Bitget Research: Altcoins continue to decline, BGB remains strong

TechFlow Selected TechFlow Selected

Bitget Research: Altcoins continue to decline, BGB remains strong

In the past 24 hours, several new trending cryptocurrencies and topics have emerged in the market, which could very well represent the next wealth-building opportunities.

Summary

The U.S. PPI year-on-year rate for March came in at 2.1%, the highest since April 2023. The cryptocurrency market as a whole is under pressure, with altcoins continuing to experience a sustained downtrend. In contrast, BGB's price performance stands out significantly. Specifically:

-

Wealth-generating sectors include: Base ecosystem, Ton ecosystem, and RWA sector

-

User search trends and hot topics: Avalon Finance, BounceBit, AI Crypto;

-

Potential airdrop opportunities: Zircuit, Nubit;

Data collection time: April 12, 2024, 04:00 (UTC+0)

I. Market Environment

The U.S. PPI year-on-year rate for March reached 2.1%, the highest level since April 2023, indicating that inflation remains sticky. Following the data release, the U.S. Dollar Index (DXY) dropped over 20 points, U.S. Treasury yields declined, short-term interest rate futures rose, and the overall crypto market faced downward pressure, with altcoins maintaining a prolonged downtrend.

In contrast, Bitget's platform token BGB demonstrated exceptional price performance. Beyond the continuous growth of Bitget’s spot business, this was also driven by frequent LaunchPool events and the newly launched PoolX listing product format. For assets listed via these two products, users can stake both BGB and USDT to earn mining rewards from new assets while simultaneously benefiting from BGB's price appreciation. Additionally, due to the high frequency of recent PoolX and LaunchPool activities, demand for BGB has steadily increased, driving the "golden shovel" BGB price higher. If the current pace of launching 2–3 new assets per week continues, BGB's price is likely to keep rising.

II. Wealth-Generating Sectors

1) Sector Movement: Base Ecosystem (AERO)

Main reasons: The Total Value Locked (TVL) in the Base ecosystem has surpassed $1.5 billion. Continued capital inflows could directly impact the overall trend of meme coins on the Base chain. Rising AERO prices, developments in the SocialFi sector, Farcaster’s potential token launch, and progress within its ecosystem have all contributed to heightened attention toward Base.

Price movement: AERO surged 18% over the past 24 hours;

Factors affecting future outlook:

Ongoing capital inflows into the Base ecosystem may directly influence the broader trajectory of meme coins on the Base chain. Traders should closely monitor metrics such as ecosystem TVL and DEX trading volume. With fundamentals continuing to improve, mentioned assets may reach new highs. However, historically, meme coins on the Base chain have limited upside potential—caution is advised against chasing price spikes.

2) Sector Movement: TON Ecosystem (INS, TREMP)

Main reasons: The wealth effect generated by the TON token itself stands out prominently amid the current market correction. Yesterday, Ton’s price broke above $7, setting a new all-time high. Additionally, the TON Foundation yesterday airdropped 300,000 TON tokens (worth approximately $2.19 million) to the most active meme coin traders on Dedust and/or Ston.fi, further fueling user trading enthusiasm on the Ton blockchain.

Price movement: INS rose 10.5% over the past 24 hours; TREMP surged 149% over the same period;

Factors affecting future outlook:

Launchpad wealth effect: The tokens INS and TREMP originate from two different launchpad projects within the Ton ecosystem, each delivering 10x–100x returns. If similar wealth effects can be replicated in future projects, the hype surrounding the Ton public chain will intensify further.

Notcoin’s listing performance: As the most popular project on the Ton chain, Notcoin is drawing massive attention, with over 27 million players and 1.68 million X (Twitter) followers. Trading volume on getgems has exceeded 3.1 million Ton (equivalent to $21 million). With the token launch imminent, strong market acceptance and favorable post-listing price performance could unlock even greater potential for the entire Ton ecosystem.

3) Sector to Watch Going Forward: RWA Sector (PARCL, MANTRA DAO)

Main reasons: BlackRock announced the launch of its first tokenized fund issued on a public blockchain. The entry of such a major player has reignited interest in the RWA sector, which may remain one of the most significant narratives in this bull cycle. With rapid development in RWA—including frequent funding rounds and project milestones—and PARCL’s upcoming token launch, the potential for wealth generation could spark a second wave of momentum in the RWA space.

Key projects to watch:

-

Parcl: The Parcl ecosystem, built on the decentralized real estate trading protocol Parcl Protocol, has announced a strategic partnership with global alternative investment firm SkyBridge Capital.

-

Mantra DAO: MANTRA has launched the Hongbai incentivized testnet—the second phase of the MANTRA Chain testnet. This initiative aims to expand the ecosystem’s user base and encourage the development of decentralized applications (dApps) on MANTRA Chain, marking the first milestone since Mantra’s transformation into an RWA-focused public chain.

III. User Search Trends

1) Popular DApp

Avalon Finance:

Avalon Finance, the first lending protocol on Merlin Chain, achieved a TVL exceeding $100 million just one week after launch, with over 7,000 users. It has become the largest lending protocol on both Merlin Chain and the broader BTC ecosystem, setting a record for the fastest-growing TVL among DeFi lending protocols in DeFi history. Avalon Finance raised $1.5 million in seed funding in March, led by SNZ Capital, Summer Capital, and Matrixport Ventures. The protocol has now launched a community airdrop program offering up to 20% of tokens, allowing users to participate in early-stage airdrops.

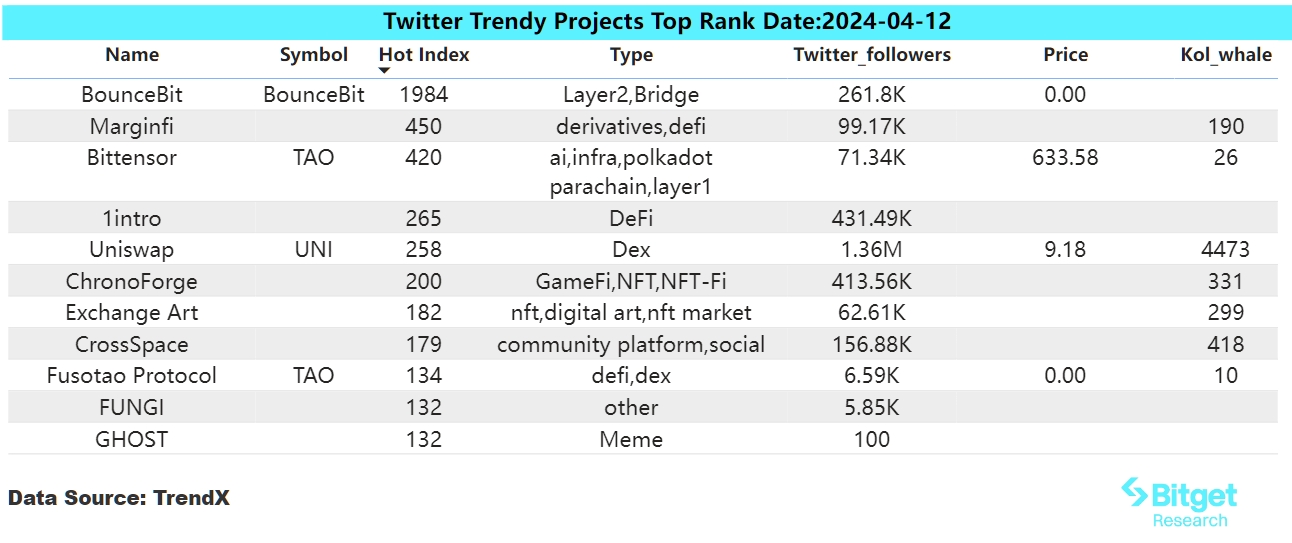

2) Twitter

BounceBit:

BounceBit is a Bitcoin restaking and CeDeFi protocol. Funded with a $6 million seed round led by Blockchain Capital and supported by Binance Custody (CEFFU), Breyer Capital, and Mainnet Digital, the project ensures security for user-staked assets. The latest update reveals that Binance Labs has invested in BounceBit to expand Bitcoin’s utility beyond traditional store-of-value functions. BounceBit’s TVL has already reached $784 million, enabling users to actively participate in network validation and various yield-generating activities.

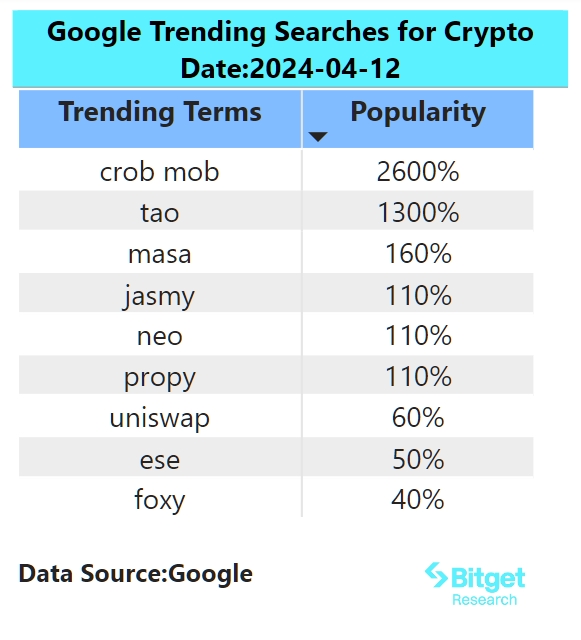

3) Google Search & Regional Trends

Globally:

Masa Network (MASA): Masa Network is a bidirectional data marketplace connecting data providers (users) and data consumers (developers)—a developer of decentralized data markets. Yesterday, it announced the mainnet launch and MASA token issuance at 20:00 Beijing time on April 11. The MASA token will be issued simultaneously on Ethereum, BNB Chain, and the Masa Network (a dedicated Avalanche subnet). Earlier, Masa Network secured a $5.4 million seed round in January led by Anagram. On April 11, Bitget will list Masa Network (MASA), with deposit channels already open. The MASA/USDT trading pair will go live today at 16:00. Investors may consider purchasing accordingly.

By regional search trends:

(1) European and CIS regions show notable interest in AI Crypto:

This stems primarily from Binance’s announcement to list Bittensor (TAO) on April 11, 2024, at 20:00 (GMT+8), sparking discussions and buzz across Twitter and various communities. As artificial intelligence (AI) gains traction in the crypto space, the cost of registering subnets on the Bittensor network has soared to $6.7 million, keeping AI-related topics highly discussed within the community.

(2) Africa, Asia, and English-speaking regions show no prominent hotspots:

Search interest in these regions appears more fragmented, with Floki, Crypto Bubbles, and RWA frequently appearing in trending searches. Ahead of the upcoming Bitcoin halving, retail investors are increasingly focusing on narrative-driven themes such as Memecoins and RWA. Overall market themes are diverging, and sector rotation is beginning amid relatively stable macro market conditions.

IV. Potential Airdrop Opportunities

Zircuit

Zircuit is a Layer 2 public blockchain project based on zkRollup with parallel processing and AI integration, backed by Pantera and Dragonfly. Its TVL has already surpassed $1.1 billion. The Zircuit ecosystem is gradually maturing, incorporating features such as staking, cross-chain bridges, and explorers. Users can gain eligibility for future airdrops by participating in ecosystem development and community engagement.

Currently, Zircuit Staking offers a multi-benefit opportunity. Users who previously participated in Eigenlayer-related ecosystem projects can maximize their returns here with minimal risk. The Zircuit staking program aims to reward participants and foster native daily liquidity on Zircuit. While there are three additional ways to earn points, only the staking method is detailed here.

How to participate: 1) Visit the staking page (https://stake.zircuit.com/) to stake and earn points; 2) Earn points by deploying nodes (https://build.zircuit.com/build).

Nubit

Nubit is a scalable, Bitcoin-native data availability (DA) layer secured by Bitcoin. It effectively expands Bitcoin’s data capacity, supporting applications such as Ordinals, Layer 2s, and oracles, thereby extending the scope and efficiency of the Bitcoin ecosystem.

Nubit has completed a $3 million Pre-Seed funding round with participation from dao5, OKX Ventures, and Primitive Ventures. The team states they are preparing for mainnet launch. Current rules indicate that wallets holding more inscriptions receive higher scores and faster access. Achieving 2,000 points unlocks access to testnet tasks.

How to participate: Connect your brc20 and Unisat wallet at www.points.nubit.org/#/?invite=CLgqe, follow them on Twitter, connect your wallet, and your score will be visible after invitation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News