The divergence reaches its most critical moment, finding the optimal choice

TechFlow Selected TechFlow Selected

The divergence reaches its most critical moment, finding the optimal choice

Next year will be the bull market led by altcoins.

Author: Zixi.eth

We recently prepared a macro-level analysis. Currently, the blockchain industry has reached a point similar to December 2022—a critical moment for determining overall investment directions in both primary and secondary markets. Except for BTC and Solana, all other tokens have performed relatively poorly, and market sentiment remains lukewarm, with many believing the bull run might be ending. However, we remain quite optimistic about the market outlook for the second half of this year and next year. In such periods of maximum disagreement between bulls and bears, whether in primary or secondary markets, correctly positioning oneself offers the greatest profit potential.

Therefore, I will first present our core views on the market, along with insights on four major tokens.

TL;DR

-

From a U.S. economic and political perspective, upcoming rate cuts in September, SEC regulatory policies, and Trump’s support for crypto are all significant tailwinds for the crypto market.

-

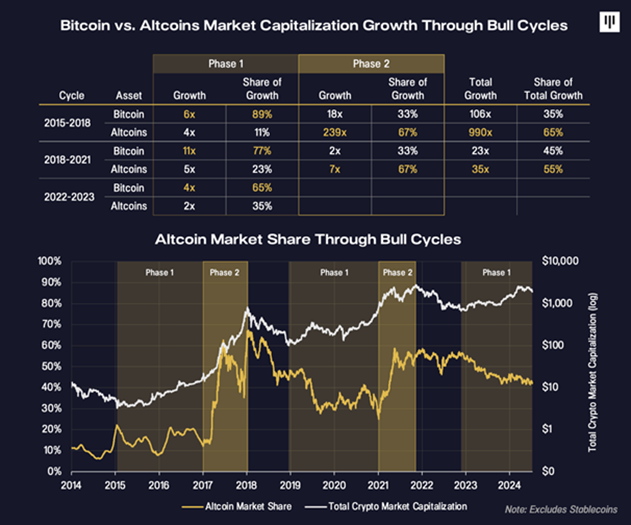

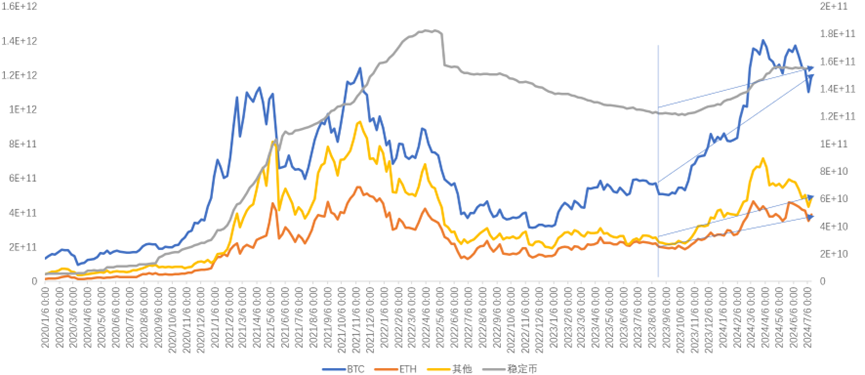

By analogy with previous cycles, the current bull market is in Stage 1—Bitcoin leads the rally, Bitcoin's market dominance rises, while altcoins' share drops sharply. This phase may last several more months. The altcoin-led bull market (Stage 2) will likely arrive next year. (See chart)

-

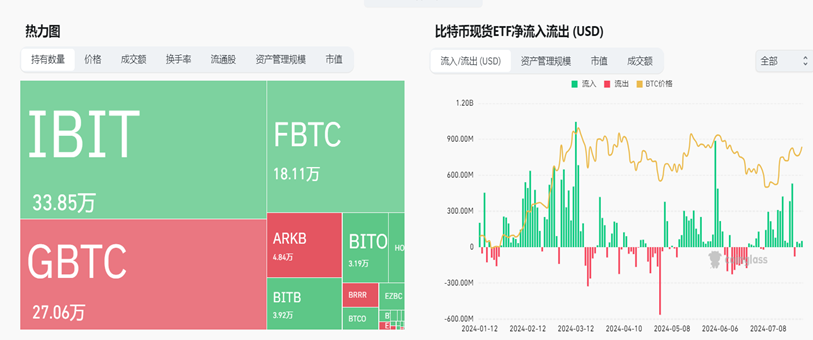

Holding BTC remains the optimal strategy over the past six months, but during the second half of this year, investors can gradually consider rotating into ETH or Solana. Since the approval of Bitcoin ETFs, ETFs have accumulated 303,000 BTC within six months, holding a total of 950,000 BTC, accounting for 4.5% of all BTC. Regarding the BTC ecosystem, we believe the only viable approach over the past six months has been developing trustless financial solutions for BTC holders and unlocking liquidity for large holders—an insight clearly reflected in SolvProtocol's data.

-

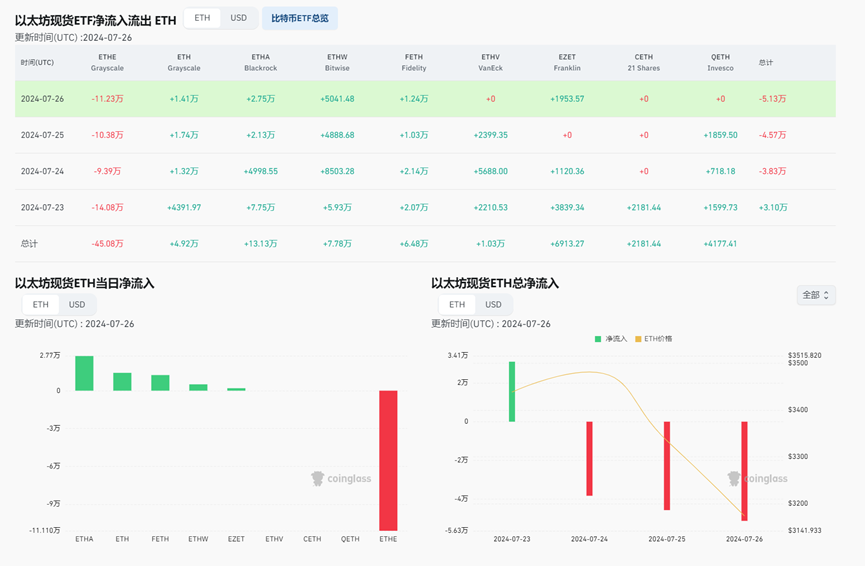

ETH is particularly suitable for accumulation in the second half of this year. After ETH began trading on Nasdaq on July 23, it will likely repeat Grayscale’s earlier process of selling off BTC holdings. This sell-off could last from half a month to one month until the market absorbs the supply. Once this threshold is reached, it will present an excellent entry opportunity. We recommend closely monitoring the BTC/ETH exchange rate during the second half of the year; once Grayscale’s net outflows end, it will be time to accumulate (referencing the 20%-30% rise in BTC one month after Grayscale’s BTC net outflows ended in February).

-

We remain long-term bullish on Solana, which delivers breakout products every quarter. Holders should continue to hold firmly, while those without exposure can consider accumulating at lower prices. Their 2C ecosystem development capability is truly strong. FTX Liquidation was perfectly resolved in the first half of this year, with a cost basis of $80 and a current price of $170–180. Unlocking has now begun, marking our most successful OTC trade in the secondary market this year. Additionally, the Solana ETF application has already been submitted, with progress expected next year. The SEC has also withdrawn its classification of Solana as a security. Following last year’s DePIN success, the Solana ecosystem launched Pump.fun (a one-stop meme coin launchpad + casino), generating daily revenues of over $1 million and $80 million in revenue over six months.

-

We are short-to-medium term bullish on Ton, but long-term sustainability requires further observation. We remain cautious on OTC pricing at current levels but could consider direct spot purchases. While there are profit opportunities with the Ton token, opportunities within the Tonecosystem are relatively limited.

1. Crypto Market Funding Comes from Financial Markets

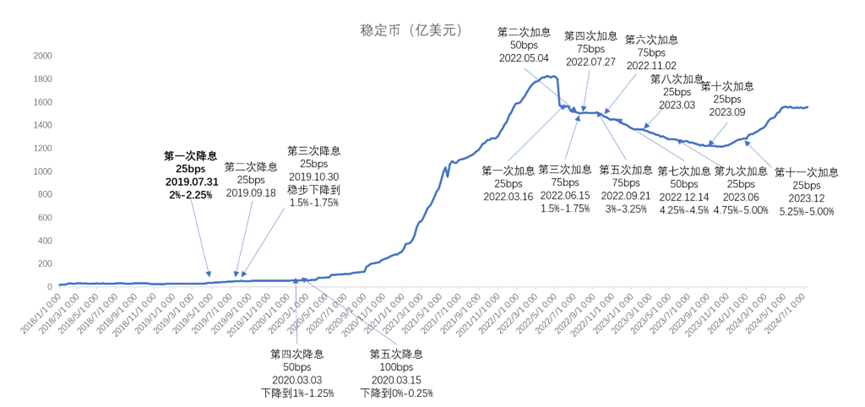

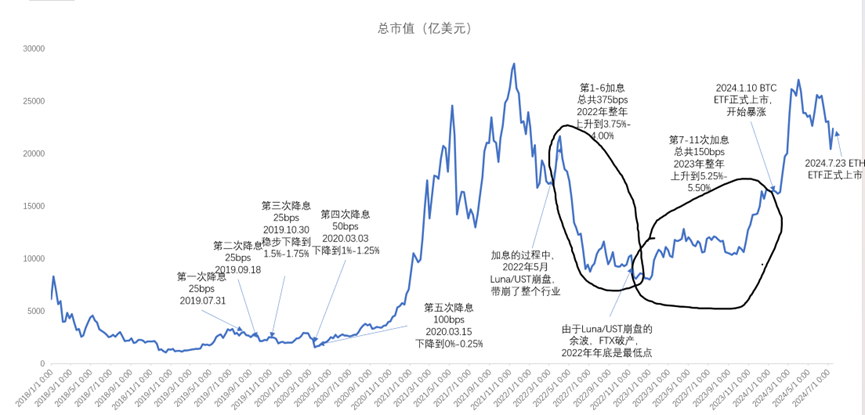

Under macroeconomic stimulus—such as significant rate cuts and money printing—capital naturally flows into trading markets. Since 2020, the crypto market has become highly correlated with U.S. equities. After the crypto industry grew into a multi-trillion-dollar sector starting in early 2021, its performance has been closely tied to macro interest rates. In the 2017–2020 cycle, the correlation with interest rates was low due to the market’s small size. The amount of speculative capital in the market can be measured by stablecoin issuance. At the end of 2021, total stablecoin supply peaked at $162 billion. Despite a sustained rally over the past six months, stablecoin supply remains at only $150 billion.

2. U.S. June CPI YoY at 3.0%, Significantly Below Forecast of 3.1%, Lowest Since June Last Year

The U.S. unadjusted CPI YoY in June came in at 3.0%, well below the expected 3.1%, dropping to the lowest level since June last year. The seasonally adjusted monthly CPI fell by -0.1%, the first negative reading since May 2020. Market expectations for a September rate cut now exceed 90%. According to CICC’s macro research, this round of easing aims to bring interest rates back to neutral levels, with analysts estimating fair U.S. Treasury yields around 4%, implying rate cuts of 100–125 bps. This cycle closely resembles 2019.

3. After the Assassination Attempt, Trump’s Probability of Winning the Election Surpasses 60% on Polymarket

Trump’s second-term monetary policy is expected to continue pursuing aggressive rate cuts and balance sheet expansion, leading to higher inflation—which typically benefits both crypto and U.S. equity markets. Additionally, Trump opposes the new energy sector and supports revitalizing traditional energy industries. Mining represents a significant consumer of traditional energy, explaining his strong interest in Bitcoin mining—he has stated he wants all future Bitcoin minted in the U.S.

In 2019, Trump expressed disdain toward crypto and demonstrated little understanding of the industry. By December 2022, he launched his own NFT cards. Starting in 2024, he began holding crypto assets worth over $10 million, including $3.5 million in TRUMP (meme coin), $3 million in ETH, and various other meme coins. At the recent Bitcoin conference in Nashville, Trump delivered a compelling speech (odaily.news/post/5197170). How much of his vision will materialize remains open to interpretation.

Additionally, recent actions by the SEC reflect a generally positive regulatory stance.

4. Stablecoin Market Cap Hit Cycle Low of $121.1 Billion on October 2, 2023

It has since recovered to $155.8 billion, representing a 28% increase, indicating $34.7 billion in real capital inflows. Just $34.7 billion in inflows led to:

-

BTC market cap rising from $545 billion to $1.2 trillion, up 120% (driven not only by stablecoin inflows but also substantial ETF buying).

-

ETH underperformed, increasing from $208 billion to $390 billion, up 87%

-

Altcoins followed, growing from $235.6 billion to $490.1 billion, up 108% (some growth inflated by new project launches).

5. The Above Token Performance Aligns Well With Our Previously Described "Reservoir" Model—Liquidity Flows Downward Gradually. Ethereum’s Underperformance vs. Bitcoin Over the Past Six Months Can Be Explained By:

-

From a narrative standpoint, apart from staking (Lido), restaking (EigenLayer), and LRT, Ethereum has seen no substantive innovation in infrastructure or business models—mainly iterative recycling.

-

Ethereum’s technological expectations are gradually fading. During the 2021–2022 ETH/BTC growth phase, optimism stemmed from soaring user demand making Ethereum gas fees extremely high (GWEI often above 70 in early 2021–2022, transaction costs around $2–3, NFT interactions costing at least $50–100). This drove the development of op/zk L2s. Two to three years later, while L2s have relieved much congestion on the mainnet, mass adoption hasn’t materialized. Moreover, building L2s is no longer a technical challenge, causing high-valuation L2 projects that issued tokens in 2022/23 to decline steadily.

-

BTC gained ETF approval and Nasdaq-backed buying pressure, whereas ETH had not yet achieved ETF listing six months ago.

-

Liquidity remains insufficient—far from reaching a stage of overflow.

6. For BTC (and Its Ecosystem), While We Are Macro Bullish Long-Term, Consider Rotating Into ETH/Solana in the Second Half of This Year:

-

Over the past six months, BTC ETF inflows have remained healthy. ETFs hold approximately 950,000 BTC, having acquired 303,000 BTC in half a year, representing 4.5% of total BTC supply.

-

Trump has shown strong interest in BTC, evident from his remarks on mining, energy, rate cuts, and regulation at the Nashville conference.

-

Rate cuts will impact BTC most significantly, with capital initially flowing into Bitcoin.

-

The BTC ecosystem has cooled slightly, but the need for trustless financial products for BTC holders denominated in USD or altcoins is evident. Most ecosystem projects rely heavily on Babylon. If Babylon partners with traditional ETF providers to offer shared security services across other PoS chains using BTC, it would be a major catalyst for Babylon-based projects.

7. For ETH (and Its Ecosystem), Short-Term Bearish Due to Innovation Stagnation, But Macro Bullish Medium-to-Long Term

-

The SEC considers ETH a commodity, not a security, but deems staked ETH (e.g., STETH) a security, which is unfavorable for staking-related projects like Lido.

-

ETH is likely to mirror Grayscale’s earlier BTC sell-off pattern. The first half-month to one month of gains may appear weak. Grayscale sold down from 600,000 BTC to 300,000 BTC over six months, averaging $60k per BTC, realizing $18 billion in sales. Grayscale still holds $7.4 billion worth of ETH, requiring time for the market to absorb.

-

All asset innovations in this cycle revolve around EigenLayer. Ethereum’s staking ratio has reached 28.21% over four years, with restaking ratio hitting 4.8% in the past six months. EigenLayer-based projects represent typical internal “self-hype” asset innovations.

-

Appchain-style RaaS continues to build on Ethereum, with infrastructure already mature. The next breakout product may come from an Ethereum appchain.

8. Long-Term Bullish on Solana—Delivers Breakout Products Every Quarter

-

FTX liquidation has been fully resolved, with linear unlocking beginning in July. Daily market sell pressure averages $3.6–4 million (at prices of $180–190).

-

Solana ETF application has been filed, with possible approval expected in 2025.

-

2C ecosystem keeps improving, offering exceptionally smooth user experience, briefly surpassing Ethereum as the largest on-chain casino. Pump.fun has become the most successful application in the past six months (pump.fun/board), generating $80 million in cumulative revenue, earning over $1 million daily.

9. Bullish on Ton in the Short-to-Medium Term, But Long-Term Outlook Depends on Token Liquidity and Ecosystem Sustainability

1. Consistent with our previous analysis on Ton: Ton has the potential to grow big, but the Ton ecosystem may not. The Ton ecosystem resembles a wilder, less regulated version of WeChat Mini Programs. So far, it has mostly produced simplistic games—tap-to-earn, idle-to-earn—with users primarily being airdrop hunters. Due to product limitations, actual on-chain engagement conversion from Web2 users is less than 10%. Although some games achieve viral success, they lack sustainability—once an airdrop ends, the project essentially concludes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News