MT Capital: New Trends in the Crypto Market After the Bitcoin Halving

TechFlow Selected TechFlow Selected

MT Capital: New Trends in the Crypto Market After the Bitcoin Halving

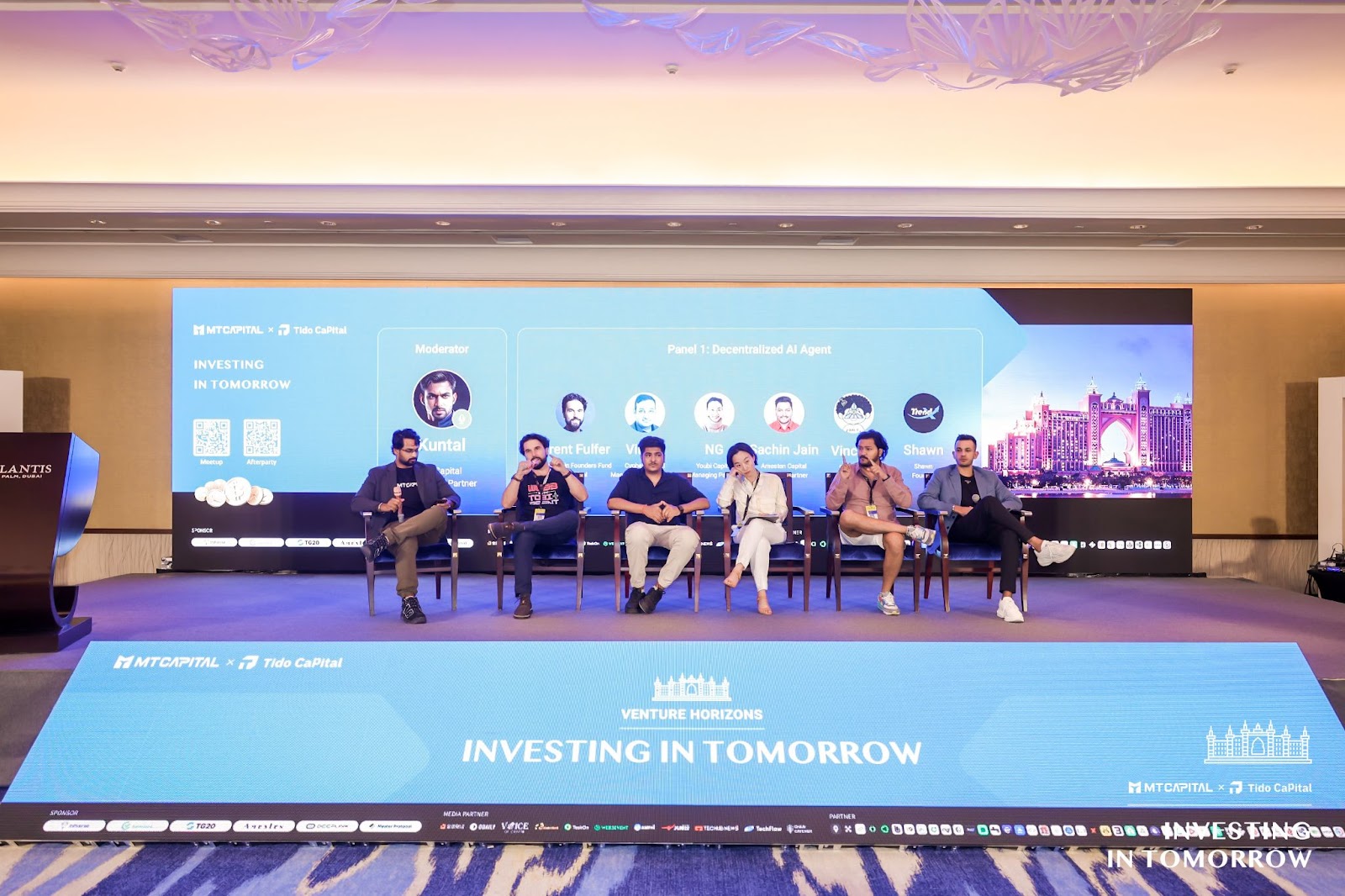

Noa, founder of MT Capital, and partner Ian delivered speeches respectively, sharing MT Capital's vision and upcoming investment strategy.

MT Capital's founder Noa and partner Ian delivered speeches, sharing MT Capital’s vision and upcoming investment strategies.

MT Capital's founder Noa and partner Ian delivered speeches, sharing MT Capital’s vision and upcoming investment strategies.

1. Why is the fund named Momentum Capital?

Noa: In physics, “momentum” represents the quantity of motion, reflecting the combined effect of velocity and mass. Similarly, in investing, Momentum symbolizes our ability to swiftly respond to market dynamics and propel projects forward. By capturing the right market momentum, we can achieve steady growth even amid volatility. We use MT Capital as a shorthand for easier recall.2. Why launch a new fund during the 2023 bear market?

We chose to launch the fund during the bear market because we aim to support truly resilient, well-prepared, and high-potential founders after the tide recedes. From an investor standpoint, bear markets offer opportunities to enter at lower valuations, allowing us to carefully select projects with strong potential to stand out when the market rebounds. Looking ahead, I am confident in Momentum Capital and the ventures we back. We are committed to investing in innovative companies and projects that solve real-world problems and generate positive societal impact. As technology matures and markets further develop, we will leverage capital to make greater contributions to the crypto space. Ian said: MTCapital is dedicated to navigating rapid market changes, ensuring sustained growth and returns in crypto investments. Our investment strategy leverages the dynamic nature of the crypto market to optimize performance. Our first fund has reached $50 million in AUM, covering both primary and secondary investments. In 2023, I met with Noa, and we agreed on the need to build a powerful, practical, and international fund ready for the next market cycle. Therefore, I left the investment team of a leading cryptocurrency exchange where I had worked for over two years and joined MT Capital. As the market shows, Bitcoin’s first halving occurred at such a turning point, and now we’re approaching the next one—market cycles are taking shape. MT Capital’s mission is to turn this vision into tangible value. Both Noa and I have over six years of experience in crypto investing, with portfolios spanning five regions including the U.S., Hong Kong, India, and Singapore. Our focus areas include native innovation, decentralized applications (DApps), gaming, and the integration of AI and DePIN. We aim to drive innovative and practical projects, leveraging the rapid growth of capital markets to create value for investors.3. MT Capital’s Investment Strategy & Key Focus on AI+Web3 in 2024

With the rapid advancement of blockchain and AI technologies, their convergence is seen as a key driver for a new era of digital and economic innovation. By combining AI’s data processing capabilities with blockchain’s transparency and security, new application scenarios and business models are rapidly emerging. Decentralized data collaboration and sharing mechanisms not only optimize data access and usage but also enhance user privacy protection, providing richer and more diverse datasets for training AI models. As technology progresses, the integration of AI and blockchain is also enabling the utilization of decentralized computing resources, lowering entry barriers while improving system performance and reliability. In short, the fusion of AI and Web3 heralds a more efficient, transparent, and decentralized future, significantly promoting innovation and economic growth across industries. Currently, MT is preparing for increased capital inflows during market booms. From an investment perspective, we prioritize projects with native innovation capable of generating high alpha returns. Second, DApps and gaming help migrate user traffic to Web3. Third, Web3 technologies integrated with AI aim to address current challenges in the AI field, such as offering more choices and strengthening data privacy. Fourth, DePIN remains a key vertical, facilitating seamless interaction between real-world users and Web3. Last year, MT invested in Sidequest, a community focused on Web3 and game discovery, which has now entered Binance MVB and is currently at MVP stage. Another promising project is Catizen, which gained 2 million users on Telegram within a month, with over 400,000 daily active users. We also backed bitSmiley, the largest native stablecoin protocol on BTC, supporting multiple BTC L2s. Additionally, Ian believes that Bitcoin ETFs are driving traditional capital into the crypto market. This process could last about six months, meaning there remains significant opportunity to attract institutional funds. Moreover, the Bitcoin halving will increase mining costs—from approximately $40,000 to $100,000 per BTC. Thus, a Bitcoin price reaching $100,000 appears highly plausible. Going forward, Bitcoin’s dominance in the market is expected to strengthen rapidly in each cycle, especially during boom phases, creating more investment opportunities among the top 100 cryptocurrencies. Finally, the global regulatory environment toward crypto is becoming increasingly favorable. We’ve seen approvals for Bitcoin-related ETFs and payment services in Hong Kong, Singapore, and the U.S., leading us to maintain a long-term optimistic outlook on the future of Web3. Below are highlights from guest speakers—due to character limits, only selected key insights from the panel discussions are presented:

Brent Fulfer, Blockchain Founders Fund Principal

Brent Fulfer: The potential and practical applications of combining AI and Web3 technologies in non-traditional areas like pet identity verification and passport services. I believe integrating blockchain and AI enables data transparency and verifiability while optimizing service efficiency and user experience. This technological synergy not only creates significant commercial value in the pet market but also meets high demand for personalized and customized services. I see huge potential in using Web3 and AI to open new markets and innovate business models, while empowering traditional applications.Vineet, Cypher Capital Managing Partner & CEO

Vineet: I see AI playing a crucial role in smart contract applications, particularly in extracting and processing data from networks to support automated decision-making in smart contracts—such as automatic hedging and adjusting loan-to-value ratios (LTV). In this way, AI can improve execution efficiency and enhance the decision-making capability and responsiveness of the entire system. We are investing in projects that simplify the integration of AI with smart contracts, reducing the need for repeated audits and accelerating time-to-market. These projects integrate multiple functions at the intelligent layer, enabling smart contracts to analyze data via AI and automatically execute complex operations, significantly improving transaction and contract management efficiency. Moreover, I believe privacy protocols are vital for enhancing retail user access to physical infrastructure, highlighting AI’s potential in optimizing Web3 infrastructure.

NG, Youbi Capital Managing Partner

NG: Let me discuss the strategy and potential impact of integrating AI and Web3 technologies, especially in data processing, computing power, and algorithm development. I categorize this integration into two main types: Web3+AI and AI+Web3. In the Web3+AI context, AI serves as an enhancement tool, primarily aimed at improving product performance and user interfaces to make them more efficient and user-friendly. In the AI+Web3 framework, however, AI is not just auxiliary—it becomes the core product, showcasing its central role and leadership in product development. Specific implementations of AI in Web3 environments include decentralized data processing and labeling, which improves data quality and usability while enhancing overall system transparency and trust. For example, using Web3 technology for data annotation allows data collection and validation in a decentralized setting, which can then be used to train and improve traditional Web2 AI models. Also, the development of decentralized computing resources, such as GPU markets, provides AI systems with large-scale data processing and complex computational capabilities. Decentralizing these resources not only increases utilization rates but also lowers entry barriers for AI projects, fostering broader innovation and participation.Sachin Jain, Amesten Capital Founding Partner

Sachin Jain: With the surge in digital counterfeits and fake content, combining AI’s predictive and generative models with Web3’s decentralization and transparency can significantly enhance authenticity verification of digital content. Several projects I’ve invested in leverage deep learning and blockchain to enter prediction markets and DeFi, demonstrating AI’s potential in financial forecasting and decision support. This technological combination not only addresses real-world security challenges but also drives innovation in financial products, such as enabling complex financial decisions through precise data analysis. Furthermore, the integration of AI and Web3 is critical for improving the accuracy of digital identity verification and online security, underscoring the strategic significance of this fusion. It offers robust technical support and broad application prospects for handling complex data, delivering reliable security verification, and advancing innovative solutions.Panel 2: Decentralized AI Computing Power Is Also a Hot Topic in AI + Web3

Mohit Pandit, IOSG Director

Mohit: The widespread deployment of AI applications faces a primary challenge: access to high-performance computing resources (e.g., GPUs and CPUs) and large volumes of data—both essential for training AI models. The current market suffers from high costs and limited availability of such resources, especially amid global chip shortages. Solving this issue through innovative technologies and business models has become an urgent priority. By using cryptocurrency as a coordination mechanism, decentralized network platforms can aggregate scattered computing resources. This model not only maximizes underutilized computing capacity but also balances supply and demand through market mechanisms, reducing costs. For instance, expensive chips that are purchased but underused can be efficiently shared with users needing massive computing power. Without sufficient data, effective AI model training is impossible. Therefore, I advocate building a decentralized data aggregation platform where individuals and institutions can contribute their data. This solves data scarcity and incentivizes more contributors via token rewards, forming a self-sustaining, growing data ecosystem. This blockchain- and cryptocurrency-based decentralized computing and data aggregation model not only overcomes barriers in AI scalability related to computation and data access but also democratizes AI technology, enabling more researchers and developers to enter the field at lower cost, thus accelerating AI innovation and adoption.Xinwei, MT Capital Head of Research

Xinwei: Traditional centralized AI and computing platforms face many limitations, particularly in data protection and resource allocation. Centralized platforms often treat user data as a profit tool rather than a protected asset, threatening user privacy and limiting data’s full potential. In contrast, decentralized AI leverages blockchain technology to democratize data and computing resources, protecting user data from misuse while increasing transparency and trust. Another major challenge lies in parallel computing and resource scheduling within decentralized systems. In traditional Web2 environments, complex task orchestration and resource management are handled effectively by mature tools like Docker and Kubernetes. But in decentralized Web3 environments, these tasks become much harder due to the lack of a central authority to coordinate resources, necessitating new algorithms and protocols to ensure efficient task distribution and execution. I also believe data transmission and synchronization deserve serious attention—especially how to efficiently handle large data volumes in decentralized networks. I recommend adopting data compression techniques to reduce the amount of data transferred between nodes, speeding up processing and lowering costs. This not only improves decentralized network performance but is also key to enabling large-scale AI applications. Scalability of decentralized AI is crucial—particularly how to expand processing capacity while maintaining network consistency. This requires innovative consensus mechanisms and smart contract designs to enable efficient resource management and rationalized incentive structures, ensuring the network operates continuously and effectively.

Darren, Bing Ventures Investment Director

Darren: In the current evolution of AI technology, expanding computing networks is key to advancing technological progress and widespread adoption. I believe both vertical and horizontal scaling are important, along with understanding the core elements and implementation paths of each. First, vertical scaling involves deepening technical capabilities, including developing more efficient hardware and optimizing algorithms to make AI training and execution more efficient. This expansion focuses not only on hardware improvements—like better GPUs or specialized AI chips—but also on software optimization such as algorithm refinement and system architecture upgrades. Vertical scaling enhances individual node processing power, accelerating AI model training and improving response speed. Second, horizontal scaling aims to expand overall system capacity by increasing the number of nodes, especially by bringing in more data providers and computing resource participants. Decentralized AI networks rely heavily on broad participation to supply necessary computing and data resources. For example, incentive mechanisms can attract more retail computing contributors and small data centers, effectively utilizing idle computing power to boost overall network capacity. This approach not only improves redundancy and attack resistance but also enhances AI model generalization and accuracy through diversified data inputs. Challenges in implementing these scaling strategies in decentralized AI networks include managing and orchestrating distributed resources efficiently and ensuring data security and processing efficiency. I believe decentralized technologies can address these issues by enhancing transparency and trust among participants. Meanwhile, emerging blockchain technologies—such as smart contracts and consensus algorithms—offer innovative solutions to these challenges. Finally, from an investment perspective, when selecting AI and blockchain projects for funding, we must evaluate their technological maturity, market potential, and team background. Through precise project selection and strategic investment, we can advance the development of decentralized AI networks and drive the entire industry forward.Panel 3: Beyond AI, BTC Ecosystem Development Is Also a Top Topic in Both Primary and Secondary Markets. Especially Around the Halving, New Asset Protocols on BTC Are Emerging Rapidly. How Will the BTC Ecosystem Evolve?

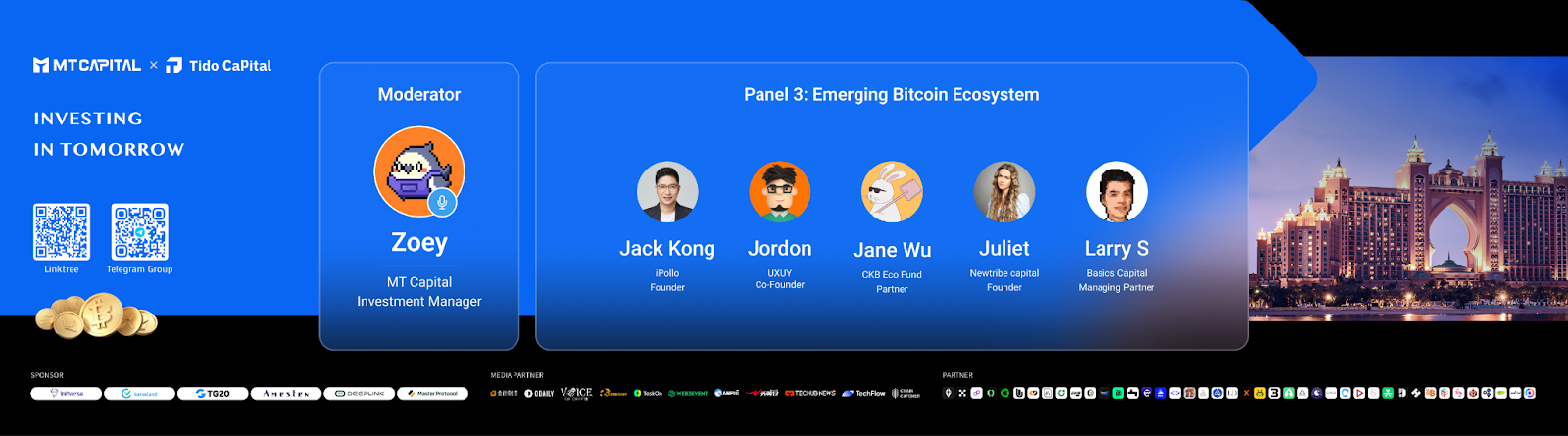

Jack Kong, iPollo Founder

Jack Kong: I believe the Bitcoin ecosystem holds long-term investment value. Over the past fifteen years, blockchain development has proven Bitcoin’s effectiveness in token issuance and transaction processing. These achievements lay a solid foundation for Bitcoin’s continued growth and market stability. Emerging protocols on Bitcoin such as BRC20 and the upcoming Runes protocol are very important. These protocols bring clear technical advantages to the Bitcoin ecosystem by streamlining token issuance. Compared to Ethereum’s ERC20 standard, a notable advantage of these new protocols is that they do not rely on smart contracts, thereby reducing the need for security audits and mitigating potential risks. This simplified issuance mechanism not only improves efficiency but also enhances overall system security. With protocols like BRC20 and Runes, the Bitcoin network will support more types of assets and transaction methods, greatly expanding its application scope and influence in the global financial ecosystem. I predict these improvements will position Bitcoin as a leader in the global blockchain landscape, attracting more investors and developers.Jordan, UXUY Co-founder

Jordan: The future development of cross-chain DEX aggregators and Layer 2 solutions in the Bitcoin ecosystem is critically important. Standards like BRC20 and the Runes protocol are vital for the Bitcoin ecosystem, offering new opportunities for asset issuance and trading—especially in enhancing security and efficiency. These innovations are key drivers of future growth in the Bitcoin ecosystem. I am highly optimistic about the future of the Bitcoin ecosystem, particularly in asset issuance and cross-chain transactions. As technology advances and the ecosystem matures, Bitcoin will unlock more potential applications, attracting more users and developers into this expanding network.

Jane Wu, CKB Eco Fund Partner

Jane Wu: I believe CKB Eco Fund plays an important role in driving innovation in the Bitcoin ecosystem, particularly in asset insurance and Layer 2 solutions. First, asset issuance protocols in the Bitcoin ecosystem are undergoing rapid development and evolution, especially with the introduction of new protocols like BRC20 and RGB++. These protocols are designed to enhance Bitcoin’s functionality by optimizing the UTXO model, enabling more efficient asset issuance and management on the Bitcoin chain. For example, the RGB++ protocol enables asset insurance on Bitcoin Layer 1, fully leveraging Bitcoin’s security and stability. UTXO Stack, as a Layer 2 solution, uses Bitcoin’s infrastructure to deliver fast, low-cost transaction processing—making it a significant innovation for applications requiring high throughput and low fees. Additionally, CKB, as a client-side validation mechanism, adds flexibility and scalability to asset issuance and transactions on Bitcoin. Despite the emergence of various asset issuance protocols, this diversity prompts developers and investors to more carefully assess each protocol’s strengths and use cases. In the coming years, a few dominant protocols are likely to emerge as market leaders.Larry S, Basics Capital Managing Partner

Larry S: My focus is on venture investment within the Bitcoin ecosystem and the potential development of Layer 1 protocols. First, Bitcoin’s status as a secure and potentially market-leading Layer 1 protocol is unquestionable. Its base-layer protocol security is the most mature and reliable among all blockchains, providing a solid foundation for upper-layer applications and innovations. Therefore, any expansion or enhancement of Bitcoin Layer 1 directly benefits from its inherent security, giving Bitcoin-based projects a unique competitive edge. I am bullish on the long-term potential of AI and deep-tech projects within the current Bitcoin ecosystem, especially regarding possibilities for further innovation and application on Bitcoin’s infrastructure. As technology evolves and markets mature, Bitcoin is no longer just a monetary system but a vast technological and financial ecosystem that enables diverse innovations. Lastly, emerging Layer 2 solutions in the Bitcoin ecosystem are highly promising. While Bitcoin currently faces challenges in transaction speed and cost, Layer 2 technologies like the Lightning Network and sidechains can effectively improve speed and reduce costs. The development and adoption of these technologies will be key drivers of future growth in the Bitcoin ecosystem.Panel 4: Web3 Mass Adoption Is Gaining Increasing Attention. RWA, Gaming, Social—Which Applications in Which Sectors Can Drive Web3 Mass Adoption, and What Is the Path Forward?

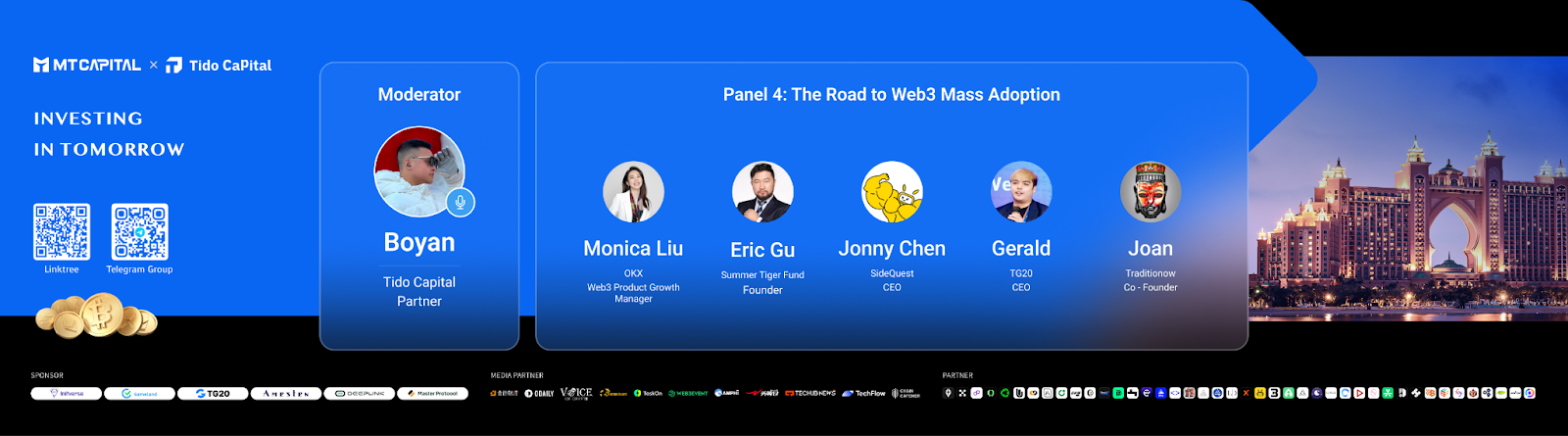

Eric Gu, Summer Tiger Fund Founder

Eric Gu: I think there may be a misframing in current discussions around Web3 adoption. We often debate how to promote adoption of technical protocols—yet protocols like TCP/IP never faced questions like “how to achieve mass adoption,” because protocol-level adoption naturally follows application-layer growth. Therefore, I suggest shifting focus to concrete applications built on Web3 or blockchain—that’s the key to driving widespread adoption. Further, the main challenge in Web3 today lies in infrastructure development, particularly the maturity of Layer 1 and Layer 2 solutions. We are still in the exploration phase of Layer 2 platform development, and I expect that over the next two to three years, refining this infrastructure will be crucial in transitioning Web3 from a technical concept to mainstream adoption. Comparing current Web3 infrastructure to the evolution of the traditional internet reveals room for improvement. Web3 promotion strategies should focus on developing applications that attract mainstream users, rather than solely optimizing protocol-level technology. This approach will more effectively drive mass adoption of Web3 and ultimately lead to its global proliferation.

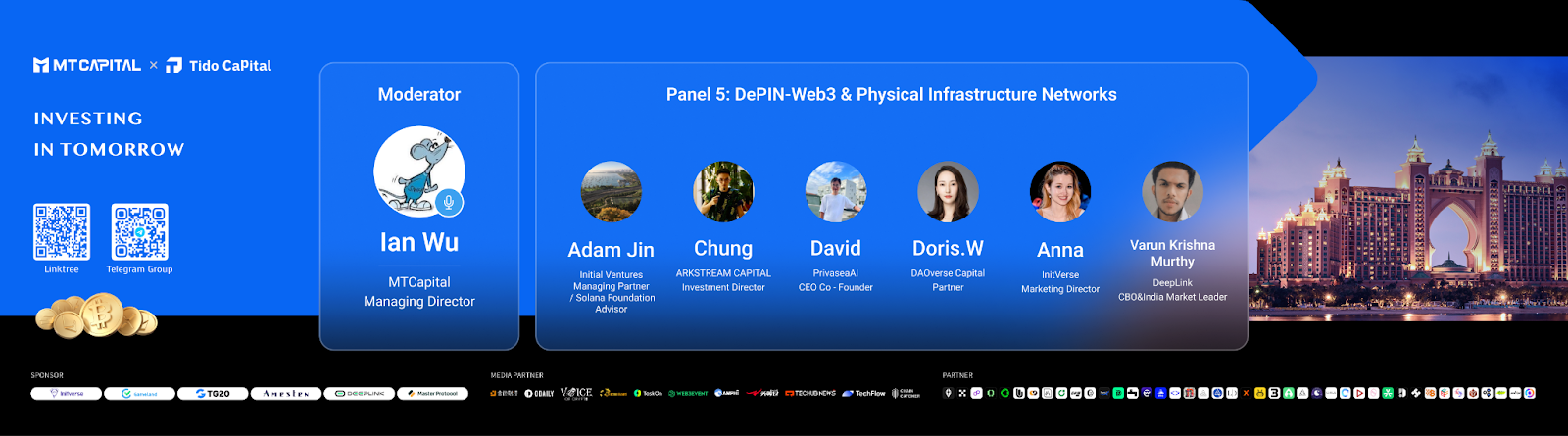

Adam Jin, Initial Ventures Managing Partner / Solana Foundation Advisor

Adam: Blockchain’s transformative power can significantly improve efficiency and user experience across sectors. Key advantages of using blockchain in decentralized infrastructure include enhanced security, transparency, and the ability to conduct transactions without intermediaries—reducing costs and increasing speed. However, blockchain integration faces many challenges, particularly in scalability and user adoption. Despite its clear benefits, the technology must overcome obstacles like high energy consumption and complex implementation processes, which may hinder mainstream acceptance. Continuous improvement of blockchain protocols—such as Layer 2 solutions and other scalability-enhancing technologies—is crucial to enable higher transaction throughput while maintaining low costs and high speed. This will make blockchain more accessible and applicable beyond finance, including healthcare, supply chain management, and even government services. Supportive regulatory frameworks for blockchain innovation and adoption are also essential. Clear and enabling regulations are critical to cultivating an environment where blockchain can thrive and safely integrate into existing economic and social systems. I firmly believe blockchain will revolutionize industries—by solving fundamental issues related to data security, transaction efficiency, and trust among parties, paving the way for a more connected and efficient global system. During the interview, Gary shared his views on the trending Meme sector:

During the interview, Gary shared his views on the trending Meme sector:

Gary Yang, Eureka Meta Capital Founder

Gary: Meme coins go beyond mere economic value—they reflect crypto culture and market dynamics. These tokens attract people not just through humor and cultural phenomena, but also through unique community-building that showcases the power of community and cultural resonance in the crypto market. For example, Dogecoin built a fun and inclusive community around its Shiba Inu mascot—this community spirit is a key reason for the lasting popularity of meme coins. From a market perspective, the performance of meme coins largely reflects sentiment swings in the crypto market. Their rapid price surges and drops are often closely tied to social media trends and celebrity comments, revealing the emotionally driven nature of the market. This phenomenon not only demonstrates the diversity and broad acceptance of the crypto market but also highlights potential bubbles and risks. To maintain market position, meme coins require strong community support and sustained media attention. Active community engagement and loyalty, combined with celebrity endorsements and continuous media coverage, collectively boost visibility and investment interest. Moreover, meme coins must continuously innovate and adapt to new market demands—such as integrating DeFi and NFTs—to provide new use cases and value-added services for community members, preserving relevance and appeal in a highly competitive market. Due to character constraints, the above are selected highlights from some of the speakers. Special thanks again to all participating guests. Including Jack Kong, founder of iPollo; Benson, investor at OKX Ventures; WhiteForest, co-founder of Foresight Ventures; Brent Fulfer, head of Blockchain Founders Fund; Chichi, partner at Hack VC; Vineet, managing partner and CEO of Cypher Capital; Pablo Solano, founder of Access Capital; Adam, founder of Initial Ventures and advisor to Solana Foundation; Will Wang, partner at Generative Ventures; Ciara Sun, founder and managing partner of C^2 Ventures; Mohit Pandit, director at IOSG; Jerome, partner at EVG; Baiyu, head of CKB Eco Fund; Garry Yang, founder of Eureka Group; NG, managing partner at Youbi Capital; Vincent, partner at AC Capital; Larry S, managing partner at Basics Capital; Chung, investment lead at ArkStream Capital; Circle, head of Antalpha Ventures; Kuntal, managing partner at MT Capital; Kay, founder of Kay Capital; Juliet, founder of Newtribe Capital; Eric Gu, founder of Summer Tiger Fund; Sachin Jain, founding partner at Amesten Capital; Sonia Shaw, global president of CoinW; Stephen Cheung, partner at WAGMi Ventures; Darren, investment director at Bing Ventures; Vandescent, VP at Edge Ventures; Sun Shuo, founder of UXLink; Jordan, co-founder of UXUY—and many other Web3 influencers.About the Organizers

MT Capital (Momentum Capital) is a global investment firm managed by a team of seasoned investors, dedicated to cross-border investments in diverse, multicultural Web3 innovation projects. Its footprint spans the U.S., Hong Kong, Dubai, and Singapore. Key investment areas include: 1) Mass adoption: Decentralized social platforms, gaming, applications, and DePIN—key drivers for spreading Web3 technology to broad user bases; 2) Crypto-native infrastructure: Focused on investing in public blockchains, protocols, and other ecosystem-strengthening infrastructure, as well as native DeFi solutions. The fund also has a dedicated secondary trading team. MT provides more than just capital. With a professional post-investment support team, we apply rigorous traditional VC methodologies to help startups grow, offering comprehensive support—from market strategy to strategic planning. We assist projects in refining tokenomics, optimizing ecosystems, and play a central role in project engagement and traffic distribution. The fund has prioritized the Indian and Turkish markets, investing tens of millions of dollars, demonstrating long-term growth commitment. MT is known for disciplined fund management and high service standards, aiming to be a strategically minded, growth-stage powerhouse fund that consistently identifies and supports high-potential projects across market conditions. Website: https://mt.capital/ Twitter: https://twitter.com/mtcap_crypto Medium: https://medium.com/@MTCapital_US MT Capital extends sincere gratitude to co-host Tido Capital, over 30 top-tier VC representatives, and outstanding project teams. The success of this event would not have been possible without your active participation and support. Special thanks to media partner: Jinse Finance Special thanks to sponsors: InitVerse, Gameland, TG20, Amesten, DeepLink, Master ProtocolJoin TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News