After surging 70% in two months post-listing, will the spot ETF effect repeat with Ethereum?

TechFlow Selected TechFlow Selected

After surging 70% in two months post-listing, will the spot ETF effect repeat with Ethereum?

Multiple spot Ethereum ETFs have been listed on the DTCC website, echoing the playbook of spot Bitcoin ETFs.

By RockFlow

Key Takeaways

① From $40,000 to $70,000, the approval of spot Bitcoin ETFs served as a strong catalyst for Bitcoin’s price. Now, the market is anticipating that the approval and full trading launch of spot Ethereum ETFs will further boost investor confidence.

② The 19b-4 filings for eight spot Ethereum ETFs have already been approved by the SEC, with official trading expected to begin in a few weeks once their S-1 registration statements become effective. The involvement of traditional financial giants like BlackRock could bring Ethereum into the spotlight for more mainstream investors.

③ Cost, liquidity, issuer reputation, and fund structure are key considerations when investing in Ethereum ETFs. With the crypto market entering a new innovation cycle, combined with improving macro conditions, potential monetary easing, and the upcoming U.S. election cycle, the crypto market may continue its upward momentum.

Since the U.S. SEC approved spot Bitcoin ETFs earlier this year, the legitimacy of crypto assets as an emerging asset class has been significantly strengthened. This is undoubtedly a pivotal moment for global investors—the convergence between traditional finance and digital assets is drawing ever closer.

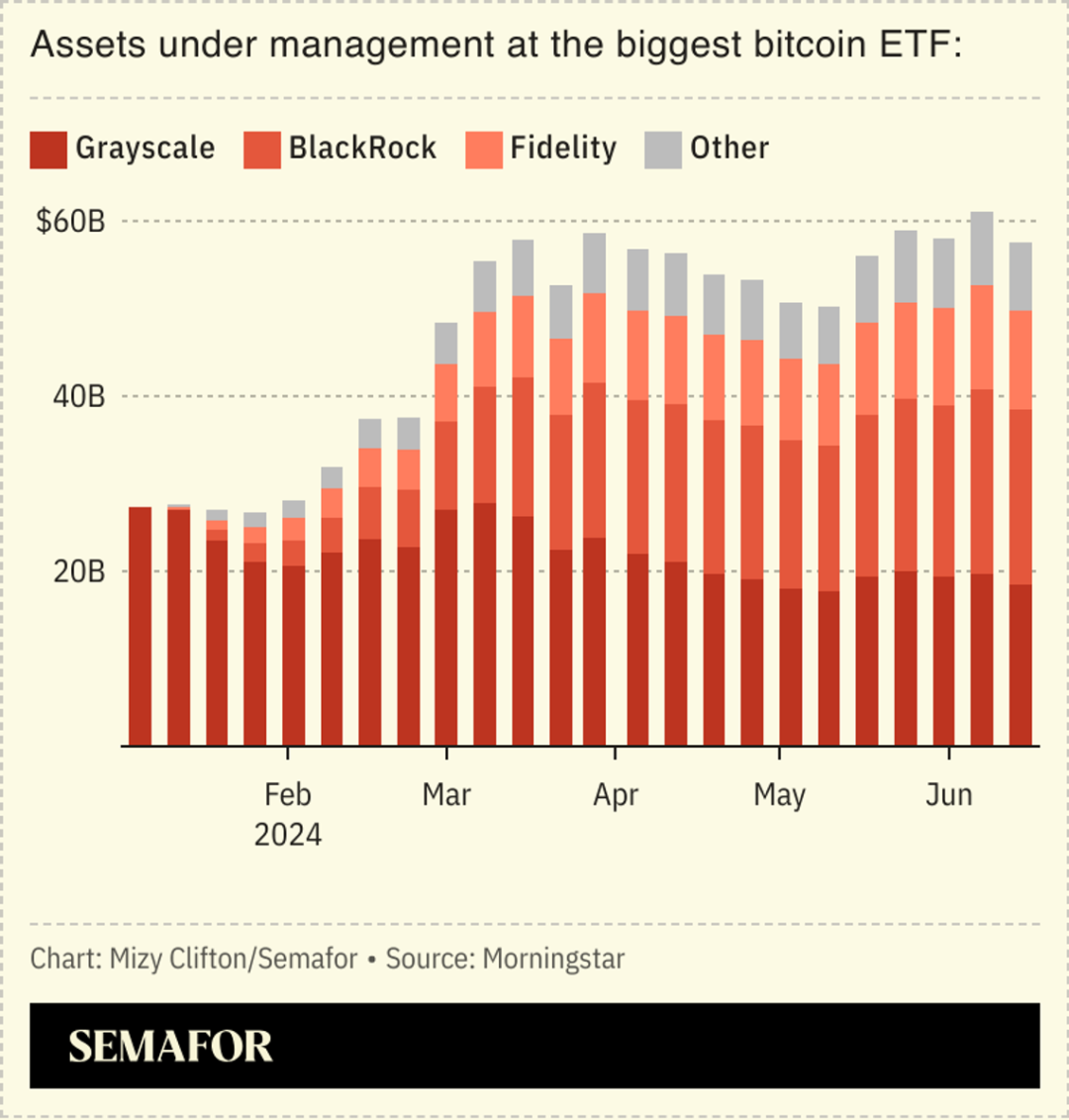

Since their launch, spot Bitcoin ETFs have attracted significant attention from institutional investors. State government investment funds, major banks, leading hedge funds, well-known asset managers, investment advisory firms, and other corporations have all entered the space. Notably, the Wisconsin State Investment Fund is now one of the largest holders of BlackRock's spot Bitcoin ETF.

The influx of institutional capital has also acted as a powerful catalyst for Bitcoin’s price (rising nearly 70% in under two months). Now, the market is looking ahead to the approval and trading debut of spot Ethereum ETFs to further bolster sentiment.

As the second-largest cryptocurrency by market cap, Ethereum hosts the most extensive ecosystem of decentralized applications (dApps). A few weeks ago, the U.S. SEC formally approved the 19b-4 filings for eight spot Ethereum ETFs from major players including BlackRock, Fidelity, and Grayscale. The news triggered an intraday surge of over 10% in Ethereum’s price and opened the door for Ethereum to gain broader acceptance in traditional financial markets.

Although trading cannot officially commence until the S-1 registration statements go effective, the 19b-4 approvals effectively solidify Ethereum’s status as a digital commodity. This article analyzes the investment value, selection strategies, and future outlook for spot Ethereum ETFs—the second-largest crypto asset by market capitalization.

1. 303% Annual Gain—ETHE

The Grayscale Ethereum Trust (ETHE) was once one of the most important tools for U.S. stock investors seeking exposure to Ethereum. Issued and managed by Grayscale, a subsidiary of Digital Currency Group, the fund once held over $10 billion in assets. Launched in December 2017 and listed in July 2019, it uses the same trust structure as GBTC.

In theory, ETHE’s price should closely track Ethereum’s value with only minor deviations. However, in practice, its secondary market price has often diverged significantly. Since its listing in 2019, ETHE traded at substantial premiums for extended periods—sometimes exceeding 1,000%. But after February 2021, ETHE entered a prolonged phase of steep discounts, which widened during the bear market.

The persistent discount stems primarily from the lack of a direct redemption mechanism. Additionally, limited arbitrage opportunities, forced liquidations by large speculators, opportunity cost, and competition from alternative products have contributed to the widening gap, preventing ETHE from accurately tracking Ethereum’s price in recent years.

Ironically, this deep discount created an exceptional buying opportunity during the bear market. While Ethereum gained nearly 100% over the past year, ETHE surged over 300%.

With multiple issuers actively pursuing spot Ethereum ETFs, Grayscale is pushing hard to convert ETHE into a spot ETF, which would likely eliminate the existing discount. In the foreseeable future, ETHE could become one of the largest spot Ethereum ETFs in the U.S., mirroring GBTC’s role in the Bitcoin market.

2. Spot Ethereum ETFs Poised for Approval

As mentioned, the 19b-4 filings for eight spot Ethereum ETFs have already been approved by the SEC, as shown below:

ARK 21Shares Ethereum ETF: Jointly filed by ARK Invest and digital asset firm 21Shares. Notably, ARK previously launched an Ethereum futures ETF—ARK 21Shares Active Ethereum Futures ETF (ticker: ARKZ)—which allocates primarily to Ethereum futures contracts.

Bitwise Ethereum ETF: Bitwise was the first among recent applicants to update its S-1 filing for a spot Ethereum ETF. The company also disclosed that Pantera Capital intends to purchase $100 million worth of shares. As a prior investor, Pantera had already bought $200 million in Bitwise’s spot Bitcoin ETF (BITB).

Fidelity Ethereum ETF: Financial giant Fidelity Investments seeks to launch an ETF holding physical Ethereum. Its application was filed just one day after BlackRock submitted its own Ethereum ETF proposal.

Franklin Ethereum ETF: Franklin Templeton filed its application in early 2024.

Grayscale Ethereum ETF: As discussed, Grayscale aims to convert its ETHE trust into a spot ETF product.

Invesco Galaxy Ethereum ETF: A joint application by Invesco and Galaxy Digital, aiming to provide exposure to the spot price of Ethereum.

BlackRock iShares Ethereum Trust: BlackRock filed its application in late 2023. This ETF aims to offer direct exposure to Ethereum, potentially boosting market confidence significantly.

VanEck Ethereum ETF: As a prominent U.S. asset manager and ETF pioneer, VanEck is actively pursuing an Ethereum ETF product.

Notably, these applications reflect strong interest from mainstream financial institutions in integrating Ethereum into traditional portfolios. Most resemble the Bitcoin spot ETFs in selecting Coinbase as the custodian, as illustrated below:

Why hasn’t Ethereum surged following the 19b-4 approvals? The answer lies in understanding the difference between regulatory filings: approval is not yet complete.

The 19b-4 form notifies the SEC of proposed rule changes allowing an ETF to trade on an exchange—such as introducing a new product or modifying trading mechanisms. Once submitted, the SEC reviews the proposal, opens it for public comment, and then decides whether to approve it.

However, ETFs must also have an effective S-1 registration statement approved by the SEC before they can officially launch. While the S-1 is not the final step, it is a crucial milestone under SEC oversight. Only after the S-1 becomes effective can fund managers finalize preparations for listing, including setting a launch date and beginning marketing.

A 19b-4 approval means the ETF is likely to happen; an S-1 approval means it’s confirmed. This process typically takes several weeks to months, which explains why Ethereum’s price hasn’t spiked immediately.

Nevertheless, since multiple spot Ethereum ETFs are already listed on DTCC, they are likely to follow a similar path to the Bitcoin spot ETFs.

3. A Concise Investment Guide to Spot Ethereum ETFs

In previous analyses on spot Bitcoin ETFs, the RockFlow research team highlighted three key metrics: fees, liquidity, and trading costs. Buy-and-hold investors should prioritize low expense ratios, active traders should focus on high liquidity, and all investors should assess how the issuer’s operational costs might impact ETF performance.

For retail investors considering spot Ethereum ETFs, the same principles apply. Given that the underlying assets of the first wave of Ethereum ETFs are identical, long-term returns are expected to be largely similar. Therefore, RockFlow recommends focusing on two key dimensions:

1) Cost and Liquidity of the Ethereum ETF

Cost is clearly critical—opting for ETFs with competitive, low fees will maximize long-term returns. Liquidity is equally important for ease of trading. Larger AUM generally signals stronger investor confidence and stability, making such ETFs more suitable for long-term holdings.

2) Issuer Background and Reputation

The first batch of Ethereum ETF issuers are established financial institutions, offering greater reliability. Their track records in launching successful ETFs lend credibility to their new crypto offerings.

4. What’s Next for Ethereum ETFs?

According to Bloomberg Intelligence, if spot Ethereum ETFs are approved, inflows could reach 10–20% of those seen with spot Bitcoin ETFs. Given that Bitcoin rose from around $40,000 to $70,000 (a 75% gain) within two months of ETF approval, a similar trajectory for ETH could push it beyond its all-time high of $4,800.

This projection is based on several factors: relatively lower institutional interest in Ethereum compared to Bitcoin; Ethereum futures ETF volumes being only 10–20% of Bitcoin’s; spot Ethereum trading volume at about 50% of Bitcoin’s; and Ethereum’s market cap currently standing at roughly one-third of Bitcoin’s.

That said, Ethereum differs meaningfully from Bitcoin in several ways:

-

Ethereum lacks the same level of “structural selling pressure” as Bitcoin, since validators do not incur operational costs like miners (who must sell part of their mined BTC to cover expenses);

-

Currently, 38% of Ethereum’s supply is staked on-chain, indicating lower selling intent;

-

Ethereum exhibits greater reflexivity—its price movements can drive on-chain activity, which in turn leads to more ETH being burned, reinforcing the bullish narrative, increasing usage, and creating a self-reinforcing cycle;

-

Ethereum acts as a more elastic “bull market call option” in crypto, while Bitcoin serves as “digital gold.” In the short term, Ethereum’s volatility is expected to remain elevated.

Overall, Ethereum may exceed Bloomberg’s projected 10–20% inflow ratio relative to Bitcoin.

From a broader perspective, the crypto market is entering a new innovation cycle. Combined with improving macroeconomic conditions, potential monetary easing, and the approaching U.S. election cycle, the approval of spot ETFs has alleviated major regulatory concerns. The RockFlow research team believes the crypto market is well-positioned for continued strong upward momentum.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News