Deep Dive into AO: The Supercomputer Bringing AI to Crypto

TechFlow Selected TechFlow Selected

Deep Dive into AO: The Supercomputer Bringing AI to Crypto

AO's trillion-dollar opportunity lies in AI.

Author: Teng Yan

Translation: Luffy, Foresight News

Earlier this month, SpaceX successfully launched its fourth "Starship" mission—the most powerful rocket ever built.

This engineering marvel features a Super Heavy booster equipped with 33 Raptor engines, generating a total thrust of 72 meganewtons. To put that in perspective, it’s twice the thrust of the Apollo moon mission rockets and three times that of NASA's Space Shuttle.

I’ve always been fascinated by how deeply tech companies develop over time. Years of relentless effort and massive R&D investments eventually lead to what appears to be overnight success. But insiders know that for a high-tech company to succeed, countless low-probability events must align perfectly. Founded 22 years ago as a startup with grand ambitions, SpaceX exemplifies this journey—a testament to hard work and continuous progress.

Such monumental achievements are rare in the world of cryptocurrency.

Among the crypto companies that emerged during the 2017–2018 ICO boom, only a few remain influential today. Cryptocurrency is a young and emerging industry where attention spans are short, and this mindset often influences how founders view their projects.

That’s why it’s exciting to see OG projects evolve to a new level.

Arweave and the AO Computer Are Deeply Connected

It took Arweave over five years to surpass 10 million transactions (reached on November 16, 2023). Source: https://viewblock.io/arweave/stat/tx

Launched in 2018, Arweave is a decentralized permanent data storage protocol. Despite the critical importance of data storage, it has long struggled to find compelling use cases and widespread adoption.

Data storage isn’t glamorous—it’s a commodity. But the AO Computer represents Arweave’s most ambitious project yet.

AR = Storage Layer

AO = Compute Layer

AO aims to become a scalable, secure, trustless, and customizable computing platform—an ultra-parallel computer.

The core idea behind AO—deterministic virtual machines + permanent data storage = reproducible state—has existed for four years but is now being realized through AO.

I want to emphasize that the AO Computer differs fundamentally from most other blockchains today. Its existence is made possible by the foundational work Sam (the founder) and the Arweave team have done over many years. Just as high-tech startups require solid foundations to succeed, AO would not be possible without Arweave’s secure, decentralized storage network.

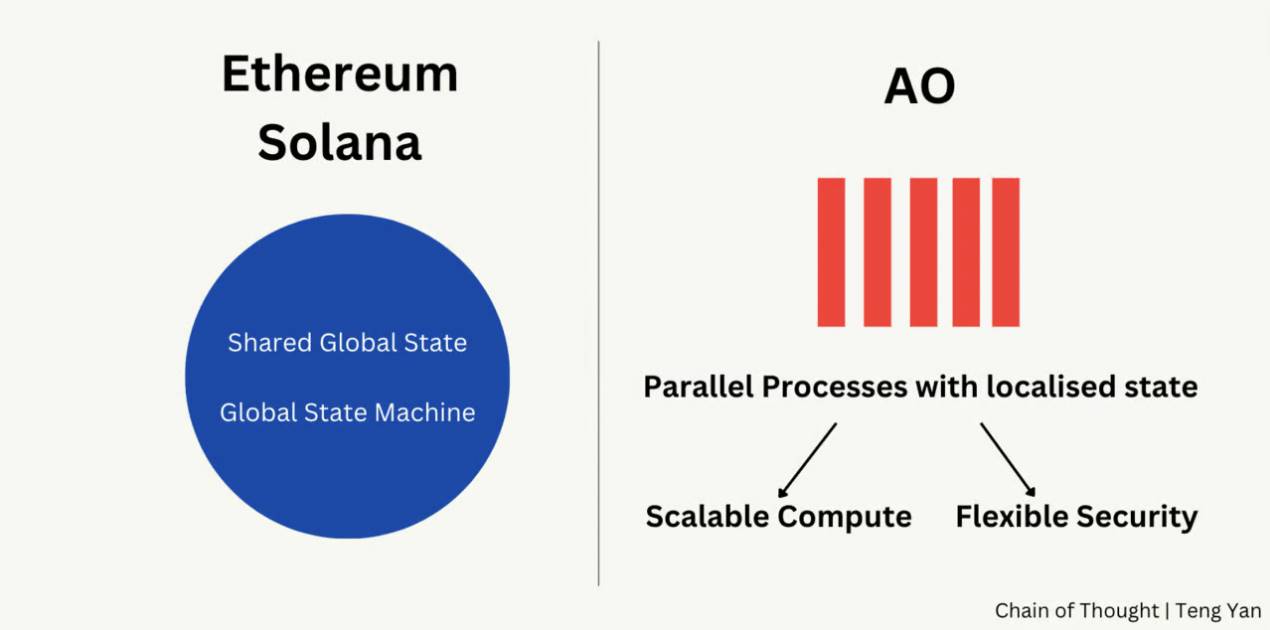

Not Another Ethereum or Solana

Ethereum and Solana are global synchronous state machines with shared global states, whereas the AO Computer is a shared global messaging machine with local states.

Shared global state is the default model for today’s blockchains. It enables consensus and trust, maintaining ledger integrity. However, it falls short of supporting future AI applications.

The AO Computer framework distinguishes itself from Ethereum and Solana in two key ways: (1) scalable compute capacity and (2) a flexible security model.

Scalable Computing

In Ethereum and Solana, adding more compute resources (new nodes) does not increase network throughput. Regardless of the number of validator nodes, Ethereum still processes only 12–15 transactions per second.

However, the AO Computer framework offers a dynamic scaling approach. As more compute resources are integrated into the network, throughput scales accordingly. This is because AO processes run locally and in parallel, unbound by global state limitations.

Security Model

Ethereum uses a uniform security model where every transaction is equally protected within its proof-of-stake (PoS) network. While this ensures consistency, it can be inefficient and costly for low-value transaction scenarios like gaming.

The AO Computer framework introduces a flexible security model, allowing developers to customize security requirements based on their process-specific needs.

Supercomputer

Imagine owning a giant supercomputer composed of many small computers distributed around the world.

This large networked computer can simultaneously execute multiple tasks, such as running games and applications. The small computers communicate via a message system. The advantage is that each small computer isn't slowed down by the rest of the network, yet still benefits from blockchain-level security.

In short, this is the AO Computer.

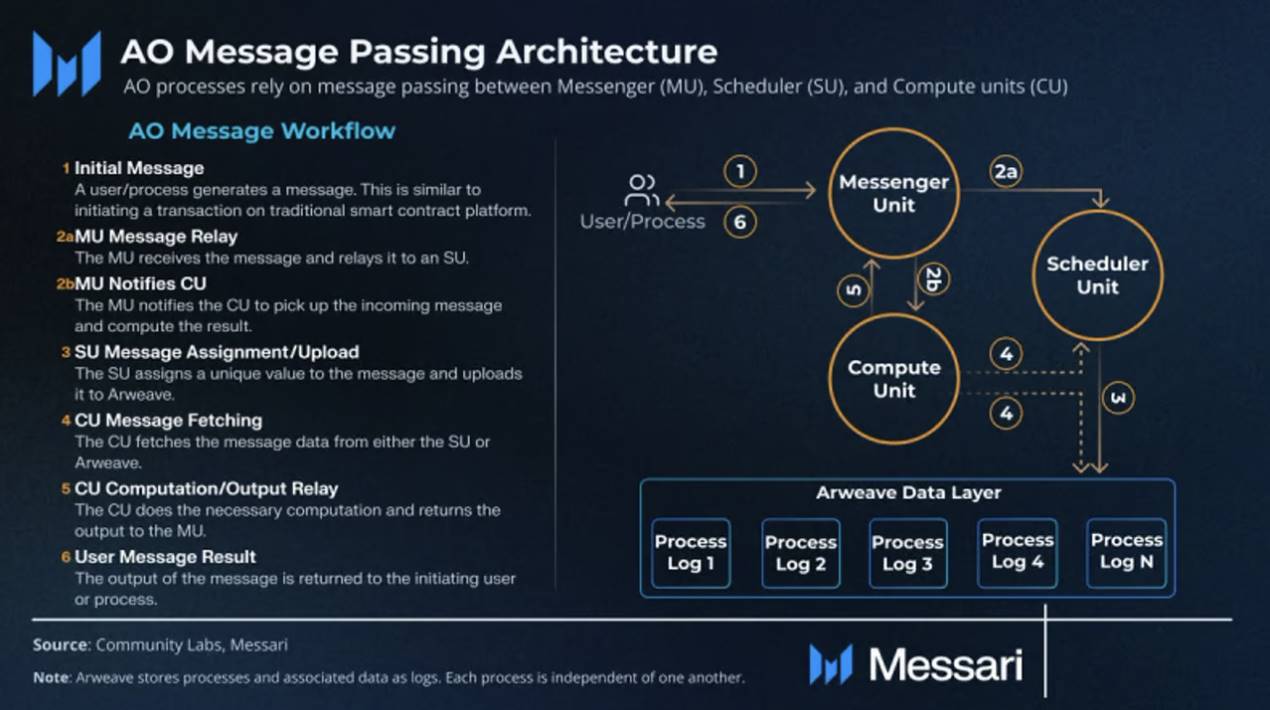

The AO Computer framework upgrades traditional blockchain node architecture by breaking it down into smaller modular components. These include:

-

Processes

-

Messaging Units

-

Scheduler Units

-

Compute Units

Each element plays a crucial role in the overall functionality of the system (full details available in documentation and whitepapers).

Source: Messari

At a high level, AO boils down to three core concepts:

-

Multiple processes capable of running locally and in parallel

-

Process sovereignty

-

Asynchronous messaging enabling coordination and communication between processes

Parallel Processing

At the heart of the AO framework are processes—the applications on the platform. These processes run independently and in parallel at the local level. Individual processes have no memory and cannot access the local state of other processes.

This isolation allows complex computations on powerful machines, expanding the design space far beyond the constraints imposed by traditional smart contracts (fees, gas limits, block size).

Compute Units play a key role here—they provide the necessary computational power to keep AO processes running efficiently.

Application Sovereignty

A notable feature of AO is the sovereignty it grants to developers.

Each process operates autonomously, allowing developers to choose their compute tasks, virtual machines, and security parameters without interference from other processes.

Developers can adjust security measures based on the value and sensitivity of specific computations.

Asynchronous Messaging

This is the glue that binds the network together. Communication within the AO protocol is managed through asynchronous messaging.

Processes exchange messages to coordinate operations and receive necessary data. All applications follow a common messaging standard, ensuring consistency and interoperability.

Messaging Units relay these messages, working in tandem with Scheduler Units (similar to Rollup sequencers) to order messages and record them on Arweave.

AO’s Trillion-Dollar Opportunity Lies in AI

Running a large AI model like LLama-3 with billions of parameters directly on Ethereum is impractical.

-

Compute requirements, data storage, and bandwidth: The LLaMA-3 model demands substantial compute resources (RAM, GPU capability). Ethereum is not optimized for the large-scale data storage and high bandwidth required by LLMs.

-

Latency and performance: Ethereum’s transaction speed cannot meet the low-latency, high-throughput demands of AI models. No user wants to wait 12 seconds (Ethereum’s block time) for a result.

-

Cost: On-chain AI computation is extremely expensive.

Therefore, I was thrilled when AO announced last week that large language models (LLMs) could run on smart contracts, bringing AI directly onto the blockchain. This would integrate human-like decision-making into a trustless network.

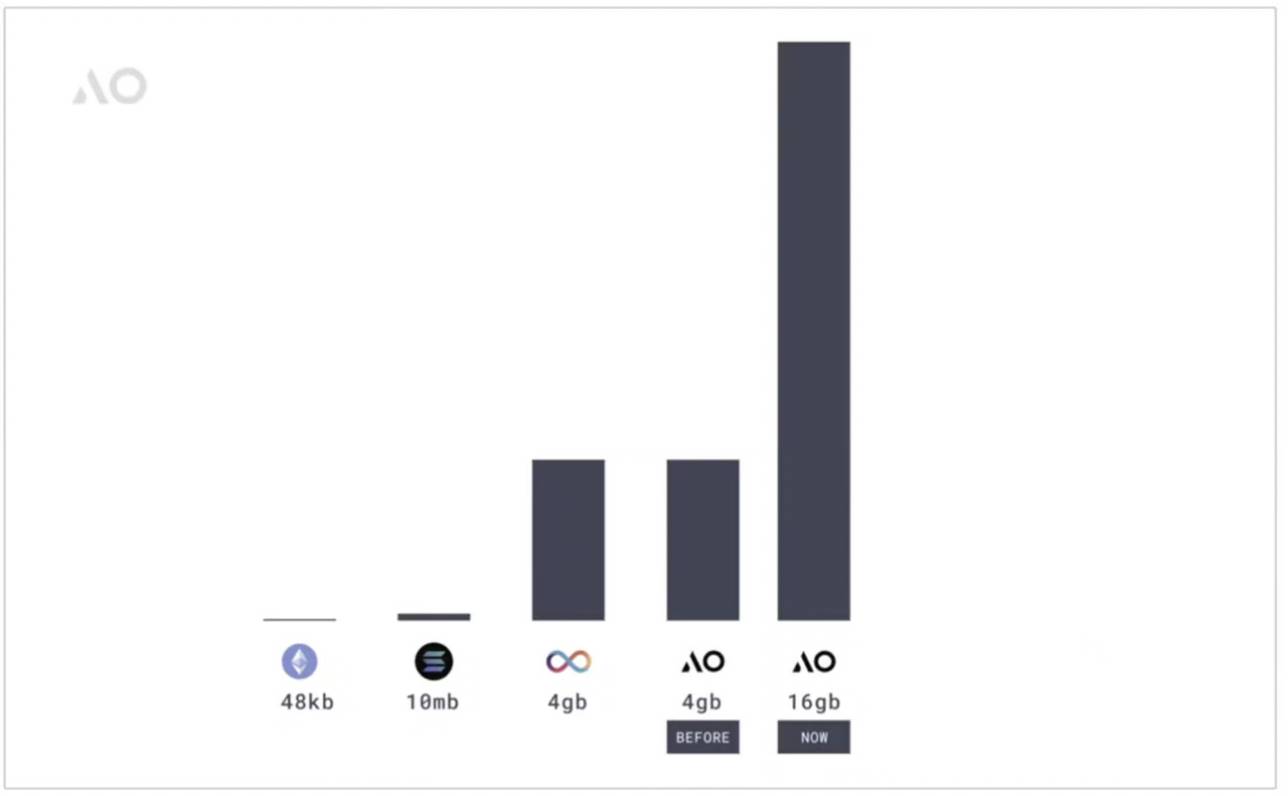

Memory

Running AI models requires loading model parameters into memory—the more parameters, the higher the memory demand.

Running a relatively small model like LLama-3-8B requires at least 12GB of RAM. GPT-4 has over 1.76 trillion parameters, and GPT-5 is expected to reach 50 trillion. Even more alarming, AI models will only continue to grow larger.

Source: AO Computer

In terms of memory, current blockchains are extremely limited at the protocol level:

-

Ethereum has a 48KB RAM limit during smart contract execution

-

Solana has 10MB of RAM

-

Even the Internet Computer (ICP), which is moving into AI, has only about 3GB of RAM.

AO uses WebAssembly in its execution environment and now supports WASM64, enabling support for high-performance applications. Currently, AO has a memory limit of 16GB, with a protocol-level ceiling of 18 exabytes (EB). This enables heavy computations such as inference on Llama-3 or Phi-3.

Data Storage

WeaveDrive is a new feature that allows AO applications to access all data on Arweave just like a local hard drive.

By acting as a local file system within smart contracts, WeaveDrive improves the efficiency and accessibility of data storage and retrieval. More dApps will be incentivized to upload and store data on Arweave.

The AO Computer framework fully leverages individual machine compute power, enabling direct on-chain execution of large AI models.

By combining an unconstrained execution environment with efficient and accessible data storage, AO significantly expands the design space for on-chain applications—especially compute-intensive and AI-driven ones. This facilitates the development of autonomous agents with smart contract-like guarantees.

Integrating cron jobs (a feature absent on most blockchains) and autonomous agents will significantly boost on-chain activity, enabling more complex and dynamic interactions.

Note: Cron is a computer term referring to scheduled tasks executed at predefined times.

As we enter an era where AI is everywhere, many may underestimate the significance of this breakthrough.

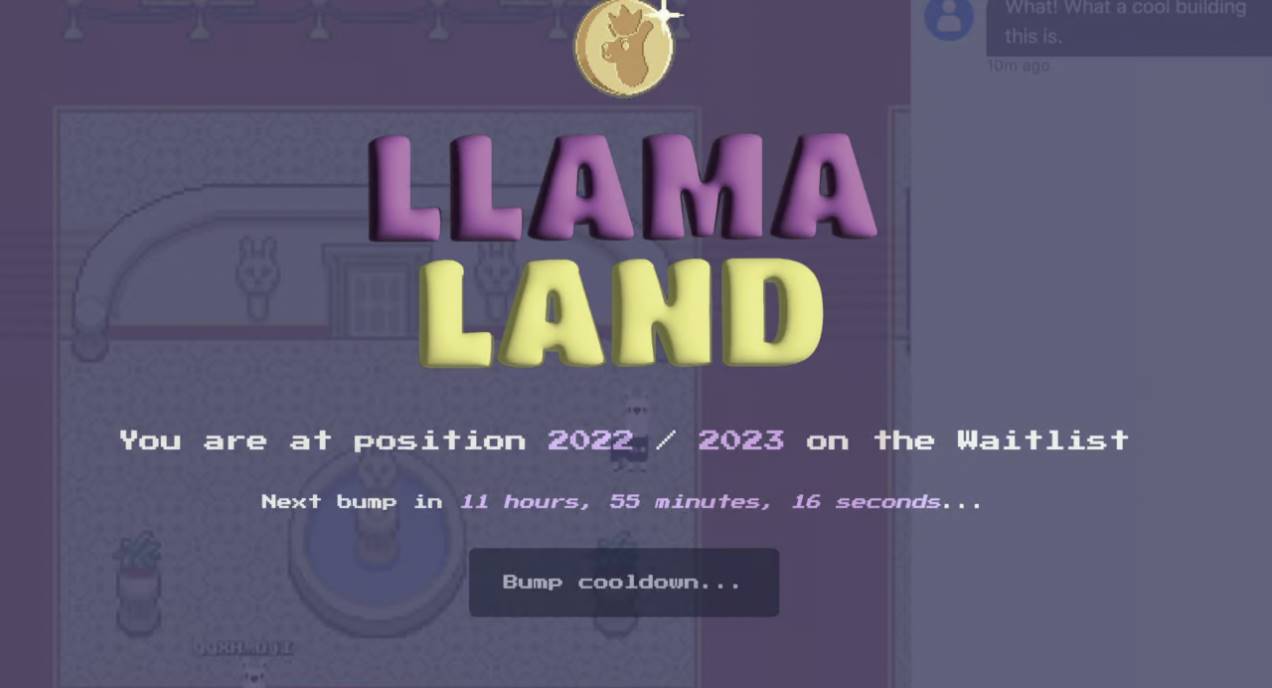

Llamaland serves as a proof-of-concept example: an AI-powered MMO game built on the AO Computer.

In Llamaland, users can submit petitions to the Llama King—an AI agent that uses a large language model to review petitions and determine how much Memecoin to allocate to each user. Notably, the entire process runs entirely on-chain, marking the first full on-chain implementation of an LLM.

Although not yet live, you can sign up to join the waitlist.

Building the Permanent Network

Odysee is a video-sharing platform.

On June 6, Arweave announced three major developments aimed at expanding its market reach:

-

Forward Research acquired Odysee

-

Autonomous Finance launched AgentFi

-

An AO venture fund committed $35 million to builders in the AO ecosystem

From my perspective, the acquisition of Odysee stands out the most. Most people underestimate its value—Odysee is one of the largest Web3 social apps almost no one has heard of. It boasts over 7 million monthly active users (20 times more than Farcaster) and receives 2.2 million website visits per month.

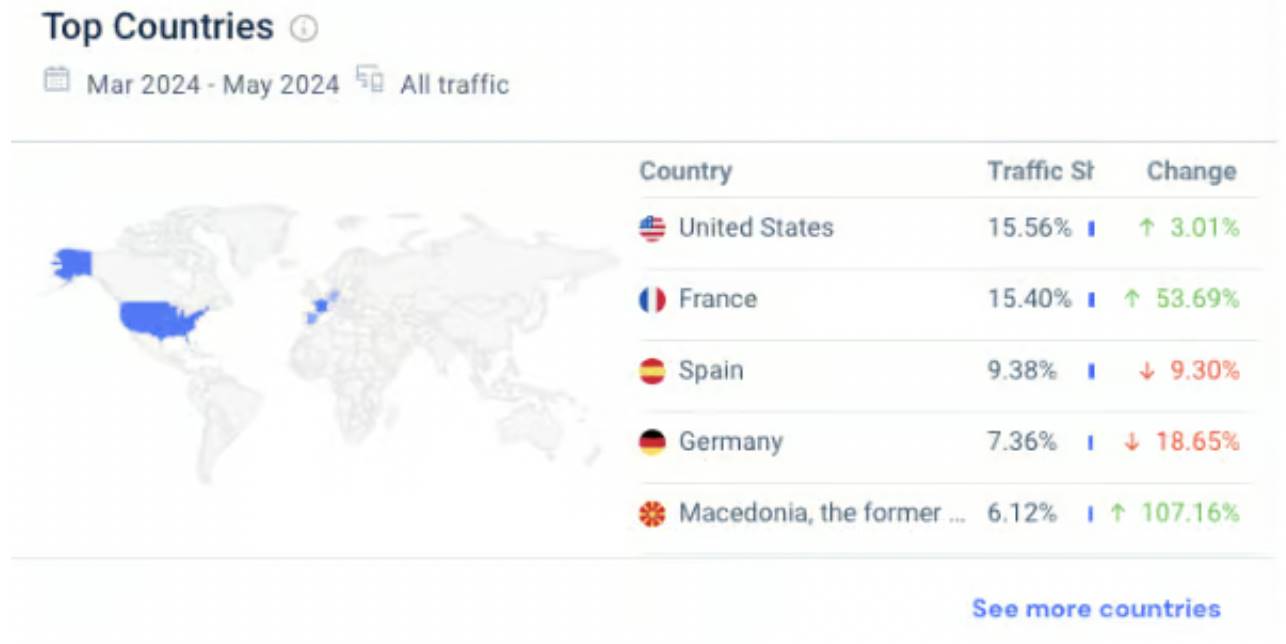

Source: Similarweb

Odysee is an open version of YouTube that uses blockchain technology to give creators greater control and freedom. Unlike YouTube, which relies on traditional ad revenue, Odysee rewards creators with LBRY Credits (LBC).

More akin to Reddit, Odysee occupies a dark corner of the internet emphasizing free speech with less content filtering. Its “Wild West” category is particularly notable for hosting more controversial and unfiltered content.

According to SimilarWeb, a significant portion of Odysee’s users come from Europe, especially France, Spain, and Germany. While Odysee doesn’t rival YouTube in scale, it still attracts a substantial user base—potential users for AO applications.

Odysee will now be built on Arweave’s infrastructure, integrating its platform into the permanent network and giving creators full control over their content.

Applications on AO

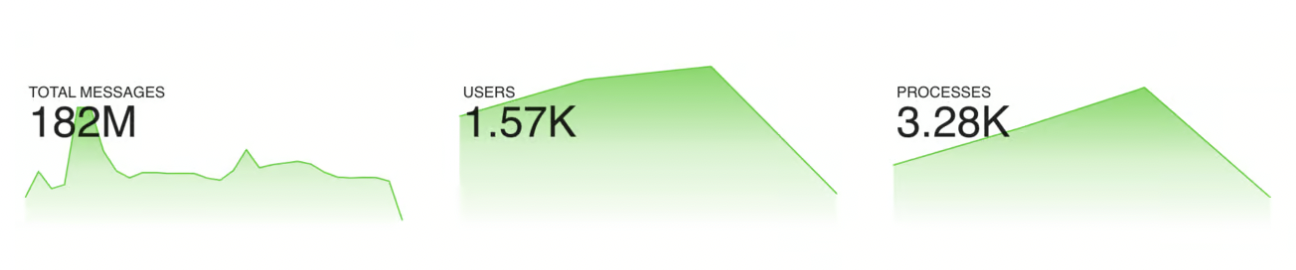

Source: ao.link, data as of June 19, 2024

AO has currently launched a testnet using Proof-of-Authority (PoA) for security. Most applications on the mainnet will adopt Proof-of-Stake (PoS). The mainnet launch date has not yet been determined.

Over the past three months, the testnet has seen approximately 7,000 daily active users, 3,000–4,000 processes, and 182 million messages sent. While these numbers aren’t staggering, they indicate a small but active community.

Dexi

Dexi automatically collects and manages asset prices, swaps, liquidity, and more. Think of Dexi as a blockchain-based Bloomberg Terminal. Managed by a network of autonomous agents hosted on Arweave, it connects to all available liquidity pools.

Dexi is permissionless—users can directly pull data from Dexi’s aggregation agents. It is censorship-resistant, and all information is verifiable on-chain.

0rbit

0rbit is a decentralized oracle network consisting of two main components: AO modules and a network of nodes that fetch data from anywhere on the internet. 0rbit is essential infrastructure for building applications on AO.

AO modules interact with 0rbit nodes to send data requests and receive results. Anyone can run a node and contribute to the network. Data is fetched asynchronously from the internet, meaning the process doesn’t need to wait for responses.

Currently, 0rbit can retrieve news from user-defined website APIs and price data from CoinGecko’s API.

While exploring, I discovered other interesting things on AO, including AMMs (Bark, Permaswap, ArSwap), Trunk (an AO meme coin), and Astro (an over-collateralized stablecoin using AR as collateral). AO is still in early stages—many projects haven’t been tested in production or accumulated significant volume.

Key Focus: AO Tokenomics

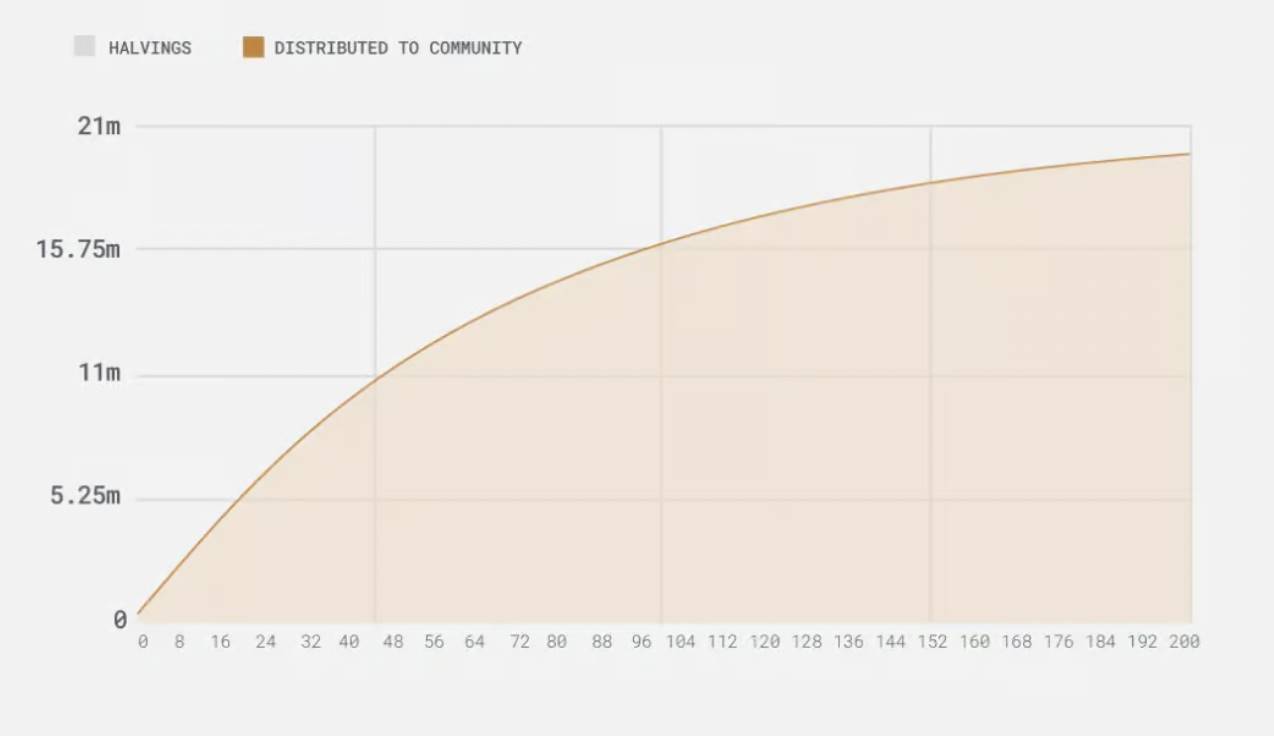

AO tokens launched on June 14, with minting dates retroactive to February 27, 2024. I appreciate its fair issuance model—no special allocations for investors or team members.

AO token minting follows a Bitcoin-like schedule: no pre-mine, capped at 21 million total supply. The rate of new token issuance halves every four years, though unlike Bitcoin, this is a smooth, gradual decline.

New AO tokens will be distributed as follows:

-

Arweave token holders (36%)

-

Stakers of assets like stETH, SOL, etc. (64%)

So far, about 1 million tokens have been minted, most of which have already been retroactively distributed to AR token holders. AR holders will continue receiving new AO tokens every 5 minutes. Testnet tokens AOCRED can be redeemed for AO at a 1000:1 ratio.

Importantly: AO tokens are non-transferable and non-tradable until 15% of the total supply is minted (around February 8, 2025). This provides time for the nascent ecosystem to develop and for the mainnet to launch, where AO tokens will secure the network.

Holding AR Earns You AO

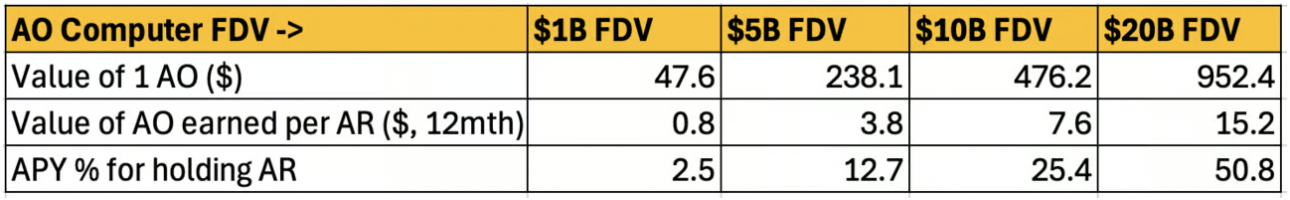

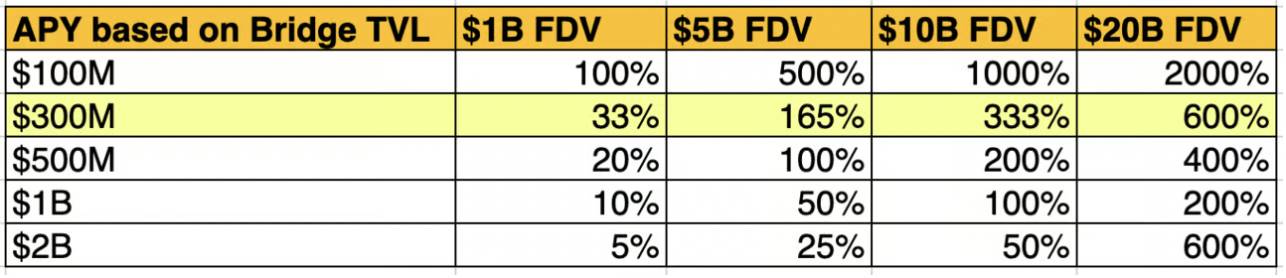

Below are some estimates I calculated for expected returns from holding AR tokens, assuming 1 AR = $30.

-

Holding 1 AR will earn approximately 0.016 AO tokens over the next 12 months.

-

About 4.2 million AO tokens will circulate within 12 months

APY for holding AR is moderate, ranging from 2.5% to 50%, depending on expected FDV, which in turn depends on market conditions when tokens become tradable next year. Assuming positive market sentiment in 2025, a $10 billion FDV seems reasonable—implying a 25% APY.

Earning AO by Staking Assets (e.g., stETH)

Users holding 0.01% of total locked value (TVL) will accumulate about 210 AO tokens over 12 months.

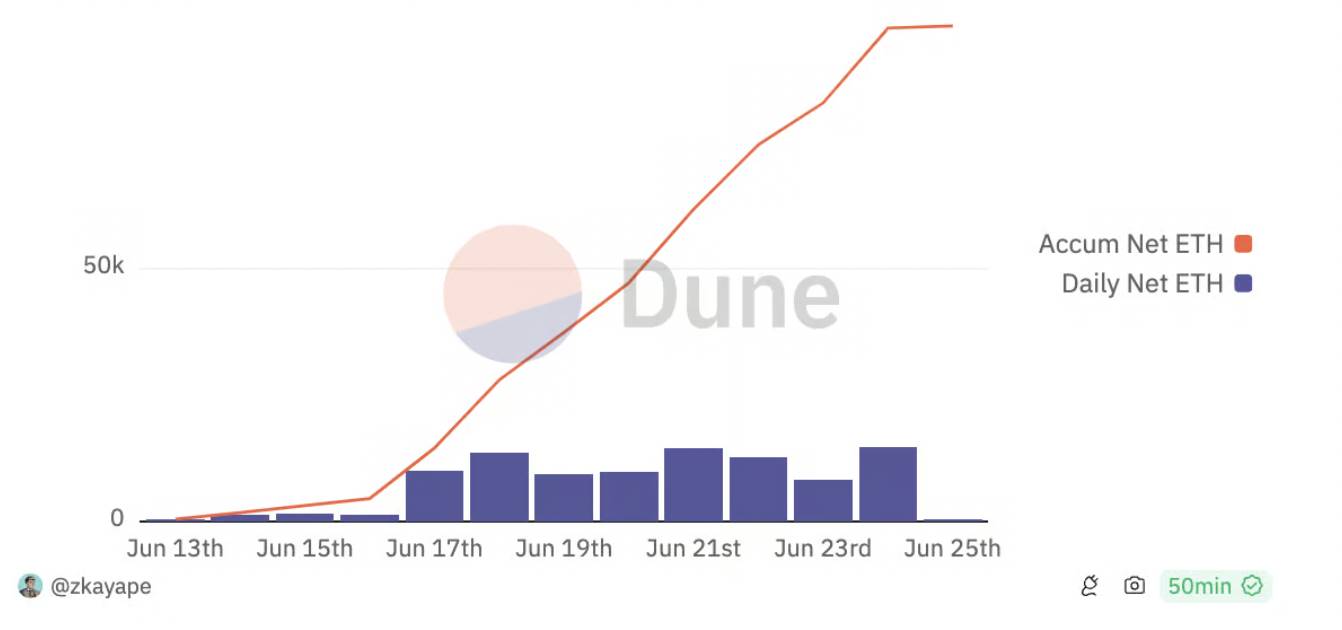

As of June 25, cross-chain stETH value was approximately $320 million. Based on TVL and FDV assumptions, APY ranges from 33% to 600%. Estimated APY is volatile and highly sensitive to total cross-chain asset value (TVL) and expected token FDV.

For anyone holding stETH today, this presents a very attractive low-risk yield opportunity.

As more users realize this and stake their stETH, APY will decrease. The idea of stETH mining creates a win-win situation for both the AO team and its users.

Staked stETH generates substantial revenue ($1 billion deposit yields ~$30 million annually), which will fund ecosystem projects and other development activities.

Source: Dune@zkayape

Monitoring TVL of staked assets is crucial, as it may eventually balance out with AR yields. If TVL remains relatively low, more people might sell AR to mine with staked assets, and vice versa.

AR has a total supply of 66 million, with 65 million currently in circulation. AR has potential deflationary characteristics, as AR used for data storage goes into an endowment fund, only released when mining becomes unprofitable.

My Thoughts on AO

When evaluating whether a protocol will succeed, I like to break it down into smaller questions.

I ask myself: What are the most important things AO must get right to achieve success comparable to Solana?

-

High demand in crypto for AI agents and applications: Given the rapid advancement of AI over the past two years, this appears to be the current trend. Other blockchains are developing off-chain computation using technologies like zkML/OpML, but currently only AO supports full AI computation directly on-chain.

-

Composability with major blockchains: AO must integrate closely with other leading blockchains. Expecting existing developers and applications to fully migrate to AO is unrealistic. Therefore, building bridges and communication channels with existing ecosystems is critical.

-

Developing a social layer: Ultimately, blockchain success isn’t about transaction speed or low fees. Cultivating a passionate developer community and attracting users is key to broad adoption.

I’ll be closely watching these three areas and adjusting my confidence accordingly.

Some Additional Thoughts

-

The AO Computer handles decentralized computing in a way fundamentally different from traditional blockchains. It could succeed—or fail. But the ability to perform large-scale computations on-chain is a key enabler for the AI era.

-

AO adopts a participant-oriented approach. Such platforms suit systems requiring high concurrency, modularity, and scalability. While the participant model has theoretical advantages, its widespread adoption and large-scale success remain unproven. Challenges include handling unexpected failures and maintaining consistency among decentralized participants.

-

AO is still in a very early stage. When experimenting on the testnet, I found users mostly trying text chat and games. AO needs better tooling, which takes time. Due to different architectures and languages, porting apps directly from other chains isn’t easy. Overall, AO feels like Solana in early 2021—only a few apps, mostly skeptics.

-

Requires long-term belief: AO demands strong conviction. Short-term traders may struggle to find immediate catalysts, as tokens won’t be tradable until 2025.

-

Arweave demand: AO will create sustained demand for AR, acting as both a growth catalyst and a new platform for app development. Every process on AO will write data to Arweave, driving AR utility.

AI and cryptocurrency are undoubtedly the two most important technological paradigm shifts of this century. Their convergence will be transformative. My intuition tells me AO will be a leading project driving this forward.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News