Silence Before the Thunder: The Opportunity and Mission of Web3 Social

TechFlow Selected TechFlow Selected

Silence Before the Thunder: The Opportunity and Mission of Web3 Social

Finding how content and communities can better interact within the new environment built on decentralized technologies will determine whether Web3 can attract traffic and truly achieve real-world adoption.

Author: Armonio, AC Capital

Preface:

Recently, Web3 discourse has been filled with hostility. To both insiders and outsiders, Web3 appears to be a massive field for harvesting retail investors—exchanges, projects, institutions, and ordinary investors seem locked in a cycle of mutual exploitation. Even friends from the Web2 world have bluntly told me: "Web3 social is just fraud!"

In my view, Ponzi schemes are neutral—they’re financing techniques that reduce operational costs and serve as protective measures toward a project’s ultimate success. Whether in DeFi, social, or other sectors, there have always been persistent builders pushing forward. As long as progress continues, the Web3 revolution hasn’t failed. All technological innovation emerges in an emergent fashion. A short-term lull in Web3 tech breakthroughs doesn’t prove the industry lacks potential. We believe in the power of crypto and look forward to a decentralized future.

At a time when the Web3 industry faces skepticism, this article aims to review, from my own perspective, the achievements, lessons, and potential opportunities in Web3 social over the past eight years—two market cycles—highlighting the builders’ contributions along the way.

In my opinion, although Web3 social hasn’t fully matured, its developmental outcomes remain commendable. Different people have different expectations for Web3: some seek better experiences and stronger digital dopamine hits; others prioritize full sovereignty over personal data. As Web3 technology advances and barriers and costs continue to fall, true product emergence may be happening right now.

The Foundational Demand Theory of Web3 Social

Any successful product must be built on solid demand. One of the most criticized aspects of Web3 projects is their inability to connect with real-world economies. To overcome the bias that “Web3 is just about harvesting retail,” we need to demonstrate, at the root level, the genuine demand for social within Web3.

Humans are social animals—we have innate social needs. This conclusion has been repeatedly validated by social products.

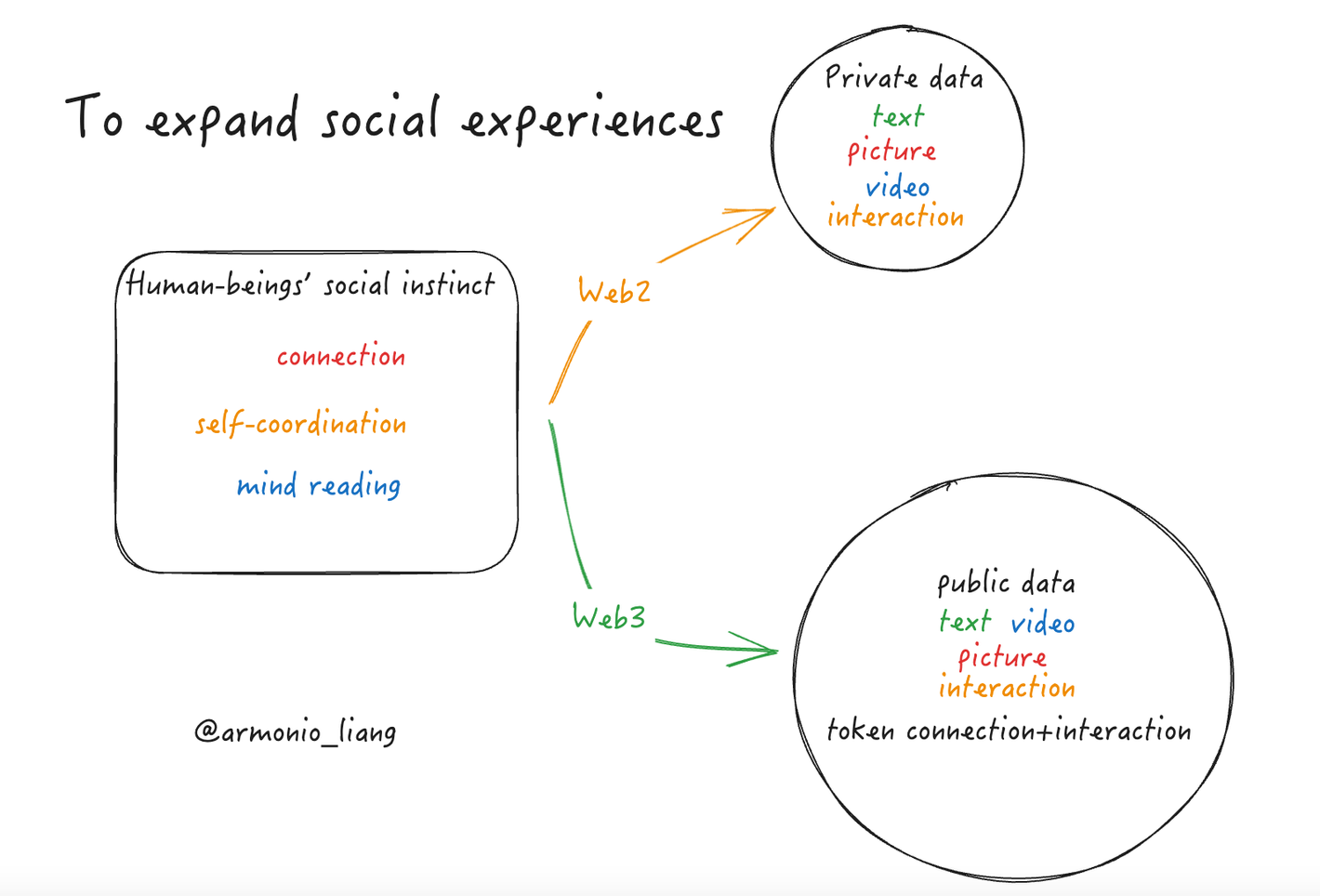

People need to establish connections with others, perceive others' emotions, attitudes, and mental states through these links, and receive feedback to adjust their own emotions and cognition. These needs are as fundamental as eating, drinking, and breathing—hardcoded into our genes through millennia of evolution. In short, human social needs boil down to connection, mindreading, and self-coordination.

Holding tokens represents a new form of connection. Open, verifiable databases expand the dimensions of information we can extract from these connections. This novel information environment will give rise to entirely new forms of social relationships and interaction patterns.

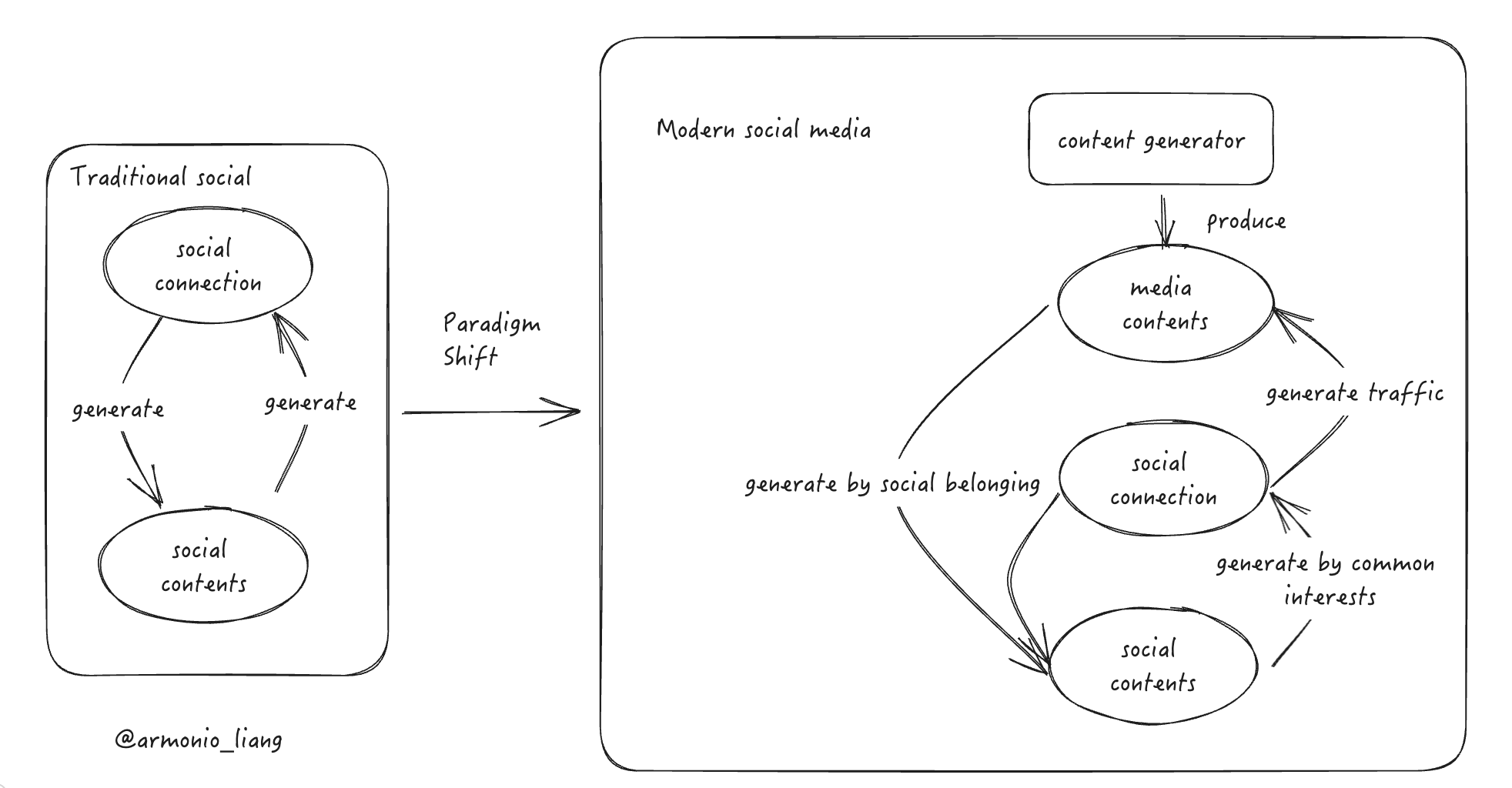

We observe that most online social behaviors stem from three psychological motivations: the need for self-expression, emotional release, and the search for belonging. Compared to traditional offline socializing, the internet, through multimedia, has created far richer social scenarios. From forums, BBS, chat rooms to blogs, instant messaging (IM), social media, and gaming spaces—the internet has evolved continuously. China's Bilibili even innovatively introduced bullet comments (danmu). Each new scenario, with its unique relational networks, content types, and presentation styles, has given birth to waves of successful platforms.

Throughout the evolution of internet socialization, economies of scale have been a defining feature. Historical experience shows that any social project or product unable to achieve economies of scale within a specific user group and purpose cannot survive.

Compared to web2 social giants handling millions of concurrent users globally, Web3 social usage isn’t even a fraction of that. Economies of scale represent a massive barrier. Without achieving scale within a particular context, a project risks being trapped in a death spiral of perpetual subsidies. The scale of social networks and content determines whether human social instincts and motivations can be effectively fulfilled. How can a product without scale help users expand their social circles? How can it enable self-expression or foster empathy?

The trajectory of Web3 development was set from the outset: in short, it’s about building an industry ecosystem supported by a trusted, open data environment and a financial system powered by tokens. How can such an environment generate a new industrial landscape? The ability to support cross-database, cross-organizational foundational data, enabling freely selectable, composable, plug-and-play social interfaces, is Web3’s unique advantage. Tokens are a hallmark of Web3—using social activity to support token issuance, with token-quantified rights interactions at the core of content and relationship-building, defines Web3’s distinctive application scenarios.

In recent years, the Web3 industry has gone to great lengths to gain scale advantages in niche social markets.

The Evolution of Web3 Social

This section aims only to show that Web3 social has been progressing steadily, demonstrating how accumulated experience, lessons learned, and advancing technologies are collectively pushing us closer to an inflection point of industry explosion.

Thanks to the advantages offered by the Web3 environment, social projects have developed along two parallel tracks:

-

Developing decentralized social technical standards

-

Using social activity to build token consensus

Competition in Decentralized Social Technical Standards

If we accept that humans are social beings, then the information we consume shapes who we are. Thus, the power held by internet social platforms is immense. We dare not imagine the consequences if such power were concentrated in corporations or governments. Losing sovereignty over our social data means losing freedom in cognition and choice. The Facebook-Cambridge Analytica scandal showed how easily our will can be manipulated. We and our descendants desperately need to control our own data. Therefore, decentralized social technical solutions will be essential in the future.

To achieve decentralized social, breakthroughs are needed in communication protocols, data storage, and applications. The communication technologies used by blockchain for global consensus aren't necessarily suitable for decentralized social messaging. Building on STEEM’s experience, next-generation projects like Bluesky, Nostr, Lens, and Farcaster have each proposed their own decentralized social protocols. By sacrificing partial decentralization of data, all these protocols have made significant progress. On any of them, replicating web2-style social tools is no longer an issue—and thanks to decentralization, users enjoy greater autonomy, including ownership of intangible assets within the system. However, as previously stated, Web3 faces a massive disadvantage in scale.

Technology isn’t the bottleneck. The real challenge for every solution provider is overcoming the mountain of economies of scale blocking the path to success. To break through this disadvantage, token incentives have become the go-to tool for most projects—at least in the short term.

The Stalled Token Incentive Revolution

The creation of tokens is like opening Pandora’s box. From the moment they enter the space, all Web3 users are thrust into a complex financial environment. For project teams, tokens allow them to leverage user greed as subsidies, reducing operational costs.

However, the token incentive revolution faces two major challenges in social contexts:

-

Subjective value of social content makes it hard to assess, casting doubt on the effectiveness of token incentives.

-

Token incentives are vulnerable to Sybil attacks.

These problems remain unresolved today. Let’s examine a case study to better understand.

The STEEM blockchain can be considered a pioneer in the entire Web3 social industry. To this day, not only do many of its conceptual frameworks and architectural designs continue to inspire current projects, but it has also incubated numerous blockchain application teams and initiatives. In 2016, STEEM experimented with innovations across multiple dimensions: token-incentivized content, token-stake-weighted curation, usable data layers, and tiered account security.

The application built on STEEM was a social media platform where content quality was determined by users weighted by the amount of tokens they staked. In the early days, the founding team held absolute advantages in both reputation and staked token volume. At that time, content production and filtering based on token-weighted voting worked effectively. Like most token-incentivized projects, the massive wealth effect attracted hordes of Sybils. However, STEEM’s staking mechanism included punitive powers, offering some resistance to Sybil attacks.

This effectiveness relied on centralized asset/power structures and strong consensus. When founder BM left, the team collapsed, and the project was sold to the controversial Justin Sun, leading to a collapse of consensus. Initially, this breakdown led more individuals to exploit Sybil attacks—users upvoting each other, proxy mining ran rampant. Later, as algorithmic recommendation systems and AIGC matured, the token-weighted voting model for content production and recommendation became obsolete. Today’s top-tier social platforms already deliver personalized content feeds—fine-grained curation impossible to achieve with human labor or simple tag-based sorting alone.

After STEEM, many projects attempted to accelerate platform scaling via token issuance—Torum, BBS, and others aiming for scale adopted token incentives. Later, some, like Lens Protocol, shifted to speculative "free mint" models. These incentives violate the "non-monetary reward" essence of social interaction. Research shows external material rewards diminish intrinsic motivation, polluting social content with non-social elements. Social connections are information channels; a platform’s value lies in aggregating data within those channels. But injecting such noise reduces social efficiency. It’s natural that such under-resourced channels would eventually decline.

On Farcaster, Degen distributes part of its tokens as tips. This leverages meme tokens to incentivize Web3-native financial functions—not content creation or curation—but rather using crypto-financial attributes of social platforms to create wealth effects and drive ecosystem growth. A platform can only have one native token, but countless meme tokens. Meme tokens can fail, but the platform token must endure. Using meme tokens to boost social projects may become a superior incentive strategy. The wealth-driven discourse around Degen, combined with innovative possibilities via Frames, has drawn increasing builders to Farcaster, fueling its ecosystem boom. Personally, I consider this a classic operational campaign. Its resulting ecosystem emergence cannot be ignored—already spawning tools like NFT piggy banks, various streaming formats (voice chatrooms, short videos, GIFs), and launchpads. While I haven’t seen Farcaster突破 Lens’s business boundaries (the current industry bottleneck), this emergence deserves close attention.

Setbacks in the Content Autonomy Revolution

Web3 emphasizes decentralization—which in business terms means de-monopolization.

The starting point of Web3 social likely dates back to 2016–2017, by which time Web2 social products were already thriving. Across the last two cycles, social projects have pursued narratives around content autonomy—trying to put content “on-chain” and further, to assetize that content.

Launched in 2016, STEEM suffered from team fragmentation and slow development. Although it achieved on-chain content from day one, lacking an EVM environment meant it couldn’t run smart contracts. After the 2020 DeFi summer, it gradually fell behind. The crown for on-chain content passed to Mirror. Mirror’s selling point was its relatively user-friendly text editor—users could sign and publish content via wallet. Content was on-chain, immutable. Others could subscribe or follow accounts, and content could be minted as NFTs and traded on NFT marketplaces. The project still operates today, though traffic has declined. Still, some degens use it to publish content and mint content NFTs.

Mirror is an excellent Web3 product—its design embodies minimalism and makes superb use of a trusted, open database. Anyone can authenticate internet content via wallet signatures, then issue NFTs and trade them in NFTfi environments on EVM chains. Mirror’s user attrition stems largely from weak operational capabilities compared to traditional Web2 content platforms. Moreover, long-form written content inherently struggles for traffic—it’s the outcast of the junk culture era. Other projects tried putting audio and video on-chain. Beyond ineffective content incentives, the sheer data volume made operations financially unsustainable. Running a content business is running media—you either attract users with great content or attract great content with massive user bases. Purely offering a technical solution won’t make a viable business.

At the end of 2013, another content-based project emerged—Bodhi, also a minimalist product. Inspired by Friend Tech, Bodhi abandoned uniform NFT pricing for associated content, instead adopting bonding curve technology—price increases with sales volume. Others, like CloudBit, forcibly replicated Web2 content onto blockchains to generate NFT assets. Many similar projects attempted to turn content into provably owned assets. Yet they couldn’t change the fact that while content can be authenticated online, the information it carries is easily copied—or outright stolen. Even in cases of infringement, putting content on-chain does little to raise the cost of violations. Thus, directly anchoring asset value to content hasn’t produced compelling examples yet.

Another reason the market remains indifferent to content assetization is simply timing. Though rationally we know personal data is valuable, users don’t actually care much about content sovereignty.

New Frontiers in Attention Sovereignty: Evolution of Recommendation Systems

STEEM inspired and encouraged a wave of blockchain projects. One of its key ideas—using token-stake-weighted voting to rank content—was subsequently borrowed by many others.

Yup, a more content-recommendation-focused project, exists as a social plugin. It issues tokens to incentivize user engagement with content via this Web3 plugin. Using that interaction data plus token stake weights, it replicates and reorganizes content from other Web2 platforms into its own curated lists.

Wormhole3 is another content recommendation plugin. Unlike Yup, it supports multiple tokens as incentives for content promotion. The entire incentive process is code-implemented. Different incentive tokens have independent category tabs on Wormhole3’s website, enabling diversified content recommendations. In Wormhole3’s model, holders of different tokens belong to respective communities, and stake size determines influence within community channels. Allocation rights for some tokens are also controlled by this influence.

Projects like Matters, Torum, BBS, and Bibox—all attempting token-incentivized list-based content recommendations—have ultimately failed. The core issue is that list-based recommendations driven by token incentives fail to capture attention. In today’s attention economy, the previous generation’s simple ranking + tagging approach can no longer compete with intelligent algorithmic recommendations. As ad systems, Web3 projects pursuing decentralization and automation often use immature algorithms that price ad slots less accurately than professional Web2 counterparts. Unlike centralized exchanges, advertising markets aren’t strongly monopolistic. Hence, projects like QuestN and RSS3, aiming to influence content distribution via data, have eventually pivoted.

Experience teaches us: even low-cost token incentives must target advanced modes of production. Phavor continues developing cross-database recommendation middleware atop Web3 databases. Recommendation systems are essential components of any social media platform. Token incentives aren’t the key to Web3 recommendation systems—token holder structure and on-chain behavior are. The integration of on-chain data into decision-making is the fundamental difference between Web3 and Web2 recommendation systems. Compared to airdrops, on-chain social interactions are extremely low-cost, enabling Sybil arbitrage attacks.

Controlling content recommendation via tokens reflects a power logic: attention is controlled by organizations, not individuals. I believe allocating content based on organizational needs resembles enterprise tools like DingTalk or Feishu. Such systems are less social tools and more like DAO infrastructure—votes reflect power. Trustless management of organizational authority is undoubtedly a strength of blockchain and Web3. Most existing content recommendation incentives are based on organizations (platforms or communities).

Popular social tools today have shifted to individual-centric attention models. Every modern social platform delivers personalized content streams, dynamically adjusting based on real-time user preferences. If we embrace 1:1 content delivery, on-chain information should primarily serve as raw tag data for users and content.

Here, BlueSky’s “subscription feed generator” deserves mention. It combines recommendation algorithms with communication protocols. Anyone can provide custom recommendation algorithms for the protocol, and users can subscribe to their preferred ones.

Debank’s social module holds great potential. Though many treat Debank as merely a data tool, its badge system, account display, and stream features have reached heights unattainable by dedicated badge projects. Information about NFTs from long-term NFT players is clearly more valuable. How can someone who never participates in DeFi offer meaningful DeFi guidance? As on-chain activities grow, using accounts as data sources to refine user and content data will improve recommendation accuracy. Though Debank currently lacks an effective recommendation system, its early groundwork positions it well to dominate this space.

Overall, the state of decentralized social development is:

-

Strategies for scaling via token incentives have struggled, failing to identify independent user groups with clear scale advantages.

-

Putting content on-chain and allowing users to own their social assets matters little without scale—users simply don’t care.

-

Content recommendation systems continue evolving, showing glimmers of hope after multiple iterations. A social product that better serves users with on-chain interactions could mark the first step toward decentralized social adoption.

Finding unique scale advantages within the Web3 user base—I think that’s viable. The biggest advantage is token integration, which introduces finance and, more importantly, enables entirely new relationship and interaction possibilities.

Two promising signs stand out:

-

TGbot: Directly integrates trading into social. Seamless social-trading linkage perfectly suits users’ habits of impulse buying tokens. Actions speak louder than words—previously offline behaviors can now become social interactions.

-

Farcaster: Integrates asset issuance into the social platform. Instead of hunting for alpha on Twitter, investors on Farcaster can communicate directly, form communities. More teams are migrating projects to Farcaster—ecosystem emergence is underway.

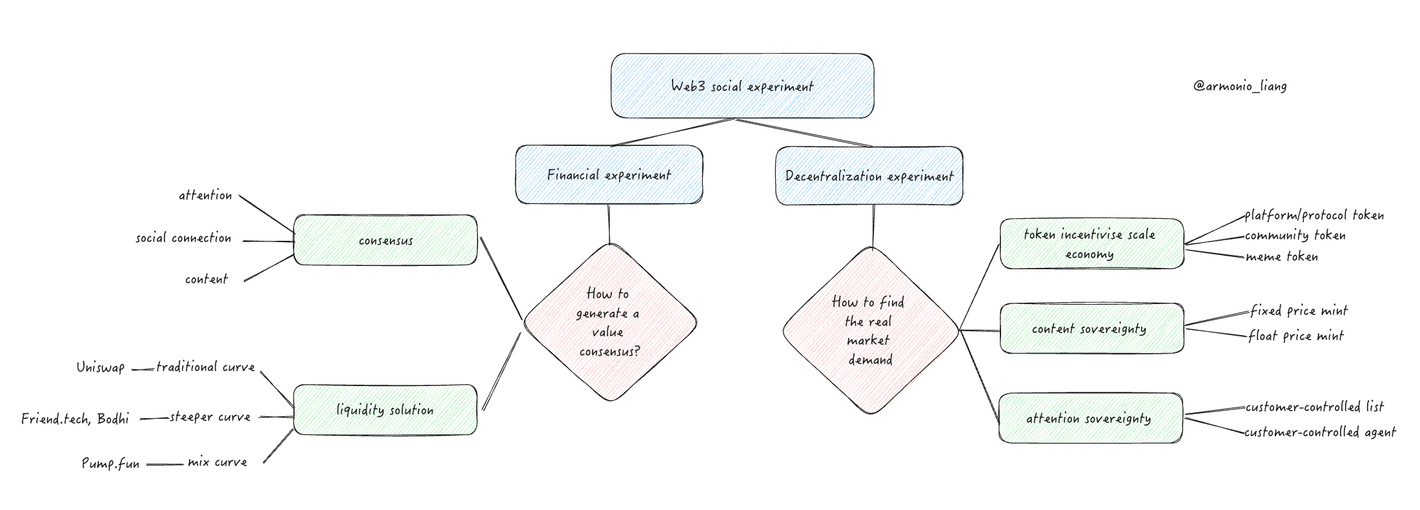

Social Asset Tokenization

The other evolutionary path for Web3 social is using social activity to launch tokens. For projects, tokens are a fundraising tool. For users, tokens aren’t necessarily just utilities—they can be products themselves. Tokens are financial products. Issuing tokens is easy; the challenge lies in building market consensus around token value and ensuring liquidity.

Building Value Consensus Through Social:

How to get the market to recognize a token’s value—this is the alchemy every project seeks. History offers three formulas.

Attention Tokenization:

Attention tokenization is the secret sauce behind meme coins. Creating attention requires content, KOLs, communities, and wealth effects—three of which are deeply tied to social. Whether it’s Farcaster’s Frames embedding direct social monetization (via tokens) into the platform, ERC404’s fusion of image and token (direct merging of content and token), or Donut’s attempt to chain inscription-based recommendation relationships—all aim to enhance the “meme” content of token launches from technical angles.

Meme coin consensus is easy to build but hard to sustain. Ignoring external factors, meme coins lack actual consumers. They create asset liquidity, but unless listed on centralized exchanges—transforming them from ownerless to owner-controlled assets (centralized exchanges require market makers)—once attention peaks pass, meme coins face irreversible downward spirals in both value and liquidity.

Social Relationship Tokenization:

If meme coins, whose value ties to cultural trends, feel abstract to ordinary people, then injecting social relationship value into tokens is grounded in reality. Even beyond Web3 or the internet, in economics, “relationships” are capital. Tokenizing social relational capital is a natural progression.

The first time I noticed social relationship tokenization was with DAOs. DAO definitions vary widely, but commonly, they’re reduced to token-governed circle organizations. Holding my token makes you part of my group; holding different tokens or quantities grants different rights. Tokens represent permissions within the organization. Whether it’s FWB, selling high-value network access (requiring application, approval, and payment), or Moonbird DAO centered on premium investment insights, they all start with permissioned social relationships to establish token value. This cycle’s breakout project, Friend.tech, follows this same path. Unlike traditional organizations aiming for massive scale, Friend.tech targets small-scale groups. Its bonding curve pricing shows that beyond 200 members, adding each new member becomes extremely costly—far smaller than earlier NFT-minting + listing models that easily gathered thousands.

Content Tokenization:

The key difference between content tokenization and attention-driven tokenization is that the former emphasizes the relationship between tokens and content ownership. From earlier products like Mirror and Paragraph to today’s Lens and Farcaster, none have abandoned attempts to assetize content ownership. Technically, this function is simple. In practice, no one uses it. Copyright is a real-world asset (RWA) issue—ownership moves from off-chain to on-chain. When on-chain ownership is highly uncertain, and enforcement only increases维权 costs, these features become ornaments. Only when most authentication processes migrate to blockchain, enforcement paths mature, and scale kicks in, will content tokenization reveal economic value.

Content tokenization also lacks wealth effects, preventing it from accelerating industry maturity. In today’s AIGC-saturated world, content isn’t scarce—attention is. Without scarcity, wealth effects cannot emerge.

Bonding Curves Solve Liquidity:

Though not a social innovation per se, bonding curves solve liquidity cost issues for small-scale projects. Friend.tech’s steep version of the bonding curve didn’t just create wealth effects with modest capital—it drastically reduced the operational cost for individuals to provide liquidity for their own tokens. Consequently, many projects are experimenting with novel pricing curves in their domains. Some have gained modest traction: Bodhi applied bonding curves to content valuation, DeBox to community asset issuance.

Although Friend.tech (FT) lost momentum due to operational missteps, later overtaken by Farcaster in attention, the impact of bonding curves is profound. FT demonstrated that for different token use cases, there’s always a more suitable bonding curve. Every curve has trade-offs—selection must fit the context. Friend.tech’s V2 aligns with this understanding, attempting multi-center, mesh-style community asset issuance (clubs), while introducing an even steeper bonding curve.

Pump.fun effectively invented a segmented bonding curve—using a steep curve until fundraising reaches $20K, then jumping directly to a standard decentralized exchange. This too is an innovation in liquidity provision.

In summary, across two cycles, Web3 social has conducted rich experiments across multiple domains and angles.

Opportunities and Mission of Web3 Social

Across two cycles, Web3 social has explored rugged terrain, suffering repeated failures. Yet progress remains evident:

Our frontends have evolved from PC to mobile, from standalone apps to progressive web apps. Wallet logins have moved from seed phrases to MPC and abstracted accounts. Entry barriers to Web3 social keep dropping. Advances in blockchain infrastructure have slashed accounting costs exponentially and reduced transaction finality to near-instantaneous. Builders at the protocol layer, striving to make decentralized social usable, have even proactively developed specialized Layer 3s, tailoring decentralization levels based on information trustworthiness. Network scalability has directly improved user experience—supporting multimedia and handling higher concurrency.

Embedded social scenarios are another industry innovation. Being open-source and permissionless, Web3 offers Lego-like composability. We can now embed any interaction into social (e.g., direct NFT trading within social feeds), or embed social into any interaction (e.g., integrating a social tool inside a game).

We’ve also achieved notable success in middleware—integrating, analyzing, and tagging on-chain data; managing token behaviors based on game theory; and offering diverse liquidity provision models.

Compared to the last cycle, our infrastructure and tools are far more robust. Native Web3 users are growing, and increasingly intuitive meme tokens and NFTs continue educating potential users through successive waves.

Social innovation isn’t a dead end—every era has challengers. Take ReelShort, recently launched, using melodramatic short dramas to attract users. It allows a streamer, MCN, or media company to build their own social platform at low cost. With proper recommendation algorithms driving traffic, it forms a federated network structure.

All this sounds abstract—let me paint a vivid picture using viral content mechanics, outlining my envisioned blueprint.

Dopamine: The Masses’ Opium, Web3’s Antidote

The above discussion follows conventional logic about Web3 social development. Within the broader competitive landscape of social products—even meme coin launches via social—current efforts seem naïve, almost virginal. Let me show you the social scenes I envision.

Since the rise of streaming media, we’ve hardly seen pure text-and-image social platforms survive.

Even within streaming, competition is fierce.

What dominates top-tier short video platforms? “Rich CEO falls for me,” late-night rollercoaster rides, “drinking alone, singing my heart out.” Now look at Farcaster, STEEM, Mirror—does anyone even post normal human speech? Unless driven by Web3 ideals or pathetic airdrop farming, I wouldn’t waste a second. Yes, Web3 social has grown crooked—not because of tech. The threshold for mass adoption is nearing. To achieve massive adoption in Web3 social, we must graft social onto the leg of content.

Our original idea of “bringing in content” was to airdrop to creators—flooding non-viral-content producers with incentives, supposedly breaking platform monopolies. In reality, 1% of super-KOLs generate 90% of traffic but get inadequate rewards.

In social, some technical details aren’t that important. For example, if TikTok suddenly announced using its own wallet login—whether MPC or AA wouldn’t matter much. Whoever has traffic rules. Whoever controls attention-grabbing content owns the traffic. Could it be possible that industry organization isn’t driven by tech-first protocols or projects operating “Web2-like” platforms, but rather by each content creator sitting at the center of a small economic loop—freely choosing protocols and tools suited to their content model, organically combining them, and allowing others to participate in their economy via tokens?

This fan economy model already exists in real life:

A high-end “emotional intimacy masseuse” might simultaneously run a Twitter account, TG group, OnlyFans, and Pornhub channel. Their product isn’t just sexual services but a complete “sexual fantasy solution.” These workers build private traffic via social media, sell exclusive short videos or livestream time to cultivate paying habits, then monetize through girlfriend experiences or roleplay services. Social and media multiply their labor value, while self-media traffic helps them escape platform exploitation.

A closer example: Japan’s artist livestream shopping platform Zaiko. The platform uses decentralized tech—artists can issue NFTs. It’s also ready to launch a platform token. The founder was a serial entrepreneur with strong ties to Japanese artists, so Zaiko never lacked users. Today, a single livestream can generate over a million dollars in sales. Decentralized tech is already reshaping our social landscape—from the other end.

We talk about reclaiming content value from platform monopolies. The most direct method? Let content build platforms, and let third-party curation or recommendation tools link them together. Let’s envision a possible Web3 future.

The Web3 Social Blueprint

Imagine a venture capitalist hires a popular fiction writer to produce a sensational script titled *Back to 2010: Stirring Up Crypto*. Inject maximum dopamine and hormonal triggers. Before the script finishes, they announce the writer blew up and fled. The project continues—filming begins. To bypass regulation, they adopt a decentralized media solution (e.g., Farcaster + Livepeer), airdropping content tokens to early viewers. Users holding certain tokens can influence plot developments, vote on new cast members, or gain early access to episodes and merch. For certain regions, they could directly sell protagonist-themed fashion, real estate, or custom goods via Frames in the show. Each main character has their own fan token, communicating via Friend.tech or a custom fan system. For additional services like chats, exclusive videos, or companion tours, separate arrangements apply. Steamy scenes require unlocking via corresponding fan tokens + content tokens. New tokens launched in the show debut simultaneously in reality via pump.fun. The show’s independent streaming platform rents out overflow traffic via curation tools like Tako or Phavor. Edited clips comply with regulations and air simultaneously on Web2 platforms.

As a Web3 user, imagine how amazing your social experience could be. Watching the show earns you tokens. Use them to boost exposure of your favorite memes within the plot, manipulate traffic for profit, support beloved actors, interact closely with them—even insert yourself as an extra, fulfilling cosplay fantasies. This level of engagement surpasses passive Web2 experiences.

All we need are more seamless logins, lower content storage costs, and reduced latency—technical support within reach.

The Mission of Web3

Web3 isn’t Guanyin saving the suffering, nor the Messiah redeeming humanity. The foundation of the Web3 revolution is liberalism. Gambling isn’t wrong, paid friendships are fine, and enjoying addictive short videos is human nature. God gives us choices—so does Web3: to offer more options. Wide gates, narrow gates, hell and heaven—all depend on individual choice. Our mission is to return rights taken by centralization to every individual. No need to dramatize. Don’t impose your ideals on others.

Conclusion:

Web3 social isn’t scam—but Web3 isn’t child’s play either. (Even my Web3 social vision has been mocked by friends as typical child’s pretend-play.) Yet industry success emerges precisely from such laughable failures.

Currently, Web3 social’s困境 stems partly from immature technology—costs haven’t dropped enough. Compared to Web2, our recommendation mechanisms are still infantile. On the other hand, while we champion creator empowerment, our industry’s organizational model remains tech-platform-centric. Social must revolve around human nature—but merely respecting human nature won’t generate cold-start traffic. Thus, borrowing traffic from content has become standard practice. I predict: future social media will center on content issuers, surrounded by users and supporting service providers.

Moreover, we haven’t yet figured out how best to use Web3 technology to enhance social interactivity. Interactivity is a crucial attribute of Web3 social—beyond autonomy and censorship resistance. Mastering interactivity to elevate user experience will determine the success or failure of future Web3 social. Discovering how content and communities better interact within the new environment enabled by decentralized technology will decide whether Web3 can gather traffic and truly land in reality.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News