funding rate arbitrage lies in leveraging the funding rate mechanism of perpetual contracts. Perpetual contracts are derivative instruments without an expiration date, and the funding rate serves to align the contract price with the spot price. Funding rates can be positive or negative depending on market supply and demand dynamics. When the funding rate is positive, long positions pay the funding fee to short positions; conversely, when it's negative, short positions pay the fee to longs.

Arbitrage Strategy Operations:

• Positive Arbitrage: When the funding rate is positive, traders can gain funding income by buying spot assets while simultaneously shorting an equivalent amount/value of perpetual contracts.

• Negative Arbitrage: When the funding rate is negative, traders can borrow coins to sell spot assets and go long on equivalent perpetual contracts to earn funding fees.

This arbitrage strategy typically settles funding fees every 8 hours, though settlement frequency may increase under extreme market conditions to curb excessive speculation.

Episode 04 presents a practical test of the funding rate arbitrage strategy, utilizing three distinct data models for evaluation:

Model 1: Funding rate arbitrage for BTC and ETH under sideways/horizontal market conditions

Model 2: Funding rate arbitrage for BTC and ETH during a downtrend

Model 3: Funding rate arbitrage for BTC and ETH during an uptrend

Testing Standards for This Episode: Entry condition: basis rate > 0.05% and funding rate > 0; Exit condition: basis rate < -0.05%.

One-sentence Summary of Funding Rate Arbitrage: Funding rate arbitrage suits traders seeking relatively low-risk returns in the crypto market, as well as professionals with solid market analysis skills and trading experience.

Pros and Cons Comparison

Specifically, the primary user groups suited for funding rate arbitrage include:

1) Traders seeking stable returns: Funding rate arbitrage is generally considered a relatively low-risk strategy, ideal for those aiming to generate steady cash flow. These traders may approach crypto market volatility with caution, preferring arbitrage strategies to achieve lower-risk gains.

2) Professional traders and risk managers: Given that funding rate arbitrage involves complex market analysis and real-time execution, it requires substantial market knowledge and experience. Thus, professional traders and risk managers are the main target audience. They can precisely execute trades based on funding rate disparities to lock in profits.

3) Traders looking to utilize idle funds: For traders holding idle capital (e.g., USDT), funding rate arbitrage offers a way to generate additional returns. These individuals may be观望 on current price movements but still wish to earn income via arbitrage.

However, despite being a relatively low-risk strategy, funding rate arbitrage still carries certain risks to consider:

1) Market volatility risk: High volatility in the cryptocurrency market can lead to sharp price swings, affecting funding rate fluctuations. Such volatility may render arbitrage unprofitable or even result in losses.

2) Liquidity risk: Liquidity and trading volume vary across exchanges. Low liquidity can widen bid-ask spreads, increasing transaction costs and reducing potential profits. It may also hinder order execution, causing significant slippage.

3) Funding rate fluctuation risk: Funding rates are not fixed and can shift with changing market supply-demand dynamics. An adverse change in funding rate direction may require timely position adjustment or closure to avoid losses.

4) Transaction costs: Arbitrage involves multiple trades, each incurring fees. These expenses can erode arbitrage profits, especially with frequent trading.

5) Operational risk: Arbitrage requires simultaneous trades across markets, ensuring matching quantities and prices. Any operational errors or delays could cause arbitrage failure.

Nonetheless, although funding rate arbitrage is considered relatively low-risk, traders must conduct thorough market research and implement robust risk management to minimize potential risks and optimize returns. Funding rate arbitrage offers several advantages:

1) Stable returns: As a market-neutral strategy, funding rate arbitrage earns funding fees by holding hedged positions. Regardless of price movements, traders receive consistent income—similar to money market funds—ideal for those seeking stable cash flows.

2) Lower risk: Compared to high-leverage futures trading, this strategy carries lower risk because it does not rely on price predictions but rather exploits funding rate differences. Hedging spot and perpetual positions reduces overall market exposure.

3) Market neutrality: This strategy operates effectively in bull, bear, or sideways markets. Traders focus on funding rate gaps rather than directional trends, offering flexibility across all market conditions.

4) Exploiting market inefficiencies: The strategy captures temporary inconsistencies in funding rates, profiting from short-term market inefficiencies that traditional trading cannot access.

5) Flexibility: Traders can apply this strategy across various cryptocurrencies and stablecoins, enabling diverse trading options. Additionally, cross-exchange funding rate differences offer further profit opportunities.

Overall, due to its stable returns, low risk, and market-neutral nature, funding rate arbitrage has become a preferred strategy for many traders pursuing consistent profits in the cryptocurrency market.

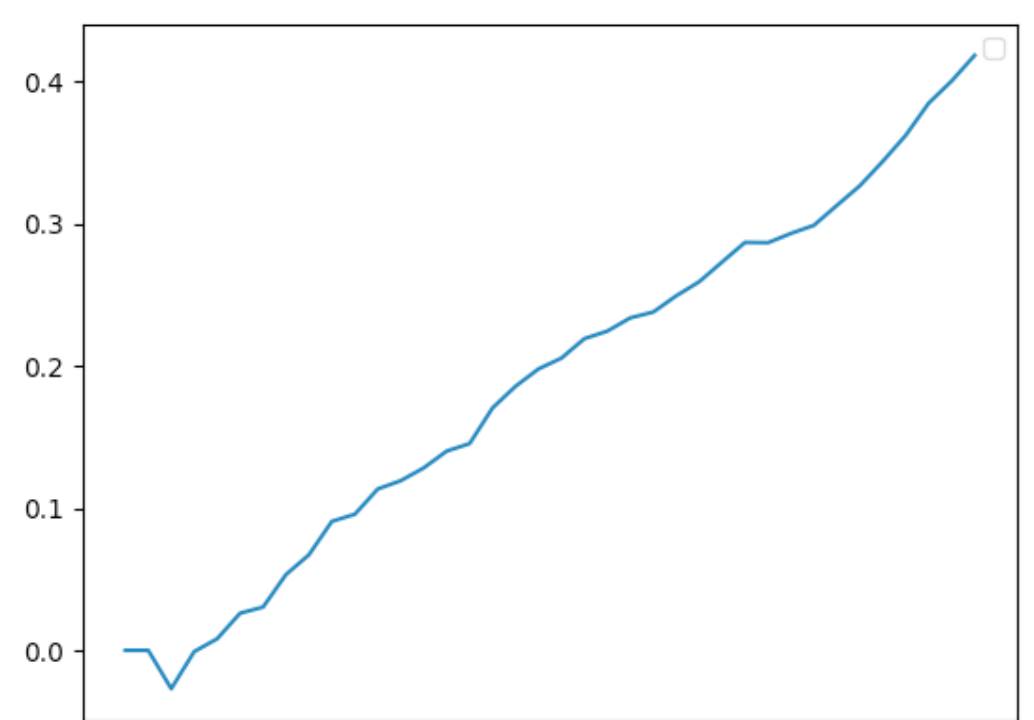

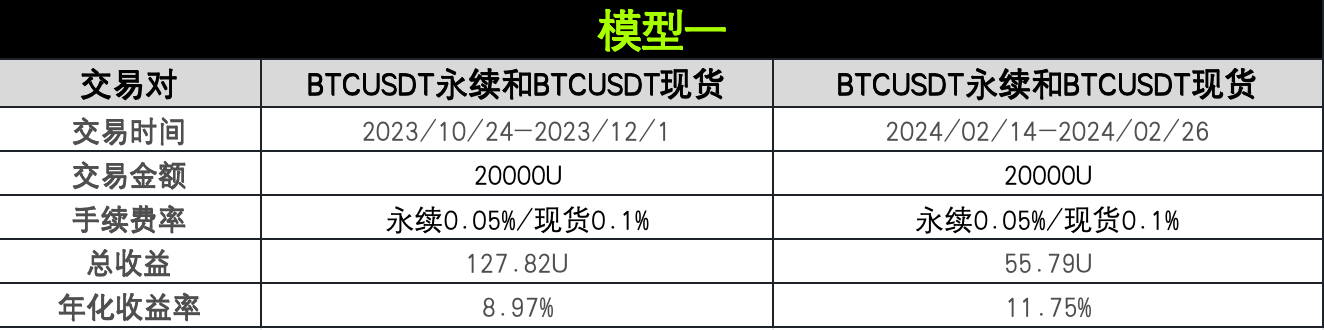

Model One

This model tests funding rate arbitrage for BTC and ETH under sideways/horizontal market conditions.

Figure 1: BTCUSDT perpetual vs. BTCUSDT spot funding rate arbitrage; Source: AICoin

Figure 2: BTCUSDT perpetual vs. BTCUSDT spot funding rate arbitrage; Source: AICoin

Figure 3: ETHUSDT perpetual vs. ETHUSDT spot funding rate arbitrage; Source: AICoin

Figure 4: ETHUSDT perpetual vs. ETHUSDT spot funding rate arbitrage; Source: AICoin

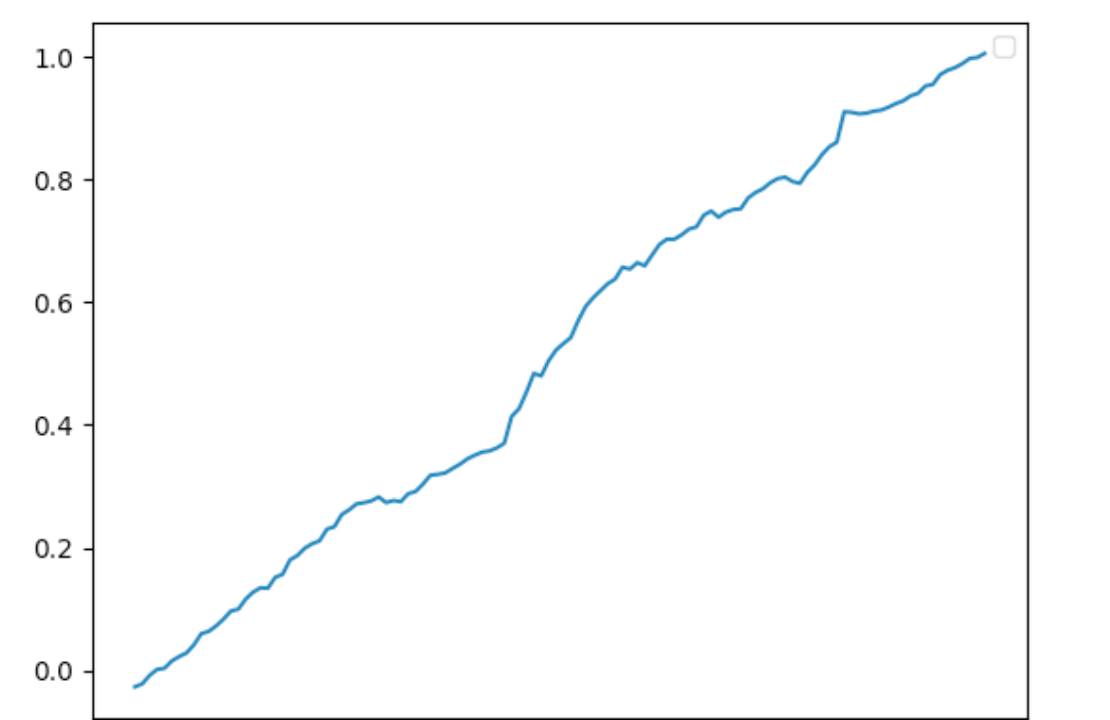

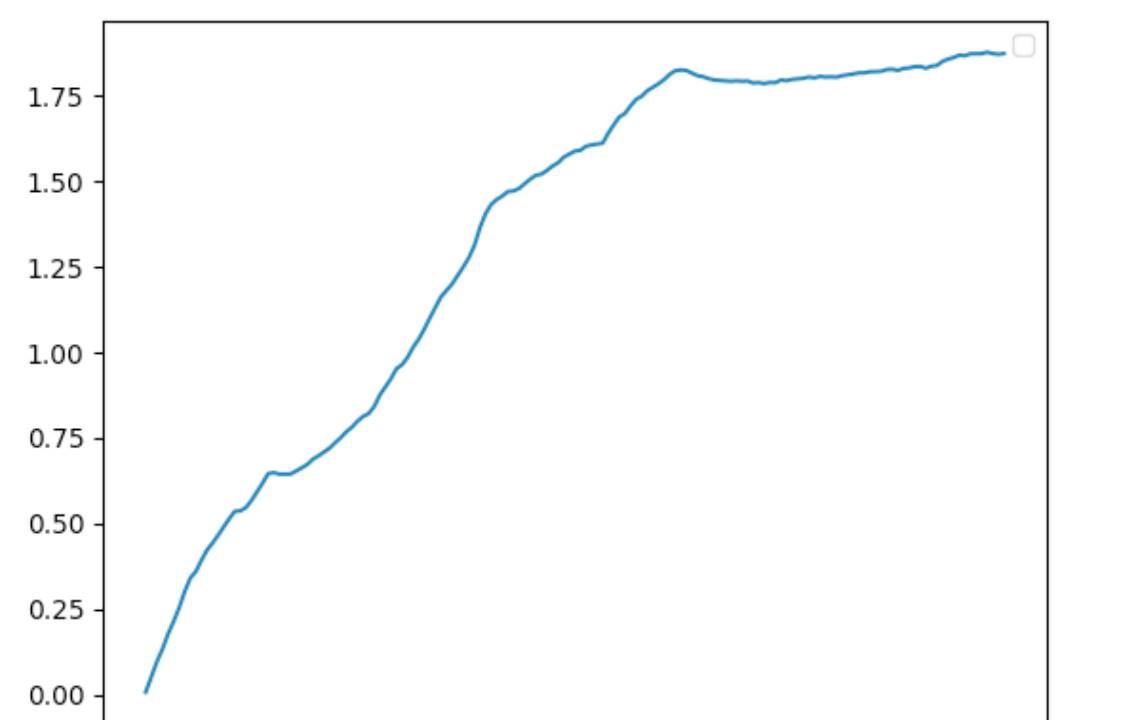

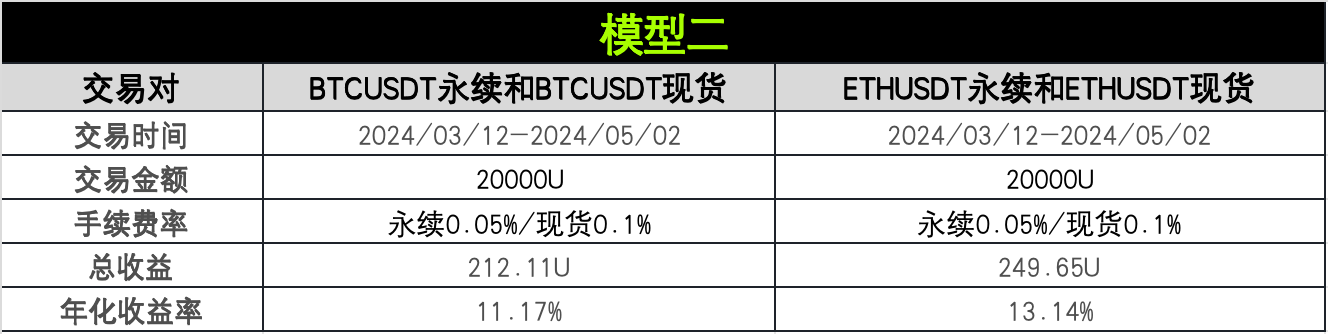

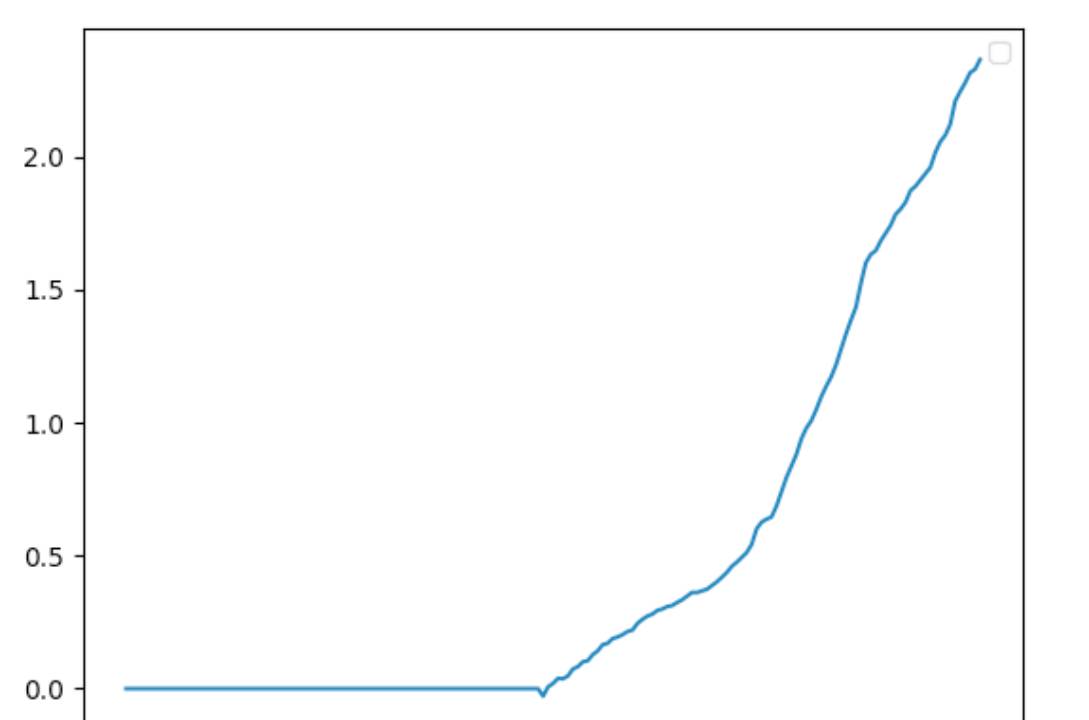

Model Two

This model tests funding rate arbitrage for BTC and ETH during a downtrend.

Figure 5: BTCUSDT perpetual vs. BTCUSDT spot funding rate arbitrage; Source: AICoin

Figure 6: ETHUSDT perpetual vs. ETHUSDT spot funding rate arbitrage; Source: AICoin

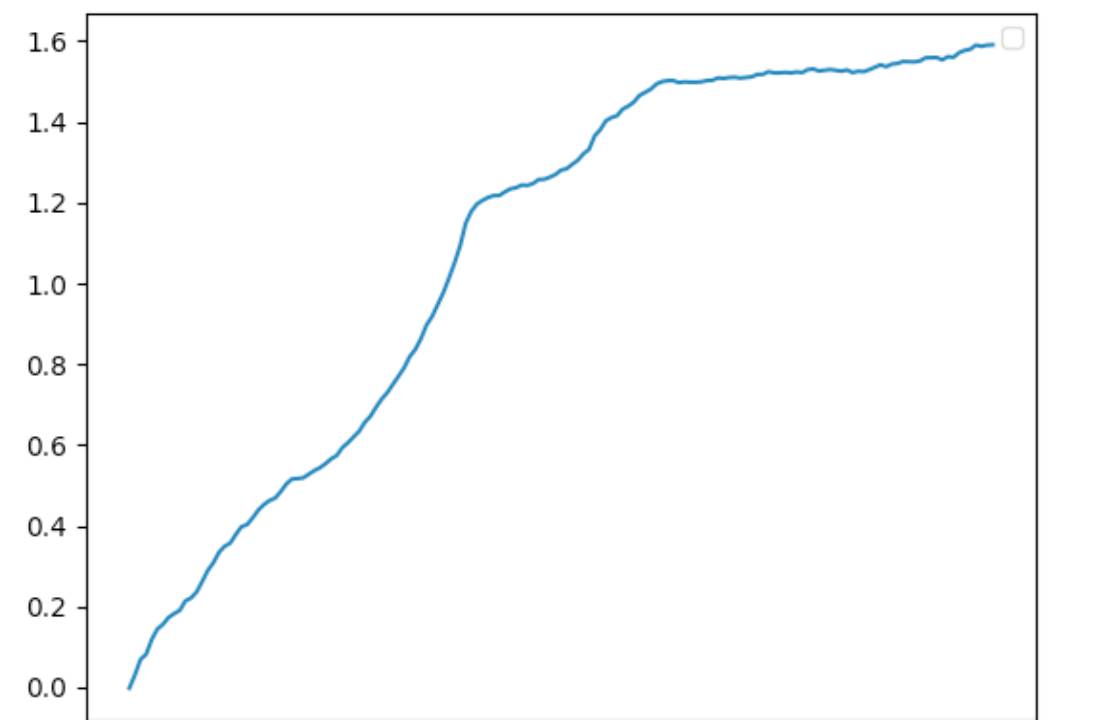

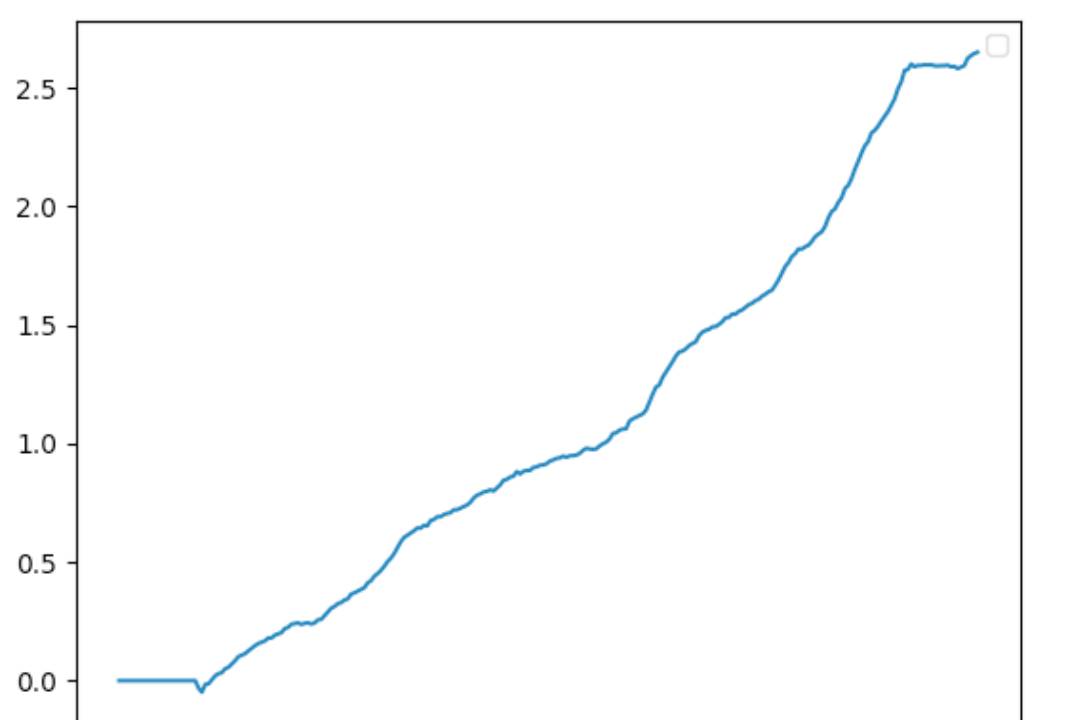

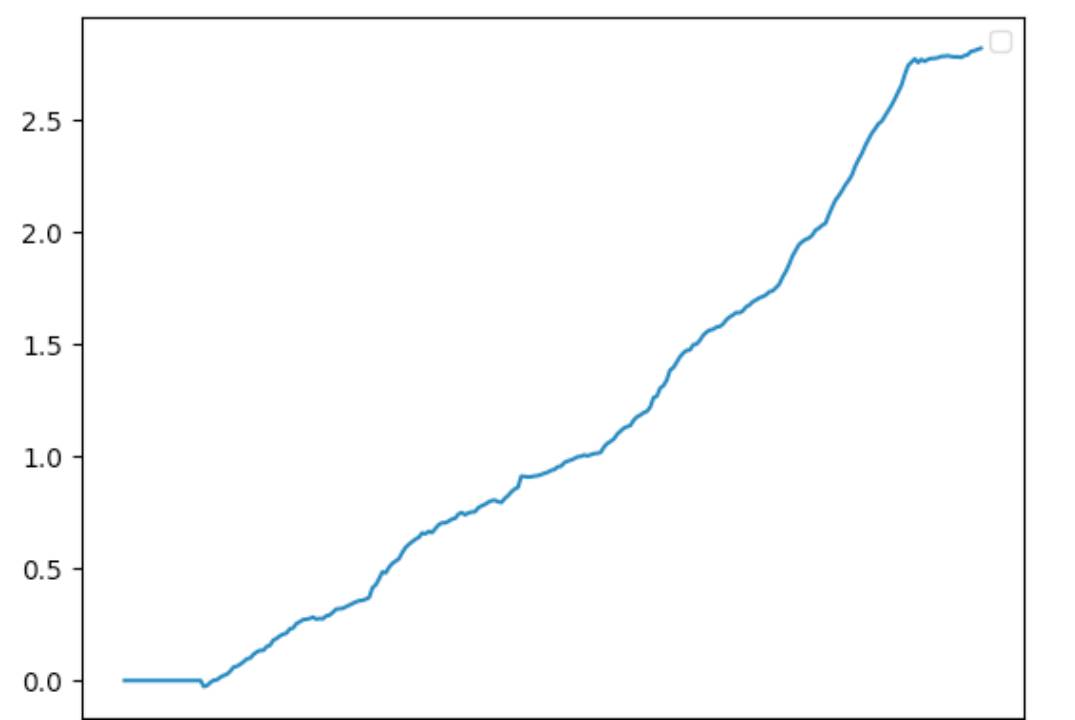

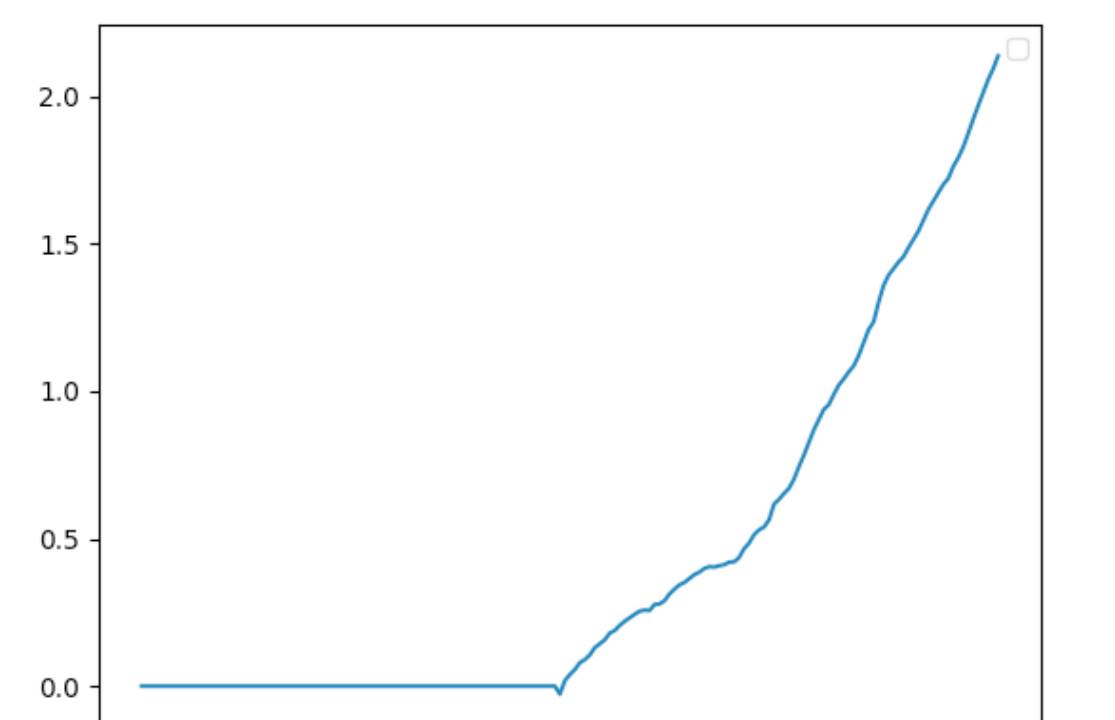

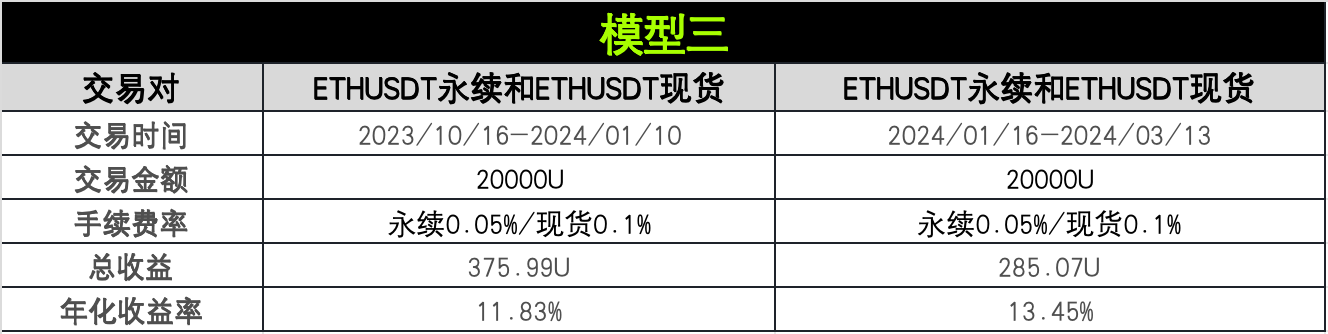

Model Three

This model tests funding rate arbitrage for BTC and ETH during an uptrend.

Figure 7: BTCUSDT perpetual vs. BTCUSDT spot funding rate arbitrage; Source: AICoin

Figure 8: BTCUSDT perpetual vs. BTCUSDT spot funding rate arbitrage; Source: AICoin

Figure 9: ETHUSDT perpetual vs. ETHUSDT spot funding rate arbitrage; Source: AICoin

Figure 10: ETHUSDT perpetual vs. ETHUSDT spot funding rate arbitrage; Source: AICoin

Analysis and Summary

Evaluating the performance of funding rate arbitrage across the three models from multiple dimensions including return performance, annualized yield, and market adaptability.

In terms of return performance: Model Three delivered the highest total return and annualized yield during the uptrend, demonstrating the strategy’s effectiveness in capturing spread opportunities in bullish markets. Model Two also performed well during the downtrend, particularly for ETH, highlighting the strategy’s adaptability across different market environments. Model One generated relatively lower returns in sideways markets, reflecting fewer arbitrage opportunities due to limited price volatility, stable funding rates, and cautious market participants.

Regarding annualized yield: Model Two stood out during the downtrend, especially for ETH, indicating that funding rate arbitrage can maintain high profitability even in bearish conditions. Model One showed lower annualized returns during consolidation, underscoring the impact of market environment on arbitrage performance.

In market adaptability: Funding rate arbitrage proves effective across different market cycles (up, down, sideways), though performance and profitability are clearly influenced by market conditions. Models Two and Three outperformed Model One, suggesting greater profit potential in volatile markets.

The analysis shows that the funding rate arbitrage strategy demonstrates strong flexibility and adaptability across market cycles. In both bullish and bearish markets, it effectively mitigates risk while maintaining stable returns. Even in choppy or range-bound markets, it provides reliable, albeit lower, returns. Traders should continuously monitor market conditions and adjust their strategies accordingly to maximize profitability.

In simple terms, this strategy performs well across various market conditions. During rallies or declines, it helps reduce risk and deliver steady returns. In volatile markets, despite lower gains, it remains reliable. By adjusting strategies according to market changes, traders can maximize returns.

OKX & AICoin Funding Rate Arbitrage

Currently, OKX Strategy Trading offers convenient and diverse strategy options.

Arbitrage generally refers to using hedging or swap mechanisms to earn interest differentials across markets with minimal risk. Common arbitrage methods include funding rate arbitrage, spot-futures arbitrage, and futures-futures arbitrage.

Arbitrageurs need to monitor two markets in real time, place orders simultaneously, and ensure near-instantaneous execution to avoid slippage. To assist users, OKX provides tools that enhance efficiency and execution accuracy. During actual arbitrage, users can leverage platform-calculated trade signals to select optimal arbitrage combinations. Quick access to OKX arbitrage: https://www.okx.com/zh-hans/trade-spot-strategy/btc-usdt

How to access more strategy trading on OKX? Users can navigate to the "Trade" section via the OKX app or website, enter "Strategy Trading," then click on "Strategy Square" or "Create Strategy" to get started. In addition to creating custom strategies, the Strategy Square features "Premium Strategies" and "Top Followers' Strategies," allowing users to copy or follow these strategies.

OKX Strategy Trading offers key advantages including ease of use, low fees, and strong security. For usability, OKX provides smart parameter recommendations to help users set trading parameters scientifically, along with visual and video tutorials for quick mastery. Regarding fees, OKX has upgraded its fee structure, significantly lowering transaction costs. On security, OKX boasts a world-class security team providing bank-grade protection.

How to access AICoin’s funding rate arbitrage strategies? On AICoin’s platform, users can find the "Arbitrage Bot" under the "Strategy" tab in the left sidebar. Upon entering this interface, users can select funding rate arbitrage strategies such as "Auto Earn," "Positive Arbitrage," or "Negative Arbitrage" under the "Arbitrage Opportunities" tab at the top.

Disclaimer

This article is for informational purposes only and reflects the author's views, not necessarily those of OKX. It does not constitute (i) trading advice or recommendations; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. We make no guarantees regarding the accuracy, completeness, or usefulness of the information provided. Holding digital assets—including stablecoins and NFTs—involves high risk and may experience significant volatility. You should carefully assess whether trading or holding digital assets is suitable for your financial situation. Please consult your legal/tax/trading professionals regarding your specific circumstances. You are solely responsible for understanding and complying with applicable local laws and regulations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News