The Cryptocurrency War: BTC's Pizza, the Ambition of Crypto Dollar

TechFlow Selected TechFlow Selected

The Cryptocurrency War: BTC's Pizza, the Ambition of Crypto Dollar

Fourteen years have passed, BTC's price has increased hundreds of millions of times, but pizza is still the same-tasting pizza.

Author: Armonio, AC Capital

Fourteen years have passed since spring turned to autumn and back again—blink and the crypto punks have already welcomed the world’s fourteenth Pizza Day.

This holiday commemorates the legendary transaction by crypto pioneer Laszlo Hanyecz, who bought two pizzas with 10,000 BTC. It wasn’t just the first-ever transaction in cryptocurrency history; it also represented BTC fulfilling all functions of money. This marked the official debut of digital cryptocurrencies on the global monetary stage. A whole new market slowly opened its doors to adventurers around the world.

Fourteen years later, even though BTC’s price has increased hundreds of millions of times over, pizza remains the same-tasting pizza. To exchange BTC for pizza today, you still need to go through fiat currency (except in El Salvador and the Central African Republic). While BTC has made significant progress in value consensus, in terms of application consensus, we’ve been stuck ever since Satoshi left. Satoshi’s vision of a “peer-to-peer electronic cash system” remains technically feasible but without real-world product implementation.

It is precisely this slow adoption of BTC that has led to today's reality: BTC is now surrounded by stablecoins and other digital currencies like XRP. In traditional markets such as low-cost, efficient global remittances and untraceable black-market transactions, BTC continues to lose market share. Global currency dominance represents massive stakes: to secure it, the U.S. government, allied with Wall Street, aims to leverage the digital payment ecosystem created by Bitcoin to further expand dollar hegemony.

At the start of this article, let me pose a question:

When did crypto organizations suddenly stop paying salaries in BTC? When did promotional campaigns giving away free BTC turn into giveaways of USD-pegged stablecoins and altcoins?

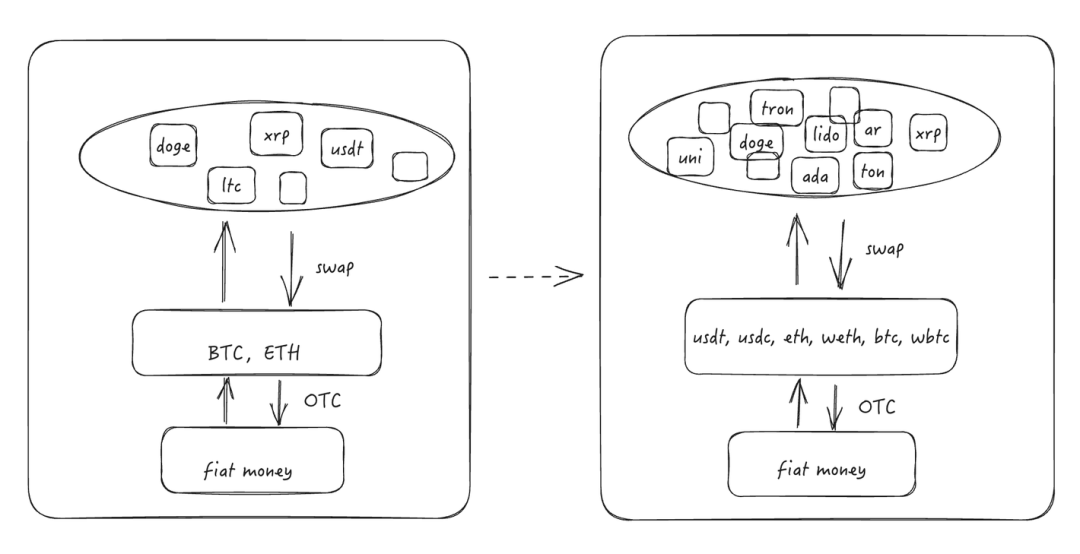

As crypto beliefs weaken, the liquidity logic within the crypto market has undergone a qualitative shift. After 2021, how many people still stubbornly stick to BTC and ETH as base units? Once the intermediary role of BTC and ETH in trading is undermined and their pricing falls under Wall Street’s control, the entire valuation framework of cryptocurrencies sinks deeper into American hands.

USD-pegged stablecoins have encroached upon the intermediary roles once held by BTC and ETH, weakening BTC and ETH’s ability to capture value.

In decentralized exchanges, BTC and ETH still hold onto dominant positions:

But in centralized exchanges, most trading pairs are priced against USD stablecoins—the number of stablecoin trading pairs far exceeds those of BTC and ETH. The pricing power over cryptocurrencies began eroding even before Wall Street locked BTC and ETH into ETFs.

Thus, what was originally a market supporting BTC and ETH prices has become subservient to dollar hegemony. Holders and traders of digital currencies have shifted from being libertarian crypto-punks to becoming short-sighted sources of dollar liquidity—and de facto supporters of dollar dominance.

The current situation feels somewhat bleak.

Desire: America Devours Global Finance

The Call of a Grand Crypto Era

Blockchain systems represent a revolutionary, systemic technological breakthrough. Decentralized payments do more than replicate Alipay’s functionality—enabling cross-border transfers measured in seconds rather than days. The birth of blockchain creates a low-cost environment of mutual trust among multiple parties. Applied to transactions, this trust reduces costs; applied internally within organizations, it gives rise to entirely new organizational structures. Although entrenched interests resist futilely, global elites have never abandoned efforts to integrate blockchain technology into traditional financial systems. Institutions like the BIS and World Bank continue issuing policy guidance on crypto assets and DCEP in official documents.

Under these sweeping trends, every sovereign nation capable of issuing fiat currency must consider how its own currency will stand in this new monetary landscape. Blockchain’s ledger mechanism resolves trust issues between financial entities, representing the latest form of money with superior productive capacity. Issuing digital fiat currencies using blockchain technology has thus become an inevitable choice for major powers. China and Europe are following one path—leveraging blockchain to rebuild their payment and settlement systems. Relatively speaking, China leads slightly ahead: issuing its own digital encrypted RMB on self-built consortium chains. Meanwhile, after two years of research, the European Central Bank found its digital asset infrastructure could support up to 40,000 TPS, laying technical groundwork for the digital euro. In contrast, the United States adopts a more open approach. Given that private banks historically issued U.S. currency, the U.S. government does not absolutely oppose private companies issuing digital dollars. As a result, the combined scale of centralized and decentralized stablecoins has already exceeded $160 billion, assuming primary responsibility for global crypto liquidity. Though not issued by the Federal Reserve, digital dollars enjoy unquestionably greater market acceptance than any competitor.

Issuing crypto-backed fiat assets is the most direct and effective way to counter native crypto tokens—a fact neither the BIS nor the World Bank shies away from.

Not only will money be tokenized, but assets will be too. Massive asset tokenization will create an integrated global financial market, alongside unified commodity and service markets. Whoever rides the fast train of crypto development and captures the largest market share will reap the greatest benefits.

The Privilege of Global Currency Issuers

During the pandemic, the U.S. massively expanded its base money supply. The Fed’s balance sheet doubled post-pandemic. To manage this excess credit, balance sheet contraction became inevitable. Alternatively, creating new markets for these excess credit instruments could bolster demand and sustain the dollar’s valuation.

Crypto dollars are eroding crypto liquidity markets. Conversely, the crypto world isn't merely unclaimed free land where any currency can compete freely. Stablecoins deployed by Tether and Circle not only rank third and sixth in crypto market capitalization but also serve as fundamental mediums of exchange in the crypto world, enjoying the highest levels of liquidity. Due to the high volatility of native crypto assets like BTC and ETH, using USD stablecoins as safe-haven assets has become a shared consensus among crypto natives. This undoubtedly lays a solid foundation for American financial expansion into the crypto realm.

Crypto dollars aren’t just undermining BTC and ETH’s liquidity dominance—they’re penetrating traditional financial markets worldwide. The decentralized nature makes them difficult for authorities to regulate. Thus, crypto finance doesn’t just border national markets—it has deeply integrated and infiltrated them. As noted in World Bank reports, cryptocurrencies present higher regulatory challenges. Because of regulation and demand dynamics, they are particularly popular in emerging nations and impoverished regions. In countries like Turkey and Zimbabwe, where local currency credibility has collapsed, digital currencies including USD stablecoins have entered circulation. OTC crypto kiosks are now commonplace on Turkish streets.

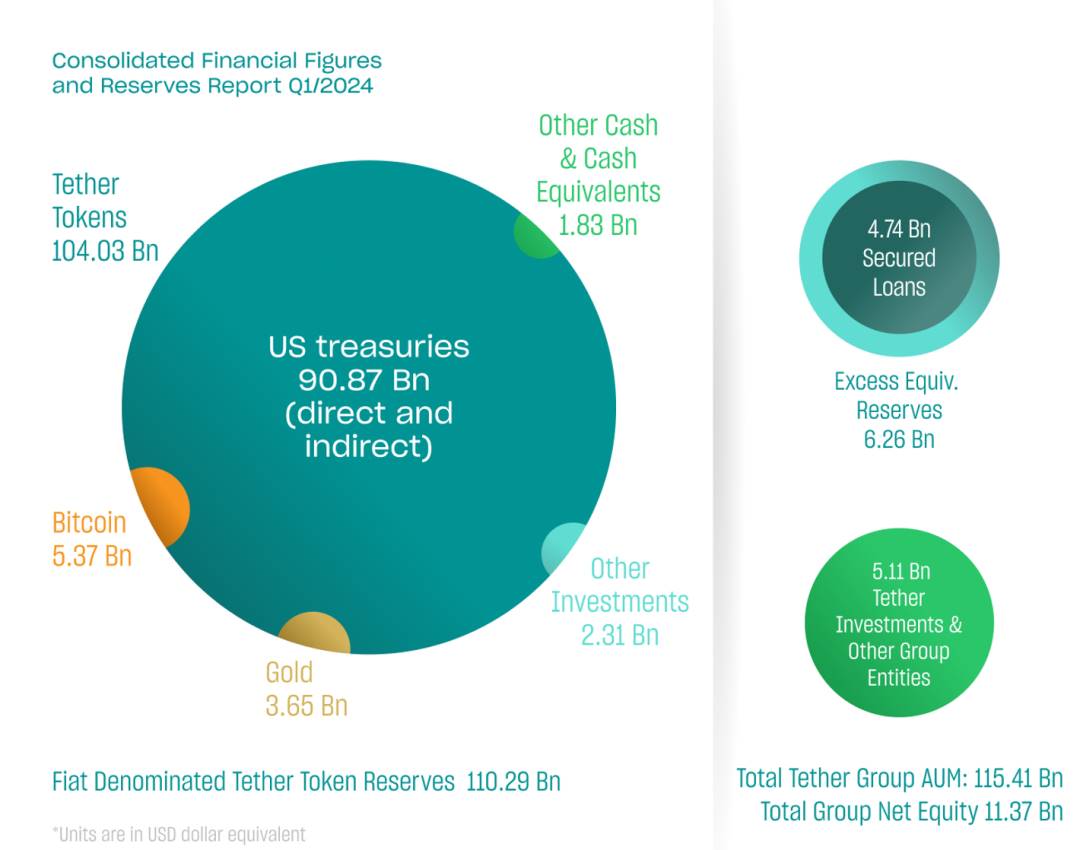

“Erosion” signifies enormous interests. Behind every centralized stablecoin lies nearly 90% U.S. Treasury holdings.

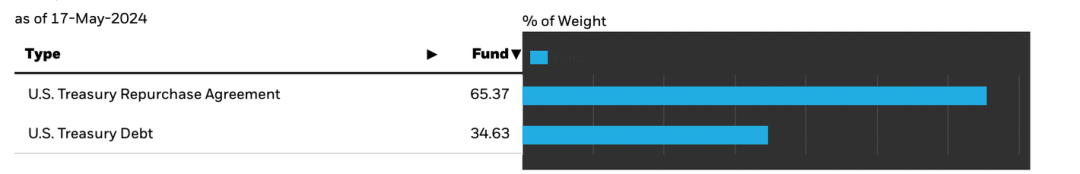

Over 90% of USDC reserves consist of money market funds managed by BlackRock, which themselves hold only U.S. Treasury repos and Treasuries.

Behind every dollar of centralized stablecoin stands $0.90 worth of U.S. Treasuries. Dollar stablecoins provide the digital crypto world with better units of account and media of exchange. In return, the liquidity demand in the digital crypto world offers behind-the-scenes U.S. Treasuries the kind of value capture—or value backing—that any token economist dreams of.

Wall Street’s Paycheck

We must remember: the predecessor of the Federal Reserve was a cartel of commercial banks. In the early days of the Fed, control over money issuance oscillated between core commercial banks and the government. Most financial institutions fail due to insufficient liquidity—having your own pipeline ensures stability regardless of drought or flood. This is why Wall Street consistently reaps profits from global markets. Yet holding monetary authority in government hands isn’t as satisfying as keeping it yourself. Today’s dominant centralized stablecoins essentially convert commercial paper and money market funds into dollars. Take USDC: only 10% consists of cash reserves; the rest are assets held in money markets managed by BlackRock.

The ability to directly monetize assets is akin to turning stones into gold. Previously, only the Federal Reserve had such power. Now, anyone able to issue stablecoins can share in the seigniorage of providing credit to emerging markets.

Moreover, controlling the faucet means having unlimited ammunition to buy the dip.

The tokenization of finance is a vast, unfolding canvas—an industrial revolution in finance.

Currently, RWA (Real World Assets) brings real-world assets onto blockchains—not only enabling low-cost global sales of dollar-denominated assets and expanding buyer bases, but also promoting U.S.-dominant financial services worldwide. Presently, global investors entering U.S. capital markets require intermediaries: complete KYC, open accounts, convert currencies into USD, and wire funds to broker-designated accounts. Personal cash and investment accounts remain fragmented and disconnected. Broker licenses must be obtained individually in each country. This cumbersome cross-border financial structure will be replaced by simple wallet + frontend and token + blockchain solutions. As long as money is on-chain, combined with decentralized KYC, anyone meeting conditions can participate in financial transactions. RWA can even use U.S. financial services to fund projects in developing countries.

As financial tokenization becomes industrialized and standardized, it inevitably draws in more service sectors. When Silicon Valley drives innovation while we use dollar stablecoins to access Wall Street-provided liquidity via SEC-regulated financial instruments—who do we call for legal advice? Who handles taxes and accounting? Whose policy guidance do we follow? Whose favor do we seek? The answers are obvious.

Industry expansion, fueled by financial leverage and securities/token issuance, brings direct credit-based wealth to Wall Street. And the industrial influence seized through economic dominance grants American capital the ongoing ability to fleece the globe.

BTC Surrounded on All Sides

Due to anti-money laundering and counter-terrorism requirements, even payments face compliance pressures. Hence the current reality: fiat firmly holds the payment赛道, while stablecoins vie to replace BTC as transactional media.

Payment Track

If the advantage of crypto assets lies in on-chain constraints, then the strength of the dollar lies in off-chain payments.

USD-pegged crypto stablecoins benefit from both on-chain constraints and off-chain payment capabilities.

Through crypto accounts and signatures, centralized dollar stablecoins carry cryptographic endorsements from issuers. For final payment settlement, U.S. financial institutions were prepared long ago.

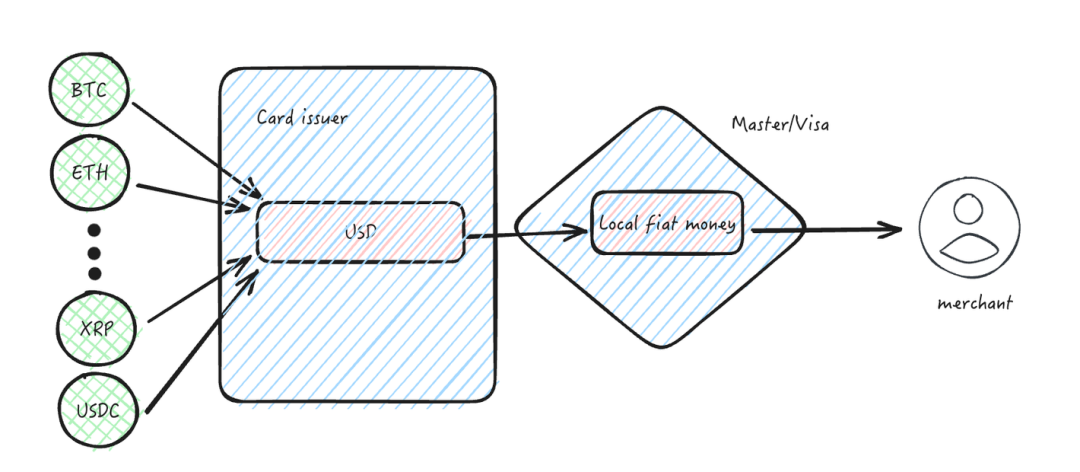

Today’s most common digital asset prepaid cards rely on Mastercard or Visa to complete the last mile. Mastercard and Visa act like gatekeepers—only those delivery services allowed entry gain access to the global real-world payment market.

Even without stablecoins overtaking BTC’s role as an on-chain medium of exchange, all off-chain payments ultimately depend on licensed payment processors. With Mastercard and Visa operating the world’s most extensive payment networks, issuers of digital asset cards must comply: settle in USD. As long as card issuers meet standard KYC and AML regulations, converting various crypto assets into compliant USD allows U.S. financial institutions to facilitate global payments for holders. Binance Pay and Dupay operate exactly this way. Within this process, digital crypto assets exist merely as financial or stored-value instruments—largely irrelevant at the point of payment.

For most non-crypto users, paying with stablecoins feels more intuitive and convenient.

RWA Track

Leveraging a global decentralized network, financial services from different countries now face zero-distance competition. BTC’s peer-to-peer cash system is itself a financial service. For assets closely tied to fiat, stablecoins offer a more convenient foundational currency layer.

One of the defining features of digital crypto assets is their ability to bypass financial regulation—thanks to decentralization and anonymity. Regulators often find themselves powerless. Unlike financial institutions required to establish physical offices and obtain local licenses when entering a jurisdiction, Web3 is the unowned territory promised by Satoshi to crypto enthusiasts. Crypto asset issuers can operate on-chain without setting up real-world offices or branches. Dollar stablecoins offer greater predictability in payments and are easier for the public to accept. However, payment functionality alone isn’t enough—they also need financial tools like Alipay. Wall Street offers ready-made, compliant financial products catering to diverse needs, allowing the public to bail out the U.S. government once and then Wall Street again.

Compared to decentralized exchanges, centralized exchanges offer far better liquidity. Binance and OKX are excellent platforms—but are NYSE, Nasdaq, and London Stock Exchange not equally reputable? Why can’t pink sheets and micro-cap stocks become meme shells? Countless low-priced penny stocks could simply change names, craft new narratives, map onto the blockchain, and absorb this windfall wealth. SBF tried it,可惜 he missed today’s golden age of memes.

Compared to BTC, most Wall Street financial assets are denominated in USD—bills, commodities, stocks, real estate. Creating trading pairs pegged to USD stablecoins and offering leveraged exposure to USD stablecoins aligns better with user habits and reduces risk. We can observe that due to USDC’s stronger compliance profile compared to USDT, many RWA projects prefer USDC.

As RWA exports U.S. financial services globally, it builds a more suitable application scenario for USD stablecoins. Stablecoin holders can consume and enjoy consumer finance simultaneously.

Blockchain Track

Blockchain technology is a decentralized ledger system—an architecture irreplaceable by fiat. Furthermore, most digital cryptocurrencies enforce strict token issuance discipline, something no central bank can truly emulate. Therefore, blockchain technology is irreplaceable in the future. There exists chain-level sovereignty on blockchains: BTC’s accounting unit is BTC; ETH’s is ETH.

To prevent BTC from becoming too dominant, cultivating competitors is one strategy. Beyond BTC, ETH, Solana, Cosmos, Polkadot, and various Layer2s have surged forward—doing everything BTC can do, plus things BTC cannot. This diverts attention from BTC and diminishes its monopoly.

Breaking BTC’s monopolistic position increases competition across the blockchain space. In principle, this is positive. But within the broader context of fiat versus native crypto assets, fragmenting the crypto market and diluting BTC’s value consensus makes it easier for Wall Street to control BTC’s—and other native crypto assets’—pricing. This facilitates an industry structure favorable to Wall Street and further entrenches a digital asset pricing system based on the dollar and dollar stablecoins, strengthening their role and weight as transactional media in the crypto world.

Mindset Imprinting

Kill the body, destroy the soul—that’s what America wants and is doing.

Primary and secondary markets alike drill dollar-denominated valuations and dollar equivalents into our minds. How many millions did this project raise? What’s its valuation in USD? We’ve forgotten the era when ETH fundraisings were paid in BTC, when early projects like EOS, DAO, Near, 1inch, DANT, and BNB used BTC and ETH for fundraising. We’ve forgotten the time when we valued projects in BTC and ETH. Mental colonization is the true reason draining liquidity from the digital crypto world.

Throughout human history, a nation’s core cohesion stems from cultural identity. What’s happening now is the destruction of crypto idealism and culture. How many newcomers joining since 2020 have read Bitcoin’s whitepaper? How many have studied Satoshi’s emails? How many know about Austrian economics, or have reflected on its values and feasibility? Some claim NFTs and Memes represent massive adoption. I raise my middle finger—this is massive adoption within the crypto bubble, not the torch passed down from Satoshi. Through several bull runs, veteran cryptos have either been arrested or left. Crypto ideals are no longer mainstream. As America wished, a cultural rupture has formed.

When an organization loses faith, all order collapses—each individual scrambles only for personal gain. Isn’t this precisely the truest reflection of today’s market and industry?

Epilogue

Another Form of Progress: U.S. Credit Without Intermediaries or Monopoly

The dollar, as global currency, leverages pervasive crypto networks and Wall Street’s might to sweep across the world. For other nations, this is grim news. Yet for humanity, it may represent progress. The eurozone emerged only after decades of consensus-building among European nations, harmonizing fiscal and monetary policies under Mundell’s theory—yet still suffers serious side effects.

In contrast, the dollar’s penetration of global finance via crypto networks happens silently and seamlessly. Many countries have weaker monetary discipline and lower currency credibility than the U.S. Yet due to payment requirements and financial environments, people are forced to hold local currencies. Governments often back their currencies with dollar and U.S. Treasury holdings.

Here, credit flows from the U.S. government to foreign governments via Treasuries and U.S. assets, then gets used by those governments to backstop domestic money creation. In this chain, foreign governments act as intermediaries. We believe eliminating intermediaries and dismantling their rent-seeking advantages holds value.

Additionally, this move integrates global capital markets further and breaks local elites’ monopolies over regional financial resources.

Although crypto-dollar globalization hasn’t achieved decentralization, it has eliminated credit intermediaries and accelerated global financial integration. Objectively, this marks progress in financial history.

The Best Is Yet to Come: Crypto’s Rebirth

I once thought I was a native of the crypto world. Actually, I’m not. I merely resonated with the libertarian ideals promoted by BTC due to my past experiences, choosing to embrace crypto ideals as my own life goals. Our generation has no true natives—we haven’t had enough time to be fully immersed in crypto culture and ideology. Generation Z are just beginning to become the internet’s first true natives.

Twenty or thirty years from now, people truly raised under crypto technology and culture will come of age. They’ll grow up reading the BTC whitepaper, studying cryptographic algorithms, playing with NFTs, and enjoying the convenience of DePIN. Their minds won’t carry divisions of China, America, East, or West. By then, decentralized technologies will be far more advanced, with costs decreasing exponentially per Moore’s Law, while the flaws of centralization become glaringly evident under decentralized thinking.

Then, sparks will ignite a prairie fire. Perhaps a free and harmonious world will emerge reborn from within dollar hegemony.

Note: The content and views expressed in this article were inspired by Rebecca, founder of Deschool, and BrainSeong, Developer Relations at Polygon. Special thanks to both.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News