The Rune Protocol has launched—should you FOMO in or expect a downturn?

TechFlow Selected TechFlow Selected

The Rune Protocol has launched—should you FOMO in or expect a downturn?

The real opportunity comes after the hype around the Runes protocol has cooled down.

Author: Ignas

Translation: TechFlow

The Runes protocol launched on April 20, and many in the market are FOMOing.

But there are several reasons to remain bearish for now

First, the pre-Rune token market was already booming before Runes went live

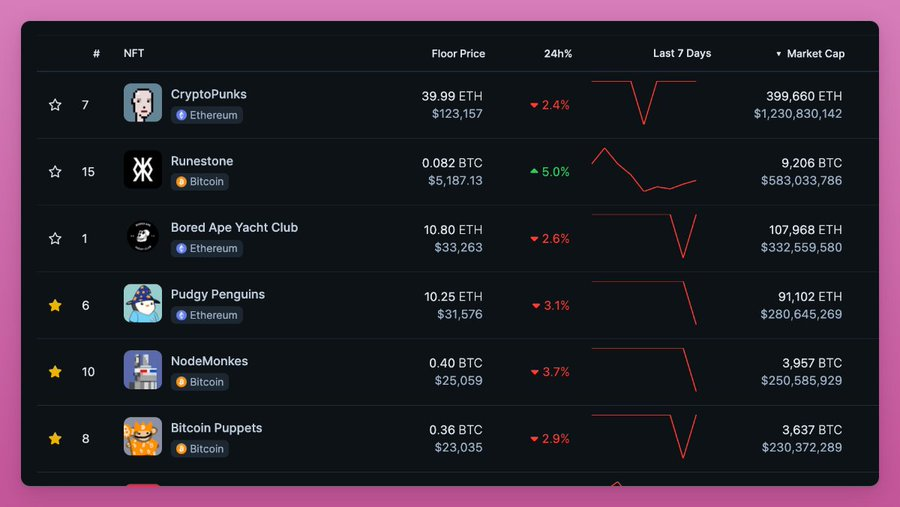

Rune Stones, RSIC, and PUPS have already seen a major rally, promising holders airdrops of new runes.

There was already intense FOMO even before Runes officially launched. However, just like the NFT craze after JPEGs dropped, the market will cool down quickly. Here's why:

-

As Bitcoin transaction fees spike, retail traders may get squeezed out and lose confidence

-

Runes may not immediately revolutionize BRC20 trading experience since UTXO and BRC20 transactions resemble NFTs

-

For example, Unisat and Ordinal wallet Rune user interfaces are identical to those for BRC20

Additionally, dozens or even hundreds of rune tokens will flood the market

This dilutes:

-

Traders' attention

-

Capital inflows per token

And Rune 0 (UNCOMMON·GOODS), created by Casey Rodarmor, isn't easy to pump either—it can be freely minted over four years with only one allowed per transaction.

Finally, utility runes will initially trade as BRC20-style memes

At least at first, the excitement around the "new" will fade, especially if no rune tokens sustain upward momentum and degens end up losing money.

Long-term bullish on Runes

Of course, some runes will perform well—you'll see success stories. If I'm right, the real opportunity comes after the hype dies down post-launch.

I am long-term bullish on Runes.

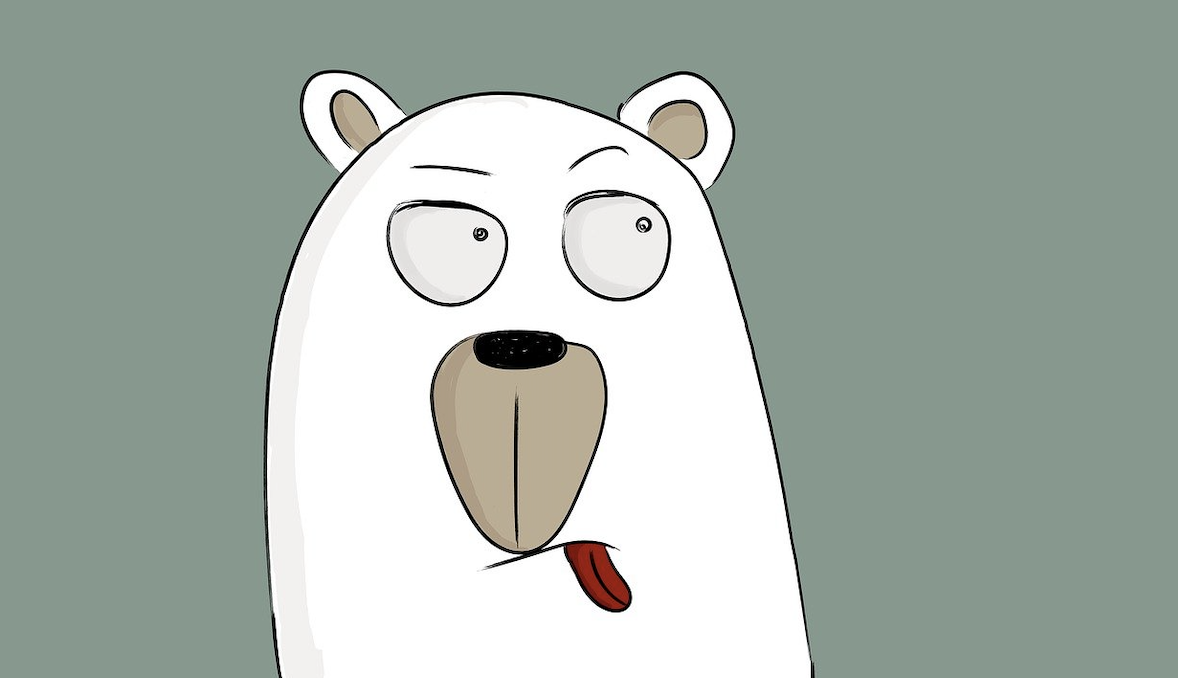

Keep in mind, narrative-driven speculation moves in waves:

Wave One: Driven by shiny new things and hype, usually from technological innovation or meme potential.

Recent examples: Friend.tech, ERC-404, Telegram bots.

Meme tokens feel like gambling—most one-hit wonders disappear quickly.

But narratives rooted in technological progress have better staying power after the hype fades.

Ordinals debuted in December 2022.

But the launch of BRC-20 in May 2023 triggered the first wave. Although initial hype faded, continued development led to second and third waves by the end of 2023.

Now, the fourth wave is Runes.

Runes aren't going anywhere—they'll outlast this current frenzy. Why?

Runes aim to unify the BTCFi industry with a single standard similar to Ethereum’s ERC-20.

Before Runes, developer attention was fragmented across BRC-20, CBRC-20, ARC-20, etc.

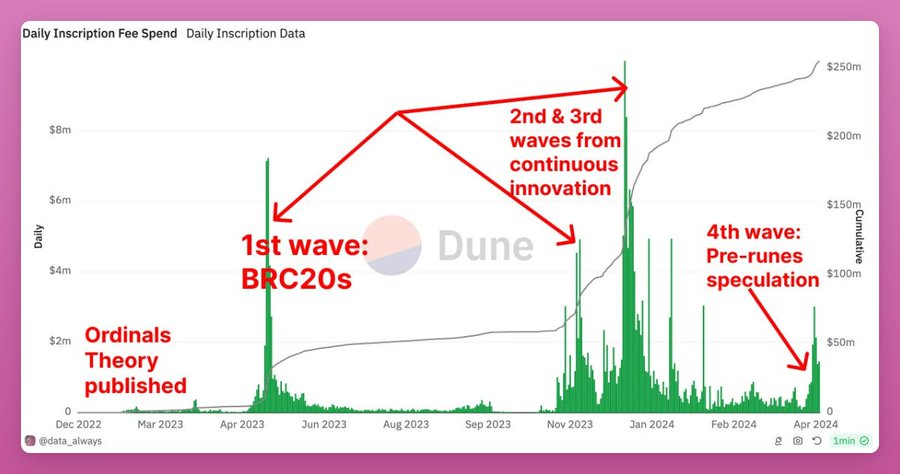

Runes are paving the way for multiple protocols and infrastructure for Rune tokens—for example, Saturn is building a DEX for Runes, and Liquidium is developing a lending market—but refining user experience takes time.

Finally, there's an even more fundamental reason I’m long-term bullish on Runes and BTCFi:

In every bull market, new technologies emerge.

Bitcoin was thought to be “unsuitable” for NFTs or tokens. Yet, Bitcoin NFTs have outperformed Ethereum NFTs.

This Ordinals innovation has given Bitcoin an extraordinary privilege—creating new tokens out of thin air and assigning them crazy valuations.

This used to be reserved for smart contract blockchains like Ethereum or Solana.

Until Ordinals accidentally enabled BRC-20—and now Runes.

Ultimately, the narrative potential of BTCFi is absolutely massive!

Storytelling breathes life into technological innovation, turning it into something people can relate to and participate in.

Bitcoin's Ordinals—as immutable NFTs on the most secure and decentralized blockchain—is a compelling story. This could trigger a meme wave on Bitcoin that surpasses anything seen on Solana or Ethereum!

With developers flooding into Bitcoin and more BTC degens joining, the future looks bright.

The good news? We’re actually very early—everyone is still catching up with the technology and the story.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News