8 DeFi Protocols with Built-in Airdrops and Yields Analyzed

TechFlow Selected TechFlow Selected

8 DeFi Protocols with Built-in Airdrops and Yields Analyzed

These protocols come from different networks and cover various DeFi sectors such as derivatives, yield, DEXs, etc.

Author: ROUTE 2 FI

Translation: TechFlow

Hello everyone!

Wishing you a great Wednesday!

If you're hunting for airdrops, yields, or points programs, here are some potentially promising DeFi protocols.

I plan to update this research report weekly, as it helps me stay current in this space.

Let’s dive in.

A New Week—8 Promising DeFi Protocols

Below are some under-the-radar opportunities—yields, airdrops, and more—in protocols you can explore today. These protocols span different networks (EVM, non-EVM, or Cosmos) and cover various DeFi sectors such as derivatives, yield, DEXs, and more. These projects stand out due to strong backing and earning potential, but none should be taken as financial advice—please do your own research before engaging:

1/ Zircuit

Zircuit is an EVM-compatible Layer 2 (L2) protocol that enables AI-level security at the sequencing layer. Unlike thousands of existing L2s, Zircuit introduces a novel on-chain security approach that protects users from smart contract exploits and malicious actors, while also offering low fees and fast transactions to improve user experience. They have secured undisclosed funding from Binance Labs and Pantera. The network is currently in testnet phase, with mainnet launch upcoming:

To prepare for mainnet, they’ve launched a points program where users can stake supported assets to earn Zircuit Points, which may convert into tokens during the token generation event (TGE). Thanks to support for various LRT assets, users can simultaneously earn other yields such as staking APR, restaking APR, and LRT points while accumulating Zircuit Points. Over $2.9 billion in assets have already been staked:

The best asset to stake right now is $mETH, which offers 5x daily rewards in the Methamorphosis campaign, generating $COOk expected to become the governance token $cMETH by October.

2/ Allora

Currently, machine learning (AI) is monopolized by industry giants, limiting transparency and accessibility. Allora aims to build a self-improving decentralized AI network powered by contributors within its ecosystem, including workers who provide AI inference, judges who evaluate the quality of inference, and consumers who request and pay for inference services.

Allora isn’t just another AI-themed shell project—it has real use cases like prediction markets. To prove this, they recently partnered with Robonet to build a political trading agent called Pauly, which uses the Allora network to analyze political markets on Polymarket, leveraging AI-driven analytics and real-time market data to identify trading opportunities such as undervalued or overvalued markets:

They’ve also raised $33.75 million, backed by top-tier investors including Polychain and Delphi Ventures. Their tokenomics are community-centric, offering multiple ways for $Allo holders to participate in the network, while maintaining a Bitcoin-like emission schedule that decreases over time, supporting long-term token value. The Allora network is currently in testnet phase, with several ways to get involved—participate in Galxe campaigns, Zealy quests, or run a node.

3/ Superposition

Superposition is a Layer 3 (L3) chain built on the Arbitrum stack, designed to enable decentralized applications (dApps) with native liquidity and utility mechanisms. Beyond speed and low fees, Superposition builds a reward system via a new yield mechanism called Super Assets. When assets are bridged to Superposition, they become Super Assets—tokens that generate yield as you hold or use them—aligning with their slogan, "the first blockchain that pays you to use it." They haven't announced any funding rounds yet, but they’re working closely with the Arbitrum team, and investments are expected to be revealed soon:

Their incentivized testnet has achieved significant milestones, with over 140,000 addresses completing more than 1.1 million transactions. There are currently three ways to engage with the testnet: first, swapping on Longtails, a V3 AMM using Uniswap’s concentrated liquidity model; second, completing social tasks on Intract; and finally, claiming your meow domain name, similar to Ethereum Name Service (ENS) but on Superposition. Be sure to turn on notifications for their social media accounts to catch future events.

4/ Movement Labs

Unlike other Layer 1 (L1) chains aiming solely to outperform Ethereum, Movement builds an L1 focused on enhancing user asset security by leveraging the Move programming language developed by Facebook. This simplifies secure development of common blockchain tasks like asset transfers and minting. Movement has two flagship products: M1, a permissionless Move blockchain, and M2, the fastest and most secure EVM-compatible Layer 2 (Mevm) settling on Ethereum and using Celestia for data availability. Users can seamlessly interact between Move and EVM environments, with M1 serving as the PoS sequencer network for M2. Movement secured undisclosed funding from Binance and raised $41.4 million, backed by top investors including Polychain.

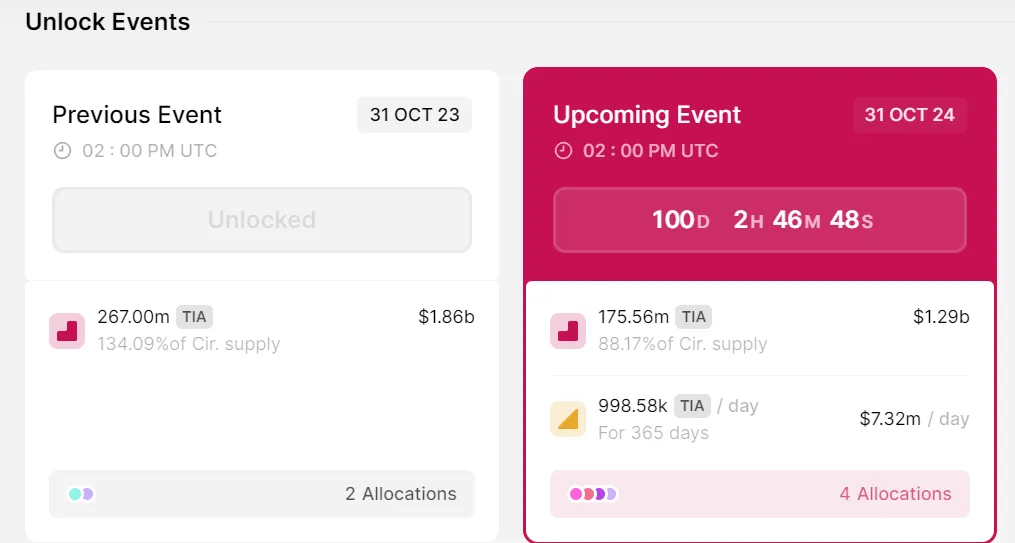

The network is currently in testnet phase, with various tasks available as highlighted in their documentation. Rumors suggest TIA stakers might also qualify for a future airdrop, but manage your positions carefully—88% of their token supply is about to unlock, so avoid getting caught in potential VC sell-offs.

5/ Gunzilla Games

Gunzilla Games is a AAA game studio and developer of the Gunz blockchain. Unlike many empty gaming projects that merely sell inflated tokens to users, Gunzilla focuses on building an interactive ecosystem where players are rewarded with in-game assets convertible into NFTs and the $Guns token. Their team comprises veterans from fintech, video games, and more, demonstrating their ability to win over both Web3 gamers and broader Web2 audiences. They've also raised $76 million from notable investors like Animoca Brands.

Gaming remains one of the most underrated sectors in crypto, with only a small fraction participating—making their rewards especially attractive, as we’ve seen with Ace. Gunzilla is currently in testnet phase, with mainnet rumored to launch this year or early 2025. They have two flagship titles: Playoffgrid and Guns blockchain.

Playoffgrid isn’t live yet, but you can apply to become a pioneer in the #OTGPioneers program, granting access to pre-release versions and exclusive rewards that could include airdrops. Guns currently runs an ongoing points program rewarding user engagement—only 20K points are needed to rank in the top 200:

Here’s a helpful YouTube video showing how to play and maximize your points.

6/ Usual Money

Stablecoins are among the most profitable areas in crypto—Tether’s net income in Q1 even surpassed BlackRock’s earnings. Yet, these staggering numbers benefit Tether itself far more than its holders. Now, imagine being able to own a piece of Tether? That’s exactly what Usual Money offers: a decentralized RWA (real-world asset) stablecoin that redistributes ownership and governance via the Usual token. Usual Money’s core mission is to break traditional finance’s pattern of concentrating wealth among a few shareholders and return power to ecosystem participants:

They’ve raised $7 million from prominent investors including Mantle and GSR, at a $75 million valuation.

They recently launched mainnet and kicked off an initiative where participants can accumulate “Pill” points by holding their stablecoin USDO or providing liquidity to incentivized pools:

7/ Plume

While nearly all Layer 2 (L2) chains are mere forks of existing L2s without unique value propositions—rendering most as “ghost chains”—Plume carved out its niche by embracing the RWA (real-world asset) concept championed by Larry Fink of BlackRock. Plume is the first modular L2 blockchain dedicated to RWAs, integrating asset tokenization and compliance providers directly on-chain. Its primary goal is to streamline RWA deployment and attract high-quality buyers to boost ecosystem liquidity. Plume secured $10 million in funding led by Haun Ventures, with participation from top investors like Galaxy.

The network is currently in testnet phase and incentivizes community participation. Active users can earn Plume Points throughout the campaign by completing tasks, inviting friends, and more:

8/ Blum

Unlike Telegram bots limited to a single chain—which makes cross-chain trading cumbersome—Blum is a hybrid Telegram trading bot set to operate across over 30 chains, including both EVM and non-EVM networks like Solana, Ton, and Cosmos. Their team’s strength earned them a spot as one of the winners in Binance’s MVB Season 7, selected from 700 competing projects:

Image content:

MVB has always been highly competitive, receiving over 700 applications in Season 7. After rigorous screening, only 1.8% of applicants were accepted, welcoming 13 teams into the Season 7 MVB accelerator, listed alphabetically by category:

DeFi

BitU is a crypto-native collateralized stablecoin protocol leveraging off-chain liquidity and efficiency to deliver higher yields.

Blum is a hybrid exchange offering universal token access through gamified features in Telegram mini-apps.

Though they haven’t announced funding yet, their user growth is astonishing: 2.9 million Twitter followers, 4.7 million YouTube subscribers, and over 10 million users. Currently, Blum’s Telegram bot is live—you can earn Blum Points (BP) by completing social tasks. The more, the better.

That’s all for today, folks!

Hope you enjoyed this piece.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News