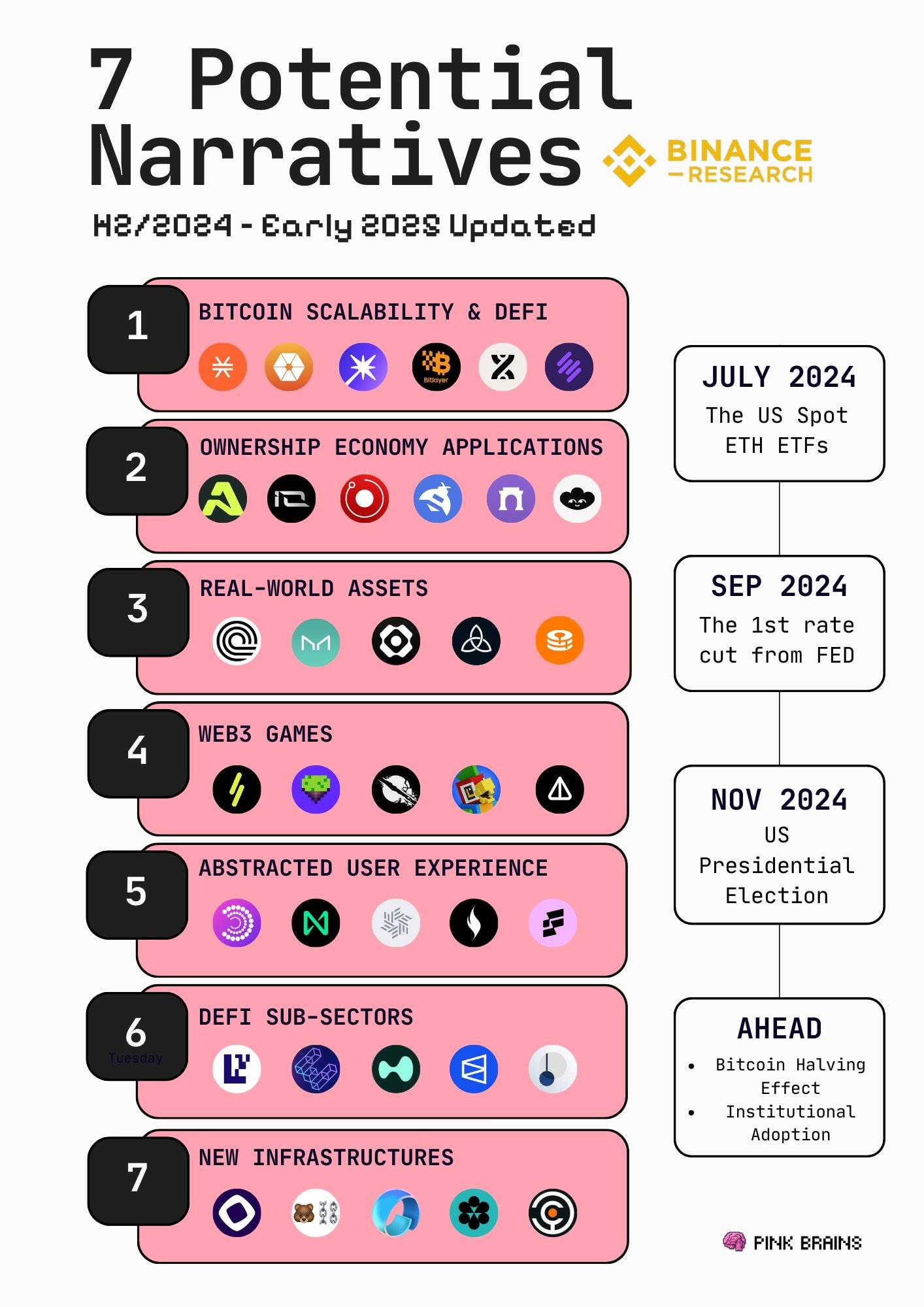

Top 7 Promising Narratives to Watch in the Second Half of 2024

TechFlow Selected TechFlow Selected

Top 7 Promising Narratives to Watch in the Second Half of 2024

It's time to pay attention to new catalysts for the remainder of this year and early 2025.

Author: Pink Brains

Translation: TechFlow

In the first half of 2024, Bitcoin's dominance, decentralized AI, DePIN adoption, Solana's rise, and ETH staking emerged as key market highlights.

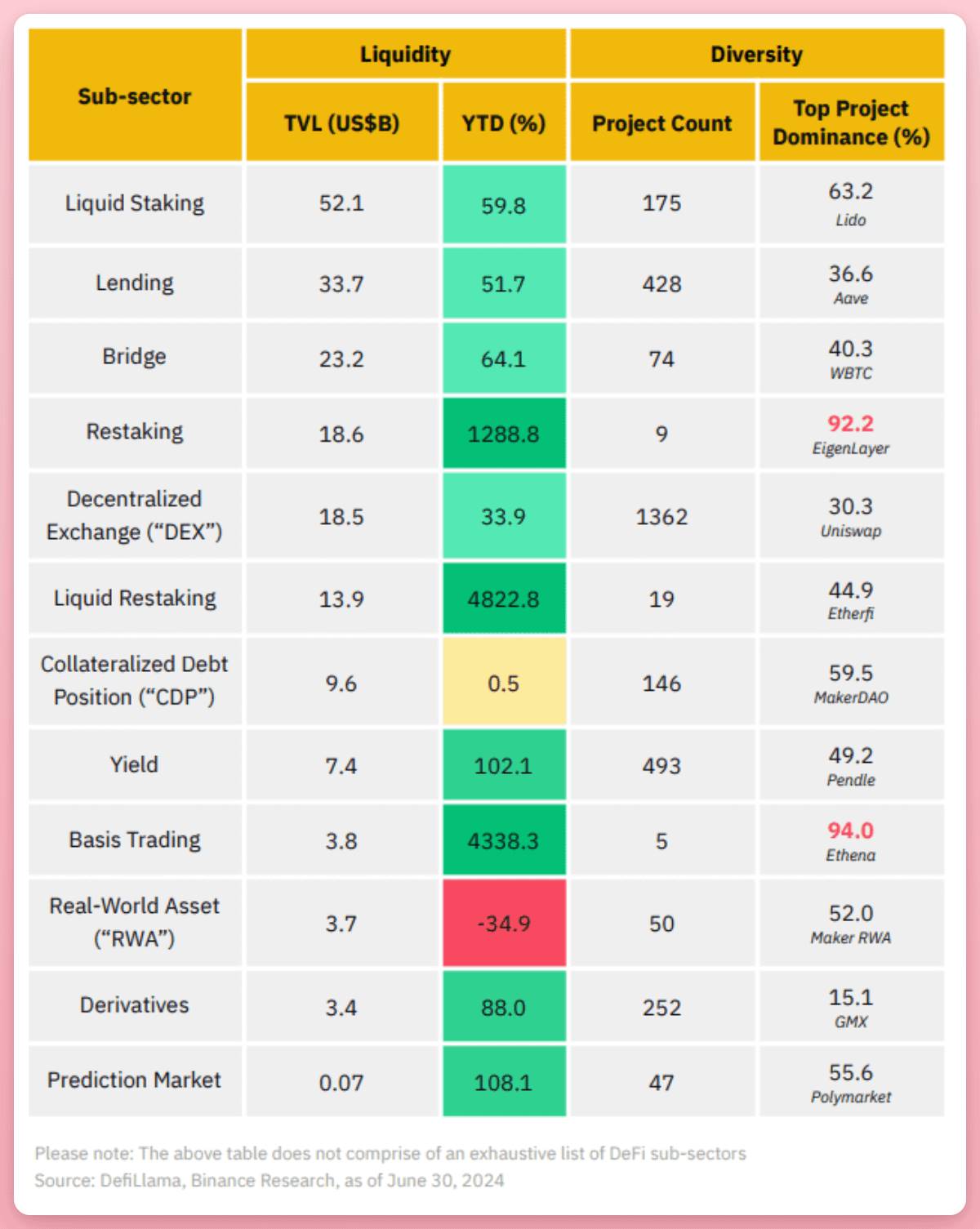

Various sub-sectors within DeFi also flourished, driven by new yield sources, airdrop frenzies, and meme coins.

Looking ahead to the second half, here are seven potential trends to watch. At the beginning of 2024, we predicted 12 key trends and ideas to welcome the new bull cycle. Most of these have now become top topics in the crypto space, with significant growth observed in price action, active users, on-chain metrics, developer activity, and funding rounds.

After six months, market sentiment and macro conditions have evolved. It’s time to focus on new catalysts for the remainder of this year and early 2025.

First, you might want to grab a coffee and bookmark this article—it’s going to be a volatile ride.

Over the next six months, macroeconomic conditions and institutional adoption will be pivotal in shaping the future of crypto.

U.S. Macroeconomic Conditions

After two years of record-high interest rates, the first rate cut could come in September. The U.S. presidential election in November currently has prediction markets favoring Donald Trump’s re-election. Both events could serve as tailwinds for the crypto market by year-end.

Ongoing Institutional Adoption

Following the approval of spot BTC ETFs in the U.S., the SEC has greenlit several spot ETH ETFs, setting the tone for the year’s market trajectory. We expect institutions to dive deeper into DeFi, infrastructure, AI, and consumer applications.

Considering these factors, here are seven exciting areas we believe are worth watching for the rest of 2024 and into early 2025.

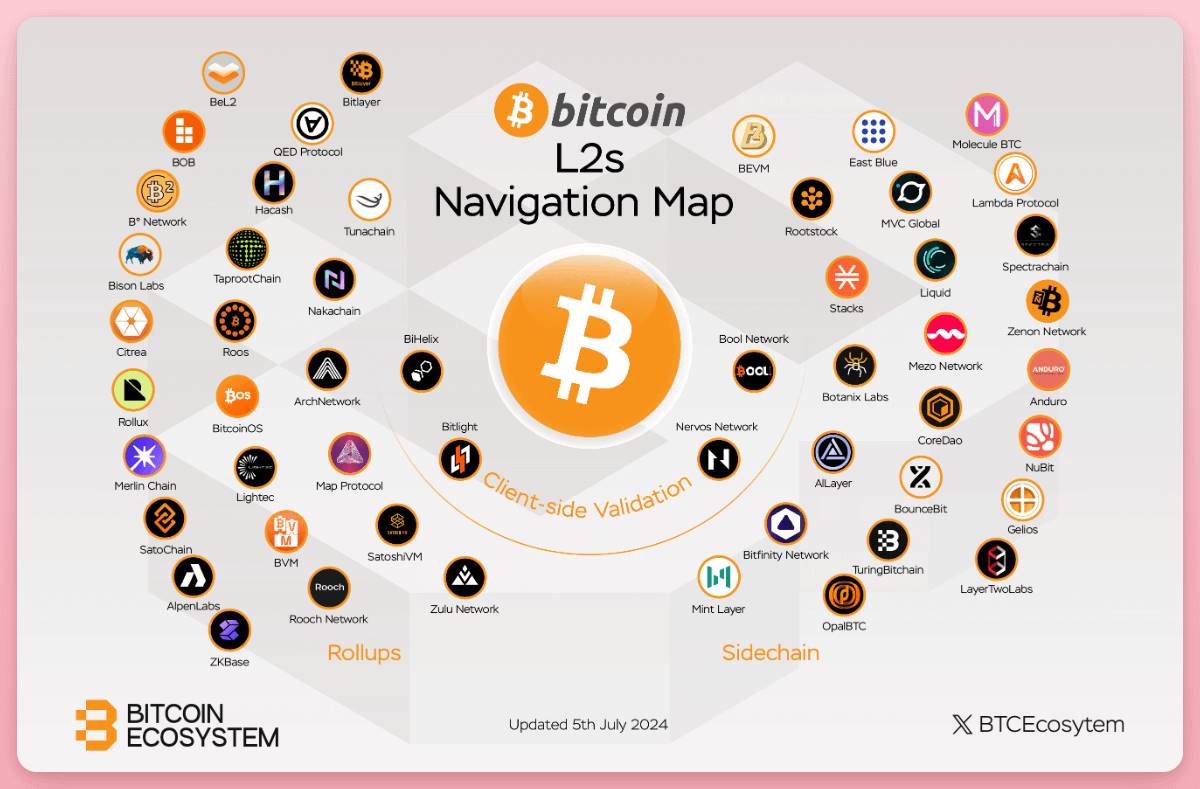

1. Bitcoin Scalability and DeFi

The Bitcoin ecosystem is expanding through ETFs and native cryptographic innovations like Ordinals, BRC-20s, and Runes. However, scalability challenges are becoming increasingly evident. Projects such as @Stacks, @citrea_xyz, @MerlinLayer2, @BitlayerLabs, and @BSquaredNetwork are building Layer 2 solutions for BTC.

Early players in Bitcoin DeFi include @bounce_bit, @babylon_chain, @SolvProtocol, and @MezoNetwork.

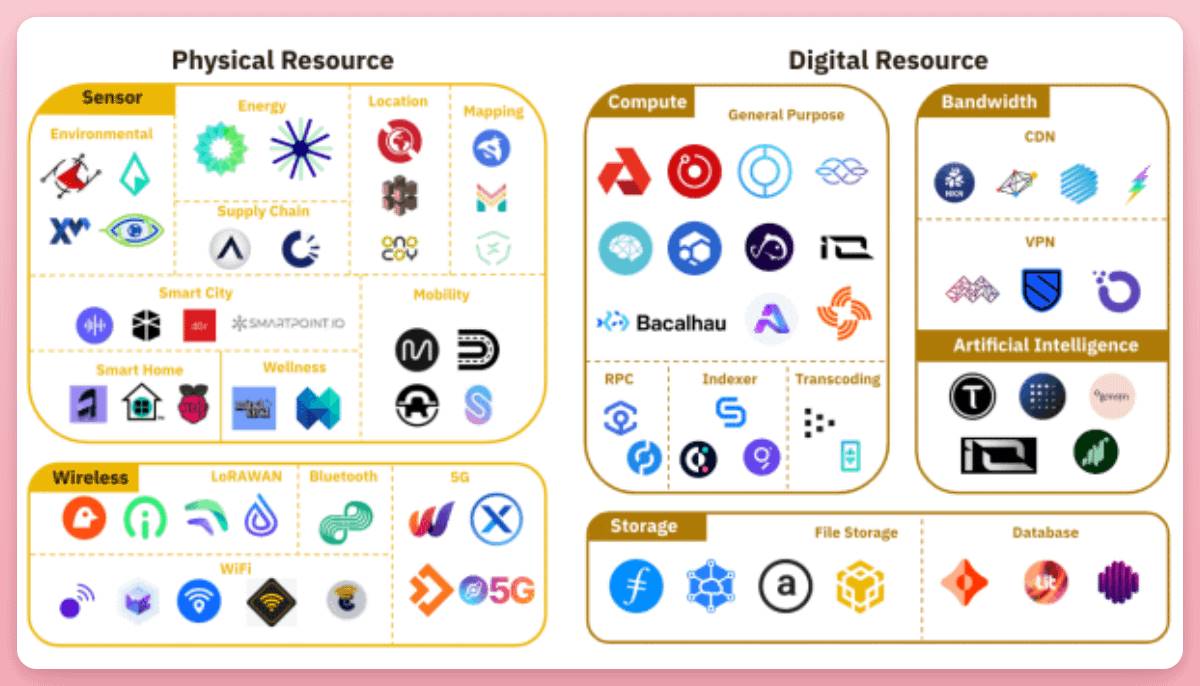

2. Ownership Economy Applications

Blockchain technology enables users to reclaim sovereignty over their personal data, creative content, and computing resources. These applications synergize strongly with the rise of AI and machine learning. Two key areas to watch:

DePin: @AethirCloud, @ionet, @rendernetwork, @Hivemapper

DeSoc: @farcaster_xyz, @LensProtocol

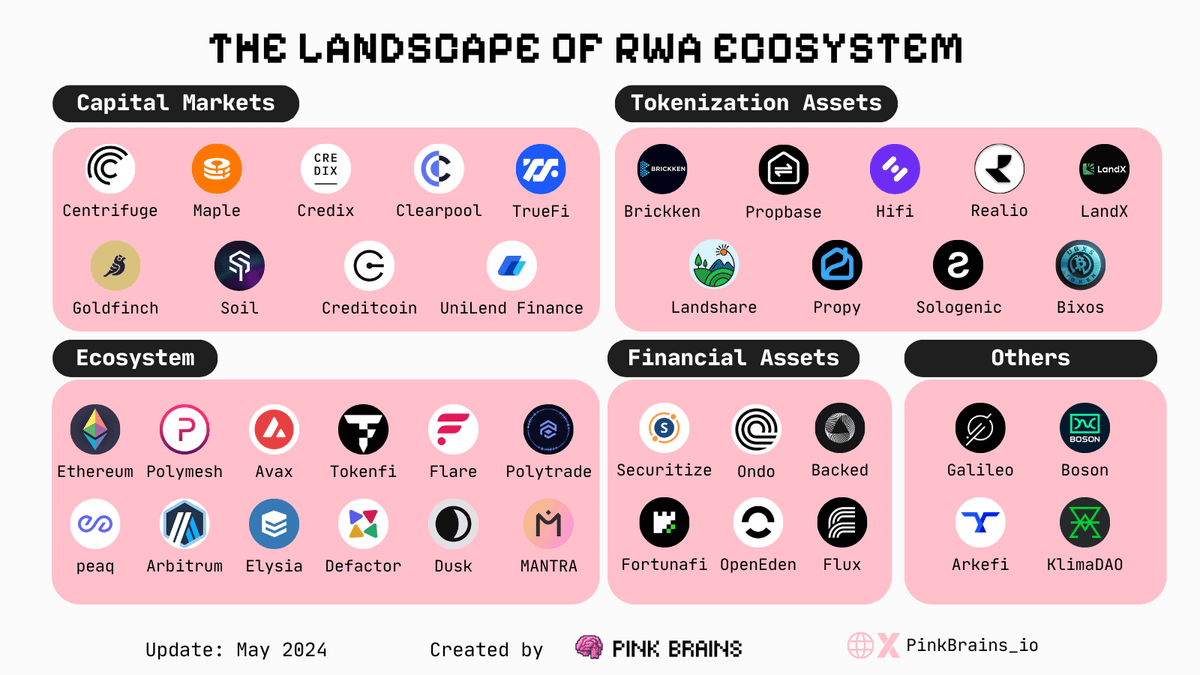

3. Real-World Assets (RWAs)

Despite upcoming rate cuts, we expect RWAs to benefit from a relatively high-interest-rate environment. Projects focused on tokenized Treasuries: @OndoFinance, @MountainUSDM, @tangibleDAO, @MakerDAO

Institutional and retail lending: @maplefinance

Beyond RWAs, supporting infrastructure such as oracles (@PythNetwork, @chainlink), decentralized identity, interoperability (@LayerZero_Labs, @wormhole), and fully homomorphic encryption (FHE) for data privacy (@mindnetwork_xyz, @zama_fhe) are also expected to gain momentum.

4. Web3 Gaming

Web3 gaming is emerging across genres—from click-to-earn hyper-casual games like @thenotcoin to well-designed titles such as @ParallelTCG, @pixels_online, @playSHRAPNEL, and @PirateNation.

A robust and sustainable in-game economy and fully on-chain game logic will represent the next major leap for Web3 gaming.

5. User Experience Abstraction

Current crypto user experiences are fragmented and complex, spanning over 100 multi-chain environments. Users face numerous challenges managing wallets, interacting with dApps, and handling assets across blockchains.

Account abstraction and Paymaster are becoming the new standard for user onboarding.

But this is just the beginning.

Over the next 6–9 months, expect new advances in chain abstraction, including key management, gas abstraction, transaction abstraction, and cross-chain interoperability.

Keep an eye on key projects: @ParticleNtwrk, @NEARProtocol, @EverclearOrg, @burnt_xion, @lifiprotocol

6. DeFi Sub-Sectors

Broad market recovery will bring significant capital inflows into DeFi. While we haven’t seen a defining "Uniswap moment" yet, certain DeFi sub-sectors are showing strong growth momentum.

-

Restaking / Liquid Restaking (LR): @eigenlayer, @symbioticfi, @solayer_labs, @Karak_Network, @ether_fi

-

Lending: @MorphoLabs, @0xfluid, @aave

-

Derivatives in new market types: @HyperliquidX, @SynFuturesDefi, @WhalesMarket, @DriftProtocol

-

Prediction Markets: @Polymarket, @azuroprotocol

-

Yield: @pendle_fi

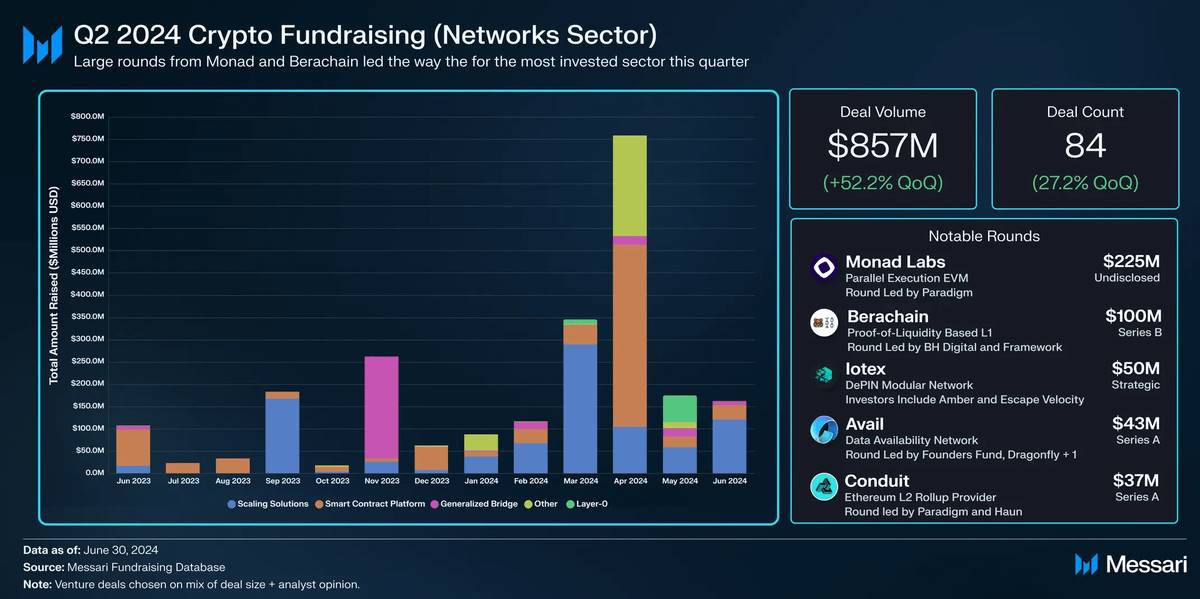

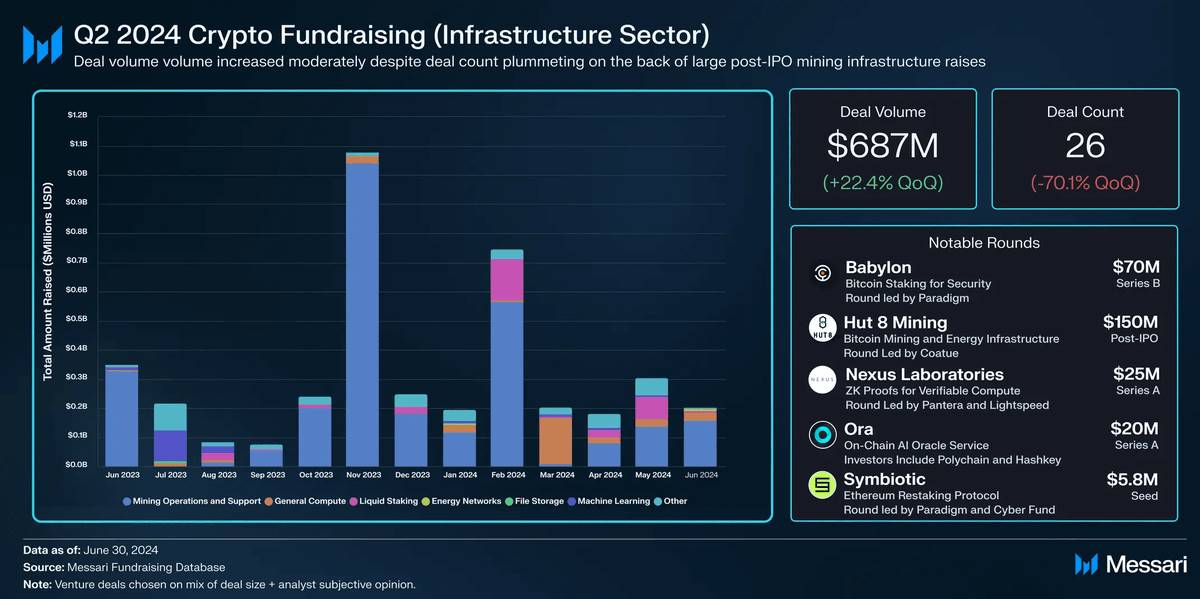

7. New Infrastructure

Infrastructure has raised over $2.58 billion in capital, making it the largest category in venture funding—highlighting VCs' strong interest in scaling solutions, interoperability, modularity, and new blockchain infrastructure.

Some top-funded projects include: @monad_xyz, @berachain

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News