Analyzing Ethereum ETFs: Expected Monthly Inflows of $1 Billion, with DeFi Ecosystem Benefiting from Sustained Net Inflows

TechFlow Selected TechFlow Selected

Analyzing Ethereum ETFs: Expected Monthly Inflows of $1 Billion, with DeFi Ecosystem Benefiting from Sustained Net Inflows

Grayscale's new mini ETH ETF could slow the outflows from ETHE.

Author: ASXN

Compiled by: TechFlow

Ethereum ETFs are set to launch on July 23. The market is overlooking many dynamics related to ETH ETFs that were absent during the BTC ETF rollout. We will explore liquidity forecasts, ETHE unwinding, and ETH's relative liquidity:

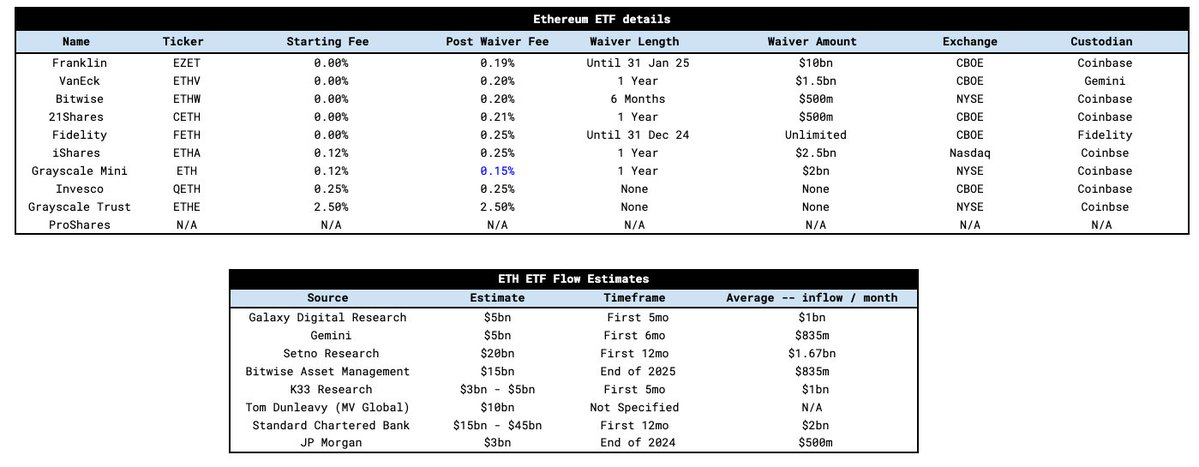

The fee structure for these ETFs mirrors that of BTC ETFs. Most providers waive fees during an initial period to help accumulate assets under management (AUM). Similar to BTC ETFs, Grayscale maintains its ETHE fee at 2.5%, a full order of magnitude higher than other providers. The key difference this time is the introduction of Grayscale’s mini ETH ETF—a product not present in the earlier BTC ETF landscape.

The mini trust is a new ETF product launched by Grayscale, initially disclosed with a fee of 0.25%, comparable to other ETF providers. Grayscale's strategy is to charge inactive ETHE holders the 2.5% fee while directing more active and fee-sensitive ETHE investors to their new product instead of letting them migrate to lower-fee alternatives like Blackrock’s ETHA ETF. After other providers undercut Grayscale’s initial 25 basis point fee, Grayscale reduced the mini trust fee to just 15 basis points, making it the most competitive offering. Additionally, they transferred 10% of ETHE AUM into the mini trust and gifted shares of this new ETF to existing ETHE holders. This transition occurred on a tax-free basis, so it was not a taxable event.

As a result, outflows from ETHE are expected to be significantly milder than those seen from GBTC, as holders simply shift into the mini trust.

Now let’s examine liquidity:

There are numerous estimates regarding ETF liquidity; we list some below. When normalized, these estimates average around $1 billion per month. Standard Chartered provides the highest estimate at $2 billion monthly, while JPMorgan’s is the lowest at $500 million.

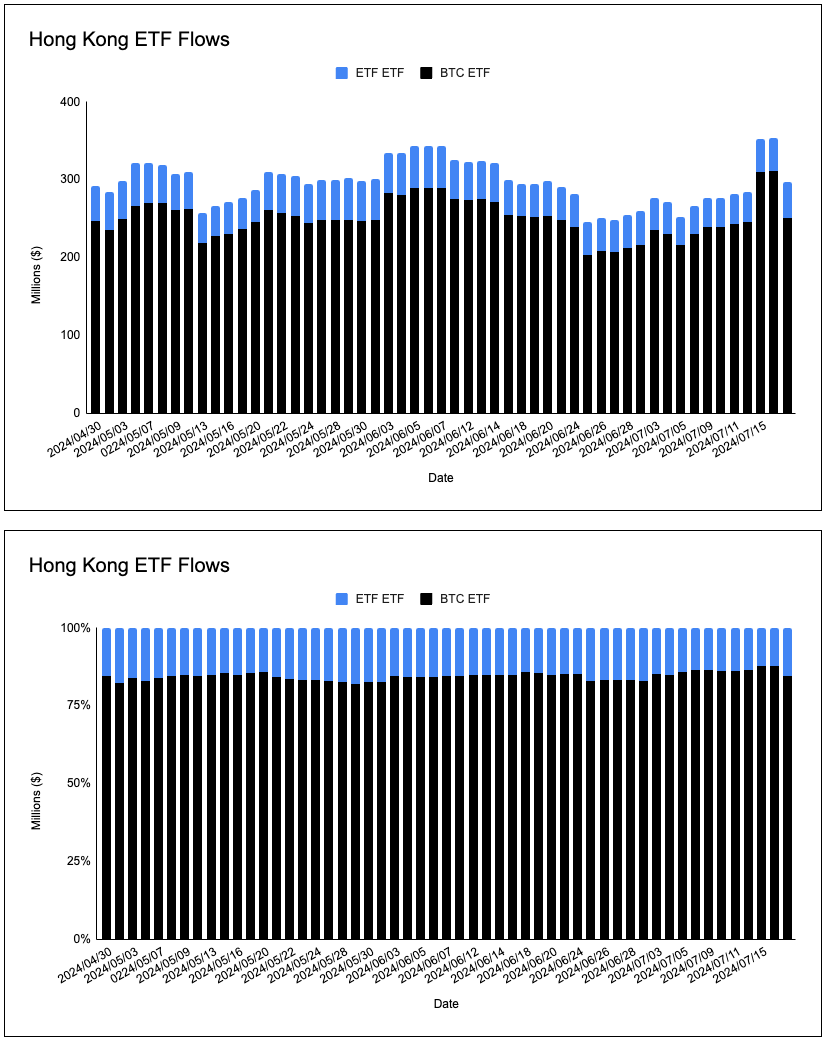

Fortunately, we can leverage data from Hong Kong and European ETPs, along with the disappearance of ETHE discounts, to better estimate liquidity. Looking at the AUM distribution of Hong Kong ETPs, two conclusions emerge:

-

Relative to market cap, BTC and ETH ETP AUM is more skewed toward BTC. The market cap ratio is 75:25, whereas the AUM ratio is 85:15.

-

The BTC-to-ETH ratio within these ETPs remains relatively constant and aligns with the BTC-to-ETH market cap ratio.

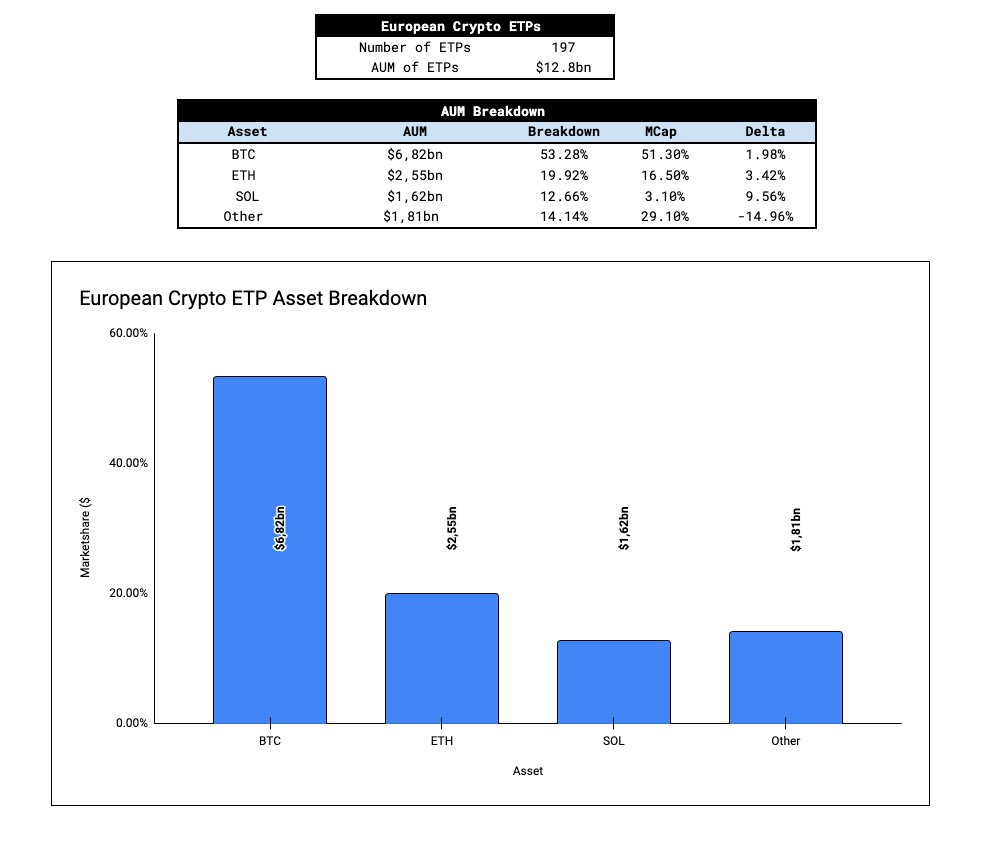

In Europe, we have a larger sample size—197 crypto ETPs with total AUM of $12 billion. Data analysis shows that European ETP AUM distribution broadly reflects Bitcoin and Ethereum’s market capitalizations. Solana’s allocation is disproportionately high relative to its market cap, coming at the expense of “other crypto ETPs” (any non-BTC, ETH, or SOL). Excluding Solana, a trend emerges—globally, AUM distribution between BTC and ETH roughly follows market-cap-weighted proportions.

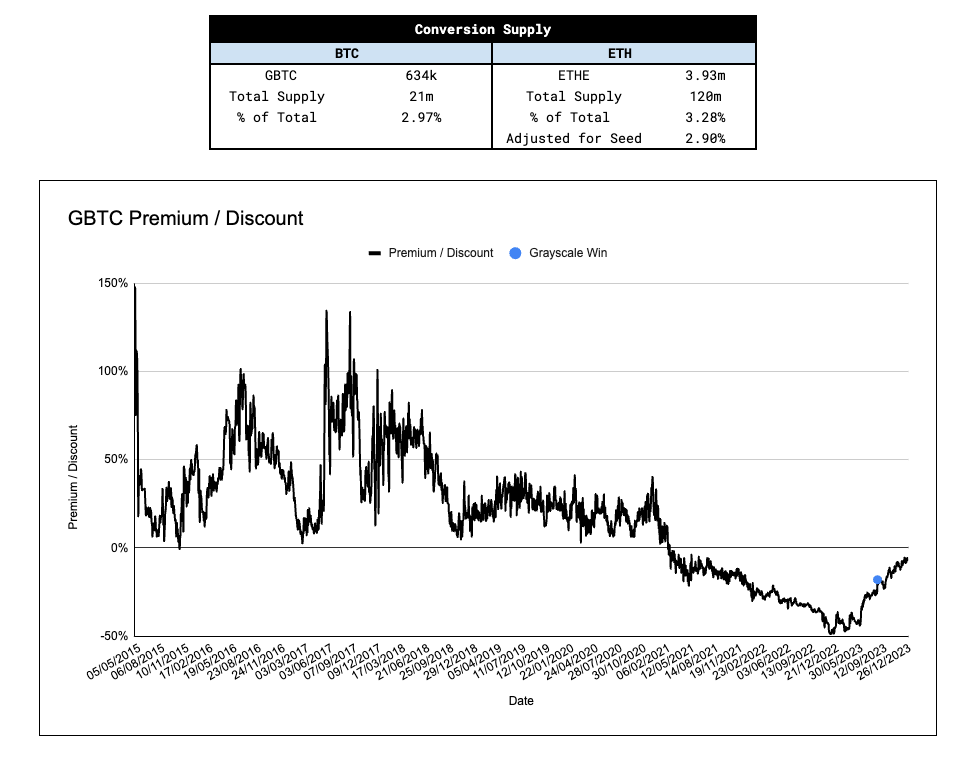

Given that GBTC outflows were driven by a "sell the news" narrative, assessing the potential for ETHE outflows is critical. To model potential ETHE outflows and their price impact, it helps to study the percentage of ETH supply held within the ETHE vehicle.

After adjusting for Grayscale’s mini seed capital (10% of ETHE AUM), the ETHE vehicle holds a proportion of ETH supply similar to GBTC’s holdings at launch. While the exact split between turnover and exit within GBTC outflows remains unclear, if we assume a similar ratio, then ETHE outflows would have a price impact comparable to GBTC.

Another overlooked key point is ETHE’s premium/discount relative to net asset value (NAV). Since May 24, ETHE has traded within 2% of NAV—whereas GBTC first traded within 2% of NAV on January 22, just 11 days after its conversion to an ETF. The approval of spot BTC ETFs and their impact on GBTC were gradually priced in by the market, and the convergence of ETHE’s discount to NAV has been even more clearly telegraphed through GBTC’s precedent. By the time ETH ETFs launch, ETHE holders will have had two months to exit near NAV. This is a crucial factor in curbing ETHE outflows, especially direct sell-offs into the open market.

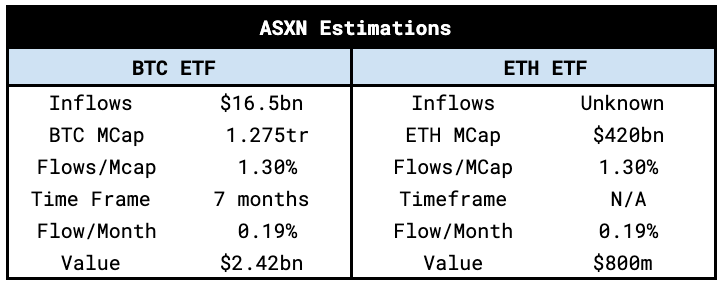

At ASXN, our internal estimates suggest monthly inflows between $800 million and $1.2 billion. This is derived by calculating the market-cap-weighted average of Bitcoin’s monthly inflows and adjusting proportionally for Ethereum’s market cap.

Our estimates are supported by global crypto ETP data, which indicates that market-cap-weighted baskets are the dominant strategy (we may see rotation flows from BTC ETFs adopt similar approaches). Moreover, given ETHE trading at par pre-launch and the introduction of the mini trust, we remain open to upside surprises.

Our ETF inflow estimates are proportional to respective market caps, so price impacts should be similar. However, it’s also important to assess how much of each asset is liquid and ready for sale—the smaller the “float,” the more sensitive the price response to inflows. Two specific factors constrain ETH’s liquid supply: native staking and tokens locked in smart contracts. As such, there is less liquid and sellable ETH compared to BTC, making ETH more sensitive to ETF inflows. That said, the liquidity gap between the two assets isn’t as large as some suggest (ETH’s cumulative +-2% order book depth is 80% of BTC’s).

Our floating supply estimates are as follows:

As we approach ETF launch, understanding Ethereum’s reflexivity is crucial. The mechanism resembles BTC’s, but Ethereum’s burn mechanism and its robust DeFi ecosystem amplify the feedback loop. The reflexive cycle looks roughly like this:

ETH inflows into ETH ETF → ETH price rises → increased interest in ETH → increased DeFi/chain usage → improved DeFi fundamentals → increased EIP-1559 burns → reduced ETH supply → ETH price rises → more ETH inflows into ETH ETF → increased interest in ETH → …

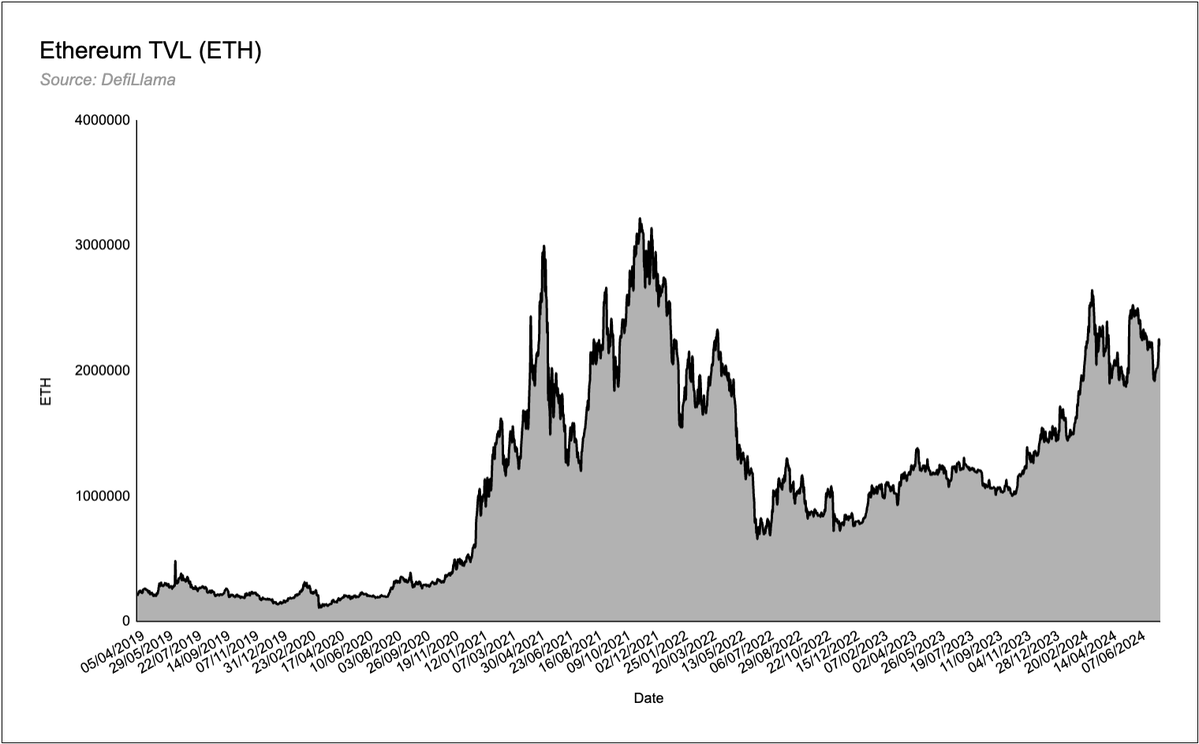

One major factor missing from BTC ETFs is the ecosystem's "wealth effect." In the emerging Bitcoin ecosystem, we haven’t seen significant reinvestment of gains back into base-layer projects or protocols, despite niche interest in ordinals and inscriptions. Ethereum, as a "decentralized app store," has a full ecosystem poised to benefit from sustained inflows into the base asset. We believe this wealth effect is underappreciated, especially in DeFi. With $20 million ETH ($63 billion) in total value locked (TVL) across Ethereum DeFi protocols, rising ETH prices make DeFi more attractive as dollar-denominated TVL and revenue surge. ETH possesses reflexivity that the Bitcoin ecosystem lacks.

Other considerations:

-

How will rotation flows from BTC ETFs into ETH ETFs unfold? Assume some BTC ETF investors want diversification without increasing their net crypto exposure. Traditional finance (TradFi) investors, in particular, tend to favor market-cap-weighted strategies.

-

How well do traditional finance players understand ETH as an asset and Ethereum as a smart contract platform? Bitcoin’s “digital gold” narrative is simple and widely known. How well will narratives around Ethereum—as settlement layer for the digital economy, three-body asset theory, tokenization, etc.—be understood?

-

How will prevailing market conditions affect ETH flows and price action?

-

Traditional finance has already selected two crypto assets to bridge into their world—Bitcoin and Ethereum. These assets are now mainstream. How will the introduction of spot ETFs change the perception of ETH among traditional finance capital allocators, especially since they can now offer a fee-generating product? TradFi’s appetite for yield makes Ethereum’s native staking rewards a highly compelling proposition. We believe staking-enabled ETH ETFs are a matter of when, not if. Providers could offer zero-fee products while earning backend yields from staking—returns an order of magnitude higher than standard ETH ETFs.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News