Understanding Corn: The First Ethereum L2 to Use Bitcoin as Gas, Backed by Binance Labs

TechFlow Selected TechFlow Selected

Understanding Corn: The First Ethereum L2 to Use Bitcoin as Gas, Backed by Binance Labs

Corn creates new value capture opportunities for Bitcoin, enabling it to be more than just a store of value asset and also an active medium of exchange.

Author: TechFlow

Bitcoin's ecosystem has recently attracted significant attention.

Whether it's the controversy surrounding wBTC or the active developments in various L2 and DeFi projects within the Bitcoin ecosystem, the market continues to show strong enthusiasm for Bitcoin-related concepts.

However, this enthusiasm largely centers on Bitcoin itself. Most projects are busy seeking additional yield opportunities for Bitcoin, essentially competing fiercely within the Bitcoin ecosystem.

Now, even the already crowded Ethereum L2 space is turning its eyes toward Bitcoin.

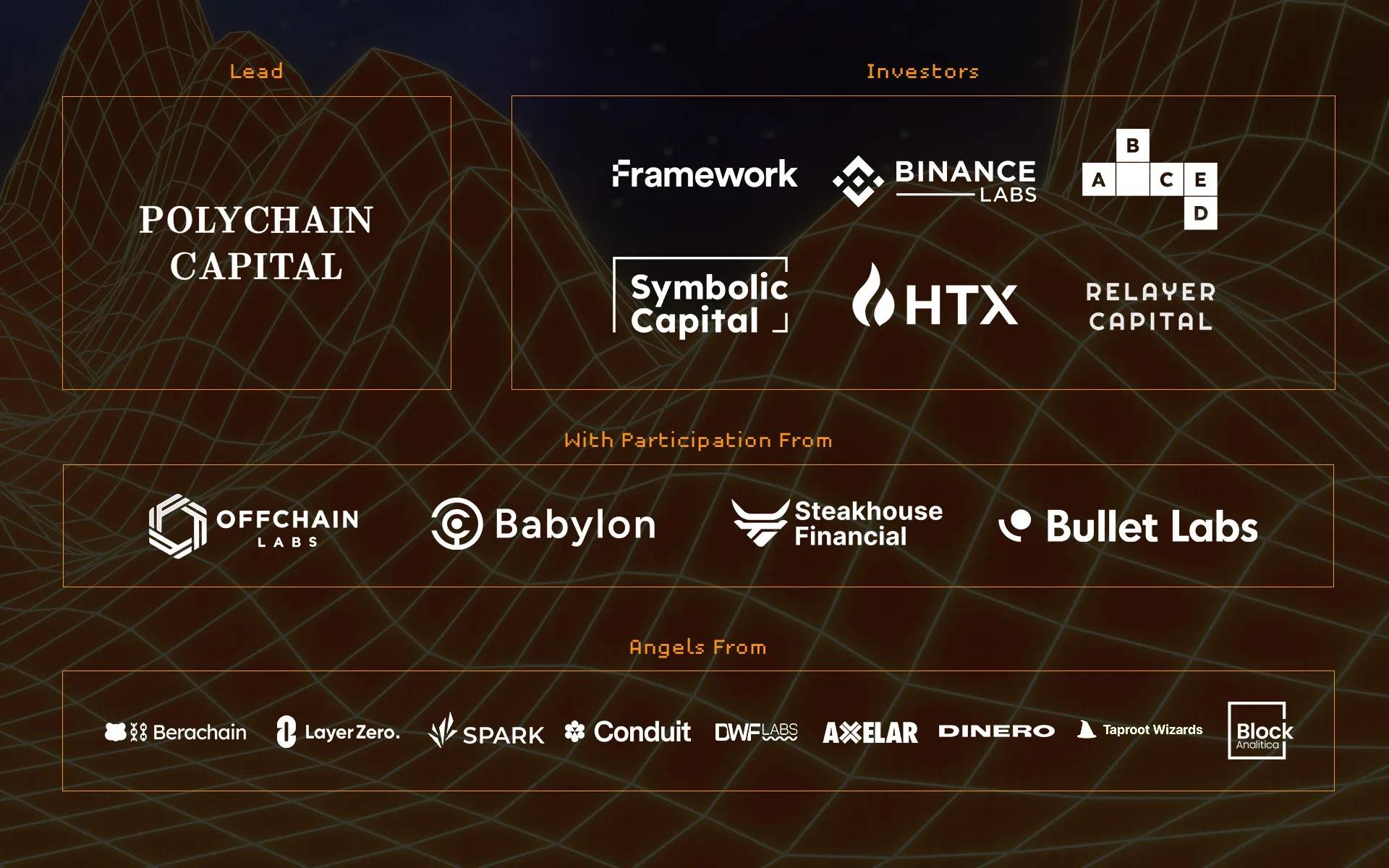

On August 20, a new Ethereum L2 named Corn announced it had raised $6.7 million in seed funding, led by Polychain Capital, with participation from Binance Labs, Framework Ventures, ABCDE, Symbolic Capital, HTX Ventures, and Relayer Capital.

Developers from well-known projects such as Polygon and Berachain also participated as individual investors.

This L2 has one standout feature — using BTC, via a form of mapping, as the native Gas token on the L2 mainnet, while creating more yield opportunities for BTC within the Ethereum ecosystem.

Previously, whether through wBTC or other DeFi applications, efforts to generate BTC yields focused on asset and application layers. Using a mapped BTC asset as Gas on an infrastructure-level L2 is unprecedented.

Additionally, the project’s name “Corn” (corn being a symbol of harvest and yield in crypto culture) hints at its core mission: an L2 designed to maximize BTC utility and returns.

How exactly will Corn achieve this? And what early participation or positioning opportunities exist?

BTC as Gas

It should be noted that Corn is still in its early stages. The website features under development, and the whitepaper and documentation have not been fully released. The following analysis is based on currently available public information.

First, let’s examine how using BTC as Gas works.

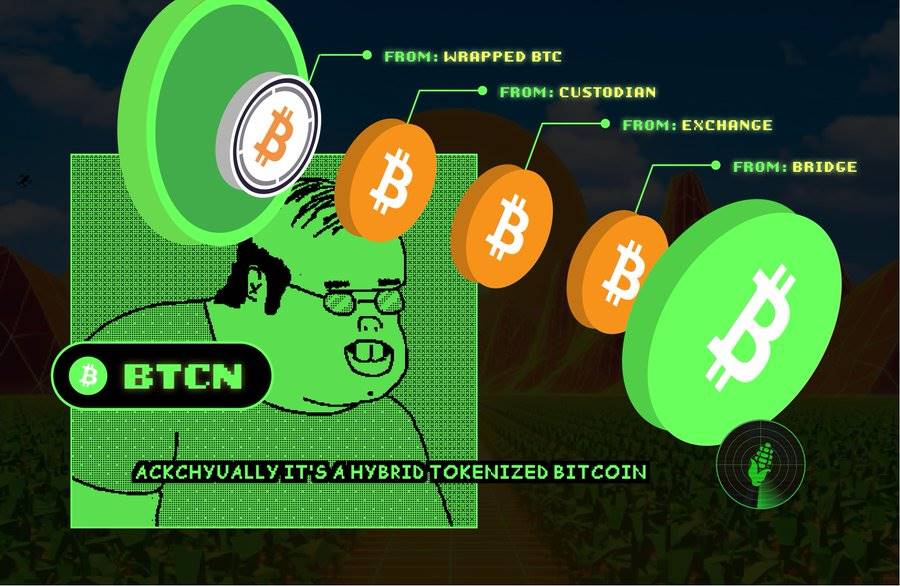

Corn introduces a new tokenized form of Bitcoin called BTCN. This is the native Gas token on the Corn network, used to pay for transaction fees.

You can think of BTCN as an ERC-20 representation of Bitcoin—similar to wBTC in concept, but likely differing technically.

Why use mapped BTCN as Gas? Some potential reasons include:

-

Improving Bitcoin's utility: By converting BTC into a usable Gas token on an Ethereum L2, Bitcoin holders can more easily participate in the Ethereum ecosystem without having to fully convert their assets.

-

Reducing transaction costs: Since BTCN operates directly on the L2, users can avoid the high Gas fees associated with transactions on the Ethereum mainnet.

-

Enhancing value capture for Bitcoin: By integrating Bitcoin into the Ethereum ecosystem, Corn creates new value accrual opportunities, transforming Bitcoin from a passive store of value into an active medium of exchange.

While Corn has not yet disclosed full technical details, we can reasonably infer the following implementation flow based on current information:

-

Multi-party custody: The minting of BTCN may not rely on a single centralized custodian but instead involve multiple custodians, smart contracts, and/or bridging protocols, enhancing both security and decentralization.

-

Bridging mechanism: Users may deposit their BTC into the Corn network via a dedicated bridge protocol. This bridge locks the native BTC and mints an equivalent amount of BTCN on the Corn network.

-

Smart contracts: A suite of smart contracts on the Corn network would manage the minting, burning, and transfer of BTCN, ensuring its supply remains pegged 1:1 to the locked BTC.

-

Liquidity pools: To maintain liquidity between BTCN and other assets such as ETH or stablecoins.

-

Verification mechanisms: Robust verification systems—possibly involving multi-sig wallets, time locks, and other safeguards—are needed to ensure the accuracy and security of BTCN minting and redemption.

Generating More Yield for BTC in the Ethereum Ecosystem

How does this L2 create additional yield for BTC?

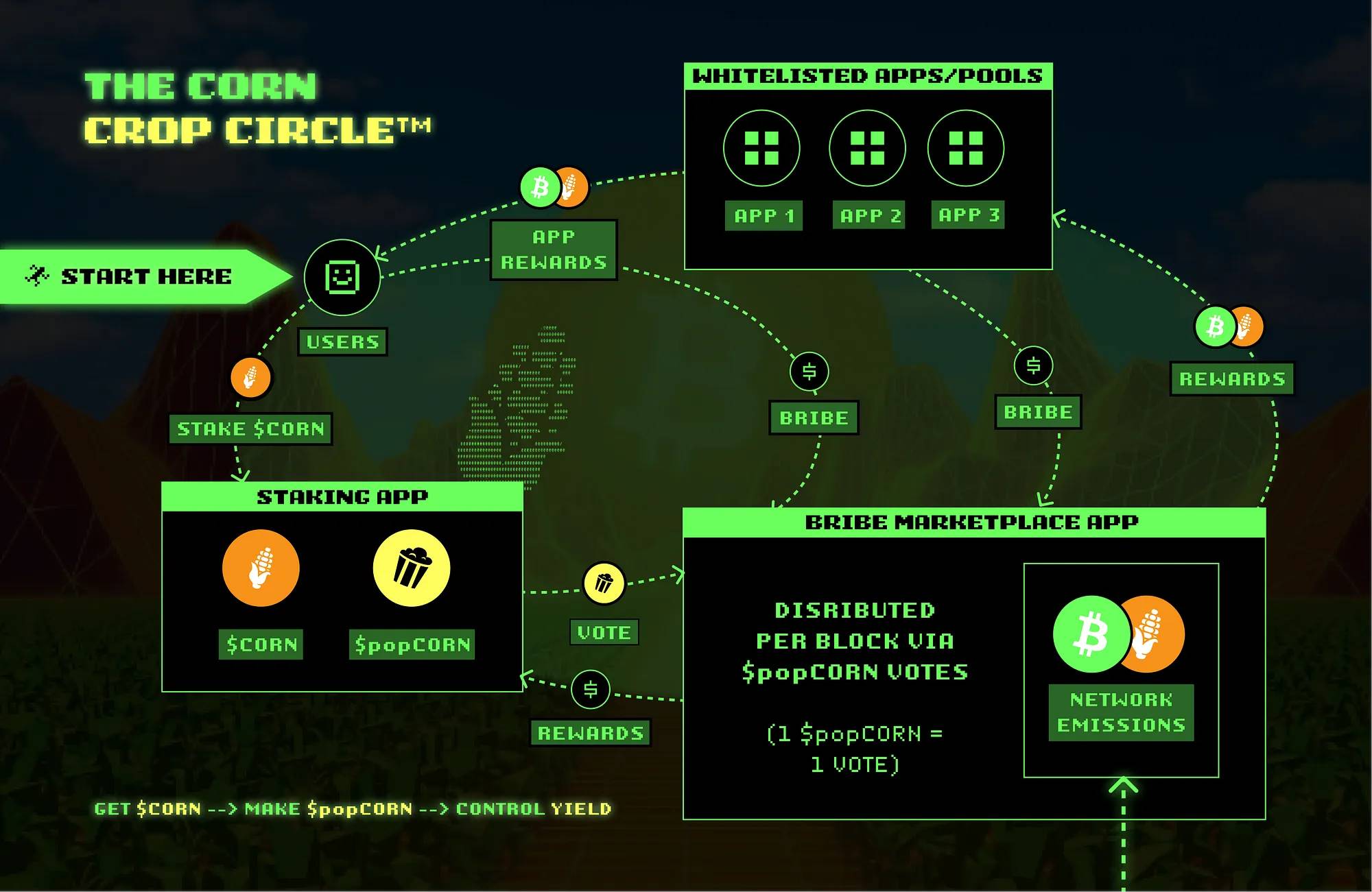

Corn introduces a concept called the "Crop Circle" (作物圈) ecosystem. The core idea is to recycle BTC’s value across multiple avenues within the Ethereum ecosystem to generate extra yield.

In the absence of further official disclosures, we can analyze and interpret the diagram provided by the team.

First, users can stake their BTCN tokens to earn network rewards. This resembles PoS staking mechanisms elsewhere, but uniquely uses an asset pegged to BTC.

Additionally, Corn may launch liquidity mining programs to incentivize users to provide BTCN trading pairs, earning extra yield. Through integration with other blockchains and DeFi protocols, Corn could also offer cross-chain yield opportunities—for example, allowing BTCN to participate in DeFi projects on other chains.

According to official tweets and blog posts, Corn plans deep integrations with existing Ethereum DeFi protocols, offering BTCN holders diversified financial services:

-

Lending: Users can use BTCN as collateral to borrow other assets on DeFi platforms, or lend out BTCN to earn interest.

-

Derivatives: Development of a derivatives market based on BTCN, including options and perpetual contracts, providing users with more investment and hedging tools.

-

Yield aggregators: Helping users optimize BTCN yields across different DeFi protocols.

Corn also introduces two tokens: $CORN and $popCORN, inspired by Curve’s vote-escrowed (ve) model.

$CORN serves as the base token, analogous to CRV in Curve. Users can earn $CORN through various means, such as staking BTCN, providing liquidity, or engaging in other ecosystem activities. $popCORN, similar to veCRV, is a governance token obtained by locking $CORN.

Locking mechanism:

Users can choose to lock their $CORN for a period to receive $popCORN. The longer the lock-up period, the more $popCORN they receive. This mechanism encourages long-term holding and participation, as extended lock-ups grant greater governance power and potential rewards.

Dynamic weight: The voting power of $popCORN may decay over time, similar to the veCRV decay mechanism in Curve. This means users must periodically "re-lock" their $CORN to maintain maximum governance influence, further promoting active ecosystem engagement.

Governance and reward distribution: Holders of $popCORN gain not only voting rights in ecosystem governance but may also receive additional rewards—such as a share of transaction fees, newly minted $CORN, or priority access to specific initiatives.

Liquidity incentives: Following Curve’s model, Corn may use $popCORN to determine the weight of different liquidity pools. Users with more $popCORN can "vote" to increase a pool’s weight, thereby attracting higher liquidity mining rewards to that pool.

Bribe Marketplace: An innovative extension of the ve model. While informal "bribe" markets already exist in the Curve ecosystem, Corn appears to formalize and integrate this concept into its platform. Users might leverage $popCORN to influence votes or earn additional incentives through this marketplace.

This application of the ve model enhances the utility of both $CORN and $popCORN. Long-term holders are rewarded with greater governance power and potential returns, which in turn increases demand and value for the tokens.

Simultaneously, this model establishes a unique positioning and value creation pathway for BTC within the Ethereum ecosystem.

Current Participation Opportunities

Currently, Corn’s testnet and token have not officially launched. However, the team has shared some preliminary engagement activities.

At 11 PM on the 21st, the project will host a Space on X to discuss details about the mainnet token airdrop. In the initial airdrop phase, only eligible users will be added to the qualification list.

The selection criteria focus on several thousand "super DeFi users" who have interacted with DeFi protocols partnered with Corn in the past 12 months. The exact list has not been disclosed; interested parties are advised to follow the official X account and attend the Space for updates.

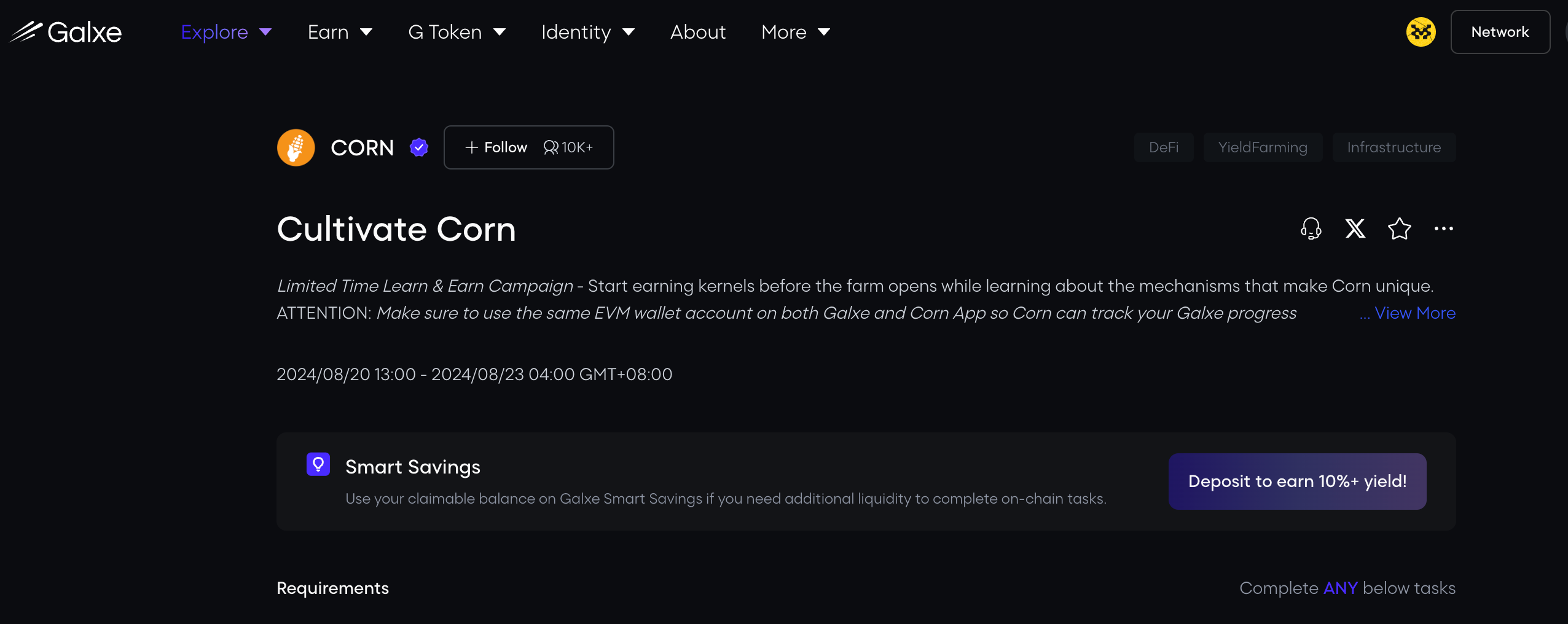

Meanwhile, a social media campaign has been launched on Galxe: Corn Social Quest, running from the 20th to the 23rd. Participants need only follow the project’s Twitter account, like and retweet designated posts to earn points, and join their Discord server to obtain the “Farmer” role.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News