Airdrops aren't dead, but don't chase trending projects too aggressively

TechFlow Selected TechFlow Selected

Airdrops aren't dead, but don't chase trending projects too aggressively

Study projects that lack popularity but have strong funding and excellent products, and participate as early as possible.

Author: Axel Bitblaze

Translation: TechFlow

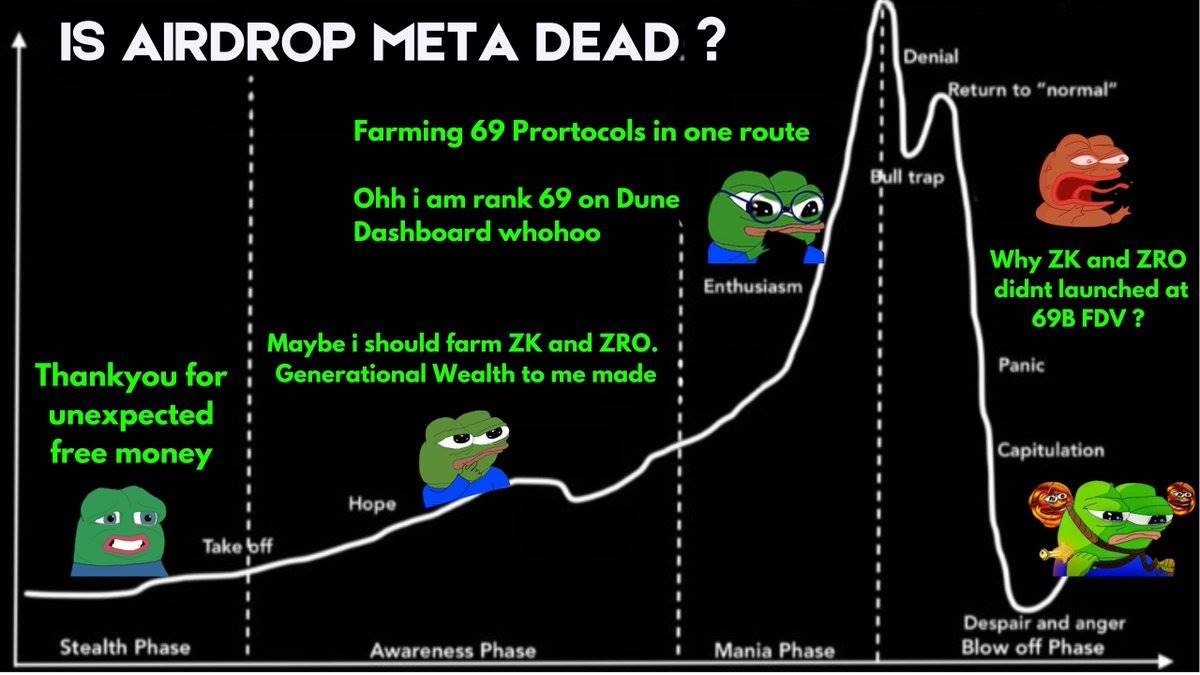

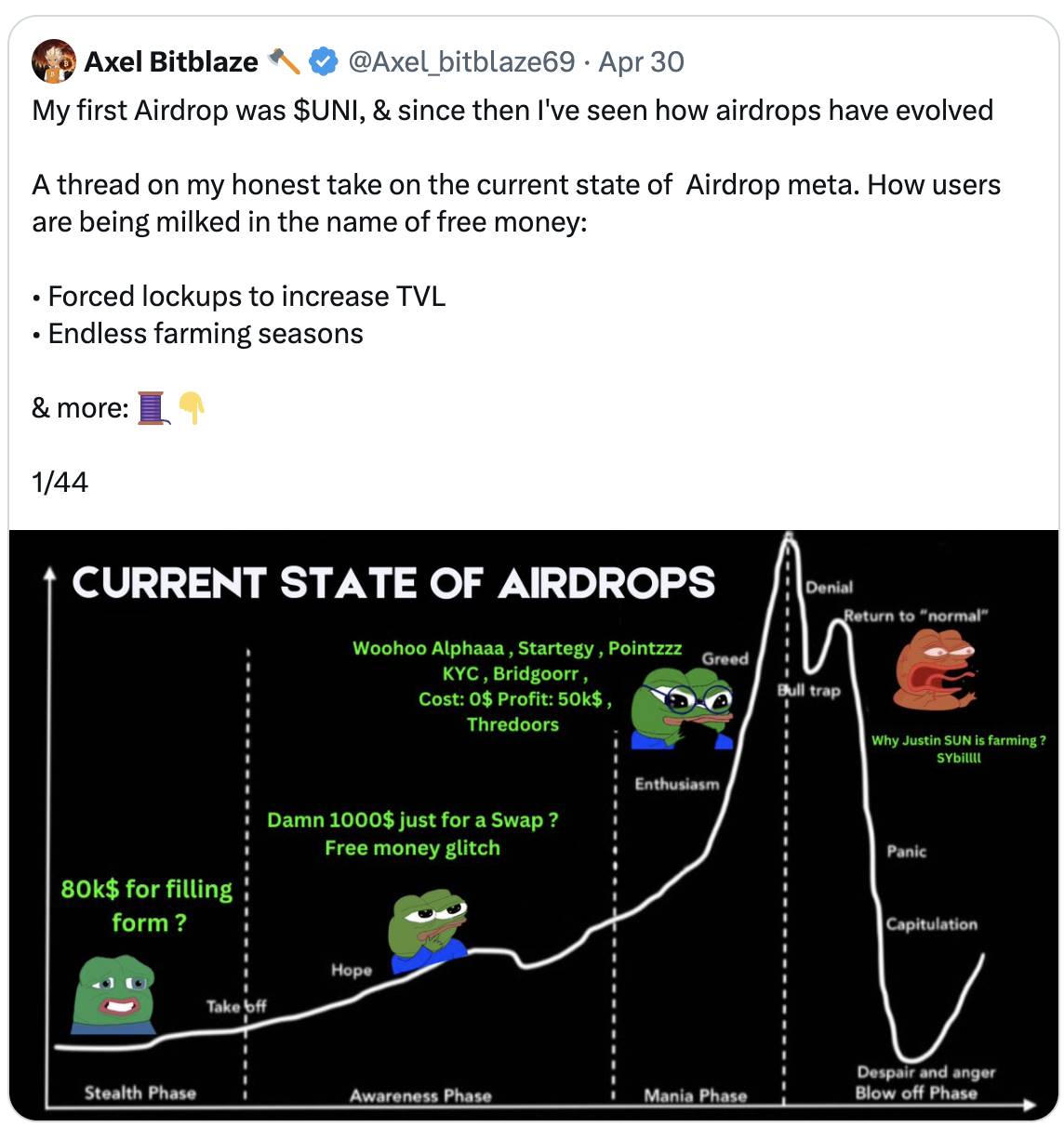

With all major airdrops (like $ZRO and $ZK) completed, the sentiment around airdrops seems to have cooled down. So, is the airdrop beta over? Are they still worth farming? What’s next for airdrops? I’ll share my thoughts in this thread.

What’s Next for Airdrops?

A few months ago, I wrote about the "current airdrop beta," mentioning three major unlaunched airdrop projects—now all are complete. Here’s my take on what's coming next.

(See tweet)

Are Airdrops Dead?

Short answer: No. The longer answer: airdrop dynamics will change.

Think of it like gaming—there are always those overly powerful cheats or strategies that get nerfed once too many players start using or abusing them.

Airdrops are no different—old methods will be weakened, but that doesn’t mean the game is over.

Before we dive in, let’s break down the key factors impacting airdrops and how to work with them:

-

Funding and valuation;

-

Level of hype and dilution;

-

Market sentiment and FDV at launch;

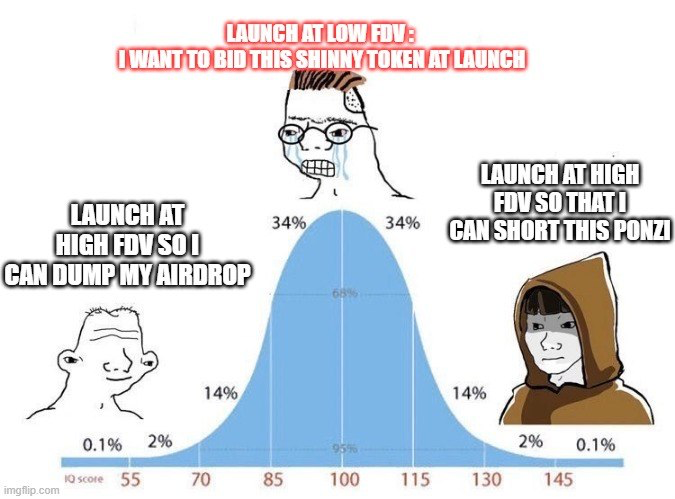

There’s been a lot of talk lately about FDV at launch, but I see this as part of a bigger picture:

-

Retail investors want projects to launch at a low FDV so they can buy new tokens and profit.

-

Airdroppers want high FDV at launch so they can sell immediately.

Projects are squeezed from both sides:

-

Retail: “Your token is too expensive—I won’t provide exit liquidity for farmers.”

-

Farmers/Community: “List at a good FDV, otherwise the airdrop is peanuts, and we’ll dump hard on you.”

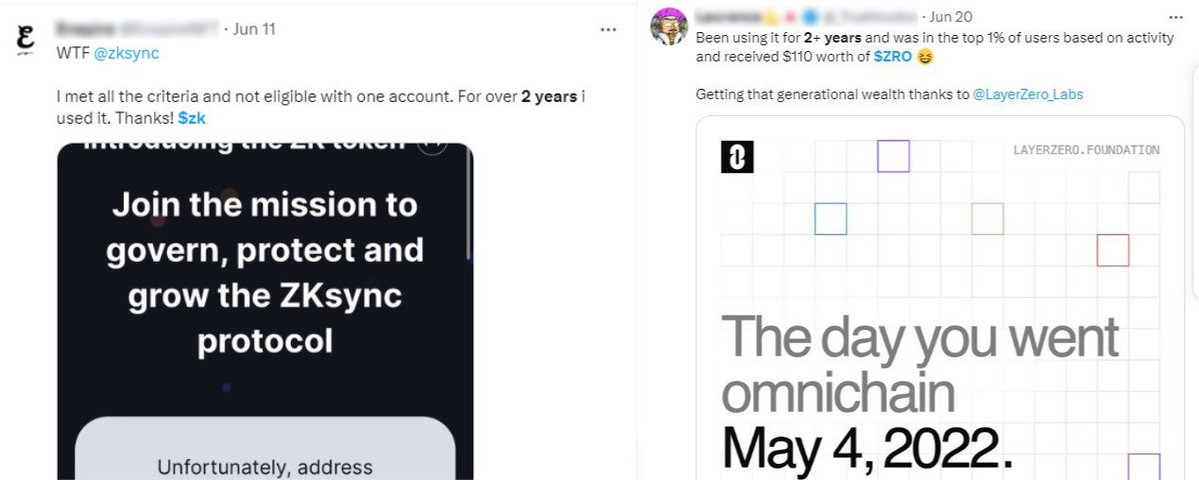

Current situation? It’s project vs farmer warfare.

Projects are trying to prevent easy farmer exits while pleasing retail by launching at lower FDVs. Retail wins—you now get VC valuations without vesting.

This was the case with recent launches like $ZK and $ZRO, along with current market conditions.

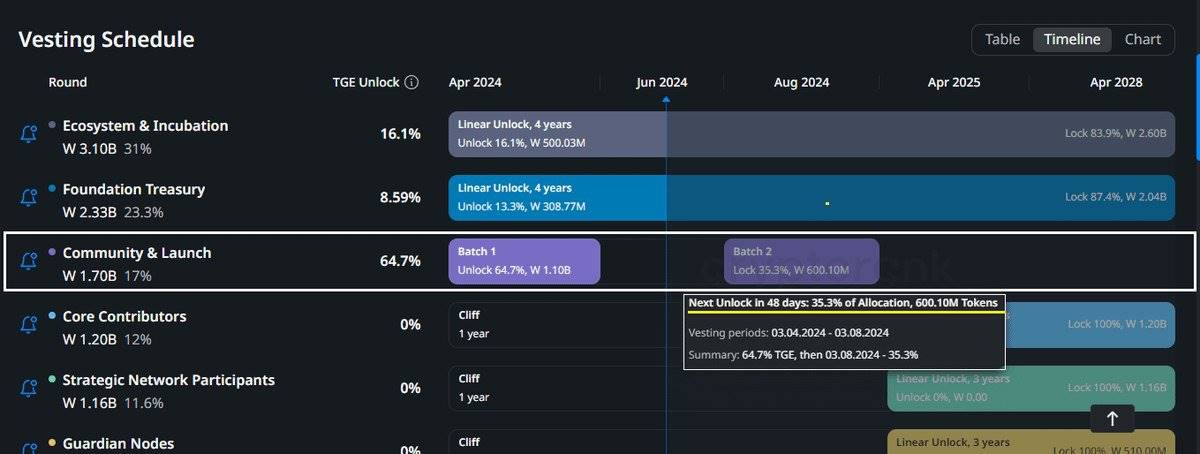

I feel they don’t want farmers cashing out big early, but instead want to sell at a lower valuation now and then dump heavily later, like $SEI and $SUI.

Though $W, $DYM, and $STRK were different—they launched at extremely high FDVs and gradually lost value.

Recipients were happy, but there were almost no market buyers at those valuations. Even staking couldn’t stop $W’s decline.

So factor 1 isn’t under our control. We need to focus on what we can influence.

I believe this adjustment is healthy, and strategy must evolve because the current market has been severely inflated by specific metrics, creating imbalance.

I recall the early ICO era when most IDOs delivered 100–500x returns—people made decent money investing just $50–100.

The same happened in early airdrops—spending $50–100 in gas could yield 100x returns from airdropped tokens, earning $5,000.

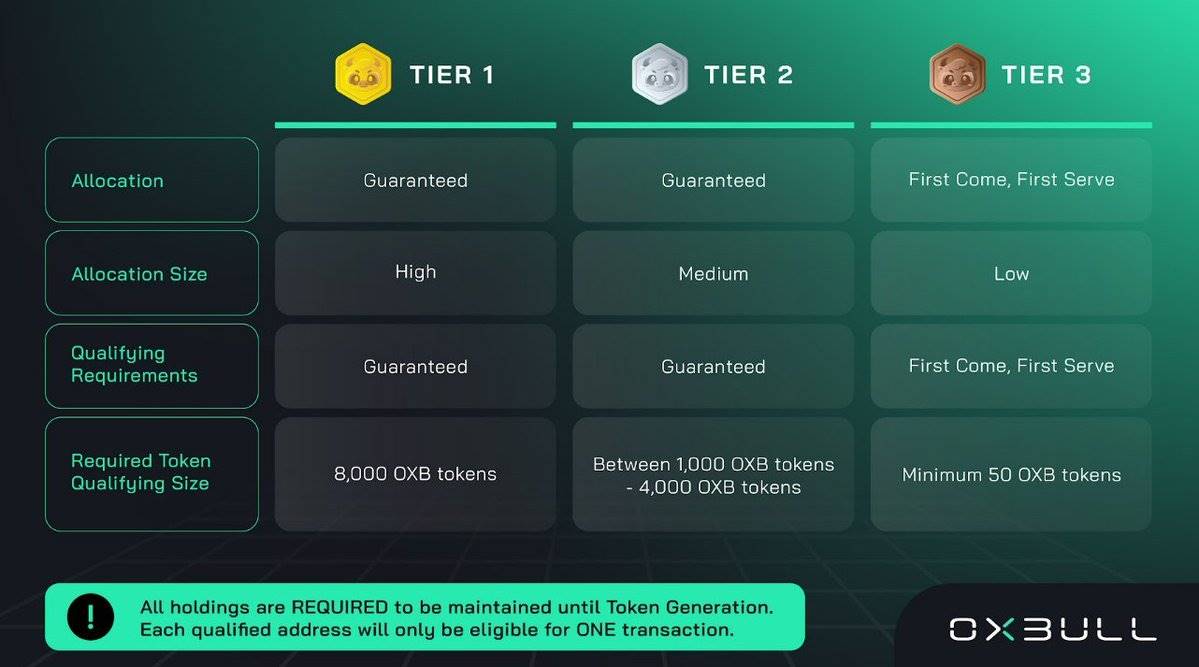

Eventually, this turned into a “pay-to-win” scenario:

-

For IDOs: stake your Launchpad token to secure allocation.

-

For airdrops: provide liquidity and lock capital on their chain/protocol.

What’s the downside?

For IDOs, when the music stops, tokens lose value. For airdrops, you’re praying the protocol doesn’t get hacked.

Anyway, moving on.

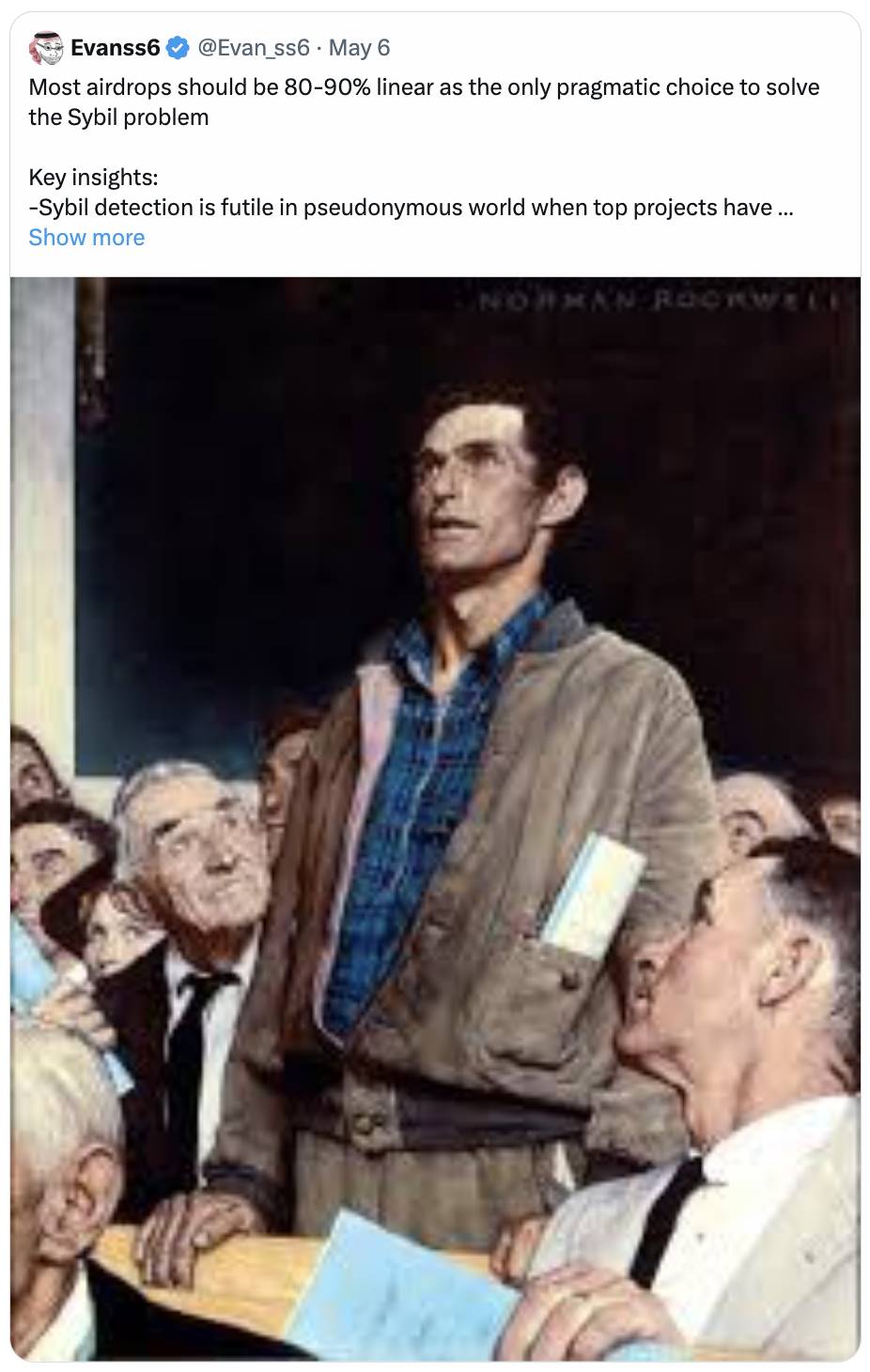

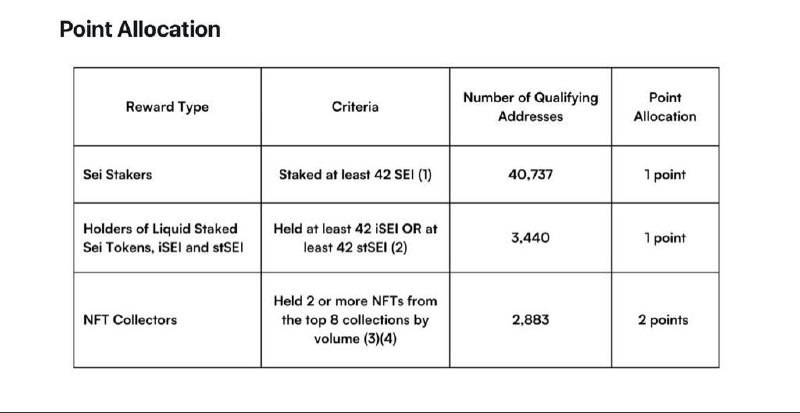

Projects may opt for linear distributions, which aren’t ideal for small-budget farmers—another dilemma.

If you have enough capital, linear airdrops might suit you.

(See tweet)

For Low-Capital Farmers:

As market conditions shift, we need to adjust habits:

-

Stop chasing hyped airdrops excessively.

-

Stop relying on useless Dune dashboards to check rankings—they exaggerate random metrics.

None of your favorite protocols use these metrics.

I think these dashboards only create a mental trap where you feel “I’m not farming well,” leading to a vicious cycle of spending unnecessary gas and time meeting arbitrary criteria.

For low-capital farmers, two strategies stand out:

-

Sybil low-tier allocations: use multiple accounts to claim small rewards.

-

Find less-hyped but well-funded projects and join early.

I believe farming low-tier allocations is a solid risk-reward strategy—you spend little gas and time but can still earn meaningful returns.

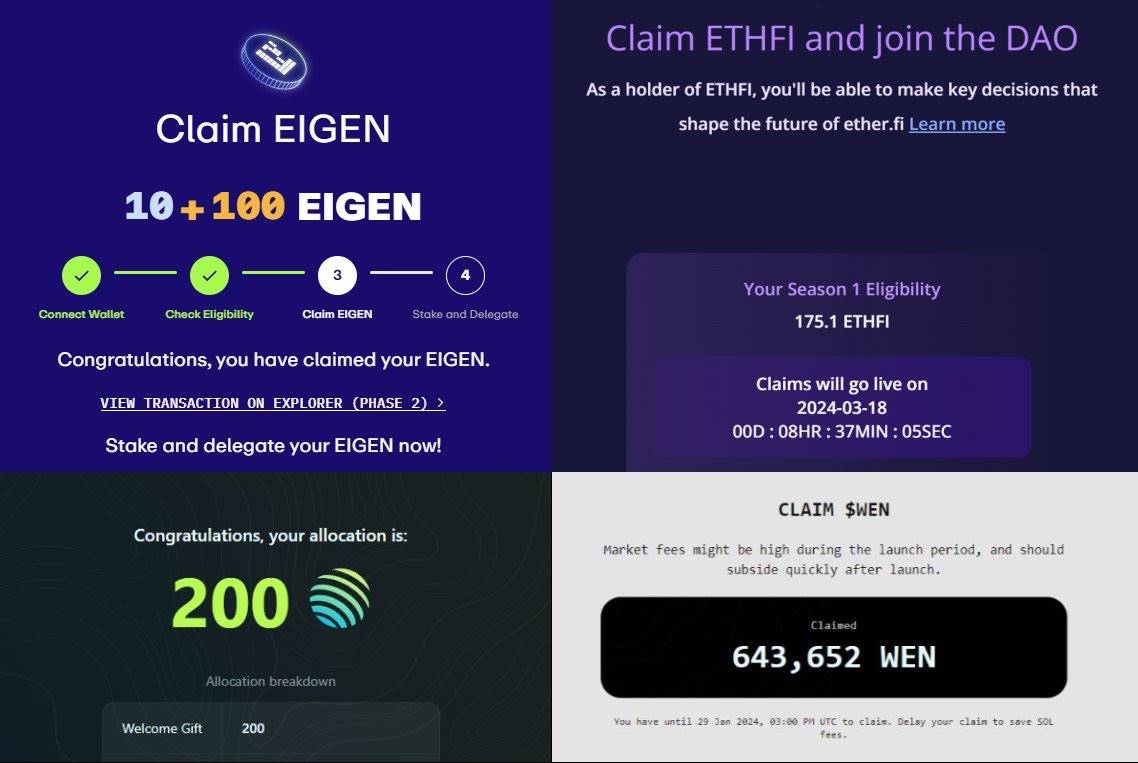

Historical Successes in Low-Tier Farming:

-

Etherfi: last-day deposits earned $900.

-

Eigenlayer: putting just $1 into Eigenlayer earned 110 tokens.

-

Jupiter: a few Solana interactions earned 200 $JUP and $WEN tokens.

Imagine spending $50 on Pendle YT and qualifying for $800 worth of $ETHFI and 110 $EIGEN.

Even in the worst-case scenario—fully linear distribution—you haven’t lost much time or money farming low-tier, so disappointment is minimal.

For long-term farmers of top-tier projects (e.g., $ZRO):

It might feel disappointing if you end up with similar rewards as someone who did minimal farming.

Factor 2: Dilution (or Number of Farmers)

As participation grows, dilution becomes real and rapid.

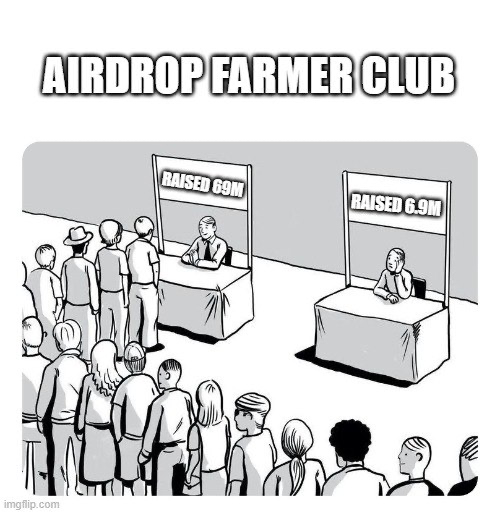

Thus, the next trend is farming projects that raised significant funds but aren’t highly hyped (and there are many).

Fewer farmers mean more tokens per wallet.

In such cases, FDV matters less since tokens are distributed among fewer farmers.

@KintoXYZ is doing similar work and may yield good results.

Example: Two projects each airdrop 5% of supply

-

Hyped project: 100k recipients—needs high FDV to satisfy demand.

-

Less-hyped project: 10k recipients—only needs reasonable FDV.

The real challenge: How do you find these hidden gems?

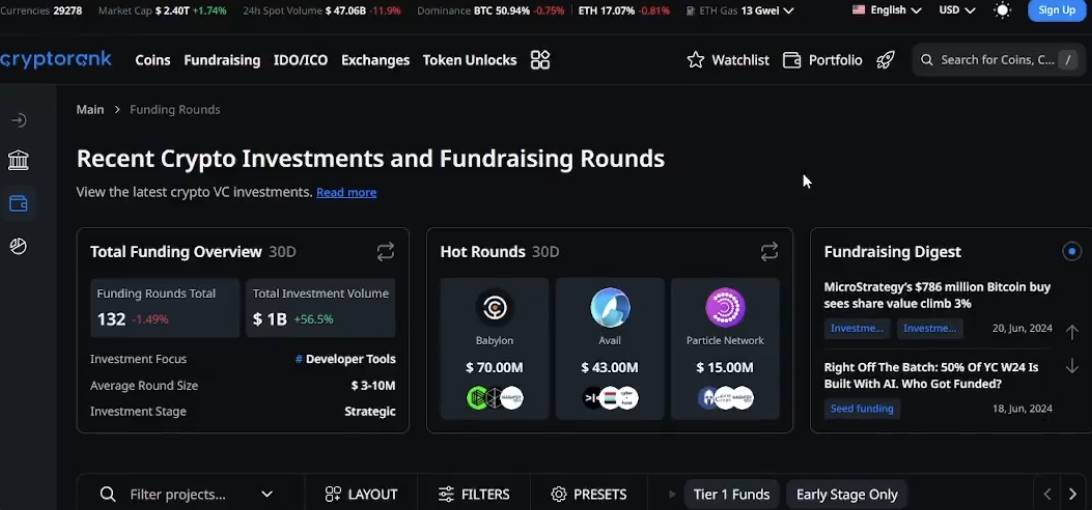

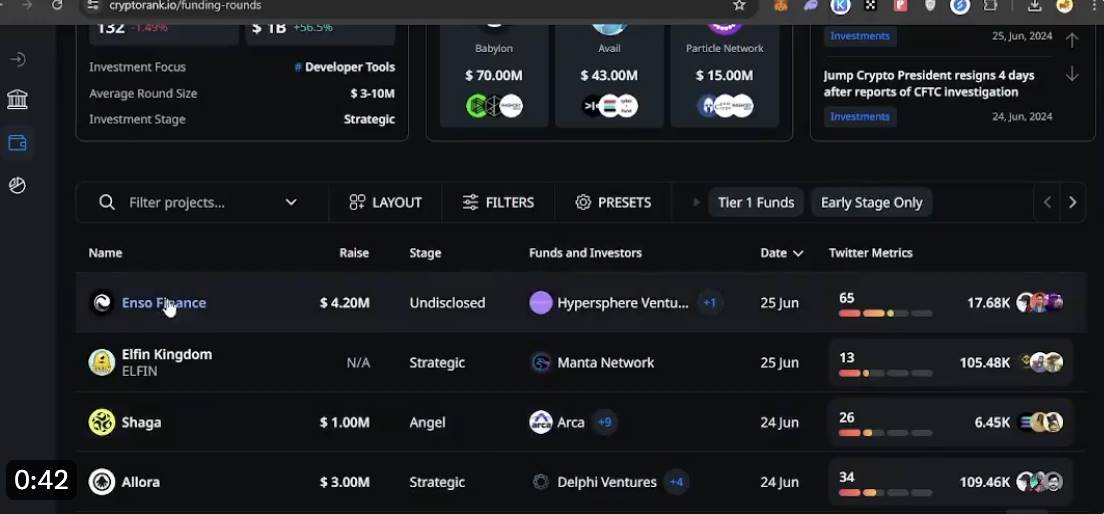

Best tool: Cryptorank.

Use filters—for example, to search Solana-based projects without tokens, go to Filters > Solana Ecosystem.

Now further filter based on the type of protocol you want to farm.

(See video)

I usually filter by: Bridge / DeFi / DEX, as these protocols offer more on-chain activity—early engagement builds strong footprints.

(See video)

Once you find a project, check its activity: review profile engagement—any ongoing events? How many participants?

Which projects are most likely to launch a token?

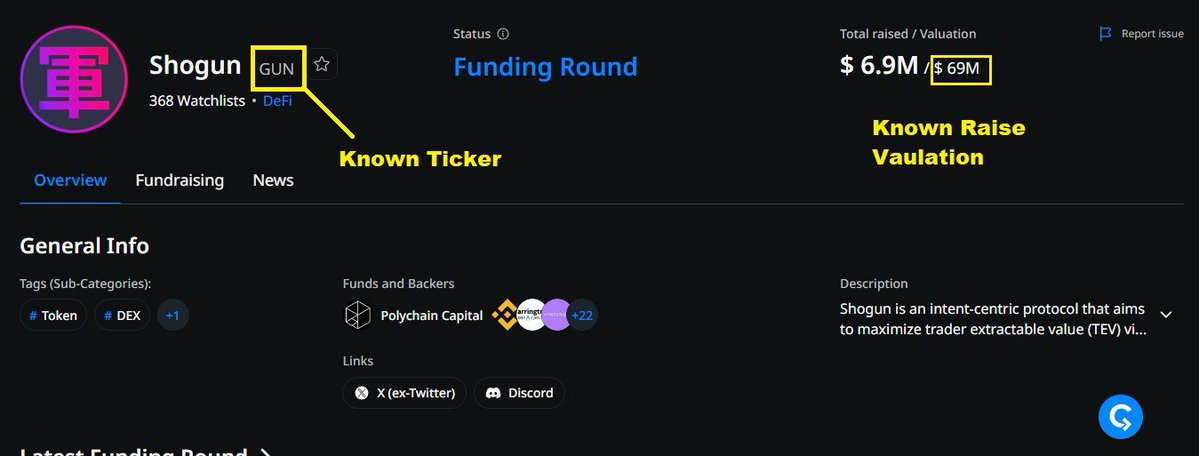

Many protocols have raised large sums, but valuations remain unknown.

I prioritize them in this order:

-

Projects with known valuations: gives you a rough idea of potential launch FDV.

-

Projects backed by notable VCs: more details in future posts.

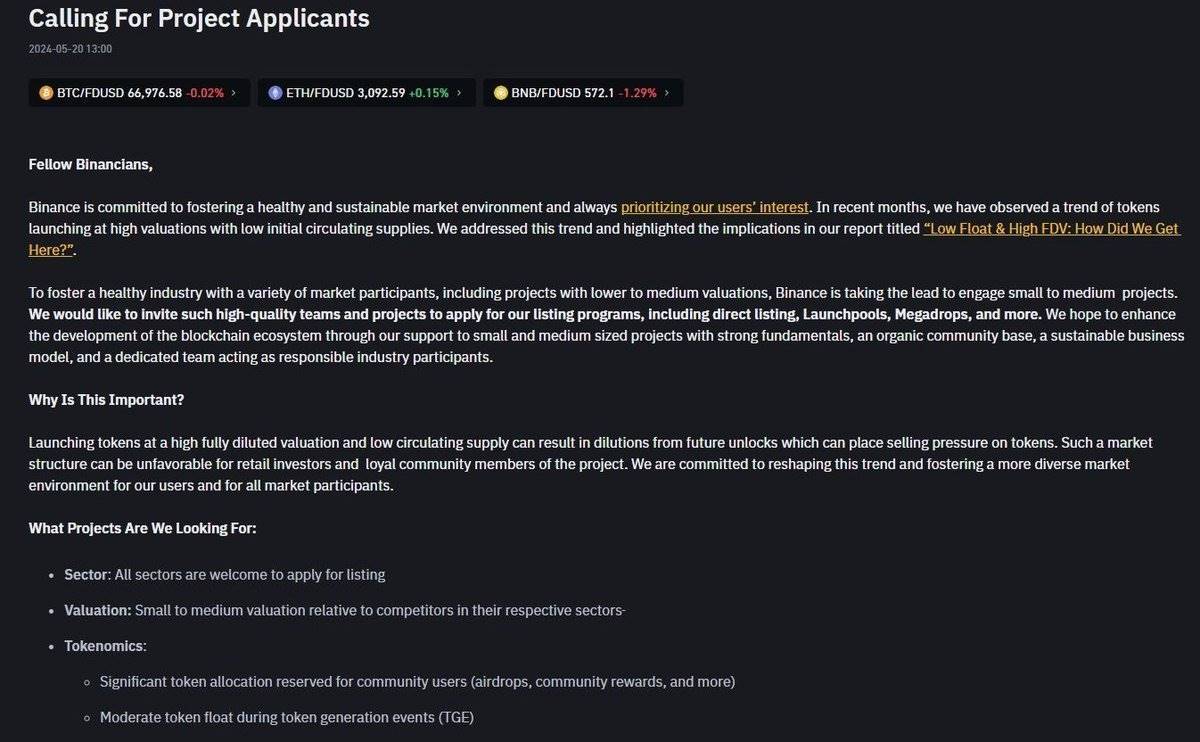

Some VCs are obvious picks. I plan a dedicated post on this, but from an airdrop perspective, I’m particularly interested in projects backed by Jump, Binance, and Multicoin Capital.

Most of these VCs clearly invest for token upside. Recently, Binance-backed projects have performed well.

Unusual Factor: Second-Wave Airdrops

We haven’t seen a wave of such airdrops yet, but they hold potential—and I’ve already seen this strategy work.

80% of users leave after TGE due to small allocations, but a core group remains.

We all joke about post-TGE project metrics—but does that mean fewer farmers now?

Even if token performance is weak initially, there’s still hope to rebound like $SEI.

Maybe farm projects planning large second-wave distributions. Examples:

-

Parcl: LP ranking is now easy as PVP ended, and it could rise if Solana rallies.

-

Wormhole: next community airdrop unlocks in weeks, current volume is very low.

Final Factor: Edge and Research

Dilution is real now—unlike the original airdrop days when awareness was low.

Get involved early, research thoroughly, check whitepapers for token mentions. Grab early roles/OATs.

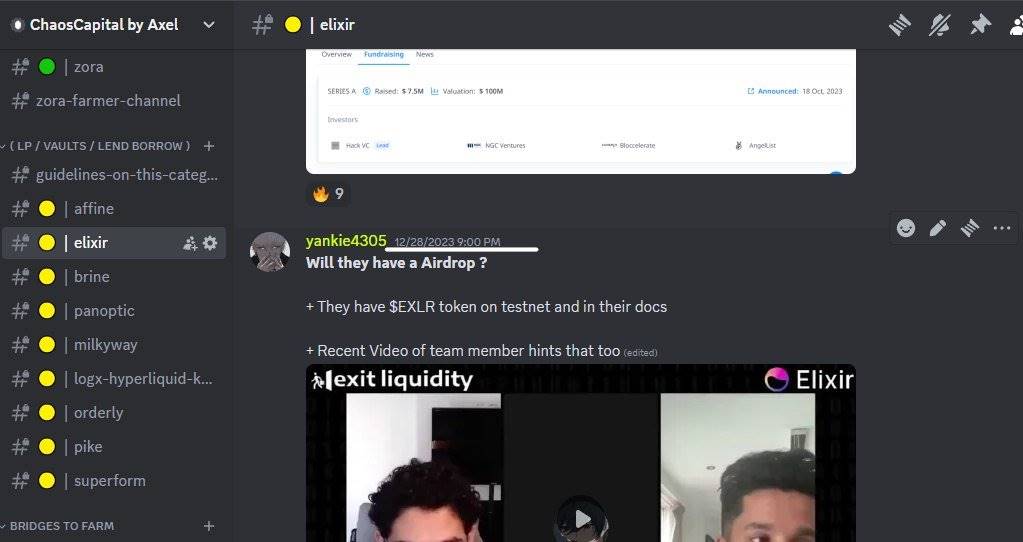

Even if diluted later, remember when we shared Elixir on Discord—no one farmed it then, but it later became popular. But we had early roles and footprints, which may help with airdrops.

Example: Lista DAO gave solid airdrops to early OAT holders.

In today’s market, extracting maximum value is key—no shortcuts. Many projects offer thousands in airdrop value for minimal effort.

Focus on upcoming launches, not long-term, two-year farming marathons.

Reinvest four-digit gains into trending sectors like meme coins and AI, rather than larger farming efforts like ZRO and ZK.

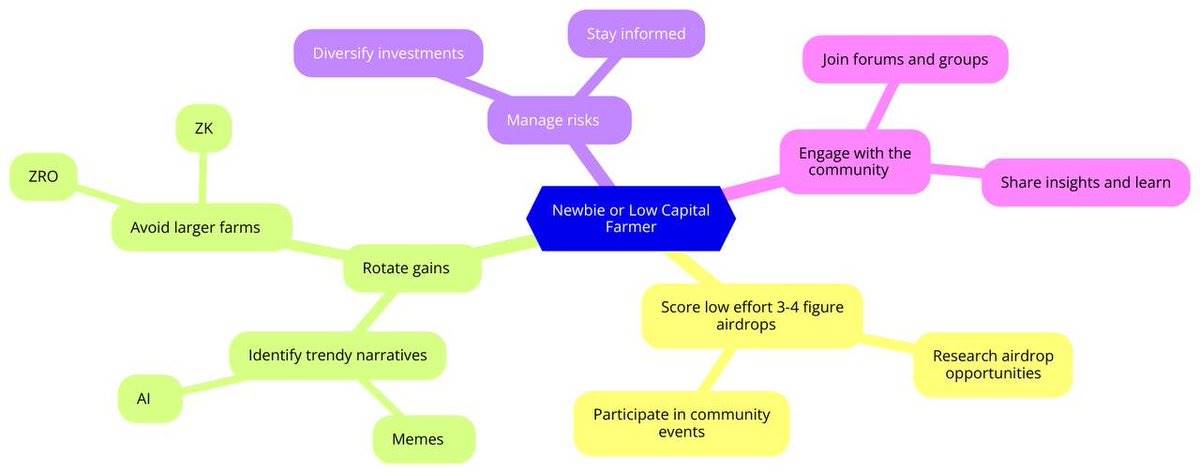

If you're new or low-capital, best strategy is:

-

Secure low-effort three- to four-digit airdrops.

-

Reinvest profits into hot themes like meme coins, AI—not bigger farms like ZRO and ZK.

We’re near market bottom—altcoins are poised for big moves. Don’t give up. Don’t lock your capital in unnecessary long-term farming.

Profiting in a one-way bull market is relatively easy.

In summary: Airdrops aren’t dead.

-

Don’t over-chase hyped airdrops just for Dune dashboard rankings.

-

Try farming low-tier allocations (great risk-reward ratio).

-

Research under-the-radar but well-funded, product-solid projects—and join early.

Join TechFlow Official Community

Telegram Subscription Group:

Twitter Main Account:

Twitter English Account:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News