The Restaking War has begun—Symbiotic, Eigenlayer, or Karaka, who will come out on top?

TechFlow Selected TechFlow Selected

The Restaking War has begun—Symbiotic, Eigenlayer, or Karaka, who will come out on top?

Hope Karak can accelerate its development pace, because Symbiotic is racing to catch up with Eigenlayer.

Author: IGNAS | DEFI RESEARCH

Compiled by: TechFlow

This week, I originally planned to write a blog post about emerging trends in crypto, but due to the sudden launch of Symbiotic and its deposit cap nearly reaching $200 million within a day, I had to shift focus to restaking. Emerging trends can wait, but high-yield airdrop opportunities cannot be missed.

Currently, with Karak included, we now have three restaking protocols. So, what sets them apart? And how should we respond?

Why Symbiotic Was Launched

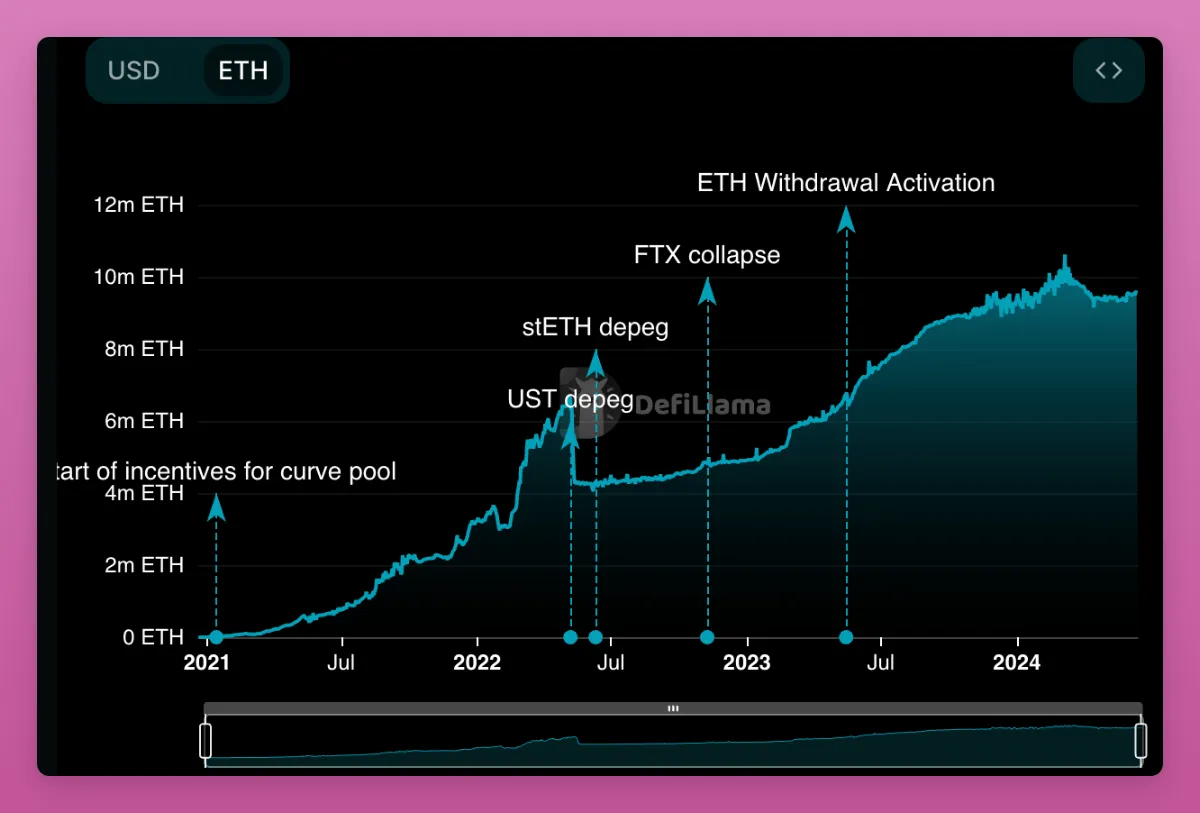

It is rumored that Paradigm approached Eigenlayer co-founder Sreeram Kannan for investment, but Kannan chose rival Andreessen Horowitz (a16z), which led a $100 million Series B round. Since then, Eigenlayer has grown into the second-largest DeFi protocol, with a TVL of $18.8 billion—second only to Lido’s $33.5 billion. The FDV of the EIGEN token stands at $13.36 billion.

Considering that Eigenlayer was valued at just $500 million FDV in March 2023, this represents a 25x paper return. Paradigm was clearly unimpressed, so it funded Symbiotic as a direct competitor to Eigenlayer. Symbiotic raised $5.8 million in seed funding from Paradigm and cyber•Fund.

The rivalry between Paradigm and a16z is common knowledge (and a running joke), but there's a second layer to this story.

Cyber Fund, the second-largest investor in Symbiotic, was founded by Lido co-founders Konstantin Lomashuk and Vasiliy Shapovalov. As Coindesk reported in May, “people close to Lido believe Eigenlayer’s restaking model poses a potential threat to its own dominance.”

Lido missed the boat on the Liquid Restaked Token (LRT) trend. In fact, stETH’s TVL has stagnated over the past three months and declined by 10%. Meanwhile, inflows into EtherFi and Renzo surged to $6.2 billion and $3 billion respectively.

Restaking via LRTs is particularly attractive because it offers higher yields, although at this stage most of it consists of points.

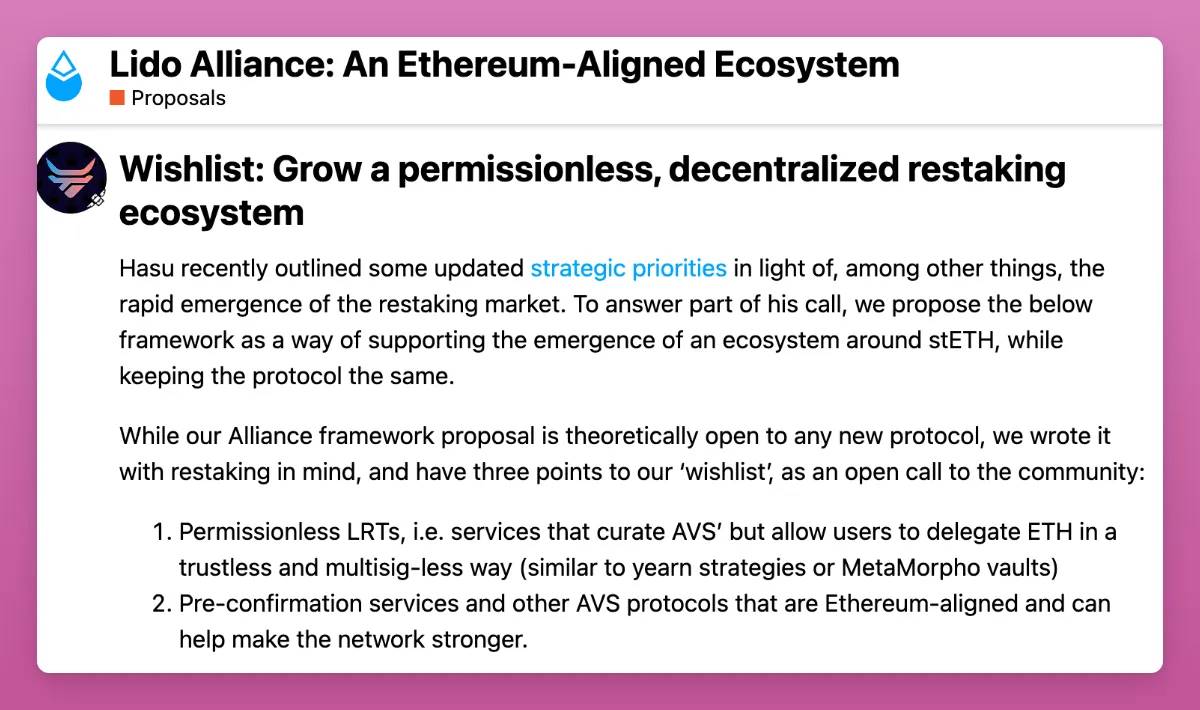

To strengthen Lido’s position, the Lido DAO launched the “Lido Alliance”, with its primary goal being to build a permissionless, decentralized restaking ecosystem.

(See details here)

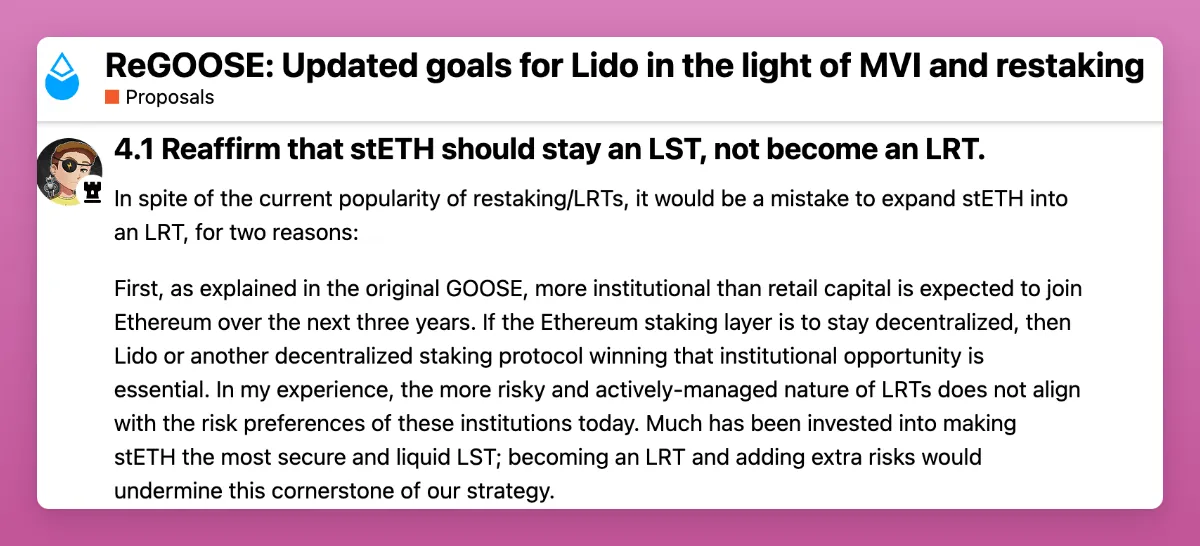

By the way, one of the strategic priorities is to reiterate that stETH is an LST, not an LRT.

This is good news for us, as it means more tokens and more farming opportunities.

Just one month after initial discussions, key alliance member Mellow launched LRT deposits on Symbiotic, supporting stETH deposits!

But let’s first step back and compare how Symbiotic differs from Eigenlayer before diving into Mellow LRT’s unique features and farming opportunities.

Symbiotic vs Eigenlayer

Symbiotic: Permissionless and Modular

Symbiotic features a permissionless and modular design, offering greater flexibility and control. Its main characteristics include:

-

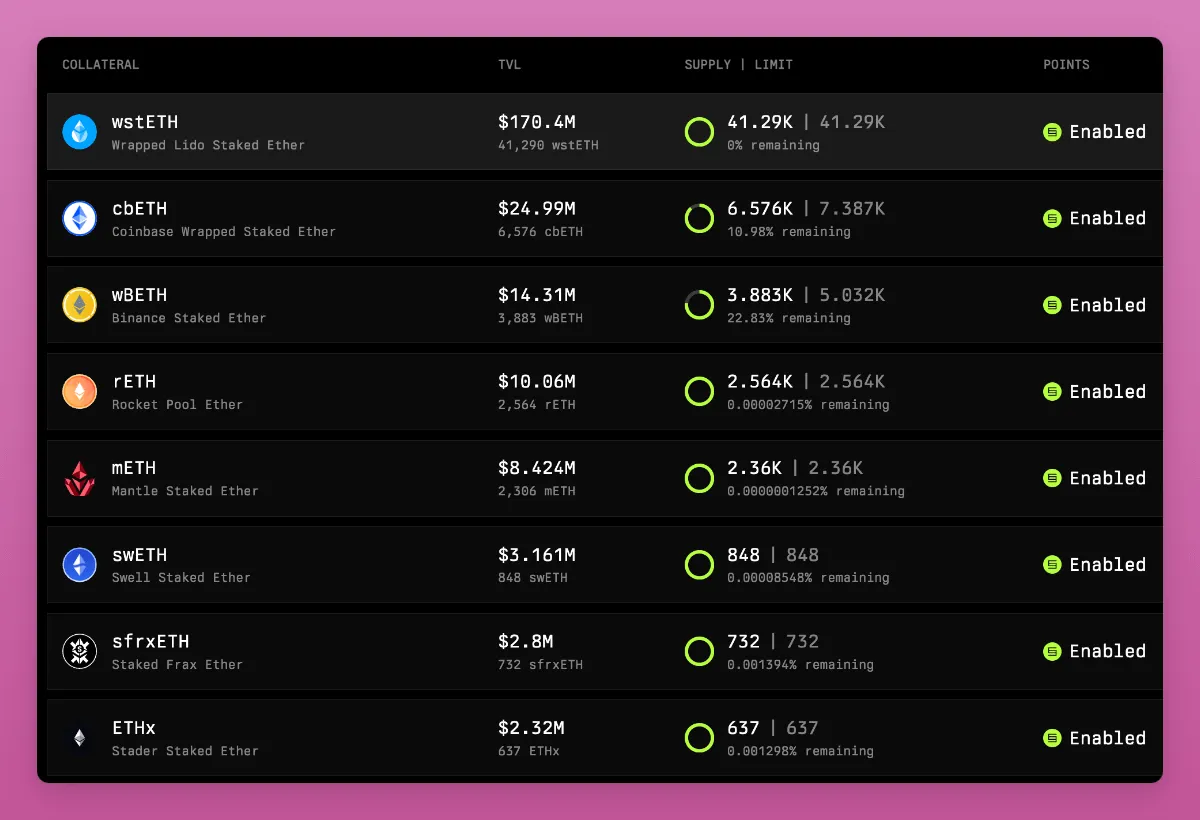

Multi-asset support: Symbiotic allows direct deposits of any ERC-20 token, including Lido’s stETH, cbETH, etc. This makes Symbiotic more diverse than Eigenlayer, which primarily supports ETH and its derivatives.

-

Customizable parameters: Networks using Symbiotic can choose their own collateral assets, node operators, reward structures, and slashing mechanisms. This modular design enables networks to tailor their security configurations to specific needs.

-

Non-upgradable core contracts: Symbiotic’s core contracts are non-upgradable (similar to Uniswap), reducing governance risk and potential failure points. Even if the team disappears, Symbiotic can continue operating.

-

Permissionless integration: Allows any dApp to integrate without approval, creating a more open and decentralized ecosystem.

“Symbiotic” means “avoid competition like avoiding fire, be as selfless and unopinionated as possible,” according to Symbiotic co-founder and CEO Misha Putiatin in an interview with Blockworks.

Misha also told Blockworks, “Symbiotic does not compete with other market players, so there will be no native staking, rollups, or data availability products.” When dApps launch, they typically need to manage their own security models. However, Symbiotic’s permissionless, modular, and flexible design allows anyone to secure their network using shared security.

As Misha put it, “Our project aims to change the narrative — you don’t have to bootstrap locally. Launching on top of us, on shared security, is safer and easier.”

In practice, this means crypto protocols can launch native staking for their own tokens to enhance network security. For example, Ethena partnered with Symbiotic to use staked ENA as collateral for USDe cross-chain securities.

According to a Symbiotic blog post, Ethena is integrating Symbiotic with LayerZero’s Decentralized Verifier Network (DVN) framework to bring Ethena assets (such as USDe secured by staked ENA across chains) onto the platform. This is just the first of several components in their infrastructure that will leverage staked $ENA.

Other use cases include cross-chain oracles, threshold networks, MEV infrastructure, interoperability, shared sequencers, and more. Symbiotic launched on June 11, and the stETH deposit cap was reached within 24 hours.

Eigenlayer: Managed and Integrated Approach

Eigenlayer adopts a more managed and integrated approach, focusing on leveraging Ethereum ETH stakers’ security to support various dApps (AVS):

-

Single-asset focus: Eigenlayer primarily supports ETH and its derivatives. This focus may limit its flexibility.

-

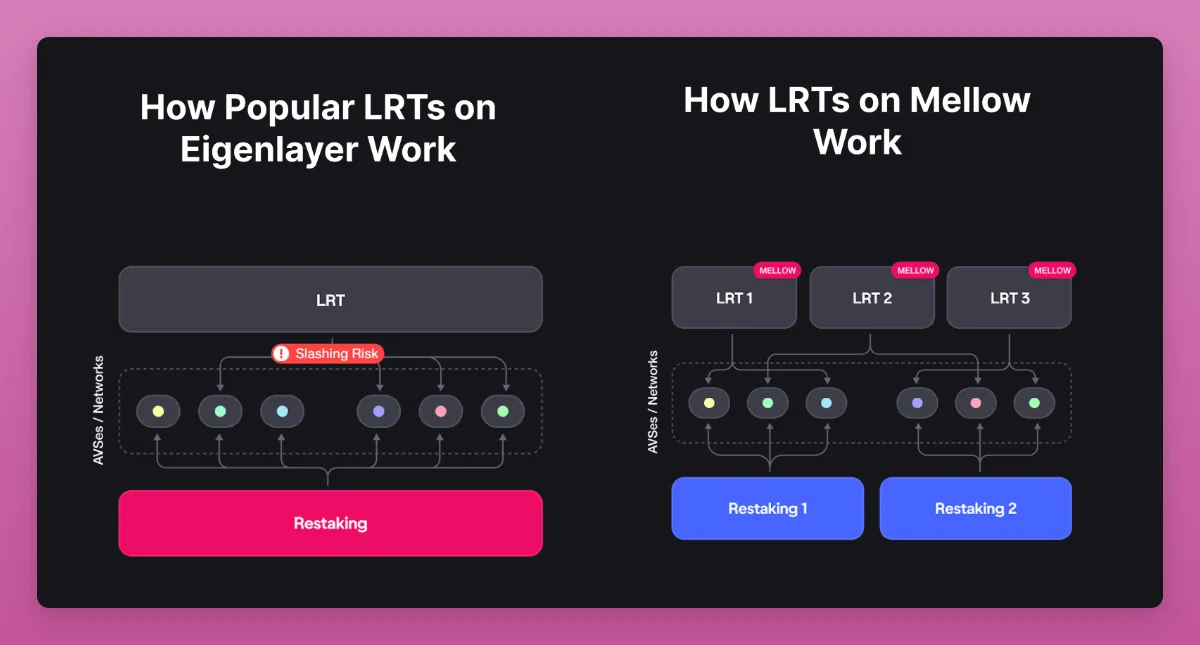

Centralized management: Eigenlayer manages the delegation of staked ETH, and node operators validate various AVS. This centralized management simplifies operations but may introduce bundling risks, making it harder to accurately assess individual service risks.

-

Dynamic market: Eigenlayer provides a decentralized trust market, allowing developers to use pooled ETH security to launch new protocols and applications. Risks are shared among pool depositors.

-

Slashing and governance: Eigenlayer’s management includes specific governance mechanisms for handling slashing and rewards, which may offer less flexibility.

To be honest, Eigenlayer is an extremely complex protocol whose risks and overall functionality exceed my understanding. I had to compile criticisms from various sources for this section, including Cyber Fund itself. I’m not taking sides, but I believe comparisons between Symbiotic and Eigenlayer will be a hot topic among DeFi enthusiasts.

Mellow Protocol: Modular LRT

One of the most exciting aspects of Symbiotic’s launch is the LRT protocol Mellow built on top of it. As a member of the Lido Alliance, Mellow benefits from Lido’s marketing, integration support, and liquidity bootstrapping.

As part of the deal, Mellow will reward Lido with 100,000,000 MLW tokens (10% of total supply), which will be locked in the Lido Alliance legal entity after TGE. These tokens will be subject to the same vesting and cliff terms as team tokens: a 12-month cliff after TGE, followed by a 30-month vesting period (edited based on received feedback).

The alliance proposal also mentions two additional benefits:

-

Mellow will help promote Lido’s geographical and technological decentralization efforts beyond Ethereum validation.

-

Lido node operators can launch their own composable LRTs and control the risk management process by selecting AVS that suit their needs, rather than being forced into AVS imposed by LRT or restaking protocols.

The impact of the partnership will take time to materialize, but LDO has already grown 9% in 2024. Interestingly, one of the four LRT caps—$42 million—was already reached before the following Lido collaboration tweet was posted.

Regardless, if you're familiar with Eigenlayer LRTs (like EtherFi and Renzo), you know depositing into Mellow brings double the fun: you earn both Symbiotic and Mellow points. But Mellow differs from Eigenlayer LRTs.

What Problems Does Mellow Solve for LRTs?

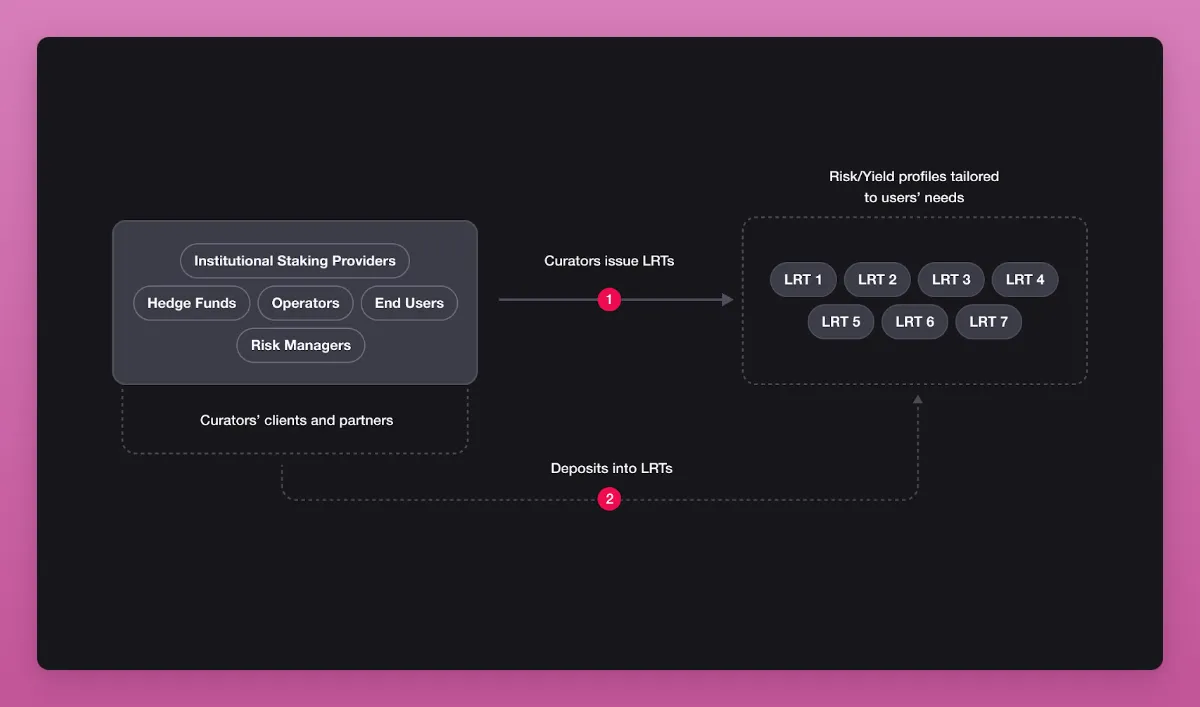

The Mellow protocol allows anyone to deploy an LRT, including hedge funds and staking providers (like Lido). This means the number of LRTs could significantly increase, potentially harming liquidity and complicating integration into DeFi protocols.

Mellow’s advantages include:

-

Diversified risk profiles: Current LRTs typically force users into uniform risk configurations. Mellow allows multiple risk-adjustment models, enabling users to choose their preferred level of risk exposure.

-

Modular infrastructure: Mellow’s modular design allows shared security networks to request specific assets and configurations. Risk curators can create highly customized LRTs tailored to their needs.

-

Smart contract risk: By enabling modular risk management, Mellow reduces vulnerability risks in smart contracts and shared security logic, providing a safer environment for restakers.

-

Operator centralization: Mellow decentralizes operator selection decisions, preventing centralization and ensuring a balanced, decentralized operator ecosystem.

-

LRT circular risk: Mellow’s design addresses liquidity crunch risks caused by withdrawal delays. Current withdrawals require 24 hours.

Interestingly, Mellow specifically mentioned that they can launch LRTs on top of any staking protocol (such as Symbiotic, Eigenlayer, Karak, or Nektar). However, I would be very surprised to see direct collaboration between Mellow and Eigenlayer.

That said, I wouldn’t be surprised if current Eigenlayer LRT protocols collaborate with Symbiotic or Mellow. In fact, Coindesk reported that a source close to both Renzo and Symbiotic mentioned Renzo had been discussing integration with Symbiotic a month ago.

Finally, the cool thing about Mellow’s permissionless vaults is that we might soon see LRTs for DeFi tokens. Imagine an ENA LRT token—liquid staked ENA on Symbiotic securing USDe bridges.

This cycle has seen little innovation in tokenomics, but Symbiotic might make holding DeFi governance tokens attractive again.

The DeFi Degen Restaking Wars Playbook

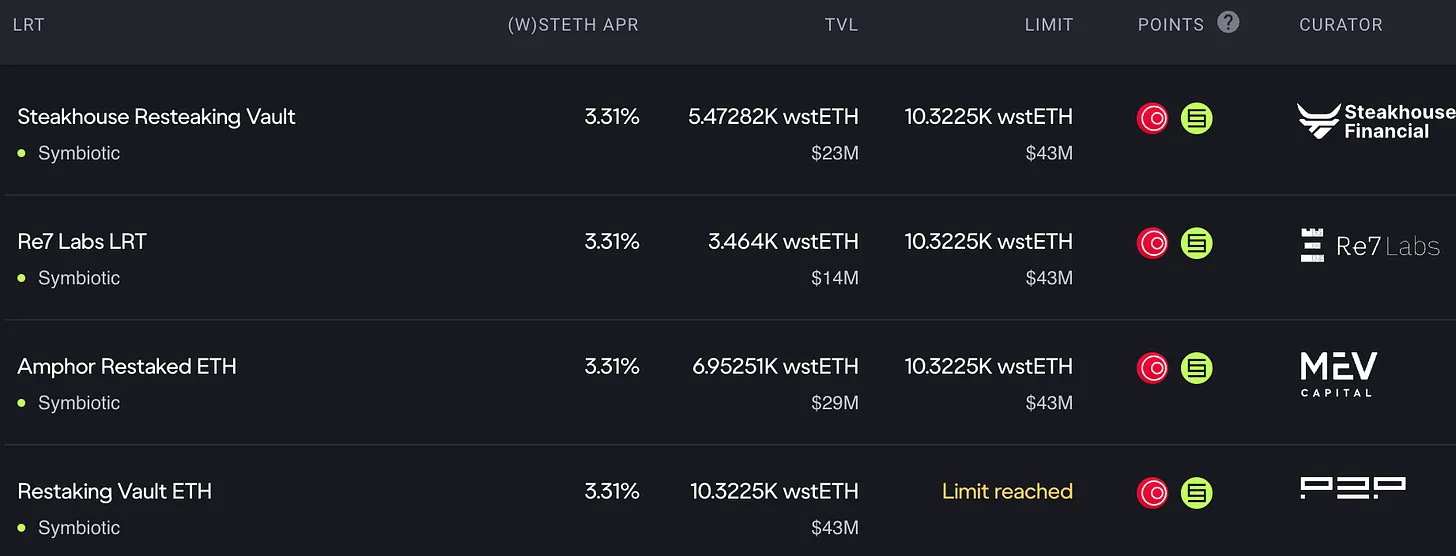

At the time of writing, there are four LRT vaults on Mellow, each managed by a unique curator, and deposit caps are nearing completion.

The timing of Symbiotic and Mellow LRT launches is perfect: EtherFi S2 points end on June 30, Renzo S2 is ongoing, and Swell’s airdrop is expected shortly after withdrawals are enabled.

I’m almost worried about what to do with my ETH after LRT airdrops end. Thanks to VCs and whale games, airdrop farmers will have plenty to gain.

At this stage, the game is simple: deposit into Symbiotic for points, or take higher risk by directly farming on Mellow. Note that since Symbiotic’s stETH deposits are full, you won’t earn Symbiotic points, but you’ll get 1.5x Mellow points instead.

The airdrop game may resemble Eigenlayer’s playbook: Mellow LRTs will likely be integrated into DeFi, and we’ll see leveraged farms on Pendle and multiple lending protocols. But I believe Symbiotic’s token might launch before EIGEN becomes tradeable.

In an interview with Blockworks, Putiatin said the mainnet might “launch some networks by late summer.” Does this imply the token will also launch?

It might be wise for Symbiotic to steal the spotlight from Eigenlayer’s restaking momentum, especially as markets turn bullish and considering Symbiotic’s aggressive partnership strategy.

Two partnerships stand out: Blockless and Hyperlane. Both protocols initially partnered with Eigenlayer as AVS for shared security—have they switched allegiances?

Perhaps Symbiotic promised more support and token allocations? I need more answers!

Either way, these restaking wars are great for us airdrop speculators—they create more opportunities and may push Eigenlayer to launch its token faster.

For Symbiotic, it’s still early days, but the initial deposit inflow looks very bullish. I’m currently farming on both Symbiotic and Mellow, but plan to migrate to Pendle YTs once strategies open.

I believe the maturity date of Pendle’s Symbiotic YT token will give us deeper insight into Symbiotic’s TGE timeline.

Finally: Karak

Karak is a hybrid—similar to Eigenlayer, but it refers to AVS as Distributed Security Services (DSS). Karak also launched its own Layer 2 (called K2) for risk management and sandbox testing of DSS. However, it functions more like a testnet than a real L2.

Karak attracted over $1 billion in TVL for two main reasons:

-

Karak supports Eigenlayer’s LRTs, so farmers can simultaneously earn points from Eigenlayer, LRTs, and Karak.

-

Karak raised over $48 million from investors including Coinbase Ventures, Pantera Capital, and Lightspeed Ventures.

Nevertheless, since its April announcement, Karak has yet to announce any major partners, LRT protocols launching on Karak, or exclusive DSS/AVS partnerships. Hopefully, Karak will pick up the pace, as Symbiotic is rapidly catching up to Eigenlayer.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News