Study on the Impact of Crypto KOL Tweets: Short-term Pump Effect Is Obvious, Following Orders with $1,000 Leads to an Average Loss of $79 After One Month

TechFlow Selected TechFlow Selected

Study on the Impact of Crypto KOL Tweets: Short-term Pump Effect Is Obvious, Following Orders with $1,000 Leads to an Average Loss of $79 After One Month

The post-event return is more negative when influencers refer to themselves as experts.

Written by: TechFlow

For retail investors, following investment calls from various KOLs (key opinion leaders) is a major source of seeking financial gains.

But are these KOLs consistently profitable market winners, or merely beneficiaries of random coincidences?

Different bloggers yield vastly different answers to this question. One correct 100x call or one disastrous recommendation leading to zero value can easily create highly subjective survivorship bias.

From an industry-wide perspective, how do KOLs actually perform in terms of investment outcomes?

In February, researchers from Harvard Business School, Indiana University’s Kelley School of Business, and Texas A&M University jointly published a paper titled "Crypto Influencers."

The study analyzed the performance of crypto assets mentioned in approximately 36,000 tweets posted by 180 of the most prominent cryptocurrency social media influencers (KOLs) over a two-year period ending December 2022, covering more than 1,600 tokens.

Key Findings:

-

Crypto influencer tweets are initially associated with positive returns. However, they are followed by significantly negative long-term returns, indicating minimal long-term investment value.

-

The effect is most pronounced when the influencer promotes low-market-cap coins, has a large Twitter following, and self-identifies as an expert.

-

Using machine learning to classify tweets, the study found that the pattern is stronger when tweets express more positive sentiment or include explicit "buy" recommendations.

Data Illustration

Crypto influencer tweets show positive short-term return effects:

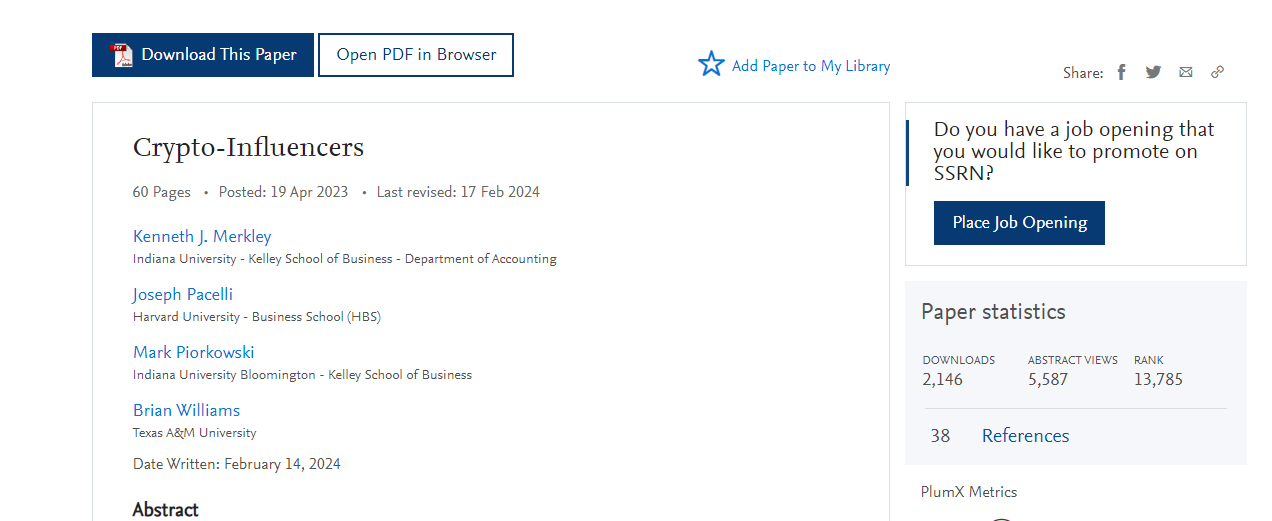

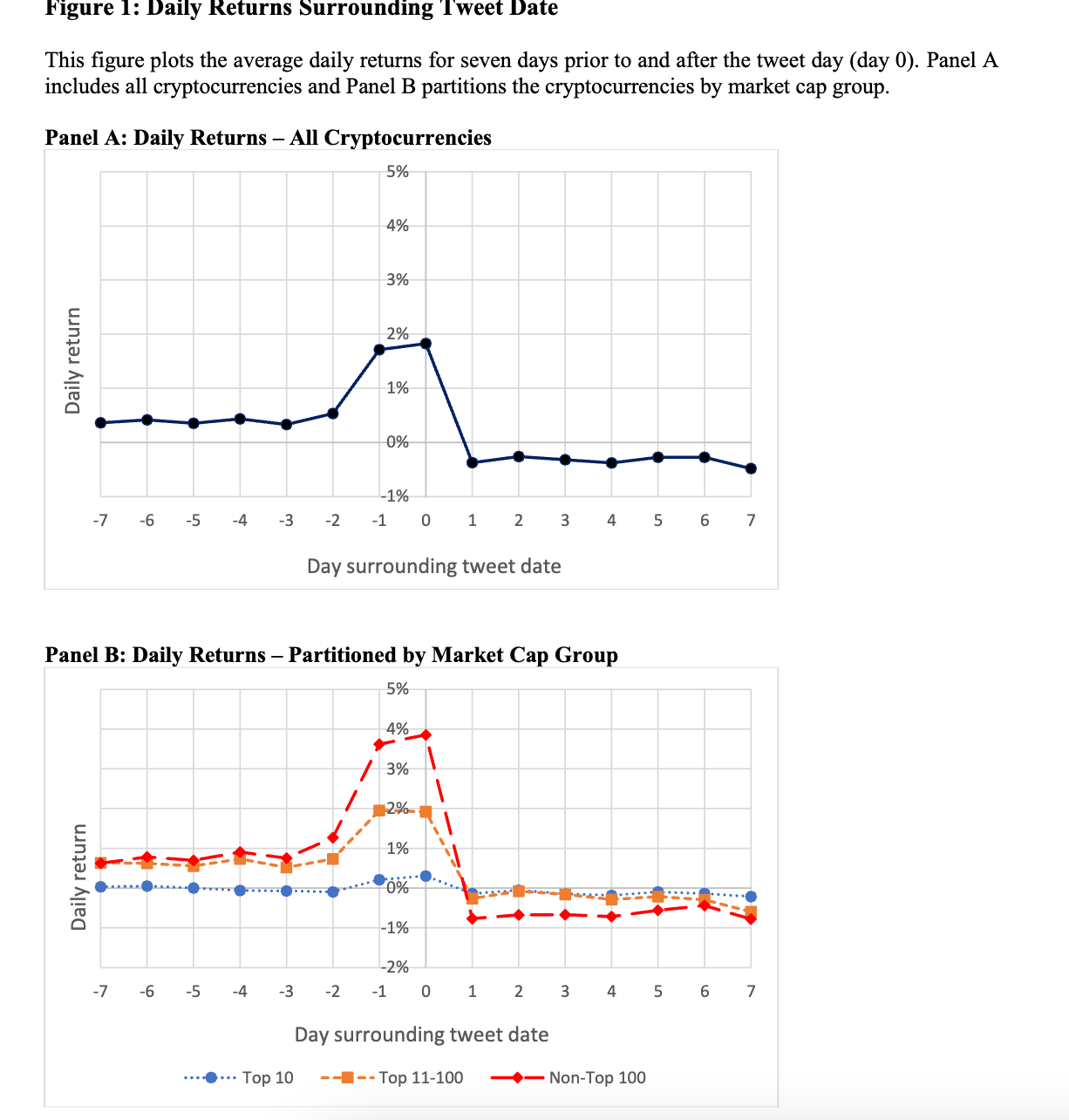

On average, a promoted coin generates a 1.83% (1.57%) return within one (two) day(s) after the tweet.

For cryptocurrency projects outside the top 100 by market cap, the one-day post-tweet return reaches 3.86%.

Returns begin declining sharply five days after the tweet. The average return from day two to day five is -1.02%, suggesting that over half of the initial gain disappears within five trading days.

From a longer-term perspective, the average cumulative returns 10 days and 30 days after the tweet are -2.24% and -6.53%, respectively. These negative post-event returns are even more pronounced for low-market-cap cryptocurrencies—where information asymmetry and liquidity issues are most severe.

A rough estimate suggests that investing $1,000 in non-top-100 crypto tokens on the day of the tweet and holding for thirty days would result in a loss of $79 (7.9%), amounting to an annualized loss of 62.8%.

Self-proclaimed experts: When influencers identify themselves as experts, post-event returns are even more negative; and the larger their follower count, the worse the returns become.

Overall, the findings indicate that, on average, investment advice from crypto influencers is unprofitable over the long term. Profits can only be realized by immediately exiting positions after the tweet—but such a strategy may not always be feasible due to insufficient market liquidity. Moreover, this immediate sell-off contradicts the crypto community's prevailing culture of "never selling."

Reflection

The collective evidence in the paper suggests that investors should exercise caution when following investment advice from crypto KOLs, as most gains dissipate shortly after the tweet is published.

However, the authors also acknowledge that the evidence is not yet conclusive. Crypto KOLs may simply be chasing trends or promoting tokens that will bring them the greatest visibility and followership, thereby benefiting them economically.

Additionally, a more benign interpretation is that crypto influencers genuinely believe these assets will eventually experience substantial growth. Influencers might also assume investors understand the implicit advice to buy short-term and sell immediately.

Nonetheless, the paper’s results still offer valuable insights, providing clear evidence that such investment advice is unlikely to be useful for those holding tokens for months or years.

The paper further suggests that regulators and business media might encourage greater scrutiny of such activities to determine whether they are associated with significant conflicts of interest.

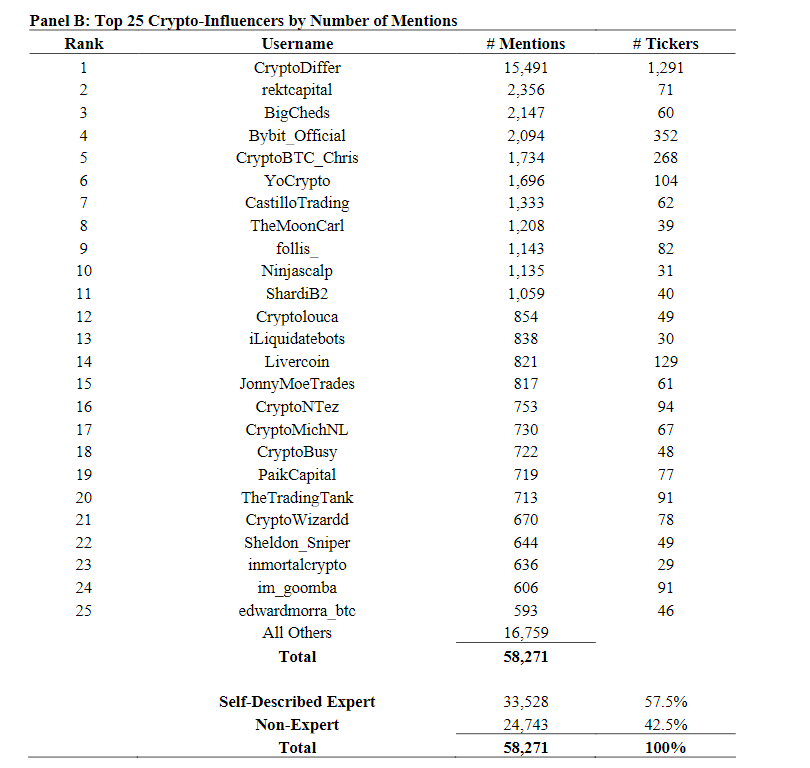

Appendix: Top 25 Twitter accounts mentioned in the paper (rankings based on data from two years ago, affected by the study’s timeframe)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News