Aerodrome, Which Outperforms Uniswap on Base, Did What Right?

TechFlow Selected TechFlow Selected

Aerodrome, Which Outperforms Uniswap on Base, Did What Right?

How Did Aerodrome, the Emerging MetaDEX on Base, Capture Uniswap's Market Share?

Written by: Blockworks Research

Translated by: Alex Liu, Foresight News

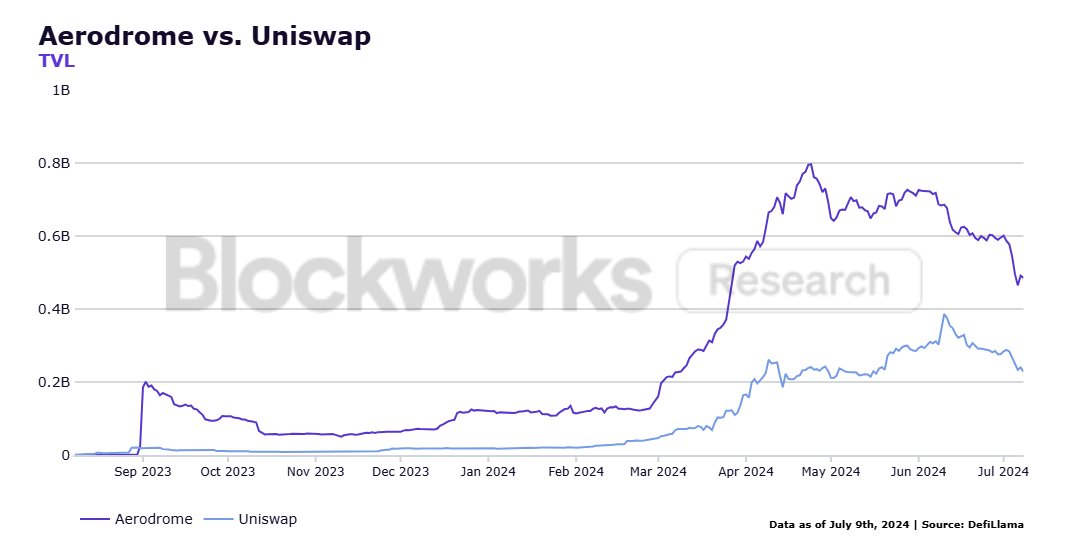

@AerodromeFi is a "MetaDEX," combining elements from various DEXs such as Uniswap V2 and V3, Curve, Convex, and Votium. Since its launch, it has become the largest protocol on Base by TVL, with over $495 million in total value locked—more than double that of Uniswap on Base.

TVL growth comparison between Aerodrome and Uniswap on Base

Architecture

Aerodrome’s success can be attributed to its unique architecture—which rebalances incentives among different protocol participants, including traders, LPs, and protocols seeking liquidity for their tokens—implemented through its ve-token governance model.

Participants must lock AERO tokens to earn fees. Locking tokens into veAERO allows users to direct the protocol’s token emissions to specific pools, where they then receive 100% of both fees and emissions.

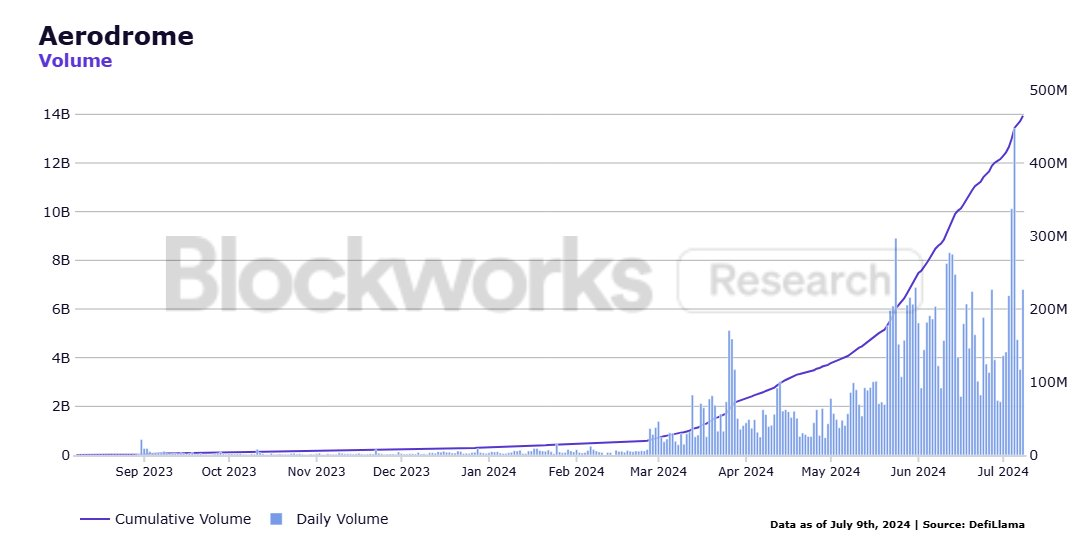

Due to these incentives, voters direct emissions toward the highest-volume pools to maximize rewards. This creates a flywheel effect that attracts LPs (liquidity providers), who in turn offer traders low-slippage trading experiences for popular token pairs. The result is significant protocol growth, clearly reflected in surging trading volumes.

Innovation

Recent protocol upgrades include Relay and Slipstream. Relay automates governance for liquidity providers, allowing them to deposit voting tokens into vaults to optimize vote allocation and automatically compound rewards.

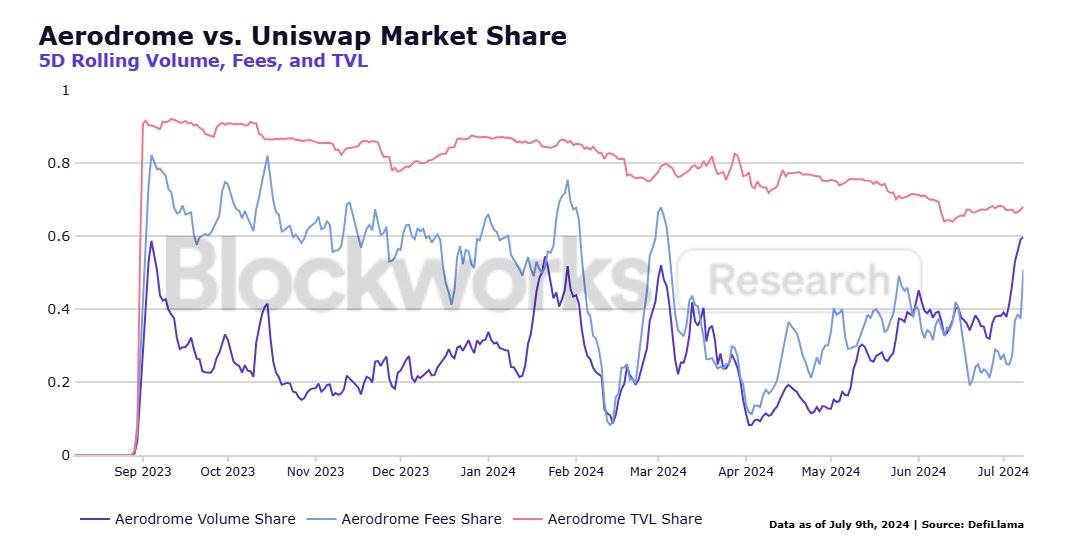

Slipstream brings concentrated liquidity pools to Aerodrome, offering better execution prices for high-volume token pairs. Since Slipstream’s launch on April 22, Aerodrome has outperformed Uniswap in TVL, fees, and share of trading volume, capturing 68%, 51%, and 60% respectively.

Ecosystem

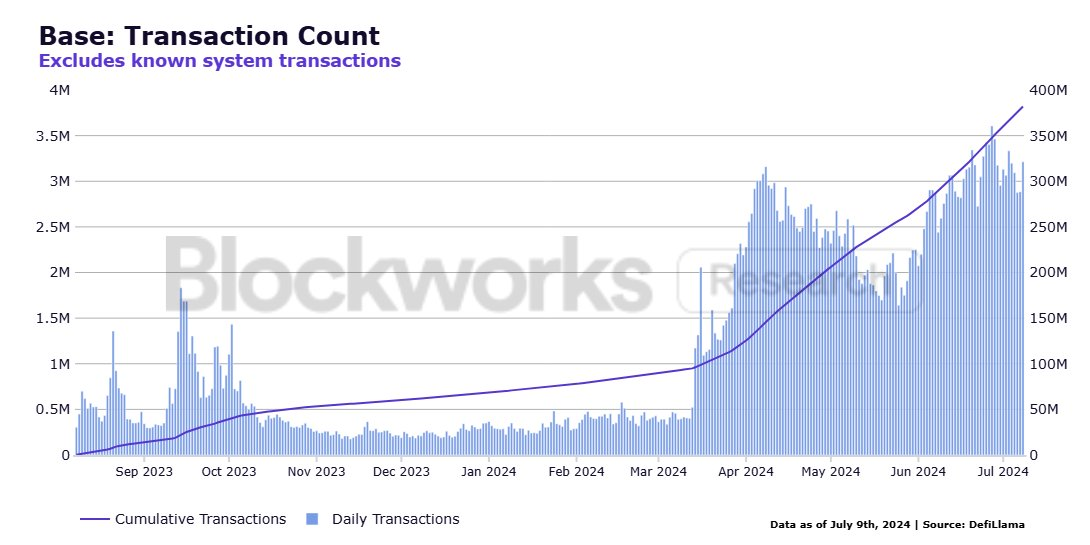

Another key factor behind Aerodrome’s success is its strategic bet on Base. The Base ecosystem has experienced explosive growth since launch, currently processing over 3 million daily transactions (excluding known system transactions).

Coinbase’s smart wallet, with over 110 million customers, will provide a mechanism to onboard millions of users directly onto Base via simple, Web 2.0-like user interfaces.

The overall correlation between Base’s daily transaction volume and the AERO token stands at 0.86. While it's difficult to prove statistical significance, this remains compelling evidence that AERO stands to benefit from increased adoption of Base.

Aerodrome has seen remarkable growth, but investors should also remain aware of potential risks, including competition from Uniswap. More information can be found in @_dshap's latest report.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News