A bull market does not equal profits—how can one cautiously exit with capital intact?

TechFlow Selected TechFlow Selected

A bull market does not equal profits—how can one cautiously exit with capital intact?

If you can seize it properly, this bull market could be your biggest opportunity.

Author: Temmy

Translation: TechFlow

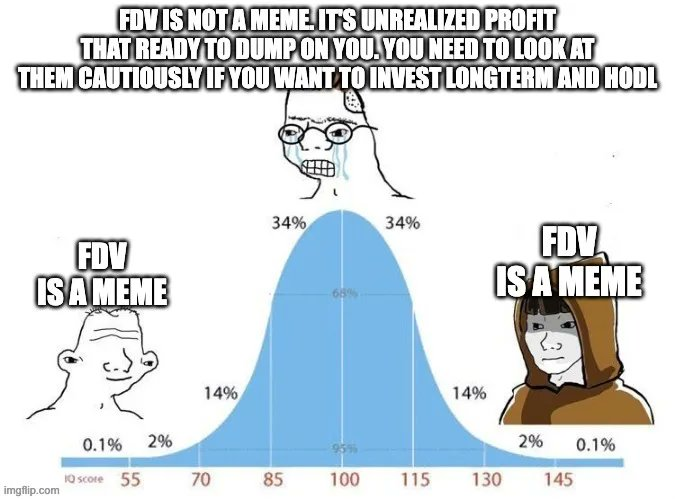

After being in the cryptocurrency space for several years, I’ve deeply felt how tough this market can be. Today, we’re in a fiercely competitive phase, facing multiple pain points such as dramatic venture capital events, SEC crackdowns, meme coins, poor tokenomics, and high-FDV projects. In this bull market, we need to be extra cautious to avoid drawdowns caused by market volatility.

We must remain cautious—how can we not be concerned when a startup with no real achievements is valued at billions? Yet it seems no one cares. But I think we should, because we love crypto. It pains me to see utility projects with terrible tokenomics receiving backing from top-tier VCs.

I don’t know what’s gone wrong in this space, but whatever it is, we need to reflect and think about how blockchain and cryptocurrency can truly change the world. Otherwise, we’ll just keep drifting. Anyway, long story short:

This bull cycle is complex; without caution, many users will end up suffering drawdowns.

I’ve seen it happen firsthand, so I can testify: To exit this bull market with strong liquidity, you must understand the difference between gambling, trading, and investing.

-

Gambling means putting money into a project and hoping it moons.

-

Trading involves strategy, timing, and understanding of market movements.

-

Investing is a long-term belief in a project’s fundamentals.

If we confuse these three, we’re setting ourselves up for failure.

As a crypto enthusiast, you should know why you’re here and stay focused on that, because our life goals differ. It’s also crucial to remember that a bull market is a once-in-a-lifetime opportunity—and if you’re not careful, it can become a trap. People often hold too long, expecting prices to keep rising, only to see their gains vanish when the market corrects. Many of us, myself included, learned this painful lesson in the last cycle.

Recall the stories from previous cycles. Some knowledgeable traders firmly believed the bull run would never end, watching their portfolios rise and then fall. They believed in their projects, their tokens, and their trades. They worked hard, engaged with markets, provided liquidity, staked tokens, participated in governance votes, and more. They were like cells in a larger organism, driving protocol growth. But they didn’t take profits—that was their downfall.

To avoid drawdowns in this cycle, here are a few things I believe we can do:

-

Learn continuously from others’ mistakes: Examples include failing to trust your own conviction, failing to act, or failing to take profits. (I wrote a thread on this)

-

Set clear profit targets: If you want to succeed, decide when to take profits. Whether it’s 20%, 50%, or 100% gains, having a plan helps avoid emotional decisions.

-

Diversify your portfolio: Don’t put all your eggs in one basket—spread investments across different projects to reduce risk.

-

Stay informed: As a crypto investor, you must stay updated on market news, project developments, and macroeconomic factors. As the saying goes, where your treasure is, there your heart will be also.

-

Avoid greed: The temptation to wait for the next big surge is strong, but markets are unpredictable. Sometimes, locking in smaller but secure gains is better. Profit-taking should be an essential part of your strategy.

As the market heats up, it’s easy to get caught up in the excitement and forget that what goes up must come down. So start planning now. Consider taking profits toward year-end months, because now is the time to buy, not sell. This market is different from 2021—it will test your discipline and strategy. But with careful planning and strict execution, you can avoid the trap of drawdowns.

Stay sharp, stay informed, and most importantly, take profits.

If you manage it well, this bull market could be your biggest opportunity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News