What recent changes in public chain infrastructure, such as ETH, are worth paying attention to?

TechFlow Selected TechFlow Selected

What recent changes in public chain infrastructure, such as ETH, are worth paying attention to?

Ultimately, the path forward will be determined by the market.

By: Lao Bai

In the current primary market, the hottest sector is undoubtedly AI, followed by BTC. About 80% of the projects discussed daily are concentrated in these two areas. At my peak, I could talk to as many as five or six AI projects in a single day.

It's foreseeable that an AI bubble will peak in the next one or two years. As hundreds of new AI projects launch and the AI sector’s market cap reaches its zenith, the eventual burst—leaving behind chaos and wreckage—will also give rise to true unicorns that successfully bridge AI and crypto, pushing this sector and the entire industry forward.

Therefore, amid today’s AI hype, it's worth pausing to examine recent changes at the infrastructure level—especially within the public blockchain infrastructure space. Some of the developments here are genuinely noteworthy.

ETH, or the Further Deconstruction of Monolithic Chains

When Celestia first introduced the concept of modular architecture and the Data Availability (DA) layer, the market took considerable time to digest and understand it. Now, this idea has become deeply ingrained. Today, various Rollup-as-a-Service (RaaS) infrastructures have become so widespread that we’ve reached an absurd stage where infrastructure count exceeds application count, which in turn exceeds user count. (RaaS stands for Rollup-as-a-Service—a ready-made rollup product and service offering that helps app developers quickly launch their own rollups.)

Over the past few months, each layer—execution, DA, and settlement—has seen distinct technical advancements, spawning new technical approaches. Even the notion of a "settlement layer" is no longer exclusive to Ethereum. We’ll briefly go over representative technologies from each layer.

Execution Layer

The hottest concept in the execution layer is undoubtedly parallel EVM, represented by Monad, Sei, and MegaETH. Existing projects like FTM and Canto are also planning upgrades in this direction. However, just as not all ZK projects offer privacy protection, projects labeled as “parallel EVM” differ significantly in both technical approach and ultimate goals.

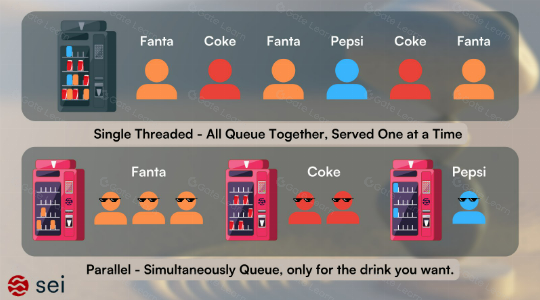

Using a diagram from Sei for illustration, it’s clear that under optimistic conditions, switching from sequential to parallel transaction processing results in significant performance gains.

Within parallel EVM, there are several distinct technical paths:

1) From the perspective of how transactions are parallelized – nothing new under the sun, just differences between a priori and a posteriori methods

A priori methods, exemplified by Solana and Sui, require transactions to explicitly declare which parts of the chain state they modify, enabling pre-block construction detection of state conflicts (e.g., access to the same AMM pool). Conflicting transactions are discarded.

A posteriori methods, also known as optimistic parallel execution, are represented by Aptos BlockSTM—transactions are accepted assuming no conflict, executed first, then checked afterward. Transactions found to be conflicting are marked invalid, results are rolled back, and re-execution occurs until all transactions in the block are successfully processed. Sei, Monad, MegaETH, and Canto adopt similar solutions.

In early-stage markets, we've also seen parallelization solutions targeting specific conflict scenarios (like simultaneous AMM pool access), though these appear more complex engineering-wise, with uncertain commercial viability—still under evaluation.

2) By degree of emphasis on parallel EVM – can be divided into two schools of thought

One school, led by Monad and Sei, treats transaction parallelism as the primary scaling strategy, making parallelization the core narrative. For example, beyond optimistic parallel execution, Monad has developed a dedicated MonadDB and asynchronous I/O system specifically designed to support parallel processing.

The other school, including Fantom, Solana, and MegaETH, views parallelization as just one of multiple scaling options, a supporting rather than central narrative, with performance gains relying more heavily on other technical innovations.

For instance, Fantom’s Sonic upgrade focuses on the FVM virtual machine combined with an optimized Lachesis consensus mechanism. Solana’s next phase centers on Firedancer’s modular client architecture, improved network communication, and signature verification, among others.

MegaETH aims to achieve a Realtime Blockchain. Building upon Paradigm’s newly developed high-performance Reth client, it further optimizes full-node state synchronization (syncing only state diffs instead of full data), sequencer hardware design (using large amounts of high-speed RAM with storage capabilities for state access, avoiding slow disk I/O), improvements to Merkle Trie data structures, and more. In essence, it comprehensively enhances software, hardware, data structures, disk I/O, network communication, transaction ordering, and parallel processing—pushing EVM performance to its theoretical limits, approaching a “Realtime Blockchain.”

Data Availability (DA) Layer

The DA layer hasn’t seen major technological breakthroughs, so competition here is far less intense than in the execution layer. The main players remain limited in number.

ETH’s CallData upgrade to Blobs has significantly reduced fees across Layer2s, making ETH now a “not-so-expensive” DA option.

Celestia’s greater impact lies in being the first project to introduce the DA layer concept, raising the ceiling of this sector from a $200 million FDV to $2 billion, thereby expanding the overall landscape and imagination. Many new Layer2 appchains now naturally choose Celestia as their DA solution. (FDV stands for Fully Diluted Valuation—a metric calculated as token price multiplied by total supply.)

Avail has spun off from Polygon and technically resembles an “enhanced Celestia,” adopting Polkadot’s Grandpa+BABE consensus mechanism, which theoretically supports more decentralized nodes compared to Celestia’s Tendermint. It also supports Validity Proofs, which Celestia does not. However, technical differences matter less than ecosystem strength—Avail still needs to catch up in terms of ecosystem development.

EigenDA launched alongside EigenLayer’s mainnet recently. Given EigenLayer’s status as one of this cycle’s strongest narratives and most skilled collaborators, I expect EigenDA’s adoption rate to be high. In practice, as long as something feels secure and is cheap, most projects won’t care whether you use Validity Proofs or Fraud Proofs, or whether DAS is supported.

More interesting, however, are the following three DAs:

1) Near DA

Near is a fascinating chain—originally built for sharding and still pursuing it, yet simultaneously developing its own DA layer. It’s cheaper than Celestia and enables fast Layer2 settlements;

Chain abstraction – Near recently launched chain signatures, allowing users to request transaction signatures on any chain via a single NEAR account;

AI – Its co-founder Illia is one of the eight authors of the Transformer paper and was personally acknowledged by Jensen Huang at NVIDIA’s conference. The team plans to hire AI engineers soon, with official announcements expected on the website next month… A true hexagonal warrior—I’m including it in the DA category too.

2) BTC & CKB

Since Bitcoin’s Layer1 doesn’t support smart contracts and cannot directly settle, dozens of BTC-based EVM Layer2s essentially use BTC solely as a DA layer. The difference lies only in whether they post the full ZK Proof onto BTC or just its hash—almost as if one couldn’t claim to be a “BTC Layer2” without doing so.

Recently, I encountered a new project openly stating: “I’m not pretending anymore—I’m actually an ETH Layer2, using ETH for both DA and settlement, but I serve the BTC ecosystem!” Quite amusing... The only truly alternative scaling approach here is CKB’s RGB++, where CKB acts as a quasi-DA layer, while BTC, thanks to UTXO homomorphic binding magic, effectively becomes the settlement layer for RGB++.

3) New DAs

Two novel DA concepts worth mentioning (project names withheld): One integrates DA with AI, serving not only as a high-performance DA layer but also as a storage layer for AI large models, training data, and training trajectories; the other improves the underlying erasure coding mechanisms of DAs like Celestia, providing enhanced network robustness even in dynamic environments where several nodes randomly drop out each round.

Settlement Layer

Originally, this layer was almost entirely dominated by Ethereum. DA had competitors like Celestia, execution had numerous Layer2s. But settlement? Other chains like Solana and Aptos don’t yet have Layer2s, and BTC’s Layer2s neither need nor can use BTC itself for settlement. Currently, the only viable settlement layer most people can think of is Ethereum.

Yet this situation is about to change. Several new projects are already moving in the direction mentioned earlier, and some older ones are pivoting accordingly—that is, ZK verification/settlement layers are further deconstructing Ethereum (taking business away from ETH).

Why is this concept emerging? Technically speaking, running ZK proof verification contracts on Ethereum Layer1 is indeed suboptimal:

From a technical standpoint, to verify the correctness of a ZK proof, developers must write verification contracts in Solidity tailored to the specific ZK project and its chosen ZK proof system. These often rely on complex cryptographic algorithms, such as support for different elliptic curves. Such cryptography is inherently complex, and the EVM-Solidity stack isn't ideal for implementing it efficiently. For some ZK projects, writing and verifying these contracts incurs high costs, hindering native integration of certain ZK ecosystems into the EVM world. That’s why ZK-friendly languages like Cairo, Noir, Leo, and Lurk currently can only verify proofs on their own Layer1 chains. Moreover, upgrading these components on Ethereum is always slow due to its scale.

From a cost perspective, although DA fees constitute the bulk of Layer2 “protection fees,” ZK contract verification still requires gas. Verifying proofs on Ethereum is certainly not cheap. With ETH gas prices prone to sudden spikes turning it into a “noble chain,” verification costs become highly volatile.

Hence, new projects focused on ZK verification/settlement layers are emerging. Most are still early-stage, with Nebra as a representative example. Established projects are also pivoting in this direction—such as Mina and Zen, which recently passed a new proposal.

The overarching strategy among most projects in this space includes:

-

Support for multiple ZK programming languages

-

Support for aggregated ZK proofs—more efficient and cheaper

-

Faster finality times

ZK settlement layers and decentralized Proof Markets are likely to converge, since technology alone isn’t enough—you also need computing power. We may see collaborations between settlement layer projects and Proof Market platforms, or compute-heavy settlement layers launching their own Proof Markets, or tech-savvy Proof Markets entering the settlement space themselves. Exactly how this unfolds will ultimately be decided by the market.

Summary

Other infrastructure domains—such as Oracles, OEV (Oracle Extractable Value) in MEV, and ZK light clients in interoperability—have been covered extensively elsewhere, so I won’t repeat them here. When I come across more exciting new developments, I’ll share them again.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News