Bittensor: How AI Subnets Are Reshaping the Collective Intelligence Network?

TechFlow Selected TechFlow Selected

Bittensor: How AI Subnets Are Reshaping the Collective Intelligence Network?

Bittensor redefines collective intelligence networks through its innovative AI subnet architecture and incentive mechanisms, achieving a seamless integration of AI and Web3.

Author: Trustless Labs

The Background of the AI Revolution

The Rise of AI

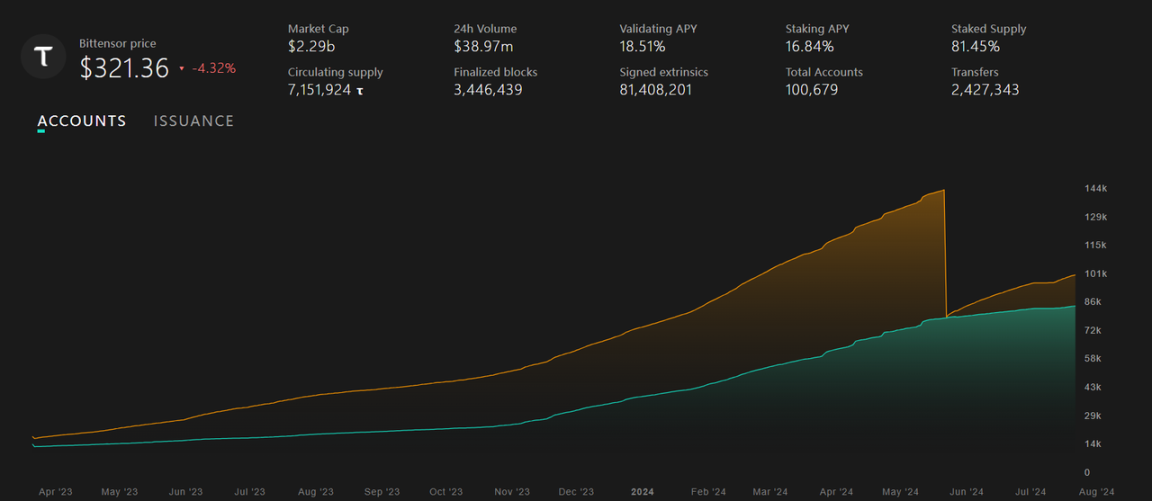

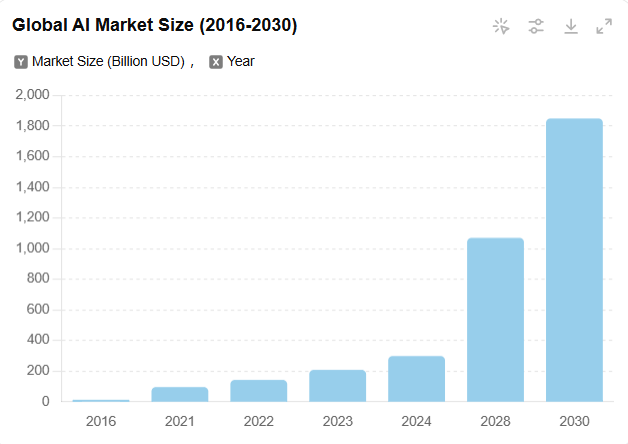

With the rapid development of artificial intelligence (AI) technologies, we are entering a new era driven by data. Breakthroughs in fields such as deep learning and natural language processing have made AI applications ubiquitous. The emergence of ChatGPT in 2022 ignited the AI industry, followed by a wave of AI tools for text-to-video generation, automated office tasks, and more—ushering in the era of "AI+". The market value of the AI industry has surged accordingly, projected to reach $185 billion by 2030.

Figure 1: AI Market Value Trends

Traditional Internet Giants Monopolize AI

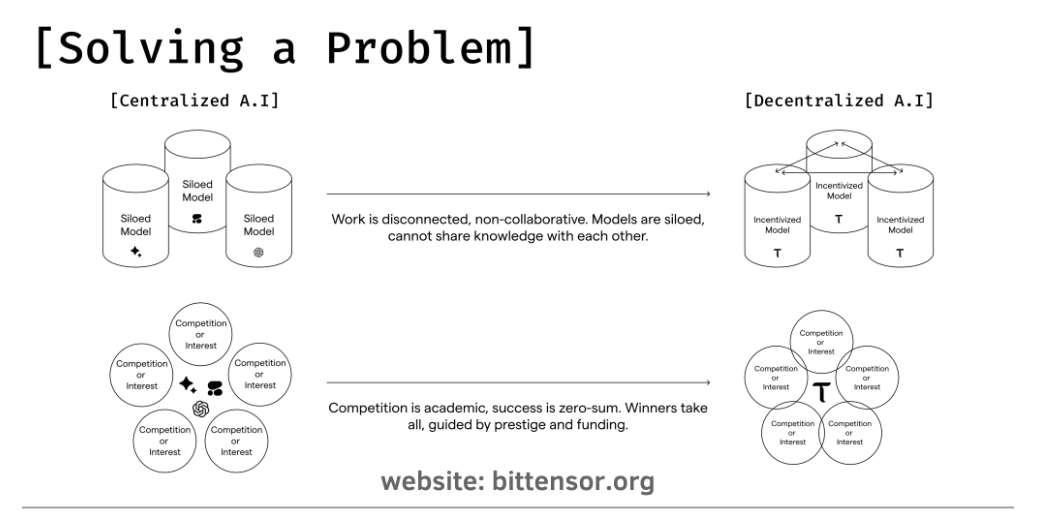

Currently, the AI industry is dominated by companies such as NVIDIA, Microsoft, Google, and OpenAI. While technological progress continues, it also brings challenges like data centralization and unequal distribution of computing resources. At the same time, Web3’s philosophy of decentralization offers new possibilities for addressing these issues, potentially reshaping the current landscape of AI development through distributed networks.

Current Progress in Web3 + AI

Amid the rapid evolution of the AI industry, a number of high-quality Web3 + AI projects have emerged. Fetch.ai leverages blockchain technology to create a decentralized economy supporting autonomous agents and smart contracts to optimize AI model training and deployment. Numerai uses blockchain and a community of data scientists to predict market movements, incentivizing model developers through reward mechanisms. Velas builds a high-performance smart contract platform integrating AI and blockchain, offering faster transaction speeds and enhanced security. AI projects fundamentally consist of three components: data, algorithms, and computing power. While Web3 + data and Web3 + computing power sectors are thriving, Web3 + algorithm initiatives have largely operated in isolation, resulting in fragmented, single-purpose applications. Bittensor identified this gap and created an AI algorithm platform with built-in competitive selection mechanisms powered by blockchain incentives, preserving only the highest-quality AI projects.

Bittensor's Development Trajectory

Innovative Breakthroughs

Bittensor is a decentralized incentive-based machine learning network and digital goods marketplace.

-

Decentralization: Bittensor operates on a distributed network of thousands of computers controlled by various organizations, addressing issues like data centralization.

-

Fair Incentive Mechanism: The Bittensor network distributes $TAO tokens proportionally based on each subnet’s contribution, and subnets similarly distribute rewards to miners and validators according to node contributions.

-

Machine Learning Resources: The decentralized network provides machine learning computing resources to any individual or entity that needs them.

-

Diverse Digital Goods Marketplace: Initially designed for trading machine learning models and related data, Bittensor’s marketplace has evolved—thanks to the network’s expansion and the Yuma consensus mechanism’s content-agnostic nature—into a platform capable of trading any form of data.

Development Timeline

Unlike many highly valued VC-backed projects in today’s market, Bittensor is a fairer, more intriguing, and meaningful project built by technologists. Its journey did not follow the typical path of “promising grand visions to secure funding.”

-

Concept Formation & Project Launch (2021): Bittensor was founded by a group of tech enthusiasts and experts dedicated to advancing decentralized AI networks. They used the Substrate framework to build the Bittensor blockchain, ensuring flexibility and scalability.

-

Early Development & Technical Validation (2022): The team launched the Alpha version, validating the feasibility of decentralized AI. They introduced the Yuma consensus mechanism, emphasizing data-agnostic principles to protect user privacy and security.

-

Network Expansion & Community Building (2023): The Beta version was released, along with a token economic model ($TAO) to incentivize network maintenance.

-

Technological Innovation & Cross-chain Compatibility (2024): The team integrated DHT (Distributed Hash Table) technology to improve data storage and retrieval efficiency. Increased focus was placed on promoting subnets and expanding the digital goods marketplace.

Figure 2: Bittensor Network Promotion Image

Throughout its development, Bittensor has avoided heavy involvement from traditional VCs, mitigating risks of centralized control. By using token incentives to reward nodes and miners, the network maintains vitality. At its core, Bittensor is a GPU-miner-driven AI computing power and service project.

Tokenomics

The native token of the Bittensor network is TAO. Reflecting admiration for Bitcoin, TAO shares several similarities with BTC. It has a total supply of 21 million, with halving events occurring every four years. TAO was distributed via a fair launch at network inception—no pre-mine, no allocations reserved for founders or VCs. Currently, a new block is generated approximately every 12 seconds, with each block rewarding 1 $TAO, totaling around 7,200 TAO per day. These rewards are distributed according to contribution across subnets, then further allocated within subnets to subnet owners, validators, and miners.

Figure 3: Bittensor Community Promotion Image

TAO tokens can be used to purchase computing resources, data, and AI models on the Bittensor network, and also serve as governance rights within the community.

Current Status

The Bittensor network currently hosts over 100,000 total accounts, with more than 80,000 non-zero accounts.

Figure 4: Bittensor Account Growth

Over the past year, TAO has appreciated by tens of times, reaching a current market cap of $2.278 billion and a price of $321.

Figure 5: TAO Token Price Movement

The Evolving Subnet Architecture

Bittensor Protocol

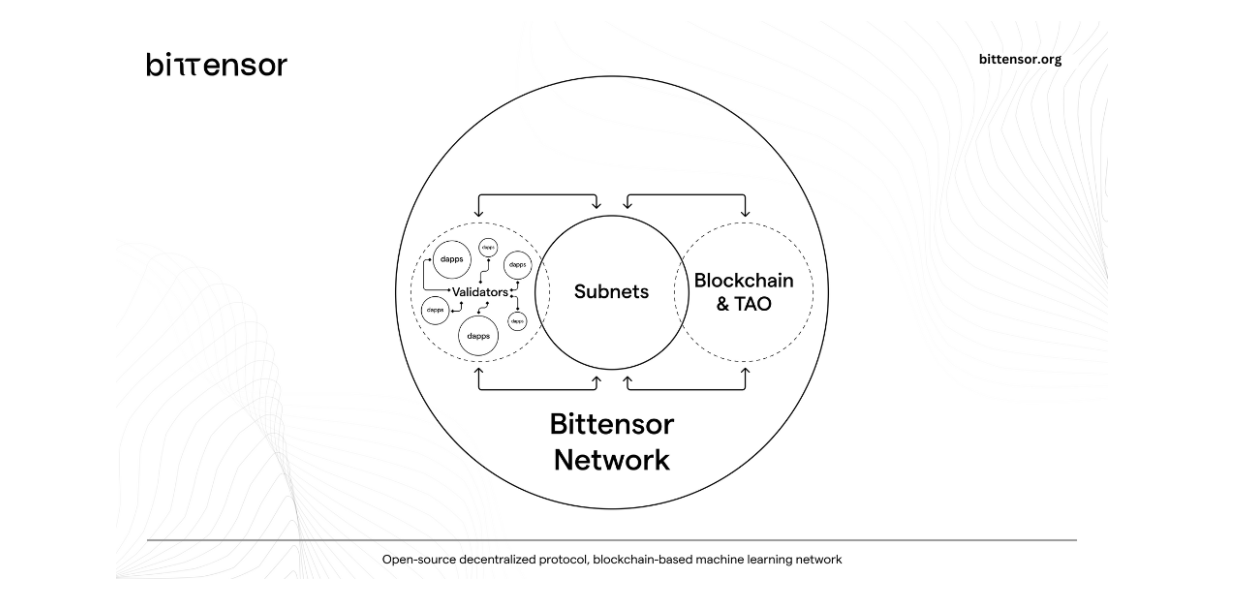

The Bittensor protocol is a decentralized machine learning protocol enabling participants to exchange machine learning capabilities and predictions, facilitating peer-to-peer sharing and collaboration of ML models and services.

Figure 6: Bittensor Protocol

The Bittensor protocol includes network architecture, subtensors, subnet structure, validators, and miner nodes. Fundamentally, the Bittensor network consists of groups of nodes running Bittensor client software, interacting with the broader network. These nodes are managed by subnets and operate under a survival-of-the-fittest mechanism—underperforming subnets are replaced by new ones, and poorly performing validators and miners within subnets are eventually displaced. Thus, subnets represent the most critical component of the Bittensor architecture.

Subnet Logic

A subnet can be viewed as an independently running codebase with unique incentive structures and functions, while maintaining compatibility with the Bittensor mainnet’s consensus interface. There are three types of subnets: local subnets, testnet subnets, and mainnet subnets. Excluding the root subnet, there are currently 45 active subnets. From May to July 2024, the number of subnets is expected to grow from 32 to 64, with four new subnets added weekly.

Subnet Roles and Emissions

The Bittensor ecosystem includes six functional roles: users, developers, miners, staked validators, subnet owners, and the council. Within each subnet, the key roles are subnet owner, miner, and staked validator.

-

Subnet Owner: Responsible for providing base miner and validator code, setting custom incentives, and allocating mining tasks.

-

Miner: Miner nodes are incentivized to continuously upgrade servers and mining code to maintain competitiveness. Miners with the lowest emissions are replaced by new entrants and must re-register. Notably, miners can run multiple nodes across different subnets.

-

Validator: Validators assess each subnet’s contribution and ensure accuracy to earn rewards. Users can stake TAO tokens on validator nodes, earning adjustable staking rewards ranging from 0% to 18%.

Subnet emission refers to the distribution mechanism of TAO tokens rewarded to miners and validators. Typically, 18% of emissions go to the subnet owner, 41% to validators, and 41% to miners. Each subnet has 256 UID slots—64 allocated to validators and 192 to miners. Only the top 64 validators with the largest stakes are granted validator status and considered active; their stake size and performance determine their standing and rewards. Miners are scored based on requests and evaluations from validators, and underperforming miners are replaced by newly registered ones. Therefore, higher validator stakes and greater miner efficiency lead to higher total emissions and better rankings.

Subnet Registration and淘汰

After registration, a subnet enters a 7-day immunity period. The initial registration fee is 100 $TAO, doubling upon re-registration, though the price gradually resets back to 100 $TAO over time. When all subnet slots are occupied, registering a new subnet will replace the lowest-emitting subnet not in immunity. Hence, subnets must maximize validator stakes and miner efficiency to avoid deletion after immunity ends.

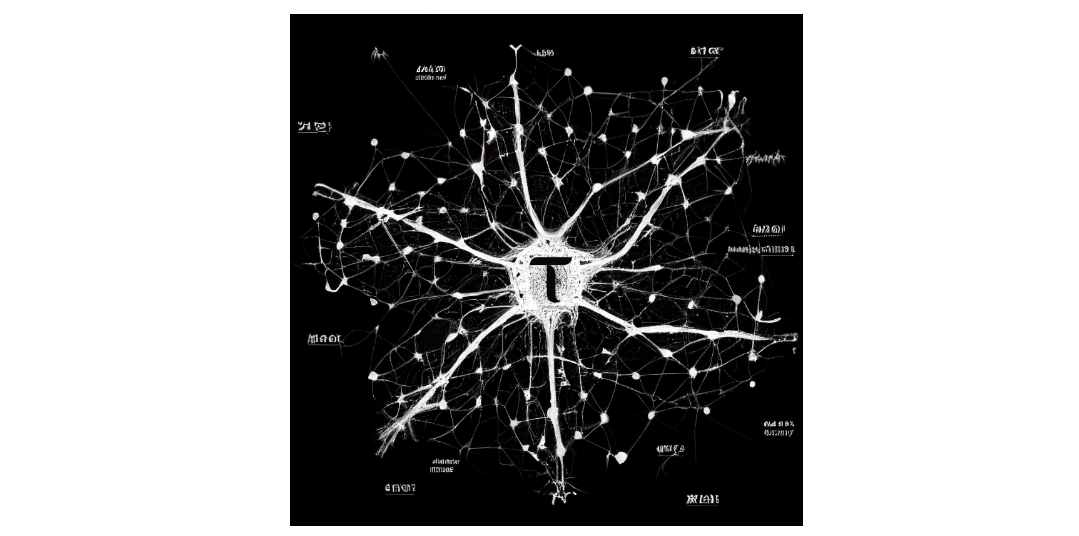

Figure 7: Subnet Names

Thanks to Bittensor’s subnet architecture, the decentralized AI data network Masa has successfully launched, becoming the first dual-token reward system on Bittensor and securing $18 million in funding.

Figure 8: Masa Promotion

Consensus and Proof Mechanisms

The Bittensor network employs multiple consensus and proof mechanisms. In traditional decentralized networks, PoW (Proof of Work) is commonly used for miner nodes to verify contributions and earn rewards based on computational power and data quality. For validators, PoV (Proof of Validation) is typically used to ensure network security and integrity. Bittensor introduces its own PoI (Proof of Intelligence) mechanism combined with the Yuma consensus to manage validation and reward distribution.

Proof of Intelligence (PoI)

Bittensor’s PoI is an innovative validation and incentive mechanism where participants prove their contribution by completing intelligent computational tasks, ensuring network security, data quality, and efficient use of computing resources.

-

Miner nodes prove their work by completing intelligent computation tasks, which may include natural language processing, data analysis, or machine learning model training.

-

Tasks are assigned by validators to miners. After completion, results are returned to validators, who score them based on quality.

Yuma Consensus

Yuma consensus is the core mechanism of the Bittensor network. After validators score task completions, they input scores into the Yuma consensus algorithm. Validators with larger TAO stakes have higher scoring weight, and the algorithm filters out outlier results inconsistent with the majority. Finally, the system allocates token rewards based on aggregated scores.

Figure 9: Consensus Algorithm Illustration

-

Data-Agnostic Principle: Ensures privacy and security during data processing—nodes can perform computations and validations without knowing the actual content of the data.

-

Performance-Based Rewards: Rewards are distributed based on node performance and contribution, promoting efficient and high-quality resource utilization.

MOE Mechanism Integration

Bittensor integrates the MOE (Mixture of Experts) mechanism, combining multiple expert-level sub-models within a single architecture. Each expert model excels in its respective domain. When new data is introduced, these sub-models collaborate, producing superior results compared to a single monolithic model.

Under the Yuma consensus, validators can score expert models, rank their capabilities, and allocate token rewards, thereby incentivizing continuous model optimization and improvement.

Figure 10: Problem-Solving Approach

Subnet Projects

As of writing, Bittensor has 45 registered subnets, with 40 officially named. During periods when subnet slots were limited, competition for registration was fierce, with prices peaking at over a million dollars. As Bittensor gradually opens more subnet slots, newly registered subnets may lag behind long-running ones in stability and model performance. However, due to Bittensor’s built-in淘汰mechanism, inferior subnets will eventually be phased out—a true case of good money driving out the bad.

Figure 11: Bittensor Subnet Project Details

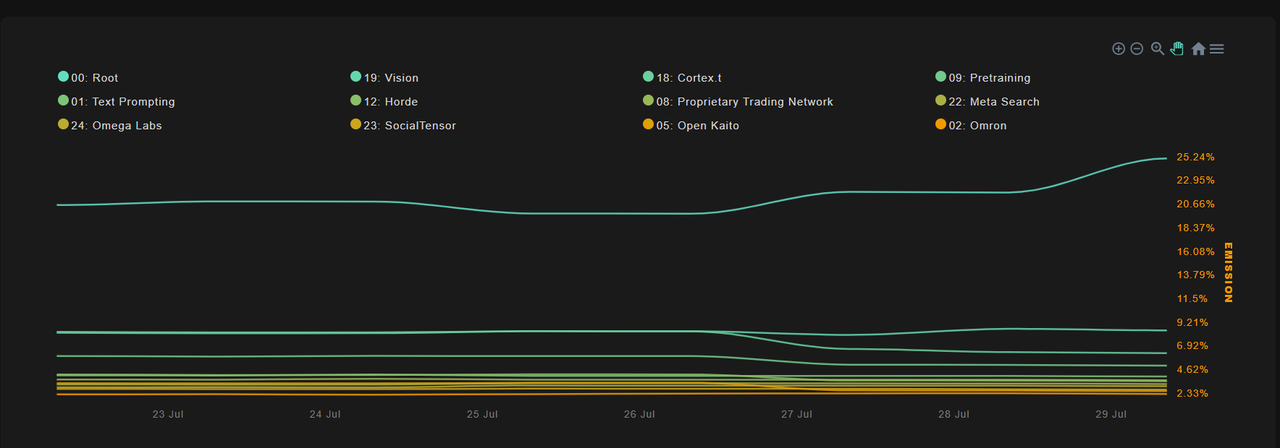

Excluding the root subnet, subnets 19, 18, and 1 have received significant attention, accounting for 8.72%, 6.47%, and 4.16% of total emissions respectively.

Subnet 19

Subnet 19, named Vision, was registered on December 18, 2023. Vision focuses on decentralized image generation and inference. The network provides access to top open-source LLMs, image generation models—including those trained on Subnet 19’s dataset—and other auxiliary models like embedding models.

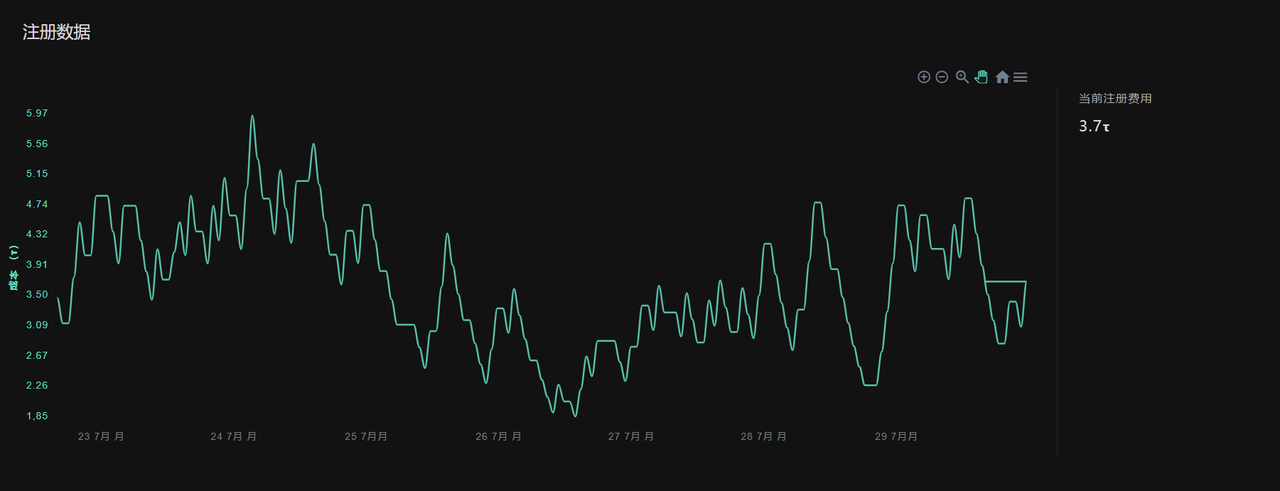

Currently, Vision’s slot registration fee is 3.7 TAO, with total daily node earnings around 627.84 TAO. Over the past 24 hours, nodes worth 64.79 TAO were reclaimed. A newly registered node achieving average performance could earn approximately 2.472 TAO per day, equivalent to about $866.

Figure 12: Vision Subnet Registration Fee Data

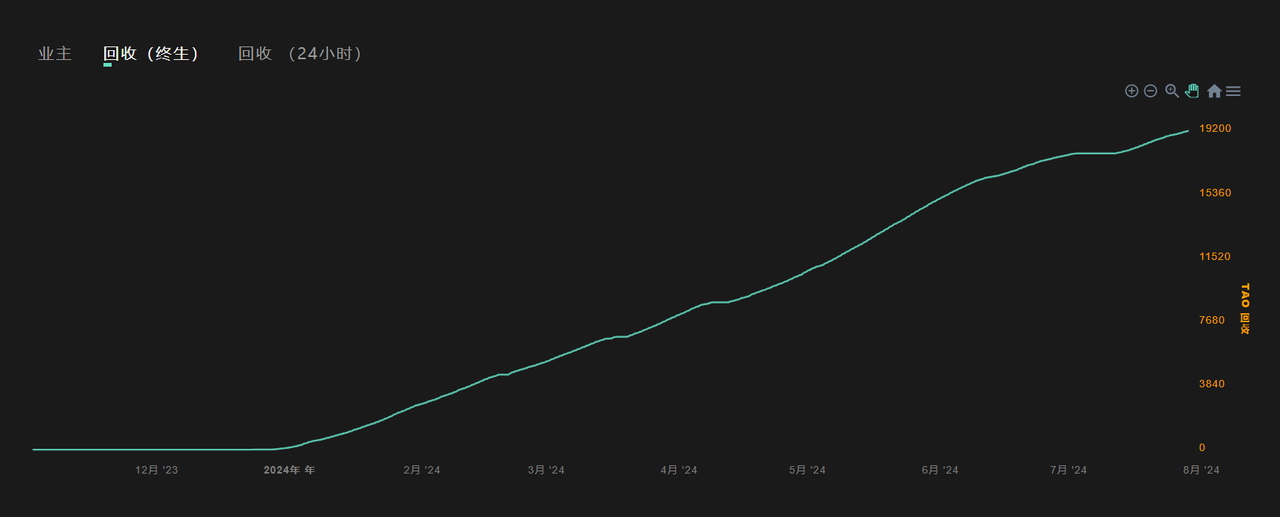

To date, the total value of reclaimed nodes on Vision amounts to approximately 19,200 TAO.

Figure 13: Vision Subnet Reclamation Costs

Subnet 18

Subnet 18, named Cortex.t, is developed by Corcel. Cortex.t aims to build a cutting-edge AI platform delivering reliable, high-quality text and image responses to users via API.

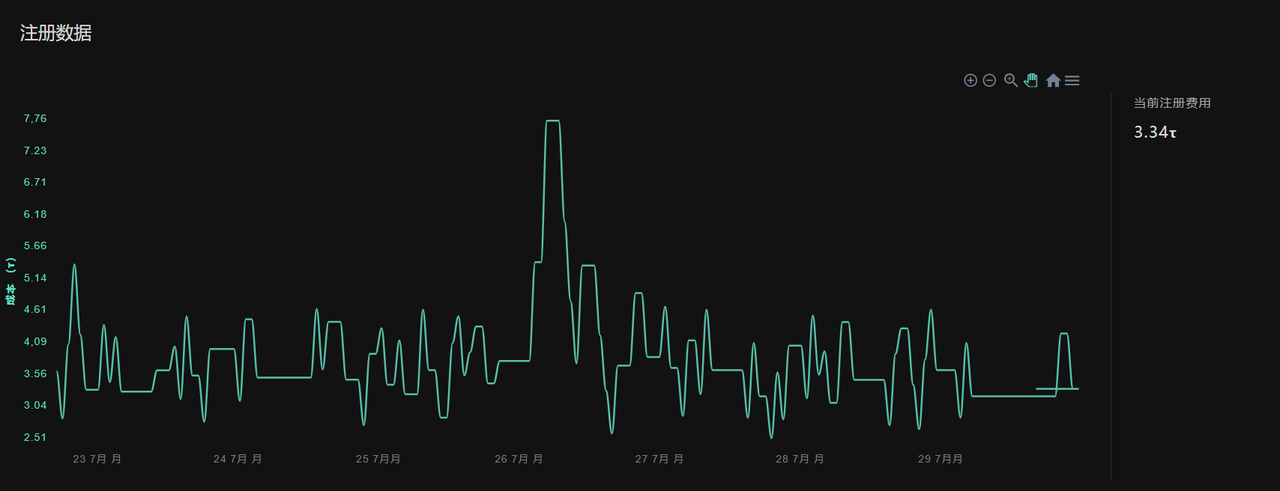

Currently, Cortex.t’s slot registration fee is 3.34 TAO, with total daily node earnings around 457.2 TAO. Over the past 24 hours, nodes worth 106.32 TAO were reclaimed. A new node achieving average performance could earn approximately 1.76 TAO per day, or about $553.64.

Figure 14: Cortex.t Subnet Registration Fee Data

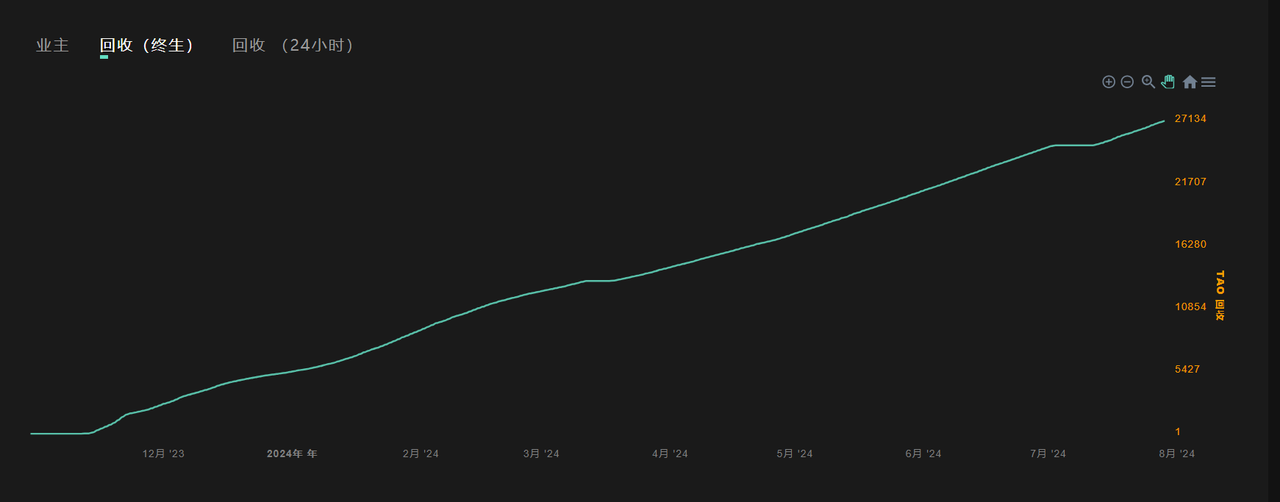

To date, the total value of reclaimed nodes on Cortex.t amounts to approximately 27,134 TAO.

Figure 15: Cortex.t Subnet Reclamation Costs

Subnet 1

Subnet 1 was developed by the Opentensor Foundation and is a decentralized subnet dedicated to text generation. As the first Bittensor subnet, it initially faced strong skepticism. In March this year, Eric Wall, founder of Taproot Wizards, referred to Bittensor’s TAO token as a meme coin in the AI space, criticizing Subnet 1 for producing nearly identical AI-generated responses across hundreds of nodes when answering textual queries, questioning its practical utility.

Others

In terms of model categories, subnets 19, 18, and 1 all belong to generative models. Other subnets focus on large-scale data processing or AI-driven trading strategies—for example, Subnet 22 Meta Search analyzes Twitter data to gauge market sentiment, while Subnet 2 Omron uses deep neural networks to learn and continuously optimize staking strategies.

From a risk-return perspective, operating a node successfully for several weeks can yield substantial returns. However, new nodes lacking high-performance GPUs or optimized local algorithms will struggle to survive in competitive environments.

Future Outlook

-

From a hype perspective, the popularity of AI rivals that of Web3, with significant capital previously flowing into Web3 now being drawn toward AI. Thus, Web3 + AI will remain a market focal point for the foreseeable future.

-

From an architectural standpoint, Bittensor is not a conventional VC-backed project. Since launch, it has appreciated by tens of times, backed by both technical innovation and market demand.

-

From a technological innovation perspective, Bittensor breaks the siloed nature of previous Web3 + AI efforts. Its unique subnet architecture lowers the barrier for AI teams to migrate to decentralized networks and achieve quick monetization. Moreover, the competitive淘汰mechanism forces subnets to continuously improve models and increase staking to avoid displacement.

-

From a risk perspective, increasing subnet capacity will inevitably lower entry barriers, raising the risk of low-quality projects entering. Additionally, as the number of subnets grows, the amount of TAO earned by existing subnets will gradually decrease. If TAO’s price does not rise alongside subnet growth, returns may fall short of expectations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News