Lessons from "Bear Market Investing": Identifying the Best Opportunities and Leveraging Bull Market Upside

TechFlow Selected TechFlow Selected

Lessons from "Bear Market Investing": Identifying the Best Opportunities and Leveraging Bull Market Upside

For investors: choose wisely, talk to people, spot opportunities, be skeptical enough, yet open to new ideas, and see the future.

Author: Pavel Paramonov

Translation: TechFlow

What can we learn from bear market investing? How do you truly benefit from bull or pre-bull market investments?

1. First, less available capital during a bear market creates more opportunities for venture investors

Why is this good? In a bear market, although there is less available capital, it doesn't mean there's no capital at all. With limited funds, VCs tend to identify stronger projects rather than spreading money across dozens of startups.

Investors are more committed to supporting founders because not everyone survives in a bear market. Moreover, in a bull market, tier-3 and tier-4 VCs almost never become stakeholders in strong protocols because they can’t compete with top-tier firms such as @polychain, @blockchaincap, @PanteraCapital, @variantfund, etc.

These leading firms bring not only capital but also deep domain expertise and reputation. If a speculator sees a prominent tier-1 or tier-2 investor on the cap table, they automatically become more interested in the project during a bull market.

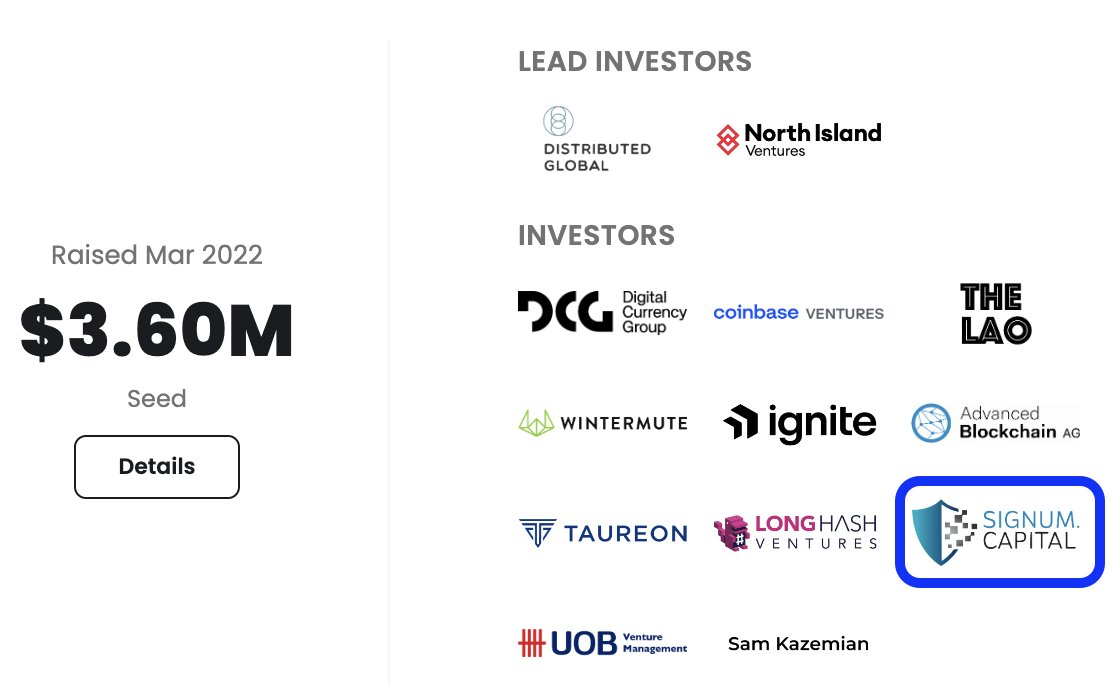

In a bear market, you must be more selective and focus on different factors. For example, @Signum_Capital invested in @Polymer_Labs in March 2022.

I'm not saying Signum Capital is a bad VC, but honestly, they aren't a tier-1 or tier-2 firm either.

It takes research and skill to spot the best investment opportunities, but even if you're smart enough to identify them, you might still miss out. Why? Because you lack name recognition. However, this becomes possible in a bear market, as top VCs often can't secure the best deals due to different risk/reward dynamics.

2. Second, builders are more committed—this level of dedication cannot be faked or simulated

I mean being deeply committed. Not everyone survives in a bear market, so surviving requires exceptional talent and hard work. Builders understand what I mean when I say fundraising is harder—much harder—in a bear market.

You need a great idea, a solid survival plan, a "Real Madrid"-level team, and you still have to maintain a low burn rate and long runway. At this stage, efficiency and commitment levels are essentially maximized.

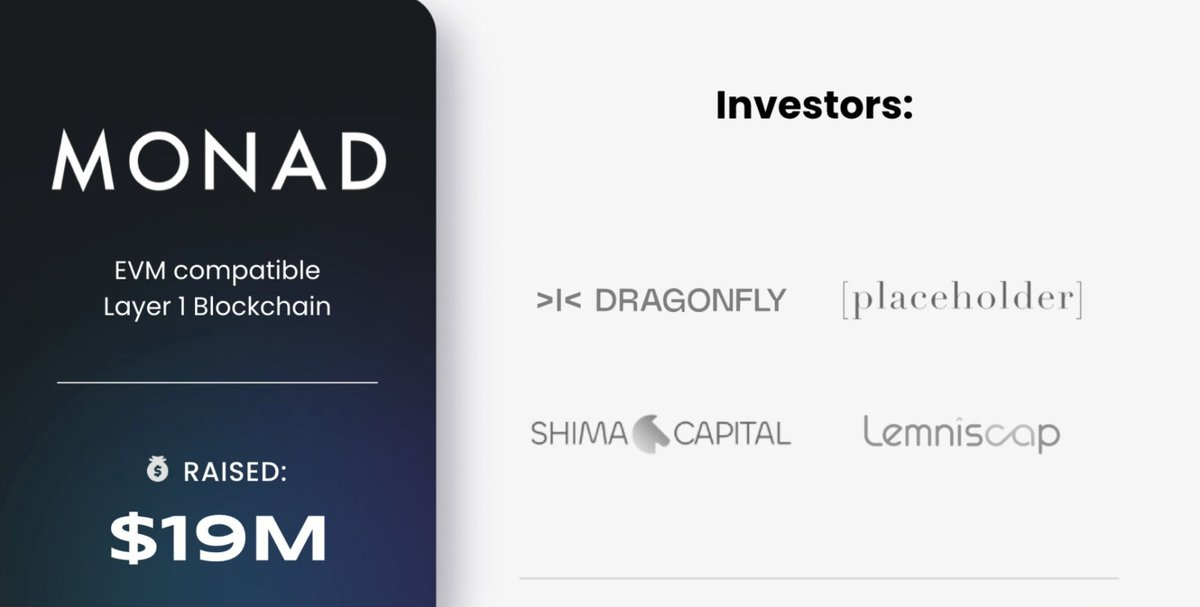

Builders are forced to make their products succeed massively. As the old saying goes, "You must want it to achieve the greatest results." @monad_xyz is a prime example—a genuine foundational project with powerful mechanics that fills every gap.

-

Outstanding team (ex-@jumptrading)

-

High commitment (building through bear market conditions)

-

Strong marketing and content

-

Excellent community-building strategy (@intern)

-

@paradigm @cbventures @ElectricCapital @egirl_capital, @dragonfly_xyz @shimacapital @placeholdervc

Due to their peak-level commitment during the bear market, they secured funding from @dragonfly_xyz, @shimacapital, and @placeholdervc in their first round, and later raised from @paradigm, @cbventures, @ElectricCapital, and @egirl_capital in their second round.

This was achieved while building one of the most well-known communities in the space, alongside @berachain.

However, I don't want to name specific projects, but what you could accomplish in the pre-bull phase was astonishing. Essentially, you could:

-

Combine three different modular solutions

-

Integrate them together

-

Write almost no code

-

Raise over $5 million at a valuation exceeding $100 million

3. Vesting schedules in bear markets are often more attractive—and it’s not because of their duration

Some may ask why vesting schedules are more attractive in bear markets, especially since in bull markets they’re typically shorter, allowing investors to exit at peaks. The reason lies in timing.

Take 2022–2026 as an example. If you raised funds in 2022:

-

Your TGE might occur in 2024

-

You release low circulating supply under relatively favorable market conditions

-

You implement daily/weekly/monthly unlocks

-

Most tokens unlock during the pre-bull and bull phases

-

This enables fair price discovery and allows room for hype

If you raise funds in 2024:

-

Your TGE might occur in 2025

-

You set lockups of at least 6–12 months for investors

-

Followed by 12–24 months of vesting

-

After 6–12 months, you’re entering the final stage of the bull run—or even the start of the next bear market

-

Vesting extends into 2026

-

Historically, this would likely be a bear market

-

With little hype, selling becomes unattractive

I’m not saying it’s completely unattractive—just that the timeline is entirely different.

How to combine the best of both worlds and make more accurate investments during a bull market?

A bull market is also a blessing. During this phase, highly dedicated teams can selectively choose the best stakeholders and gain maximum "added value." You can raise substantial capital to build meaningful infrastructure for the industry. Community engagement, opportunities, networks, and overall participation are all significantly higher.

For investors, whether in liquid or illiquid assets: Be selective, talk to people, spot opportunities, stay skeptical yet open-minded, and envision the future.

For builders: Build great tools you genuinely want to use—not just build for the sake of building.

For speculators: Keep speculating, keep identifying the best opportunities. Never underestimate the importance of speculation in crypto.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News