Market boring? Let's explore 5 DeFi yield-farming projects this week

TechFlow Selected TechFlow Selected

Market boring? Let's explore 5 DeFi yield-farming projects this week

This week's first airdrop opportunity is Bracket, a platform designed to enhance yields for liquid staked and liquid restaked tokens.

Author: HANGRY

Compiled by: TechFlow

Good morning, humble farmers!

Despite potential market fluctuations, we’ve got some fresh farms to lift your spirits.

Here’s this week’s Humble Farming roundup.

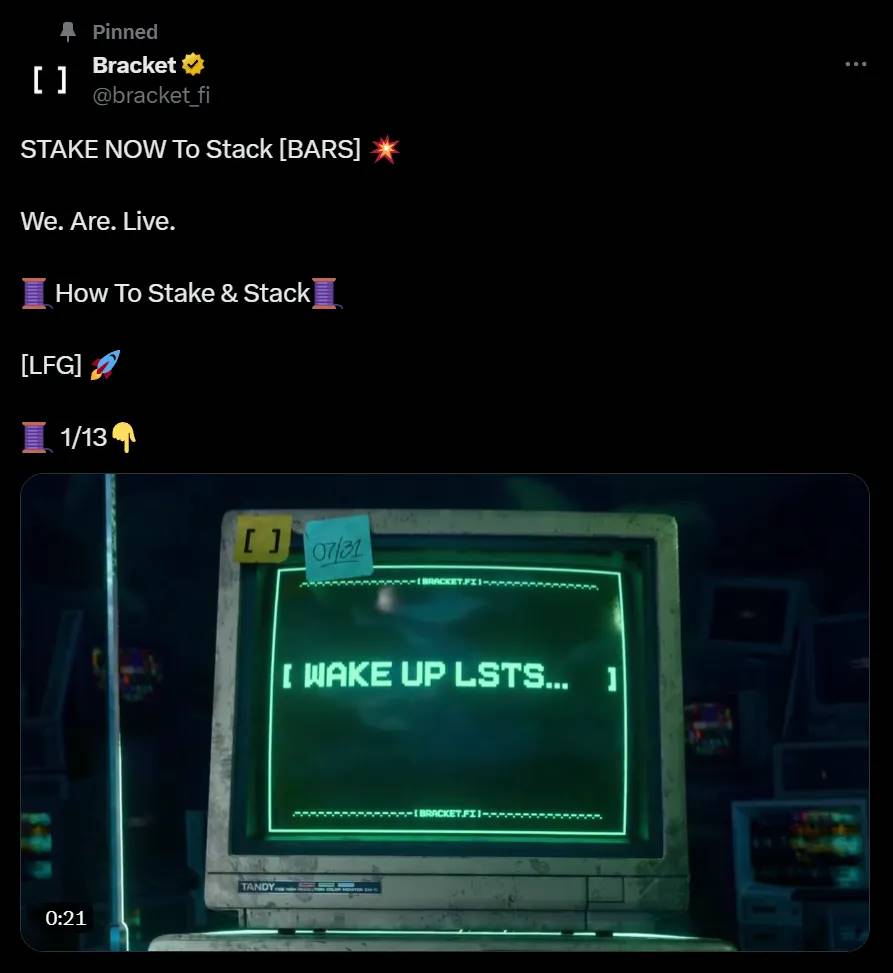

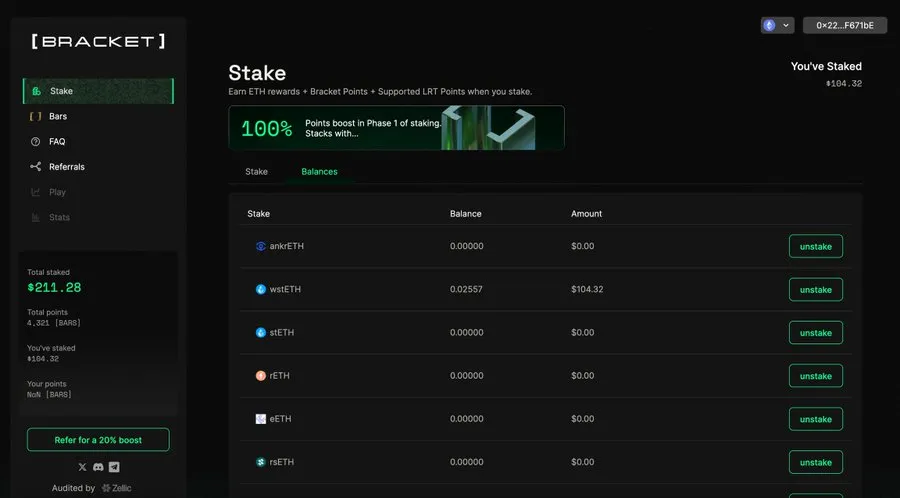

1. Bracket

Our first farming opportunity this week is Bracket, a platform designed to boost yields for liquid staking and liquid restaking tokens.

Bracket has just launched on mainnet, where you can earn Bars, ETH yield, and LRT points by depositing.

To start earning, simply deposit your preferred liquid staking or liquid restaking token.

You can earn multiple point multipliers—deposit now and receive a 200% bonus in points.

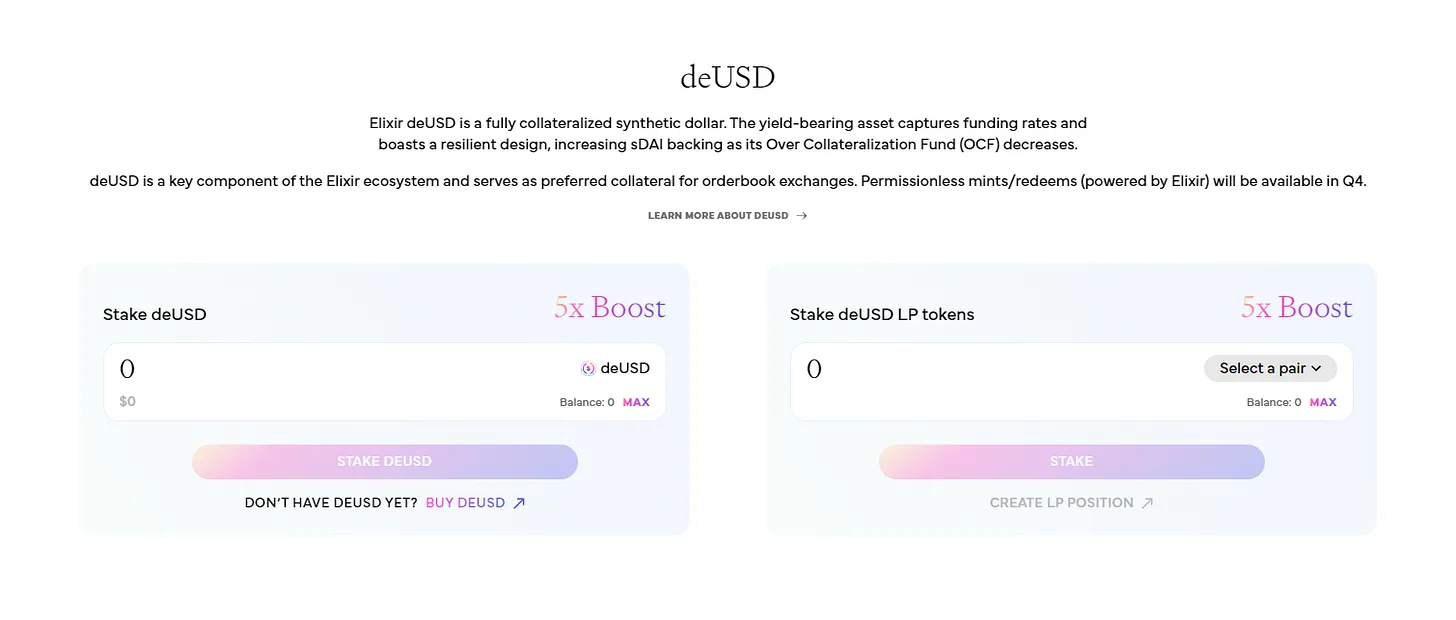

2. Elixir

Next up is Elixir, a modular network aiming to power liquidity across DeFi.

We’ve mentioned Elixir before—they’ve just announced a new 10-week points campaign for their new deUSD stablecoin.

Elixir uses an approach similar to Ethena’s stablecoin; deUSD is a native yield-generating stablecoin that leverages stETH, sDAI, and funding rate arbitrage.

Holders can stake deUSD or provide liquidity to earn yield and points.

3. Avantis

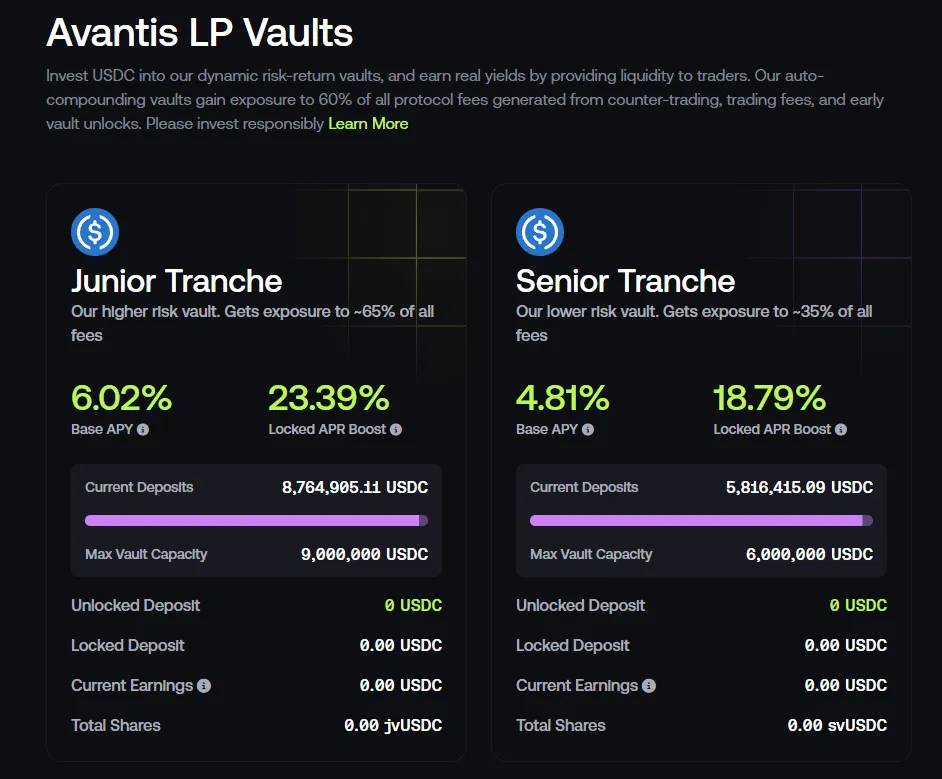

The next farm this week is Avantis, a perpetuals exchange on Base supporting RWAs and various tokens.

Avantis currently runs a points program for traders, liquidity providers, and referrers.

Depending on your risk tolerance, users can choose to deposit at either the Junior or Senior tier to earn USDC yield.

Although nearly at capacity, it's an ideal place to park stablecoins while earning XP.

4. Smilee

Next is Smilee, a volatility trading platform allowing users to go long or short on assets with high leverage.

In addition to its deployment on Arbitrum, Smilee has just gone live on Berachain bArtio testnet.

Smilee is among the latest recipients of ARB incentives, offering substantial returns for liquidity providers.

As shown, liquidity providers can earn double- or even triple-digit APYs depending on the chosen trading pair.

5. Flat Money

Our final farming opportunity this week is Flat Money, a capital-efficient stablecoin backed by rETH.

Flat Money is essentially a decentralized version of Ethena—the protocol captures funding and staking yields by hedging through its own perpetuals exchange.

By minting UNIT, you earn fees paid by rETH leveraged traders on the Flat Money exchange, typically yielding between 20–30% APY.

On the other hand, traders gain access to low-cost ETH perpetual contracts with minimal funding rates while also earning points.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News