Monad testnet approaches, get a preview of the ecosystem landscape

TechFlow Selected TechFlow Selected

Monad testnet approaches, get a preview of the ecosystem landscape

This article will provide a detailed overview of the current state of Monad's ecosystem development across multiple sectors, including DeFi and cross-chain interoperability protocols.

Author: Nicky, Foresight News

In April this year, Layer1 blockchain Monad Labs announced a $225 million funding round—the largest crypto project raise so far in 2024. The round was led by investment firm Paradigm and included participation from IOSG Ventures, SevenX Ventures, Electric Capital, and Greenoaks.

Monad Labs aims to enhance Ethereum Virtual Machine (EVM) performance through its parallel EVM Layer1 project, Monad, by introducing parallel execution and superscalar pipelining to address the low throughput issues of existing EVM-compatible blockchains. Currently, the Monad network is in the Devnet phase, with the joint testnet still under preparation.

This article provides a comprehensive overview of the current state of the Monad ecosystem across multiple sectors including DeFi, NFTs, cross-chain interoperability protocols, and more. It should be noted that many native projects within the Monad ecosystem are still in very early stages of development, and investors and participants should remain cautious and fully aware of the associated risks.

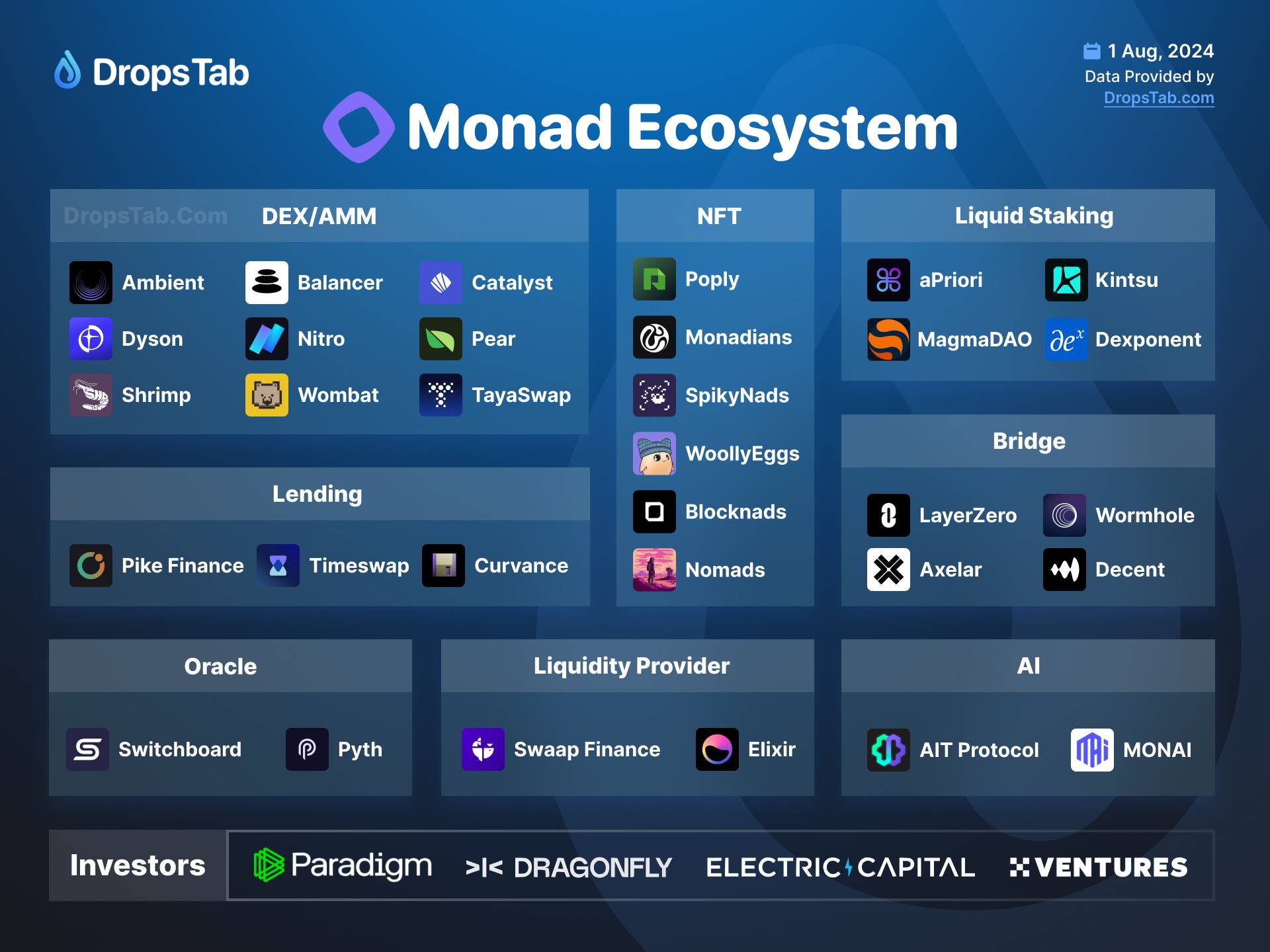

Overview of Monad ecosystem projects as of August 1, 2024. (Source: Drops Tab)

DeFi Protocols

DEX / AMM Protocols

Ambient Finance

Ambient Finance is a decentralized trading protocol that enables bilateral AMMs combining concentrated and constant product liquidity on any pair of blockchain assets. In July last year, Ambient Finance announced a $6.5 million seed round led by BlockTower Capital, with participation from Jane Street, Circle, Tensai Capital, and several individual investors.

Backpack

Backpack is a fully regulated global cryptocurrency exchange platform integrating centralized exchange services, on-chain wallets, and NFTs, aiming to deliver seamless and innovative crypto experiences for users and planning to expand into broader blockchain ecosystems. Its exchange has obtained a VASP license from Dubai’s Virtual Assets Regulatory Authority (VARA) and will support the Monad network on the day of its public testnet launch.

Balancer

Balancer is a DeFi AMM protocol that allows anyone to create asset pools with predefined weights. Balancer aims to become a platform for DAOs and other protocols to build tools, providing liquidity for users and products. To date, trading volume of Liquid Staked Tokens on Balancer has exceeded $25 billion.

Catalyst

Catalyst is an open-source protocol providing liquidity across modular blockchains. With Catalyst, any new modular blockchain can automatically connect liquidity and trade with any chain—including major liquidity hubs like Ethereum and Cosmos. In May this year, Catalyst launched its mainnet, enabling OP Stack-based Layer 2 networks such as Optimism and Base to share liquidity across their Rollups.

Dyson Finance

Dyson Finance is a retail-friendly DEX aiming to democratize on-chain liquidity paradigms. Through dual investment, innovative dynamic AMMs, and an exclusive referral program, anyone can easily provide liquidity and earn high returns like professionals.

Kuru

Kuru is a fully on-chain order book DEX built on Monad, offering users a single platform to discover, research, and trade spot assets on-chain. In July this year, Kuru announced a $2 million seed round led by Electric Capital, with participation from Brevan Howard Digital, CMS Holdings, and angel investors including Keone Hon.

Swaap Finance

Swaap Finance is a market-neutral automated market maker (AMM) that combines oracles and dynamic spreads to provide sustainable yields for liquidity providers and cheaper prices for traders.

Timeswap

Timeswap is an oracle-free and liquidator-free decentralized money market protocol based on AMM. Unlike Uniswap, where assets can be swapped instantly, borrowing and lending on Timeswap requires exchanging tokens until repayment is completed.

Wombat Exchange

Wombat Exchange is a multi-chain stablecoin trading DEX offering services such as open liquidity pools, low slippage, and single-sided staking.

Lending Protocols

Curvance

Curvance is a decentralized stablecoin lending protocol initially focused on LPs from the Curve, Convex, Aura, and Frax ecosystems. Curvance aims to deliver optimized yields for users while maximizing capital efficiency through peer-to-peer lending. In December last year, Curvance announced a $3.6 million seed round with participation from Offchain Labs (Arbitrum’s developer), Wormhole, and angel investors including Polygon co-founder Sandeep Nailwal. In April this year, Curvance launched a testnet for early supporters.

Pike Finance

Pike Finance is a native cross-chain lending market enabling direct and secure interactions between different blockchains. Pike is built on Wormhole’s cross-chain data messaging protocol and Circle’s native USDC minting protocol CCTP. In March this year, Pike Finance revealed its tokenomics, aiming to drive cross-chain DApp development through its governance token P.

Liquidity Network Protocols

aPriori

aPriori is a MEV infrastructure and liquid staking protocol natively built on Monad, aiming to create a transaction-centric architecture for Monad that reduces gas fees, optimizes network traffic, and provides sustainable incentives for validators—enhancing throughput and user experience. In July this year, aPriori announced an $8 million seed round led by Pantera. Previously, aPriori raised a Pre-Seed round co-led by Hashed and Arrington Capital, bringing its total funding to $10 million, with participation from Consensys, OKX Ventures, Manifold Trading, and others. Additionally, Binance Labs announced its investment in aPriori through the Binance Labs Season 6 incubation program. aPriori co-founder and CEO Ray S revealed that this round gives aPriori a post-money valuation in the "nine-figure" range.

Elixir

Elixir is a modular liquidity network allowing users to directly provide liquidity to order book exchanges and receive market-making rewards similar to AMMs. Its network supports significant liquidity from exchanges such as Vertex, Bluefin, and RabbitX, and will integrate with platforms like dYdX and ApeX. In March this year, Elixir announced an $8 million Series B round led by Mysten Labs and Maelstrom. In October last year, it closed a $7.5 million Series A at a $100 million valuation, led by Hack VC with participation from NGC Ventures and others.

Kintsu

Kintsu is a liquid staking protocol within the Monad ecosystem. In July this year, Kintsu announced a $4 million seed round led by Castle Island Ventures, with participation from Brevan Howard Digital, CMT Digital, Animoca Ventures, and others.

NFT Sector

Monad Nomads NFT

Monad Nomads NFT is the first community-driven NFT proposal on Monad.

Poply

Poply is a community-based native NFT marketplace on Monad.

Cross-Chain Interoperability Protocols

Axelar Network

Axelar is a decentralized cross-chain communication network designed to improve interoperability in Web3 by connecting heterogeneous blockchains and enabling optimized asset mobility and programmable composability for builders and end users.

Decent

Decent aims to provide chain abstraction services for applications and blockchains, enabling users to make payments using any asset in their wallet.

LayerZero

LayerZero is an interoperability protocol for message passing, enabling any cross-chain contract call containing a payload.

Wormhole

Wormhole is a general-purpose message passing protocol launched in October 2020, initially incubated and supported by Jump Crypto. It enables developers to build native cross-chain applications spanning multiple chains and has evolved from a bidirectional bridge between Ethereum and Solana into a multi-chain general message passing protocol.

AI

AIT Protocol

AIT Protocol is a Web3 data infrastructure built on blockchain, primarily used for data annotation and AI model training, rewarding users who participate in “Train-To-Earn” tasks and contribute to AI model development and training. At the end of last year, AIT Protocol announced a new funding round with participation from MorningStar Ventures, Megala Ventures, Contango Digital Assets, and others.

On-Chain Tools

Notifi

Notifi offers flexible communication support for any Web3 project, featuring advanced application capabilities and built-in global infrastructure to support large-scale project deployment.

Parsec

Parsec is a blockchain on-chain data analytics platform. In October last year, Parsec announced a new $4 million funding round and launched its DeFi and NFT analytics product “team.” The round was led by Galaxy Digital, with participation from Uniswap Labs Ventures, Robot Ventures, CMT Digital, and others.

GameFi

Breath of Estova

Breath of Estova (BoE) is a Play-to-Earn 2D game built on the Monad network. BoE leverages Monad’s parallel performance to integrate blockchain functionality, allowing users to earn ESTOVA tokens and obtain unique in-game items and pets.

RareBetSports

RareBetSports is a Web3 ecosystem built on the Monad network, aiming to capture the convergence of sports and cryptocurrency experiences and serving as an ideal platform tailored for next-generation fans and future communities.

Oracles

Pyth Network

Pyth Network is a next-generation price oracle solution designed to deliver valuable financial market data—such as cryptocurrencies, stocks, forex, and commodities—on-chain to projects, protocols, and the public via blockchain technology.

RedStone

RedStone is a blockchain oracle similar to popular solutions like Chainlink and Pyth Network but based on a modular design. In July this year, RedStone completed a $15 million Series A round led by Arrington Capital, with participation from Kraken Ventures, White Star Capital, Spartan Group, and angel investors including Smokey the Bera and Homme Bera from Berachain, and Mike Silagadze from Ether.Fi.

Switchboard

Switchboard is a fast, permissionless, customizable, multi-chain oracle protocol for generic data feeds and verifiable randomness. In May this year, Switchboard announced a $7.5 million Series A round co-led by Tribe Capital and RockawayX, with participation from Solana Foundation, Aptos, StarkWare, and select angel investors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News