Dragonfly partner: Why have all these low-circulating, high-FDV tokens declined?

TechFlow Selected TechFlow Selected

Dragonfly partner: Why have all these low-circulating, high-FDV tokens declined?

For you: be cautious of single-factor explanations.

Author: Haseeb >|<

Translation: TechFlow

Has market structure broken down? Are venture capitalists too greedy? Is this a manipulation game against retail investors? Almost every theory I've seen on this point seems to be wrong. But I'll let the data speak.

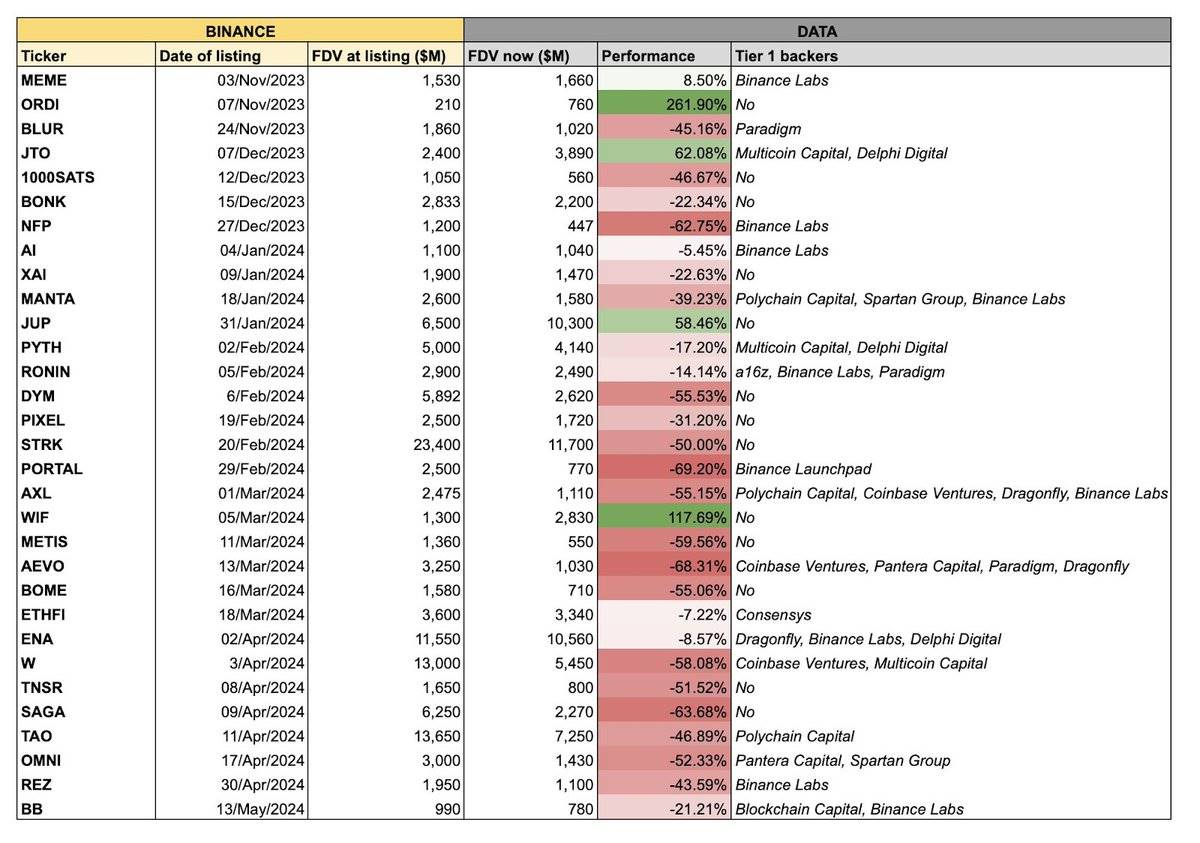

Here's a widely circulated table provided by @tradetheflow_, showing that a batch of recent Binance listings have performed poorly. Most are mocked as "high FDV, low circulating supply" tokens, meaning they carry massive fully diluted valuations (FDV) but very little circulating supply on day one.

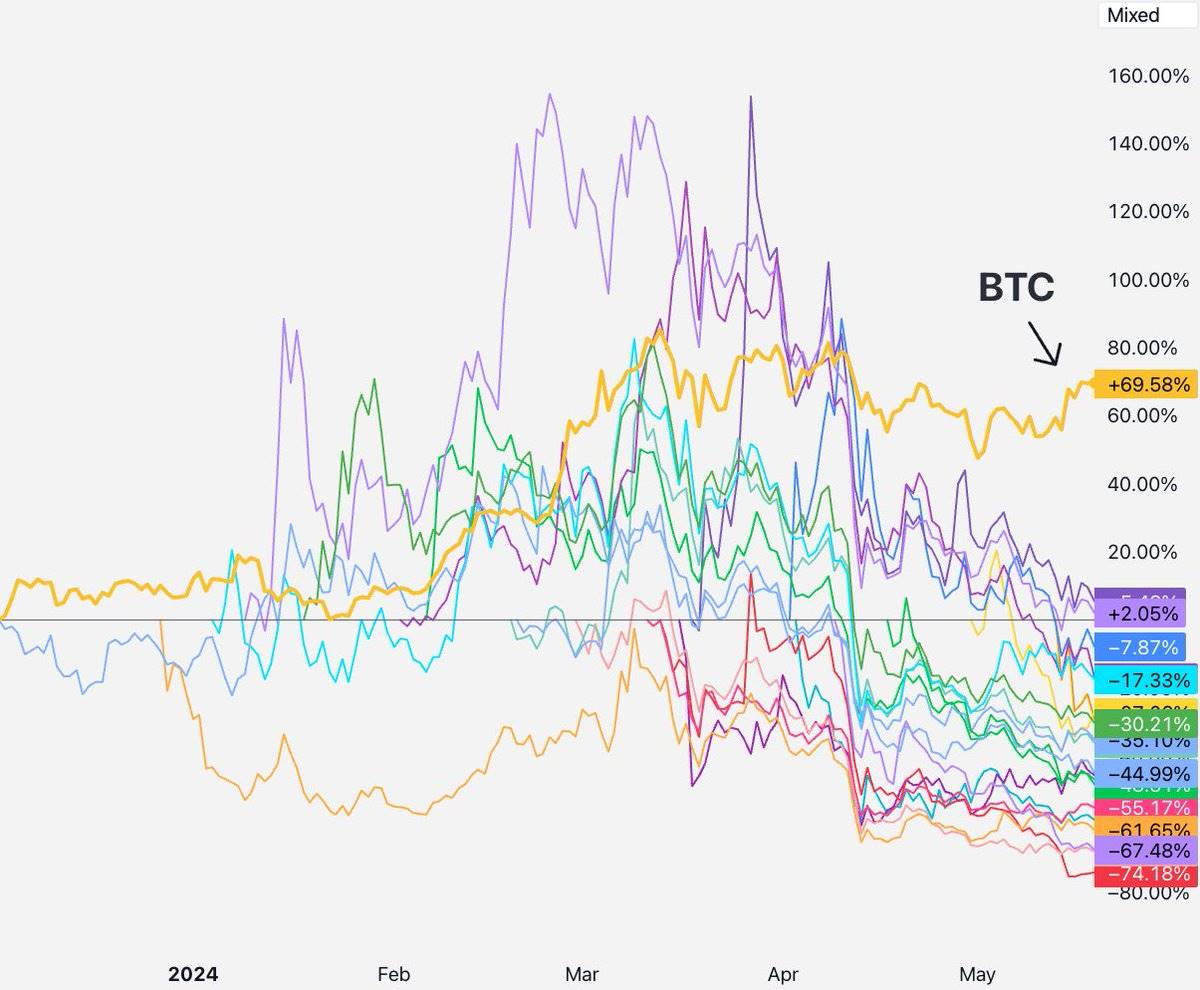

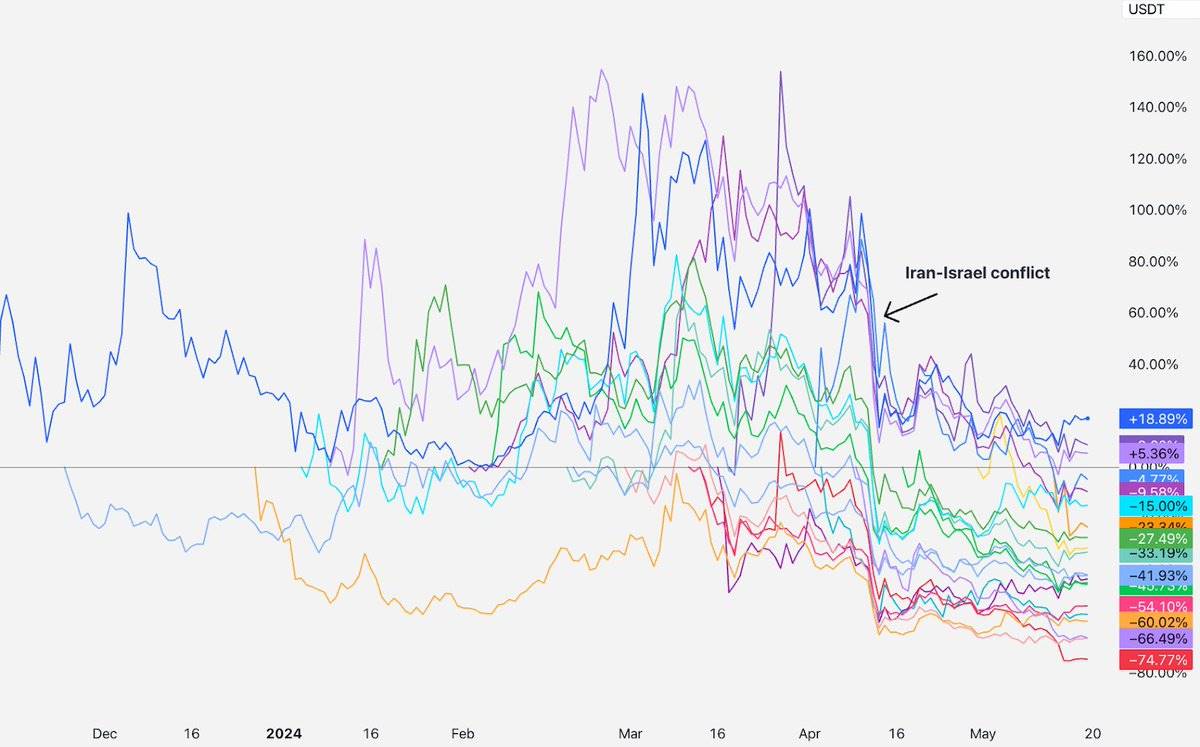

I charted all these tokens and removed their labels. I excluded any obvious memes, as well as tokens that had already conducted token generation events (TGEs) prior to Binance listing, such as RON and AXL. Here’s what it looks like, with BTC (beta) shown in yellow:

These "low-circulating, high-FDV" Binance listings have almost all declined. Why is that? Everyone has their own theory about what’s wrong with market structure. The three most popular ones are:

-

Venture capitalists (VCs) / Key Opinion Leaders (KOLs) dumping on retail

-

Retail investors abandoning these tokens for Memes

-

Too little supply for meaningful price discovery

All are plausible theories—let’s examine whether they hold up. For scientific rigor, we need a null hypothesis to test against. Here, our null hypothesis should be: these assets were simply repriced, with no deeper structural issue (the classic “more sellers than buyers”). We’ll go through each theory one by one.

1) VCs / KOLs dumping on retail

If this were true, what would we expect to see?

We should observe that tokens with shorter lockups get dumped faster than others, while projects with longer lockups or without KOL involvement should perform better. (Perpetual contracts could also be another channel for such dumping.)

What does the data show?

From listing until early April, these tokens actually performed reasonably well—some above listing price, some below, but most clustered around zero. Before that, there was no sign of VCs or KOLs dumping.

Then, in mid-April, they all dropped simultaneously. Despite being listed on different dates and involving various VCs and KOLs—did all these unlock at once and begin selling into the retail market?

Let me be clear: yes, some VCs do dump on retail. Some have no lockups, hedge off-exchange, or even violate lockup terms. But these are lower-tier VCs—the teams partnering with them rarely get listed on top exchanges. Every top-tier VC you can think of faces at least a one-year wait before receiving tokens, followed by multi-year vesting schedules. For anyone regulated under SEC Rule 144a, a one-year holding period is effectively mandatory. And for large VCs like us, our positions are too big to hedge off-exchange, and we usually have contractual obligations not to do so.

Thus, here’s why this narrative fails: all these tokens are less than a year post-TGE, meaning VCs with one-year lockups are still locked!

Maybe some lower-tier VC-backed projects did sell early—but all tokens fell, including those backed by top VCs who remain locked.

So while investor/KOL dumping may be real for certain tokens—and bad actors always exist—this theory cannot explain why all tokens dropped at the same time.

2) Retail investors are abandoning these tokens for Memes

If true, we’d expect to see falling prices on these new listings as retail rotates into Meme coins.

But here’s what we actually see:

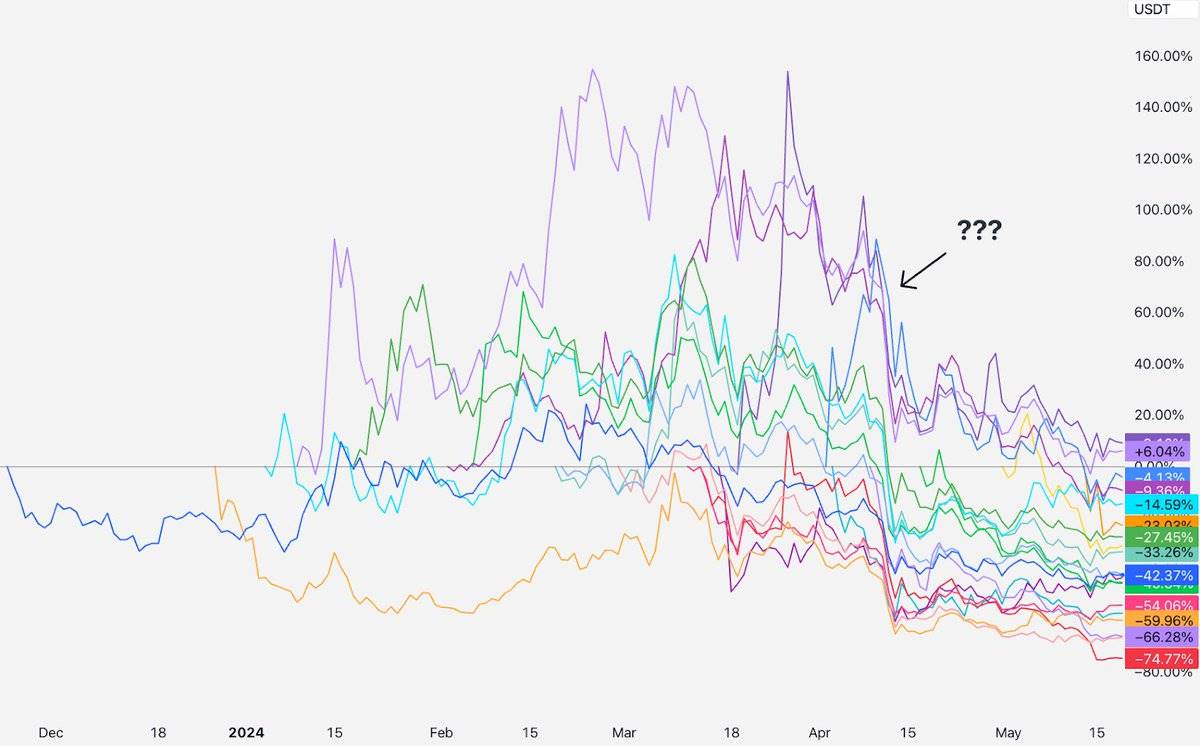

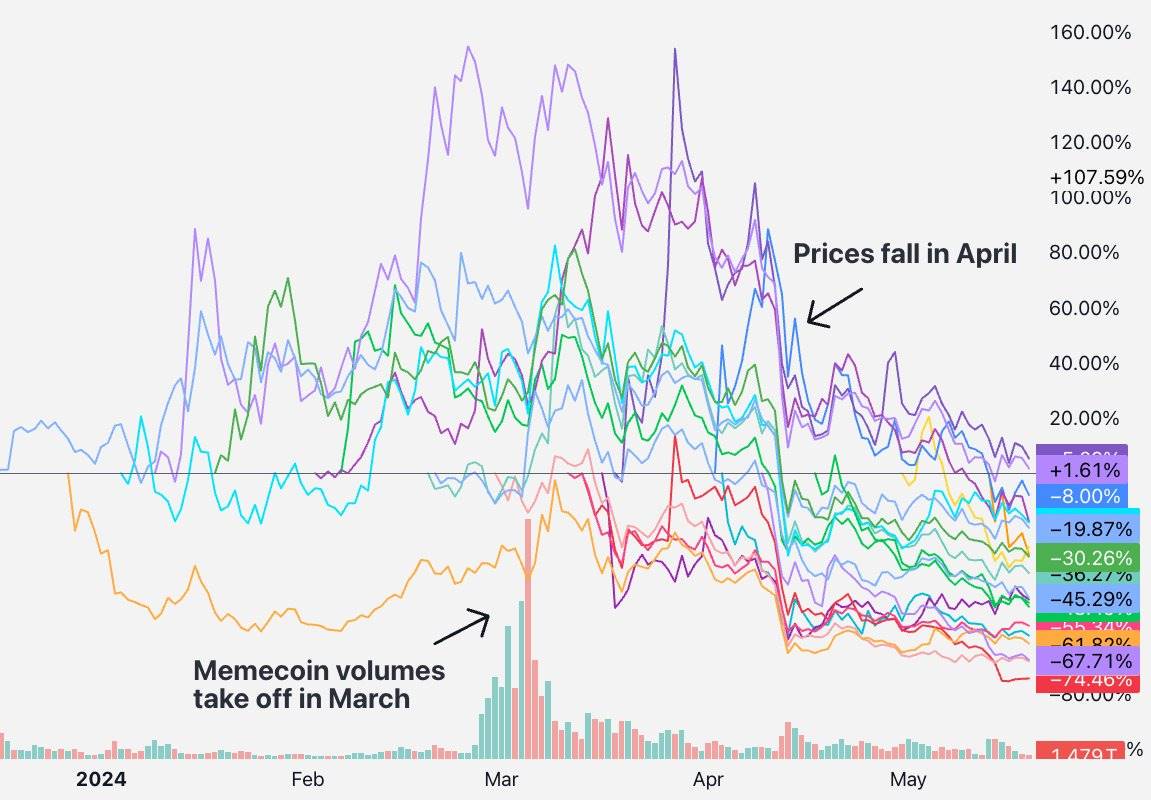

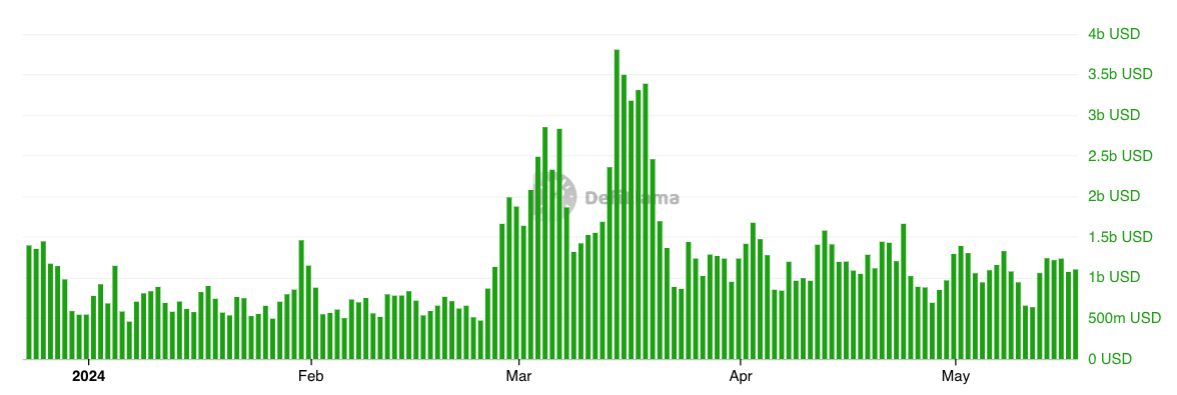

I compared SHIB trading volume with these tokens. The timing doesn’t match. Meme mania peaked in March, but these tokens didn’t start falling until mid-April—over a month later.

Here’s trading volume on Solana DEXes—it tells the same story. Meme activity exploded in early March, long before mid-April. So this contradicts the narrative. There was no broad capital shift into Meme trading when these tokens fell. People trade Memes, but they also trade new tokens—the volume data shows no clear signal.

The issue isn't volume—it’s asset pricing.

Many push the story that retail has become disillusioned with “real” projects and now only cares about Memes. I checked Binance’s Coingecko page for the top 50 highest-volume tokens: about 14.3% of Binance volume today comes from Memes. Meme trading is just a small slice of crypto. Yes, financial nihilism exists and is loud on social media, but most people still buy tokens because they believe in some tech narrative—right or wrong.

Perhaps retail isn’t moving funds from VC tokens to Memes directly, but here’s a sub-theory: VCs own too much of these projects, causing retail to rage-quit. They realized (in mid-April?) that these are scammy VC tokens, with teams + VCs holding ~30–50% of supply. That must’ve been the final straw.

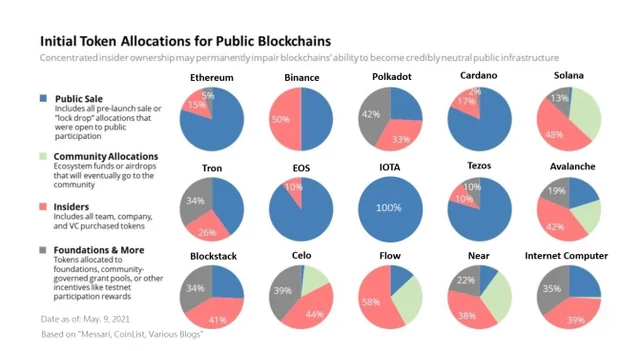

That’s a satisfying story. But I’ve been in crypto venture capital for a while. Here’s a snapshot of token allocations from 2017 to 2020:

Look at the red-shaded portion—that’s the insider share (team + investors). SOL 48%, AVAX 42%, BNB 50%, STX 41%, NEAR 38%, etc. Today’s allocations aren’t much different. So if the argument is “tokens weren’t VC plays before but now they are,” it contradicts the data. Capital-intensive projects always launch with oversized team/investor holdings, regardless of cycle. These “VC tokens” went on to succeed—even after full unlocks.

Overall—if something happened in the last cycle too, it can’t explain a unique current phenomenon.

So while the “retail rage-quits for Memes” story sounds compelling, it doesn’t align with the data.

3) Too little supply for price discovery

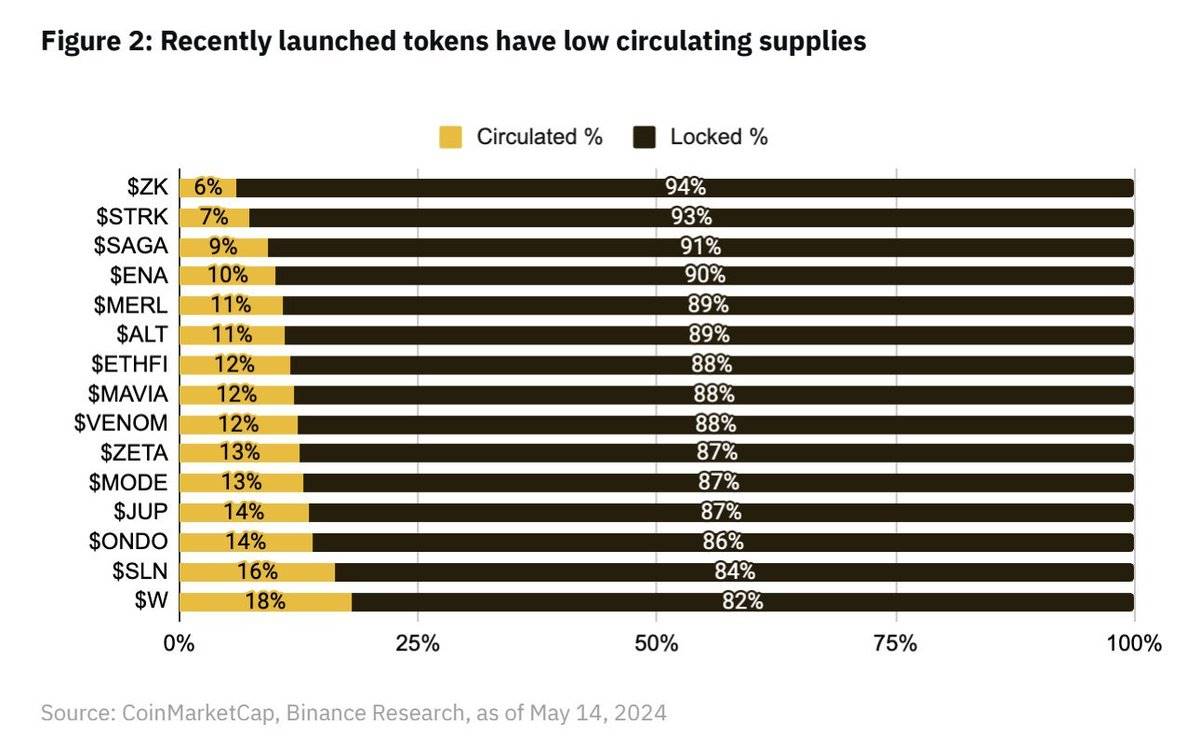

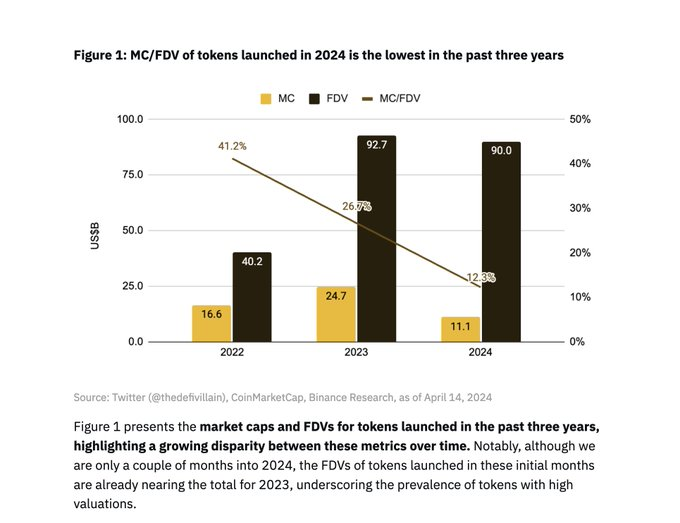

This is the most common theory I’ve seen. It sounds reasonable! Its lack of drama is a plus. Even Binance Research published a solid report highlighting this:

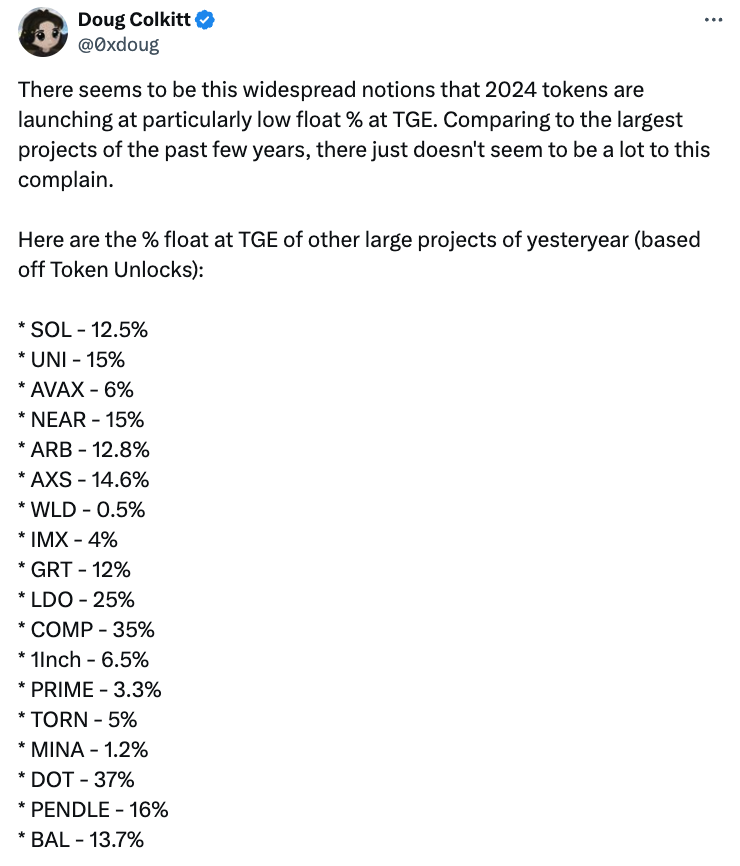

The average appears to be around 13%. Clearly very low—much lower than past cycles, right?

Data thanks to @0xdoug

The average circulating supply at TGE for these tokens in the last cycle was 13%.

The same Binance Research article features another widely shared chart: tokens launched in 2022 had an average of 41% circulating supply at listing.

I was there in 2022—projects did not launch with 41% circulating supply.

I reviewed Binance listings from 2022: OSMO, MAGIC, APT, GMX, STG, OP, LDO, MOB, NEXO, GAL, BSW, APE, KDA, GMT, ASTR, ALPINE, WOO, ANC, ACA, API3, LOKA, GLMR, ACH, IMX.

I randomly checked a few since not all are on TokenUnlocks: IMX, OP, and APE resemble the latest batch. IMX had 10% circulating on day one; APE had 27% (but 10% belonged to the APE treasury, so I rounded to 17%); OP had 5% circulating on day one.

On the other hand, LDO (55% unlocked) and OSMO (46% unlocked) were already live a year before their Binance listing—so comparing them to fresh launches is misleading. I suspect non-day-one unlocks combined with random enterprise tokens like NEXO or ALPINE inflated this number. This doesn’t reflect TGE trends—it reflects Binance’s annual listing preferences.

Alright, maybe you’ll concede that 13% is consistent with past cycles. But isn’t it still too low for price discovery? Public equities don’t have this problem. The median float for 2023 IPOs was 12.8%.

But seriously, extremely low circulating supply is a problem. WLD is a particularly bad case, with only ~2% circulating. FIL and ICP had similarly low floats at launch, resulting in terrible price action. However, most of these Binance tokens fall within historically normal day-one circulating ranges.

Moreover, if this theory held, we’d see the lowest-circulating tokens punished hardest, while higher-circulating ones outperform. But we don’t see strong correlation—everything fell together.

So while the “lack of price discovery” argument sounds persuasive, after reviewing the data, I’m not convinced.

Solutions

People complain endlessly, but few offer real solutions! Before revisiting the null hypothesis, let’s assess proposed fixes.

Many suggest reviving ICOs. Sorry—but don’t we remember how ICOs led to brutal post-listing dumps, burning retail? Plus, ICOs are illegal almost everywhere, so I don’t take this seriously.

@KyleSamani suggests investors and teams unlock 100% immediately—impossible under Rule 144a for U.S. investors (and would worsen “VC dumping”). Also, I think we learned in 2017 why team vesting matters.

@arca proposes having underwriters for tokens, like traditional IPOs. Maybe? Token listings resemble direct listings—they go live on exchanges with some market makers, nothing more. I’m okay with that, but I prefer simpler structures and fewer intermediaries.

@reganbozman suggests projects list at lower prices so retail can get in earlier with upside. I get the intent, but it won’t work. Artificially pricing below market-clearing level just means whoever snags the mispricing in the first minute wins. We’ve seen this in NFT mints and IDOs. Artificially undervaluing your listing only benefits a handful of traders who front-run the order book in the first 10 minutes. If the market values you at X, you’ll trade at X eventually in a free market.

Others advocate returning to fair launches. Sounds great in theory, fails in practice—teams jump ship. Trust me, everyone tried it during DeFi Summer. In the past few years, besides Yearn, how many non-Meme fair launches succeeded?

Many suggest teams conduct larger airdrops. I think this is reasonable! We generally encourage teams to release more supply on day one to improve decentralization and price discovery. Still, doing absurdly large airdrops purely for circulation is unwise—protocols have much more to do post-launch to succeed. Dumping all tokens on day one just for high float is short-sighted—you’ll face competition in future token grants. You don’t want to be the token that years later must re-inflate supply because the treasury ran dry.

So what do VCs want? We want token prices to reflect reality in year one. Our returns don’t come from paper gains—we earn via DPI, meaning we must eventually sell our tokens. We can’t live off paper profits, nor do we mark locked tokens to market (anyone who does is insane, in my view). For VCs, astronomical valuations that crash post-unlock are terrible. It makes LPs think the asset class is fake—great on paper, broken in reality. We don’t want that. We’d rather see steady, gradual appreciation over time—what most people actually want.

Are these high-FDV valuations sustainable? I don’t know. Compared to initial prices of ETH, SOL, NEAR, AVAX, etc., they’re eye-popping. But crypto is bigger now—successful protocols clearly have much larger market potential than before.

@0xdoug made a strong point—if you normalize past altcoin FDVs using today’s ETH price, you get numbers nearly identical to current FDVs. @Cobie mentioned this recently. We won’t return to $40M FDV L1s—everyone sees how big the market is now. But when SOL and AVAX launched, retail paid prices comparable to ETH-adjusted levels.

Much of the frustration stems from this: crypto has surged over the past five years. Startup valuations are based on comparables—so all numbers inflate. That’s just reality.

Alright, it’s easy to critique others’ solutions. But what’s my clever fix?

I don’t know.

Free markets will sort this out. If tokens fall, others will be repriced, exchanges will pressure teams to list at lower FDVs, burned traders will buy cheaper, and VCs will relay this feedback to founders. Due to public market comps, Series B rounds will drop, upsetting Series A investors, eventually trickling back to seed—price signals always propagate.

When real market failures occur, clever interventions may help. But free markets know how to fix mispricing—just change the price. Those who lost money—VCs or retail—don’t need thought pieces or Twitter debates. They’ve learned their lesson and will pay less next time. That’s why all these tokens now trade at lower FDVs, and future tokens will be priced accordingly.

This has happened before—it just takes time.

4) The Null Hypothesis

Now let’s reveal what actually happened in April that caused all tokens to drop.

The culprit: Middle East tensions.

For months prior, these tokens traded flat after listing—until mid-April. Suddenly, Iran and Israel threatened World War III, and markets plunged. Bitcoin recovered, but these tokens didn’t.

So what best explains why these tokens kept falling? My answer: these new projects were psychologically categorized as “risky new tokens.” Interest in “risky new tokens” dropped in April and never recovered—markets didn’t want to buy back in.

Why? I don’t know. Markets are sometimes fickle. But if this basket of “risky new tokens” had risen 50% instead of falling 50% during that period, would you still argue crypto market structure is broken? That would also be mispricing—just in the opposite direction.

Markets eventually correct mispricing. Want to help? Sell high, buy low. If the market is wrong, it will fix itself. No further action needed.

What should be done?

When people lose money, everyone wants someone to blame. Founders? VCs? KOLs? Exchanges? Market makers? Traders? I think the best answer is: no one. Blame is not a useful framework for understanding market mispricing. Instead, I’ll frame it as how participants can adapt and improve under new market mechanics.

Venture capitalists: Listen to the market, slow down, maintain price discipline. Encourage founders to stay realistic on valuation. Don’t mark locked tokens to market (as far as I know, nearly all top-tier VCs hold their locked tokens at steep discounts to market). If you catch yourself thinking “I can’t lose on this deal,” you’ll probably regret it.

Exchanges: List tokens at lower prices. Consider using open auctions to price tokens on day one instead of relying on last private round valuations. Don’t list tokens unless all investors (including KOLs) have standard market lockups. Don’t list unless all investors/teams have contractual obligations not to hedge. Improve FDV countdown charts—show retail the familiar visuals we all know and love—and educate them more on unlocks.

Teams: Try to release more tokens on day one—anything below 10% supply is too low.

Conduct healthy airdrops, and don’t obsess over low day-one valuations. To build a healthy community, the best price chart is a gradual uptrend.

If your token drops, don’t panic. You’re not alone. Remember:

AVAX dropped ~24% two months after listing.

SOL dropped ~35% two months after listing.

NEAR dropped ~47% two months after listing.

You’ll be fine. Focus on building something you’re proud of and keep moving forward. The market will sort it out.

To you, anonymous reader: Beware single-factor explanations. Markets are complex and sometimes fall. Doubt anyone claiming to know exactly why. Do your own research, and never invest anything you can’t afford to lose.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News