PYUSD Rises to Sixth Largest Stablecoin: Riding Solana Momentum and High APY, Supply Surges Over 2x in Past 3 Months

TechFlow Selected TechFlow Selected

PYUSD Rises to Sixth Largest Stablecoin: Riding Solana Momentum and High APY, Supply Surges Over 2x in Past 3 Months

Looking back at the past year of development, leveraging Solana has been a key turning point for PYUSD's market expansion, and tangible subsidies along with expanded use cases are making it more competitive.

Text: Nancy, PANews

Backed by payments giant PayPal, the dollar-pegged stablecoin PYUSD has emerged as the sixth-largest stablecoin after a strong start last year. Over the past year, leveraging Solana has been a pivotal turning point for PYUSD’s market expansion, with direct financial incentives and broader use-case adoption further enhancing its competitiveness.

Rising to Sixth-Largest Stablecoin: Market Cap and Trading Volume Surge After Expansion to Solana

PYUSD has demonstrated rapid growth this year. According to DeFiLlama data, as of August 20, the total market capitalization of the stablecoin sector reached $167.99 billion. At the beginning of the year, PYUSD had a circulating supply of $230 million, accounting for less than 0.2% of the overall market. Now, with a market cap of nearly $870 million, it holds a 0.5% market share, ranking sixth—surpassing stablecoins such as USDD, TUSD, and FRAX.

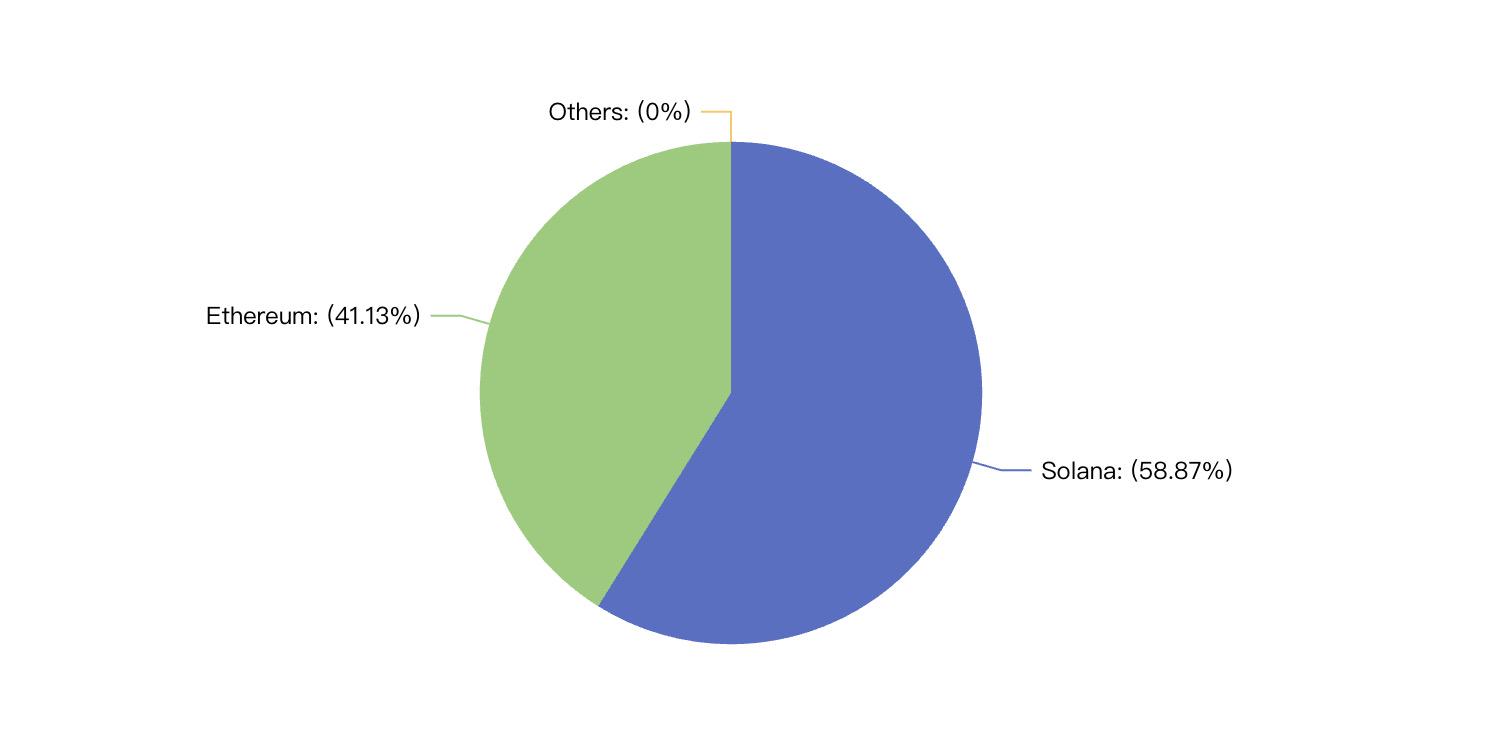

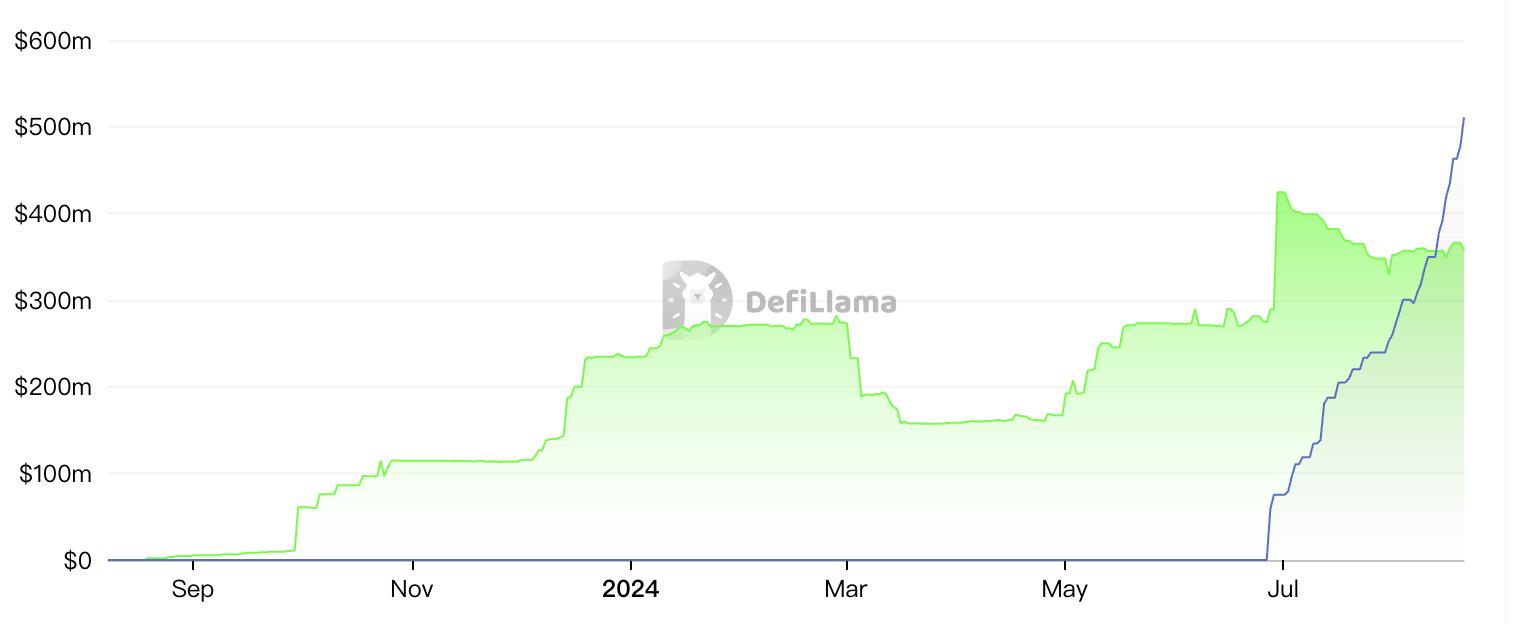

Unlike stablecoins like USDT, USDC, and DAI, which are issued across dozens of blockchains, PYUSD is currently only available on Solana and Ethereum. As of August 21, according to DeFiLlama, PYUSD’s circulating supply on Solana stands at $510 million, representing nearly 58.9%, while Ethereum accounts for $350 million, or 41.1%.

Although the market shares on these two blockchains are relatively close, the expansion to Solana was only completed at the end of May this year. PYUSD initially planned to launch on Solana in collaboration with FTX back in 2022 and even signed a cooperation agreement, but due to FTX's collapse, it ultimately launched on Ethereum instead.

Prior to this, it took about ten months for PYUSD on Ethereum to reach a scale of under $300 million. However, after deployment on Solana, its market cap surged by 217.9% in under three months. In terms of supply growth, PYUSD’s adoption rate on the Solana network is rising rapidly. On-chain data shows that over the past 30 days, PYUSD’s supply on Solana increased by 131.8% to $510 million, while on Ethereum it declined by 2.4% to $350 million, indicating accelerating adoption on Solana.

PYUSD also now occupies a significant share of Solana’s stablecoin market. According to DeFiLlama, as of August 21, the total stablecoin supply on Solana reached $3.81 billion, with PYUSD ranking third among 26 stablecoin projects. Over the past month, PYUSD’s market cap grew by 132%, outpacing USDC (14.03%), which ranks first, and USDT (down 2.64%), which ranks second.

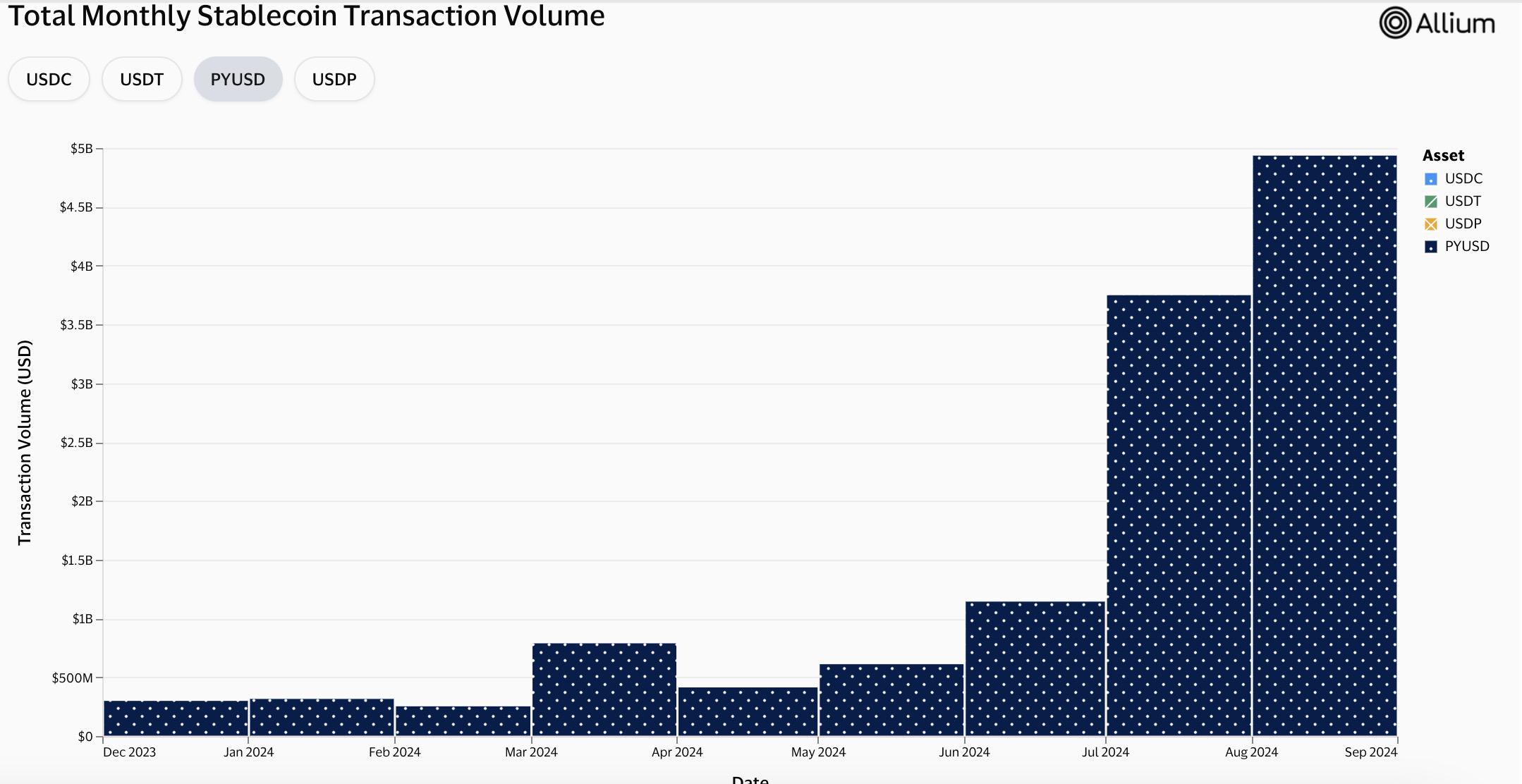

Alongside market cap growth, PYUSD’s trading volume has also surged significantly. Data from blockchain analytics provider Allium Labs shows that PYUSD’s trading volume reached $4.94 billion in August, up more than 15.4-fold from just $320 million at the beginning of the year. Particularly after expanding to Solana, PYUSD achieved over $9.84 billion in trading volume in the past three months—3.6 times the cumulative volume before that ($2.69 billion).

High APY Drives Usage; Multiple Initiatives Boost Adoption

The rapid expansion of PYUSD’s market size is closely tied to generous subsidies offered through partnerships with major DeFi protocols on Solana, along with broader payment integrations.

Recently, PYUSD has partnered with numerous protocols including Jupiter, ORCA, Wormhole, Drift Protocol, Kamino Finance, and Marginfi. For example, when Jupiter listed PYUSD, the stablecoin also became usable across all of the platform’s integrated payment systems, including Sphere Labs and Helio Pay. Kamino introduced PYUSD and launched a deposit incentive program, increasing weekly rewards for PYUSD by 64% to 192,000 tokens.

Moreover, these DeFi protocols offer high yields to incentivize users to adopt PYUSD. For instance, on Kamino, $350 million worth of PYUSD earns an APY of 17.64%; Marginfi offers an 18.58% APY on PYUSD deposits; and Drift Protocol provides APYs ranging from 17.49% to 18.28% for PYUSD.

PYUSD APY on Marginfi

The consistently high yields across Solana-based platforms are believed to be linked to Solana Foundation’s strong advocacy for PayFi, with payments and stablecoins highlighted as key focus areas for Solana’s future. In stark contrast, PYUSD’s APY on Ethereum’s Aave is only 3.55%.

Beyond yield incentives, PayPal introduced new features when deploying PYUSD on Solana to improve user experience, including “confidential transfers” that protect transaction amount privacy while meeting regulatory requirements, transfer hooks that allow developers to invoke custom logic during token transfers between individuals and merchants, and memo fields enabling users to attach notes during payments. To further encourage innovation and adoption of PYUSD on Solana, a global hackathon was recently announced with a prize pool totaling 40,000 PYUSD.

In addition to expanding use cases, PYUSD has boosted its profile through lower fees, cross-border transaction support, and developer outreach. Web3 payment infrastructure provider Transak launched a fiat-to-crypto on-ramp specifically for PayPal USD to promote digital asset payments. During Bitcoin Pizza Day, trading fees were temporarily waived for swaps between PYUSD and assets like BTC and ETH. PayPal’s cross-border remittance service Xoom also began offering free money transfers to PYUSD users, aiming to grow its international remittance market share.

Overall, after establishing a foundation on Ethereum—with its vast user base and strong market consensus—PYUSD has made notable progress by riding Solana’s momentum and offering attractive yield opportunities, gaining a degree of market recognition. However, it still has a long journey ahead to achieve greater influence within the competitive stablecoin landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News