Finding the optimal token distribution structure: 5% unlocked at TGE, circulating supply not exceeding 15%

TechFlow Selected TechFlow Selected

Finding the optimal token distribution structure: 5% unlocked at TGE, circulating supply not exceeding 15%

Trading based solely on hype, smart money movements, or technical analysis is a bad idea.

Author: Ronin

Compiled by: TechFlow

Over the past 6 months, I've invested in 189 private/KOL rounds and identified the best-performing allocation strategies.

“Damn it, why should I read this crap!?”

A great product and a strong community around a project are excellent.

But that doesn't guarantee further token growth, especially if the tokenomics are only designed for the next 1-2 years.

First, fundamentals must address long-term sustainability—that’s why I’m sharing this with you.

The Ideal Tokenomics I Would Invest In

TGE Unlock: 5–7%

Yes, we all want to make quick profits—right now. But wanting to taste profits too early at launch is dangerous. With this TGE unlock structure, we get:

-

Low circulating supply (leaving significant room for rapid market cap growth)

-

Stable and rising token price

-

Opportunity to exit during investor-driven rallies in bull markets

Circulating Supply at TGE: 11–15%

Unlock schedule as follows:

-

11–15% at launch → 20% by end of Year 1 → 30–35% by end of Year 2 → Then linear unlocks over several additional years

Lock-up Period: 3–6 Months

Investing with a 12-month lock-up is extremely unwise, as your unlock will likely coincide with a bear market. However, a 6-month lock-up builds retail investor confidence, leading to more buying pressure and added liquidity.

When retail investors are confident, large investors and market manipulators become cautious. This leads to steady growth over months or years—allowing us to sell our tokens at market peaks.

Team Vesting After Investors (Rule)

Linear Vesting

-

Daily — Excellent

-

Monthly — Good

-

Quarterly — Not good

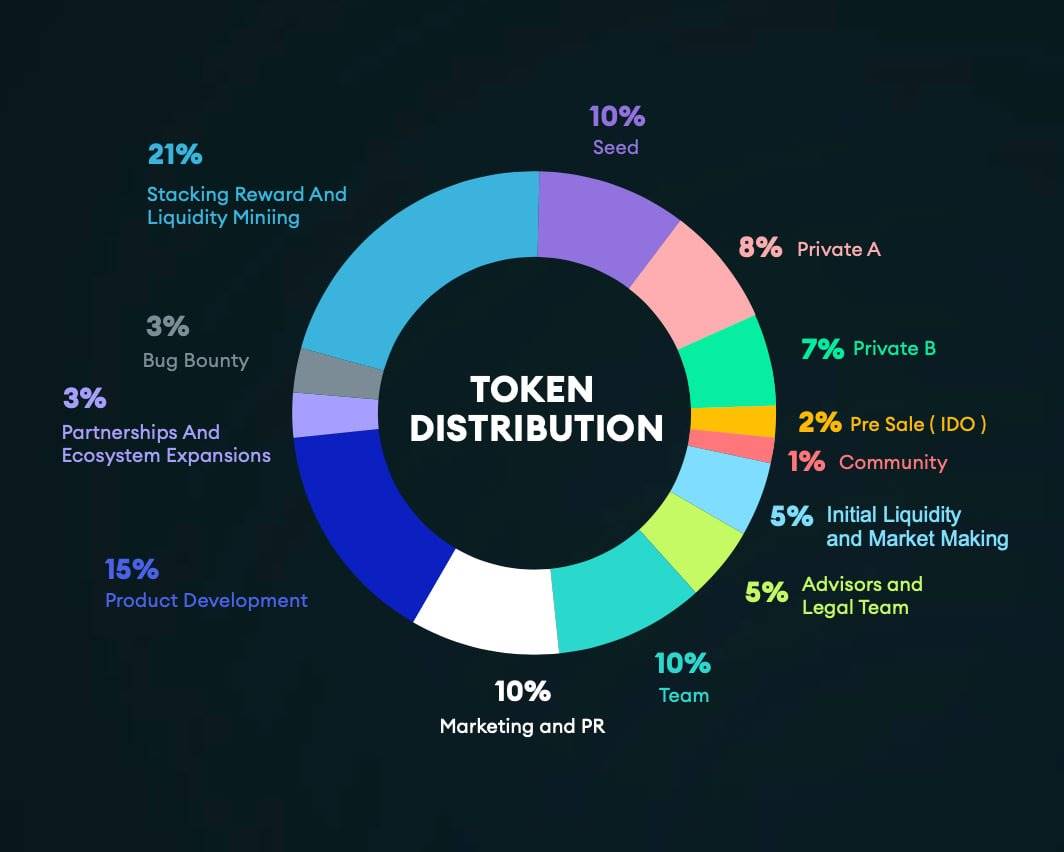

Optimal Allocation

-

30–40% to community/ecosystem

-

15% to investors

-

15% to founders

-

25% to treasury/reserve

-

5% to advisors/KOLs

-

5% to market makers and CEXs

Ideally, on TGE day (Token Generation Event), the unlocked portion should be: 4% for investors/advisors, 5% for public sale, 6% for community/reserve—totaling 15%.

Conclusion

If you decide to invest in any altcoin, evaluate it using the criteria I’ve outlined above.

If you’re investing in private/KOL rounds, carefully apply these standards (though sometimes, faster, better deals may exist).

I hope my losses over these past six months can at least teach some of you how to achieve greater profits in your investments.

Remember! If you trade based purely on emotion—you're gambling.

If you analyze and act based on news—you're a master.

Trading solely based on hype, smart money flows, or technical analysis is a bad idea. You must also follow fundamentals and current news—that's the only real path to success.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News