Bitcoin Spot ETF Launch: A Three-Month Review and Analysis of Its Current Status and Future Impact

TechFlow Selected TechFlow Selected

Bitcoin Spot ETF Launch: A Three-Month Review and Analysis of Its Current Status and Future Impact

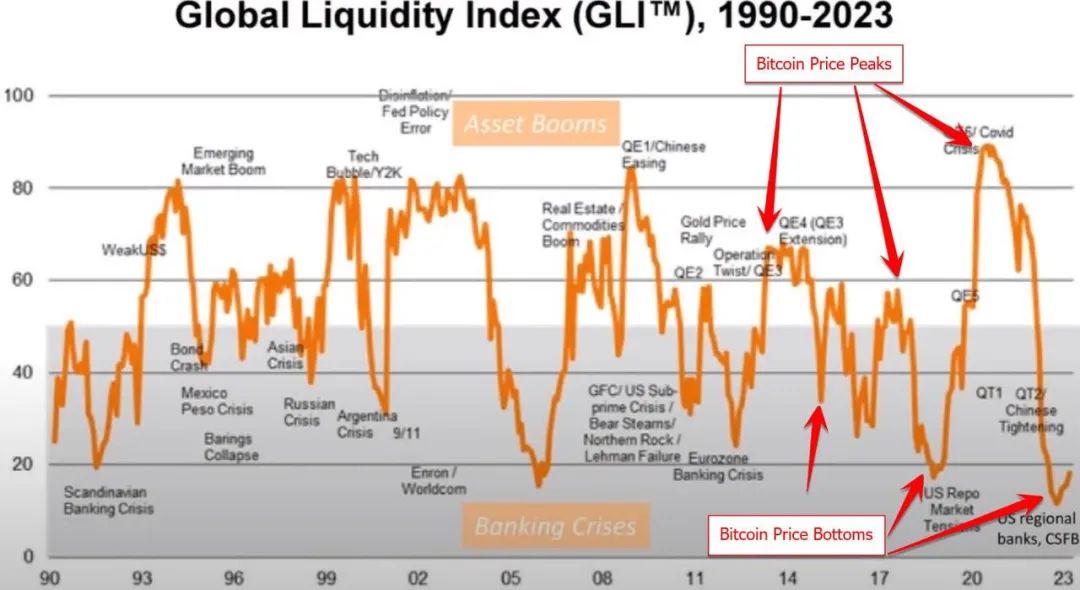

Bitcoin's current bull market aligns with the global liquidity cycle as well as the Bitcoin halving cycle.

Author: RockFlow

Key Takeaways

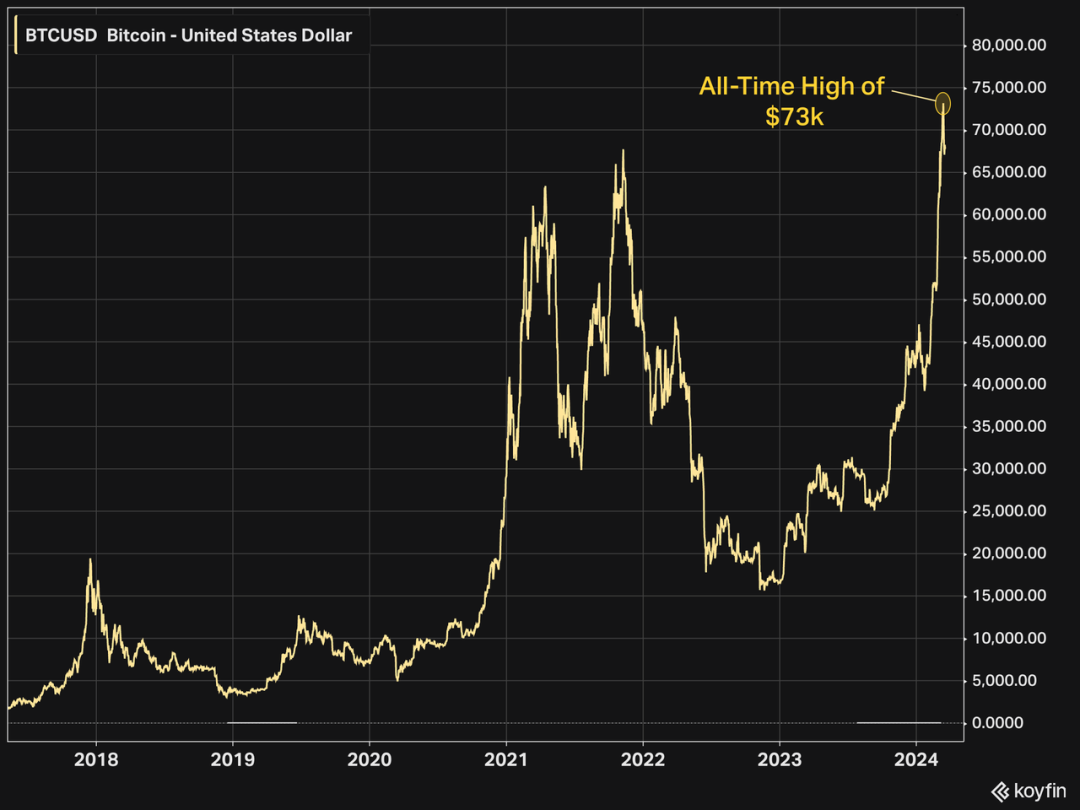

① The launch of Bitcoin spot ETFs brought hundreds of billions of dollars in traditional capital into the market within three months, effectively driving Bitcoin to a new all-time high of $73,000.

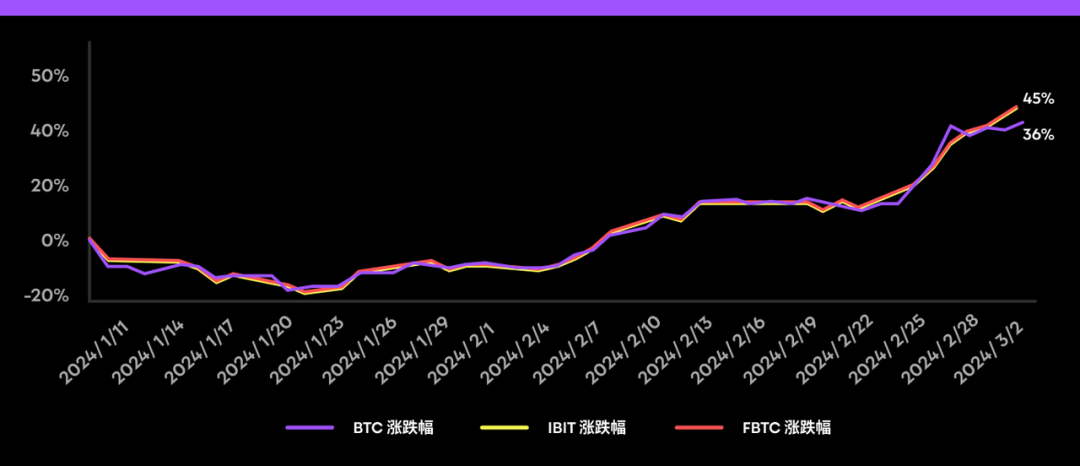

② Bitcoin spot ETF prices closely track Bitcoin itself. Within three months of launch, BlackRock's IBIT and Fidelity's FBTC delivered nearly 45% returns (with smaller ETFs largely matching this performance).

③ This bull run aligns with both the global liquidity cycle and Bitcoin’s halving cycle. The approval of spot ETFs marks a “turning point” for the crypto industry—signaling deeper integration with traditional finance.

2024 is the year Bitcoin goes mainstream.

In January, the U.S. SEC approved Bitcoin spot ETFs from dozens of issuers led by BlackRock. Many view this as the moment when Bitcoin—a nascent asset class—came of age. Bitcoin has officially arrived on Wall Street.

BlackRock’s IBIT quickly emerged as the leader, reaching $10 billion in assets under management (AUM) in just seven weeks—a record previously held by SPDR’s gold ETF GLD, which took 27 months to achieve the same milestone. In under three months, IBIT approached $18 billion in AUM, while Fidelity’s FBTC surpassed the $10 billion mark.

This article provides an in-depth review of the market enthusiasm and expectations since the launch of Bitcoin spot ETFs three months ago. Why are investors so drawn to this new product category? What is its current state of development? And how has it impacted Bitcoin’s price?

Additionally, scan the QR code below to instantly track the latest developments in Bitcoin spot ETFs:

1. Advantages of Bitcoin ETFs

In terms of performance, Bitcoin spot ETFs have fully achieved their goal of tracking Bitcoin’s price movements. Since their launch on January 11, BlackRock’s IBIT and Fidelity’s FBTC have delivered nearly 45% returns over approximately three months—with smaller ETFs largely delivering similar results.

A key question among investors is: why buy Bitcoin through an ETF instead of directly owning it via platforms like Coinbase?

The RockFlow research team has summarized five advantages of Bitcoin spot ETFs:

1) Lower Cost:

Purchasing Bitcoin via ETFs is cheaper than buying it through crypto platforms. Stock trading eliminates the fees and friction associated with crypto transactions and deposits/withdrawals. Many Bitcoin ETFs now offer zero trading commissions, making stock brokerage costs negligible.

2) Security:

Bitcoin spot ETFs offer greater security compared to self-custody. If assets are compromised, the ETF’s custodian will compensate investors through commercial insurance. For example, BlackRock’s IBIT prospectus states:

“Direct investment in Bitcoin requires individuals to determine how to store it (e.g., in a digital wallet or on an exchange), exposing investors to certain risks such as theft or loss of private keys. Holding a Bitcoin spot ETF is different—investors do not bear custody risks, which are managed by the ETF custodian.”

3) Convenience:

ETFs reduce the hassle of managing multiple platform accounts and simplify tax reporting. For most people, buying Bitcoin through the same broker they use for stocks is far more convenient than using a crypto exchange.

4) Regulatory Compliance:

Bitcoin itself may not meet the requirements of certain institutional investors or financial advisors. Before spot ETFs, Bitcoin futures ETFs were an option—but spot ETFs have broader appeal and enhanced safety due to their regulatory compliance.

5) Diversification Potential:

Although current Bitcoin spot ETFs only provide exposure to a single asset (Bitcoin), it is conceivable that these funds could eventually offer diversified investment options. Such diversification would further enhance their appeal.

Bitcoin spot ETFs offer a cheaper, safer, more compliant, and simpler investment pathway. As more traditional institutions include them in portfolios and offer them to clients, we can expect continued inflows of new capital.

2. How Do Bitcoin ETFs Impact Bitcoin Itself?

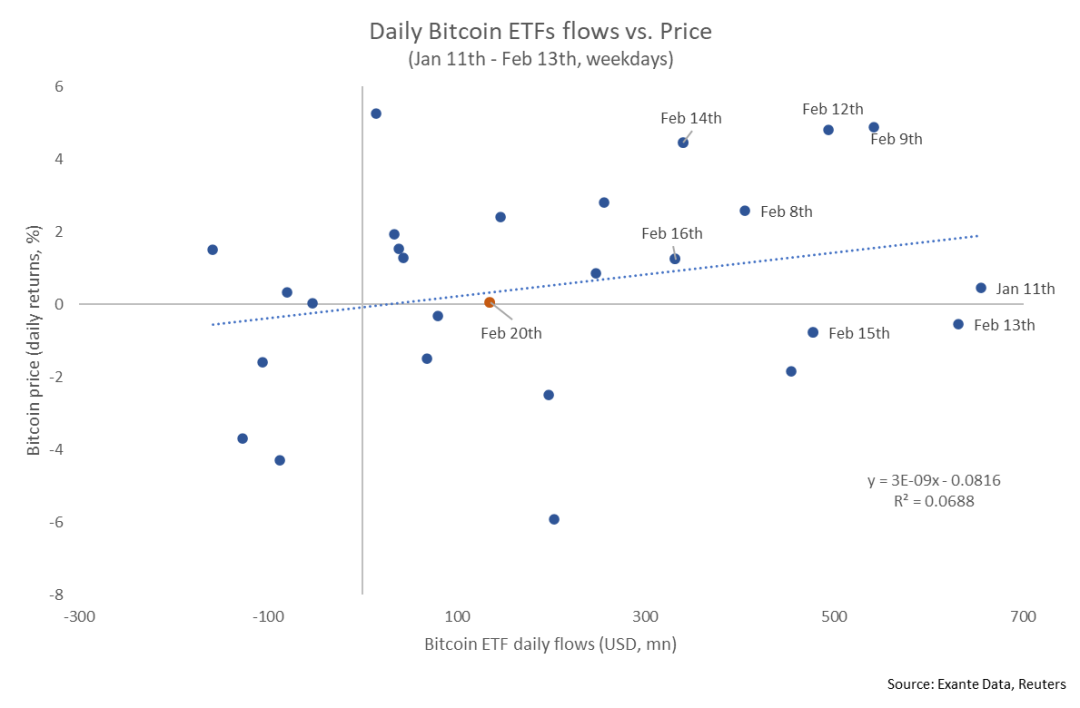

The chart below shows the correlation between Bitcoin ETF inflows and Bitcoin’s price. In the first ten days after launch (January 11–23), Bitcoin’s price dropped 15%, dampening investor enthusiasm. However, in the following three weeks, Bitcoin rose about 30%, triggering significant capital inflows into the crypto market.

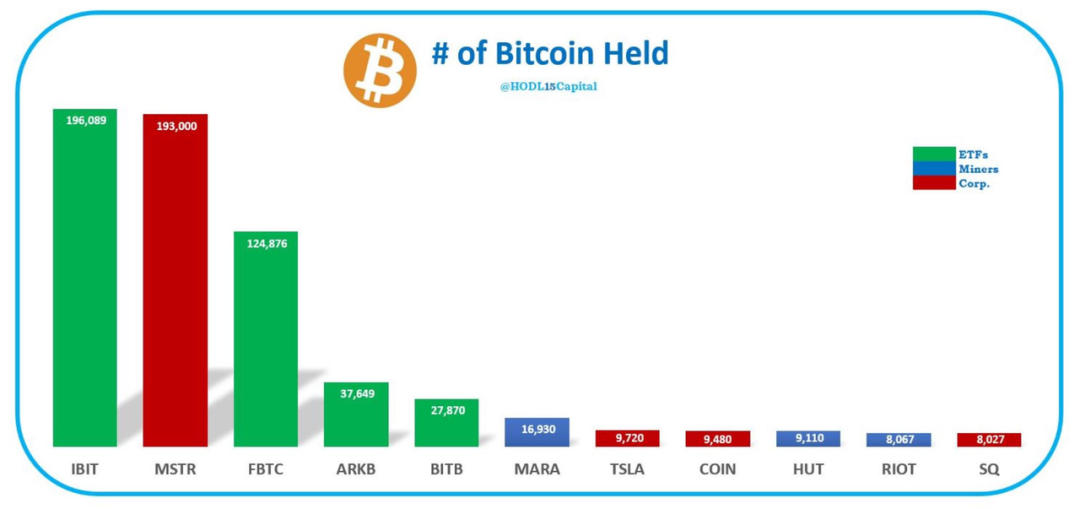

As mentioned earlier, within three months, BlackRock’s IBIT and Fidelity’s FBTC reached $18 billion and $10 billion in AUM respectively. The total AUM of Bitcoin spot ETFs now exceeds 4% of Bitcoin’s current circulating supply. We believe these massive external inflows play a crucial role in sustaining Bitcoin’s buying pressure and balancing sell-side pressure from long-term holders taking profits.

Meanwhile, Bitcoin’s price surged to a record high of $73,000—driven by hundreds of billions of dollars in traditional capital. This marks Bitcoin’s fourth all-time high, following previous peaks of $19,450 in 2017, $63,400 in April 2021, and $67,700 in November 2021.

Consider another figure: U.S. venture capital raised around $67 billion in 2023. At current pace, BlackRock’s IBIT alone—one of eleven existing Bitcoin spot ETFs—could match last year’s total U.S. VC fundraising by the end of this year.

Additionally, according to The Block, Bitcoin spot ETF trading volume nearly tripled in March to $111 billion, up from $42 billion in February.

February was the first full trading month since the ETFs launched on January 11. The surge in March trading volume highlights growing interest in this new financial instrument, exceeding the combined volumes of January and February by more than double. What will April bring? The outlook is promising.

3. Are Bitcoin ETFs Cannibalizing Gold ETFs?

Gold has long been the traditional hedge against inflation, but Bitcoin—known as “digital gold”—has emerged as a new alternative. Recently, as Bitcoin’s price climbed, gold also hit new highs. Some investors wonder: could these two compete?

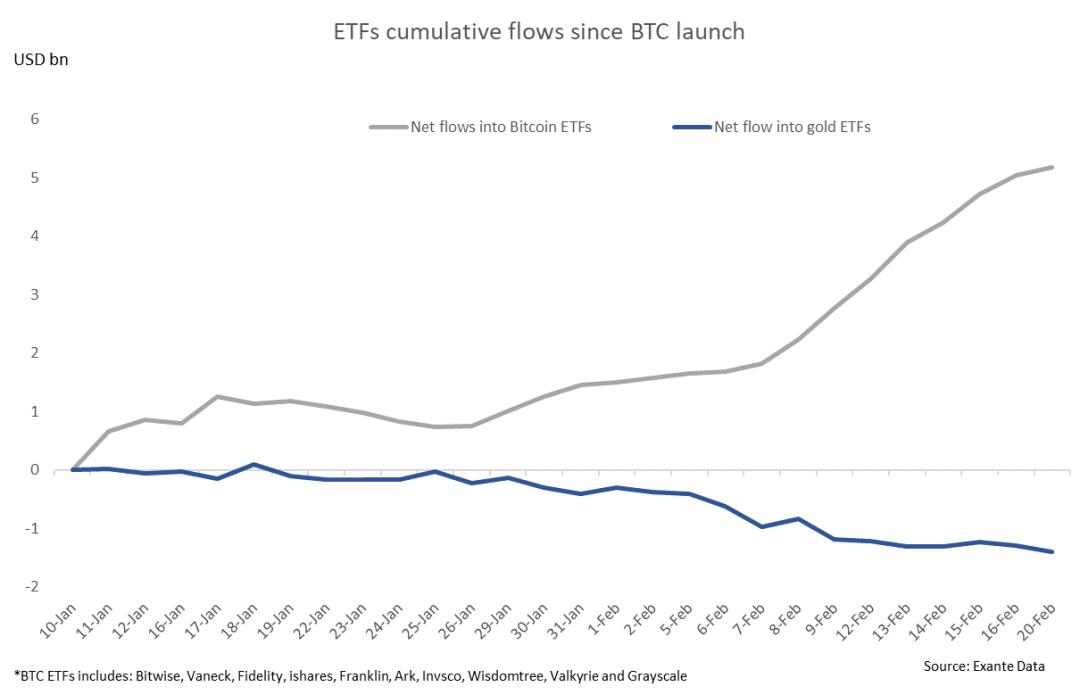

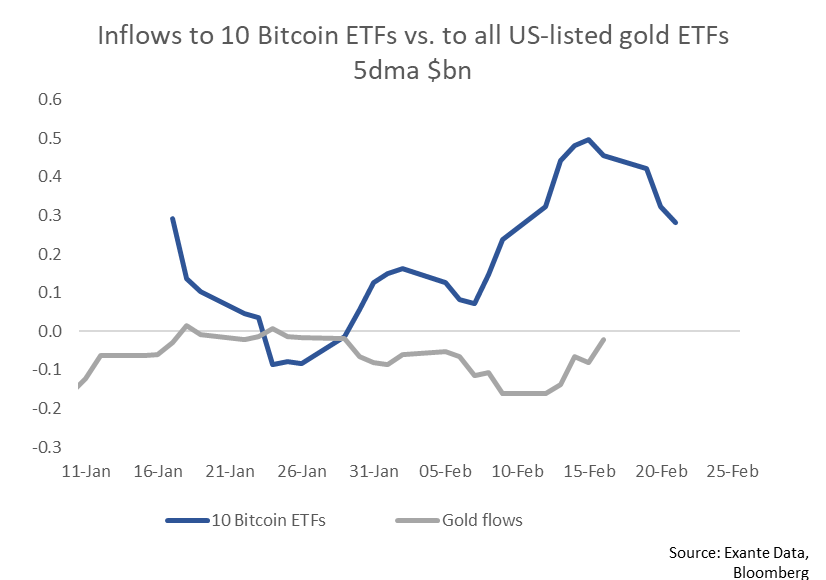

Looking at recent data from GLD—the largest gold ETF—we see that since the launch of Bitcoin ETFs, gold ETF inflows have turned negative. This suggests Bitcoin ETFs may indeed be diverting some capital that would otherwise flow into gold ETFs.

At the same time, during late February when Bitcoin ETF inflows slowed, outflows from gold ETFs also decreased. This indicates that the分流 effect has eased somewhat in the short term.

Overall, both assets benefit from their inflation-hedging properties and remain attractive portfolio choices amid today’s global inflationary environment, suggesting strong long-term potential.

4. Beyond ETFs: Other Price Drivers for Bitcoin

We observe that this Bitcoin bull run aligns with both the global liquidity cycle and Bitcoin’s halving cycle.

Moreover, repeated corporate purchases underscore institutional interest in Bitcoin. From February 26 to March 10, MicroStrategy spent $821.7 million acquiring approximately 12,000 bitcoins, increasing its total holdings to 205,000 BTC—very close to BlackRock IBIT’s current Bitcoin holdings.

Bitcoin’s fourth halving, expected in two weeks, is also likely to boost market attention and enthusiasm. Historically, halvings increase Bitcoin’s price volatility and ultimately lead to higher prices.

We believe the crypto industry—led by Bitcoin—is entering a new phase. Like past innovation cycles, as the industry matures, investment is gradually shifting from speculation and narrative-driven approaches toward value- and fundamentals-based investing. The approval of Bitcoin spot ETFs marks a pivotal “turning point,” signaling deeper integration between crypto and traditional finance.

In addition, RockFlow has also launched several Grayscale-managed trusts offering exposure to crypto assets. These trusts operate through compliant fund structures to serve institutional and high-net-worth investors. In addition to the well-known Bitcoin Trust GBTC, they include trusts for ETH, SOL, LINK, LPT, and other cryptocurrencies, as well as diversified crypto trusts holding major digital assets:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News