Chinese-speaking Crypto Market Survey: Uncovering the Realities of the Chinese-Speaking Crypto Community from Trading Habits and MBTI to Popular Sectors

TechFlow Selected TechFlow Selected

Chinese-speaking Crypto Market Survey: Uncovering the Realities of the Chinese-Speaking Crypto Community from Trading Habits and MBTI to Popular Sectors

Do you really understand Chinese-speaking crypto users?

Overview

Do you truly understand Chinese-speaking crypto users?

Chinese-speaking users have long been a pivotal force in the cryptocurrency market. Whether contributing active addresses and TVL, providing liquidity in secondary markets, or supplying developers to public chain ecosystems, they remain at the forefront of the crypto space. Understanding this group's investment preferences and scale is crucial for identifying market trends, optimizing product offerings, and enhancing user experience.

To this end, TechFlow conducted a survey titled "Crypto Investment Habits of Chinese-Speaking Users" from May 22, 2024, to June 30, 2024. The questionnaire was distributed via social media platforms and community forums, collecting a total of 2,107 responses. After data cleaning and filtering, 54 invalid responses were removed, leaving 2,053 valid responses. All information collected during this survey strictly adheres to privacy protection protocols and will be used solely for research purposes.

This report analyzes data from the 2,053 valid responses, aiming to deeply explore behavioral patterns and market demands among Chinese-speaking crypto investors. The analysis is divided into four main sections:

Part 1: Respondent Demographics

Part 2: Market Focus within the Chinese-Speaking Community

Part 3: Centralized Exchange Preferences Among Chinese-Speaking Users

Part 4: A Deeper Dive into Investor Mindsets

Key Highlights

-

The respondent group exhibits clear characteristics: predominantly male, concentrated in the 26–35 age range, and mostly holding bachelor’s degrees or higher.

-

In MBTI personality assessments, IN (Introverted Intuitive) types are most common. These individuals typically excel at identifying trends, innovation, and future directions, often possessing strong strategic foresight.

-

Bitcoin and its ecosystem are the most favored and invested-in sectors. Most respondents are optimistic that Bitcoin will surpass $100,000–$150,000 in this market cycle.

-

Self-driven research and independent purchasing are the primary factors influencing investment decisions. X (formerly Twitter) is the dominant platform for accessing crypto market news and alpha, followed by blockchain media outlets.

-

When asked about the most respected crypto venture capital firms, a16z, Paradigm, and Binance Labs ranked top three based on nominations.

-

In the competitive landscape of centralized exchanges within the Chinese-speaking community, Binance holds a significant advantage: It leads across key metrics—most frequently used exchange, exchange with largest asset allocation, highest profit generation, and primary platform for participating in token launches—with over 60% share in each category. Notably, 96.72% of respondents selected Binance as their most-used CEX, highlighting its immense influence and user base in the Chinese-speaking crypto market.

-

A majority (69.61%) stated that regulatory actions do not affect their exchange preferences, indicating growing investor desensitization toward government regulations.

-

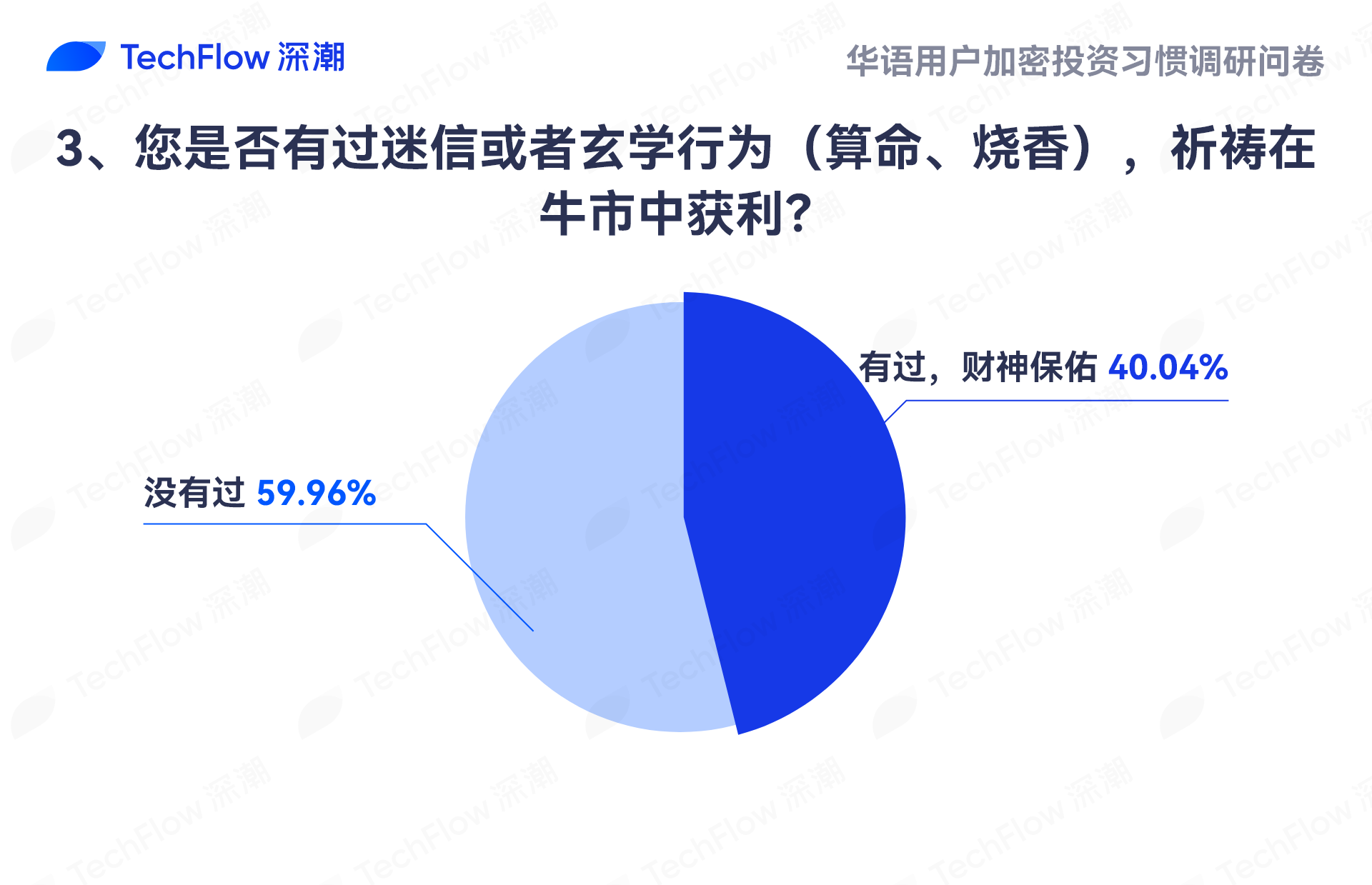

In an era where mysticism is popular, 40.04% of respondents admitted engaging in superstitious practices such as praying to wealth gods.

-

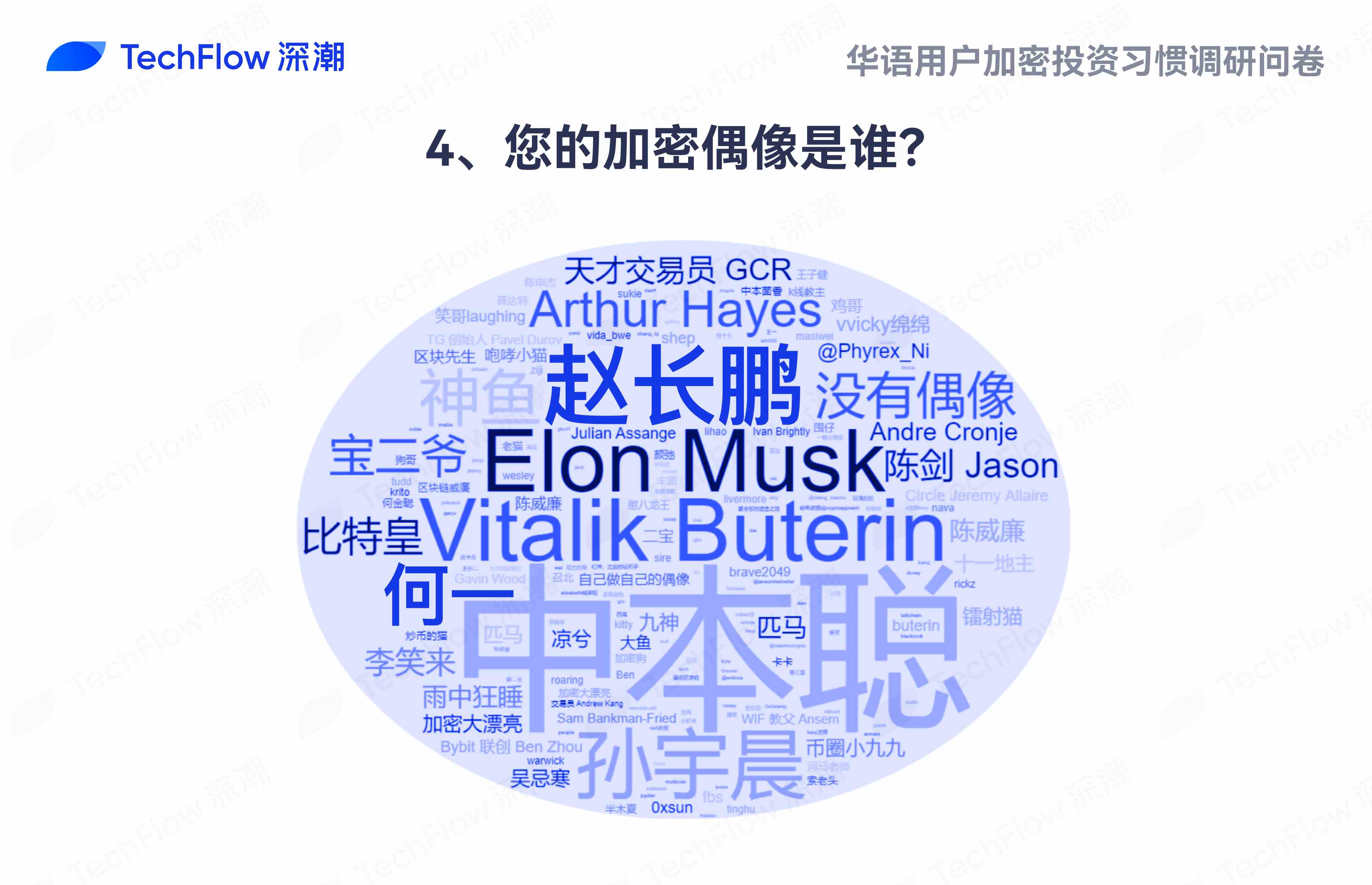

Among respondents' crypto idols, Satoshi Nakamoto (Bitcoin founder), Vitalik Buterin (Ethereum founder), Elon Musk (SpaceX CEO), and CZ (Binance founder) were mentioned most frequently.

-

Exchanges are the most desired Web3 employers. Many believe exchanges aggregate premium information and offer early access to lucrative opportunities. Among them, Binance received the highest mentions as the dream workplace.

-

Regarding whether they would exit after making enough money, most respondents rejected the idea, viewing Web3 as a long-term belief. When asked how much wealth is needed to retire comfortably, over two-thirds said they’d need over $10 million in assets—A8 represents a critical financial threshold.

-

Top-performing crypto assets cited include Bitcoin, ETH, Solana, BNB, and PEPE—reflecting current market dynamics: strong beta plays dominate, while alpha opportunities are scarce, with many altcoins underperforming major cryptocurrencies.

Part 1: Respondent Demographics

This section covers various aspects including gender, age, education level, duration of crypto investing, and personality traits. The goal is to build a comprehensive profile of participants to support deeper data analysis and identification of distinct user segments.

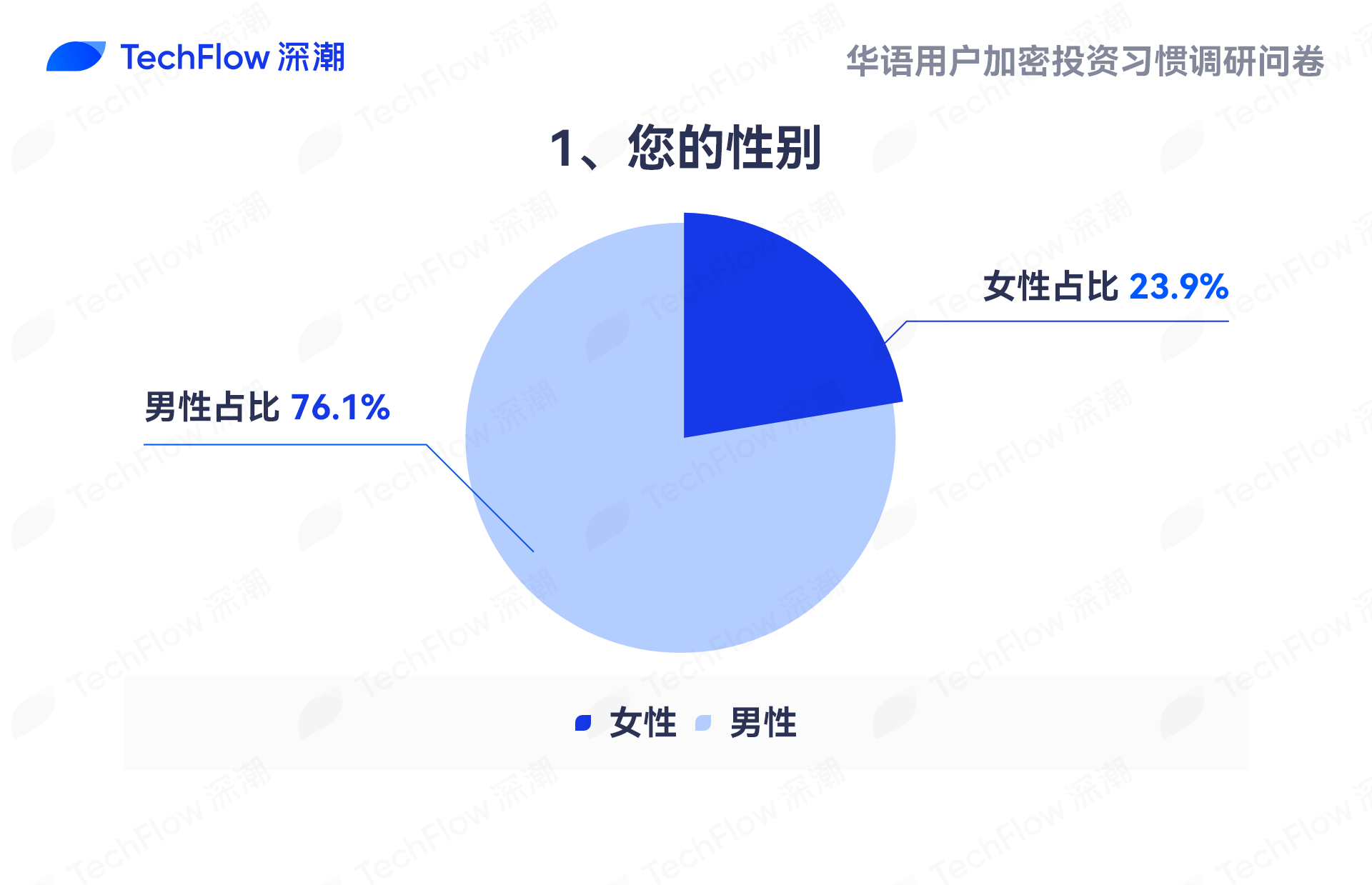

1. Gender Distribution:

Our survey reveals a significant gender imbalance, with male respondents showing much higher participation.

Specifically, male respondents numbered 1,562 (76.1%), while female respondents totaled 491 (23.9%).

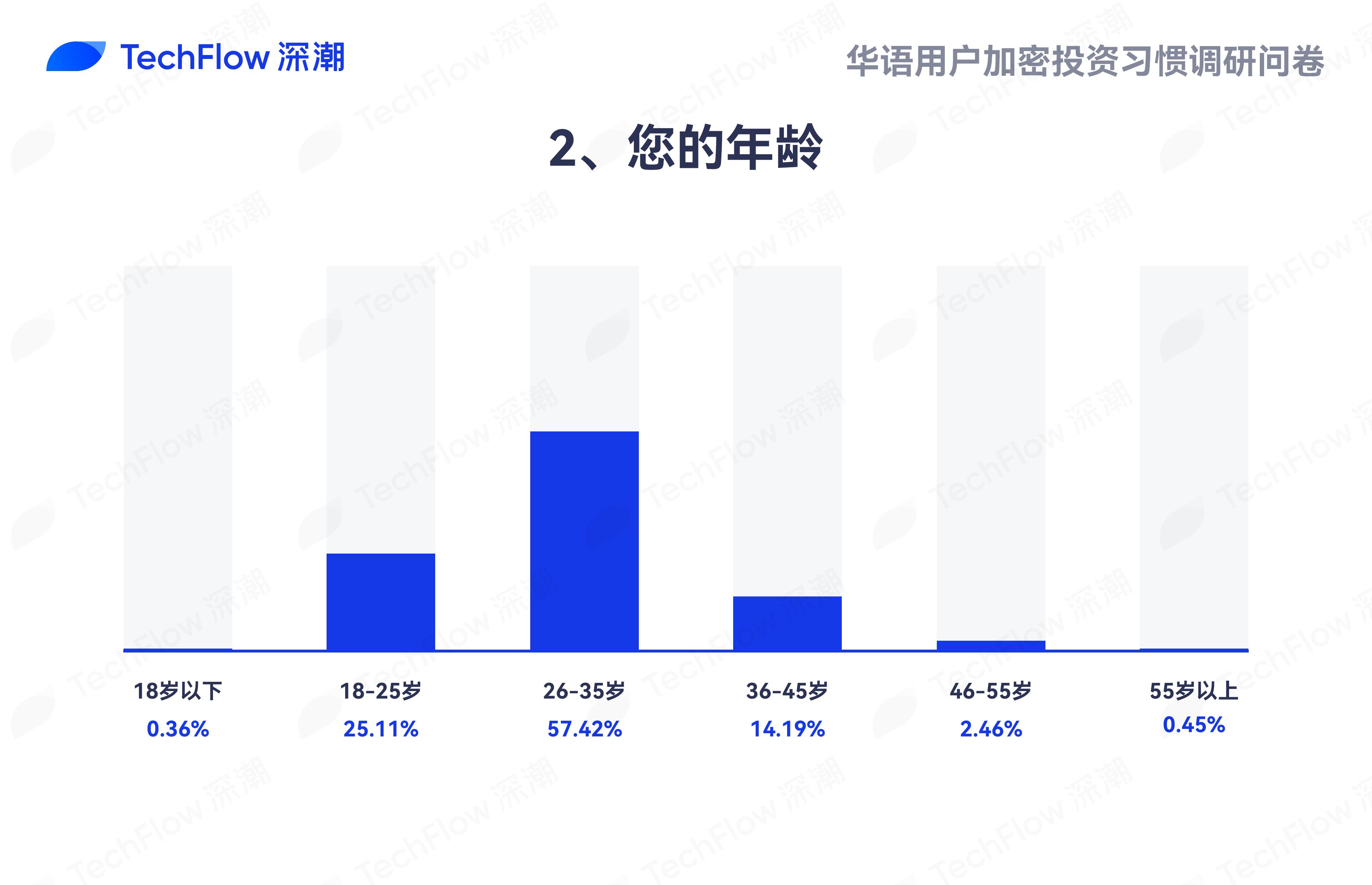

2. Age Distribution:

Age distribution shows a clear concentration among younger demographics, who demonstrate greater engagement in crypto investing.

Specifically, respondents aged 26–35 make up the largest group at 57.42%, followed by those aged 18–25 at 25.11%, and 36–45 at 14.19%. Notably, users aged 18–45 account for 96.72% of all respondents.

Those aged 46–55 represent only 2.46%, and those above 55 just 0.45%, suggesting declining participation with age.

Additionally, users under 18 account for merely 0.36%, likely due to limited financial independence and investment capacity.

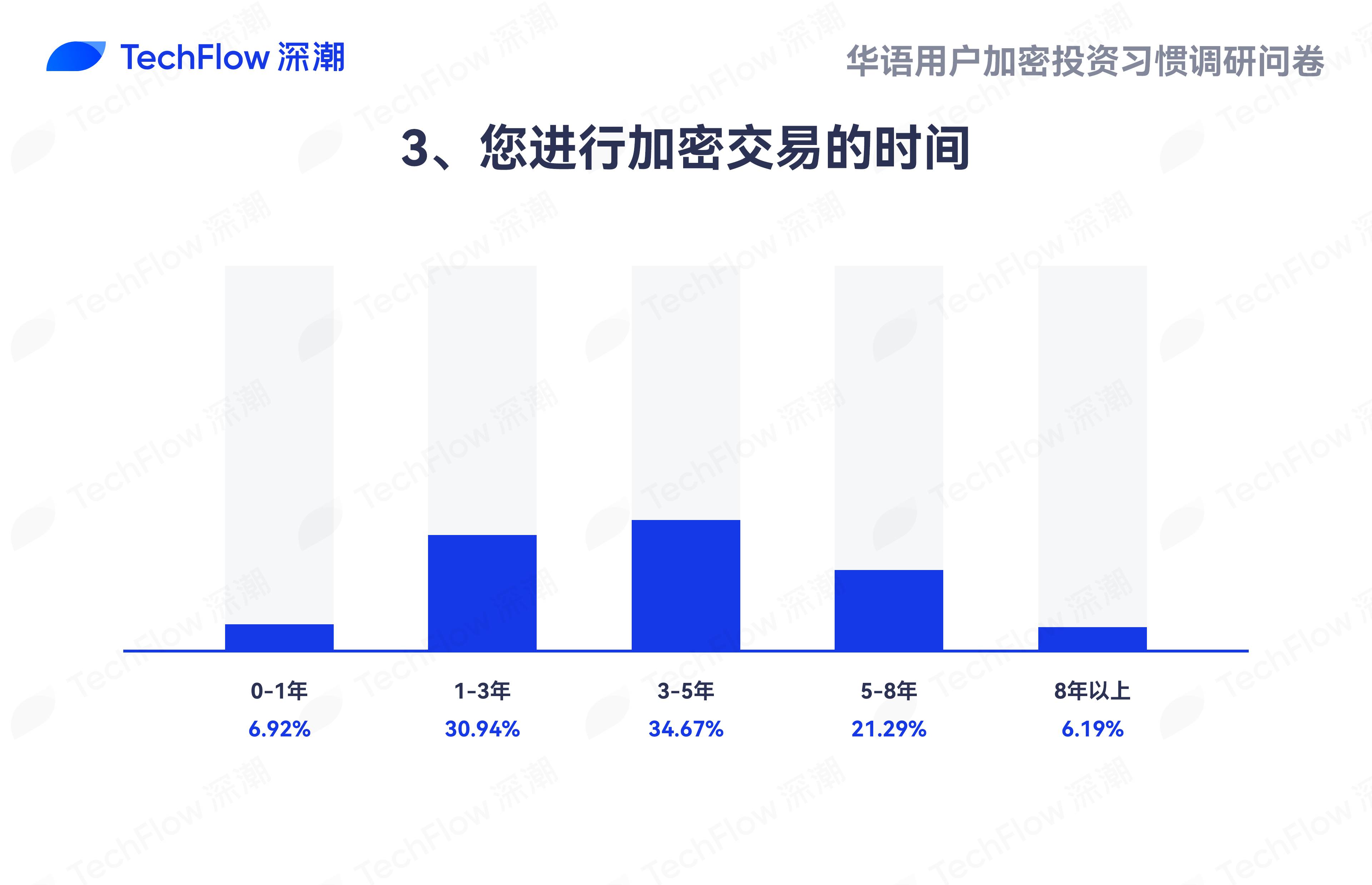

3. Duration of Crypto Trading Experience:

Respondents show balanced experience levels, forming a stable and diverse user base conducive to long-term market development.

Specifically, 34.67% have 3–5 years of trading experience—the largest share—followed by 30.94% with 1–3 years, and 21.29% with 5–8 years. Combined, those with 1–8 years of experience make up 86.9%.

Meanwhile, 6.92% have less than one year of experience, and 6.19% have over eight years—indicating both new entrants and experienced veterans coexist, reflecting market dynamism.

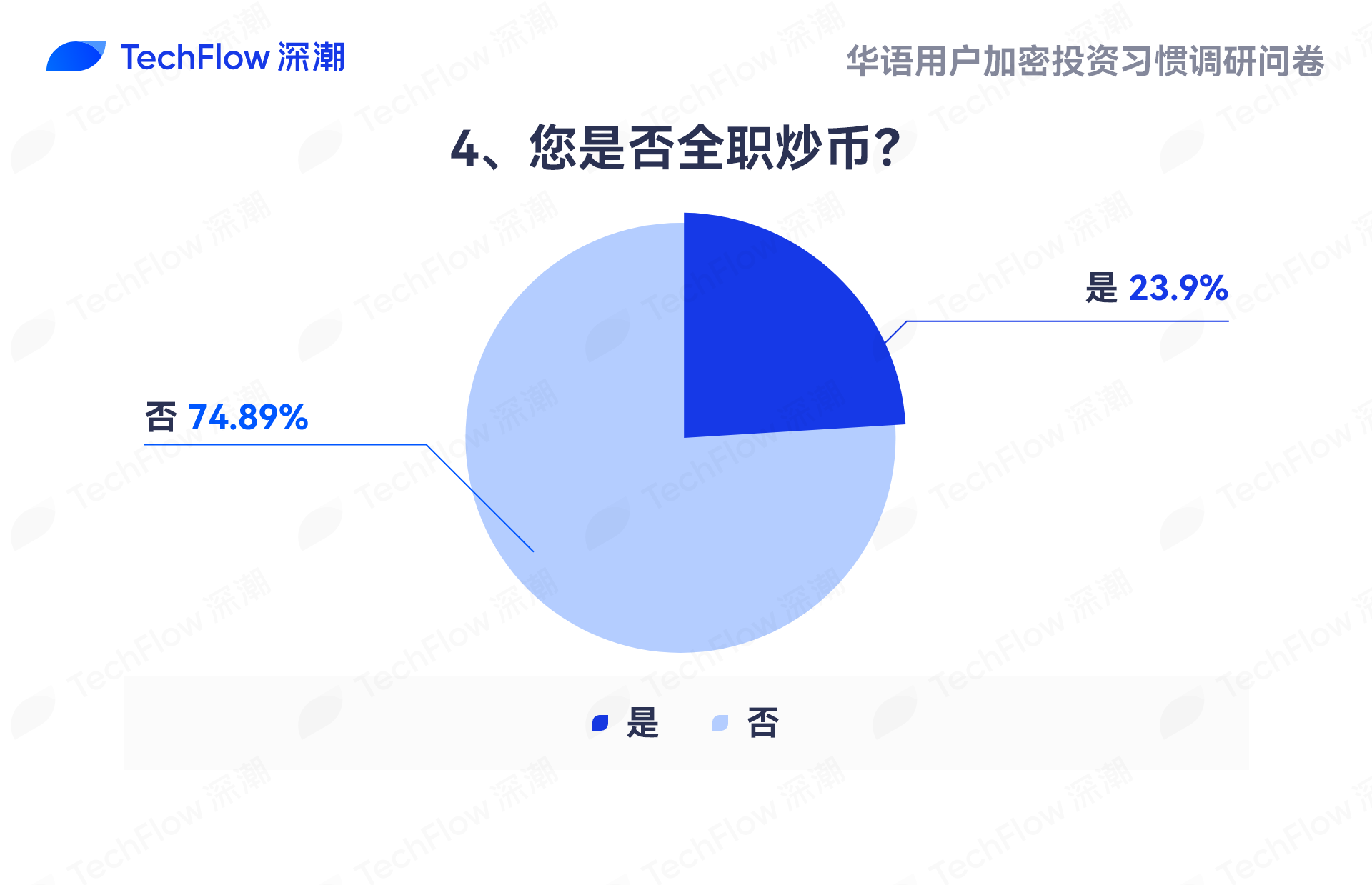

4. Are You a Full-Time Crypto Trader?

Only 25.11% of respondents consider themselves full-time traders—i.e., they rely primarily on crypto investments for income.

Conversely, 74.89% are non-full-time traders, treating crypto investing as a side activity or hobby rather than a career path—viewing it more as part of their asset allocation strategy.

This diversity reflects the flexibility of the crypto market: full-timers can focus entirely on market movements, while part-timers maintain risk control through diversified professional lives.

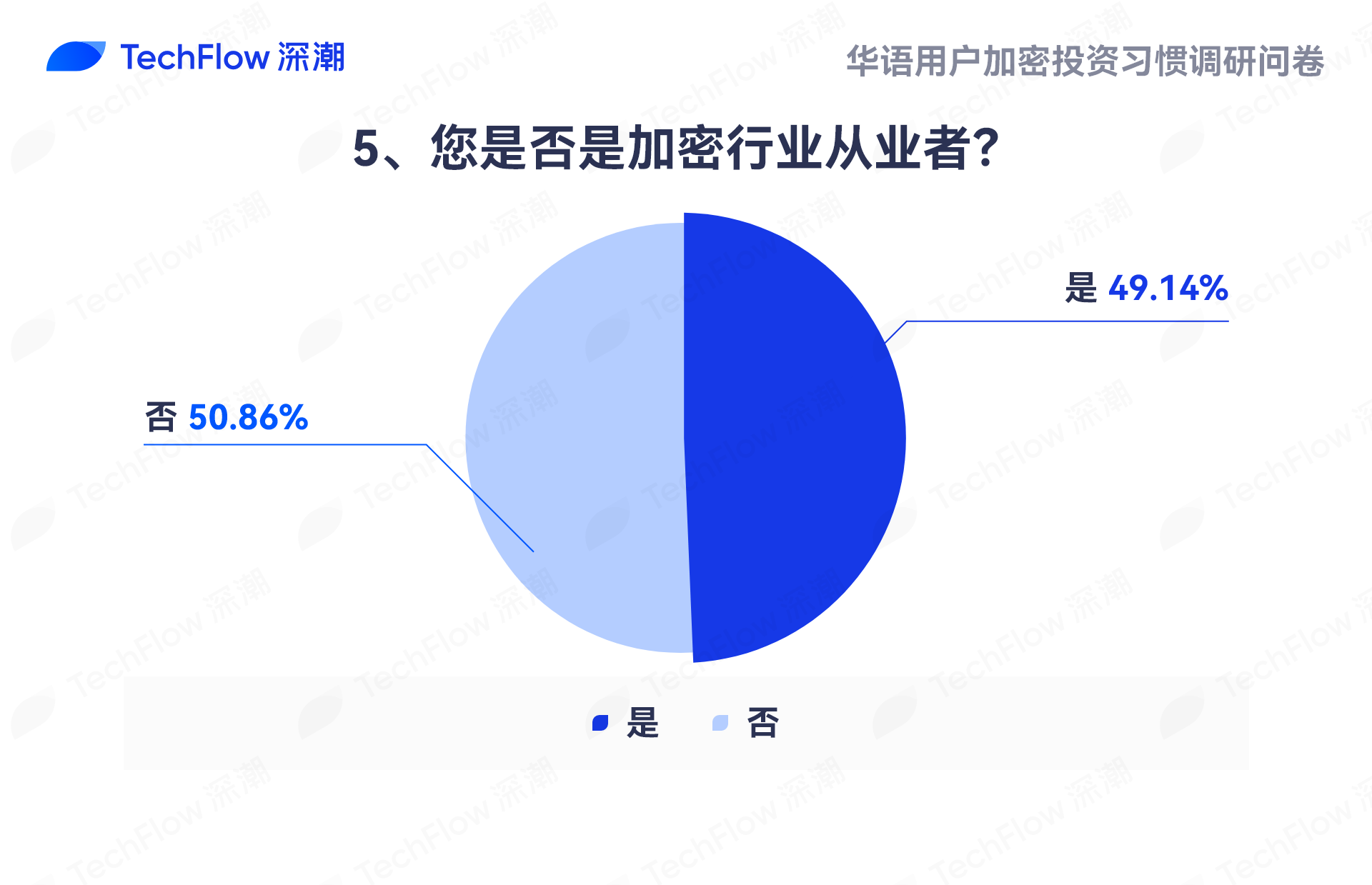

5. Are You a Professional in the Crypto Industry?

Nearly half (49.14%) of respondents work professionally in the crypto industry, indicating deep involvement.

The remaining 50.86% are not industry professionals, playing roles more aligned with investors or enthusiasts focused on investment opportunities and market developments.

This balanced occupational background underscores the inclusivity and diversity of the crypto ecosystem—both insiders and outsiders contribute meaningfully.

6. Educational Background:

Overall, respondents exhibit high educational attainment, suggesting strong analytical capabilities.

Specifically, bachelor’s degree holders constitute the majority at 58.60%, master’s degree holders at 21.20%, and PhDs at 1.91%, indicating substantial academic rigor and research ability supporting rational investment decisions.

Respondents with associate degrees or lower account for 17.83%, and others 0.45%, bringing varied perspectives to the industry.

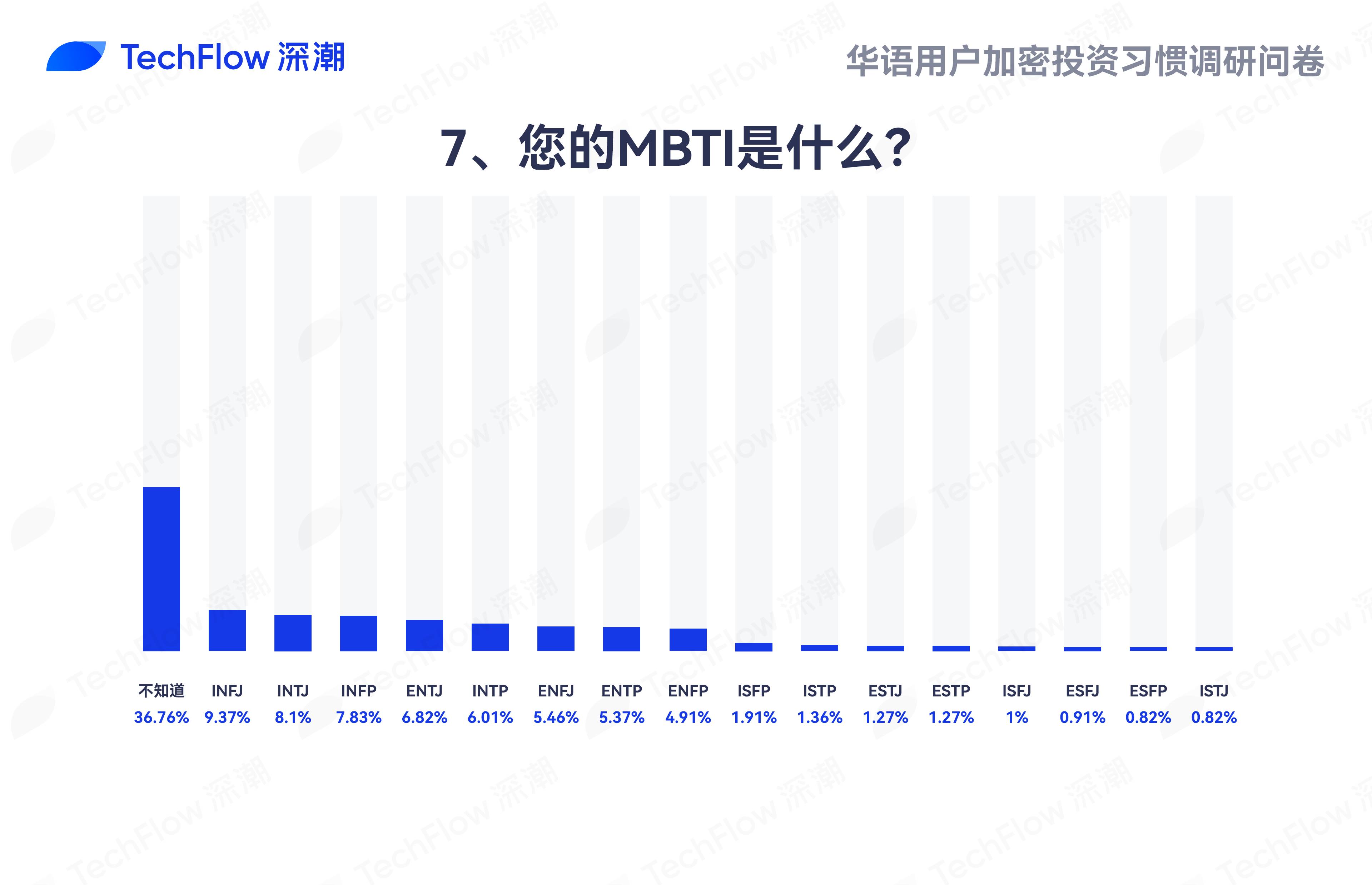

7. MBTI Personality Types:

MBTI is a widely used psychological tool to understand personal traits and behavioral tendencies.

36.76% of respondents don’t know their MBTI type, suggesting room for broader awareness despite its popularity in the space.

Among those who do identify their type, INFJ (9.37%), INTJ (8.10%), and INFP (7.83%) are most prevalent—indicative of introverted intuitive personalities known for strategic thinking, innovation, and empathy.

ENTJ (6.82%), ENTP (5.37%), and ENFJ (5.46%) also feature prominently—extroverted intuitive types often skilled in leadership, communication, and decision-making.

Sensing and judging types are relatively rare: ESFJ (0.91%), ESFP (0.82%), ESTJ (1.27%), ESTP (1.27%), ISFJ (1.00%), ISTJ (0.82%)—all below 1.3%.

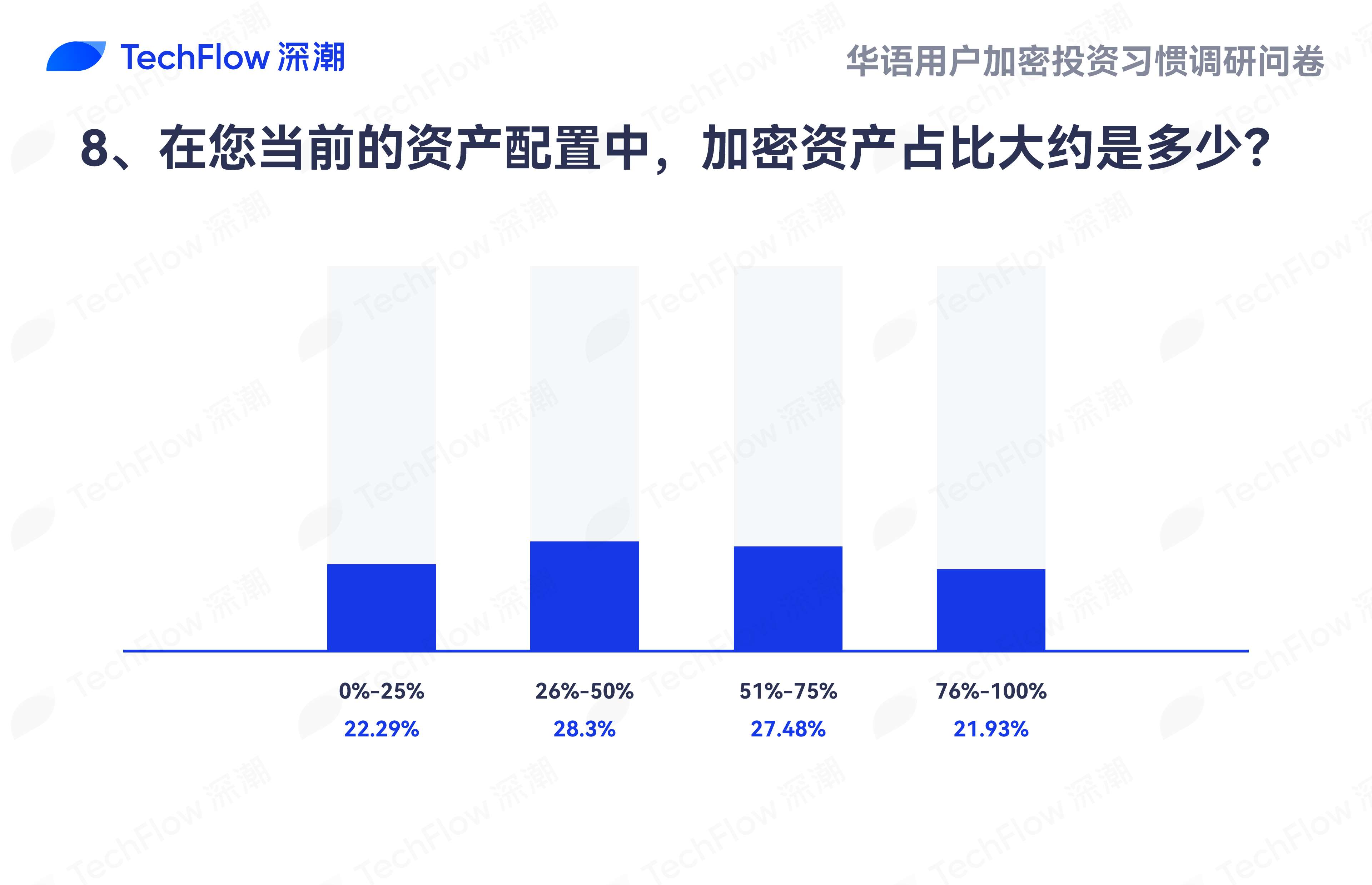

8. Crypto Asset Allocation Proportion:

Asset allocation shows balanced distribution, reflecting varying risk management approaches.

Specifically, 22.29% allocate 0%–25% of their portfolio to crypto; 28.30% allocate 26%–50%; 27.48% allocate 51%–75%; and 21.93% allocate 76%–100%.

Approximately half (50.59%) keep crypto exposure below 50%, indicating cautious risk attitudes, while the other half (49.41%) hold over 50%, signaling confidence and higher risk tolerance.

Part 2: Market Focus within the Chinese-Speaking Community

The fast pace defines the crypto market. In the first half of 2024 alone, we've seen successive narratives around inscriptions, AI, MEMEs, and BTCFi gain traction. As market conditions shift rapidly, so too do investor interests. Understanding which sectors users follow, how they source information, and their overall market sentiment provides valuable insights for anticipating trends and better serving user needs.

1. Sectors of Interest:

This multiple-choice question allowed respondents to select up to three preferred sectors:

Bitcoin and its ecosystem emerged as the top choice, selected by 65.24% of respondents. This aligns with observable trends: growing interest in Bitcoin inscriptions, evolving Layer 2 solutions, and the rise of BTCFi—all driving rapid transformation and attracting developers and investors alike.

Positions 2–5 were closely contested: Ethereum ecosystem (L2, LSD, etc.), MEME coins, Solana ecosystem, and AI-related projects.

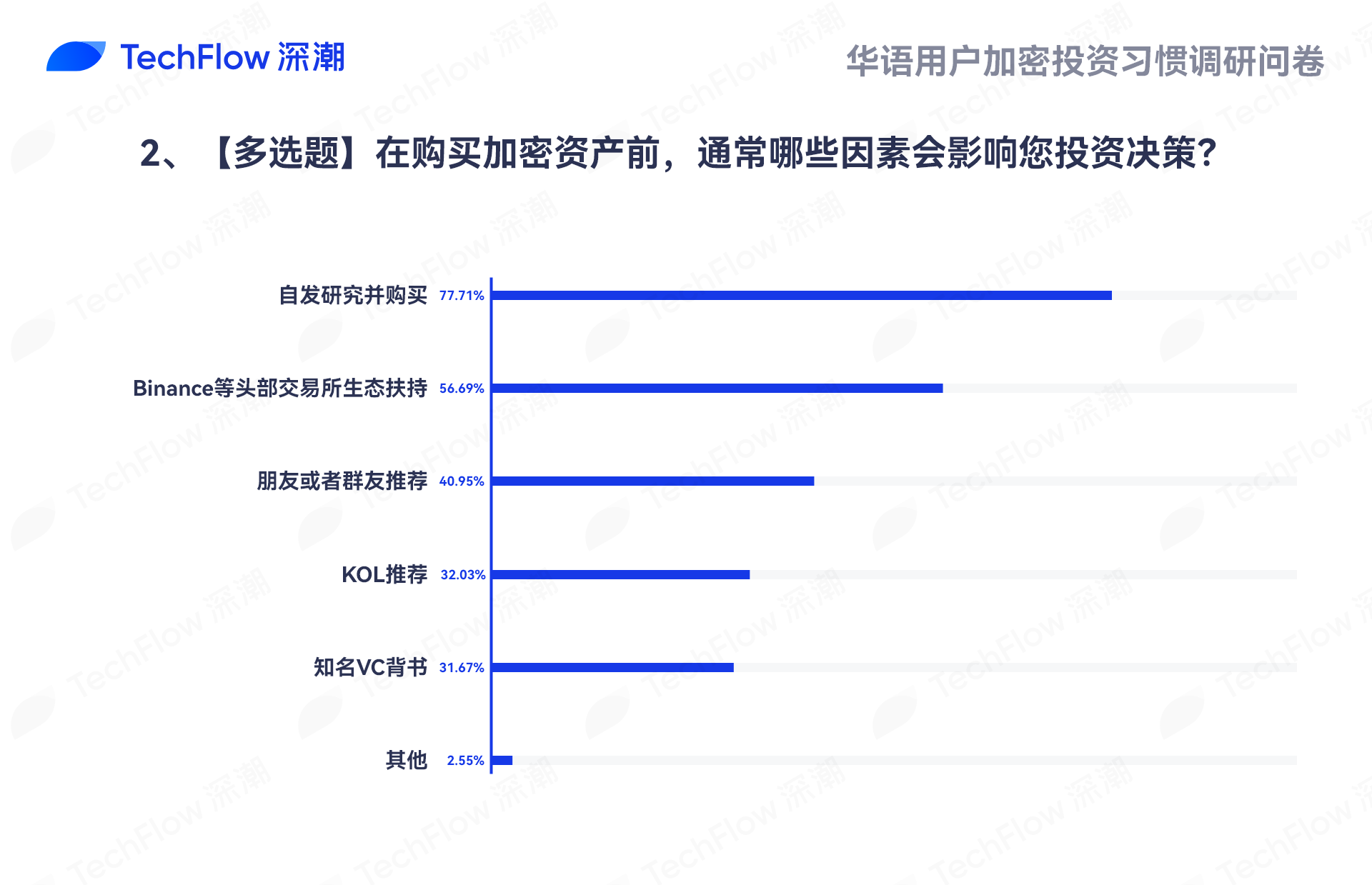

2. Factors Influencing Investment Decisions:

This multiple-choice question revealed self-directed research as the dominant factor—77.71% cited independent analysis, highlighting a trend toward informed, rational investing amid abundant information sources.

Support from leading exchange ecosystems ranked second. Major exchanges offer extensive resources and visibility, making them attractive launchpads for new projects.

Other influential factors included recommendations from friends/community members (third), KOL endorsements (fourth), and VC backing (fifth).

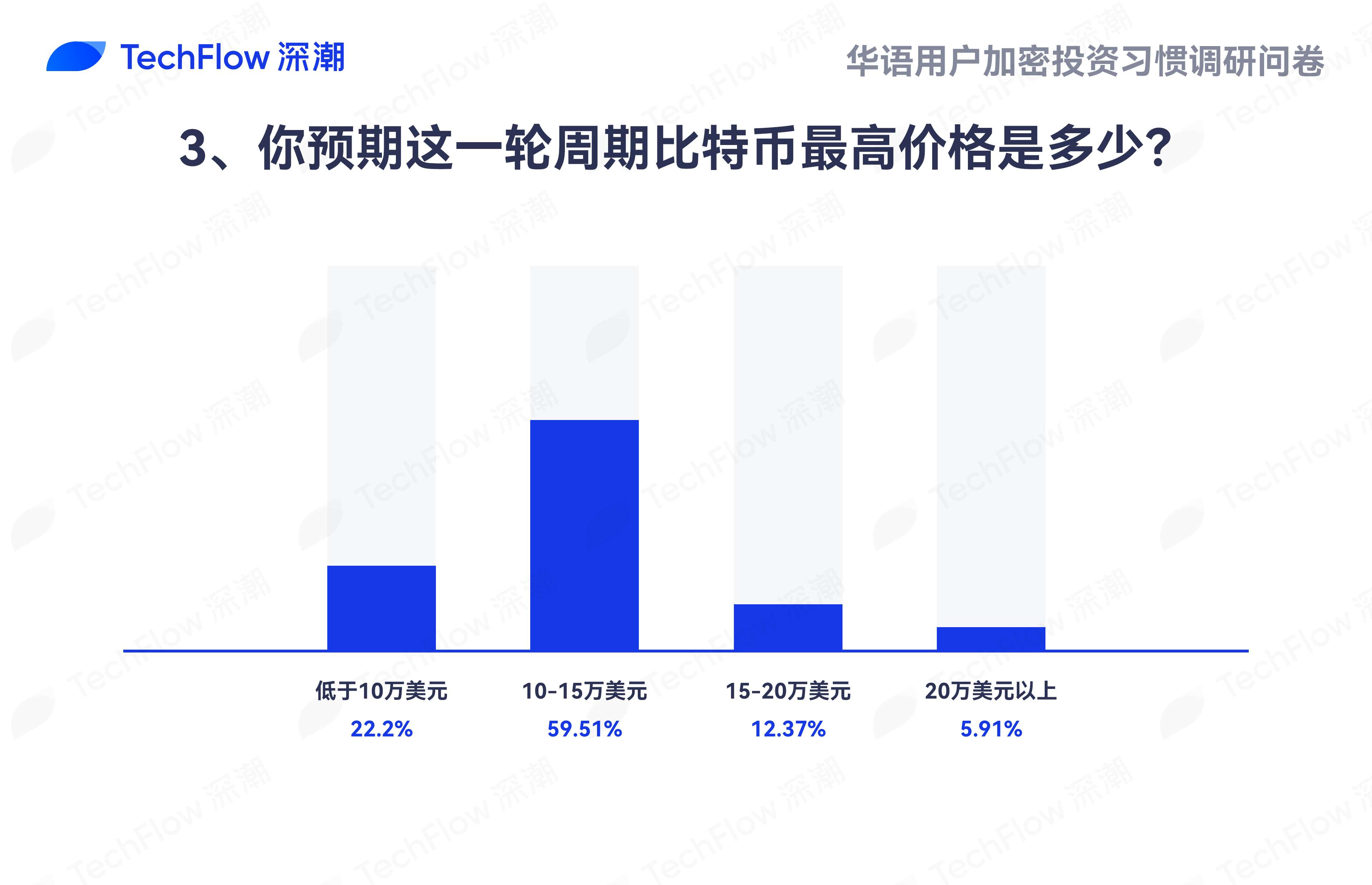

3. Bitcoin Price Outlook for This Cycle:

Expectations show a clear consensus: 59.51% believe Bitcoin will peak between $100,000 and $150,000—indicating generally optimistic yet cautious sentiment.

22.20% expect prices below $100,000—likely reflecting conservative views on volatility and risks.

12.37% foresee peaks between $150,000 and $200,000; 5.91% anticipate exceeding $200,000—demonstrating bullish optimism about record-breaking highs.

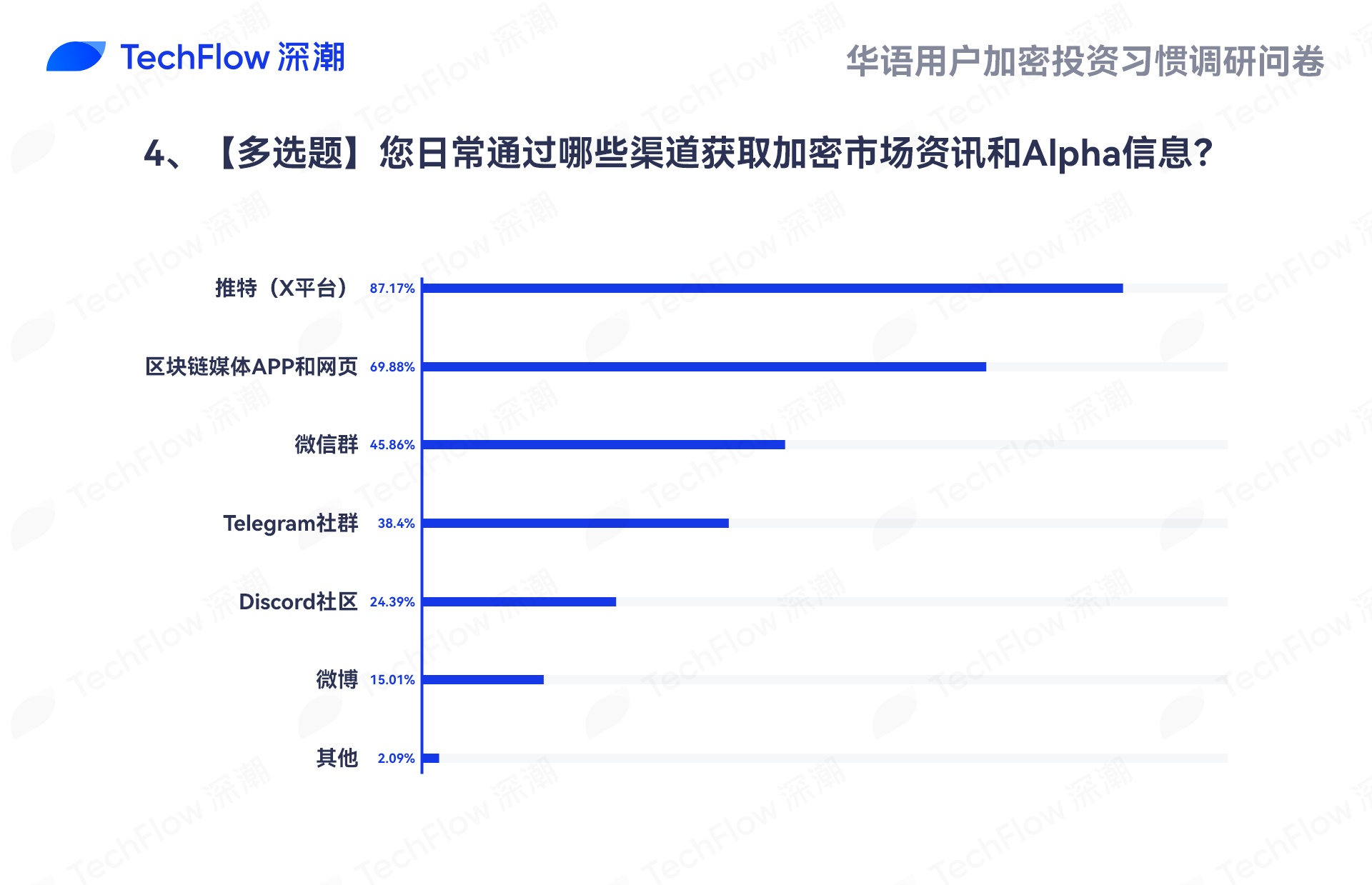

4. Sources for Crypto News and Alpha:

This multiple-choice question identified X (formerly Twitter) as the primary source, chosen by 87.17% of respondents. Blockchain media apps/websites ranked second.

Community-based channels like WeChat groups, Telegram, and Discord also play key roles, ranking third, fourth, and fifth respectively.

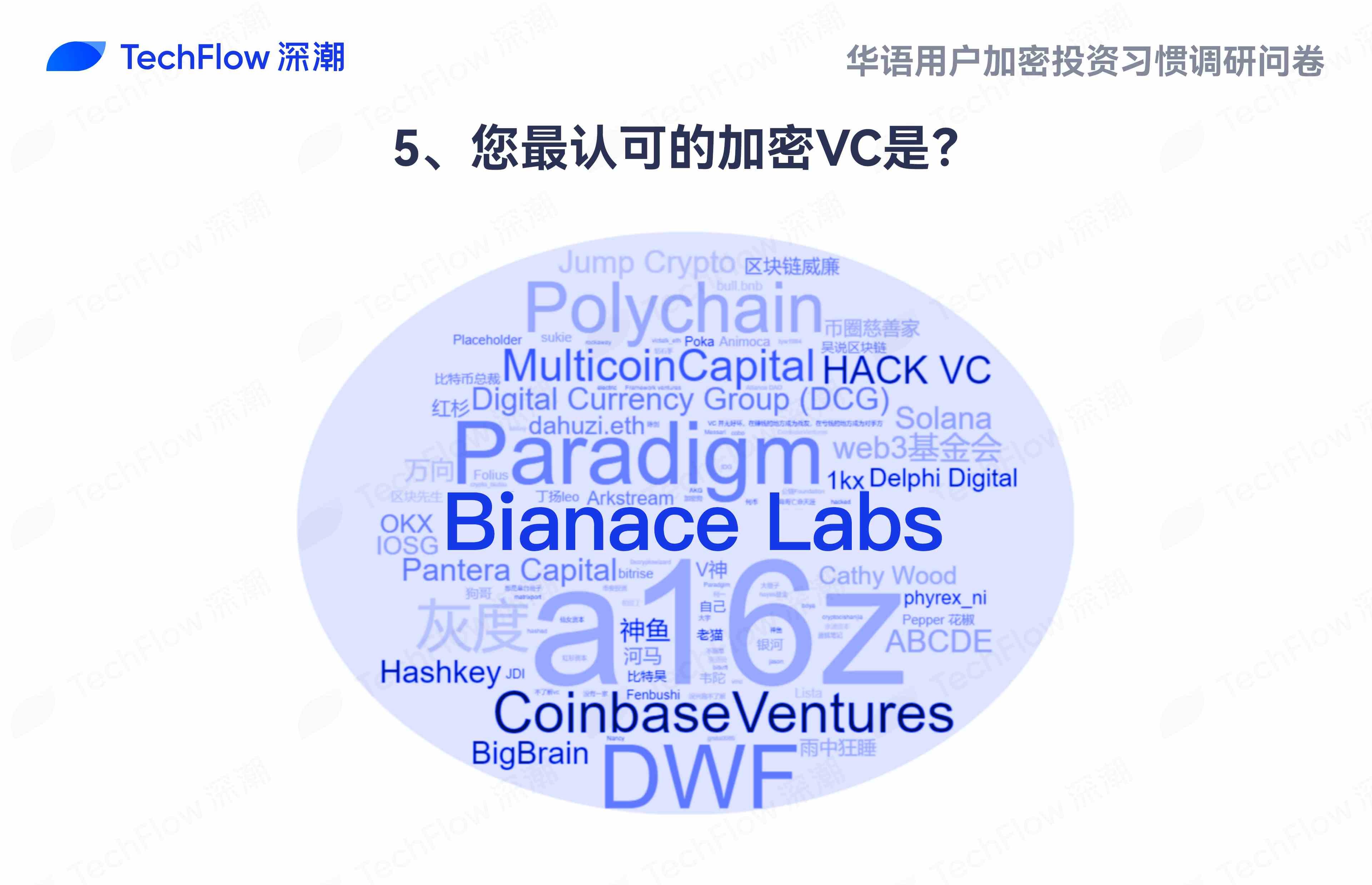

5. Most Respected Crypto VCs:

This optional question gathered nominations to create a word cloud visualization:

Respected Crypto VCs - Word Cloud:

a16z, Paradigm, Binance Labs, and Coinbase Ventures appear most frequently—established names enjoying strong credibility.

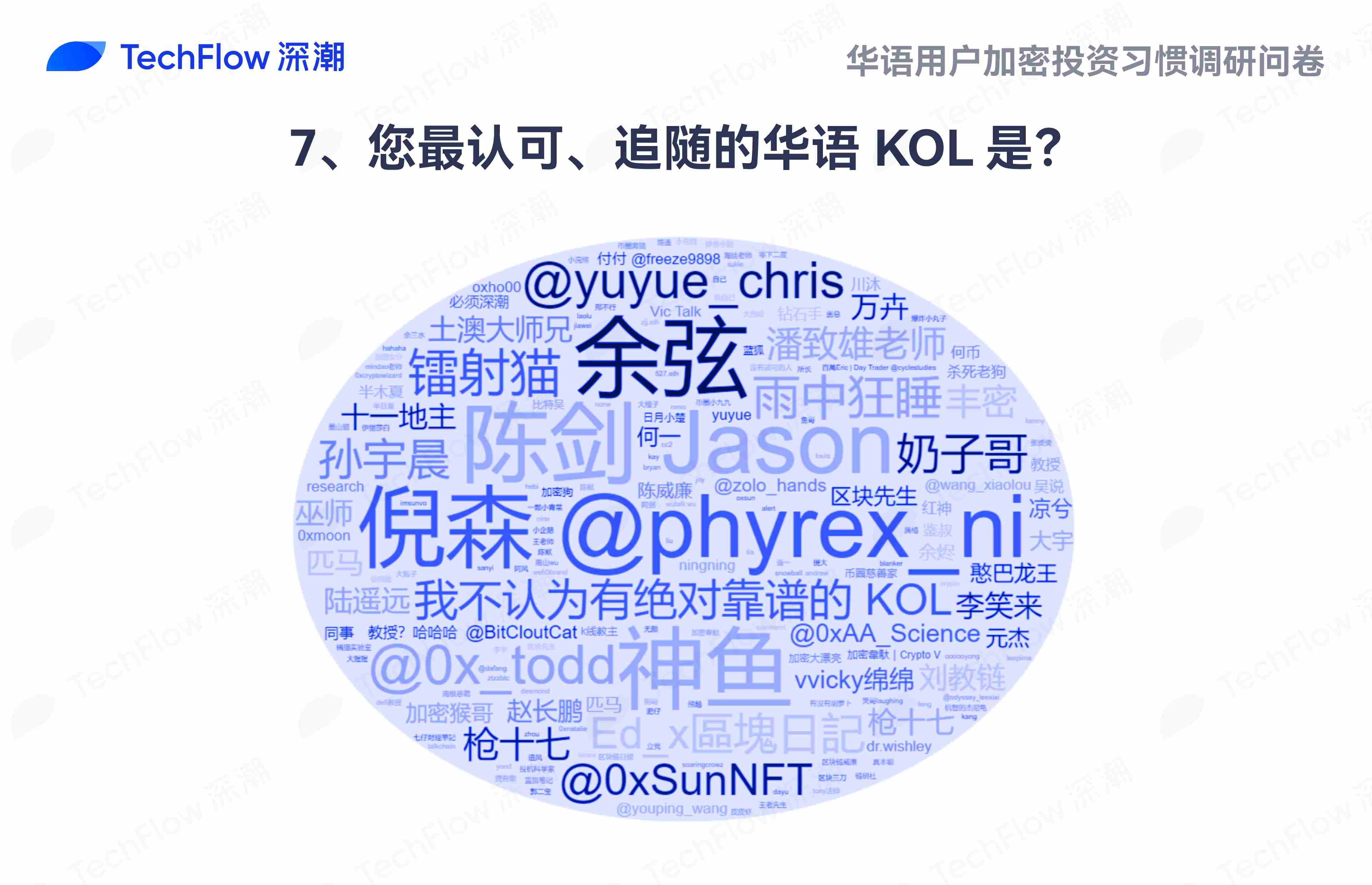

6. Most Respected Chinese-Speaking Crypto KOLs:

Another optional question generated a word cloud based on frequency of mention:

Most Respected Crypto KOLs - Word Cloud:

KOLs Considered “Contrarian Indicators”:

Acknowledging that respect/disrespect is subjective and influenced by media reach, individual judgment prevails.

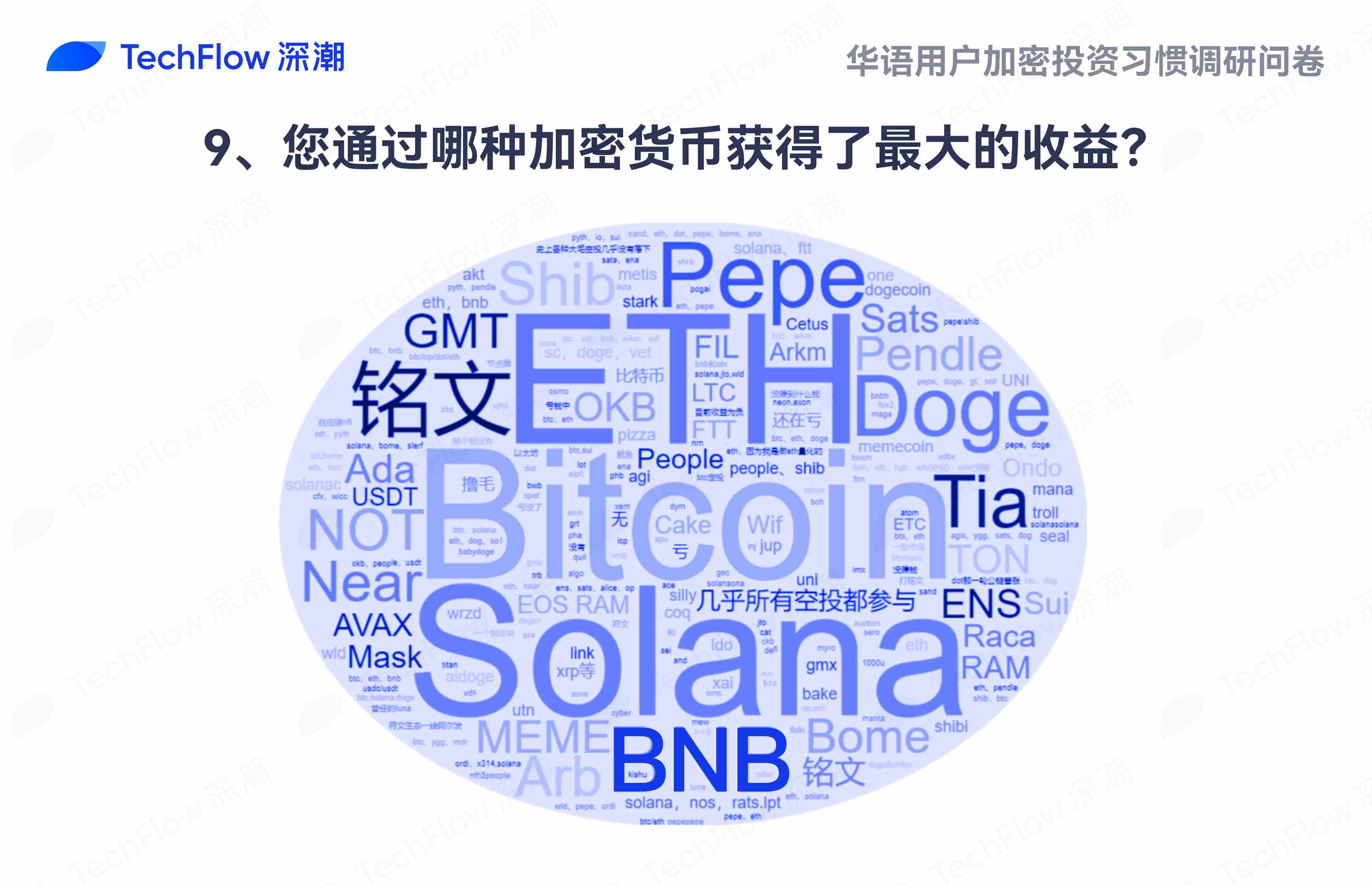

7. Highest-Gain Cryptocurrencies:

An optional question captured top-performing assets mentioned by respondents:

Bitcoin, ETH, Solana, BNB, and PEPE topped the list—mirroring current market trends where major coins outperform most altcoins.

Highest-Gain Cryptocurrencies - Word Cloud:

Part 3: Centralized Exchange Usage Preferences Among Chinese-Speaking Users

Exchanges serve as central hubs in the crypto market. Particularly, centralized exchanges (CEXs), thanks to user-friendly interfaces and high liquidity, are the primary entry points for most users. Understanding user preferences, service feedback, and functional demands helps identify pain points and drive improvements toward more comprehensive, efficient, and secure trading experiences.

1. Most Frequently Used CEX:

This multiple-choice question required selecting up to three preferred exchanges:

Overall, Binance dominates usage frequency, selected by a staggering 96.72% of respondents—highlighting its unparalleled influence and user base in the Chinese-speaking market. As one of the world’s largest digital asset platforms, Binance offers extensive trading pairs, low fees, and diverse financial products, making it the go-to gateway for entering and engaging with the crypto market.

Overall, Binance dominates usage frequency, selected by a staggering 96.72% of respondents—highlighting its unparalleled influence and user base in the Chinese-speaking market. As one of the world’s largest digital asset platforms, Binance offers extensive trading pairs, low fees, and diverse financial products, making it the go-to gateway for entering and engaging with the crypto market.

OKX follows distantly but still commands notable preference at 83.53%—13.19 percentage points behind Binance—making it another major player among Chinese-speaking users.

Beyond these two leaders, Gate.io and Bitget show relatively stronger performance compared to others.

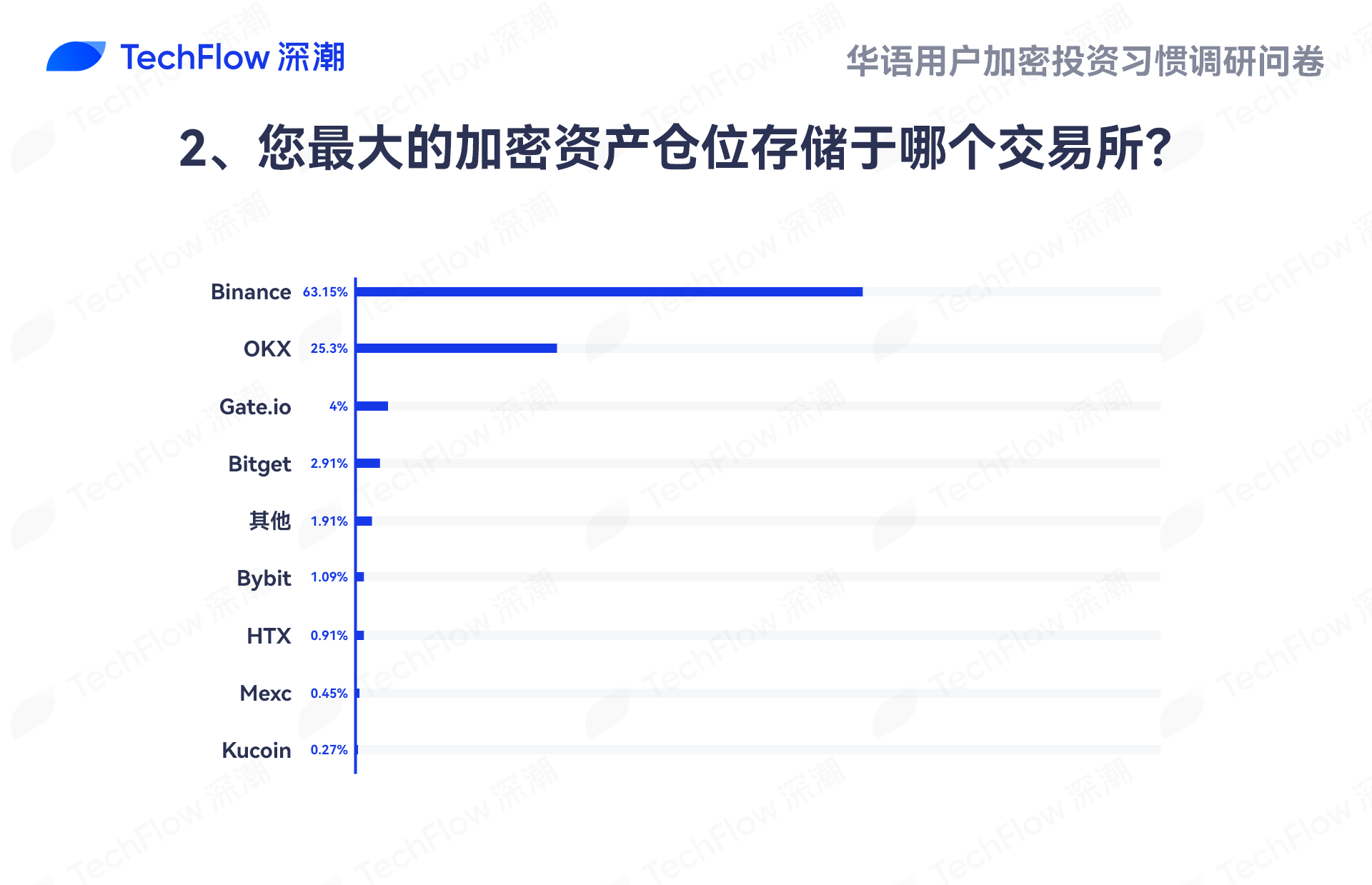

2. Exchange Holding Largest Crypto Position:

This metric reflects trust and recognition regarding security and reliability.

Binance stands out: 63.15% store their largest positions there, underscoring its dominant market share, user trust, and loyal following.

OKX ranks second, chosen by 25.30% for storing their biggest holdings.

Other exchanges like Gate.io, Bitget, Bybit, etc., hold smaller shares but maintain dedicated user bases.

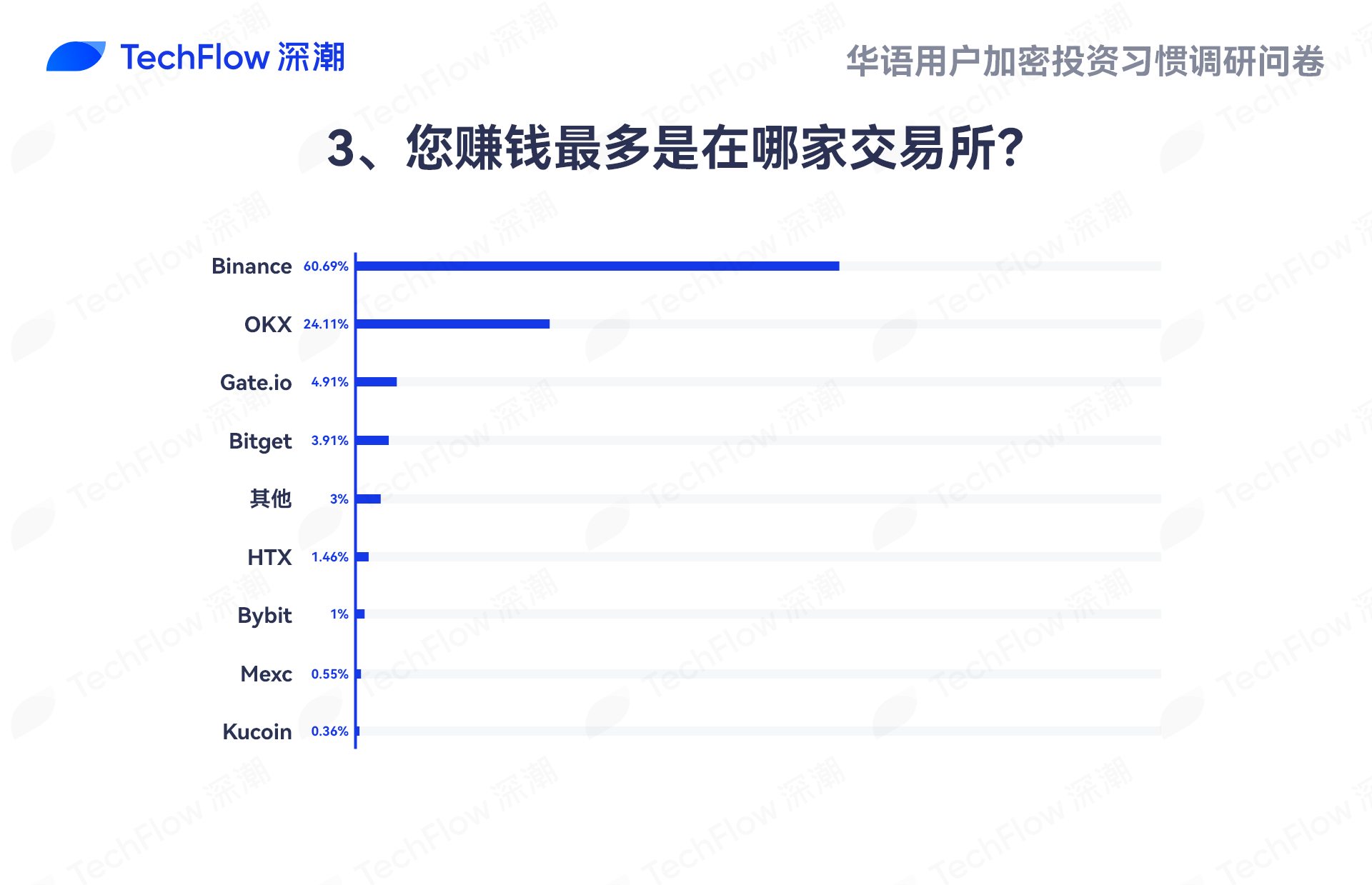

3. Exchange Where Respondents Earned the Most Profit:

Profitability reflects real value delivered by exchanges.

Binance again leads: 60.69% reported earning their highest returns here—confirming not only market dominance but also tangible profit generation.

OKX places second at 24.11%. Other exchanges trail significantly: Gate.io (4.91%), Bitget (3.91%), Bybit (1.00%), HTX (1.46%), KuCoin (0.36%), MEXC (0.55%).

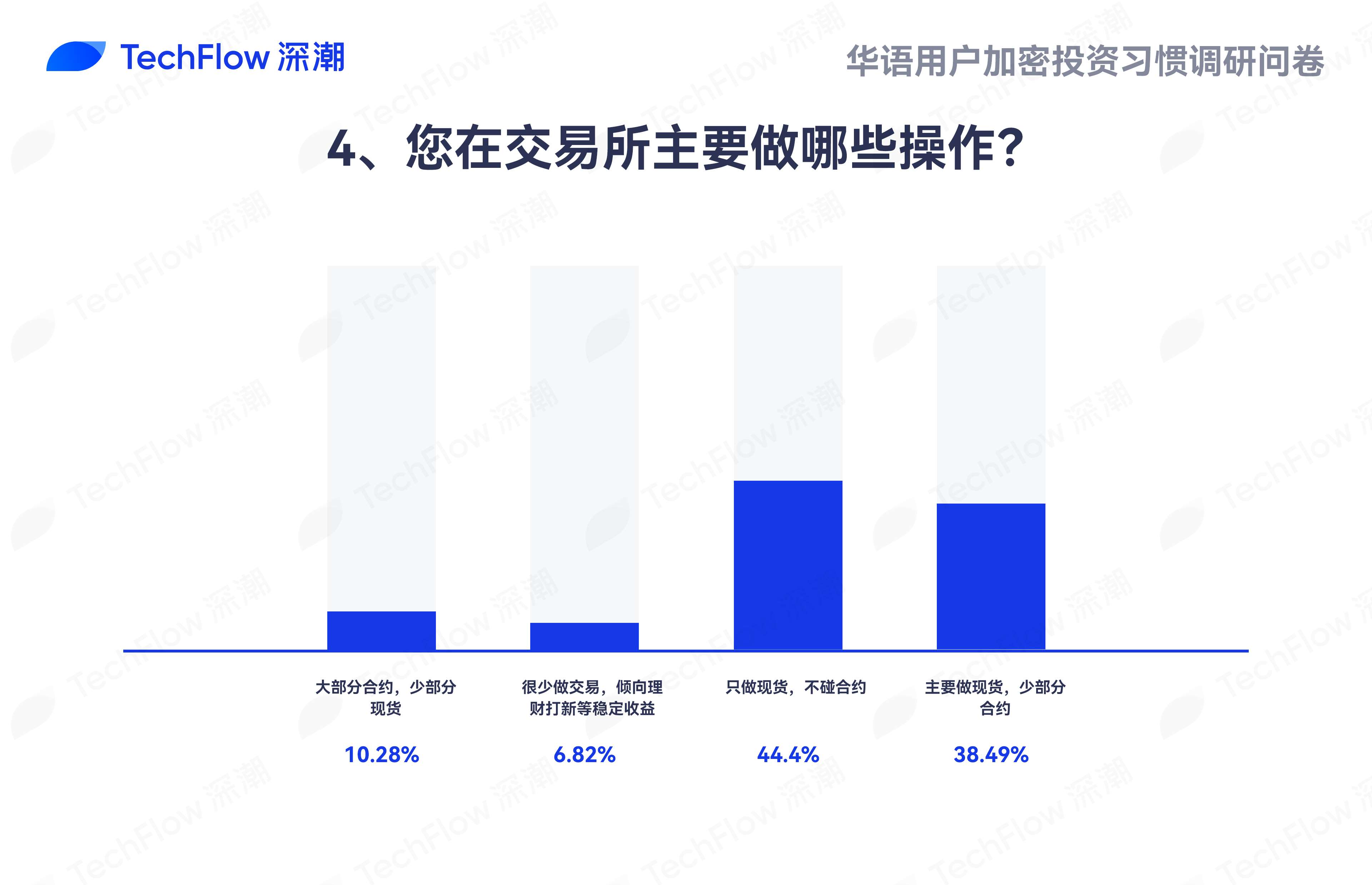

4. Primary Activities on Exchanges:

Breakdown of main trading behaviors:

“Spot-only, no futures” accounts for 44.40%—nearly half prefer conservative strategies, avoiding derivatives’ high risks.

“Mainly spot,少量 futures” makes up 38.49%—many seek modest gains through limited leverage while maintaining stability.

“Mostly futures,少量 spot” at 10.28%—favor aggressive, high-risk/high-reward models.

“Rarely trade, prefer staking/launchpad for steady returns” at 6.82%—lean toward conservative, passive income strategies.

Overall, spot trading dominates (>80% combined), indicating most users prioritize stable returns over volatile derivative trades.

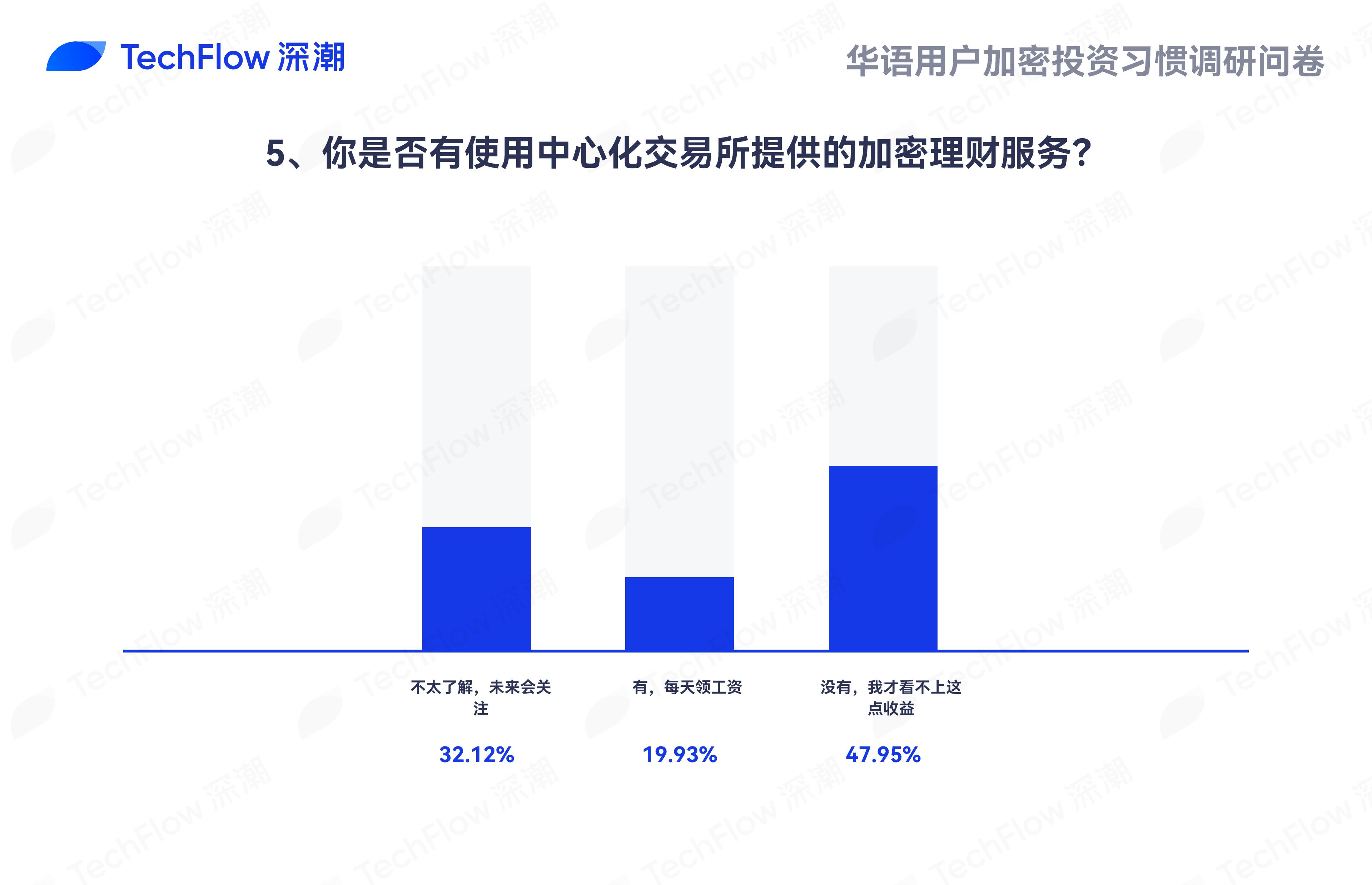

5. Use of Exchange-Provided Crypto Wealth Management Services:

Responses break down as follows:

47.95% said: “No, I’m not interested in such small returns.” Nearly half find current yields unattractive.

32.12% said: “Not familiar yet, might look into it later.” These users may be converted through improved education and outreach.

19.93% said: “Yes, I collect daily rewards.” Already actively using services for passive income.

6. Participation in Exchange Marketing Campaigns:

6. Participation in Exchange Marketing Campaigns:

This multiple-choice question showed relatively even distribution:

“New listings / IEO participation” tops the list at 57.53%, reflecting strong interest in emerging projects and early-stage opportunities.

Mining and airdrop campaigns follow closely—separated by just 0.18%. Registration/referral bonuses also rank highly. Some (16.01%) reported never participating in any campaigns.

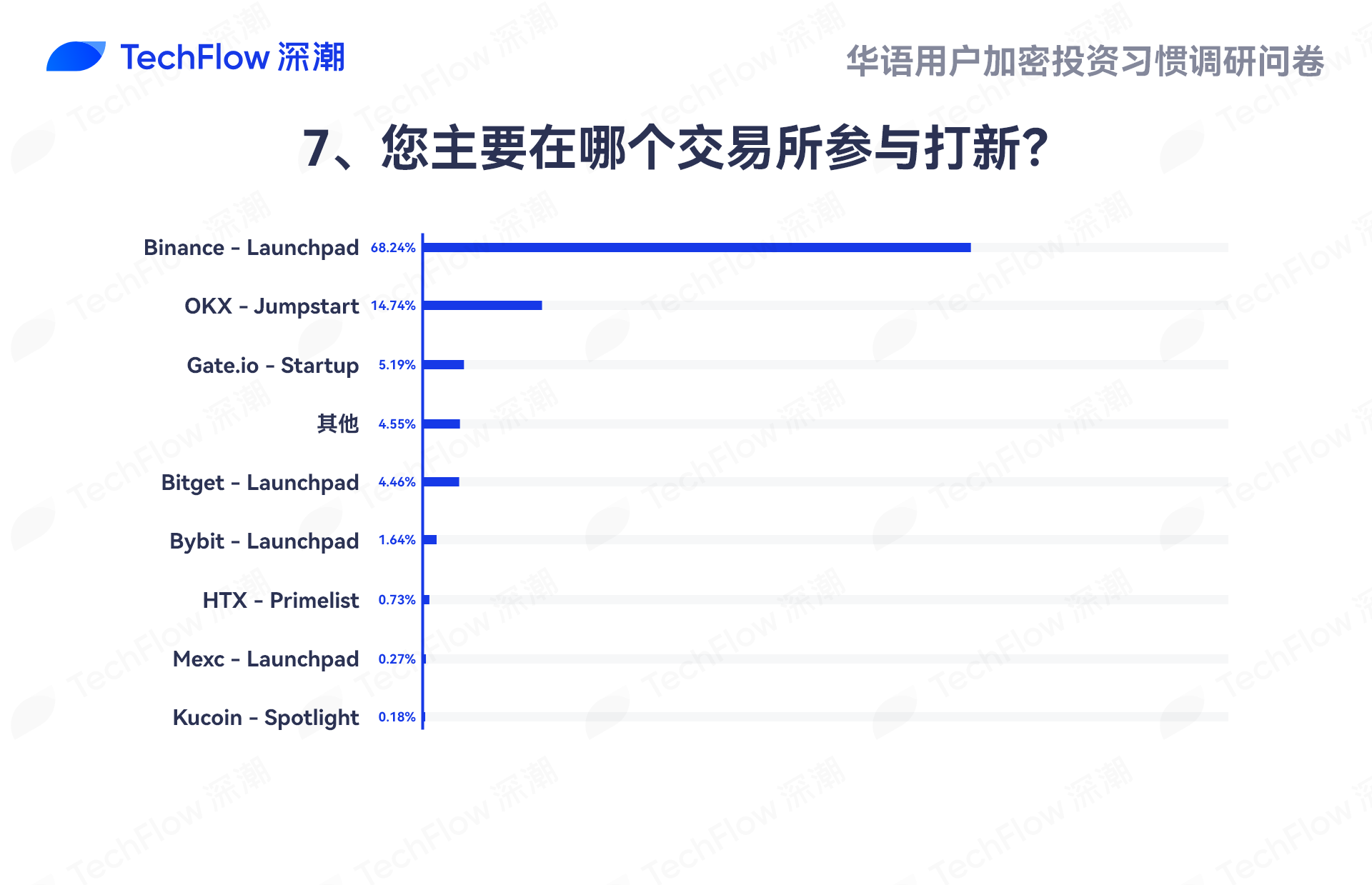

7. Exchange Launchpad Platform Preference:

68.24% choose Binance Launchpad—demonstrating its overwhelming lead as the preferred platform for initial coin offerings.

14.74% choose OKX Jumpstart—still trailing far behind Binance but slightly ahead of competitors. Other platforms hold minimal market share.

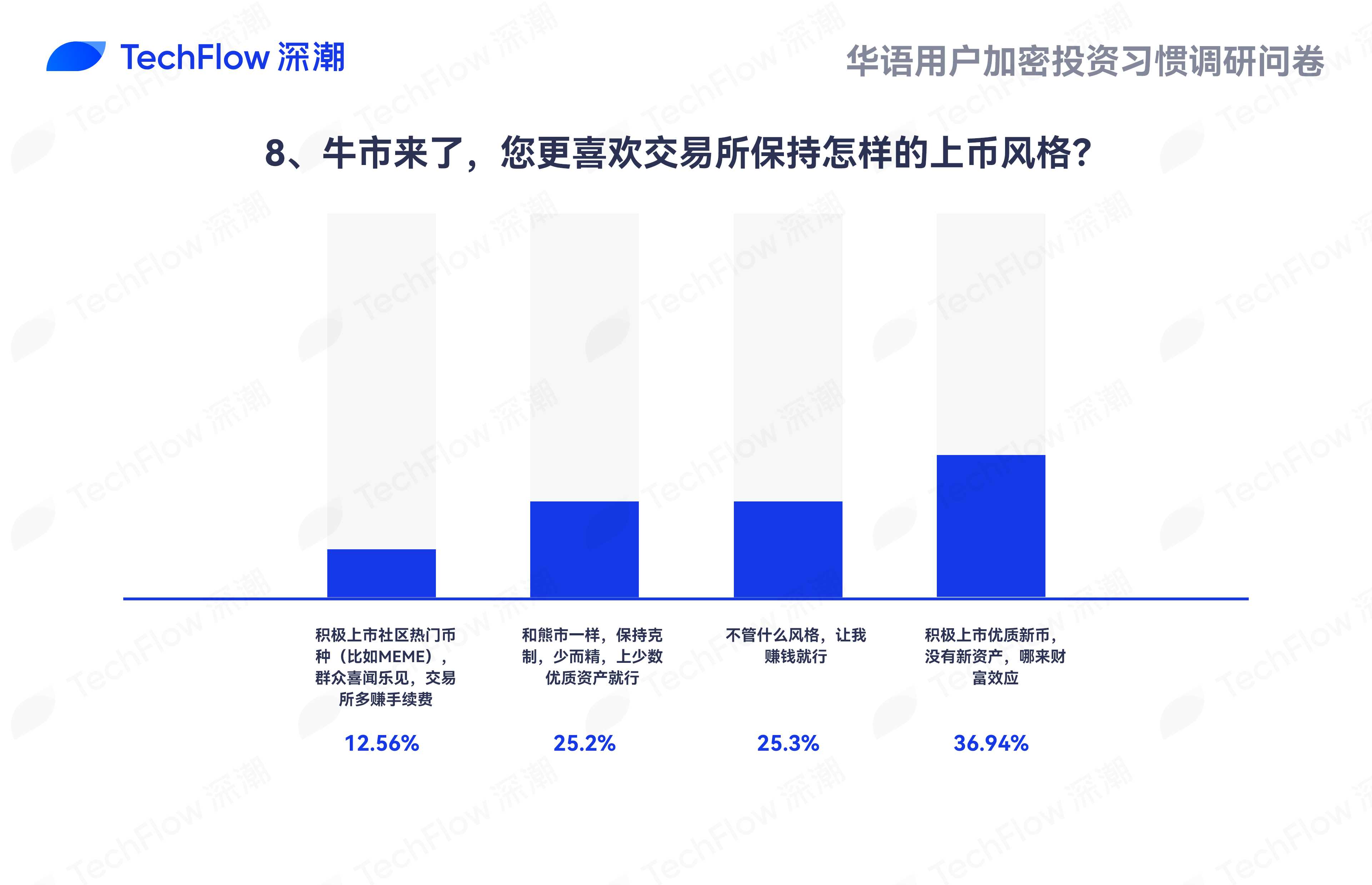

8. Preferred Exchange Listing Strategy:

36.94% prefer: “Actively list high-quality new tokens—without innovation, where’s the wealth effect?” Wanting exchanges to proactively discover and onboard promising new projects.

25.30% say: “Whatever works, as long as I profit.” Focused purely on outcomes, indifferent to listing philosophy.

25.20% favor: “Stay disciplined like in bear markets—fewer, higher-quality listings.” Prioritize quality over quantity.

12.56% support: “List trending community tokens (e.g., MEMEs)—popular with users and profitable for exchanges.” Want exchanges to capture market momentum for mutual benefit.

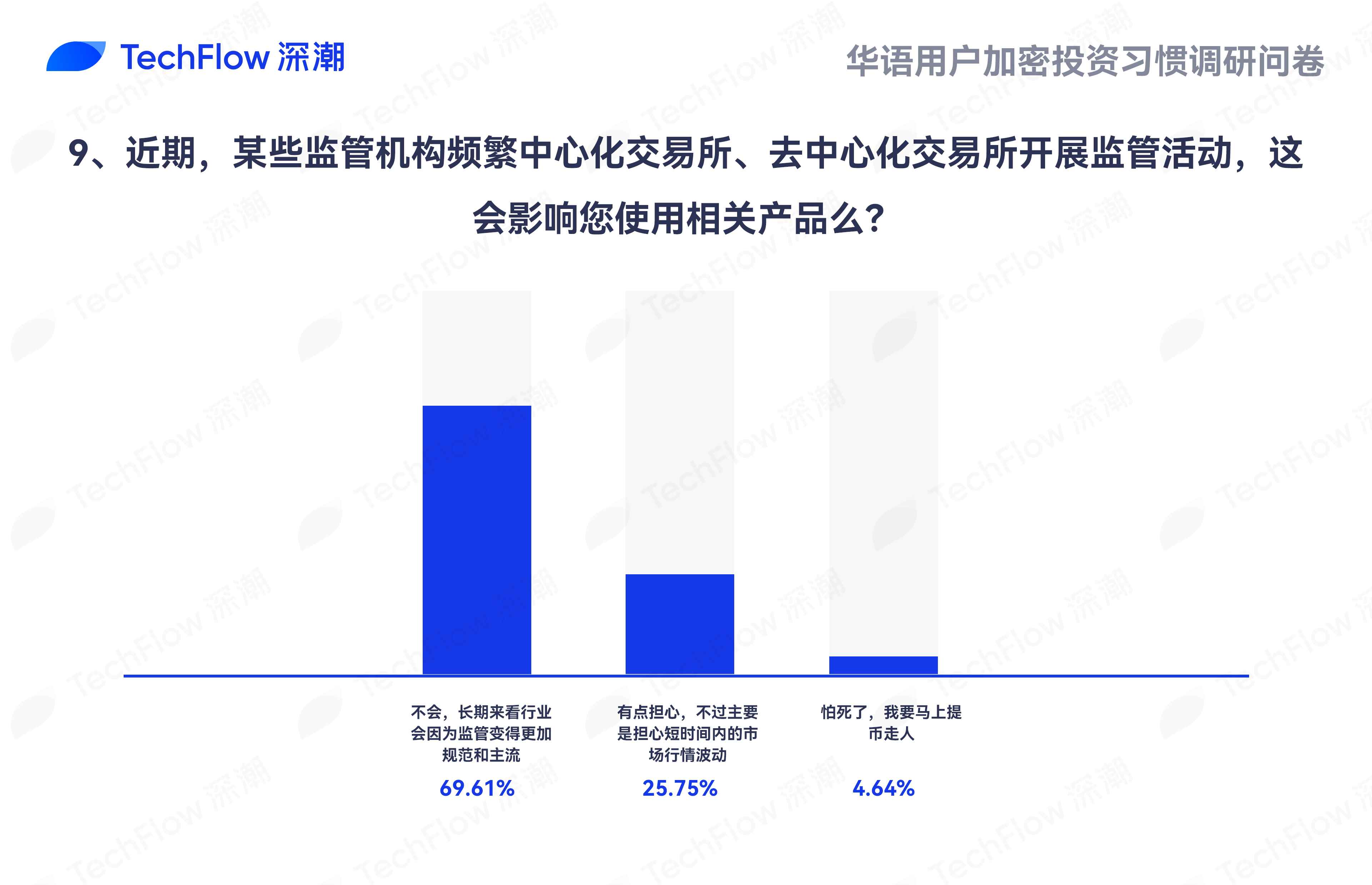

9. Sentiment Toward Exchange Regulation:

69.61% stated regulation does not impact their exchange preferences—indicating increasing investor desensitization to regulatory actions.

25.75% express caution, mainly concerned about short-term volatility.

Only 4.64% feel significant fear or distrust, potentially opting to withdraw funds immediately.

Part 4: A Deeper Dive into Investor Mindsets

Beyond basic demographics, this survey aims to portray a more authentic, vibrant picture of the Chinese-speaking crypto community. By analyzing sentiments around market anxiety, crypto idols, Web3 beliefs, and retirement considerations, we aim to provide richer, more nuanced insights into the complexity and diversity of this ecosystem.

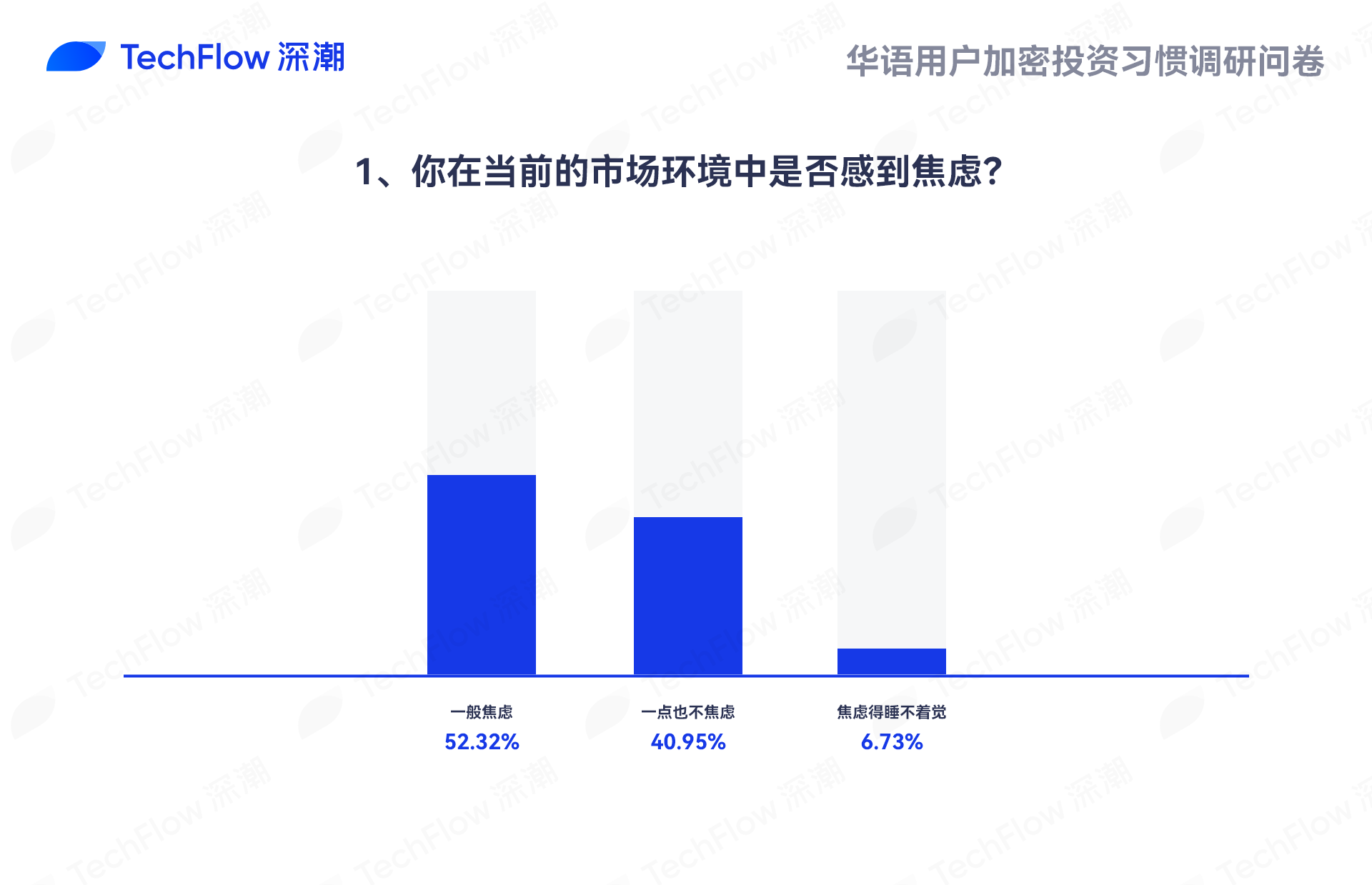

1. Current Market Anxiety Levels:

52.32% report moderate anxiety—common but manageable, not severely impacting daily life.

40.95% feel no anxiety—showing strong resilience and adaptability.

6.73% are so anxious they can't sleep—a minority group.

Overall, anxiety exists but remains largely under control.

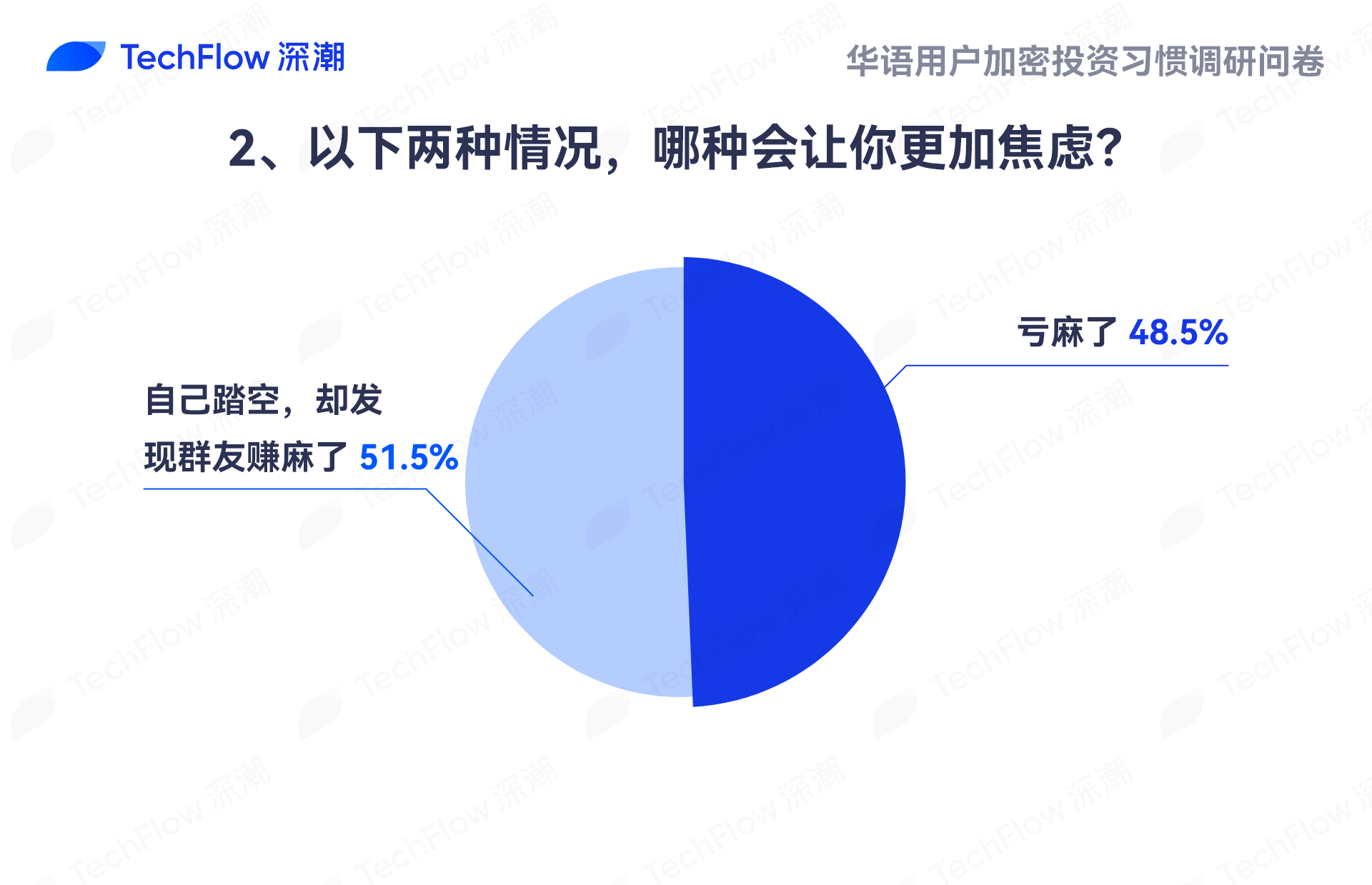

2. Sources of Anxiety:

51.50% become more anxious when they miss out while seeing peers profit—highlighting the psychological impact of relative performance.

48.50% worry most about their own losses—focused on absolute performance.

3. Superstitious Behaviors:

59.96% deny practicing any superstitions; 40.04% admit praying to wealth gods.

This divide reflects differing coping mechanisms—some rely on rationality, others on ritualistic hope amid uncertainty.

4. Crypto Idols:

Optional responses compiled into a word cloud:

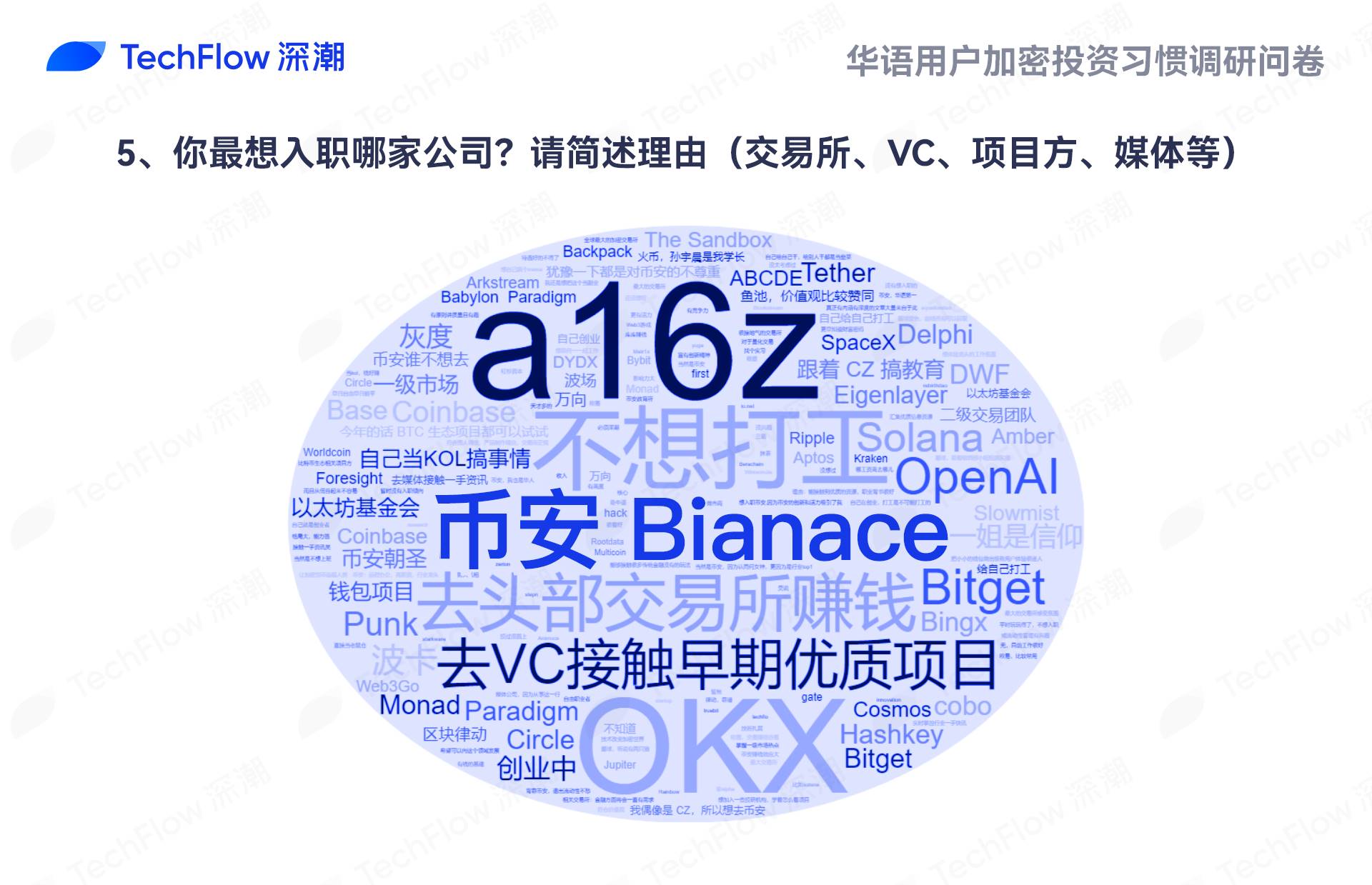

5. Dream Web3 Employers and Reasons:

Word cloud based on open-ended responses:

Exchanges are the most desired employers—valued for aggregating premium information and offering early access to lucrative opportunities. Within this category, Binance receives the most mentions. Reasons include high salaries, early access to profitable ventures, being a top-tier Chinese-speaking platform, working alongside influential figures, and appealing merchandise. OKX also garners frequent mentions for its product experience, information aggregation, and favorable hiring prospects for Chinese speakers.

Beyond exchanges, VCs and crypto media are also highly desirable. VCs offer insight into early-stage innovations and connections with top builders; media roles enable access to cutting-edge knowledge and foster systematic research skills for producing high-quality content.

Interestingly, due to the decentralized nature of Web3 work and the fact that most aren’t full-time traders, many expressed alternative aspirations such as avoiding traditional employment, launching startups, or becoming independent KOLs for knowledge monetization.

6. Crypto Holdings Amount:

The largest segment holds $10K–$50K (20.93%), followed by $100K–$500K and $50K–$100K. Together, these three brackets account for 57.32%. The smallest group holds $500K–$1M USDT. Overall, holdings span a wide spectrum—from small retail investors to large-capacity holders.

7. Thoughts on Exiting the Space:

66.52% have no intention of leaving—they view Web3 as a long-term conviction and career direction.

33.48% have considered exiting—often those prioritizing profit-taking upon reaching targets.

This contrast highlights divergent mindsets: some embrace idealism and faith in Web3; others adopt pragmatic, results-driven approaches.

Join TechFlow official community to stay tuned Telegram:https://t.me/TechFlowDaily X (Twitter):https://x.com/TechFlowPost X (Twitter) EN:https://x.com/BlockFlow_News