A new round of meme stocks emerges, as Jia Yueting's failed car venture spawns a speculative stock frenzy

TechFlow Selected TechFlow Selected

A new round of meme stocks emerges, as Jia Yueting's failed car venture spawns a speculative stock frenzy

The battle between bulls and bears of Faraday Future could last for weeks or even months.

Author: RockFlow

Key Takeaways

① Based on a previous average entry cost of $0.2–0.3, early investors in Faraday Future realized gains of 10–15 times at the peak. Retail investors who bought at the low of $0.04 achieved even greater returns—over 80 times.

② The 2021 GameStop event was essentially a "short squeeze," and the same applies to Faraday Future. As of April 30, its short interest reached an extremely high 95.37%. This indicates widespread pessimism about Faraday Future, but if longs concentrate their efforts on a squeeze, the odds of success are quite high.

③ Faraday Future is merely another replay of the earlier GME and AMC events. Similar phenomena have already emerged across multiple niche markets: meme stocks, NFTs, SPACs, cryptocurrencies, and sometimes even large-cap stocks like Tesla. Reality is often crazier than expected.

Just one week ago, the U.S. stock market seemed to revert back to 2021.

It all started with a tweet posted by Keith Gill on Sunday night. Better known as "Roaring Kitty," he was the de facto leader of retail investors during the last surge in meme stocks.

This marked his first social media post in three years.

Subsequently, within just two days—Monday and Tuesday—GameStop and AMC shares surged over 100%, leading to extreme price volatility. On Tuesday alone, these stocks were halted 38 times. According to data firm S3 Partners, short sellers lost approximately $2.2 billion on GME in those two days.

Unlike in 2021, however, the rally for GME and AMC dissipated quickly this time.

But the story didn't end there. The Chinese electric vehicle company Faraday Future (FFIE) picked up the torch. It surged 5,700% during the latest wave of meme stock frenzy, becoming the new favorite among retail investors after GME and AMC.

According to Nasdaq's official statistics, from May 14 to 16, Faraday Future’s daily trading volume increased more than tenfold compared to previous averages, with a single-day peak exceeding 1.5 billion shares. Using the prior average participation cost of $0.2–0.3, early investors achieved 10–15x returns at the peak. Those who bought at the low of $0.04 saw even higher profits—exceeding 80x.

On established online communities such as subreddits run by Roaring Kitty fans and Shortsqueeze, retail investors holding hundreds of shares turning into tens of thousands, or positions growing from thousands to 500,000, began sharing their holdings—further fueling widespread retail enthusiasm, dissemination, and bottom-fishing.

Data from Thinknum shows that on May 17—the height of this surge—Faraday Future became the second most mentioned stock on Reddit’s WallStreetBets, the epicenter of retail investing in the U.S., trailing only Nvidia.

So how did FFIE surpass predecessors like GME and AMC to become China’s own meme stock in this cycle? And who will be next? The RockFlow research team offers a brief analysis below.

Additionally, the RockFlow research team has recently published in-depth reports on Palantir, Coinbase, Duolingo, and Adobe. With several of these companies entering a new earnings season, click below for quick insights into their recent business developments and investment potential:

After Nvidia, Who Will Be the Next Early Beneficiary of AI?

Adobe: An AI Winner or a Victim of Sora?

Duolingo: How Is AI Shaping the Future of Education?

Coinbase: Exchange, Broker, Crypto Bank, or a Faith Movement?

1. Faraday Future’s Fundamentals and the Conditions for Selection

Over the past six months, Faraday Future’s share price dropped from $1.50 to four cents. Yet in just five days, it soared rapidly, breaking above $1, $2, and $3 for the first time since January this year.

Before exploring why Faraday Future was chosen by retail investors (or perhaps big players?), let’s briefly review the company.

Faraday Future went public on Nasdaq in 2021, headquartered in New York, with a market cap then exceeding $4 billion. Its stock peaked at $4,980 on February 1, 2021. It then steadily declined in a straight line, falling to a low of $0.038 earlier this year—a drop of 99.99%, with a market cap under $2 million at the trough.

Compared to peers delivering tens of thousands or even hundreds of thousands of vehicles annually, Faraday Future delivered only 10 new cars in 2023—including one purchased by founder Jia Yueting himself. Clearly, such minimal delivery volume is far from sufficient to achieve profitability.

From a fundamental standpoint, Faraday Future is clearly trapped in a death spiral. It failed to file financial reports for the past two quarters on time. In its most recently reported quarter (Q3 2023), revenue was $551,000, with a net loss of $78.046 million. Cash on hand stood at $8.567 million, practically sealing its fate for delisting.

A delisting notice from Nasdaq added further pressure. In April this year, Faraday Future received a delisting warning due to its low share price. In its latest communication, FFIE plans to request additional time and may conduct a reverse stock split.

Amid this crisis, one figure stands out: according to Nasdaq, as of April 30, its number of outstanding shorted shares reached 36 million. Based on a total float of 38.1063 million shares, the short interest ratio hit 95.37%.

Such a high level of shorting indicates extreme bearish sentiment toward Faraday Future. But conversely, it also means that if longs concentrate their forces to trigger a short squeeze, the probability of success is very high.

A "short squeeze" is a common financial phenomenon. When a heavily shorted stock rises rapidly, short sellers are forced to buy back shares to cover their positions. If borrowing costs are high and buying pressure intensifies, the rising demand further drives up the stock price. The more short sellers rush to close out, the more shares they must repurchase, creating a self-reinforcing upward spiral.

The essence of the 2021 GameStop incident was precisely such a "short squeeze." At that time, despite GameStop’s strong rally, Robinhood—under pressure from major financial backers—banned retail investors from buying additional shares (only allowing sales), causing the stock to plummet. In the end, Wall Street won, while many retail followers suffered heavy losses.

This time around, retail investors discovered Faraday Future and began rallying again. Both sides could now engage in sustained battles around key price levels. This conflict between bulls and bears could last for weeks, or even months.

2. Sequential News Catalysts Keep the Story Alive

The possibility of a short squeeze is only one reason Faraday Future was selected.

Meme stocks are characterized by intense retail interest, high social media discussion, volatile pricing, and detachment from the company’s underlying financial health. Faraday Future meets all these criteria. With Roaring Kitty’s return and his legendary involvement in GameStop reigniting retail enthusiasm, emotions ran high—demanding one or more outlets for expression.

In fact, Faraday Future’s rise as the vanguard of this meme stock wave was amplified by several external catalysts:

1) Geopolitical Developments

One factor driving Faraday Future’s stock price was the U.S. government’s announcement on May 14 of additional tariffs on Chinese electric vehicles and other products. This sudden news prompted agile investors to recognize Faraday Future’s uniqueness.

As the only EV company with Chinese roots headquartered and operating locally in the U.S.—and thus the only Chinese EV ADR unaffected by the tariffs—Faraday Future holds a unique position, potentially offering some merger or acquisition value. This served as one spark for speculative trading.

2) Fundamental “Value”

As previously noted, Faraday Future is indeed suffering severe losses, with over $600 million lost in the past year. However, some analysts expect its fundamentals might improve this year and next. If one insists on finding a silver lining, the company is projected to reach EPS of $0.12 by 2025—an optimistic narrative that may also contribute to the stock’s rebound.

3) Jia Yueting’s Need to Protect FFIE’s Listed Status

Another key factor behind Faraday Future’s recent surge is the proactive measures taken by its founder, Jia Yueting. After receiving the delisting notice in April, Jia took action, aiming to leverage his personal brand to benefit the company.

Over the past few weeks, Jia, who also serves as Chief Product and User Ecosystem Officer (CPUO), has posted multiple videos across social media platforms. In them, he announced plans to commercialize his personal IP to generate extra income, pay off debts, and inject funds into Faraday Future to support car production and overall operations. He emphasized his commitment to working with the co-CEO to play a more active leadership role in overcoming the company’s challenges.

If even a fraction of his statements is credible, it might persuade some retail investors to buy in.

3. Where Will the Next Meme Stock Emerge?

Clearly, Faraday Future is just another repeat of the earlier GME and AMC episodes.

Looking back at the GME saga, beyond Keith Gill, the central figure was Ryan Cohen. He exited Chewy, the pet e-commerce company he founded, in 2017, and chose to enter GameStop in 2020. In September 2020, Cohen disclosed a 9% stake in the company.

Cohen, known for skillful Twitter engagement and proven success in e-commerce, immediately attracted investor attention (not just retail). Upon the news, the stock rose 24%.

Two months later, he issued an open letter to GameStop’s board outlining a plan to develop its e-commerce business. In January 2021, Cohen increased his stake to 12.9% and joined the board, shocking the world once again.

At that point, much like today’s Faraday Future, GameStop had accumulated massive short interest due to weak fundamentals. Then came the short squeeze, sending its stock up over 1,000%.

Some retail investors may have missed GameStop in 2021, but this time—with GME, AMC, and now Faraday Future—they won’t want to miss out again.

Over the past few years, similar phenomena have surfaced across multiple niches: meme stocks, NFTs, SPACs, cryptocurrencies, and occasionally even large-cap stocks like Tesla.

In each case, the asset generated emotional value detached from its intrinsic worth. This is closely tied to a company’s visibility and liquidity—even if fundamentals remain unchanged, being noticed by the market can temporarily assign it new value (though often fleeting and fragile).

4. Conclusion

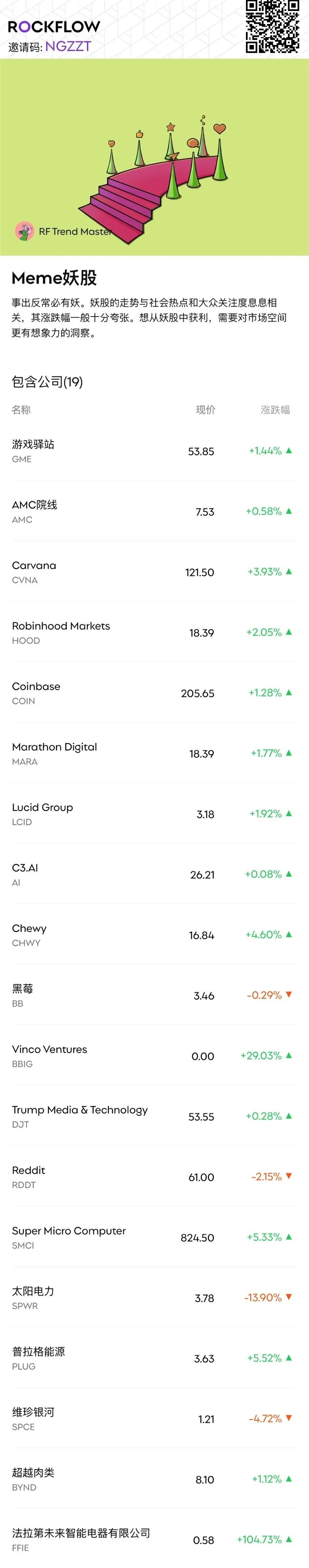

Faraday Future’s recent extreme price swings reflect both the risks and allure of the stock market. Reality is often wilder than imagination—especially in the U.S. equity market, where retail sentiment, geopolitical factors, and internal corporate dynamics collide. The RockFlow research team has curated a list of meme stocks—scan the QR code below to follow their latest moves and performance:

As for Faraday Future’s current game—when will it end? And who will be next? We’ll just have to wait and see.

Finally, if you’re interested in U.S. stock investing, feel free to scan and add our dedicated investment advisor on WeChat. You can also join our discussion group to receive daily AI-powered trading ideas, news alerts, and participate in deeper conversations~

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News